A wave of altcoin ETFs is being launched; how are the first batch of projects performing in the market?

- 核心观点:山寨币ETF加速上市,合规进程制度化。

- 关键要素:

- 通用上市标准缩短审批至60-75天。

- 8(a)条款实现20天自动批准机制。

- 政府停摆后积压申请集中处理。

- 市场影响:推动加密资产纳入主流金融体系。

- 时效性标注:中期影响

Original article | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

Recently, spot ETFs for altcoins such as XRP, DOGE, LTC, and HBAR have quietly launched in the US market, while similar products for assets like AVAX and LINK are currently under review. Since November, the approval process for altcoin ETFs has accelerated significantly. Compared to the ten-year wait for Bitcoin ETFs, these similar products have completed the entire process in just a few months, a remarkably fast pace. For example, Grayscale's DOGE and XRP spot ETFs were simultaneously listed on the NYSE Arca on November 24th. All of this seems to indicate that the compliance process for altcoins is moving towards a more institutionalized new stage.

The recent surge in altcoin ETF listings is mainly attributed to the seamless integration of two key mechanisms between late October and mid-November, coupled with the concentrated processing of backlogged approval documents following the government shutdown, which together propelled this listing peak.

Universal listing standards implemented: The "institutional highway" for altcoin ETFs officially opens.

First, on September 17, 2025, the SEC officially approved the "Common Listing Standard for Commodity Trust Shares" proposed by the three major exchanges (Nasdaq, NYSE Arca, and Cboe BZX). This rule changed the approval logic on the exchange side.

Previously, any cryptocurrency seeking to list on an ETF had to submit a 19b-4 rule change application and undergo a multi-round review process by the SEC, lasting over 240 days. The new universal standard changes this logic:

If any of the following conditions are met, the standard will be automatically applied and the listing process will begin automatically:

① It must have at least 6 months of trading history in a futures market regulated by the CFTC and have an effective market monitoring agreement;

② Existing listed ETFs have an exposure rate of over 40% for this asset.

This means that eligible altcoins no longer need to "knock on doors" individually, but can directly enter the fast track set by the system. The review cycle on the exchange side has been shortened from 240 days to 60-75 days, improving efficiency by 3-4 times. On October 3, REX-Osprey used this to submit 21 single-asset and collateralized ETF filings at once, ushering in the era of batch processing. However, this regulatory advantage was temporarily "frozen" in October.

The retaliatory crackdown following the government shutdown: From "freeze" to "full speed ahead".

In October 2025, the U.S. federal government experienced a shutdown lasting over a month, resulting in severe staff shortages in the SEC's review department. More than 130 cryptocurrency ETF applications (including Dogecoin, Litecoin, Solana, etc.) were forcibly suspended. Following the shutdown's conclusion, to demonstrate a "new government and a fresh start" as quickly as possible, the SEC released two significant guidance documents in November:

- On November 13, the SEC released the "Framework for Orderly Resumption of Review After Shutdown," which clarifies the processing priorities for backlogged applications.

- On November 14, the SEC further released "Rules on the Application of Section 8(a) in Crypto ETFs", which for the first time allows issuers to voluntarily remove "delayed amendment clauses".

The most decisive factor is 8(a). It means that as long as the SEC does not issue a stop order within 20 days of the effective filing of the S-1, the ETF is automatically approved.

This effectively provides the market with an automated mechanism of "default approval," reducing the process, which previously required multiple rounds of SEC approval and often dragged on for months, to a minimum of 20 days , improving efficiency by more than 12 times.

Therefore, when the "exchange-side general listing standard" and the "registration-side 8(a) fast track" came into effect at the same time, the more than 130 applications accumulated in October were released in November—and the explosion of fake ETFs naturally followed.

The performance of altcoin ETFs: generally constrained by the broader market, with SOL performing slightly better.

