Following its $1.25 billion SPAC listing, Securitize will issue on-chain "true equity" shares.

- 核心观点:Securitize将推出原生链上股票,实现法律确权。

- 关键要素:

- 代币代表真实股份,享有完整股东权利。

- 已与贝莱德等巨头合作,代币化资产超30亿美元。

- 计划通过SPAC合并上市,估值达12.5亿美元。

- 市场影响:推动RWA从概念验证进入制度融合阶段。

- 时效性标注:中期影响。

Original article | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

On December 17th, the RWA platform Securitize announced plans to launch a native on-chain stock product in the coming months, with a target timeframe of Q1 2026. Unlike most "stock tokenization" solutions on the market, Securitize will directly issue real, regulated shares on the blockchain and simultaneously record them in the issuer's official capital structure table; its tokens represent full shareholder rights, including dividends and proxy voting.

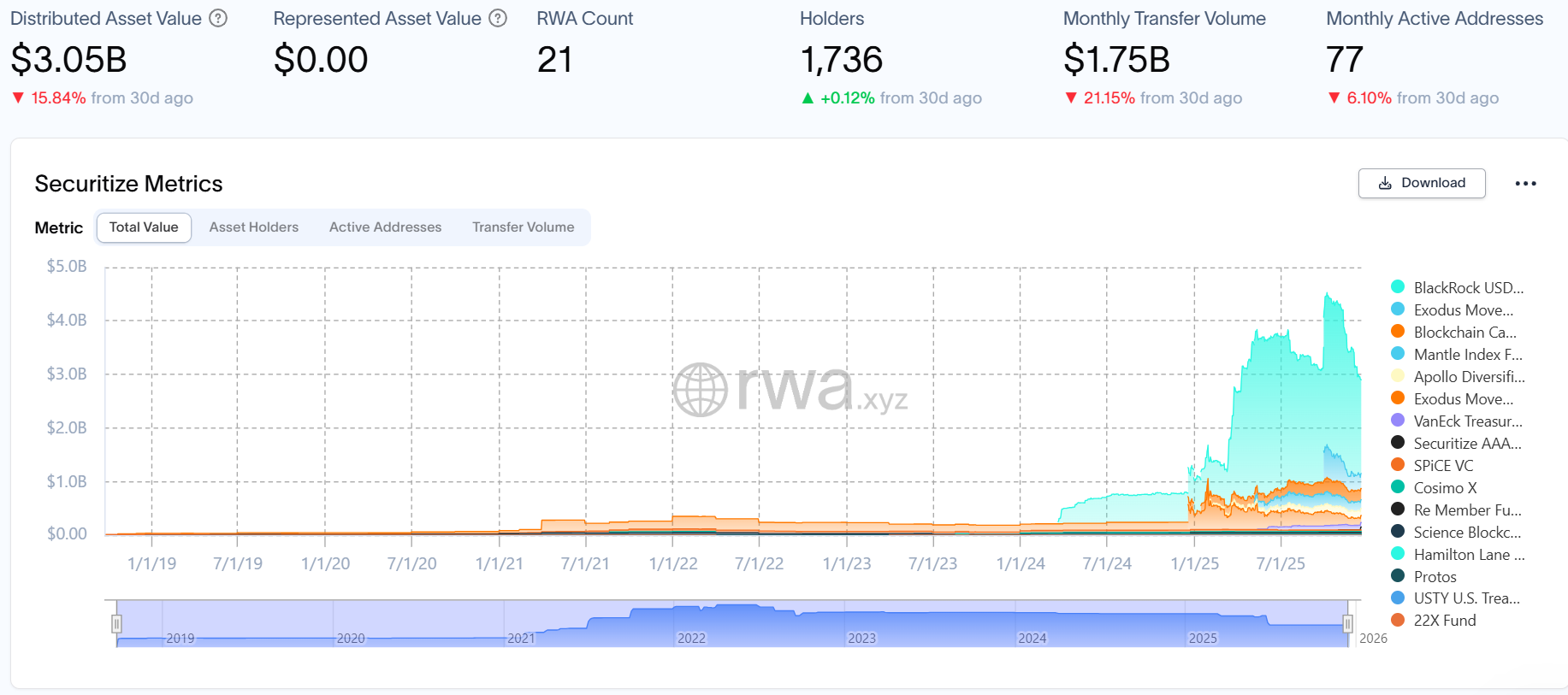

On October 28th of this year, Securitize disclosed its plan to go public through a SPAC merger, with a post-merger valuation expected to reach $1.25 billion and the stock ticker SECZ. As a key player in the tokenized money market fund sector, Securitize has partnered with traditional asset management firms such as BlackRock, Apollo, KKR, Hamilton Lane, and VanEck, accumulating over $3 billion in tokenized assets.

With the RWA narrative still going strong, Securitize, with its frequent moves, has become the focus of the market. Odaily will analyze the company from a business perspective to help readers gain a deeper understanding of its strategy and prospects.

Native on-chain shares: not "price mapping", but shares in a legal sense.

To understand the importance of the Securitize product path, we first need to examine it within the overall structure of the current stock tokenization landscape. Most existing stock tokenization platforms can be broadly categorized into two main models.

