Having defied market trends and surged all the way, can ZEC continue to rise?

- 核心观点:ZEC因隐私需求和矿工风险引发多空对决。

- 关键要素:

- 监管收紧激发隐私需求,屏蔽池余额增长140%。

- 灰度信托重启,管理资产增至2.69亿美元。

- 矿机回本周期仅105天,存51%攻击风险。

- 市场影响:隐私币关注度提升,投机风险加剧。

- 时效性标注:短期影响

Over the past two months, ZEC, which has surged nearly tenfold and exhibited independent price action, has been the focus of market attention. Discussions surrounding ZEC have evolved from early pronouncements by figures like Naval, Arthur Hayes, and Ansem regarding privacy concepts to a phase of debate between bullish views based on actual demand in the privacy sector and bearish views based on the mining coin's hashrate and mining revenue.

So, besides the recommendations from well-known figures, what are the detailed arguments of those who are bullish and bearish on ZEC?

Multiple parties

"Shelter Premium" under Regulation

On the surface, tightening regulations should suppress privacy coins, but the reality is quite the opposite. It is precisely because of the high pressure of regulation that the demand for privacy has been stimulated.

Tightening policies are accelerating. The EU's draft Anti-Money Laundering Regulation (AMLR) explicitly proposes to completely restrict the trading of privacy coins within the EU by 2027; the US Financial Crimes Enforcement Network (FinCEN) also plans to increase scrutiny of "high-risk self-custody addresses." With Bitcoin and Ethereum spot ETFs coming under regulatory scrutiny, all on-chain transactions are facing stricter tracking.

As compliant assets become increasingly transparent, privacy assets are becoming scarcer. Therefore, Western media have even dubbed this market trend the "Crypto Anti-Surveillance Wave." ZEC and XMR are being redefined as the "last line of defense for on-chain anonymity." Social media consensus is even more direct: "Privacy is not a feature, but a fundamental right."

On-chain data confirms the growth in real demand. The ZEC shield pool balance has grown from less than 2 million at the beginning of the year to about 4.8 million today, an increase of 140%; the number of shielded transactions has also increased with the overall network activity, averaging about 10% per week.

The recent two major "BTC asset fraud cases," the Chen Zhi case and the Qian Zhimin case, involving a total of over 180,000 BTC, have prompted the market to re-examine the real-world boundaries of Bitcoin's narratives regarding "censorship resistance" and "anonymity." With the launch of BTC ETFs, the deep involvement of institutional funds, and the regulatory system's increasing demands for transparency in crypto assets, the early narratives of Bitcoin centered on anonymity and censorship resistance have gradually faded from the mainstream.

If even BTC struggles to fulfill the role of "censorship-resistant currency," then who will be the next symbol of privacy and on-chain asset storage? The market's answer may already be emerging—ZEC, which is bucking the trend and trending upwards at this juncture, is becoming the appropriate "version of the answer."

The return of institutional funds

The relaunch of Grayscale's ZEC Trust was the most significant event in October. On October 1st, Grayscale announced the reopening of new subscriptions for the ZCSH Trust, offering two major upgrades: waiving management fees and adding a staking function, providing an annualized return of 4-5%. This combination significantly improved the risk-reward ratio.

Over the past decade, Grayscale has been virtually the only compliance bridge and price indicator for traditional institutions allocating crypto assets. Its US-issued trusts have long provided crypto exposure for pension funds, family offices, and hedge funds, making it a leading indicator of institutional entry size and changes in preferences.

Since launching its first Bitcoin Trust in 2013, Grayscale has successively launched more than ten single-asset trusts, including ETH, SOL, LTC, BCH, ETC, FIL, and XLM. Many of these assets have experienced the typical "Grayscale effect"—capital inflows driving price increases, widening premiums, and forming a consensus narrative. The ZEC Trust (ZCSH), first established in 2017, also experienced a period of soaring premiums during the 2020-2021 bull market, and at one point became a major target for institutional allocation in the privacy sector.

However, following stricter regulations and compliance pressures on privacy coins, ZCSH suspended subscriptions in 2022 and entered a period of inactivity in 2023. This resumption signifies Grayscale's renewed endorsement of privacy assets, and its signaling significance is even greater than the funds themselves.

