With a 20-fold increase in 3 months, is ZEC's "Bitcoin Silver" narrative tenable?

- 核心观点:隐私币板块强势回归,ZEC领涨。

- 关键要素:

- ZEC三个月涨幅20倍,创七年新高。

- 灰度信托重启,机构资金流入。

- 屏蔽池余额增长,真实需求支撑。

- 市场影响:推动隐私板块普涨,重塑市场叙事。

- 时效性标注:短期影响

The cypherpunks' pursuit of privacy can be traced back to the birth of Bitcoin 16 years ago, which embedded privacy mechanisms within a completely transparent ledger, thus ushering in the entire cryptocurrency world. Even today, privacy remains a crucial issue in the crypto space.

If you bought ZEC when Mert, the "version king" of this round of crypto, first recommended it and have held it until now, you could have achieved a rare 20x return in less than 3 months, a feat uncommon among altcoins this year.

When ZEC surged from $238 to $580 in 40 days, a 20-fold increase in three months, reaching a seven-year high, the crypto market realized that a long-forgotten sector was making a strong comeback. The entire privacy coin sector has surged by about 80% in the past 7 days, with established projects such as DASH, DCR, and ZEN seeing gains of over 100%.

Even more surprising is the shift in market sentiment. Just a few months ago, privacy coins were labeled as "regulatory outcasts," with Kraken delisting XMR and the EU's 2027 ban draft causing investors to shy away. But now, "privacy is a necessity, not a feature" has become a frequent topic on Twitter, Arthur Hayes publicly declared "ZEC's target is $10,000," and Vitalik has repeatedly endorsed ZKsync.

What is the real driving force behind this market rally? Is it the demand for safe-haven assets under regulatory pressure, or pure speculative trading? More importantly, how long can this surge last?

Who are leading the price increases?

ZEC is undoubtedly the absolute leader in this round of market rally. Starting from $237.84 on October 23, it reached $532.06 on November 7, a 120% increase in 40 days, and a cumulative increase of 700% year-to-date. This price not only set a new high since 2018, but also brought ZEC back into the spotlight of mainstream investors.

Looking back at several key moments, the upward trajectory of ZEC can be clearly seen:

October 1: Grayscale announced the reopening of the ZEC Trust (ZCSH), offering fee waivers and staking capabilities. ZEC surged 22% that day.

October 24: A "flag breakout" pattern emerged in the technical chart, with on-chain indicators OBV and CMF rising in tandem, resulting in a 40% increase within 4 days;

November 1st: Open interest (OI) surpassed $770 million for the first time. Arthur Hayes again called for a "target of $10,000," triggering a short squeeze and resulting in a 15% intraday increase.

November 7: Prices broke through $532, and 24-hour spot trading volume reached $1.75 billion, 1.4 times the monthly average.

