summary

Equity in unlisted companies represents a trillion-dollar sector in global asset allocation, but it has long been constrained by high barriers to entry and limited exit channels, ultimately leading to severe liquidity challenges for private equity (PE) and venture capital (VC) firms. Equity tokenization, a key application of the Real-World Asset (RWA) wave, offers a new path to solving this structural problem. This report aims to delve into the current market status, core models, key bottlenecks, and future trends of unlisted company equity tokenization, and assess its potential to empower PE/VC exits.

Research has found that:

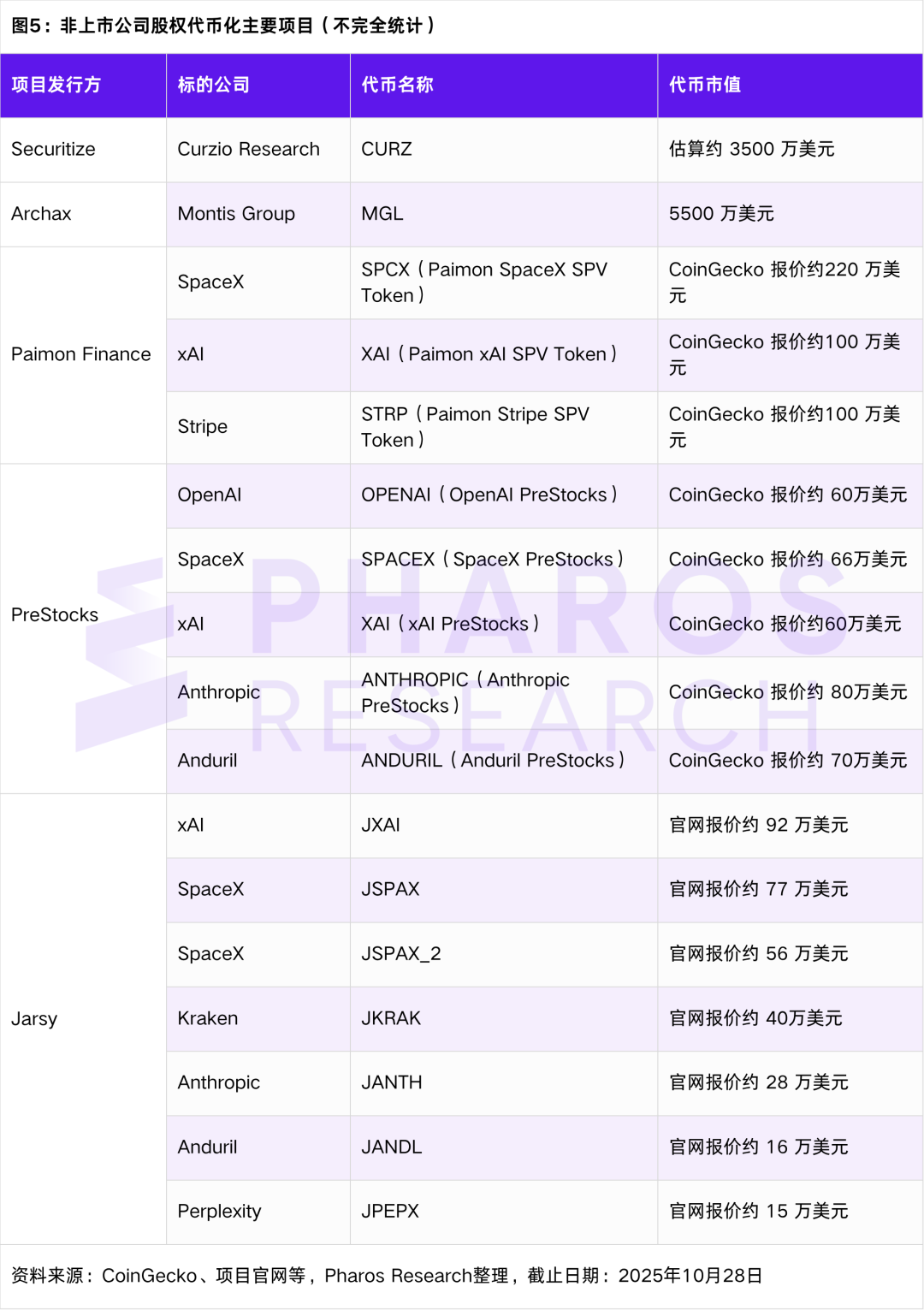

(1) The current market situation presents a huge contrast between “trillion-dollar potential” and “tens of millions of dollars reality”. Although the total valuation of unicorn companies has exceeded 5 trillion US dollars, the market value of currently tradable equity tokens is only in the tens of millions of US dollars. The market is still in its very early stage, and the targets are highly concentrated in leading companies.

(2) The market has differentiated into three mainstream models: native collaboration type (compliant but rarely implemented, such as Securitize), synthetic mirror type (pure derivatives, such as Ventures), and SPV indirect holding type (such as PreStocks, Jarsy).

(3) The SPV model, as a pioneering force that first validates market demand, has demonstrated a high degree of flexibility. Although the current market faces challenges in terms of regulatory compliance, liquidity depth, and IPO finality, this has also driven it to evolve towards a more mature model.

This study argues that the future evolution of the market will not be a simple replacement of existing models, but rather a process of integration and transformation. The core driving force will be the changing attitudes of non-listed companies (issuers) themselves—that is, as Web3 becomes increasingly mainstream, real-world enterprises are beginning to proactively view tokenization (STO) as a new and efficient tool for financing and market capitalization management, driving the market from one-way exploration to two-way collaboration. Meanwhile, the true blue ocean of tokenization is not super unicorns, but rather the broader pool of mature private companies seeking exit strategies; its large-scale explosion will depend on the maturity of native RWA liquidity infrastructure.

Keywords: Private equity, real-world assets, tokenization, PE/VC exit, SPV

I. Introduction

Equity in unlisted companies, especially in high-growth unicorn companies, represents a significant asset segment in the global economy. ① However, the investment opportunities and substantial gains in these high-value assets have long been primarily enjoyed by professional institutions such as private equity (PE) and venture capital (VC), limited to a small number of institutions and high-net-worth individuals, making them inaccessible to ordinary investors. In recent years, the rise of blockchain technology has made the tokenization of equity in unlisted companies possible, that is, by issuing digital tokens on the blockchain to represent these equity shares, potentially changing the rules of the game in the traditional private equity market. Tokenization is seen as a bridge connecting traditional finance (TradFi) and decentralized finance (DeFi), and is also an important part of the wave of real-world assets (RWA) going on-chain.

This trend is driven by huge market potential. The Boston Consulting Group (BCG) predicts that the on-chain RWA market will reach $16 trillion by 2030. [1] Citigroup also points out that tokenization in the private market is expected to surge 80 times in this decade, reaching nearly $4 trillion. [2] The huge market forecast reflects the industry’s high expectations for the prospects of tokenization. On the one hand, non-public companies (such as unicorns valued at hundreds of billions of dollars) contain huge value; on the other hand, blockchain tokenization technology is expected to break down the barriers of the current private market and achieve greater efficiency and wider participation.

