Is Solana truly finished? Multidimensional data reveals the real picture of Solana.

- 核心观点:Solana呈现技术升级与生态挑战并存的局面。

- 关键要素:

- TVL增长26%,稳定币供应增三倍。

- Alpenglow确认速度150ms,Firedancer超百万TPS。

- Pump.fun募资6亿美元验证链上性能。

- 市场影响:巩固高性能公链地位,吸引机构资金。

- 时效性标注:中期影响

Author | @blocmates

Compiled by Odaily Planet Daily ( @OdailyChina )

Translator | Dingdang ( @XiaMiPP )

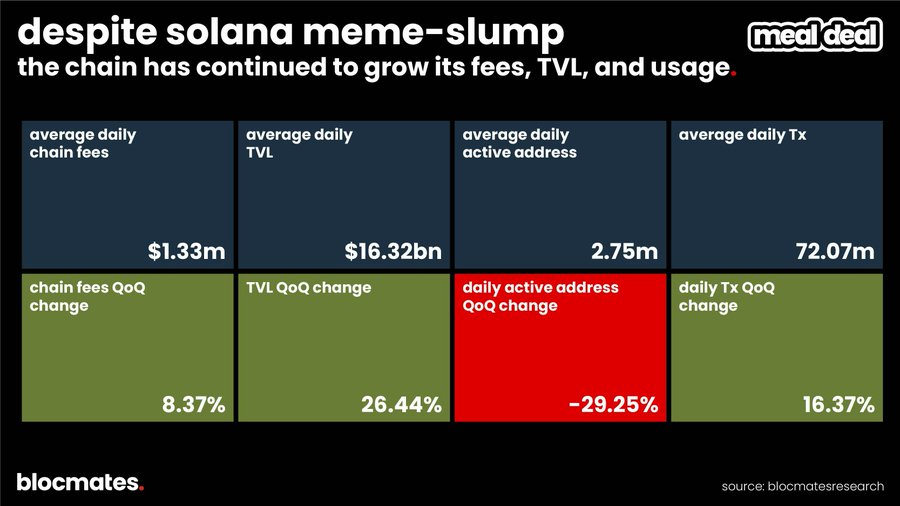

The third quarter of 2025 was a "two-sided story on the same chain" for Solana. On the surface, the "meme waning" brought a noticeable cooling effect: daily active addresses declined, and user dominance was gradually eroded by competitors. However, beneath the surface, the fundamentals of this chain became increasingly solid. The Solana core team maintained a high frequency of iteration, continuously advancing one of the most ambitious technology roadmaps in the crypto industry; at the same time, its TVL grew by more than 26% in the third quarter, and the stablecoin supply has almost tripled since the beginning of the year.

This report will systematically review the core technology upgrades that are defining Solana's future (such as Alpenglow and Agave), deeply analyze on-chain data performance and the health of ecosystem applications, and summarize our key insights on how Solana can solidify its position as the "default high-performance public chain".

Technological innovation in multiple directions

While most users of the platform are busy chasing the latest memes, the @solana core team has been pushing forward with an ambitious system-wide upgrade roadmap. This isn't just about tweaking a single metric, but a comprehensive systemic project to improve network performance, security, decentralization, and user experience. These upgrades can be broadly categorized into three main types.

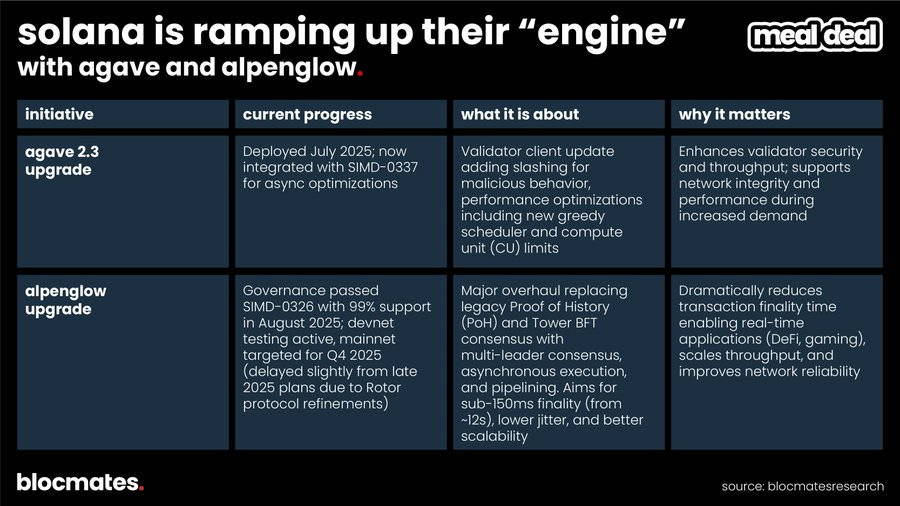

Category 1: Core Engine (Consensus and Client)

This is a fundamental overhaul of the Solana "engine," aiming to improve performance, speed, and security at the most basic level. Here's a great visualization to give you an overview of the current staking ecosystem if you're curious.