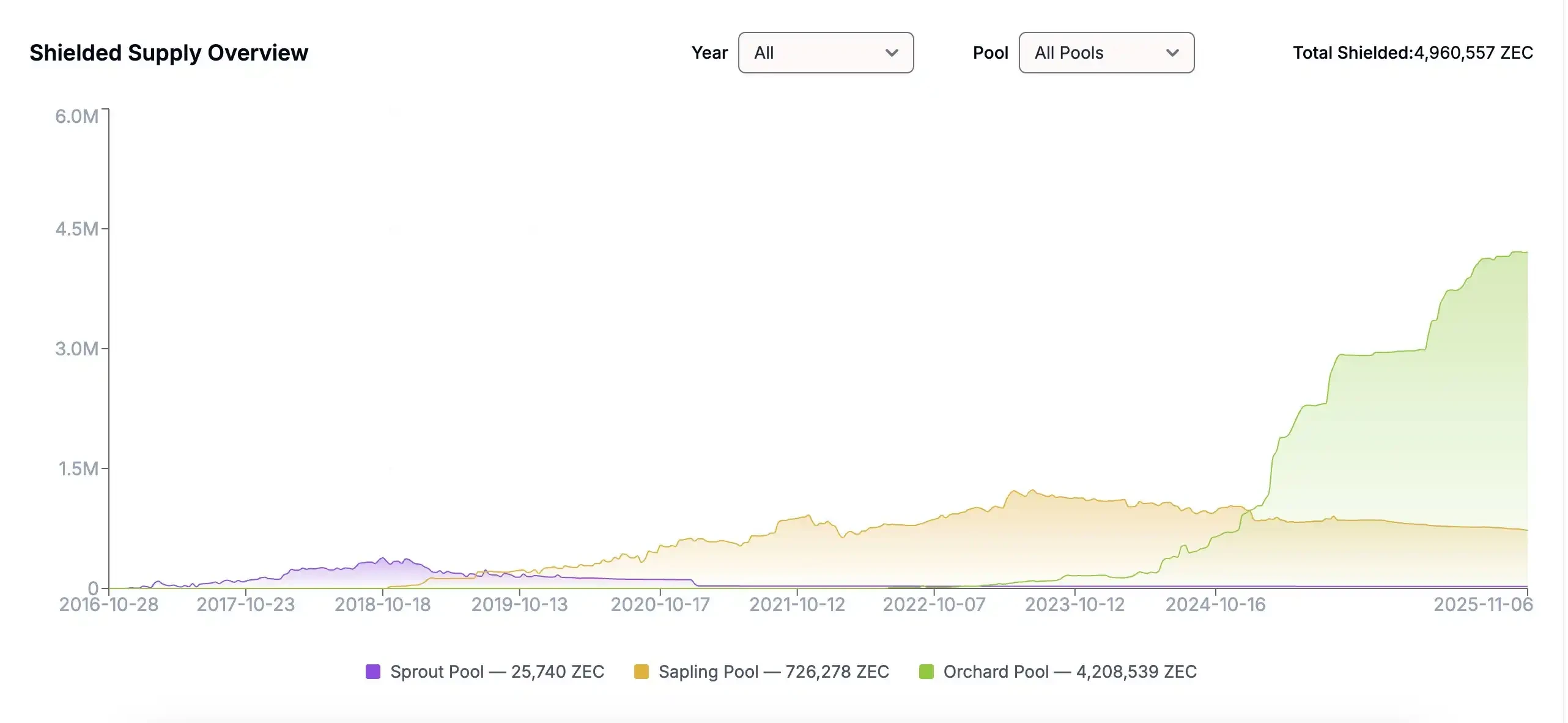

More noteworthy is the improvement in fundamentals: the ZEC shielded pool balance surpassed 5 million ZEC for the first time, representing approximately 30% of the circulating supply. This equates to $2.5 billion in funds choosing a completely anonymous storage method. Daily transaction volume increased from 10,000 to 12,600, with shielded transactions jumping from less than 10% to 25-30%. These figures indicate that ZEC's rise is not purely speculative but is supported by genuine privacy needs.

ZEC's strong performance ignited the entire privacy sector, and a number of previously forgotten established projects also experienced a surge:

There are two key drivers behind this collective surge:

First, there was a surge in new listings on trading platforms. From November 2nd to 6th, Binance, OKX, and Bitget successively launched perpetual contracts or new spot trading pairs for DASH, ZEN, and SCRT, bringing not only increased liquidity but also amplifying effects from high-leverage derivatives. Taking DASH as an example, the 24-hour spot and contract trading volume exceeded $1.2 billion, a 2.8-fold increase compared to the previous period.

Secondly, there are substantial advancements in technology or protocols. DASH became a native asset of the Maya Protocol on November 2nd, enabling anonymous cross-chain swapping; ZEN completed its migration to Base L2, doubling the efficiency of zk-SNARK; and SCRT and ROSE benefited from the new narrative combining privacy computing with AI.

