Was buying ZEC a ploy to dump BTC? 4 industry truths behind the surge in privacy coins.

- 核心观点:隐私币因监管压力与市场避险需求重获关注。

- 关键要素:

- 美国没收150亿美元BTC引发隐私担忧。

- 名人Naval与机构灰度高调背书ZEC。

- ZEC技术升级推动隐私池占比达30%。

- 市场影响:隐私板块流动性增强,短期波动加剧。

- 时效性标注:短期影响

Original article by Odaily Planet Daily ( @OdailyChina )

Author|Wenser ( @wenser2010 )

ZEC's market capitalization surpassed a new high of 7 billion, and DASH contract volume hit an all-time high, marking a return of privacy-related tokens to the mainstream market. It's astonishing how much time has passed. Amidst market volatility and decline, privacy coins have become one of the few sectors that have remained resilient and even continued to rise, leading many to place high hopes on them. Crypto KOL Ansem placed ZEC on par with BTC , and BitMEX co-founder Arthur Hayes twice predicted ZEC would reach $10,000. Behind this frenzied surge lies a unique "value transfer" effect played by privacy coins. Odaily Planet Daily will provide a brief analysis and discussion of the truth behind the privacy coin sector's surge in this article for readers' reference.

The privacy coin market is experiencing a renewed surge in enthusiasm, analyzed by multiple underlying factors.

It is worth mentioning that the emergence and development of privacy coins is not something that happened overnight.

As early as 2014, DASH became known in the market as a "privacy token." Before it, there was Bytecoin, which introduced the CryptoNote protocol and used Ring Signatures technology to achieve anonymous transactions, as a pioneer in the field.

In 2016, ZEC was created, characterized by the use of zk-SNARKs (zero-knowledge proof technology) to achieve "optional privacy," giving users the option to make transactions transparent or hidden. Around the same time, XMR forked from Bytecoin and used the RingCT protocol to provide default full privacy protection, which made it very popular in the market.

After 2019, privacy coins cooled down due to regulatory pressure and exchange delisting, but new privacy coin projects still broke through, such as ZEN, which introduced the concept of sidechain privacy, and ARRR, which achieved 100% mandatory privacy.

Strictly speaking, privacy coins can be considered the cryptocurrency sector that best embodies the spirit of decentralization after Bitcoin . However, looking at the recent surge in the privacy coin sector, besides the high-profile endorsement of ZEC by renowned Silicon Valley investor Naval, there are several other underlying reasons—

The US government's seizure of $15 billion in Bitcoin may be the immediate trigger.

On the 14th of this month, the U.S. Department of Justice's seizure of a huge amount of BTC assets from Chen Zhi, the founder of Cambodia's Prince Group, was made public through a lawsuit. This asset, amounting to 127,271 BTC and worth $15 billion, has once again cast a shadow over the past "advantages" of the cryptocurrency market, such as decentralization and anonymity.

When the iron fist of regulation strikes a single individual, no matter how much wealth they possess, they are powerless to resist its crackdown. Consequently, the market demand and attention for privacy coins have surged again. Further reading: " $15 Billion BTC Changes Hands: US Department of Justice Busts Cambodia's Prince Group, Transforming Itself into the World's Largest BTC Whale ."

Celebrity endorsements and institutional backing have helped privacy coins regain liquidity.

Among the recent surges, ZEC, as a benchmark in the sector, has undoubtedly seen the most remarkable rise. The initial catalyst for its soaring price can be traced back to a post by Helius founder Mert, quoted by renowned Silicon Valley investor Naval on October 1st : "Bitcoin is insurance against fiat currency. ZCash is insurance against Bitcoin." At that time, ZEC was priced at only around $68.

On October 20th, Naval reiterated ZEC and emphasized its advantages: "(Despite the delisting of privacy coins like XMR from CEXs), this is why Zcash offers transparent options—keeping tokens listed on exchanges for as long as possible. However, as we gradually move into the DEX era, this is no longer as important." His words conveyed strong confidence in ZEC's technological roadmap.

Investment gurus and billionaires are like a butterfly flapping its wings, triggering a fierce "privacy coin storm" in the crypto market.

In addition, Grayscale's ZCSH Trust holdings of over $100 million and its listing on Coinbase have brought significant institutional support to ZEC and the entire privacy coin sector, resulting in increased market liquidity.

Privacy projects continue to develop and technologies are constantly being upgraded.