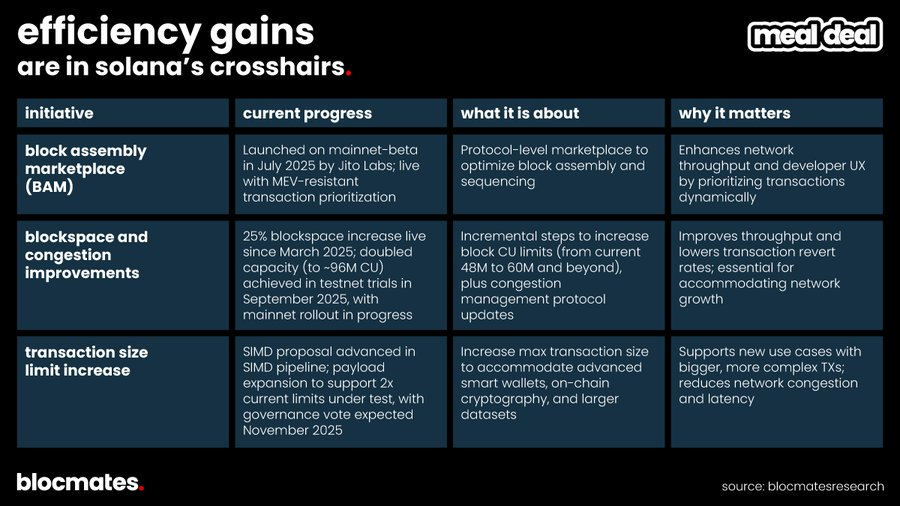

Category 2: High-speed network (throughput and efficiency)

The focus of this part of the work is to widen the network "lanes" and optimize traffic scheduling after improving the underlying performance, so that it can withstand higher loads in the future without congestion. If the goal is for institutional users to truly come to the blockchain in the future, then low latency and a stable experience are fundamental, not optional.

Category 3: Destination (New capabilities at the ecological and application layers)

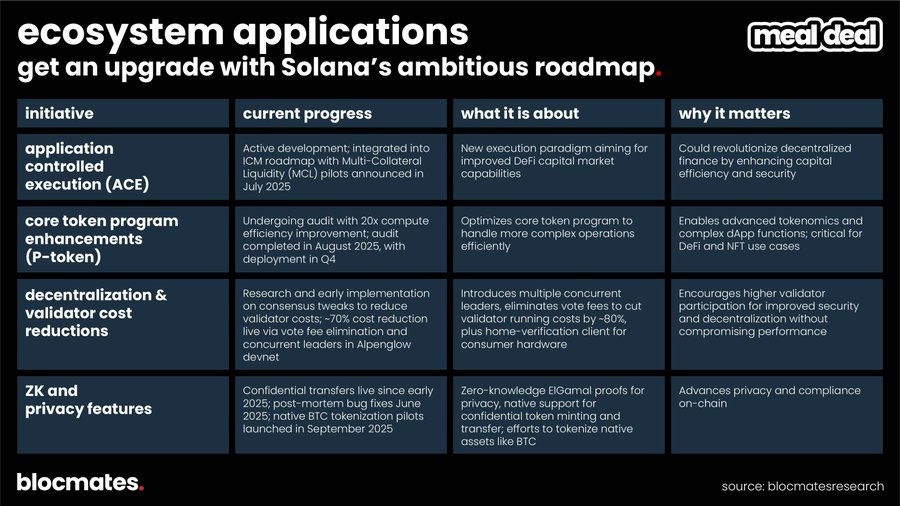

This type of upgrade is geared towards the most direct developers and end users , aiming to provide more new features, support new types of applications, and further enhance the decentralization of the blockchain. In other words, it's a module that allows the blockchain to "do more."

The actual impact of technological improvements

From a practical usage perspective:

- Alpenglow: With a final confirmation speed of less than 150ms, retail users can use high-frequency DeFi, gaming, or micropayment applications on the chain, and its performance is approaching the level of Binance's 100ms and Aptos' 200ms.

- Firedancer: Its potential capacity of over 1 million TPS far exceeds that of Ethereum and its L2 (such as OP's approximately 2,000 TPS), Sui's 300,000 TPS, and centralized exchanges (Coinbase's peak at approximately 500,000 TPS). It also significantly reduces the systemic risk of a single client failure (Ethereum's Geth still accounts for 60% of nodes).

- Block space improvements, congestion mitigation, and transaction size limit optimizations: Enhance the overall experience of using the chain, enabling more granular microtransactions, ICOs (such as $PUMP), and faster transactions, while reducing failures caused by congestion.

- Decentralization and reduced node costs: This allows users with lower technical barriers to run nodes, thereby improving the security and decentralization of the entire network.

- ZK and Privacy Support: Providing a compliant, privacy, and security foundation for RWA and institutional users' access.

- BAM (Fair Transactions, Anti-MEV): Ensures fair transactions and protects users from MEV losses, making the on-chain experience closer to the predictable low-cost environment of CLOB.

- ACE (Multi-collateralized Liquidity): Further promotes the deepening of the DeFi capital market, enabling it to compete with platforms such as Aave and support more complex financial instruments.

PUMP ICO: Verification through On-Chain Stress Testing

In July 2025, Pump.fun's ICO became a real "stress test" of Solana's performance. Within just 12 minutes, @pumpfun raised $500 million on-chain and $100 million on centralized exchanges, corresponding to a valuation of $4 billion. During this period, 3,878 investors transparently subscribed on Solana's DEXs such as Raydium and Jupiter, while some CEXs (such as Bybit) experienced delays due to multiple API failures, forcing approximately 2,500 users who had confirmed their investments to request refunds because they were unable to place orders in time due to API delays.

