Weekly Editors' Picks Weekly Editors' Picks (0827-0902)

"Weekly Editor's Picks" is a "functional" column of Odaily.On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Now, come and read with us:

Now, come and read with us:

Investment and Entrepreneurship

Investment and Entrepreneurship

Messari: Three Crypto Trends That Could Spark the Next Bull Run

There are many people betting on the potential track. Messari has released the framework this time. The main considerations include innovation, value growth potential, total addressable market, value capture and competitiveness. The trends introduced include application protocols ( The main challenges include incentives and supervision), decentralized social networking (the main challenges are scalability, privacy, and user experience), and Web3 games (the main challenges include competition, instability, and long development cycles).

Framework Ventures: Web3 Salary Research Report

Framework surveyed 18 companies in the portfolio (mostly DeFi, infrastructure and Web3 gaming companies) in May and June 2022, ranging in size from 2 to 80 employees. These figures represent compensation for early and mid-stage companies, typically backed by venture capital funds. The main conclusions include:

Fiat currency (payment) is still king in the US, but stablecoins already have a lot of influence internationally; teams based in the US are unlikely to launch tokens, nor do they even plan to launch tokens in the future, in Among international projects, more than 25% of projects have launched tokens, and most projects are considering launching in the future; for decentralized networks or DAOs, token ownership (and equity) is the standard way to motivate employees; compare For companies that provide equity and token ownership, the equity ratio is about twice that of token ownership; distributed office has become the new normal.

DeFi and regulation

Encryption Legal Experts Debate Web3 Regulation: Compliance or Decentralization?

This article is the interpretation of two lawyers on the regulation that Web3 may face in the future. The main points include: after the merger of Ethereum, the transformation of the POS consensus mechanism will not bring greater regulatory risks; DeFi smart contracts may be regulated in a roundabout way (by prohibiting or restricting relevant individuals and institutions); Ethereum validator nodes have not been temporarily The risk of direct supervision; the future encryption world will be diverse, but there will be differentiation at the application layer. Encryption teams need to face the limitations of pure virtual assets, and at the same time need to give up the markets of some countries. The important thing is in supervision and anti-censorship Find a balance between them; any innovation brought about by technology will ultimately be unable to avoid government power (unless the government itself disappears in human society), but will only change the specific way the government exercises power; even Crypto Native’s DAO needs to have A deep understanding of the regulatory rules, to strive for the most favorable regulatory environment; decentralization is the most important talisman of DAO; even if the code of the smart contract is interpreted as a contract, it does not mean that all the execution results of the smart contract must be accepted unconditionally And follow; Code is law can only be said to be the value proposition of some technical geek groups at best, but it is neither the consensus of the society as a whole, nor the reality of the law; we need the symbiotic system of Code+Law.

USDC's "White Terror": Can the full-stack of the DeFi protocol save the decentralized narrative?

NFT

The future encryption world will be divided into two factions: the "regulatory majority" represented by USDC, and the "decentralized minority" represented by DAI. We will lead to the decentralized future of "Multi-Stablecoin".

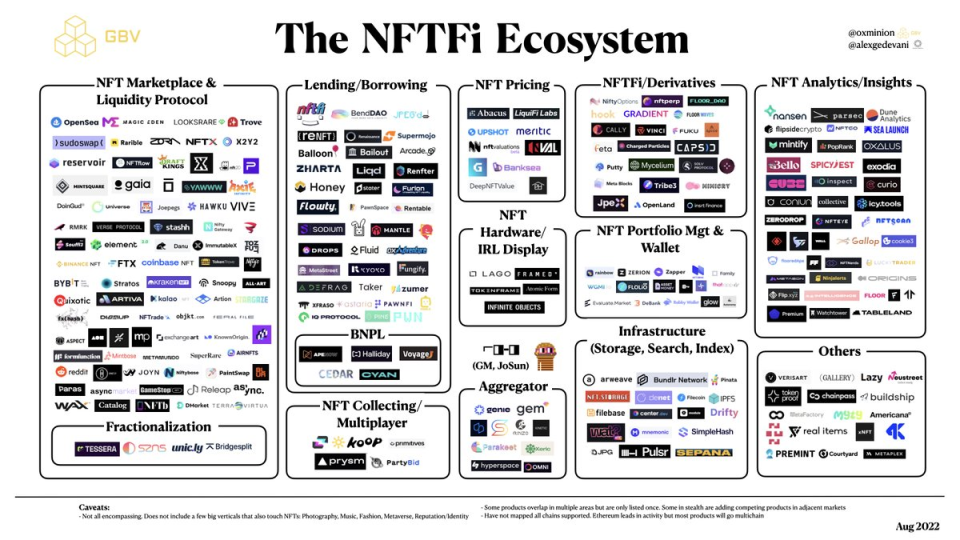

IOSG Ventures: Is the NFTFi Summer led by Sudoswap coming?

