Hardcore teardown: The X402 wanted to fix the "payment gap" in the internet, but fell into the same old pitfall again.

- 核心观点:x402协议存在五大架构缺陷。

- 关键要素:

- 中介经济模型不可持续。

- 双阶段结算延迟过高。

- 代币兼容性严重受限。

- 市场影响:阻碍AI Agent支付生态发展。

- 时效性标注:中期影响。

This article is from: @yq_acc

Compiled by Odaily Planet Daily ( @OdailyChina ); Translated by Ethan ( @ethanzhang_web3)

In 1994, Marc Andreessen made a crucial mistake he later admitted to: Netscape failed to integrate payment functionality into its browser. Due to regulatory uncertainty and financial institutions' risk aversion, Netscape's partnerships with Visa and Microsoft's with MasterCard both fell through. This led to ad surveillance-centric business models becoming the default choice for the internet for the next thirty years—a trillion-dollar industry built on comprehensive behavioral tracking rather than direct value exchange.

AI agents are now disrupting this balance. Autonomous systems neither watch ads, nor can they be analyzed through psychological profiling, and they lack the attention resources available for monetization. Content publishers face an either-or choice: either allow parasitic scraping that undermines content creation, or build a direct payment mechanism. The x402 protocol is currently the most promising attempt to revitalize the long-dormant "402 Payment Required" status code in the HTTP standard, combining it with blockchain settlement and cryptographic authorization mechanisms.

The timing was impeccable. Blockchain infrastructure had matured with the development of Layer 2 networks, achieving transaction costs below 1 cent and confirmation speeds in the sub-second range. Stablecoins across more than 20 chains had a circulating supply exceeding $42 billion. Google's A2A protocol explicitly envisioned an agent ecosystem based on "paying for services and charging fees." However, after studying the v1 specification, the v2 proposal change notes, and observing early ecosystem development, we discovered fundamental limitations in its infrastructure. Without significant revisions, the widespread adoption of x402 may be hindered .

This article provides a systematic critique based on the principles of distributed systems, the economics of payment protocols, and real-world deployment cases, and then outlines the core architectural transformation directions required to support internet-level deployments.

Understanding the architecture of x402

The protocol utilizes transferWithAuthorization() method of EIP-3009 to enable "gas-free" stablecoin transfers.

Specifically, the client constructs a cryptographically signed authorization that allows a third party (i.e., a Facilitator , an intermediary executor) to perform the transfer operation on its behalf.

