The Underestimated Advantage of Prediction Markets: Counter-Cyclical, Anti-Volatility, Always Active

- Core Viewpoint: Despite the overall bearish sentiment in the current crypto market, the prediction market sector, driven by its real-world event-based nature, demonstrates strong counter-cyclical growth momentum. User activity and trading volume remain at historically high levels, and several leading projects are on the eve of their Token Generation Events (TGE), attracting significant market attention.

- Key Factors:

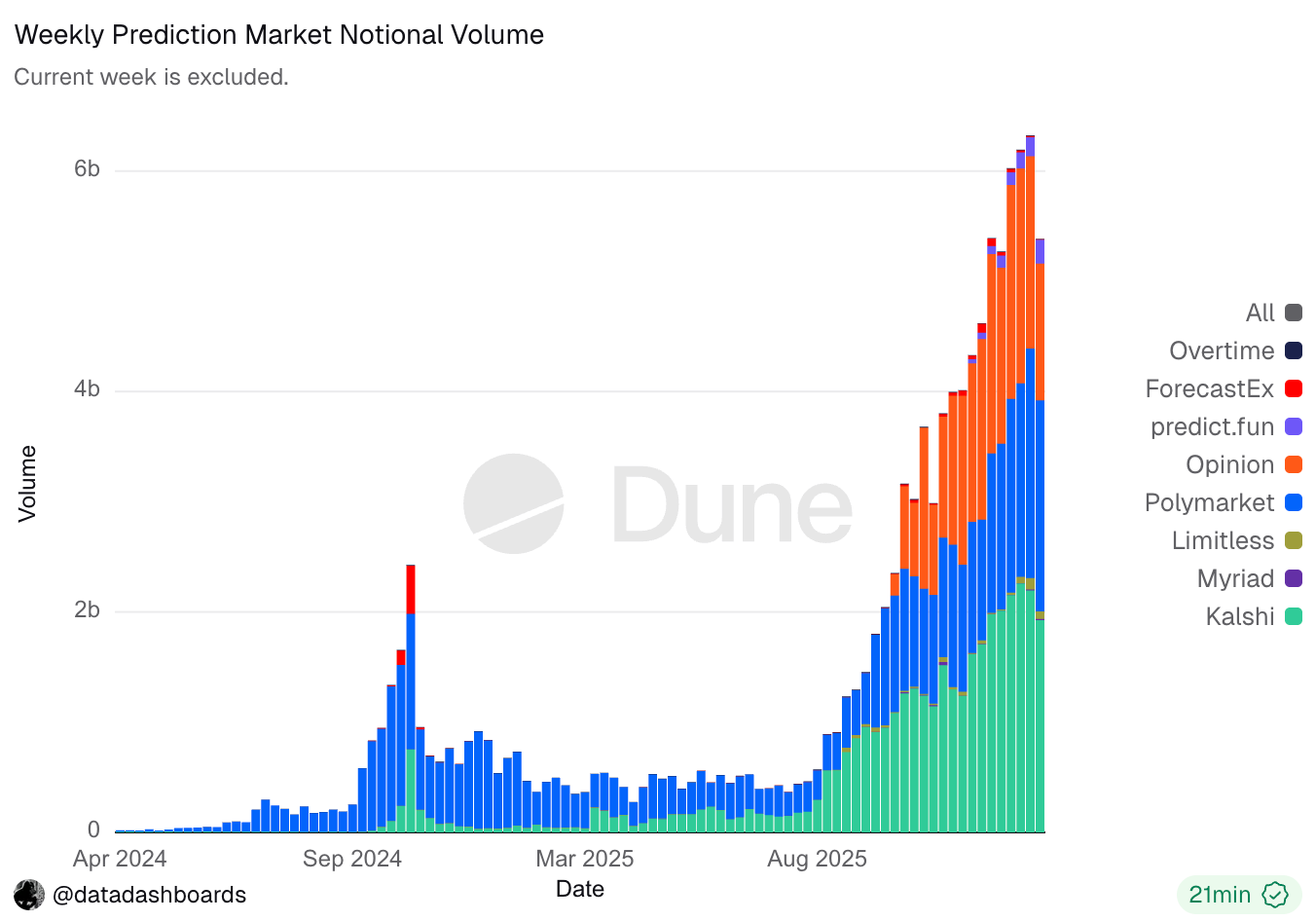

- Divergence between Market Sentiment and Prediction Market Performance: The Crypto Fear & Greed Index has fallen to "Extreme Fear," yet the weekly nominal trading volume of prediction markets has consistently remained near historical highs, indicating their activity is less sensitive to market price fluctuations.