Does this mean we are seeing a possibility in the future—that decentralized blockchains will begin to outperform centralized exchanges?

So where does Solana stand now? The truth revealed by the data.

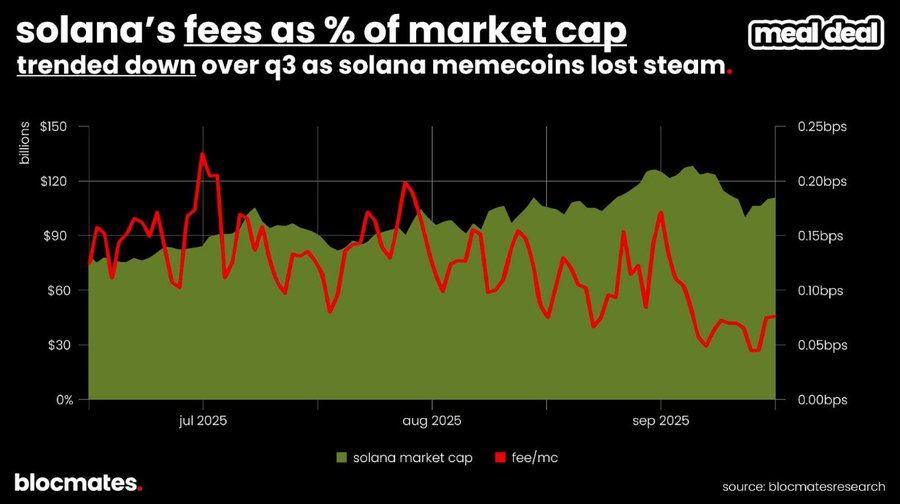

Data shows that as traders shift from Meme speculation to perpetual contracts, Solana's on-chain yield metrics have been significantly impacted: on-chain fees as a percentage of SOL's market capitalization have declined by more than 60% since their July peak.

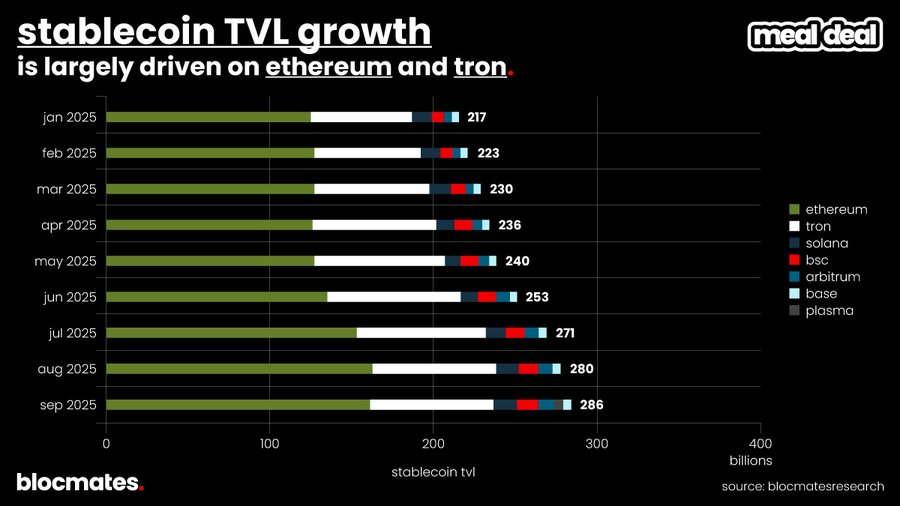

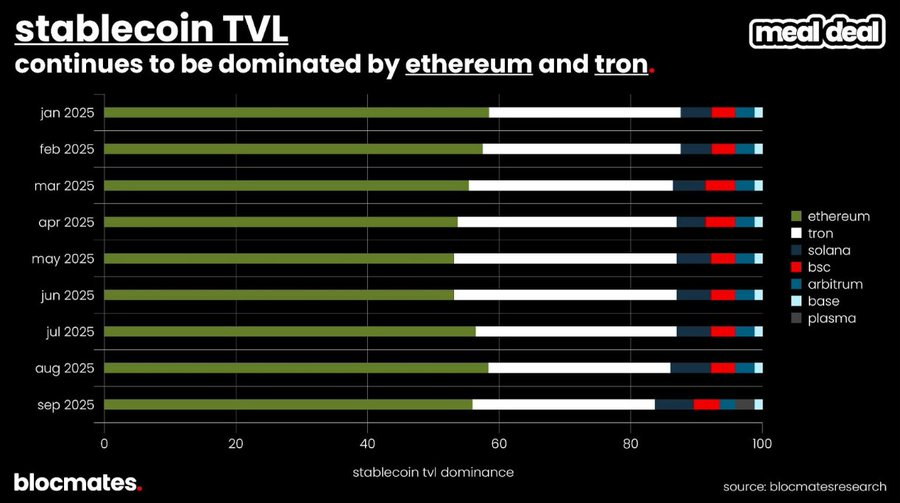

Meanwhile, despite ongoing discussions about stablecoins on Capitol Hill and Wall Street, Ethereum and Tron remain the dominant players, while chains like Solana, Base, BSC, and Arbitrum are in the "second tier."