The application scenarios of NFT AMM are mainly divided into blue-chip NFT and long-tail NFT. For blue-chip NFTs, one step before entering AMM is to fragment them first. Fragmented NFTs will facilitate price discovery. AMM is one of the ways to improve liquidity/capital efficiency (mainly to promote the price discovery of NFT near the floor price), but AMM is not a suitable trading model. Representative products include NFTx and Sudoswap.

NFT lending is mainly divided into P2P and P2pool. P2P stands for Flowty and NFTfi. How to formulate terms more accurately and quickly will be something that P2P protocols need to think about. For some high-net-worth NFTs, due to their high risk, they need to rely on some liquidity solution providers (such as metastreet) to complete the loan. Representatives of P2Pool include BendDAO, Defrag, and Astaria.In the future, we will also see more mature NFT future, NFT option, NFT insurance, and NFT structured products.Attached "

《"NFTFi Summer" is coming? An overview of NFTFi's prosperous ecology"Industry map in:

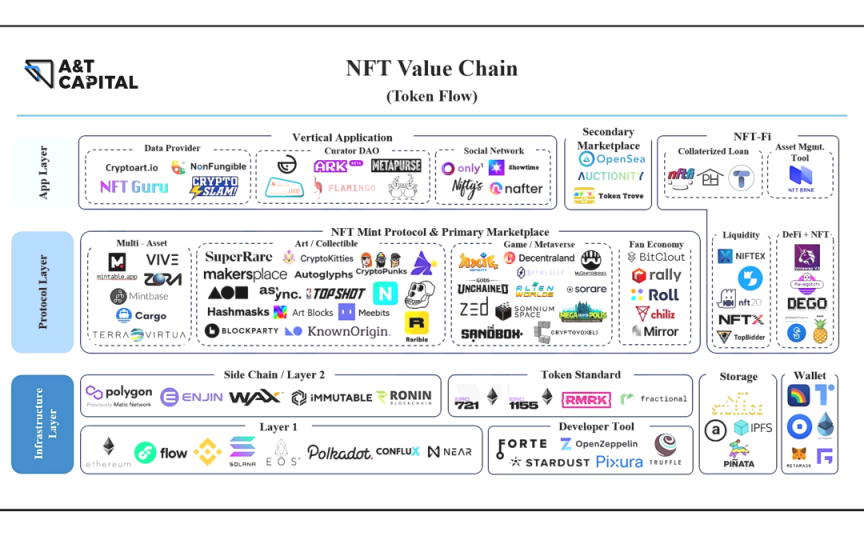

A&T Capital: A Quick Look at the Existing NFT Protocol Map

"Industry map in:

"Industry map in:

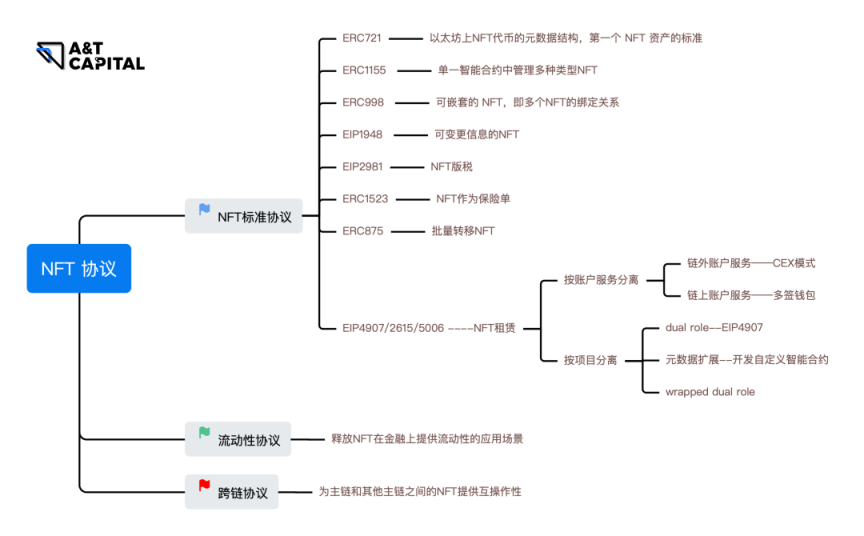

Classification of NFT leasing methods:

GameFi

1confirmation partner: 5 key insights about the mainstream NFT market

Twitter is the best marketing channel in the NFT field; OpenSea has the highest network traffic among all NFT markets, and its number of unique visitors reached 28.7 million in August; the user base visiting the NFT market is skewed towards men, and shows an annual trend; the NFT market There is a correlation between the number of users and the proportion of mobile device traffic; most of the network traffic in the NFT market comes from the United States, followed by Canada, the United Kingdom, Turkey and India.

