Odaily Exclusive Interview with "Polymarket's First Person in the Chinese Region": A 25-Day Journey to 225x Returns

- 核心观点:交易员在Polymarket实现25天225倍收益。

- 关键要素:

- 基于电竞认知押注英雄联盟赛事。

- 利用盘前流动性和灵活止盈止损。

- 选择监管友好且存在认知套利机会。

- 市场影响:推动预测市场关注度与资金流入。

- 时效性标注:短期影响。

Original article by Odaily Planet Daily ( @OdailyChina )

Author|Wenser ( @wenser2010 )

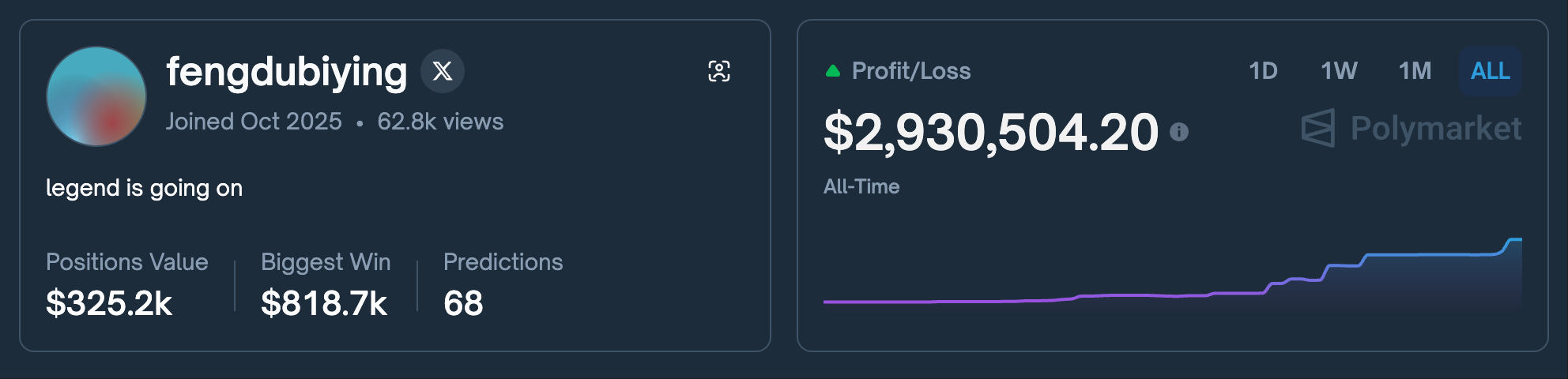

With Polymarket officially confirming the token airdrop and the return to the US market, prediction markets have become one of the few crypto sectors still experiencing explosive growth in data. In this emerging market, a trader with the ID "fengdubiying" (meaning "always winning") achieved an impressive 225-fold return on assets in just 25 days , growing from $13,000 to a profit of $2.93 million. How did he achieve such results in a sluggish market? How did he select the events he bet on? What unique strategies did he employ?

With these questions in mind, Wenser, a reporter from Odaily Planet Daily, conducted a brief interview with the trader behind this ID, Lone Wolf Capital ( @AnselFang ), and the Q&A is summarized below.

The Road to Becoming a Crypto Whale: From a Low Point with Only $50,000 in Assets to a Point Where Only BTC Contracts Could Hold Me

Q1: Let me start with the question that readers are probably most concerned about: What prompted you to start your Polymarket prediction betting journey?

A: I personally entered the NFT circle and have fully experienced the industry booms of inscriptions, runes, meme coins, etc. I've achieved quite a few significant results in the industry. Although during the lowest point, my assets shrank to $50,000 due to the ORDI crash, I still managed to achieve great results step by step through my own efforts and industry trends. Therefore, this year, my capital size dictates that only BTC contracts can meet my trading depth requirements. However, the hellish market conditions still caused me to experience a very large drawdown.

So, after it was confirmed that Polymarket would be issuing its own token, I started my betting journey on Polymarket with a casual attitude. In addition, as a long-time follower of the League of Legends World Championship , and with this year's World Championship under my belt, based on my past experience, I chose to focus my betting on the League of Legends World Championship. Most importantly, esports events like this have relatively high viewership, and the liquidity of betting events is relatively good, which can accommodate a certain amount of funds.

There's also the idea of changing the mindset from the contract trading track, which I mentioned in my previous posts . "(Prediction market betting) for me is just a change of battlefield for contract margin."

(Note from Odaily Planet Daily: The post also mentioned that the Hyperliquid address had a peak profit of around $9 million, avoiding the crash on October 11th. The short positions also earned about $2.8 million through automatic liquidation. However, after the crash on October 11th, liquidity collapsed, and the opening of new positions suffered repeated setbacks.)

