2025 Survival Rules for Dealers: Where Gold Was Once Everywhere, Now We Rely on These Two Trump Cards

- 核心观点:2025年撸毛赛道收益骤减,模式转型。

- 关键要素:

- 山寨行情低迷,空投代币价值缩水。

- 传统交互收益锐减,工作室大规模退场。

- 新模式涌现,如“嘴撸经济”与币安Alpha。

- 市场影响:推动撸毛策略向精品化、多元化转变。

- 时效性标注:中期影响。

Original article | Odaily Planet Daily ( @OdailyChina )

Author | Asher ( @Asher_0210 )

2025 is almost over, and as the author of Odaily Planet Dailywho "loves to talk about 'Lu Mao' the most and loves to write about interaction design the most" (I wrote the vast majority of the articles in the interaction design tutorial section this year), it's time to do an annual summary of 'Lu Mao'.

After clearing out my Meme coin holdings in the on-chain AI Agent sector at the beginning of the year, I devoted most of my time to various popular interactive projects. I tried every popular project I could get my hands on, and of course, I also avoided most of the pitfalls. As the end of the year approaches, I've had many conversations with friends who are also passionate about arbitrage, summarizing the changes in the industry this year. Because of this, I deeply feel that arbitrage in 2025 has quietly slid from a "gold rush for everyone" to a "collective ebb."

Profits from exploiting fake items plummeted, leading to the collective exit of studios.

