After Bitcoin fell below $100,000: Who bucked the trend and surged, and who took the opportunity to go to zero?

- 核心观点:加密市场暴跌,流动性枯竭凸显抗跌资产。

- 关键要素:

- 衍生品爆仓21亿美元,比特币跌破10万美元。

- Sui生态MMT、AIA及隐私币ZEC逆势上涨。

- Euler因xUSD机制缺陷产生2.85亿美元坏账。

- 市场影响:资金向实用型赛道转移,DeFi风险暴露。

- 时效性标注:短期影响

Original article | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

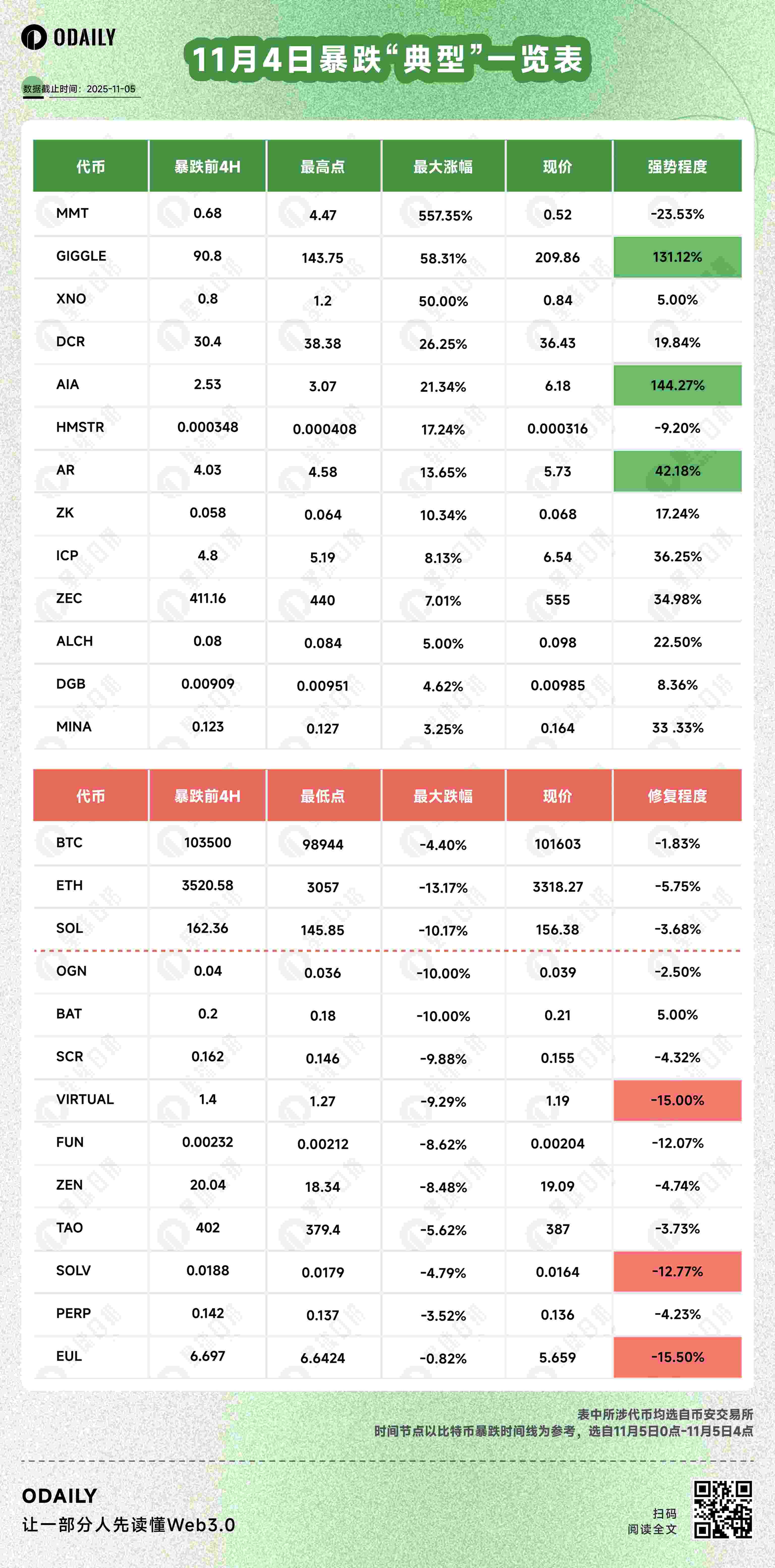

At 5:00 AM on November 5th, the cryptocurrency market suffered a severe blow. Derivatives liquidations totaled $2.1 billion , with long positions accounting for $1.68 billion. While these figures are far lower than the over $20 billion "liquidation of the century" on October 11th, this decline was far more devastating.