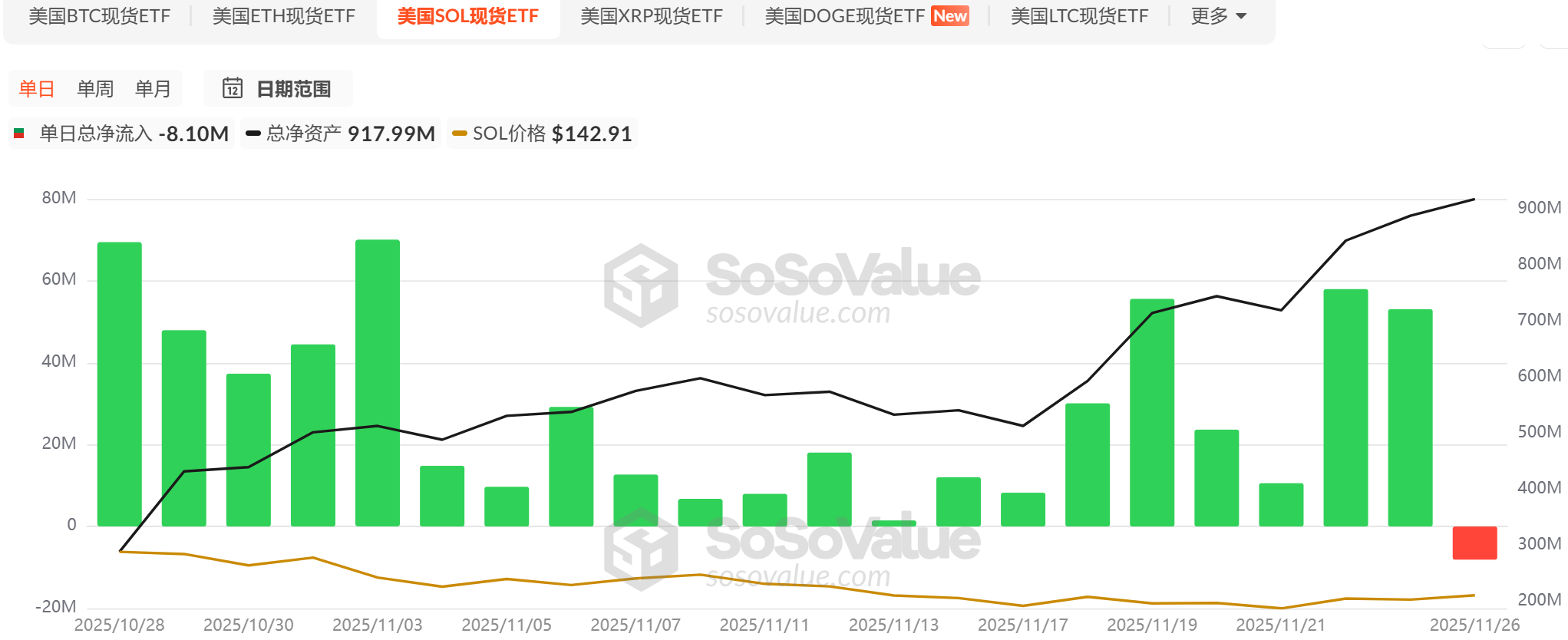

The Solana ETF is one of the earliest recently launched altcoin ETFs to be successfully launched. According to data from sosovalue, as of now, six issuers have launched SOL spot ETFs, including Bitwise, Grayscale, and 21Shares. Since its launch on October 28th, the SOL ETF has seen net inflows for 21 consecutive days, accumulating over $ 600 million ; however, it experienced its first net outflow on November 26th, with a single-day net outflow exceeding $800 million.