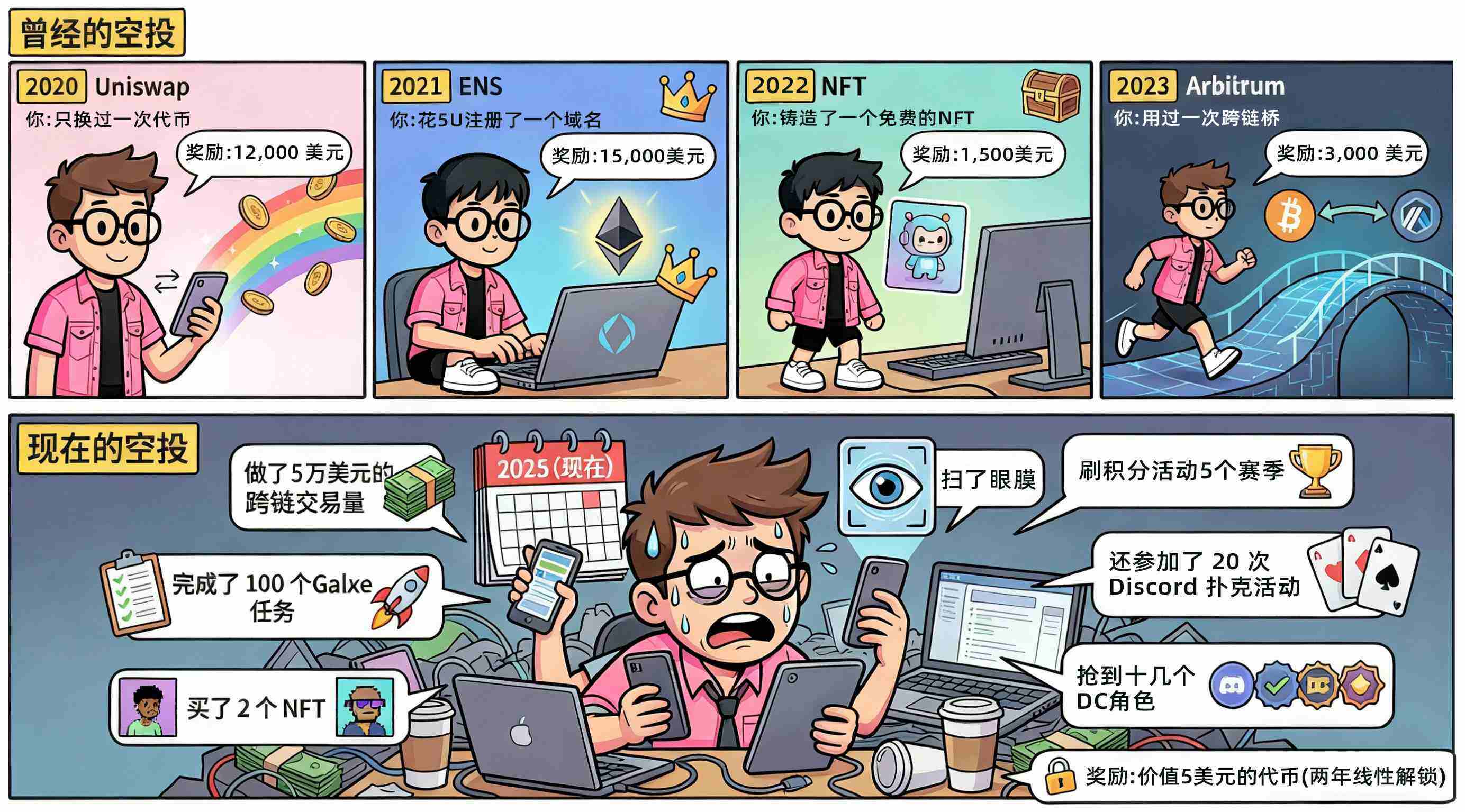

Looking back at 2025, the arbitrage sector plummeted from a "get-rich-quick myth" to a "winter of intense competition." Large arbitrage tokens disappeared, smaller ones shrank, and being "reverse-exploited" became the norm. The most common saying among arbitrageurs this year most vividly illustrates this change: "Small arbitrage tokens are only $5 to $10, and the gas fees for claiming airdrops are more expensive than the tokens themselves; the previously over 10% unlocked airdrop rewards are now only 2 to 3%, and they have to be unlocked in batches."

The sharp drop in profits has triggered a mass exodus of studios. "From a time when making money was easy, we can't even cover the team's basic salaries now. It's not that we didn't work hard; the door of the times has quietly closed." According to an interview with Odaily Planet Daily, many teams have either shut down entirely or shifted to more controllable businesses like cross-border e-commerce. The few remaining teams are barely surviving, relying almost entirely on the daily "guaranteed airdrops" from Binance Alpha. However, the significant drop in the value of Binance Alpha airdrop tokens throughout November suggests that studios may face a second wave of mass exodus in the near future.

Even more absurdly, this year, the biggest source of profit for many studios was not token airdrops, but hoarding hardware. A studio friend joked, "I didn't make much money from airdrops this year, but the memory sticks I hoarded in February went from 55 yuan to 240 yuan. A bunch of memory sticks became the most profitable investment of the whole year."

The pet-growing industry has gone from a "get-rich-quick myth" to a "cold and competitive winter."

The lack of a market for counterfeit goods is the root cause of declining profits from profiteering.