In addition, there is a special player in the privacy section: ZKsync (ZK).

From a technical perspective, ZK is Ethereum's Layer-2 scaling solution, and transactions at the main chain level remain transparent; however, due to its optional ZK privacy features and the Prividium enterprise private chain, mainstream platforms such as CoinGecko and Santiment categorize it under the privacy category.

Over the past 7 days, ZK has surged by more than 130%, becoming one of the top-performing projects in the privacy sector. This performance is driven by three factors:

The Atlas upgrade brings a performance leap: Fully activated on November 1st, the Atlas upgrade theoretically increases TPS from 2,000 to 15,000-30,000, reduces ZK finality from 3 hours to 1 second, and lowers single transaction fees from $0.0013 to below $0.0001. Previously, ZK's biggest limitation was its significantly higher fees compared to OpenFlow; however, the Atlas upgrade has greatly improved this issue.

Token economic model restructuring: The "ZKnomics Part I" proposal announced on November 4th is the first to redirect network transaction fees and enterprise licensing fees back to Treasury for "buy-back-burn + staking rewards," transforming ZK from a pure governance token into a cash flow asset. The estimated staking APY is 8-12%.

Vitalik's public endorsement: On November 1st, Vitalik posted two tweets stating that ZKsync was "undervalued," and ZK's trading volume surged 30-fold that day. The endorsement from a key figure played a crucial catalytic role in market sentiment.

What are the underlying logics behind the rise of the privacy narrative?

"Shelter Premium" under Regulation

On the surface, tightening regulations should suppress privacy coins, but the reality is quite the opposite; it is precisely because of the high pressure of regulation that the demand for privacy has been stimulated.

Tightening policies are accelerating. The EU's draft Anti-Money Laundering Regulation (AMLR) explicitly proposes to completely restrict the trading of privacy coins within the EU by 2027; the US Financial Crimes Enforcement Network (FinCEN) also plans to increase scrutiny of "high-risk self-custody addresses." With Bitcoin and Ethereum spot ETFs coming under regulatory scrutiny, all on-chain transactions are facing stricter tracking.

As compliant assets become more transparent, privacy assets are becoming increasingly scarce.

Therefore, Western media have even dubbed this round of market activity the "Crypto Anti-Surveillance Wave." ZEC and XMR have been redefined as the "last line of defense for on-chain anonymity." Social media consensus is even more direct: "Privacy is not a feature, but a fundamental right."

On-chain data confirms the growth in real demand.

The ZEC shield pool balance grew from 4 million to 4.9 million in 40 days, an increase of 25%; the proportion of shielded transactions jumped from less than 10% to 25-30%, indicating that more and more users are choosing completely anonymous transactions. The more users there are, the stronger the privacy guarantee, and the more pronounced the network effect.

The increased on-chain activity of ZEC, DASH, and ROSE is further evidence of this. ZEC's daily transaction volume increased from approximately 10,000 transactions on October 1st to 12,600 transactions on November 7th, a 26% increase. DASH's 30-day average on-chain transaction volume increased by 15%, from approximately 1,300 transactions to 1,500 transactions; and ROSE saw an even more dramatic surge of 200%, from approximately 3,300 transactions to 10,000 transactions.

ZK's TVL rebound is also noteworthy. After the Atlas upgrade was activated, ZKsync Era's TVL rebounded from $500 million to $600 million, an increase of 20%, which is a counter-trend growth achieved against the backdrop of declining TVL across the entire Layer-2 ecosystem.

Trading platform inflow data also reflects the trend of locked-up tokens. ZEC's net inflows to trading platforms plummeted from $41.8 million to $3.66 million in 48 hours, a drop of 91%. This indicates that holders are not engaging in short-term speculation, but rather are optimistic about the long-term growth in privacy needs.

ZEC's grayscale effect

The return of institutional funds is one of the most important catalysts for this round of market rally.