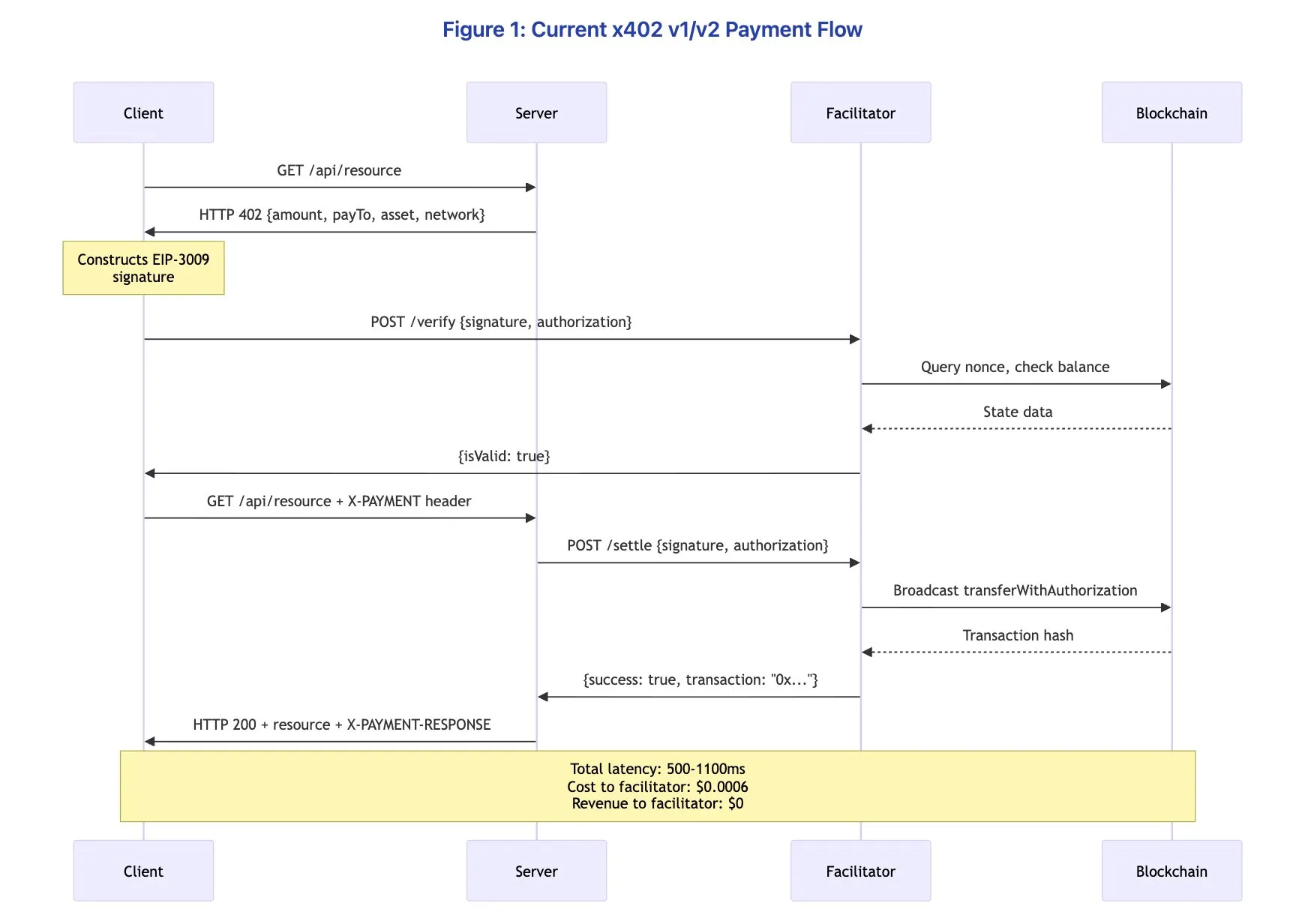

Figure 1: Current x402 v1/v2 payment process

Key findings: This design provides encrypted payment verification without requiring merchants to directly handle private keys or manage blockchain infrastructure. Settlements occur on chains such as Base (Ethereum Layer 2), with a final confirmation time of approximately 200 milliseconds and gas costs of less than $0.0001. While the protocol appears simple and elegant, this apparent simplicity masks several deep-seated architectural flaws.

Question 1: Imbalance in the economic model of the Facilitator (intermediary executor)

The Facilitator performs three functions: cryptographic verification of EIP-3009 signatures, broadcasting transactions to the blockchain, and providing API infrastructure. For these services, the Facilitator receives exactly zero compensation from the protocol. Its economic mechanism needs to be clearly defined: Coinbase's CDP Facilitator currently provides fee-free processing for USDC transactions on the Base chain. Each transaction consumes approximately $0.0006 in Facilitator gas fees. Based on processing 1 million transactions per month, the gas cost alone reaches $600 (not including server infrastructure, RPC node access, monitoring systems, compliance expenses, and engineering maintenance costs). The Facilitator has absolutely no cost recovery mechanism at the protocol level.