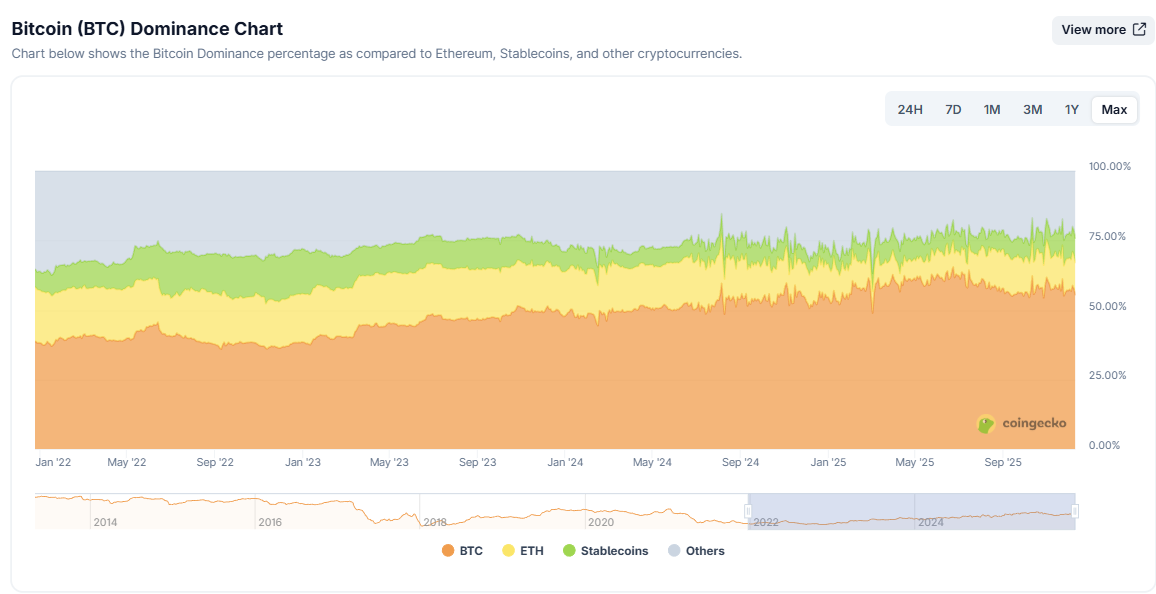

The profitability of airdrops essentially depends on the subsequent performance of the airdropped tokens, and the amplification of airdrop value often relies on the "altcoin season"—the golden window of opportunity when altcoins collectively rotate and experience explosive growth. However, throughout 2025, the crypto market was trapped in a prolonged BTC-dominated landscape, with altcoins generally sluggish. According to on-chain data, BTC's market capitalization share continued to rise, reaching a peak of 63% this year. BTC's dominance means that liquidity does not spill over, altcoins do not rotate , and new projects find it more difficult to gain momentum—without a price amplifier, the value of airdrops cannot rise, and the profitability of airdrops is destined to weaken.

BTC market capitalization percentage

This situation of "no counterfeit market" directly hits the core pain point of profiteering - the gas fees, time and resources invested in the early stage are often exchanged for tokens that open low and continue to fall, or even go to zero. The income of a single account has shrunk from tens or even hundreds of dollars in the past to a few dollars, which cannot even cover the gas fees.

Further analysis reveals two key points. First, the market capitalization of newly launched projects this year has generally declined, leading to a complete collapse in valuations. From the previous boom of ARB and STARK airdrops, which boasted FDVs of $100 to $200 billion at launch, many projects now start with FDVs of only a few hundred million or even tens of millions of dollars. Prices lack room for imagination, rendering airdrops worthless at launch. (It must be said that the inflated valuations of once-dominant projects are also partly attributable to the practice of airdrop investors who aggressively inflate data, lack engagement, and abandon projects immediately after purchase.)

On the other hand, even if the opening valuation is not high, it is difficult to expect a "catch-up rally". Many projects have "insider trading" practices, where investors enter the market early and then ruthlessly dump their holdings once listed, or even simply abscond with the funds. Various types of crashes are constantly occurring: single-day halvings, drops of over 80%, initial surges followed by a steady decline, and concentrated selling of airdrops are all recurring scenarios ( for more related content, see: From Sahara to Tradoor, a review of recent altcoin "fancy drop" tactics ) . Many experienced altcoin investors lament that "sell as soon as you get it" should be an ironclad rule, because 90% of altcoins are destined to go to zero, and the risks of heavy speculation far outweigh the potential returns.

Therefore, the initial gains from airdrops are already extremely limited. If one chooses to stubbornly hold on to the market and become a "diamond hand" (i.e., hold on to a losing position), not only will they not see a rebound, but their final gains will also be even lower.

Despite a significant drop in ROI for token airdrops in 2025, the industry hasn't completely stagnated. Odaily Planet Daily observed that the methods for generating ROI are quietly diversifying, moving beyond simply participating in daily testnet interactions and boosting mainnet trading volume to try and win token airdrops. Instead, several niche approaches have gradually emerged.

Diverse grooming methods

From traditional fluffing to "skilled fluffing"

In 2025, the biggest innovation in the crypto space will undoubtedly be the "talk-and-talk economy." InfoFi (Information Finance) uses token incentives to reward high-quality information creators directly, while also alleviating the problems of information fragmentation and lack of trust in the crypto world.

Since Kaito launched its "Yap-to-Earn" mechanism , Twitter feeds have been flooded with posts analyzing upcoming TGE projects. Subsequently, Cookie launched Cookie Snaps , highlighting "rewards for high-quality Crypto (CT) content by analyzing crypto projects and KOLs," while Galxe used Starboard to help projects select and incentivize key contributors through a data-driven approach. These mechanisms sparked a frenzy among KOLs to publish project analysis posts in competition for token airdrops, and also popularized the concept of "talking and commenting"—easily obtaining project airdrops simply by posting and writing reviews.