Polymarket homepage information

Q2: What was your betting strategy for the League of Legends World Championship? What do you think was the biggest reason for your ability to make huge profits?

A: Actually, it's mainly based on my past experience and understanding of the game League of Legends. Before the World Championship started, I only invested $13,000, and then quickly grew it to $30,000 by predicting the drop in BTC. After that, when the Swiss round of the World Championship started, I continued to grow my investment from $30,000 to $420,000 .

The main trading strategy is actually based on understanding the strength of each team and player. I mostly place bets before the market opens because the amount of capital available before the market opens is relatively large, reaching hundreds of thousands of dollars. Once the game starts, the liquidity is very poor, and it is difficult to place orders exceeding tens of thousands of dollars.

Most importantly, with the adoption of the global ban/pick (BP ) mechanism in League of Legends this year, which limits the number of times a champion can appear in a best-of-five series to once , the BP process essentially determines the course of the game. Basically, if a team chooses tank champions, their lineup is guaranteed a minimum win rate, significantly increasing their chances of winning.

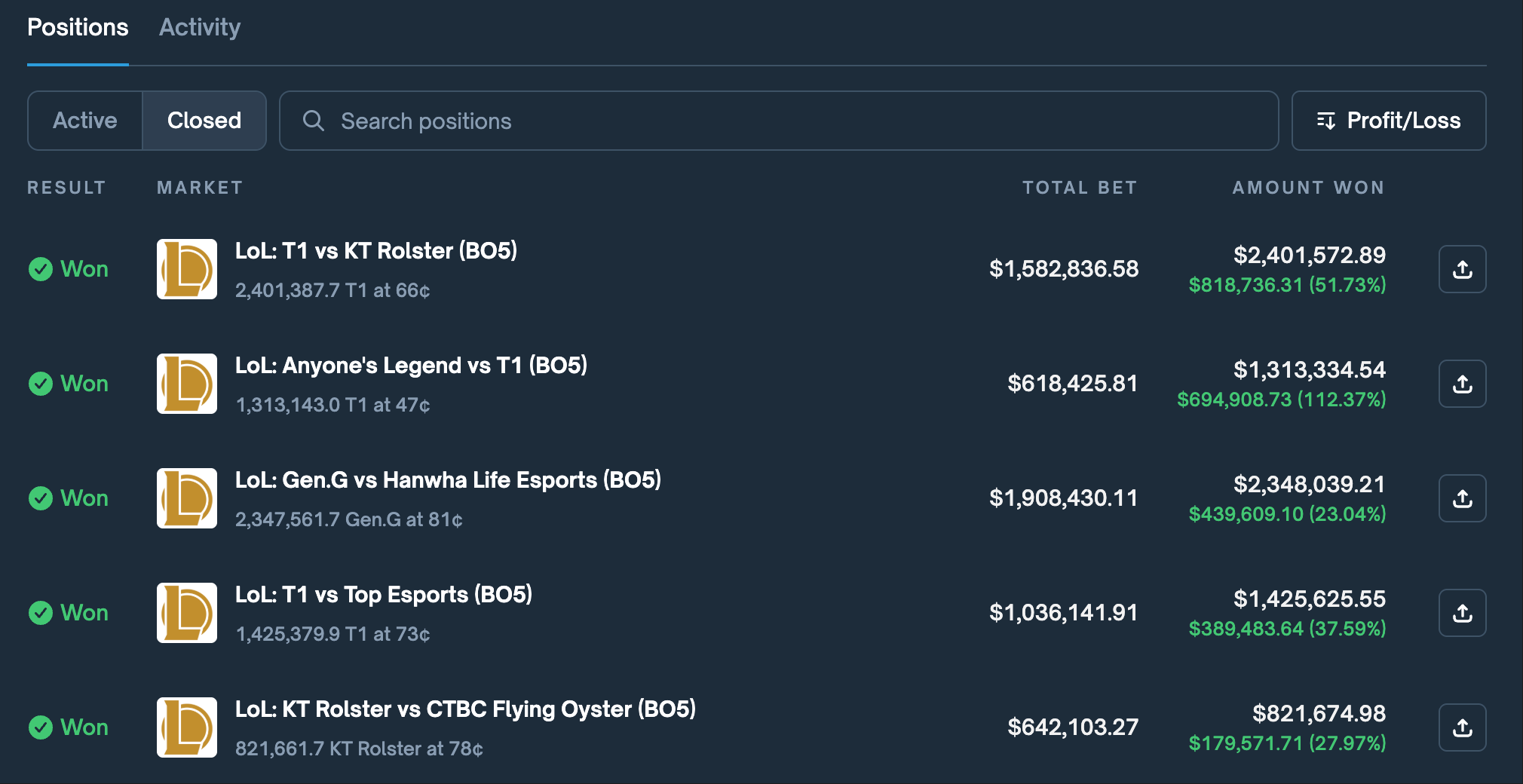

Another advantage of Polymarket is its more flexible trading mechanism , which allows for the execution of stop-loss and take-profit orders. During the BO5 match between Gen.G and KT, I adjusted my position, reducing my losses to around $20,000. Compared to the $600,000 profit I made in the previous Gen.G vs. HLE match, this was essentially a break-even situation.