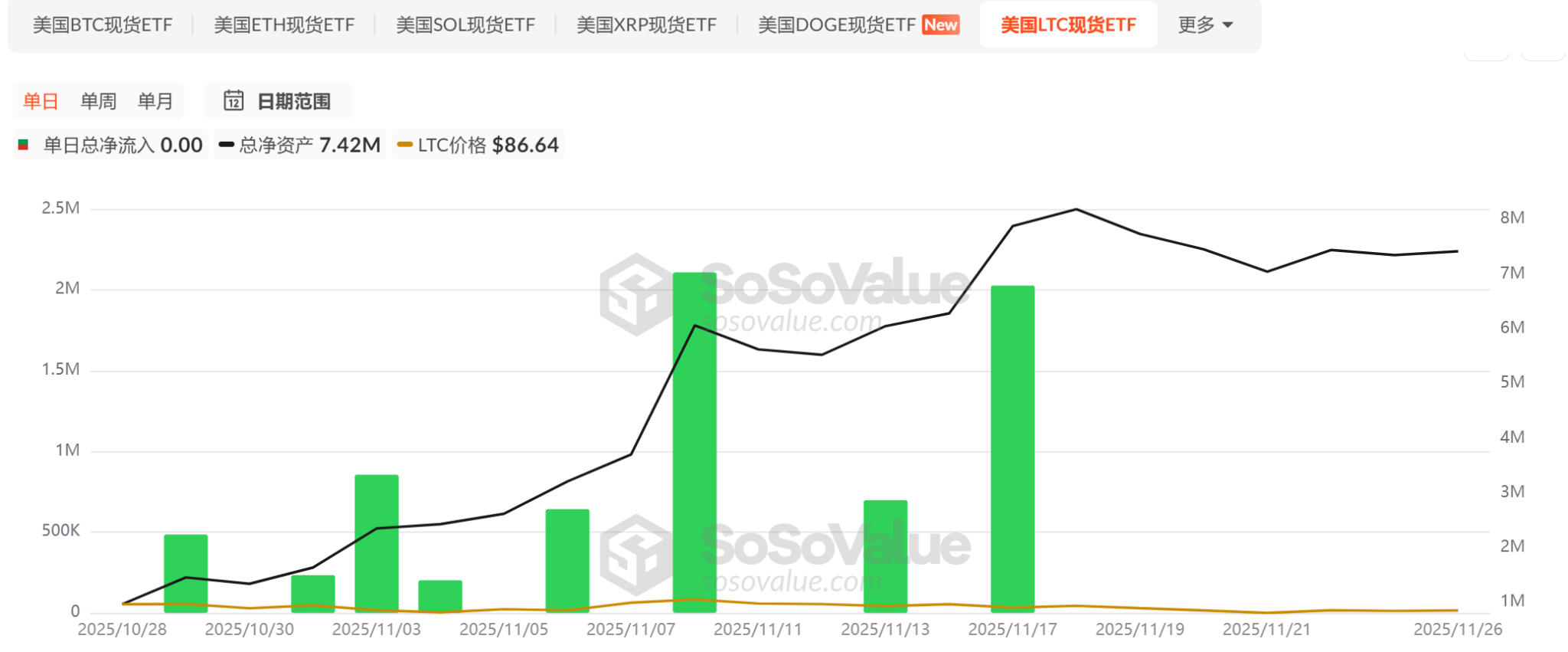

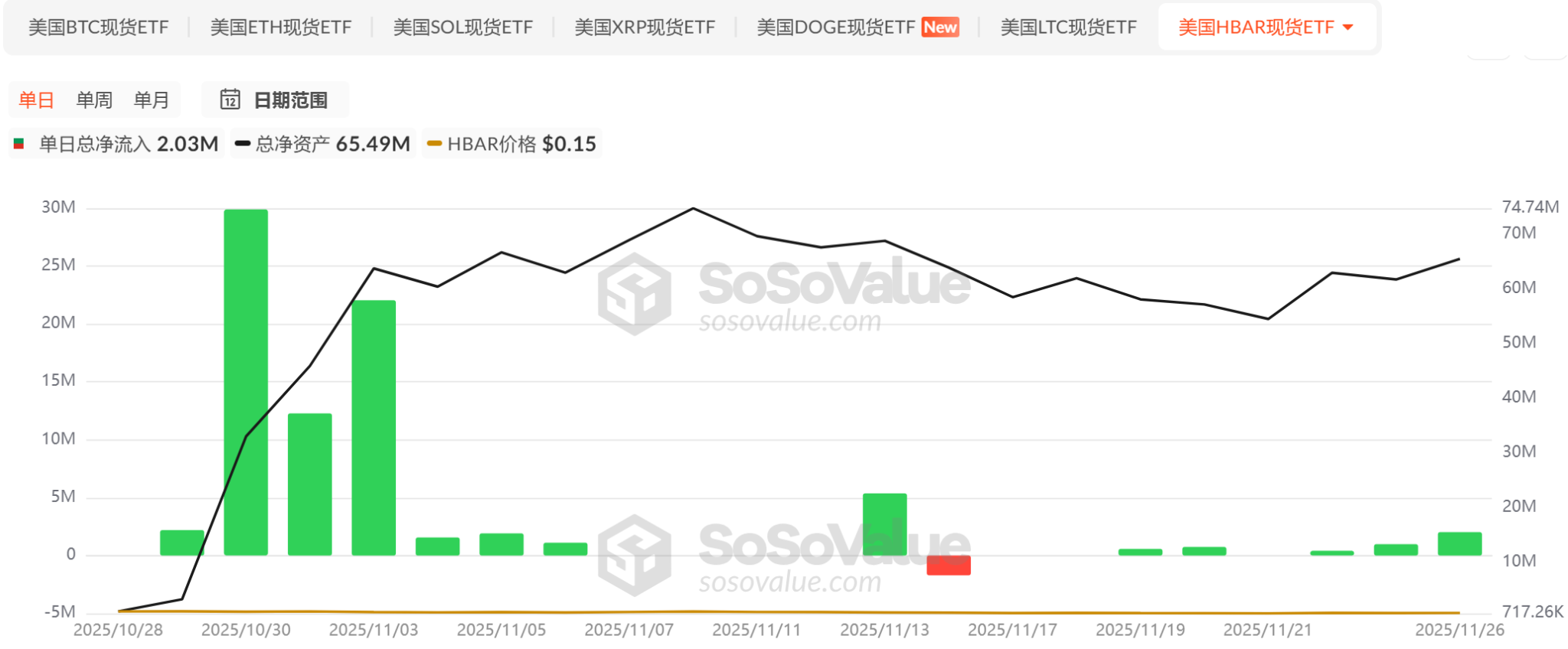

Both the LTC and HBAR spot ETFs were issued by Canary and launched simultaneously on October 29th, but their issuance size was far smaller than that of the SOL spot ETF. The former saw a cumulative net inflow of $7.26 million, while the latter saw a cumulative net inflow of $79.46 million. Although both saw net inflows in the first few days after their launch, the net inflows in the past week have been almost negligible or even nonexistent.