This article will delve into the background and current status of equity tokenization in non-listed companies, analyze the pain points of traditional markets, tokenization solutions and advantages, and review major global platform cases, technical support, regulatory policies and challenges. Finally, it will look ahead to future development trends to help readers understand the wave of financial innovation being led by this popular field.

(① This article focuses not only on the tokenization of private equity funds managed by traditional PE institutions, but also on the core value of tokenizing the "original equity" of highly valued unlisted companies (unicorns) from the perspective of the 'target company' (i.e., the issuer), including but not limited to the tokenization of private equity.)

II. The Equity Market for Unlisted Companies: A New Blue Ocean of Tokenization

Unlisted company stocks—especially those of unlisted unicorn companies—represent one of the largest but most illiquid silos in global asset allocation. It is precisely this stark contrast between scale and efficiency that makes it one of the most promising new frontiers in the asset tokenization (RWA) wave.

2.1 The Trillion-Dollar Siege: The Value Landscape of Equity in Non-Listed Companies

1. Asset Boundaries: Which entities are covered by the equity of non-listed companies?

In a broad sense, non-listed company equity refers to the shares of all companies that are not publicly traded on a stock exchange. This is an extremely large and heterogeneous asset class, encompassing equity in everything from early-stage startups to established large private conglomerates. Its holders include not only professional private equity (PE) and venture capital (VC) funds, but also large founding teams, employees holding employee stock ownership plans (ESOPs) or restricted stock units (RSUs), and early-stage angel investors.

As shown in the table above, apart from strategic investors and founding teams, the vast majority of private equity holders have a strong desire to realize their equity and obtain a certain return. The exit needs of private equity funds (PE) and early-stage investors (such as angel investors and VCs) are particularly urgent. Furthermore, employees holding equity incentives also have a practical motivation to realize their options and "secure their profits" when considering leaving the company. However, under traditional channels, apart from a few channels such as company buybacks, the secondary market circulation of private equity is not smooth, leading to a general structural dilemma of difficult exits and poor liquidity.

2. Scale Assessment: The Asset Size of the Trillion-Yuan "Siege"

First, it's important to clarify that there is currently no unified official data regarding the total size of equity in globally unlisted companies. This is primarily due to the inherent subjectivity and non-public nature of company valuations in the primary market. Nevertheless, we can still use key publicly available data to estimate the magnitude of this market.

① Dry Powder: refers to the uninvested reserve funds under management in the fund.

② Unicorn companies: Companies founded within the last 10 years with a valuation of over $1 billion.

Based on the data in the table above, we can estimate the enormous size of this "walled city" from two dimensions:

First, in terms of assets under management (AUM), global private equity (PE) and venture capital (VC) funds—as the main institutional allocators of unlisted equity—manage a total of $8.9 trillion ($5.8T + $3.1T). Although this includes some of the funds' dry powder, this figure itself reflects the substantial capital reserves that the institutional market has reserved for allocating such assets.

Secondly, in terms of asset valuation, the total market capitalization of global "unicorn" companies (private companies valued at over US$1 billion) alone has reached trillions of dollars. As shown in Table 2, the data from Hurun Research Institute is US$5.6 trillion. [3] Although the results from different data sources vary slightly, for example, statistics from CB Insights show (as of July 2025) that the cumulative valuation of 1,289 global unicorn companies exceeds US$4.8 trillion, all of them confirm this huge scale. [4]

Figure 1 lists the top ten unicorns in the world by valuation, as compiled by CB Insights. OpenAI (valued at over $500 billion), SpaceX (valued at $400 billion), and ByteDance (valued at $300 billion) are at the top of the list.

It is important to emphasize that whether it is 4.8 trillion or 5.6 trillion, these are only the top few thousand companies at the very top of the pyramid; the enormous value of tens of thousands of mature private enterprises and growth companies worldwide that have not yet reached the unicorn level has not been included in the statistics.

In summary, the global private equity market is a vast, encircled territory with a total value far exceeding trillions of dollars. This astonishingly large but illiquid blue ocean of assets undoubtedly offers highly imaginative application prospects for tokenization.

2.2 The "Siege" Dilemma: The Challenges of "Participation" and "Exit" in High-Value Assets

The private equity market holds trillions of dollars in value, but this potential remains largely untapped under traditional models. Lacking effective channels for value transfer, the market has become a "walled city" : its immense value is firmly constrained by structural dilemmas of "difficult exit" and "difficult participation." It is precisely this significant friction between high value and low efficiency that constitutes the fundamental market driver for the tokenization of private equity.

The difficulty in participating lies in its high entry barriers. Unlike public markets, investment opportunities in the equity of non-listed companies are strictly limited to a small circle of "accredited investors" or institutional investors in almost all jurisdictions. Minimum investment thresholds of hundreds of thousands or even millions of dollars, along with stringent requirements on personal net worth, constitute a high wall, excluding the vast majority of ordinary investors from this high-growth opportunity. This not only perpetuates inequality of opportunity but also fundamentally restricts the supply and breadth of capital in the market.

The difficulty in exiting lies in the extreme scarcity of liquidity outlets. For holders within the "walled city"—whether early-stage angel investors, VC/PE funds, or employee teams holding equity incentives—the exit path is extremely narrow and time-consuming. Traditionally, exits heavily rely on two end-game events: initial public offerings (IPOs) or mergers and acquisitions (M&A). However, the trend of unicorn companies generally delaying their IPOs has made it common for investors to have lock-up periods of up to ten years, leaving huge amounts of wealth at book value for extended periods. Private equity secondary market transfers outside of IPOs represent an inefficient and high-friction narrow gate: it heavily relies on offline intermediaries, the process is opaque, and it is accompanied by cumbersome legal due diligence, high transaction costs, and lengthy settlement cycles.

It is precisely this dual predicament of "not being able to get in" and "not being able to get out" that has jointly constructed the walled city structure of the equity market for non-listed companies, resulting in trillions of dollars in value being deeply locked up. This sharp contradiction between high value and low efficiency provides the most urgent and imaginative application scenario for tokenization technology.

2.3 Mechanism Restructuring: The Core Advantages of Tokenization in Empowering Equity in Non-Listed Companies

Faced with the siege dilemma analyzed above, tokenization technology offers not just simple repairs, but a systemic solution that fundamentally reshapes the equity value chain of unlisted companies. Its core role goes far beyond passively resolving the friction between "participation" and "exit," and lies in proactively introducing entirely new market mechanisms and valuation paradigms.

First, the primary advantage of tokenization lies in building continuous secondary liquidity, thereby breaking the stalemate. This is specifically manifested in two aspects:

- For external investors : Tokenization significantly lowers the investment threshold by finely dividing high-value equity into smaller shares, breaking the previous "difficulty in participation" barrier and opening up access for a wider range of compliant investors. This is fundamentally different from the tokenization of listed stocks (such as US stocks): stock tokenization primarily optimizes the convenience of trading (such as 24/7 trading), while the tokenization of non-listed company equity, under the premise of compliance, fundamentally achieves a "breakthrough" of the asset class—it gives compliant ordinary investors the opportunity to access this type of high-growth investment target for the first time—allowing ordinary people to easily purchase OpenAI equity.

