Synthetix Contract Trading Competition: A Record of Disheartening Participants – 80% Lost Over 90%

- 核心观点:Synthetix合约大赛惨败警示高杠杆风险。

- 关键要素:

- 98选手中68人亏损超90%。

- 冠军独揽111万美元奖金。

- 总亏损近600万美元虚拟资金。

- 市场影响:暴露合约交易高风险性。

- 时效性标注:短期影响

Original author: Eric, Foresight News

Synthetix, a "DeFi veteran" that returned to the Ethereum mainnet from the OP Mainnet, launched a contract trading competition a month ago today. This DeFi protocol, which was launched on Ethereum as early as 2018, has gone through a long and winding road before finally returning to the mainnet. After exploring areas such as stablecoins and synthetic assets, it chose the order book perp DEX.

However, as Synthetix itself stated , they do have considerable experience with perp DEX, having spent two or three years working on the OP Mainnet. But as they themselves admitted, those years were indeed wasted, and this return to the Ethereum mainnet can be seen as a fresh start in a sense.

However, none of that is the main point. The main point is that, to commemorate this restart and to promote its new platform, Synthetix held a contract trading competition, which ran from October 20th to November 20th local time, which just ended according to Beijing time.

Judging from the results, the competition was a disaster. I don't know if it achieved its promotional goals, but in terms of discouraging people from playing the contract game, this competition was truly educational...

Get 100,000 for free without doing anything

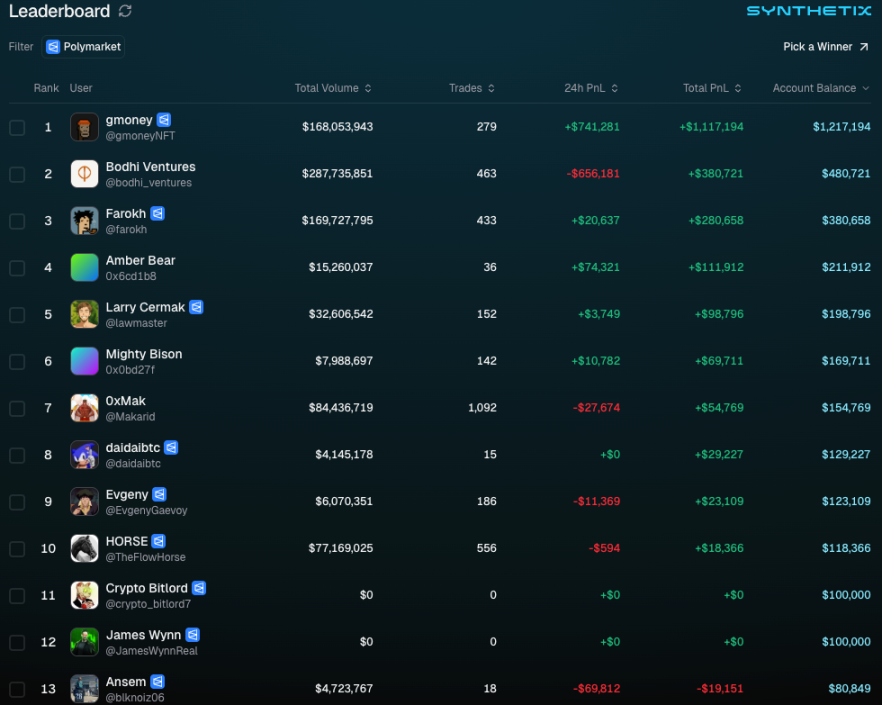

How disastrous were the results? According to Synthetix's Leaderboard, out of the 98 participants in this competition, only 12 people didn't lose money, and two of them didn't make a single trade. 68 people lost more than 90%, and 27 people went broke.