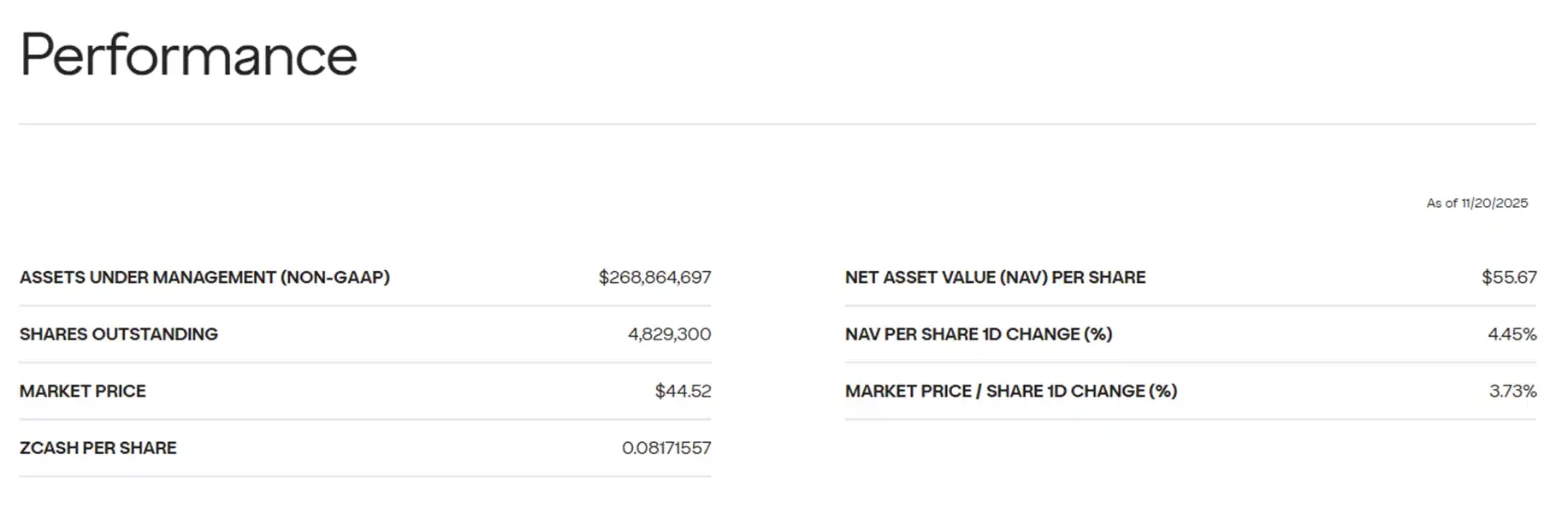

Data shows that ZCSH's AUM (Assets Under Management) has increased from approximately $42 million a little over a month ago to $269 million, accounting for about 2.4% of ZEC's circulating supply. For an asset with a daily trading volume of hundreds of millions of dollars, nearly 2.5% of the tokens are locked in the trust for a long period of time, resulting in a significant tightening effect on the supply side.

A deeper logic lies in the circumvention effect of ETFs. The approval of Bitcoin and Ethereum spot ETFs has brought these assets under a strict regulatory framework, making every transaction traceable. To circumvent this transparency, some institutions and high-net-worth individuals have begun shifting their funds to anonymous assets. Grayscale's ZEC Trust conveniently provides a compliant channel—offering exposure to privacy coins while still allowing operations through traditional financial channels.

short side

Can ZEC's miner economics model, network security, and on-chain interaction activity really support an FDV of over 10 billion US dollars? Lacie (@Laaaaacieee) raised this question and provided an in-depth analysis.

Extremely short payback periods (extremely high ROI) are often a precursor to mining disasters and cryptocurrency price crashes.

Based on calculations of the payback period for ZEC mining using the most mainstream ZEC miner, the Bitmain Antminer Z15 Pro, a single Z15 Pro can generate a net profit of over $50 per day. The static payback period for the Z15 Pro is only about 105 days, translating to an annualized return of nearly 350%. Furthermore, historical data shows that such high returns have been sustained for at least a week.

Lacie points out that this figure is extremely rare—even unusual—in the entire history of PoW:

- The payback period for BTC mining rigs during a price surge typically takes 12–24 months.

- The ROI of mining machines in the ETH PoW era is between 300 and 600 days.

Historically, PoW projects with a payback period of less than 120 days (FIL, XCH, RVN, etc.) almost all collapsed after a few months.

Lacie also reviewed the recurring cases of Hardware-Price Scissors, such as Chia and KAS. Hardware-Price Scissors are a recurring "harvesting" scenario in the history of PoW mining. Miners order mining machines at several times the premium when the price of the coin is at its highest and FOMO sentiment is at its strongest (at this time, the ROI seems extremely low, requiring only 4 months to break even). However, when the mining machines are actually delivered and the hashrate skyrockets (usually with a delay of more than 3 months), the big players often sell at high prices, causing miners to face a double whammy of "coin price halving + production halving," and their mining machines instantly become overpriced scrap metal.

Network security issues caused by computing power scale

Lacie points out that, according to the latest network data, ZEC's total network hashrate is approximately 12.48 GSol/s. Assuming a single Z15 Pro miner has a hashrate of 0.00084 GSol/s, only about 14,857 Z15 Pro miners would be needed, corresponding to an energy consumption of approximately 40 MW, equivalent to the scale of a small to medium-sized Bitcoin mining farm. Generally, initiating a 51% attack requires controlling more than 50% of the network's hashrate simultaneously. If ZEC's nearly 16,000 Z15 Pro miners constitute the main force, then an attacker could potentially control more than 50% of the hashrate simply by renting or purchasing a few thousand devices. On a public blockchain with a FDV of nearly ten billion US dollars, the fact that a mere million-level investment in hashrate could trigger a potential chain reorganization or double-spending is itself a structural risk that cannot be ignored.

ZEC's current hashrate is not only far lower than that of mainstream PoW chains such as BTC/LTC/KAS, but even chains such as ETC, BTG, VTC, and BSV, which have been successfully attacked by 51%, generally had higher hashrates than ZEC when they were attacked. This means that ZEC's network security has actually fallen into a dangerous range where it can be attacked.

The actual growth in genuine privacy usage demand is not as optimistic as it seems.

Lacie also raised questions about the genuine privacy needs of ZEC. Over the past month, the average daily transactions were only 15,000–18,000, just 1%–2% of those on large public chains. As a privacy chain, the vast majority of transactions are still transparent, with shielded transactions (privacy-protected transactions) accounting for less than 10%.

BuyUCoin CEO Shivam Thakral also cautioned that ZEC's rise was more driven by speculation than by fundamental growth. The key reason cited was the limited growth in the number of Zcash's shielded transactions.