- For insiders : It promises to open up a completely new exit path. Beyond traditional IPOs, buybacks, M&A exits, or inefficient secondary equity transfers, shareholders (such as employees and early investors) can transfer their shares and "put them on-chain" through a compliant tokenization platform, gaining liquidity in a 24/7 on-chain market. This provides traditional private equity and venture capital firms with a new exit channel beyond IPOs and M&A exits, and this exit method can reach a wider range of ordinary investors.

Figure 4: Summary of Exit Paths in the Primary Market

Source: Pharos Research

Secondly, tokenization brings a continuous price discovery mechanism, empowering proactive market capitalization management. The valuation of traditional unlisted company equity relies on private financing rounds that occur every few months or even years, resulting in discrete, lagging, and opaque prices. However, the continuous secondary market trading enabled by tokenization provides unlisted company equity with high-frequency price signals approaching those of the public market for the first time. This continuous price discovery mechanism eliminates the "blind box" of valuation, allowing companies and primary market investors to more fairly price subsequent financing and conduct more reasonable and proactive "market capitalization management," significantly reducing the valuation gap between the primary and secondary markets.

Finally, tokenization opens up new financing channels, allowing companies to restructure their capital strategies. Tokenization is not only a tool for transferring existing assets, but also a new financing channel for incremental capital. High-growth companies (such as unicorns) can partner with professional Web3 projects or tokenization platforms to bypass the lengthy cycle and high underwriting costs of traditional IPOs, directly offering security tokens (STOs) to qualified global digital investors. This digital listing model is essentially a revolutionary expansion of corporate fundraising channels, enabling them to access a larger and more diverse global capital pool. Currently, emerging platforms such as Opening Bell are actively exploring this type of cooperation with non-listed companies, seeking to develop this cutting-edge fundraising path.

III. Current Market Status of Equity Tokenization in Non-Listed Companies

3.1 Market Size and Overview of Target Assets

Precisely measuring the overall market size of tokenized equity in non-listed companies presents certain challenges. On one hand, some platforms (such as Robinhood) do not disclose complete market capitalization data for their tokenized equity; on the other hand, synthetic contract products such as Ventures only have "open interest" and no so-called "equity token market capitalization." Therefore, this section primarily uses a review of the market capitalization of some key products available in public markets (such as CoinGecko) to provide a macro-level estimate of the current market size.

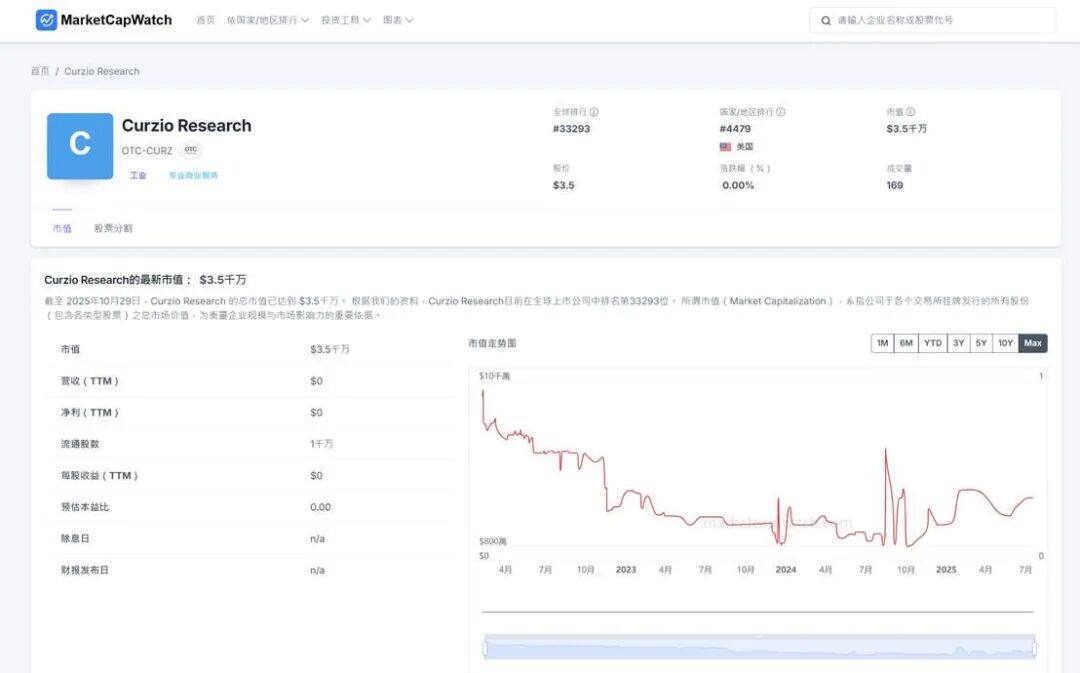

① CURZ tokens are traded on tZERO (ATS platform). The platform does not publicly disclose its total market capitalization. The data in the table is estimated by "latest available price × total share capital". In addition, this product is not a product that can be freely traded on DEX or CEX in the traditional sense, but is traded within the Alternative Trading System (ATS).

② The MGL token issued by Archax is part of the UK Financial Conduct Authority (FCA) Digital Securities Sandbox project launched in July 2023. This asset is issued on the Hedera blockchain by Montis Group, with Archax providing custody. It is a tokenized equity asset, but it is not yet publicly traded.

③ Jarsy's tokens also include listed stocks (such as Nvidia and Tesla), but their TVL (total value attributable to shareholders) is generally low. Additionally, some tokens with a market capitalization below $100,000 were not included in the statistics.

Based on the incomplete statistics in the table above, the market for tokenization of equity in non-listed companies is still in its very early stages. Its total market value is estimated to be between US$100 million and US$200 million. After excluding Securitize and Archax[1], the total market size is estimated to be in the tens of millions of US dollars, which is a very niche market.[1] The reason for excluding Securitize’s CURZ and Archax’s MGL is that the former is traded in the alternative trading system (ATS) tZERO, and the latter is a product of the UK regulatory sandbox. Neither of them currently has liquidity in the traditional Crypto-native sense.

From a market structure perspective, market share is highly concentrated in leading projects that are compliantly issued. The combined market share of CURZ issued by Securitize and MGL (a regulatory sandbox project) issued by Archax alone exceeds 60% of the total market.

From the perspective of underlying assets (excluding special projects like Securitize and Archax), the current tokenized assets on the market exhibit a high degree of convergence, concentrating on top US high-tech unicorn companies, especially in the AI sector. Companies like OpenAI, SpaceX, and xAI have become the most sought-after assets. This primarily reflects the tendency of project teams, in the early stages of market cultivation, to prioritize leading companies with the highest brand recognition and the greatest potential to attract investor interest. In contrast, although some project teams have stated they are in talks with equity holders of Chinese-backed unicorns (such as ByteDance and Xiaohongshu), no actual projects have yet materialized.