Further analysis of the TVL (Total Value Linked) share of stablecoins reveals that Ethereum and Tron have maintained a near-dominant position over the past few quarters , while some emerging application chains—such as @Plasma —are gradually entering this landscape.

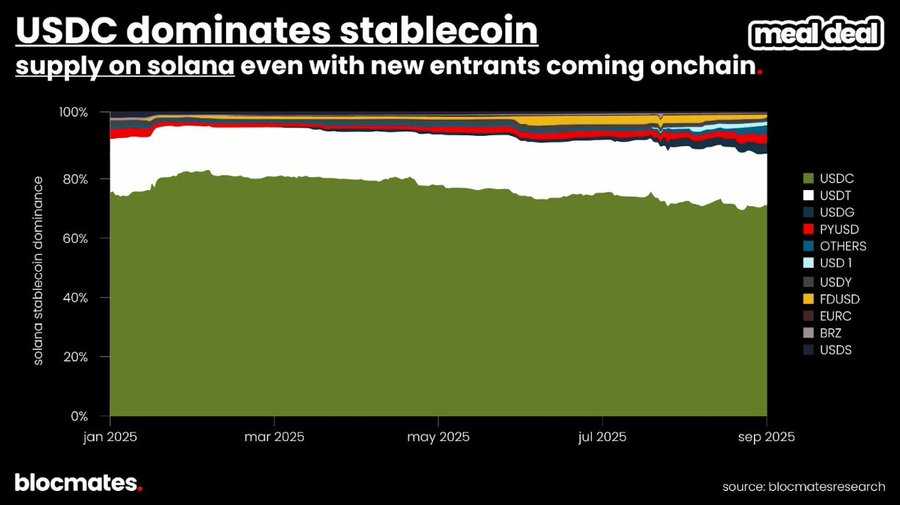

Nevertheless, Solana still provides a fast, low-cost, and highly liquid environment for using USDC, which may be why Western Union chose to build its stablecoin business on Solana.

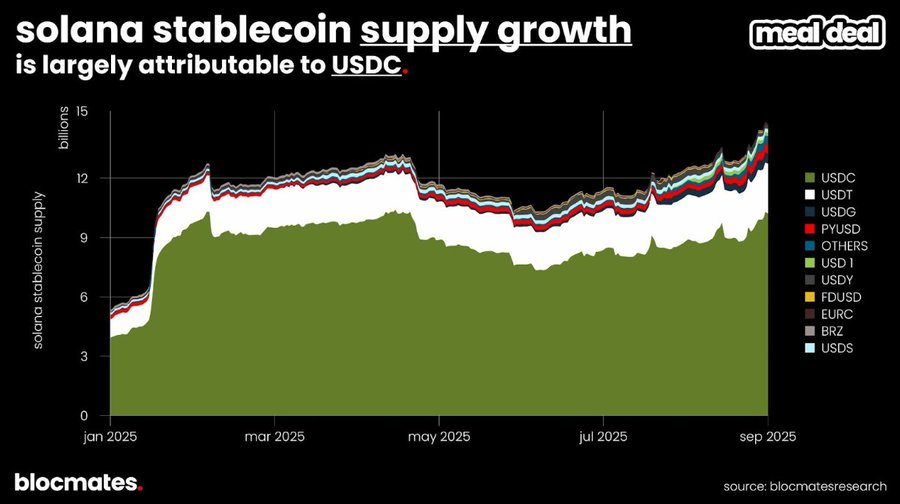

"Experimentation" will be one of the core themes of this report, and this spirit is also reflected in the stablecoin ecosystem: new projects are gradually eroding USDC's dominance and bringing more competition to the Solana stablecoin landscape.

Which ecosystem participants are driving the chain's growth?

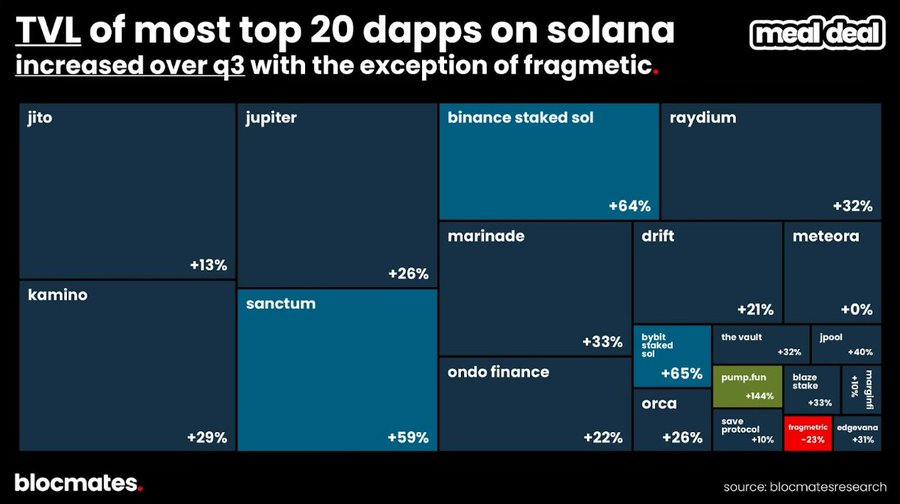

In terms of TVL growth, staking products were the absolute highlight of Solana applications in the third quarter. Staking SOL offered by Binance and Bybit, as well as products from @Sanctumso , all recorded growth of over 50% in the third quarter.