Let's start with a brief overview of the basic rules of this competition. Synthetix plans to invite 100 people to participate in the first season of the competition, with 50 of them participating through direct invitations. The directly invited participants are all well-known trading bloggers on Synthetix or executives of well-known companies in the industry, including James Wynn, who made 100 million in 70 days and then lost it all; Evgeny Gaevoy, CEO of Wintermute; Kain, the founder of Synthetix, and Bodhi Ventures, which he founded with Jordan. Feng Wuxiang and Zhuifeng Lab from the Chinese community are also among those directly invited, and even zoomer, who specializes in reporting important Web3 news, has joined in the fun.

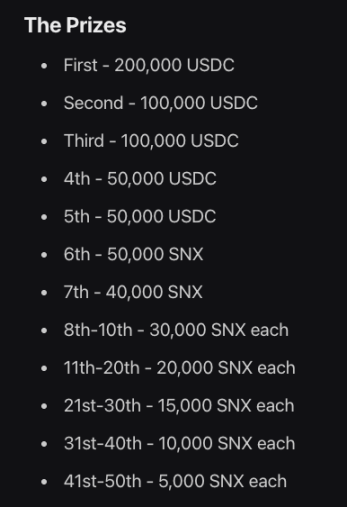

Another 50 spots were awarded to sUSD and sUSDe pre-deposits and Kwenta Points holders, bringing the final number of participants to 98. The prize pool for this competition was extremely unbalanced, with the first-place prize being $1 million, while second through tenth place winners received only a maximum of 25,000 SNX (worth approximately $15,000 at the end of the competition's price) and a Patrons NFT that could be airdropped in Infinex tokens.

Each participant starts the competition with a 50,000 USDT margin, which will be replenished to 50,000 USDT for each participant on November 5th. Additionally, starting November 1st, Synthetix will allow the community to vote on airdropping 10,000 USDT to a participant with less than 1,000 USDT in margin. Of course, these USDT can only be used on the platform and cannot be withdrawn.

There are few restrictions on trading leverage, and the trading instruments focus on a select group of popular markets, including mainstream crypto assets such as BTC, ETH, XRP, BNB, SOL, DOGE, SUI, and ENA. Under these rules, most participants have only one goal: to win the championship.

In the early stages, while many players were cautiously testing the waters, Feng Wuxiang took the lead and gained a seemingly insurmountable advantage by using high leverage to go long.

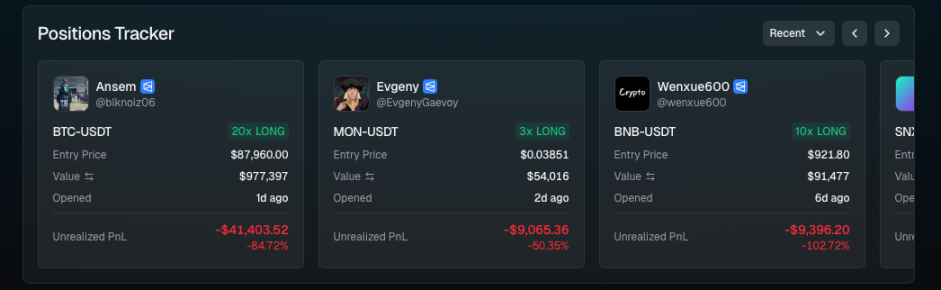

But the outcome... after 132 transactions totaling over $70 million, Feng Wuxiang suffered a margin call a few days ago when Bitcoin fell below $90,000. This is undoubtedly a prime example of "you can win against the market 100 times, but the market only needs to win against you once." Feng Wuxiang himself stated on YOX that he believes everyone in this competition is aiming for the championship, and it's difficult to achieve a high ROI without high leverage. However, he also cautioned that in real trading, low leverage and proper hedging are still advisable.