Traditional exploitation methods may have reached a turning point. The arduous work of "using multiple accounts to run scripts and grinding interactions" often ends up being wiped out by the witch system in the end—not only is all the work wasted, but not a single reward is achieved. Projects that were supported for several years with high expectations have ended up with a "reverse exploitation" outcome, leaving people utterly disheartened.

With the advent of the "talking it out" era, platforms like Kaito and Cookie have lowered the barrier to entry by using content points and influence rewards, resulting in faster returns, lower costs, and greater potential. In this new landscape, a high-quality post on platform X, complete with images and opinions, can generate even more value than a week's worth of on-chain interactions.

The "talking about it" posts on the X platform these days is actually just a different way of creating a premium "freebie" account. By going with the flow and actively adapting to the new freebie model, people can get more token airdrops.

Binance Alpha: The main source of revenue for studios to survive

Since its launch in May 2025, Binance Alpha has been hailed as a "wealth engine" for arbitrage, reaching its peak during the "golden month" of September. Starting in May, Binance Alpha and Binance Booster ( for more related content, see: Don't just farm points for airdrops, Binance Alpha's Booster program is also worth participating in ) provided "stable start-up capital" for studios, earning $500 to $2000 per month, allowing studios to go from "survival" to "expansion." Many arbitrageurs joked, "Binance is giving away money like crazy, making people feel like money is falling from the sky."

In September, Binance Alpha experienced a "token issuance boom," with numerous projects flocking to TGE, resulting in airdrops of 1 to 2 tokens per day. Driven by the "wealth effect" of Binance Alpha, on-chain data showed that Binance Web3 wallet's daily transaction volume surged to $5 billion, accounting for 95% of mainstream wallets; the number of users also skyrocketed from 100,000 in August to 400,000.

Despite a surge in users, the returns are extremely limited. According to Binance Alpha earnings report released by crypto KOL Pumpman on September 17th, among the 26 airdrop projects from September 2nd to September 16th, the highest-yielding project was STBL, with an opening value of $200. If held until September 17th, its value would reach a staggering $675. Holding all 26 projects until September 17th would yield a total value of $2529; even selling them all at the opening would have yielded $1544.

Binance Alpha Earnings Report (Statistics as of September 17)

However, since October, the returns from airdrops on Binance Alpha have shown a significant downward trend. The community is widely complaining that "some studios have already stopped airdropping, and some accounts with less than $1,000 have started to leave." Binance Alpha has shifted from the "big airdrop" era of September (where single-account airdrops often exceeded $100, with opening highs reaching $300, and even over $500) to a phase of "small airdrops" or "break-even/minor loss."

There are two reasons for this change. First, there's an oversupply of participants. The wealth effect in September attracted a large influx of new users, especially those engaged in "airdrop farming," leading to increasingly higher points thresholds and fiercer competition during the claiming phase. Many could only watch helplessly as their shares were snapped up amidst endless error reports and verifications. But more critically, there's a shortage of rewards. Although the number of participants in Binance Alpha dropped from over 400,000 to 200,000 in November, seemingly a significant decrease, the actual value of the airdropped tokens shrank even more dramatically. Many projects experienced immediate price drops or flash crashes upon opening, resulting in a sharp decline in the returns per coin. This made the profit from airdrop farming far more severe than the impact of the reduced number of participants.

Admittedly, "talking about it" and Binance Alpha have brought new ways to make money in the cryptocurrency trading sector, but in the sluggish crypto market of 2025, they are only short-term stimuli with very limited profit windows. What truly allows cryptocurrency trading to persist and stabilize returns are the two major supporters: "new token offerings" and "stablecoin investment."

Subscribing to new shares is also an important part of earning profits from IPOs.