In contrast, while TVL for DEX, DeFi, and infrastructure products also increased, they failed to surpass the 28% increase in SOL itself—meaning that , in SOL terms, these categories actually experienced net outflows over the past quarter .

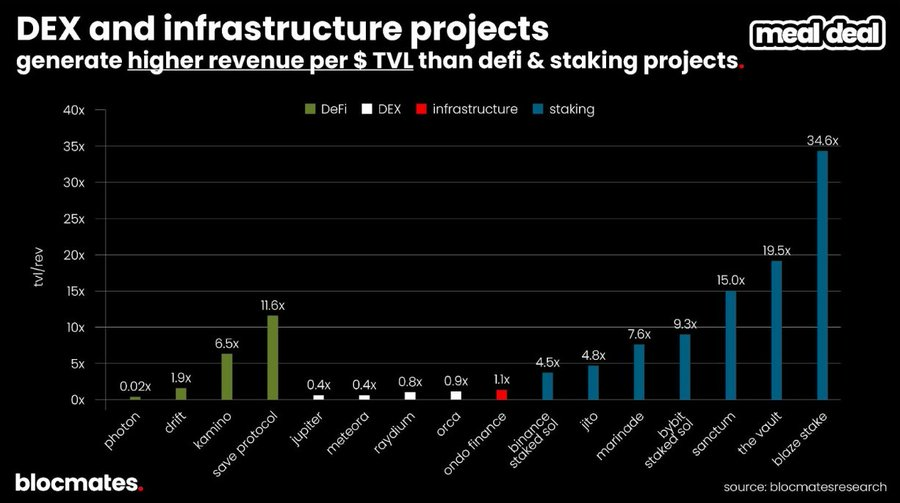

The weakness of staking products lies in their relatively weak profitability : on average, a staking protocol needs a TVL of 21.7x to reach the average revenue level of the DEXs in this sample. This again illustrates the fact that in the crypto world, speculators contribute far more profits than savers .

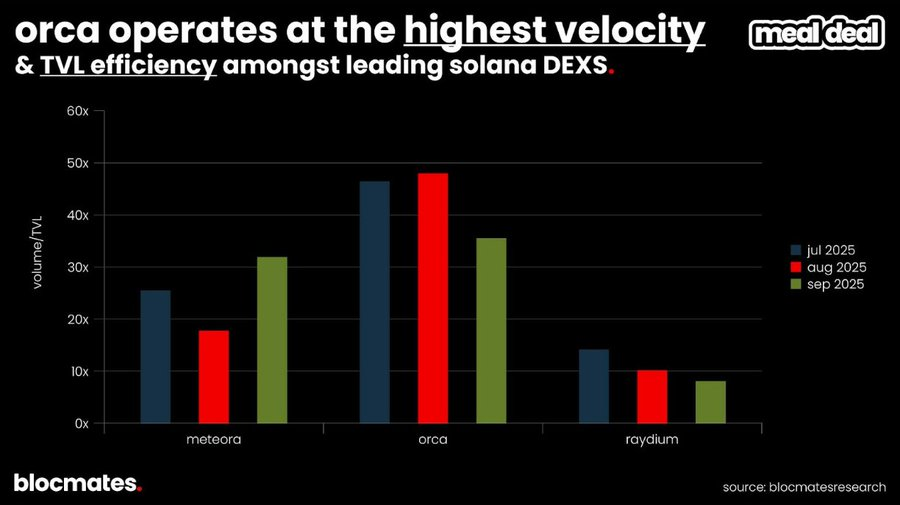

In the DEX sector, @Orca_so has consistently maintained a leading position in TVL efficiency (i.e., "trading speed"). For a given liquidity level, Orca offers the highest trading frequency per dollar.

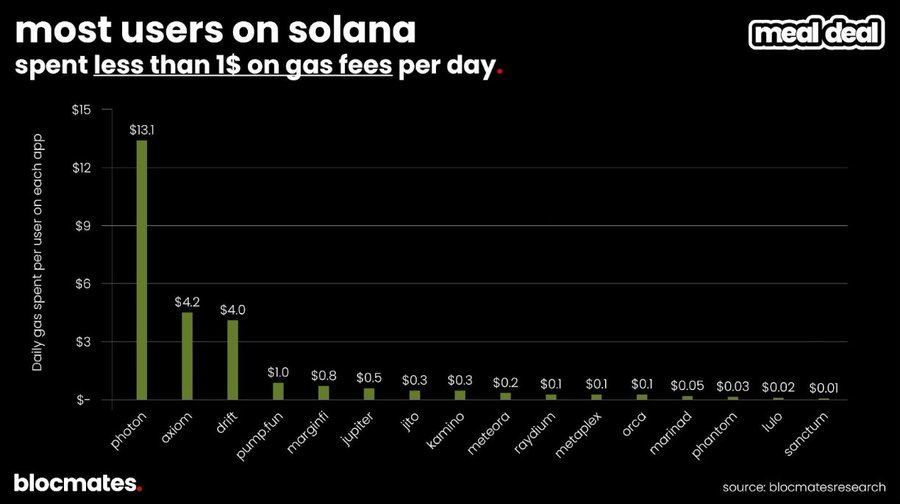

While Solana is known for being "fast and cheap," this doesn't mean there aren't exceptions. For example, some high-frequency traders spend far more on daily transaction fees than expected on trading platforms like @tradewithPhoton or @AxiomExchange .