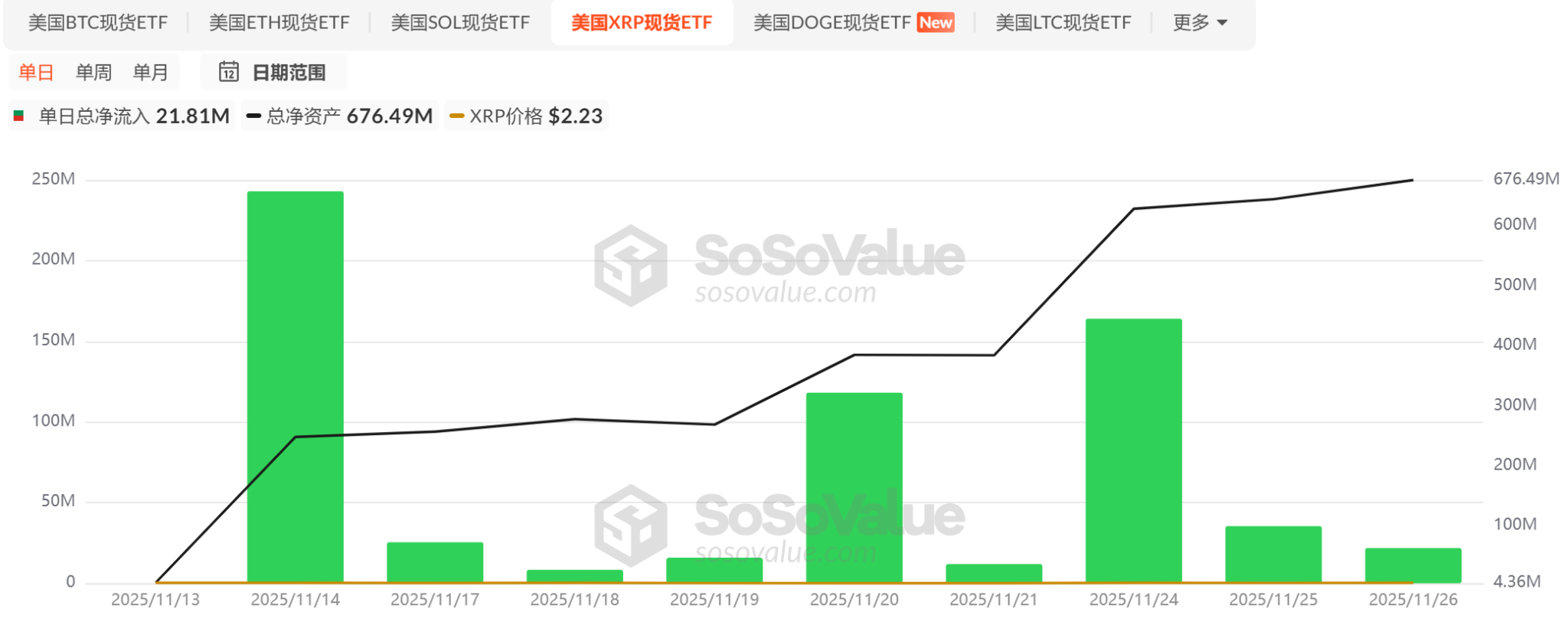

The XRP spot ETF was launched on November 13th and currently has four issuers, with a cumulative net inflow of $64.39 million. Considering both launch time and issuance size, its performance is second only to SOL and HBAR.

However, the overall market environment in November was unfavorable. Although BTC briefly stopped falling on November 22, it remained in a weak rebound range, and risk appetite struggled to recover quickly. The emergence of altcoin ETFs also failed to bring about a strong price recovery for these alt assets. Perhaps the true significance of altcoin ETFs lies in the fact that the US regulatory system, for the first time, has incorporated "crypto assets" as a standardized, scalable asset class into its regulatory pipeline. However, market prices will ultimately be determined by a complex interplay of factors, including macro liquidity, asset fundamentals, and risk appetite.