Analysis of the status quo of Web3 games: the market performance is lower than the overall market, 65% are still in the development stage

The crypto gaming sector has fallen over 60% since the beginning of the year, in line with the overall crypto market downturn, but worse than the overall market/DeFi sector.

There are about 1575 projects in the entire game market, about 40% are concentrated on BSC, 26% are on Ethereum, and 15% are on Polygon. Game-specific chains like ImmutableX, Gala Games, WAX, Enjin, and WemixNetwork only have a market share of 1% to 6%. Only 33% of GameFi items are playable right now, and 65% are still in development. 38% of GameFi are web games, followed by mobile (37%) and PC (24%). Many game project developments center around action and role-playing. Currently, the best performing gaming tokens are StepN’s GMT (+615%) and Binary’s BNX (+115%); the worst performing tokens are ThetanArena’s THG (-98%) and PlayCrabada’s CRA (-97%) %). The top five blockchain games with daily active addresses are: AlienWorlds, AxieInfinity, Solitaire Blitz, splinterlands, and UplandMe.In addition, Levan provided a data: "》。

Web 3.0

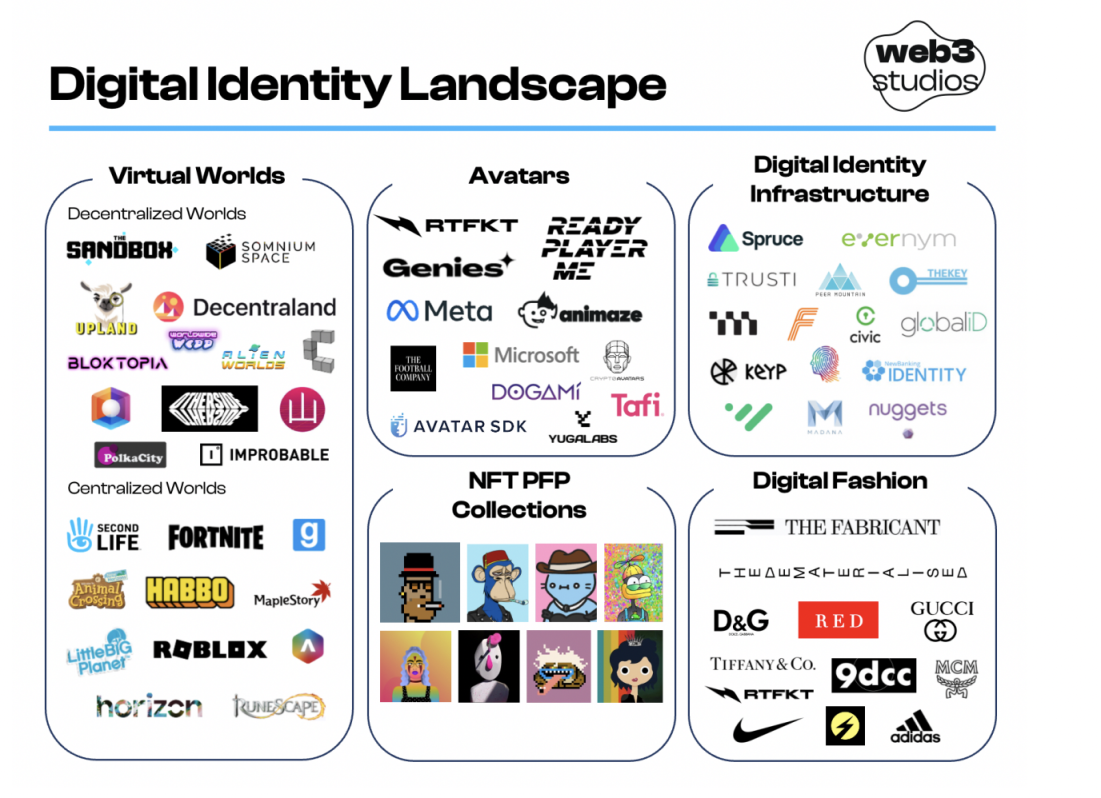

Analyzed 60 blockchain games and found that 40% of the players are robotssecondary titleRegarding the topic of Web3 social and DID, the following three articles are recommended: The large and comprehensive "A comprehensive analysis of Web3 social: a booming field full of identity crisis》《DID: Refactoring the Web3 social model》。

Ethereum and scaling

A Glance at the Market Structure of "Digital Identity": Who Will We Be in the Metaverse?