However, for the vast majority of users, using the most frequently used applications on Solana only costs a few cents per day.

A horizontal comparison of Solana with its core competitors

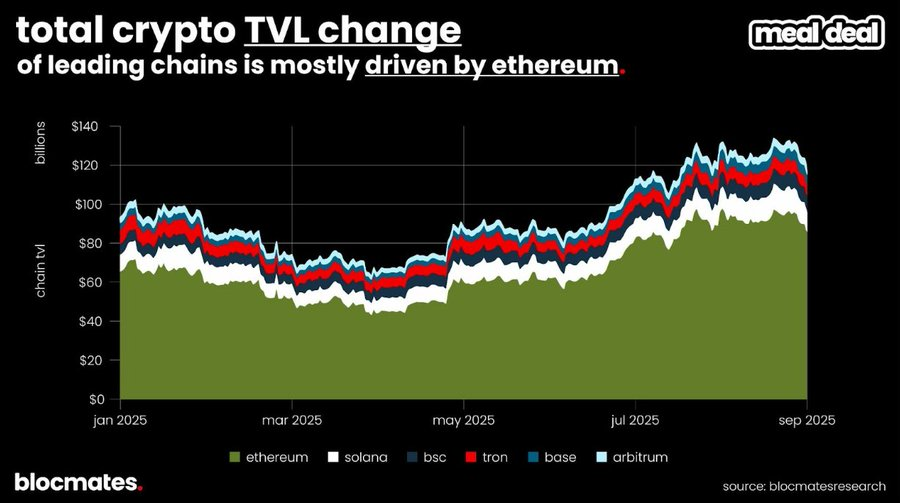

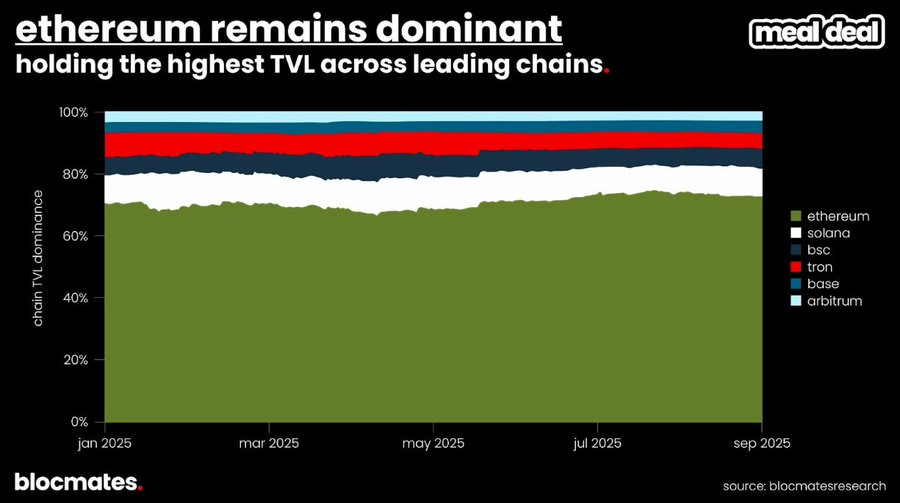

The total TVL of the entire chain was slightly lower than the historical high of nearly $180 billion in 2021 at the end of the third quarter. However, if we compare the competing public chains horizontally, we can find that the quarter-on-quarter changes in their TVL are actually very limited .

The market share chart below clearly shows how the TVL of these competitors fluctuates synchronously every week. As Newton said, "Idle capital tends to remain idle," and once capital is tied up, it is often difficult for it to migrate on a large scale.