3.2 Three Mainstream Models of Equity Tokenization in Non-Listed Companies

Currently, the market has evolved three distinct implementation models in exploring the path of tokenization of equity in non-listed companies . These models differ fundamentally in terms of compliance, asset attributes, and investor rights. The third model, SPV indirect holding, is the current mainstream model.

① A transfer agent license refers to the right to maintain, manage and change the shareholder register after completing the transfer agent registration with the SEC. It is the beginning of compliance for tokenizing equity in the United States. The full set of compliance for securities issuance and operation with the U.S. SEC also requires a Broker-Dealer license and an Alternative Trading System license.

② SPV (Special Purpose Vehicle) is a common financial term that means a "separate" company set up for a specific transaction (or asset holding) with the purpose of risk isolation. Simply put, it is a "shell company".

③ Although Opening Bell adopts the method of cooperating with target companies and tokenizing company equity, its current implementation cases are all listed companies. Its cooperation with non-listed companies is only at the publicity level and has not yet been implemented.

1. Native Collaborative Issuance Model

This model involves direct authorization and deep involvement from the target company (i.e., the non-listed entity) to register and issue "legally valid equity" directly on the blockchain. Under this model, the on-chain token is the equity itself, and its legal effect is completely equivalent to that of the offline shareholder register (specific rights are executed according to the company's articles of association and the laws of the jurisdiction).

Therefore, token holders are the registered "listed shareholders" of the target company, typically enjoying full voting rights, dividend rights, and access to information. The issuing platform must hold key financial licenses, such as an SEC-approved "Transfer Agent" license, to legally manage and change the shareholder register. Examples of this approach include Opening Bell (which advocates "on-chaining" the company's legal stock) and Securitize (whose model is also widely used for the compliant tokenization of fund units, possessing a full suite of licenses including Transfer Agent, Broker-Dealer, and Alternative Trading System).

However, there are currently limited successful implementation cases for this model. Securitize has very few successful implementation cases, while Opening Bell's current implementation cases are all with publicly listed companies, and its cooperation with non-public companies is currently limited to the publicity and promotion level.

2. Synthetic Mirror Model

This model typically involves a third-party project team issuing bonds unilaterally without the target company's permission. What is issued is not equity, but rather synthetic derivatives that mimic the economic returns of the target company's equity, such as "Contingent Value Notes" or on-chain perpetual contracts.

The tokens purchased by investors do not correspond to actual shares, and holders are not registered as shareholders, thus lacking voting rights and dividend rights. Investors' profits or losses depend entirely on contract settlement with the issuer. Therefore, this model is subject to significant counterparty risk, price tracking errors, and severe regulatory uncertainty. Representatives of this path include Republic (its mirrored note-like tokens) and Ventures (a perpetual company valuation contract based on Hyperliquid).

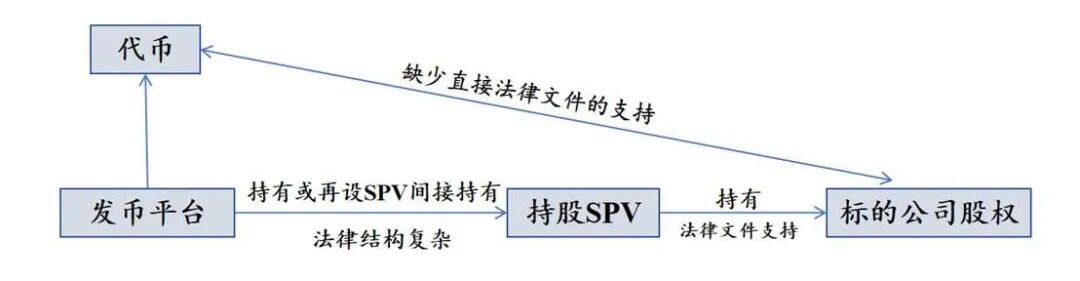

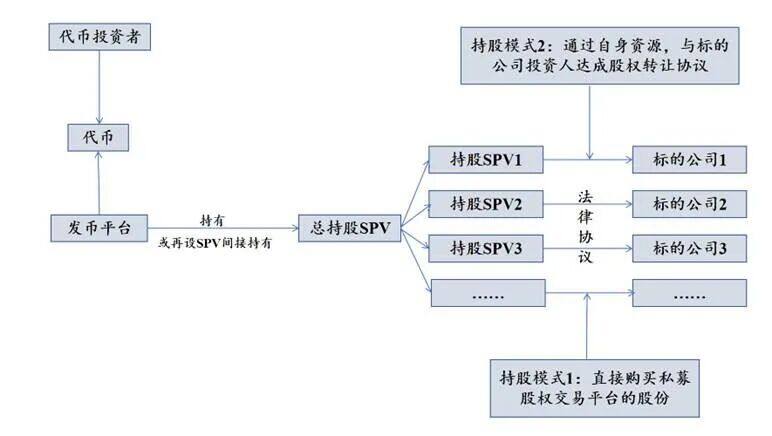

3. SPV Indirect Holding Model

This model is currently the mainstream method for tokenizing equity in non-listed companies, and is itself a common workaround structure. The tokenization platform first establishes a "special purpose vehicle" (SPV), which acquires and holds the actual equity of the target company through the traditional private secondary market. Subsequently, the platform tokenizes the "equity shares" or "beneficiary certificates" of the SPV (rather than the equity of the target company itself) and sells them to external parties.

Figure 7: SPV Indirect Holding Issuer Structure Diagram

Source: Pharos Research

In this structure, investors hold contractual economic benefits of the SPV, not nominal shareholder rights in the target company, and therefore typically do not have voting rights in the target operating company. This model is equivalent to issuing tokens based on SPV shareholding. There are legal documents supporting the equity relationship between the SPV and the target company, but the tokenization of SPV shares attempts to bypass the direct permission of the target company.

This model suffers from operational opacity and compliance warnings for the target company. Issuing platforms (project teams) often employ complex offshore SPV structures to seek "regulatory arbitrage." Its transparency is often one-way: investors typically only see proof of the SPV's "asset side," confirming that the SPV does indeed hold equity in the target company (through asset certificates and escrow documents); however, the SPV's "liability side"—the project team's own operational status, financial health, and specific details of token issuance—often lacks transparency, resembling a "black box." Furthermore (as will be discussed in detail later), such operations have already received legal warnings from some target companies (such as OpenAI). Examples of platforms following this path include PreStocks, Jarsy, Paimon Finance, and Robinhood.

3.3 Implementation and Compliance Path of Equity Tokenization in Non-Listed Companies

The three models analyzed above (native collaboration, synthetic mirror, and indirect holding by SPV) differ in their legal framework, investor rights, and risk exposure. This section will delve into their specific implementation methods and compliance paths.

1. Synthetic Mirror Type: Using derivatives to simulate equity.

Synthetic mirror tokens are essentially financial derivatives. Their value is not anchored to real equity, but rather tracks the valuation performance of the underlying company through a mechanism similar to "Contracts for Difference" (CFDs). This is typically achieved by "indexing" the valuation and dividing it into tradable contract units, then matching them through an on-chain protocol.