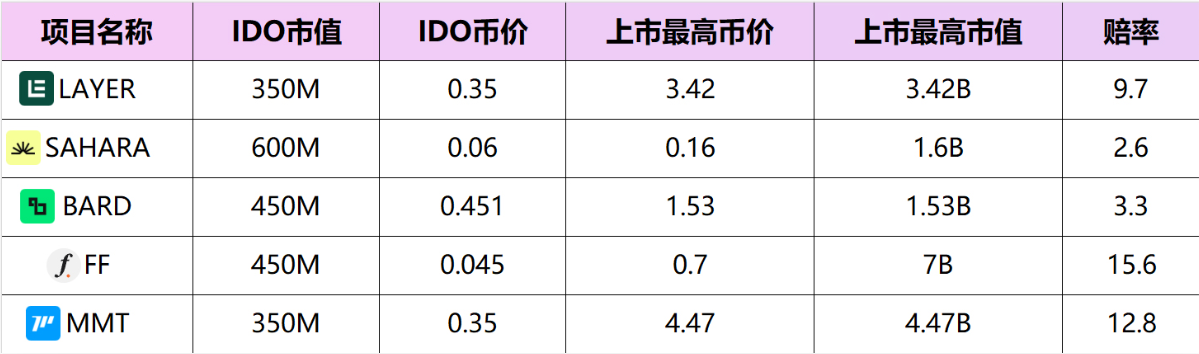

Although most new cryptocurrencies this year have experienced a "high opening and low closing" pattern, with some dropping by half or even 90% from their peak, the returns from subscribing to new offerings (IPOs) for highly funded projects that generate significant social media buzz and high investor sentiment remain quite impressive. For these projects, if the initial offering price is reasonable and all TGE tokens are unlocked, it's essentially a "win-win" situation.

The underlying logic is not complicated. These highly funded projects often launch with intensive promotion before and after their opening, coupled with a large number of KOLs collectively endorsing them, rapidly maximizing market hype in a short period. The higher the sentiment, the easier it is for a liquidity rush to occur at the opening, and the first-day price is significantly inflated. For those looking to profit from this, there's no need to bet on a particular sector or gamble on the long term; as long as they seize the opening window, they can capture this "short-term premium."

The five projects launched on the BuildlPad platform this year are all "guaranteed profit" IPOs. Overall, TGE projects generally offer 2 to 5 times the immediate return, with FF and MMT even reaching over 10 times the return at their historical highs.

BuidlPad IPO Profit Chart

Besides BuidlPad, other popular IPO platforms such as Kaito and Legion, while offering IPO prices for some projects, generally present worthwhile opportunities if two signals are met simultaneously: high pre-IPO community buzz and significant oversubscription during the subscription phase. Selling on the TGE day usually yields good returns. Therefore, a new wave of IPO frenzy has begun in December, but not all projects are worth participating in. It's still essential to conduct thorough research and focus on projects with high funding levels, high oversubscription rates, and high community discussion to have a chance of achieving good returns.

"Stablecoin investing" is not a side business, but the foundation for long-term profit-making.

Profiteering isn't just about "high-risk, high-reward" strategies; earning stable returns is also essential. The core of profiteering isn't about taking risks, but about acquiring more certain assets with minimal capital loss. Therefore, depositing stablecoins to mine and claim airdrops is essentially profiteering—simple to operate, low-risk, and with near-zero loss.