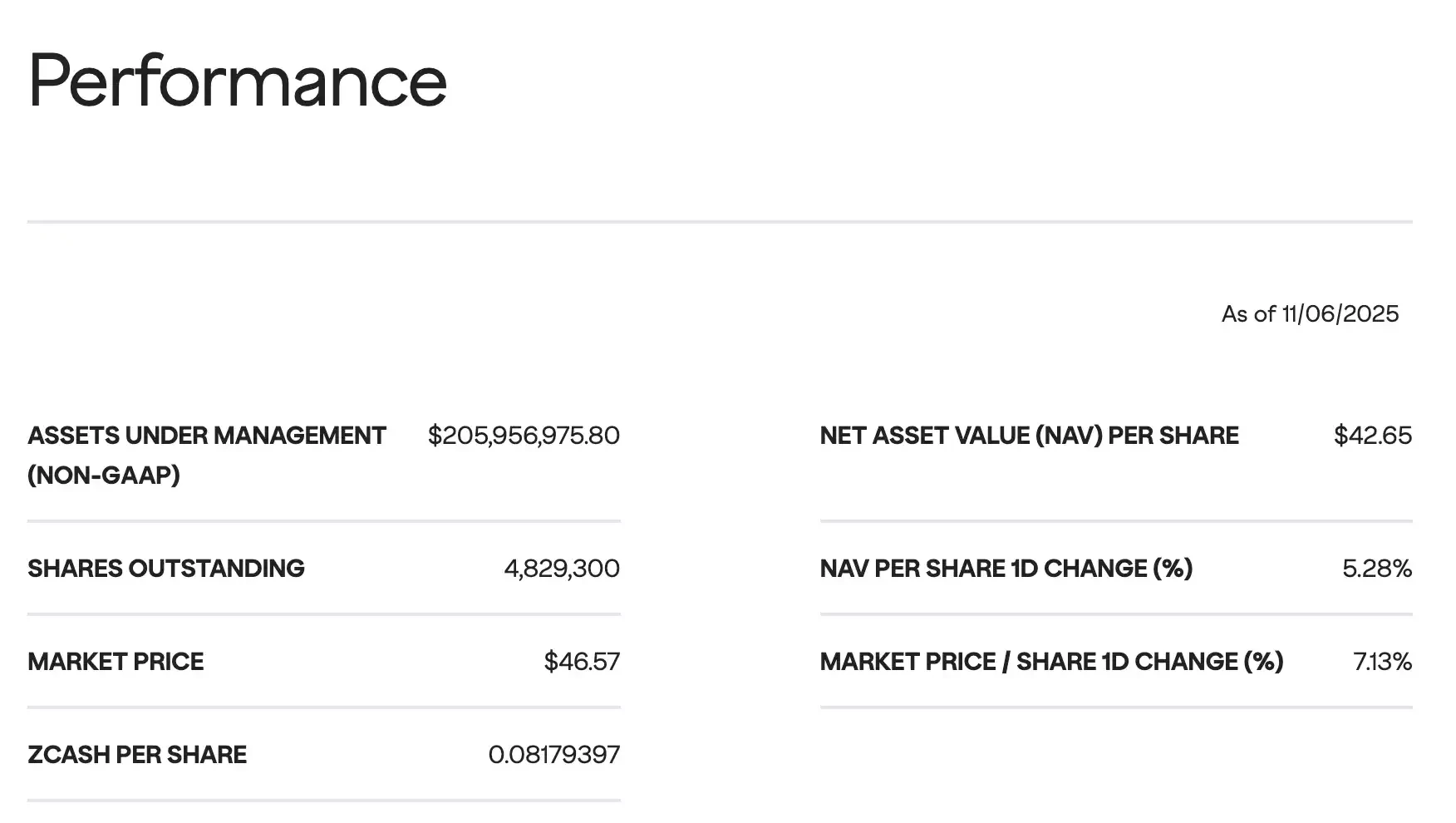

The relaunch of Grayscale's ZEC Trust was the most significant event in October. On October 1st, Grayscale announced the reopening of new subscriptions for the ZCSH Trust, offering two major upgrades: waiving management fees and adding a staking function, providing an annualized return of 4-5%. This combination significantly improved the risk-reward ratio.