Bitcoin fell below the $100,000 mark, dropping as low as $98,944, a 4.8% decline on the day; in the previous flash crash, Bitcoin only dipped to $102,000. ETH and SOL fell by 8.8% and 6.6% respectively.

At a time when liquidity is strangling us, which stocks are most resilient to market downturns, and which are heading towards "zero"?

Because the data is based on the Bitcoin crash timeline and only the tokens are from the Binance exchange, the data on the biggest drop may not be as dramatic. However, it does reveal an undeniable fact: most altcoins have already been drained of liquidity, and slow bleeding is their usual symptom .

From the data charts, MMT and AIA are the most outstanding tokens in this round of market activity. They both belong to the Sui ecosystem, with MMT being the native token of Momentum, a leading DEX on Sui, and just launched on November 4th. MMT performed strongly in its initial launch phase, with considerable short-term gains, but as of this writing, the price has seen a significant pullback, still falling victim to the ironclad rule of new Binance tokens falling immediately upon listing. AIA, on the other hand, focuses on AI infrastructure and has increased more than 30 times since its listing on Binance on September 25th.

Even more surprisingly, during the market downturn on November 4th, many old cryptocurrencies considered "outdated" suddenly became active. XNO, ZEC, ICP, DCR, AR, and other "stars of the old era" bucked the trend and rose during this storm. Since ZEC reignited the privacy narrative, these tokens, once buried by time, seem to have rediscovered their own narrative window.

Especially two days after the crash, when we tracked the prices of these tokens again, most of them were still performing well, with the privacy sector remaining a mainstay . ZEC led the gains, while MINA and ZK also showed strong performance. Among the older coins like XNO, ICP, and DCR, which adhere to the fundamental logic of digital cash and attempt to address Bitcoin's shortcomings using different technological approaches outside the Bitcoin framework, ICP continued its strong upward trend, while XNO and DCR have retreated and entered stress testing.

(Personal observation: The liquidity of altcoins has been dried up, and governance tokens have essentially become "useless," a consensus almost universally held in the market. However, since the resurgence of the privacy narrative, while we've seen many older coins revived for sentimental hype, we may only be focusing on their "oldness." A more noteworthy signal is that funds seem to be favoring "practical" sectors , such as the storage sector which surged today. In fact, both privacy and storage seem to be moving towards "practicality." Therefore, I boldly predict that the next sector to see a surge may also lean towards "practicality." This is merely my personal observation and does not constitute investment advice.)

Below, Odaily Planet Daily has selected several of the most representative projects from this period of turmoil and panic:

GIGGLE: A Binance plaything manipulated

The development team behind GIGGLE is the BSC community team GiggleFund, inspired by Giggle Academy, an educational charity founded by former Binance CEO CZ. On September 21st, Giggle Academy announced it would begin accepting public donations in cryptocurrency to help more children access free, high-quality education. GiggleFund seized this opportunity to launch GIGGLE and announced that all GIGGLE transaction fees would be donated to Giggle Academy. This excellent entry point led to GIGGLE's rapid growth; Giggle Academy received over $1 million in donations within 12 hours of opening donations, approximately 90% of which came from GIGGLE transaction fees. CZ even wrote a special article praising this initiative, and GIGGLE was subsequently listed on Binance Spot.

GIGGLE holders had previously called on Binance to donate trading fees from GIGGLE spot and futures transactions on its platform to continue the token's initial vision, a move that was successfully implemented on November 3rd. Stimulated by this positive news, GIGGLE surged from around $70 to a high of $113.99, a short-term increase of over 60%.