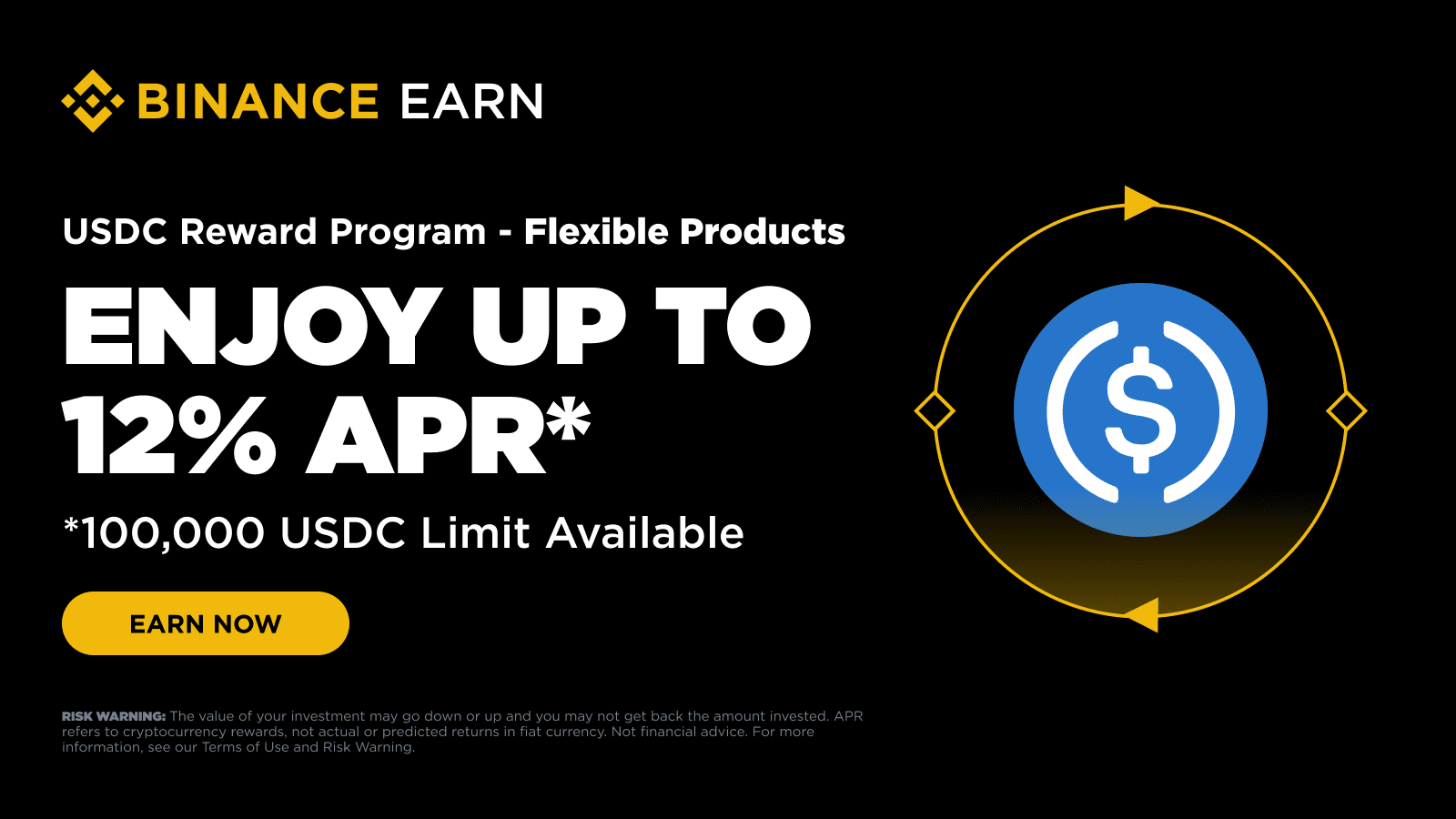

In August of this year, Binance launched a month-long USDC flexible deposit program with a single account limit of $100,000 and an annualized return of up to 12%, a typical "high-yield, low-risk" opportunity to profit. Therefore, products with similar annualized returns that can be consistently maintained at around 10% are worth allocating a portion of your funds to – they are "recovery devices" to maintain your health during a bear market.

Binance launches USDC flexible deposit program

In 2025, Plasma undoubtedly reigned supreme as the "ceiling" for stablecoin mining rewards. On August 20th, Plasma partnered with Binance to launch an on-chain earning program, allocating 1% of the total supply (100 million XPL) as deposit rewards and offering a 2% annualized return on USDT deposits. The program immediately went viral: the initial allocation of 250 million USDT sold out in less than an hour; the second allocation of 250 million USDT lasted only 5 minutes. Subsequently, Binance lowered the subscription limit per account to 10,000 USDT and opened up a final allocation of 500 million USDT, which was also fully subscribed within hours, ultimately attracting over 30,000 Binance users.

Based on Binance's final allocation of 1 billion USDT, users who deposit 10,000 USDT will receive approximately 1,000 XPL. At the opening price of $0.60, this airdrop yields about $600. More importantly, this return only takes about one month, translating to an annualized return of over 70%. Combined with USDT's built-in 2% annualized interest rate, the actual return for those seeking to profit from this airdrop will be even higher. For stablecoin mining, this is truly a once-in-a-lifetime opportunity.