Why is the name "Grayscale" so valuable? Because for the past decade, Grayscale has been virtually the only compliance bridge and price indicator for traditional institutions allocating to crypto assets. Its trusts issued in the United States have long provided crypto exposure for pension funds, family offices, and hedge funds, making it a leading indicator of institutional entry scale and changes in preferences.

Since launching its first Bitcoin Trust in 2013, Grayscale has successively launched more than ten single-asset trusts, including ETH, SOL, LTC, BCH, ETC, FIL, and XLM. Many of these assets have experienced the typical "Grayscale effect"—capital inflows driving price increases, widening premiums, and forming a consensus narrative. The ZEC Trust (ZCSH), first established in 2017, also experienced a period of soaring premiums during the 2020-2021 bull market, and at one point became a major target for institutional allocation in the privacy sector.

However, following stricter regulations and compliance pressures on privacy coins, ZCSH suspended subscriptions in 2022 and entered a period of inactivity in 2023. This resumption signifies Grayscale's renewed endorsement of privacy assets, and its signaling significance is even greater than the funds themselves.

Data shows that ZCSH's AUM (Assets Under Management) surged 228% in one month, from approximately $42 million to $136 million, accounting for about 1.9% of ZEC's circulating supply. For an asset with a daily trading volume of hundreds of millions of dollars, nearly 2% of the tokens are locked in the trust for a long period of time, resulting in a significant tightening effect on the supply side.

A deeper logic lies in the circumvention effect of ETFs. The approval of Bitcoin and Ethereum spot ETFs has brought these assets under a strict regulatory framework, making every transaction traceable. To circumvent this transparency, some institutions and high-net-worth individuals have begun shifting their funds to anonymous assets. Grayscale's ZEC Trust conveniently provides a compliant channel—offering exposure to privacy coins while still allowing operations through traditional financial channels.

Common positions of the crypto version's son

Social media has acted as an amplifier in this round of market activity.