For example, Republic's Mirror Token is legally classified as a tokenization of a contingent payment note, which is a debt instrument issued by the platform and whose value is anchored to the valuation of unicorns. Ventures, on the other hand, are more straightforward, being valuation perpetual contracts (Perps) launched by Hyperliquid, and are pure contract derivatives.

From a compliance perspective, the paths taken by these tokens have diverged because they do not grant holders shareholder rights. Projects like Ventuals have adopted a purely Web3-based "regulatory circumvention" approach, with their Hyperliquid protocol explicitly not targeting US investors. Republic, on the other hand, demonstrates a different compliance strategy: its platform has a broad business scope, a high degree of compliance, and a broker-dealer license. Its Mirror Tokens (debt notes) are issued as securities under US securities laws, and it explicitly indicates whether specific products are open to US investors.

2. Native Collaborative: Achieving compliant on-chain recording of real shares.

In the field of native collaboration, market explorers are mainly focusing on Securitize and Opening Bell. Opening Bell is a sub-project launched by Superstate, and its core proposition is "real equity tokenization through issuer collaboration." Currently, its implementation cases (such as Galaxy Digital and Exodus) involve target companies actively tokenizing their equity using the Opening Bell platform.

However, it must be pointed out that Opening Bell's current implementation cases are all with listed companies, not the non-listed companies that this article focuses on. Its collaborations with non-listed companies are currently only at the promotional level, with no actual projects yet implemented. Therefore, under the native collaboration model, Securitize's path is currently a more valuable case study for analyzing the tokenization of equity in non-listed companies.

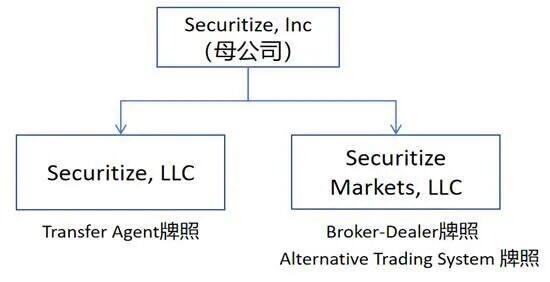

- Founded in 2017, Securitize is an infrastructure service provider specializing in RWA tokenization. Its core business model involves transforming traditional financial assets such as company equity and fund shares into compliant digital securities that can be issued, managed, and traded on the blockchain, and providing end-to-end services for these securities, from primary market issuance to secondary market trading.

- To achieve this closed-loop business model, Securitize, under the regulatory framework of the U.S. SEC and FINRA, holds three key licenses through its subsidiaries: Transfer Agent (TA), Broker-Dealer (BD), and Alternative Trading System (ATS), thus forming a complete set of compliance qualifications.

Figure 8: Schematic diagram of Securitize's compliance licensing architecture

Source: Securitize official website

Securitize's practices offer two directions for unlisted companies: one is the tokenized IPO path represented by Exodus; the other is the long-term circulation path in the private market represented by Curzio Research.

Path One: From ATS to the NYSE – Exodus's Tokenized IPO: The partnership between US crypto wallet company Exodus and Securitize serves as a benchmark case showcasing the complete lifecycle of tokenized non-listed equity. As of November 1, 2025, the project's token market capitalization reached $230 million, accounting for over 30% of the entire stock token market share. Furthermore, its successful listing on a public exchange clearly demonstrates the evolution of liquidity paths for tokenized equity at different stages of development.

(1) Project History: The collaboration between Exodus, a US-based crypto wallet company, and Securitize is a benchmark case showcasing the complete lifecycle of tokenized equity in non-listed companies. As of October 2025, the project's token market capitalization reached $230 million, making it an important part of the tokenized stock market. Its successful listing on public exchanges clearly demonstrates the evolution of the liquidity path of tokenized equity at different stages of development.

- Exodus's tokenization began in 2021 when the company, as a privately held company, partnered with Securitize to mint "equity tokens" from its Class A common equity on the Algorand blockchain using its DS protocol. Throughout the process, Securitize acted as its core transfer agent (TA), responsible for the creation, maintenance, and destruction of all tokens.

- Since then, the project has experienced a series of key development milestones: from initially supporting only peer-to-peer transfers between whitelisted wallets, to launching compliant trading on Securitize Markets and tZERO (both ATS platforms); and finally, in December 2024, Exodus successfully listed on the New York Stock Exchange (NYSE American) (ticker symbol: EXOD), officially making its tokenized equity a publicly traded security. Following its listing, to expand asset reach, Exodus announced a partnership with Superstate's Opening Bell platform in 2025 to further expand its equity tokens to the Solana and Ethereum networks, while Securitize's core role as a transfer agent remained unchanged.

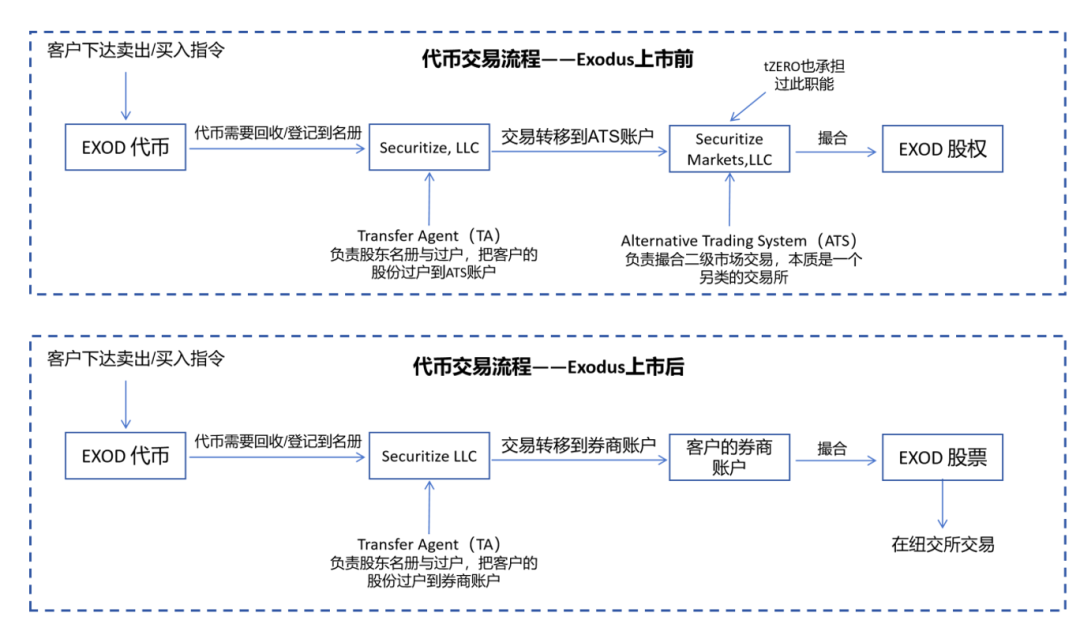

(2) Liquidity realization mechanisms at different stages of Exodus products: Depending on the stage of the asset, the liquidity realization mechanisms of Exodus stock tokens are mainly divided into the following three types:

- Pre-IPO (2021-2024): Circulation via ATS Platforms: Prior to the public listing, the primary liquidity channel for this token was licensed Alternative Trading Systems (ATS). The standard procedure was as follows: Investors first deposited their tokens with a securitize to update the shareholder register. Subsequently, the securitize transferred the corresponding holdings to an ATS broker (such as tZERO Markets or Securitize Markets). Finally, investors submitted trading instructions through the corresponding ATS platform, and the system completed the matching, execution, and settlement.