Plasma and Binance jointly launch an on-chain earning program.

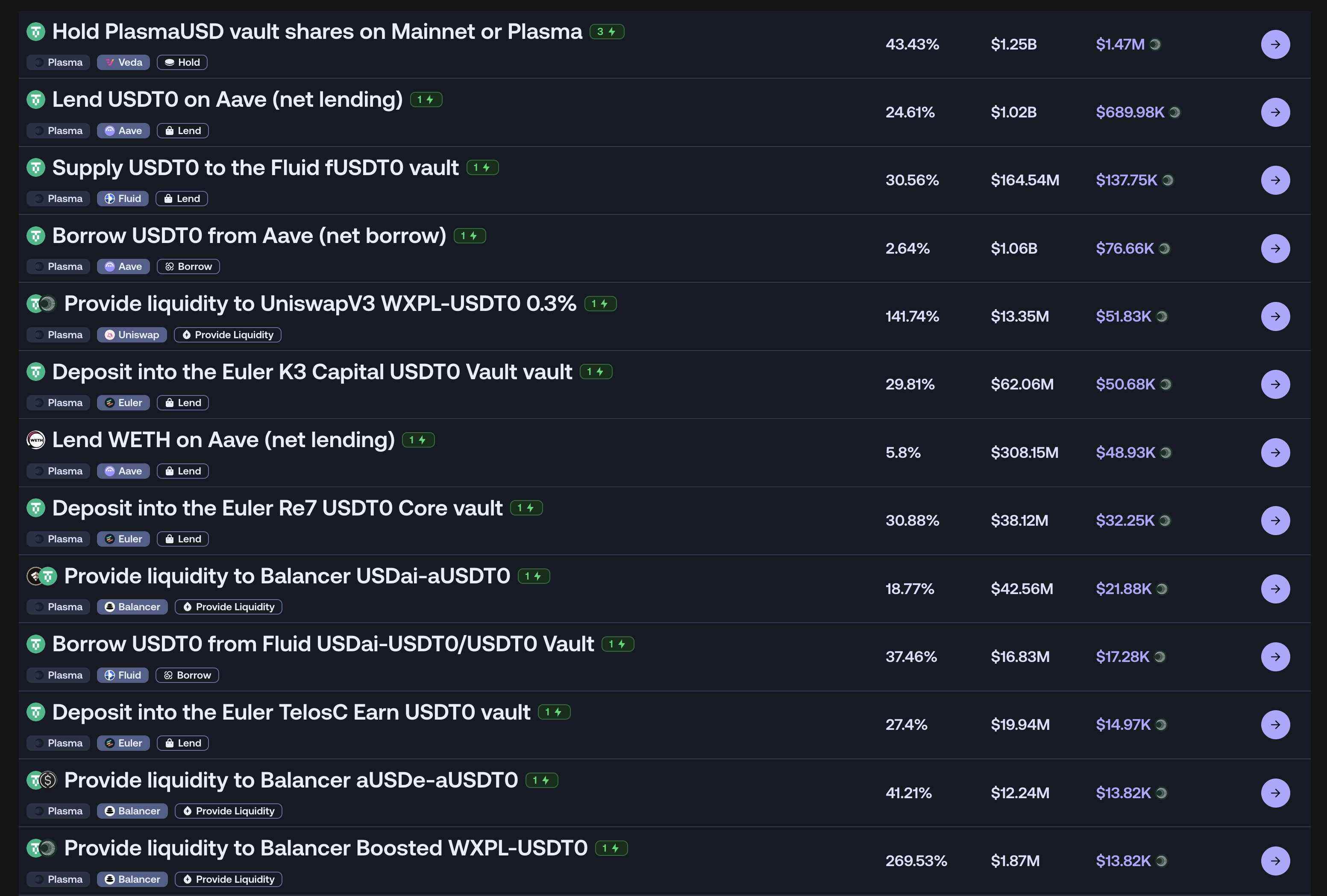

Furthermore, the "early mining rush" is also a golden opportunity for token collectors, with short-term annualized returns often reaching 30% to 40%. Popular community projects like Plasma, Monad, or Linea all offer token airdrops to reward network participants after their mainnet launch. Although these "early mining windows" are short-lived, the returns are considerable, making them a worthwhile opportunity to capitalize on.