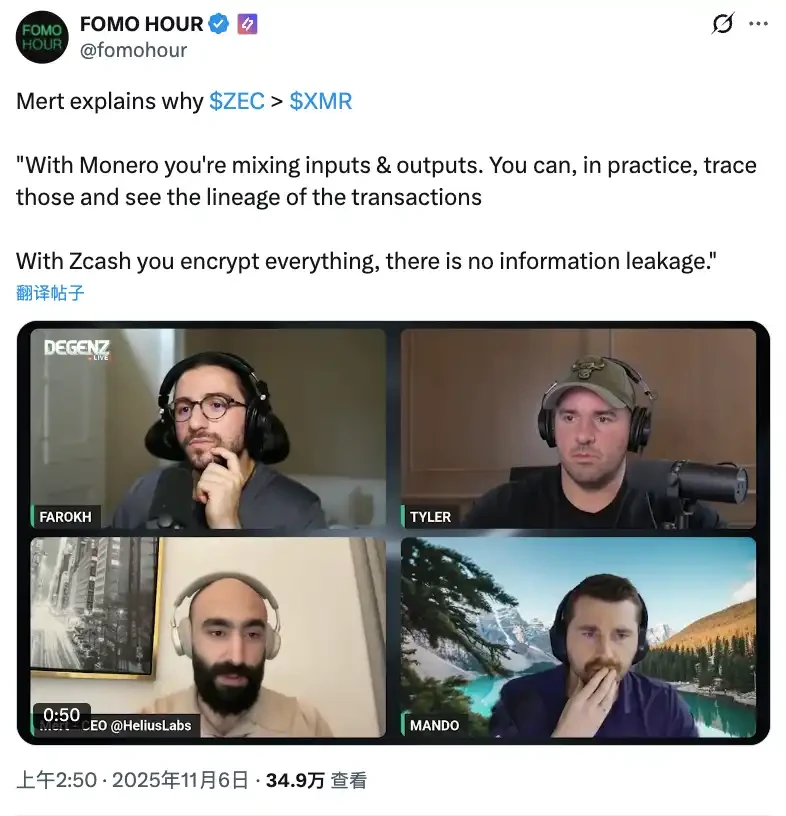

During ZEC's surge, Mert ( @0xMert_ ), considered the driving force behind this Solana ecosystem version, was undoubtedly one of the most crucial voices behind the price increase. As the CEO of Helius, the core infrastructure of Solana, and one of the most recognized voices in the Solana ecosystem, Mert began heavily recommending ZEC at $30 and consistently promoted it almost daily on X, live streams, and podcasts. Consequently, the ZEC community and the Solana community have significant overlap.

Even more catalyzing was Arthur Hayes's continuous market recommendations. This BitMEX co-founder was one of the most astute predictors of cyclical shifts during the last bull market. His initial prediction of a $1,000 target for ZEC on October 31st was already remarkable; he then increased it to a $10,000 target on November 1st, positioning ZEC as a "safe-haven asset in the crypto market." This tweet garnered over 200,000 interactions in a single day, causing ZEC trading volume to surge and a short-term 15% increase.

Subsequently, Naval Ravikant's statement elevated the ZEC narrative from a "speculative asset" to a "debate over values versus technological approaches." Naval redefined the value foundation of privacy assets with the statement, "Privacy is a fundamental right, not a tool for crime."

Vitalik Buterin, a self-proclaimed "biggest ZK enthusiast," tweeted a series of times on November 1st that ZKsync was "undervalued," which directly led to a 30-fold surge in trading volume of ZK-related assets, fueling the ZK sector and making "ZK Seaon is here" a hot topic.

Is ZEC really "Bitcoin Silver"?

Amidst the price surge of ZEC, the community has presented a narrative of it being "Bitcoin Silver." But is this positioning truly tenable?

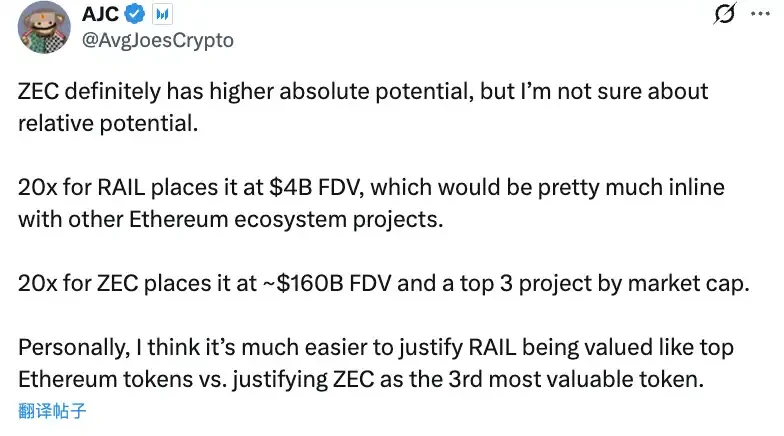

Optimists believe that ZEC's rise is not solely due to the privacy narrative. A key piece of evidence is the divergence in market performance: if ZEC's rise is only driven by privacy needs, then RAIL, as a core privacy project within the EVM ecosystem, should also benefit.

RAIL is a privacy protocol on the Ethereum ecosystem that anonymizes ETH, ERC-20 tokens, and NFTs. More importantly, Vitalik Buterin himself has not only anonymized millions of dollars' worth of ETH using RAIL, but has also natively integrated it into his new project, Kohaku (a wallet SDK), with MetaMask and OKX wallets as partners. Fundamentally, RAIL charges a 0.25% fee on funds entering and leaving its privacy pool, and 77% of its token supply is staked and locked for 30 days, meaning the actual circulating supply is far lower than the stated figures. This is a project with a clear business model and tokenomics, rather than a purely speculative investment.