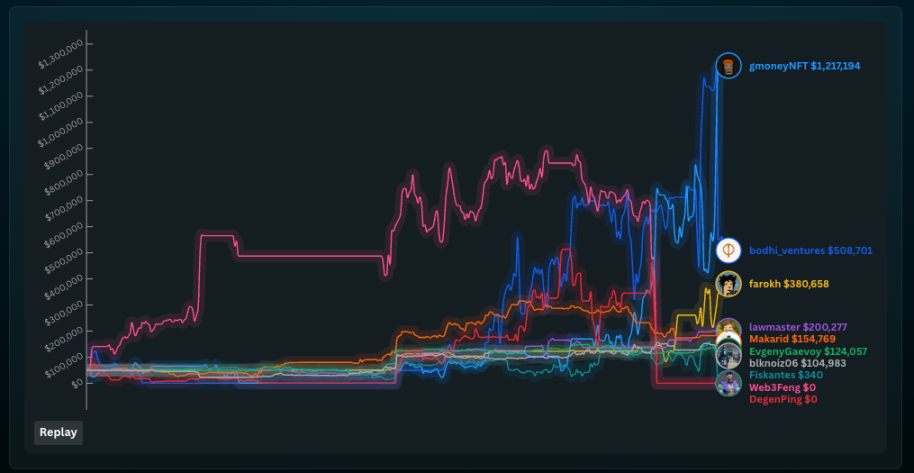

The winner of this competition was Gmoney , who has nearly 320,000 followers on X. Gmoney's "breakthrough move" was buying CryptoPunk #8219 for 140 ETH (worth approximately $176,000 at the time) in January 2021, setting a record for the highest price at the time. This NFT still features his X profile picture.

In fact, until last night, the leader was still Bodhi Ventures, led by Synthetix's own people, with a lead of hundreds of thousands of dollars. However, the "former champion's" long position and Gmoney's short position strategy swapped the rankings in another round of market movements last night. It can be said that this timely drop delivered the final blow before the end of the game.

The final ten finishers were the only ten who remained on the water. Our old friend James almost made it into the top ten without doing anything. Meanwhile, in the Polymarket prediction market, of the 59 participants listed, 6 were profitable, 2 didn't trade, and of the remaining 51, only 1 lost less than 20%, and only 11 lost less than 90%.

The top ten players collectively earned $2.184 million from an initial investment of $1 million, while the champion alone earned $1.117 million. According to the rules, Synthetix should have distributed 10 million USDT in trial funds, but these 98 players ultimately lost only $4,020,154, a total loss of nearly $6 million. If this were real money, Synthetix would probably be quite distressed. However, if you were watching the competition as the opponent of all the other players, and you had enough funds, you could earn $6 million in a month – it sounds exciting!

As Feng Wuxiang said, the competition for the sole championship may have been intense, leading to frequent high-leverage trading that resulted in many losing everything even after adding 50,000 USDT in margin during the competition. Regarding this outcome, I believe the educational value of teaching people to quit gambling far outweighs the promotion of the platform. If most of the carefully selected so-called "top" traders ended up with almost nothing, what about ordinary people?

Looking back at this competition from a God's-eye view, the start time coincided with the beginning of a sustained market decline. Although there were some initial rebounds, the market continued to fall almost without looking back. During the competition, Bitcoin's price dropped by 30% between its highest and lowest prices. It's obvious that the players who went to zero or almost zero were stubbornly going long.

Human greed and obsession know no race, gender, or age. Readers, please remember: the others you see in this competition are also a reflection of yourself.

The second season of the "Discouragement Contest" will begin the following month.

Following the conclusion of the first season, the second season of this "discouragement contest" will launch on December 1st. The second season will expand the total number of participants to 1,000, consisting of 200 top traders and 800 community members. Directly invited participants need to share their views on the contest on X as their entry ticket. Community participants will be selected from the top 800 users who have pre-deposited sUSD with Synthetix, with a minimum deposit of 10,000 sUSD.

Perhaps learning from the wildly imaginative ideas of the first season, the prize money in the second season was distributed much more evenly.

If you want to challenge yourself, you can try using the "Happy Beans" provided by the organizers. If the disastrous outcome of the first round was due to the prize money distribution issue, then we have reason to look forward to the results of the second season to see whether the lure of the grand prize fueled greed, or if this is simply human nature.