Of course, there are some differences between League of Legends and sports events like football. Relatively speaking, the chances of an upset are lower in League of Legends. After all, if a team in a game can gain a lead of around 10,000 gold, it is indeed relatively difficult for them to lose, unlike football where a game can be turned around in a few minutes with just one or two goals.

A summary of Polymarket's betting results

Q3: What do you think are the differences between event betting in the prediction market and binary options/contract trading?

A: First of all, I think Polymarket's prediction market track is a very innovative product because it is different from traditional betting platforms and offline venues. Here, the user's opponent is not the "bookmaker" with an inherent advantage, but other users and the truth of the event. In this process, Polymarket only provides a trading platform and will not interfere.

Secondly, Polymarket can be seen as the shortest path to monetizing knowledge . If you have sufficient knowledge and research on a thing or a field, you can make money by judging events, which is quite different from the more directional approach of long or short positions.

Secondly, as mentioned earlier, Polymarket's trading methods are more flexible. You can place limit orders or sell early to take profits or cut losses. Moreover, the course of events is subject to different possibilities. It is not a simple "Yes or No" event (of course, most betting events still fall into the category of either/or).

Finally, Polymarket's return to the US market is a done deal, so US regulators are very welcoming of it, which lays the groundwork for future growth in the market.

Most importantly, regarding League of Legends World Championship betting, in my observation, it hasn't yet entered the mainstream market's sphere of influence, and there are still certain asymmetric opportunities. Neither Riot Games, the developer behind League of Legends, nor the truly wealthy traditional financial giants and bookmakers have yet to extend their reach here. After all, the current depth of the Polymarket makes it difficult to attract these individuals, as the return on investment is not worthwhile. However, as the market develops and the prediction market matures, some may come to act as bookmakers, manipulating matches or engaging in insider trading, which is another form of "time arbitrage." Of course, as I mentioned in a previous post , there is also an element of luck. We also need to consider which approach will attract more attention and generate more buzz for the game's organizers, a common consideration for experienced betting traders.

A single transaction yielded over $800,000.

Q4: What advice do you have for users who start betting on Polymarket with a small amount of capital?

A: Simply put, you must only play games you understand; don't touch what you don't understand. Because betting events really test a person's knowledge, especially since there are always insider deals and pre-emptive betting. So, the event I chose was the League of Legends World Championship, which I have done some research on. My strategy from the beginning was to focus on the draft phase, plus some team strength comparisons and some game-related mystical elements (such as T1's dominance over Chinese teams, Gen.G's loss to KT, etc.).

Secondly, the range of choices is wider. You don't necessarily have to play e-sports competitions. You can participate in political events, macroeconomic events, etc. Moreover, sports events such as NFL and NBA have relatively better mobility.

Finally, don't bet based on other people's opinions . It's like playing Meme coin; if you follow someone else's trades, it's like buying whatever they recommend. Differences in capital and trading strategies might mean someone loses money here but makes money elsewhere, while a small investor could lose it all in one go.

Q5: Have you used other prediction market platforms, such as Kalshi, Opinion in the BSC ecosystem, etc.?

A: No. While Polymarket's depth is average, its product experience is undeniably superior . Kalshi requires KYC, so it's unusable; Opinion previously required a corresponding usage code, and like other products in the BSC ecosystem, many features are "copies" of leading platforms, resulting in a poor user experience. For example, Aster's trading functionality is significantly inferior to Hyperliquid's, which is why many crypto whales, including myself, choose Hyperliquid. Even during the 10/11 crash, trading was incredibly smooth—that's the difference.

Q6: Are all transactions performed manually? Are there any technical means or AI products, such as those for betting on the closing bell, used?

A: Yes, all transactions are done manually. I don't have any technical skills, including when I traded Meme contracts. As for the closing bell, I almost never trade. For the same reason I mentioned before, it's hard to guarantee that something is truly certain. You might end up losing your principal trying to bet on the small profits from the closing bell, which is definitely not worth it.

Further reading:

A Polymarket Top 0.7% Winner's Account: How to Lose $19,000 in One Minute

Exposing the Mafia Within Polymarket DAO: Nepotism, Double Standards, and Abuse of Power