Plasma mainnet launch day "first mining" revenue chart

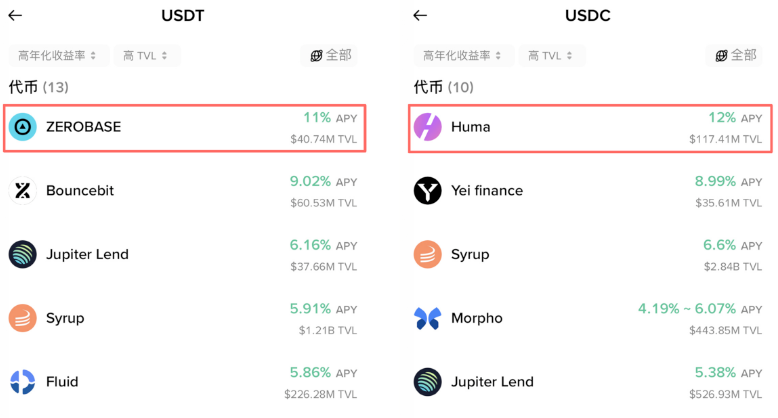

Finally, for individuals, I generally participate in DeFi projects with annualized returns exceeding 10% among the USDT and USDC investment products in my Binance Web3 wallet. Instead of dabbling in various on-chain products, unsure of their authenticity, it's much safer and more convenient to choose DeFi products directly within the Binance wallet.

Financial products in Binance Web3 wallet

"Stablecoin investment" is not a side business, but the foundation for long-term profit-making. Only by ensuring steady growth of funds and maintaining the core capital can one avoid being drained when the market is cold and have sufficient "ammunition" when the market is hot.

As long as the industry survives, profiteering will never die.

In 2025, it wasn't that the altcoin trading sector was dead, but rather that the altcoin market was terrible. Whether it was short-term speculation or long-term holding, it was almost impossible to make money; everyone was getting burned. Futures traders were liquidated six times a month, accumulating debt and feeling overwhelmed; spot traders went to zero twice a year, questioning their existence; while altcoin traders couldn't wake up with hundreds of dollars in their wallets every day like they did two years ago, their losses were still within a manageable range, making them one of the few groups that managed to survive in this bear market.

Regardless of whether the market is hot or cold, profiting from promotions remains a low-cost and sustainable way to make money.

When the market is sluggish, airdrops allow us to slow down. Although the number of airdrop projects is decreasing, this slower pace actually gives us time to thoroughly research each project, understanding its mechanics, gameplay, and long-term value. Instead of randomly opening high-leverage contracts on exchanges and blindly hoarding a bunch of altcoins, it's better to focus on refining your "best investment accounts." Bear markets may seem boring, but they are actually the best time to develop sound investment plans and prepare your "best investment accounts."

When the market is hot, arbitrage is more like a stable strategy of "securing profits." In a bull market, altcoins generally rise, and the market valuation of new projects like TGE is even higher, naturally increasing arbitrage returns. Compared to hoarders who bet heavily and rely on a single project to gamble on A7, the advantage of arbitrage is that you can sell decisively at the opening and cash out immediately after mining, without being completely tied to market sentiment. This not only locks in profits steadily but also allows returns to accumulate continuously, providing a controllable cash flow even in a volatile bull market.

Therefore, given the changes in the airdrop market this year, a more strategic approach is needed in 2026. While refining your X account, "talking about airdrops" is still worthwhile; Binance Alpha requires a comprehensive evaluation of multiple factors, including token value, airdrop thresholds, and transaction wear and tear, before deciding whether to participate; and for new token offerings and stablecoin investments, it's crucial to focus on finding high-quality targets to maintain stable returns under varying market conditions.

While profiteering may not bring overnight riches like it did in the past, it still allows for steady wealth accumulation. The path of profiteering is ultimately solitary, requiring sound judgment, patience, and execution. Luck always plays a role, but those who truly survive and continuously accumulate wealth in this field are those who understand the importance of perseverance, learning, and maintaining a good pace.

As long as the industry survives, profiteering will not die out—I believe that as long as we persevere, we will still have a chance to have the last laugh in 2026.