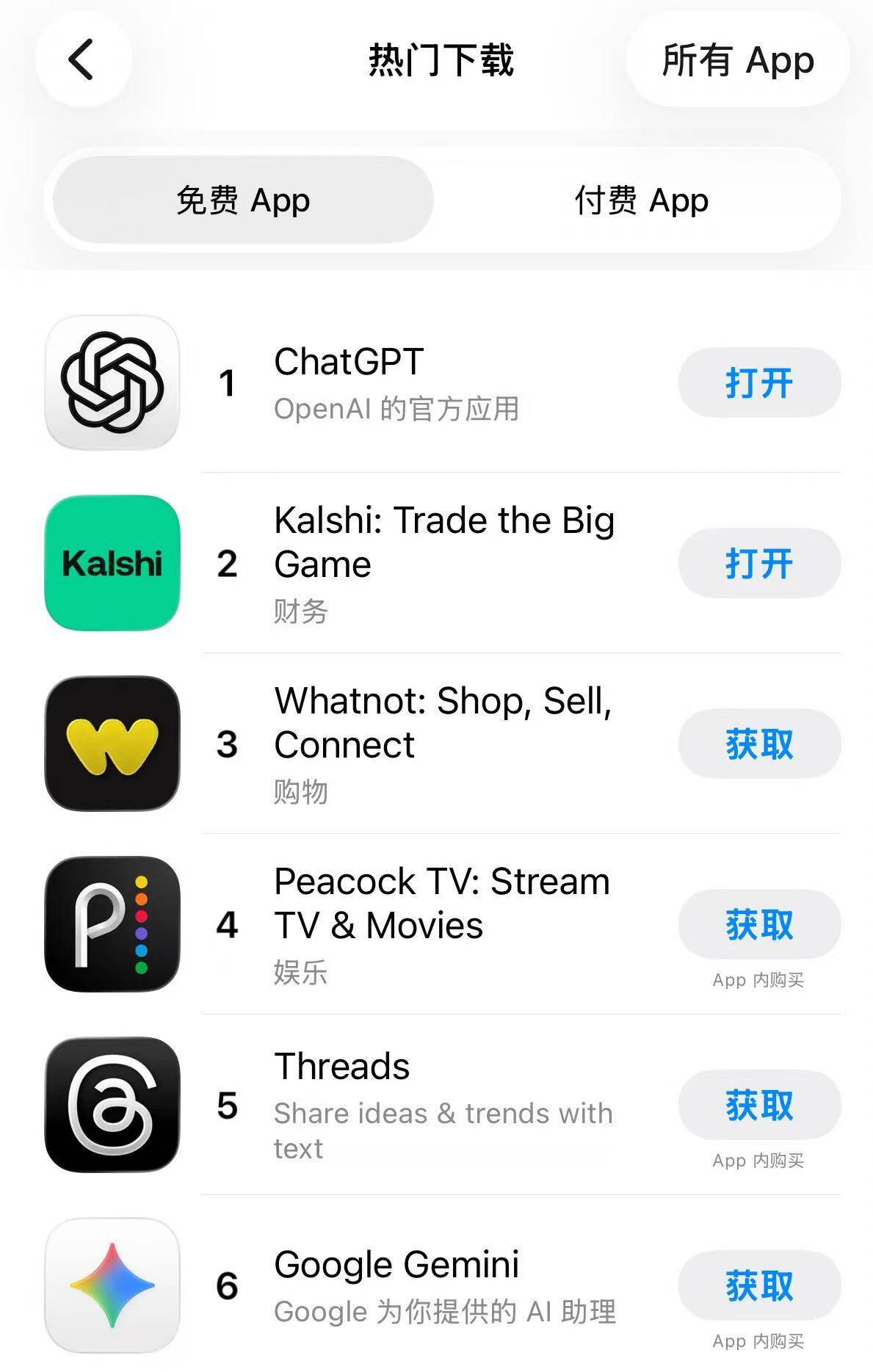

- Migration of User Attention: Polymarket website traffic continues to climb, while Robinhood and Coinbase see declines; the Kalshi app has surged to #2 on the US App Store's free chart, suggesting trading demand is shifting towards event-driven markets.

- Projects in Early Token Cycle Stages: Polymarket has filed a "POLY" trademark application and confirmed a future token airdrop; Opinion on BNB Chain has completed a $20 million Series A funding round and launched airdrop tasks, signaling an imminent TGE.

- Positive Market Expectations: On Polymarket, the probability for the bet "Opinion's FDV exceeds $500 million on its first trading day" is as high as 76%, with trading volume nearing $4 million, reflecting strong market confidence in its initial listing price.

- Catalysis by Major Sporting Events: The US Super Bowl generated over $700 million in related prediction trading volume on Polymarket, suggesting the upcoming World Cup could be a key catalyst to propel the sector's user base and trading volume to the next level.

Original | Odaily (@OdailyChina)

Author | Asher (@Asher_ 0210)

Crypto Market Sentiment Plunges to Extreme Fear, Yet Prediction Markets Keep Setting New Activity Records

If you only look at the price action, there's nothing particularly exciting about the crypto market right now.

Following last week's major crypto market crash, Bitcoin's rebound has been limited, altcoins remain generally sluggish, and capital's risk appetite has clearly contracted. The change in market sentiment confirms this: according to Alternative.me data, the Crypto Fear & Greed Index remained in the 25 (Fear) range last month, and yesterday it briefly dropped to 7 (Extreme Fear). Even with a slight recovery today, the market is still in the "Extreme Fear" stage.

Yet, against this backdrop, one vertical sector is showing a completely different trend—prediction markets are continuing to heat up.