- Post-IPO (December 2024 - Present): Conversion to Publicly Traded Shares: Following a successful listing on the NYSE American, the token gained access to the public market. The standard process is as follows: investors entrust their tokens to Securitize, a transfer agent, which assists in converting the tokens into traditional registered shares (i.e., street-name holding) in their personal brokerage account. Once the conversion is complete, investors can trade regular stocks on the public market through their brokerage under the ticker symbol "EXOD".

Figure 9: Schematic diagram of the token trading process before and after Exodus' listing

Source: Paramita Venture

Basic Path: Compliant Over-the-Counter (OTC) Transfers: As a consistently existing underlying trading method, tokenized EXOD shares also support compliant OTC or peer-to-peer (P2P) transfers. The core premise of this path is that both parties' wallet addresses must be whitelisted by the transfer agent Securitize. The transaction price and consideration payment are negotiated and finalized offline by both parties, followed by on-chain token transfer. It's worth noting that during the transition period from the project's delisting from ATS to its official listing on the NYSE, this compliant OTC path was the only way to achieve liquidity at that time.

Path Two: Long-Term Circulation in the Private Equity Market – The Norm of Curzio Research's ATS: While Exodus's listing path paints the ideal picture, for the vast majority of unlisted companies, private circulation within an ATS platform is not a transitional phase to an IPO, but rather their ultimate, long-term form. The case of the US investment research firm Curzio Research profoundly reflects this common reality.

The company tokenizes its equity in CURZ tokens through Securitize and continues to trade them on tZERO's ATS platform for accredited investors. The core value of this model lies in providing a compliant, continuous, but illiquid secondary market for a wide range of private companies that are unable or unwilling to go public, thus solving the critical exit problem for early shareholders.

Its market capitalization trend (as shown in Figure 6) also confirms the characteristics of private placements on the ATS platform: after its issuance in 2022, the CURZ token's market capitalization experienced a long-term decline, bottoming out in early 2024. Subsequently, its market capitalization entered a period of high volatility, exhibiting typical characteristics of a "thin market" with scarce liquidity and low price discovery efficiency, which contrasts sharply with the high liquidity of public markets such as the NYSE.

Figure 10: Curzio Research token market capitalization chart (traded on the ATS platform)

Data source: MarketCapWatch

3. SPV indirect holding type: the mainstream "regulatory arbitrage" path

The SPV indirect holding model is currently the most mainstream practice in the field of equity tokenization of non-listed companies . Its core structure is that the issuing platform sets up a special purpose entity (SPV) (usually offshore), which holds the equity of the target company through private secondary market, and the platform then tokenizes the beneficial certificates of the SPV.

In terms of asset acquisition, SPVs primarily acquire target equity through two pathways:

- One approach involves leveraging the issuer's core resources in the traditional PE/VC field to directly acquire shares from private equity or venture capital funds that already hold equity in the target company. In this structure, the holding SPV typically acts as a new LP (limited partner) of the fund, holding shares indirectly.

- The second option is to purchase through private equity secondary market platforms (such as EquityZen, Forge Global, and Hiive). While this approach is more standardized, it may also incur additional legal structuring costs and compliance risks.

Figure 11: SPV Indirect Holding Type Token Issuance Structure Diagram

Data source: Pharos Research

The key to this model lies in circumventing the transfer restrictions in the target company's shareholder agreement. Since the share acquired by the SPV is typically small, and the transaction (such as in Path One) may be considered a transfer of LP shares within the investor fund, it often does not require reporting to the target company. This provides the platform with legal leeway to temporarily bypass the target company's permission.

However, this model often operates with a lack of transparency. Issuance platforms utilize complex offshore SPVs, offering only one-sided transparency: investors can only verify the SPV's asset holdings (the underlying equity), while the project's own financial health and operational details remain a "black box." This lack of transparency is also specifically reflected in its issuance model, with common market practices falling into two categories:

- The "buy first, sell later" model refers to a situation where the project team (and its subsidiary SPVs) first purchases equity in the target company using their own funds, then tokenizes the equity held by the SPVs and sells it to the public to raise funds. This model is relatively stable, as the assets are locked up in advance.

- The "issue first, buy later" model refers to a project where the project team first issues tokens to raise funds, and then promises to use the funds raised to purchase equity in the target company. This model carries high risks, as the project team may face insufficient fundraising, fluctuations in the price of the target asset, or even the inability to fulfill its commitment to purchase the asset, exposing investors to significant uncertainty.

Of course, this lack of transparency in operations is relative. Compared to "synthetic mirror-image" derivatives that have no asset backing whatsoever, the SPV model at least provides tangible equity asset backing, thus offering relatively higher asset stability.

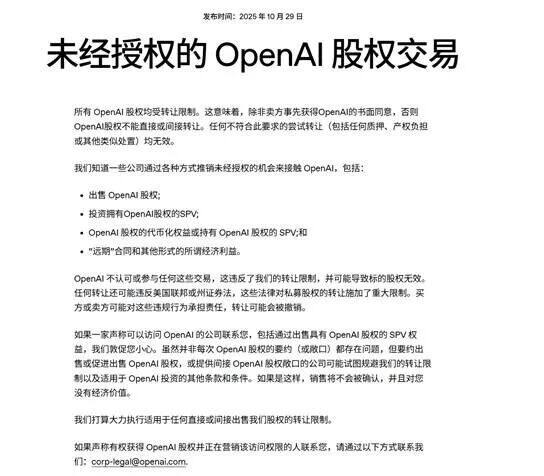

However, the real concern with this model lies not in its internal operational risks, but in the external legal and compliance challenges posed by its "regulatory arbitrage" structure. Because the project's unauthorized tokenization has been publicly opposed by some target companies (such as OpenAI), SPV shareholding under this "regulatory arbitrage" model often faces dual restrictions from both regulatory compliance (from the government) and corporate legal departments (from the target company). This will be discussed in detail below.

IV. Reflection and Outlook

4.1 Proceeding with Caution: The Core Bottleneck of Equity Tokenization in Non-Listed Companies

While the tokenization of equity in non-listed companies has shown the potential to reshape a trillion-dollar market, its current development is still in its very early stages and faces four core bottlenecks that urgently need to be addressed.