Ethereum and scaling

4D Analysis "The Merge" has a profound impact on Ethereum

The article is divided into the following sections that readers are interested in: ETH will move towards sustainable deflation and digital bond narrative; the changes in energy saving, security, decentralization and technical risks of the Ethereum chain; MEV still exists and intensifies The benefits of verifiers are unequal; the property of ETH assets is prominent, which is good for the pledge market; the migration of miners is good for ETC; forks; regulatory disputes and review storms after PoS.

Ouyi Research Institute: Ethereum mining crisis, where do the miners go?

Miners will switch to the original chain fork, ETC mining, other mining machine compatible coins, etc. And Staking pledge mining will rise.

Vitalik Buterin: Demystifying the technical characteristics of sharding

Sharded blockchains are scalable (can handle many more transactions than a single node), decentralized (can survive on an ordinary laptop without relying on any supernodes), and secure. The key goal of sharding is to replicate as closely as possible the most important security properties of traditional (non-sharded) blockchains, but without requiring every node to personally verify every transaction.

New ecology and cross-chain

New ecology and cross-chain

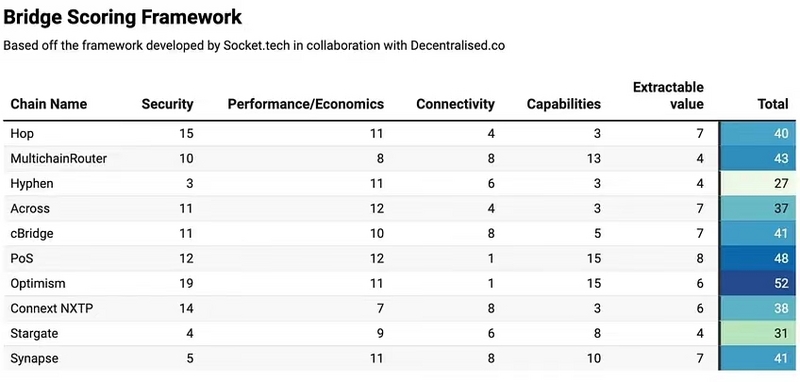

It should be noted that the score itself does not quantify the quality of the cross-chain bridge, and a specific cross-chain bridge may be optimized for different parameters depending on the user's use case and needs. It is not recommended for individuals to use this framework to evaluate cross-chain bridges. Instead, it will be used on independent platforms (such as DeFi Llama or L2Beat) to provide users with information in a quantitative way, rank cross-chain bridges, and at the same time help cross-chain bridges identify their shortcomings and guide users to find Better Service Providers.

hot spots of the week

secondary titlehot spots of the weekIn the past week, Avalanche has been exposed as "vicious competition scandal,", multi-platform in NFT and GameFi fieldsCancellation of NFT royaltiesMusk formally terminates Twitter acquisition, and charged Twitter with spoofing and fraud,Mt. Goxtwitter respondedMusk's cease and desist letter was invalid and wrong,;

The start date of the repayment process was postponed to mid-September,Former MicroStrategy CEO Michael Saylor to be indicted for alleged tax evasionIn addition, in terms of policy and macro markets, Federal Reserve Chairman Powell said that as the policy stance is further tightened,Slower pace of rate hikes would be appropriate, the first task isreduce inflation to 2%Monetary Authority of Singapore

perspectives and voices,A regulatory approach to stablecoins will be proposed;perspectives and voices,state street bankVice President: Will be working on asset tokenization in 2023, SBF responded:FTX Has No Plan to Acquire Huobi, "Forbes":About 51% of Bitcoin's Daily Transaction Activity Is Likely Fake,Pantera Capital:, V god remindsUsers update the client in time before the mergeEthereum tightens more than the Fed, MakerDAO co-founder Rune Christensen wrote "", CZ said;

Institutions, large companies and top projects,The "free-to-own" concocted by VC will not be free foreverInstitutions, large companies and top projects,The 3.3 billion USDC and 499 million USDP held by the Maker agreement are allocated in the PSM reserve,SushiSwap, Ethereum mining poolEthermine Launches ETH Staking ServiceReduce the proposed CEO salary and will vote on a new CEO,Yearn FinanceCurve's native stablecoin crvUSDor will be launched next month,Immutable X launches staking rewards

NFT and GameFi fields,NFT and GameFi fields,,OpenSea integrates Seaport into PolygonMeta has supported displaying personal NFTs on Facebook and InstagramOpenSea integrates Seaport into Polygon, launched functions such as no online threshold, batch transfer, etc.OpenSea will only support PoS chains after the Ethereum merger, readers can donate on Gitcoin and getDigiDaigakuV God's new book "Proof of Stake" NFT, free Mint, Stealth DropCompleted nearly a thousand times the income in one day,With "Editor's Picks of the Week" series...well, another week of ups and downs.

With "Editor's Picks of the Week" seriesPortal。

See you next time~