Perhaps to prevent excessive hype within the community, CZ posted a clarification on the evening of November 3rd stating that "GIGGLE is not the official token of Giggle Academy," triggering a panic sell-off: the price plummeted from $230 to $50 (a drop of 78%), and the market capitalization evaporated by over 70%.

However, dramatic turns often come just as violently.

On the evening of November 4th, CZ quoted an official statement from Giggle Academy, announcing that 25% of Binance's GIGGLE transaction fees would be burned directly, and 25% would be donated to Giggle Academy. Simultaneously, Binance spokesperson He Yi also commented. This burning narrative transformed panic into FOMO (Fear of Missing Out), causing GIGGLE's 24-hour price surge by a staggering 155%.

ZK: Privacy Resurgence and Buyback Logic

ZK (the native token of ZKsync) is the governance and utility token of ZKsync, an Ethereum-based Layer 2 scaling solution. ZKsync achieves high throughput and privacy protection through zero-knowledge proof (ZK-Rollup) technology, primarily for DeFi, NFT, and cross-chain applications.

On November 1st, Ethereum founder Vitalik Buterin posted a message praising ZKsync for its "quiet but valuable contributions to the Ethereum ecosystem." This tweet acted as a signal, and amidst the renewed focus on privacy, ZKsync became the focus, with its stock price surging by over 160% in the short term.

Although the price subsequently declined, on the evening of November 4th, ZKsync founder Alex released "ZK Token Proposal Part I," proposing a major update to the ZK token economic model: all network revenue will be used to buy back and burn ZK tokens, transforming them from simple governance tokens into assets with value capture capabilities.

Amidst a general market decline, this update caused ZK to buck the trend and rise. However, the community is not entirely convinced. Some voices question whether ZKsync's network revenue is sufficient to support the buyback. In other words, while the narrative is enticing, whether it can be delivered remains to be seen.

EUL: The Debunking of the DeFi "Leverage Illusion"

Euler (EUL), an Ethereum-based platform focusing on permissionless lending, is characterized by the ability for anyone to become a Curator, freely creating lending pools, allocating user deposits, and earning performance fees. To attract funds, curators have begun pursuing high TVL (Total Value Locked) and high APY (Annualized Yield).

Euler's recent collapse stemmed from xUSD. xUSD (Staked Stream USD) was a yield-generating stablecoin issued by the Stream Finance protocol. It promised a stable peg to $1 plus up to 18% annualized returns, which sounded very attractive. Its mechanism was as follows: users deposited USDC, the protocol minted xUSD, and lent it to lending platforms. This leveraged cycle of repeatedly pledging, lending, and depositing xUSD created the illusion of "unlimited liquidity" and "extremely high returns." Euler's curators saw an opportunity. They invested all the USDC users deposited into Euler into the xUSD cyclical strategy.

However, this also sowed the seeds of a problem: the xUSD price oracle was hardcoded to be greater than $1. Regardless of how much the market fell, the system always assumed xUSD was above $1. If the actual price of xUSD fell, the liquidation mechanism would fail to trigger, and bad debts could not be automatically processed.

On November 3rd, the Balancer hack was exposed, resulting in the theft of $128 million. Multi-chain liquidity pools were affected, and Stream's xUSD pool also experienced selling pressure, with the price fluctuating abnormally for the first time, dropping to $0.98. At this point, it seemed someone discovered that its circular minting was a Ponzi scheme: there was no real return to support it, relying entirely on new funds to pay off old ones. However, the oracles in the Euler system still showed "xUSD > $1". This meant that borrowers could use xUSD worth 10 cents as collateral to borrow $1 of USDC, but the system wouldn't trigger liquidation because it "didn't see" the price drop. Within a few hours, $93 million of USDC was withdrawn, and xUSD hit a low of $0.10. Euler detected a surge in bad debts and suspended xUSD-related pools, ultimately resulting in $285 million in bad debts.

Euler wasn't the only one affected, but the de-pegging of xUSD served as a magnifying glass, revealing the full extent of the DeFi leverage illusion: seemingly high-yield stablecoins exposed insufficient collateral and mechanism flaws in the panic, and more importantly, the fragility of the entire DeFi ecosystem.