However, in mid-to-late October, a key signal emerged in the market: ZEC continued its surge, while RAIL began to stagnate. This may indicate that ZEC's rise was not solely due to privacy concerns, but rather a market revaluation of its monetary attributes and store-of-value function. In other words, privacy may have been merely a catalyst; the real narrative is "Can ZEC become the silver of Bitcoin?"—a narrative with a much higher ceiling.

Optimists believe ZEC possesses all the elements to become "Bitcoin Silver." From a technical perspective, ZEC employs a Proof-of-Work (PoW) mechanism, ensuring network security through a competition of computing power, just like Bitcoin. This aligns better with the principle of "monetary neutrality" than Proof-of-Stake (PoS)—no one can control the network simply by holding coins. ZEC's total supply is fixed at 21 million coins; this hard-cap supply mechanism is a core characteristic of value stores, avoiding the risk of inflationary dilution. More importantly, ZEC's privacy features are not a burden but an advantage: in a world of increasingly stringent regulations and complete transparency in on-chain transactions, privacy is shifting from an "optional feature" to a "monetary necessity." While every Bitcoin transaction can be tracked and every address can be tagged, ZEC's transaction shielding provides true fungibility—one of the most fundamental attributes of currency.

From a valuation perspective, optimists also point out that ZEC's market capitalization is still extremely low relative to Bitcoin, implying significant room for revaluation. If ZEC is truly accepted by the market as a store of value, even if it only receives 5-10% of Bitcoin's share, it represents a potential upside of several times. Historically, the value ratio of silver to gold has fluctuated between 1:50 and 1:80. Using the same logic, ZEC still has a substantial valuation gap to close relative to Bitcoin.

But the pessimists offered a completely different perspective.

They believe that if ZEC's value truly lies in its role as a "currency/store of value," then Ethereum, not ZEC, is the real challenger to Bitcoin.

Ethereum not only boasts smart contracts, a massive DeFi ecosystem, and institutional recognition, but more importantly, it has effectively become a "programmable currency"—hundreds of billions of dollars in stablecoins circulate on Ethereum, and hundreds of billions of dollars in value are locked in Ethereum's DeFi protocols. In contrast, while ZEC offers privacy and a fixed supply, it lacks ecosystem depth and application scenarios, making it more like a "single-function tool" than an "all-around currency."

Within this framework, pessimists are more optimistic about projects like Railgun. By enhancing Ethereum's privacy, Railgun is effectively improving ETH's monetary attributes. This means that Railgun benefits not only from the privacy narrative but also from Ethereum's monetary narrative—it stands on a larger, more mature ecosystem, rather than attempting to build a new monetary system from scratch.

From a valuation perspective, there is a significant difference in the upside potential between the two. If RAIL increases 20 times, its fully diluted valuation (FDV) will reach $4 billion, which is roughly in line with the valuations of other top projects in the Ethereum ecosystem, making it easily understandable and acceptable to the market. However, if ZEC increases 20 times, its FDV will reach $160 billion, becoming the third-largest cryptocurrency by market capitalization, after Bitcoin and Ethereum. This requires the market to believe that ZEC can truly stand shoulder-to-shoulder with Bitcoin and Ethereum—an extremely high hurdle.

This is not a question that can be resolved through theoretical debate, but rather requires the market to answer with concrete actions: Will the ZEC shield pool balance continue to grow in the next 12-24 months? Will institutions allocate ZEC through compliant channels like Grayscale? Will regulatory pressure overwhelm ZEC or instead strengthen its scarcity?

The answers to these questions will determine whether ZEC's "Bitcoin Silver" narrative holds true, and will also determine the sustainability and depth of this privacy coin rally.