The first type is the synthetic model. Early examples like Mirror Protocol and Synthetix belong to this category. Tokens track stock prices through derivative structures or oracle mechanisms, providing only price exposure without involving any actual shares. These products lack shareholder rights, are subject to counterparty risk and pricing discrepancies, and are essentially derivatives rather than equity.

The second type is the beneficial interest model. For example, MSX typically has real shares held by the platform or a third-party custodian (usually backed 1:1), and tokens are issued to represent beneficial interests or claims on those shares. Holders receive economic exposure (such as dividends from price fluctuations), but are not the direct legal owners; the official share capital table records the custodian, not the token holders.

Unlike these two paths, Securitize is attempting a third model— the native on-chain stock model . Securitize plans to issue shares that are legally recognized as real shares, issued directly and natively on the blockchain and simultaneously recorded in the issuing company's official capital structure table. Token holders possess full shareholder rights, including dividends and proxy voting. Crucially, Securitize itself acts as an SEC-registered transfer agent, ensuring that token holders are the direct legal owners, not indirectly held through intermediaries or SPVs. In other words, this type of asset is neither a price tracker nor a custodian's "IOU."

However, it is undeniable that the complexity of native on-chain equity models is significantly higher than that of synthetic or beneficial rights-based schemes. It not only needs to address the issues of on-chain issuance and instant settlement, but also must simultaneously comply with a series of traditional financial rules such as securities regulation, company law, and transfer agency provisions, while achieving seamless integration with existing financial infrastructure. In reality, this translates to higher compliance costs, a longer implementation cycle, and means that every step will be exposed to regulatory and institutional friction.

In contrast, synthetic or beneficiary rights-based solutions offer significant advantages: faster deployment, lighter structure, lower cost, and easier 24/7 trading and DeFi compatibility. Securitize's chosen path is not aimed at "circumventing regulation," but rather at truly eliminating the long-standing structural barriers between the traditional financial system and on-chain systems within the regulatory framework.

It is under this choice that Securitize's position in the RWA race has become clearer.

Securitize is becoming one of the "standard answers" for RWA infrastructure.

Founded in November 2017 by Carlos Domingo and Jamie Finn, Securitize is headquartered in San Francisco, California. The company focuses on using blockchain technology to transform traditional financial assets (such as stocks, funds, bonds, and private equity) into compliant digital securities.

This positioning directly determines Securitize's partners and business model. Securitize's most well-known example is the BUIDL money market fund , which provides tokenization services for BlackRock . To date, the fund has exceeded $ 1.7 billion in size, making it the largest tokenized money market fund in the current RWA market.

In addition, Securitize has partnered with several traditional asset management institutions, including Apollo, KKR, Hamilton Lane, and VanEck. Official data shows that its cumulative tokenized assets have exceeded $ 3 billion . If RWA initially focused more on "conceptual feasibility," then Securitize's business has begun to verify "institutional feasibility."

This "bridge-like" positioning is also clearly reflected in Securitize's financing and shareholder structure.

Publicly available information shows that Securitize has raised approximately $122 million to $147 million through multiple rounds of private equity financing. Early investors were primarily from the crypto industry itself, including Coinbase and Ripple. However, as the RWA narrative has become clearer, its shareholder structure has changed significantly, with traditional financial giants such as Morgan Stanley and BlackRock entering the fray, bringing the total number of investors to over 50. It has also gained a significant stake in ARK Invest , owned by Cathie Wood.

This process of moving from "recognition within the crypto community" to "endorsement from Wall Street" is not accidental, but rather a natural result of its business path and institutional choices.

Given this logic, going to the capital market is not surprising.

Securitize announced on October 28 that it will go public through a merger with special purpose acquisition company (SPAC) Cantor Equity Partners II, Inc. The transaction is expected to value the company at $ 1.25 billion , and it plans to trade under the ticker symbol SECZ.

Cantor Equity Partners II, Inc. (NSDQ: CEPT) is sponsored by a subsidiary of financial services giant Cantor Fitzgerald and headed by Brandon Lutnick, son of the U.S. Secretary of Commerce . Notably, Twenty One, the third-largest Bitcoin reserve company, also went public through a merger with another SPAC under Cantor Fitzgerald, demonstrating the group's continued involvement in the cryptocurrency space.

To support its listing and public market operations, Securitize is also strengthening its compliance and governance capabilities, announcing the appointment of former PayPal Digital Assets Legal Head Jerome Roche as General Counsel to prepare for future disclosures and regulatory communications on Nasdaq.

Conclusion

Returning to Securitize itself, as a leading project in the RWA sector, the market's initial expectation for it was probably simply when it would issue its token. However, judging from today's progress, this expectation may just be a matter of habitual thinking within the crypto market.

Ultimately, Securitize didn't become a narrative stage revolving around tokens, but rather a part of the larger structure comprised of capital markets and regulatory systems. This choice itself isn't surprising, because from its inception, its role has been closer to that of a bridge connecting TradeFi and DeFi.

In this sense, Securitize's development path may reflect the profound transformation that the RWA narrative is undergoing, moving from imagination to reality, and from concept to system. How far this path can go depends not only on the expansion speed of a single company, but also on whether the traditional financial system is truly willing to reserve a real space for "native on-chain assets".