Looking at on-chain data, the weekly nominal trading volume for prediction markets has risen significantly in recent weeks. Although it dipped last week, it remains consistently high within a historical range, indicating that user demand for trading on prediction markets has not declined significantly as the broader market cools. Instead, activity appears more stable.

The core reason behind this is that the trading impetus for prediction markets does not rely on crypto asset price volatility, but rather on the continuous stream of real-world events—from major sports events like basketball, soccer, American football, tennis, hockey, and League of Legends, to changes in macro policies, Federal Reserve interest rate cuts, potential US government shutdowns, and even entertainment topics. New trading subjects are generated almost daily. Because of this, compared to traditional crypto trading which depends on market cycles, prediction market activity is more driven by the "event stream". It is significantly less sensitive to market ups and downs, allowing it to maintain high participation and trading frequency even during bearish phases.

Prediction Markets Weekly Trading Volume

The migration of user attention is also clearly visible. 1confirmation founder Nick Tomaino recently noted that monthly website visits to Polymarket continue to climb, while visits to Robinhood and Coinbase are trending downward. This suggests that some trading and speculative demand is shifting from traditional trading platforms to event-driven markets.

Meanwhile, Kalshi's growth is even more concrete: its iOS app has now jumped to second place on the US App Store's free app download chart, right behind Coinbase. This performance is particularly noteworthy during a phase when overall crypto market trading sentiment remains low.

Apple App Store Free App Download Rankings

More Importantly, Prediction Market Projects Are Still on the Eve of Token Launches

Many sectors in crypto often share a common problem: by the time most people start paying attention, the token has already been launched, and the profit phase for true early participants is largely over. However, the current position of prediction markets is the opposite—user growth has already begun to appear, while the token cycle is just starting.