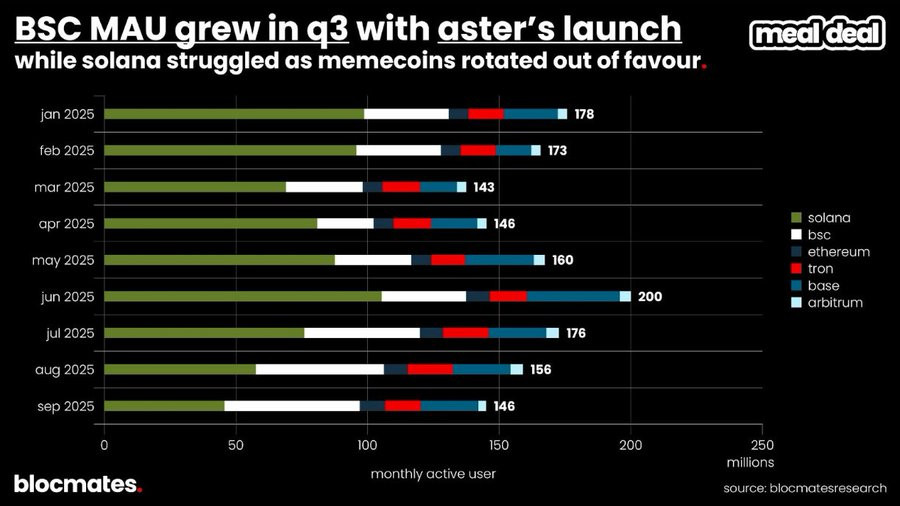

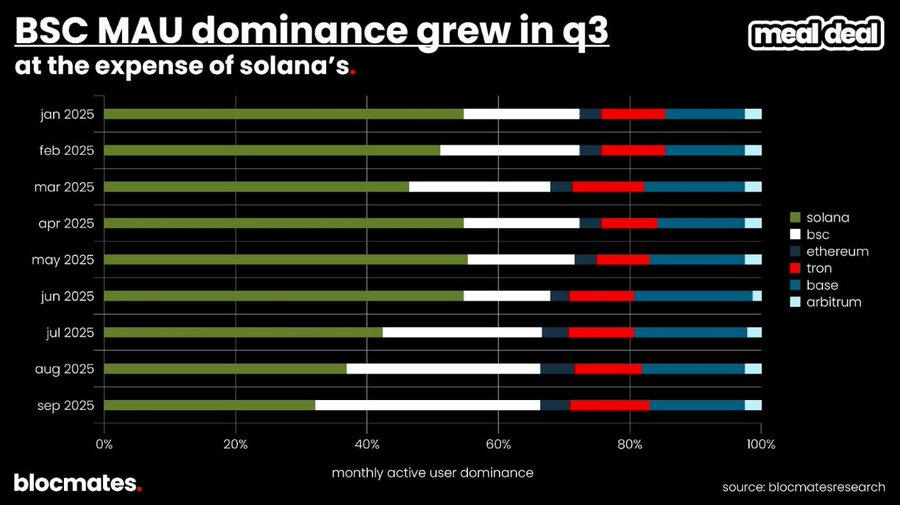

In terms of user scale , Binance Smart Chain garnered the most attention in the third quarter with its perpetual DEX, Aster, which is linked to CZ. Many users either left in early summer or migrated from Base and Solana to BSC.

Although Solana saw significant user growth in the second quarter, its share declined in the third quarter, a trend that almost coincided with a decrease in market interest in meme transactions.

However, it's worth noting that thanks to a surge in interest in stablecoins , Solana's stablecoin supply nearly tripled from the beginning of the year to the end of the third quarter. This demonstrates that "fast and cheap" is a major selling point for attracting users to stablecoins, especially given the already mature DeFi ecosystem of Solana.

While these metrics depict the current landscape, they don't reflect future directions. Solana remains a "chain of experiments." To understand future use cases and narratives, we must observe which new experiments are receiving funding for.

Where VC funds are flowing: Which projects are receiving funding?

The following are some Solana projects that received investment from well-known institutions in the third quarter:

- @raikucom : Raikucom completed a $13.5 million seed round of funding in September 2025. It is a DeFi infrastructure platform on Solana focusing on real-time liquidity scheduling and cross-chain bridging, primarily serving high-frequency trading applications, supporting sub-second settlement and mitigating MEV risks. This round was led by @PanteraCapital, and the funds will be used for mainnet upgrades and further integration with DEXs (such as @JupiterExchange).

- @bulktrade : Completed a $5 million seed round in August 2025. It's a perpetual DEX targeting institutional users, focusing on zero-gas batch execution with single transactions reaching $10 million. This round was led by @robotventures and @6thManVentures , with Solana co-founder @aeyakovenko also participating as an angel investor. Its AlphaNet testnet launched in Q3.

- @meleemarkets : In July 2025, it completed a $3.5 million pre-seed funding round. It's a gamified prediction market protocol that combines DeFi with social prediction, allowing users to earn rewarding tokens through accurate predictions. This round was led by @variantfund and @dba_crypto , with funds earmarked for oracle integration and mobile launch. The project placed second in the Solana Breakout Hackathon.

- @hylo_so : A $1.5 million seed round was completed in September 2025 for a decentralized stablecoin protocol on Solana, which supports the issuance of yield-bearing stablecoins (such as sUSD) through over-collateralization and automatic rebalancing mechanisms. This round was led by @robotventures , with participation from @SolanaVentures . The funds will be used for the mainnet launch and integration with lending platforms such as @Kamino .

Where are the opportunities and risks?

Solana presented a situation of "both breakthroughs and burdens" in the third quarter. On the one hand, innovative applications are constantly approaching product-market fit, and Digital Asset Treasury (DAT) companies are also shining brightly; on the other hand, the entire ecosystem has to face some thorny issues.

Outstanding projects in Q3

Among the large number of dApps that emerged this quarter, the following projects that have already been launched stand out:

- @Titan_Exchange is a new DEX aggregator launched in the third quarter. It uses an improved algorithm to extract depth from different liquidity pools with machine-level precision, thereby obtaining the best quotes and outperforming existing similar products in 80% of cases.

- @DefiTuna is a new DeFi AMM launched in the third quarter. It integrates a true on-chain limit order mechanism directly into the AMM design, avoiding the security risks associated with off-chain matching, while allowing LPs to use up to 5x leverage for liquidity position allocation (leveraged returns).