1. Compliance Challenges: The Double Threat of Government Regulation and Corporate Legal Affairs

Compliance is the primary and most complex bottleneck currently facing the tokenization of equity in non-listed companies. Unlike the tokenization of listed stocks, the tokenization of equity in non-listed companies not only faces securities law regulations from agencies such as the SEC (Securities and Exchange Commission), but also legal risks from the target company itself.

In particular, the SPV indirect holding model is essentially an attempt to circumvent transfer restrictions in the target company's shareholder agreement for regulatory arbitrage. Recently, companies such as OpenAI and Stripe have issued public warnings (as shown in Figures 8 and 9), explicitly stating that the equity held by the SPVs behind such tokens violates the transfer agreement, their token holders will not be recognized as company shareholders, and that SPVs holding shares in this manner may be subject to sanctions by the company.

Figure 12: OpenAI's warning announcement regarding tokenized equity

Source: OpenAI official website

Figure 13: Stripe's warning announcement regarding tokenized equity

Source: Stripe official website

This risk has rapidly become a reality. For example, after Robinhood (which has an entity in Lithuania) launched the OpenAI token in June 2025, it immediately received a public warning from OpenAI in July (as shown in Figure 10) and was investigated by Lithuanian regulatory authorities within the following week. This dual pressure from government regulation and corporate legal affairs constitutes the greatest compliance uncertainty at present.

Figure 14: The X post that landed Robinhood in the investigation

Source: OpenAI's official X account

Nevertheless, it should be noted that there are certain mitigation mechanisms for the risks of such dual pressures.

- On the one hand, the complex SPV legal structure constructed by the project team objectively exploits the legal ambiguity of the "equity transfer restriction" clause. Although the target company publicly opposes it, there is still uncertainty as to whether it can successfully prevent such indirect transfer at the legal level—moreover, the time and economic costs of such legal proceedings are extremely high, and it is unknown whether the target company has a strong motivation to enter into legal proceedings.

- On the other hand, only a minority of companies have publicly expressed strong opposition (such as OpenAI and Stripe), while most leading companies in the market (such as Musk's SpaceX) have adopted a "no comment" strategy, which is interpreted by the market as tacit approval.

- More importantly, as crypto assets are increasingly accepted by mainstream finance, corporate attitudes towards tokenization are also dynamically evolving (for example, some companies have begun to adopt DAT treasury strategies). Therefore, it is indeed possible that companies currently opposed to tokenization will turn around and seek cooperation in the future—a dramatic turn of events. We believe that the core direction of future evolution in this field lies in whether it can promote the integration of the "SPV indirect holding" model into the "native collaborative" model. The key dividing line lies in the penetration of crypto assets into traditional financial and technology companies.

2. Unclear price discovery mechanism: lack of a fair value anchor.

The pricing mechanism for tokenized equity also has significant flaws. The equity of non-listed companies lacks continuous public market pricing, and its valuation anchor (such as the valuation of the most recent round of financing) is infrequent, lagging, and opaque. When such non-standard assets are tokenized and placed in a 24/7 market, the effectiveness of their price discovery mechanism is severely tested.

For investors, it's difficult to discern the rationality of a token price—is it anchored to a lagging financing valuation or a speculative premium reflecting market sentiment? This makes secondary market token prices more susceptible to significant fluctuations due to market sentiment, potentially deviating significantly from the true valuation in the primary market. When the target company (or its industry) faces extreme market volatility, this pricing mechanism lacking a stable value anchor may fail, and its potential risk transmission mechanism remains unclear.

3. Liquidity Dilemma: Constraints of Market Depth and Scale

While one of the core goals of tokenization is to unlock liquidity, this goal has not been achieved, judging from the current market performance. As shown in Table 3 above, the market capitalization of freely tradable equity tokens (excluding Securitize and Archax) is extremely low, with most only in the millions of dollars, and trading is mainly scattered on DEXs (decentralized exchanges).

This combination of small market capitalization and fragmented trading results in a severe lack of liquidity depth. The market exhibits typical thin market characteristics: bid-ask spreads are significantly widened, and any slightly larger order can easily trigger sharp price slippage. This fragile market structure makes token prices highly susceptible to shocks and volatility, failing to effectively support large exit demands from traditional shareholders and significantly increasing transaction costs and risks for ordinary investors.

4. Difficulties in IPO transition: The ultimate risk of the SPV model

When tokenized private companies (such as OpenAI) eventually seek an IPO, the existing SPV model will face significant transition challenges. As warned by companies like OpenAI, indirect shareholding through an SPV may violate "transfer restrictions," leading to legal obstacles for the registration and conversion (into publicly traded shares) of the shares held by the SPV controlled by the token issuer during the IPO. If the SPV's shareholder status is not recognized, its tokens cannot be converted into publicly traded shares, thus preventing them from being sold on the open market to realize value exit, and potentially excluding them from future shareholder rights (such as dividends and rights issues).

Currently, the only successful example of transitioning from tokens of non-listed companies to shares of listed companies is Exodus, a case involving Securitize. However, even this compliant path is not without its challenges. During the nearly one-year transition period in which Exodus delisted from the ATS platform and prepared for its listing on the NYSE American, trading in its tokenized equity almost completely ceased (only the compliant OTC path remained), and market liquidity stagnated.

Furthermore, once the nature of the assets changes from pre-IPO equity to publicly traded stocks, the complexity of compliance, clearing and settlement, and transfer agency will increase significantly. Currently, the project teams that lead SPV issuances (mostly Web3 teams) generally lack the professional licenses (such as Broker-Dealer, Transfer Agent, etc.) and operational experience required to handle post-listing compliant securities. This lack of operational capability adds new uncertainty to whether the assets can smoothly transition to the public market, and also makes the value realization path of the SPV model in the crucial final exit stage unclear.

Of course, facing this "endgame" dilemma, some SPV-based projects are actively building compliance qualifications for tokenizing listed company stocks (such as considering acquiring securities brokers with compliant licenses). Other projects have proposed an alternative exit strategy: after the target company's IPO, the SPV (as the original shareholder) immediately liquidates all its shares after the lock-up period expires, and then distributes the resulting fiat currency gains as "dividends" to all token holders. This approach theoretically circumvents the compliance issues of "token-to-stock" conversion, but its effectiveness, liquidation timing, and the project's reputational risk have not yet been validated by the market and time.

4.2 Outlook: Three Major Trends in Equity Tokenization of Non-Listed Companies

Despite the aforementioned bottlenecks, the tokenization of equity in non-listed companies remains one of the most promising areas in the RWA (Real Money Exploitation) sector, and its potential to reshape traditional financial structures cannot be ignored. We believe that after the current phase of rapid growth, the market will evolve towards the following three key trends:

1. Evolution of Driving Forces: From "One-Way Arbitrage" to "Two-Way Integration"

The legal frictions arising between the SPV model and target companies (such as OpenAI) clearly reveal the frictions and limitations faced by circumventing the issuer. Such operations directly touch upon the core clauses regarding transfer restrictions in the target company's shareholder agreement, not only triggering legal risks but also leading to public resistance from the target company (such as Stripe and OpenAI).