Recently, Electric Coin Co. (ECC), the ZEC development organization, released its Q4 2025 roadmap, focusing on reducing technical debt, improving privacy and usability for Zashi wallet users, and ensuring the smooth management of the development fund. Key initiatives include adding temporary transparent addresses to all ZEC swaps using the NEAR Intents protocol, generating a new transparent address after funds are received, and supporting Pay-to-Script-Hash (P2SH) multi-signature for Keystone hardware wallets.

Meanwhile, the latest data shows that, possibly due to the upgrade of the Orchard ecosystem protocol, the total number of Zcash's Shielded Supply tokens has recently exceeded 4.9 million, reaching 4.927 million, accounting for about 30% of the total circulating supply, and the actual adoption rate is self-evident.

On the other hand, the established stablecoin DASH is also advancing the development of the Evolution testnet, with plans to support privacy-preserving DeFi and improve TPS to 1000+ by combining cross-chain bridges (such as Solana integration), which is expected to attract more new projects to join its ecosystem.

In the crypto market, tokens reign supreme, but technological prowess is equally indispensable. Without continuous technological and experiential advancements, even soaring token prices are ultimately just a mirage, leaving investors with nothing but a mess.

Is privacy ostensibly a means to dump cryptocurrency, and is the value of privacy coins only in their exchange with BTC?

Aside from the relatively objective facts mentioned above, another possible explanation for the surge in privacy coins is their value as "anonymous cash."

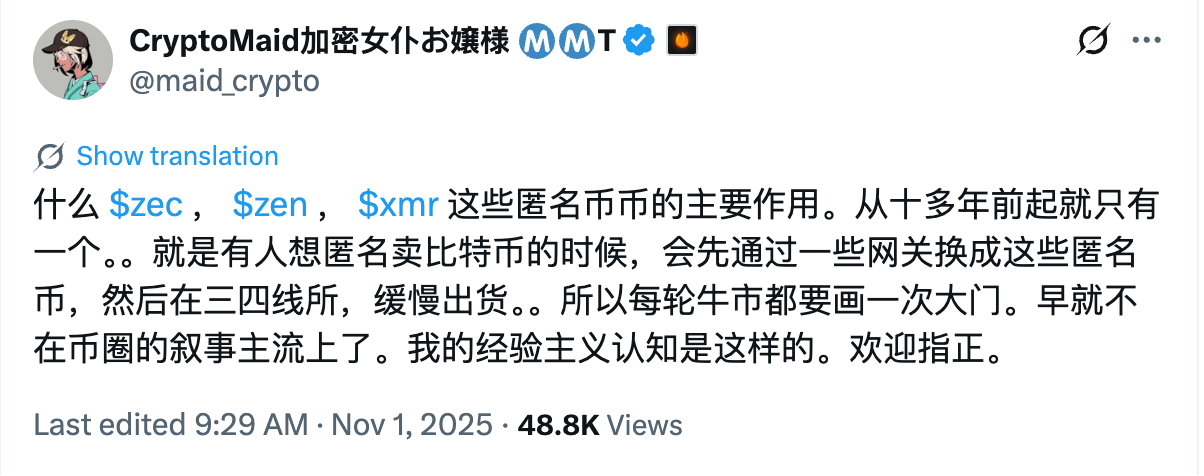

Crypto KOL CryptoMaid wrote : "The main function of anonymous coins like ZEC, ZEN, and XMR has been the same for over a decade— when someone wants to sell Bitcoin anonymously, they first exchange it for these anonymous coins through some gateways, and then slowly sell it off on third- or fourth-tier exchanges. So every bull market has to go through this process. It's no longer part of the mainstream narrative in the crypto world."

It must be said that, considering the recent downward trend of BTC, this viewpoint has some merit.

Often, the so-called "decentralization" and "privacy" are just packaging concepts used for shipping, while the more important thing is the interests behind the concepts.

The world is bustling with activity, driven by profit and loss, and this is especially true in the crypto market.

In conclusion: Privacy is not a panacea; hype can only provide a quick fix.

Of course, privacy coins are not a "panacea." As Super Jun from the Benmo Community posted , "After some research, I discovered that two privacy coins removed their privacy features two years ago, so they shouldn't be considered privacy coins anymore." Furthermore, after clicking on the withdrawal option for one of them, the privacy coin project didn't even have a main chain anymore; it was just a regular token hosted on the Base chain. (Odaily Planet Daily note: Several users in the comments section pointed out that this viewpoint directly targets the privacy token project ZEN.)

In the pursuit of privacy, no one wants to participate in a purely altruistic project that champions the ideals of decentralization, but even fewer want to become a mere "air coin investor." After all, the latter often comes at a far more severe cost.