- @xStocksFi tokenizes stocks held in custody by licensed brokers, enabling crypto users to easily access the economic interests of the underlying stocks; it launched in early Q3 and saw a quarterly trading volume of over $800 million, capturing approximately 60% of the market share.

- Pump.fun (streaming + mobile) launched a token buyback in the third quarter after experiencing significant selling pressure, and relaunched its live streaming function. By the end of the quarter, the cumulative buyback amount reached $100 million.

- @MetaDAOProject made headlines for projects with massive oversubscription, including Umbra . Projects offered through MetaDAO (see our report ) tie legal, economic, and governance rights to their tokens, which are called "ownership coins." Furthermore, their governance proposals are not decided by voting, but rather through trading in "futarchic markets," allowing participants to express their opinions with real money.

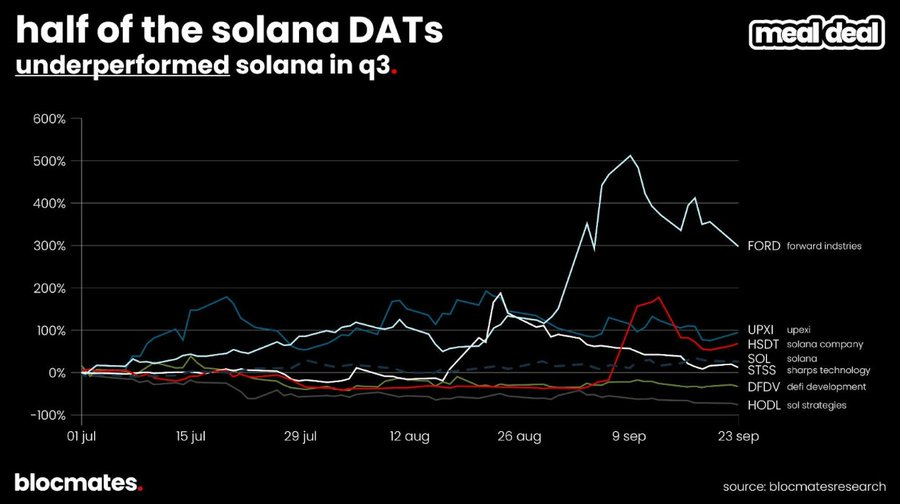

DAT Development Status

In the third quarter, DAT in the Solana ecosystem raised approximately $4.25 billion through private placements, PIPE, and equity offerings, with Forward Industries (FORD) being the largest contributor. Of this, approximately $3.5 billion was used to purchase 14.5 million SOL tokens, representing 2.3% of the circulating supply of SOL.

Nevertheless, Solana DAT could not escape the pressure of mNAV contraction that was common in the crypto DAT ecosystem in the third quarter.

Responding to common criticisms

Like almost all crypto projects, Solana is in a continuous evolutionary phase and is far from perfect. From our perspective, the criticisms below are more of a necessary growing pain, but they are still worth paying attention to.

Biggest risk: Brand narrative

Solana has long been labeled "the best place to experiment." Where did these innovations first emerge: trading robots, ICMs, consumer applications, AI agents? Solana.

However, during this cycle, attention became increasingly scarce, and projects that found product-market fit seemed to be concentrated in only a few sectors and a very limited number of applications. This stagnation gave competitors the opportunity to seize the narrative:

- Perpetual contracts have migrated from general-purpose blockchains to application-specific blockchains like Hyperliquid;

- Base is heavily betting on the consumer application narrative through the Base app and Zora, which was once Solana's area of strength.

- Stablecoin chains such as Tempo, Plasma, Stable, and Arc continue to threaten Ethereum and Tron's stablecoin dominance.

This also leads to a core risk : Yes, Pump is a revenue machine and has indeed withstood competition from both "external" (Base/BSC) and "internal" (BonkFun), but the side effect of this success is that it may permanently lock Solana's brand as a "casino chain" .

To reverse this trend, Solana must drive a new narrative. Perhaps the answer remains Pump, but through its live streaming platform; it could be MetaDAO's proposed "no-runaway ICOs" and new governance structure; or it could be Toly's experimental, personalized approach , directly targeting Hyperliquid. The ecosystem needs a new story that can dilute the stigma associated with "retail investors holding positions for seconds."

Our assessment of Solana's prospects

Although the market was slightly subdued after the Meme season, the significance of short-term price fluctuations is diminishing. Solana has established a solid position and is poised for long-term growth.

Newly launched high-performance public chains (such as Sui, Aptos, and Sei) have not posed a substantial threat to Solana as they did to Ethereum in the previous cycle. Even though some competitors are theoretically more technologically advanced, Solana is already "fast enough, cheap enough," offers a good enough user experience, and supports a large ecosystem.

Technical capabilities and a smooth user experience are fundamental to adoption. Solana doesn't stagnate; instead, it continuously and rapidly iterates (see the upgrade section earlier in this report) to maintain its position and expand its capabilities. For these reasons, developers continue to choose Solana as their top choice for high performance, and we believe this trend will not reverse.

Solana embodies the spirit of "daring to try, open competition, and extreme market orientation" in the crypto space, making it the best arena to test product-market fit. Regardless of where this cycle leads, Solana possesses the conditions to survive and continue to thrive. Even if some transaction volume flows to application-specific chains, we still believe Solana will continue to hold a leading position in the general-purpose blockchain space.