However, the real breakthrough driving the market's direction doesn't solely stem from external regulatory pressure, but rather from a shift in the attitude of the target companies (non-listed companies) themselves—from passive defenders to active participants. As Web3 and crypto assets gradually enter the purview of Wall Street and traditional finance, technology companies' understanding of tokenization is rapidly maturing. They are beginning to reassess the advantages that tokenization (such as STOs) may offer as an efficient, global capital strategy tool compared to traditional IPOs, including:

(1) Lower issuance costs;

(2) Access to a broader global pool of compliant capital;

(3) Obtain continuous price discovery and market value management capabilities before the IPO.

Therefore, the mainstream market path in the future may not be a simple replacement of "SPV arbitrage" by "native collaboration," but more likely a fusion and transformation. The divergence in the attitudes of target companies (OpenAI's resistance and SpaceX's silence) and dynamic evolution (such as some companies having begun to adopt the DAT treasury strategy) make it highly likely that some companies that currently hold opposing views may dramatically seek proactive cooperation in the future—just like the attitudes of countless business stars and politicians towards BTC.

We believe that the core direction of future evolution in this field lies in whether it can promote the integration of the "SPV indirect holding" model and the "native collaboration" model—that is, whether the SPV model can gradually gain the recognition of issuers by virtue of its flexibility and market acumen, and ultimately transform "regulatory arbitrage" into "issuer-led" compliant collaboration.

2. Infrastructure Evolution: From DEX Speculation to Native RWA Liquidity Deepening

The current liquidity crisis in thin markets on DEXs cannot be resolved by retreating to traditional, non-native trading systems like ATS. The future of crypto trading assets lies in building and deepening true "on-chain native liquidity."

It is foreseeable that the focus of the next phase will be on infrastructure development, which specifically includes:

(1) The extensive deployment of multi-chain and L2 has brought assets to new continents such as Solana and Base, which have a large number of users and capital;

(2) The emergence of dedicated RWA protocols and the construction of DEXs on them that provide order books, market makers and clearing services specifically for security tokens (rather than memecoins);

(3) The project team builds its own exchange or dedicated liquidity layer to manage the secondary market of its tokens in a more centralized and efficient manner (under the premise of compliance) to ensure the stability of the market depth.

3. Target Evolution: From Super Unicorns to Long-Tail Private Enterprises

Currently, the market is highly concentrated on star unicorn companies like OpenAI and SpaceX. In their early stages, this was largely driven by marketing motives to attract market attention. However, these leading companies are typically well-funded and have robust legal mechanisms, and their shareholder agreements pose the most severe legal challenges and resistance to the tokenization path of the SPV model. In contrast, a large number of mid-to-late-stage, non-leading unicorns—and even some established private companies—are more motivated to actively collaborate.

Therefore, another vast untapped market for tokenization may lie in serving tens of thousands of established private companies seeking exit paths beyond IPOs. As the Curzio Research case demonstrates, these long-tail value companies may not have immediate IPO plans, but their employees and early investors have urgent liquidity needs. Only when these companies actively seek partnerships with native liquidity platforms can the private equity tokenization market truly shift from marketing-driven to pragmatism, ushering in a phase of large-scale explosive growth and unleashing its true market potential.

V. Conclusion

Tokenization of equity in non-listed companies aims to provide a solution to the "siege" of the world's largest but most illiquid asset pool, worth trillions of dollars. This report, through analyzing its market size, core pain points, mechanism advantages, mainstream models, and future challenges, draws the following conclusions:

First, the market exhibits a stark contrast between its "trillion-dollar potential" and its "tens of millions in reality," indicating it is still in its very early stages. On one hand, the equity of unlisted companies, represented by unicorn enterprises, constitutes a massive "walled city" worth trillions of dollars—long plagued by pain points such as "difficulty in participation" (high barriers to entry prevent investors from entering) and "difficulty in exiting" (long-term lock-up periods prevent PE/VC shareholders from exiting). On the other hand, in stark contrast to its enormous potential, the current (excluding sandbox and ATS projects) market capitalization of freely tradable tokens is only in the tens of millions of dollars. This indicates that the market is still in its very early, nascent stage, and its core functions, such as price discovery and liquidity release, are far from being realized.

Second, the current model exhibits a divergence in exploration paths. The market has differentiated into three models: native collaborative models (such as Securitize) represent the ideal compliance path, but have a long implementation cycle and few cases; synthetic mirror models (such as Ventures) are pure Web3 derivatives; while SPV indirect holding models (such as PreStocks and Jarsy) are currently the most prevalent practical path. This model has pioneered the market through its flexible architecture, but it also has issues that urgently need improvement in areas such as communication with the target company and final IPO arrangements.

Third, the core of future market evolution is "integration and transformation," rather than simple "replacement." The SPV model, as a pioneering force that first validated market demand through its flexibility, is currently facing challenges in regulatory compliance, IPO finalization, and liquidity shortages, which are driving it towards a more mature model. The core driving force in the future will be the shift in the attitude of non-listed companies (issuers) themselves—that is, with the increasing mainstreaming of Web3, real-world enterprises are beginning to proactively view tokenization (STO) as a new and efficient financing and market capitalization management tool. This maturing understanding will drive the SPV model from one-way market exploration to compliant collaboration involving "target company participation."

Fourth, the blue ocean of long-tail private enterprises and the implementation of native infrastructure are key to large-scale explosive growth. The true blue ocean of tokenization is not limited to super unicorns, but rather to a broader range of mature long-tail private enterprises seeking exit paths (as shown in the Curzio Research case). When these utility-driven issuers are combined with tailor-made "native RWA liquidity infrastructure" (such as dedicated RWA protocols and L2 deployments), the private equity tokenization market will truly move from a "marketing-driven" prologue to a "utility-driven" stage of large-scale explosive growth.

In conclusion, the tokenization of equity in non-listed companies is at a critical juncture, gradually moving from spontaneous market exploration to "ecosystem compliance and collaboration." This sector is undoubtedly one of the most worthy of long-term attention and exploration for RWA and even the entire crypto-finance field. Its final form remains to be seen, but once this door is opened, it may herald the beginning of a completely new financial model.

Reference source

[1] Kumar, S., Suresh, R., Kronfellner, B., Kaul, A., & Liu, D. (2022, September 12). Relevance of on-chain asset tokenization in “crypto winter”. Boston Consulting Group & ADDX.

[2] Citi Global Perspectives & Solutions. (2023, March 30). Money, Tokens, and Games: Blockchain's Next Billion Users and Trillions in Value. Citigroup.

[3] Hurun Research Institute. (July 2025). Press release for the Global Unicorn Index 2025.

[4] CB Insights. (July 2025). The Complete List of Unicorn Companies. CB Insights Official Database.

- 核心观点:股权代币化破解非上市公司流动性困局。

- 关键要素:

- 市场潜力超万亿,实际规模仅千万级。

- SPV间接持有成为当前主流实践模式。

- 面临监管合规与IPO衔接核心挑战。

- 市场影响:为PE/VC开辟全新退出渠道。

- 时效性标注:长期影响