The most watched signal comes from Polymarket. Its parent company, Blockratize, recently filed a trademark application for "POLY," covering tokens and related financial services. Reportedly, Polymarket's management has confirmed plans to launch a native POLY token and conduct an airdrop in the future, though a specific timeline hasn't been announced. This means that the substantial trading and interaction activity currently happening on the platform is likely still in the early window of a potential airdrop cycle.

At the same time, Opinion, the most discussed prediction market on BNB Chain recently, has listed an OPN token airdrop task on Binance Wallet's Booster, which the market widely sees as a signal of an approaching TGE. Furthermore, Opinion recently announced the completion of a $20 million Series A funding round, with participation from institutions like Hack VC, Jump Crypto, Primitive Ventures, and Decasonic. This also reflects that investment firms are positioning themselves early in this sector.

From a market expectation perspective, the community is also paying close attention to Opinion's TGE performance. Data from the Polymarket website shows that the probability for the betting event "Opinion's FDV exceeds $500 million on its first trading day" is currently as high as 76%, with trading volume nearing $4 million. In the current environment where the overall altcoin market is performing poorly, the sustained high probability of this prediction also reflects a general market expectation that the project may receive strong price support in its initial launch phase.

Betting Event: "Opinion FDV Above $500M One Day After Launch"

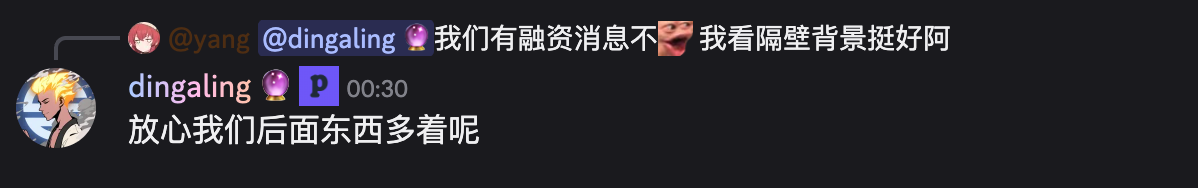

Possibly driven by expectations of Opinion's imminent TGE, predict.fun, another prediction market on BNB Chain with top weekly trading volume, has also seen a noticeable increase in community activity recently. It's worth noting that the project's founder, dingaling, recently stated in the official Discord community, "There's still a lot being prepared behind the scenes," hinting at new developments to be announced this month, which has further heightened market attention to its next moves.

Screenshot of founder dingaling's reply in the official Discord

The Period Before the World Cup Could Be the True Breakout Phase for Prediction Markets

The US Super Bowl that started this morning already provides a very clear reference. On Polymarket alone, the trading volume for prediction events related to the "US Super Bowl Champion" exceeded $700 million. The trading scale brought by a single event is already quite substantial.

But the Super Bowl is essentially a domestic (and most-watched) event in the US, while the World Cup is a catalyst of a completely different magnitude.

Compared to a single match, the World Cup lasts longer, has more matches, and involves countries from all over the globe. From the group stage to the knockout rounds, new prediction market subjects are generated almost daily: qualification probabilities, score ranges, knockout matchups, Golden Boot winner, championship odds, etc., all continuously form new markets. This sustained, high-frequency event stream over several weeks can often bring more stable and longer-lasting trading activity, not just short-term traffic spikes.

Therefore, if the US Super Bowl has already proven that major sports events can bring massive trading volume to prediction markets in a short time, the World Cup is more likely to be the key node determining whether the sector's overall user base and trading volume enter the next stage.

It's believed that around the time of the World Cup, many prediction market platforms will conduct their TGEs. Perhaps now is the best time to position oneself. For me personally, with the market performing poorly, it might be better to 'place some bets' in prediction markets rather than buying altcoins.

Related Content

Prediction Market Activity Hits Record Highs: Key Events for Top Projects to Watch

Hot Sector, New Interaction Opportunities: Three Prediction Markets Favored by YZi Labs

Step-by-Step Guide to Participating in predict.fun, Backed by CZ