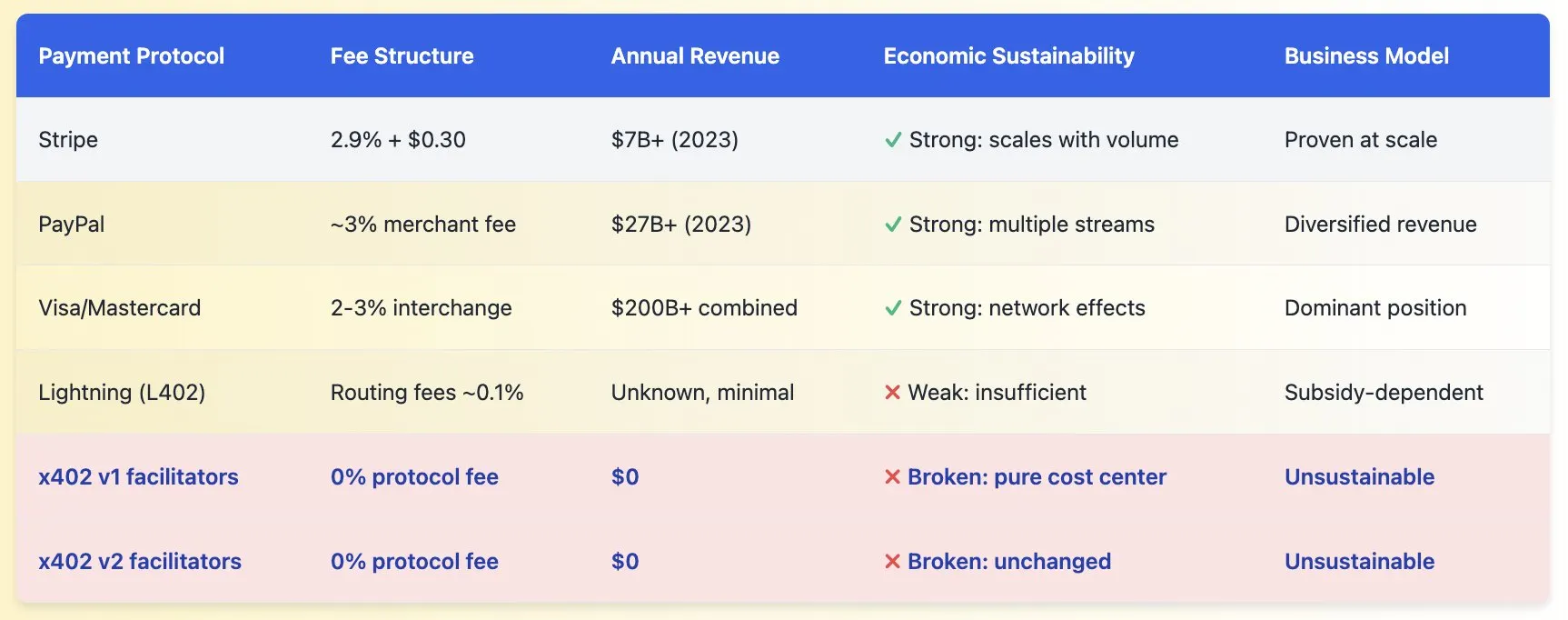

Table 1: Comparison of the Economic Sustainability of Payment Agreements

Figure 2: Facilitator Cost Breakdown (1 million transactions per month)

Key takeaway: Compared to all successful payment protocols in internet history: Stripe charges $2.9% + $0.30 per transaction; PayPal's merchant fee is approximately 3%; credit card networks extract 2-3% through merchant discount rates. These protocols achieve value capture because they provide value, thereby establishing a sustainable business model that scales with transaction volume. While the x402 Facilitator model provides real value, it completely fails to capture value.

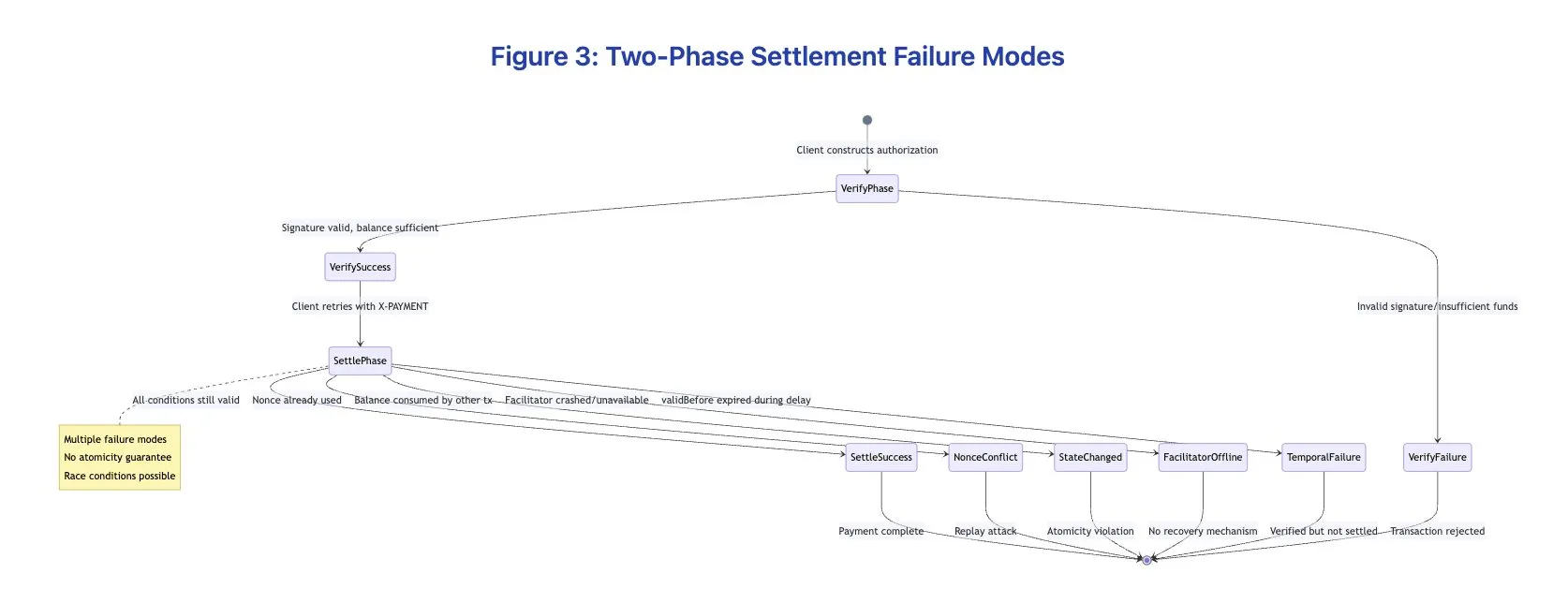

Question 2: Two-phase settlement causes delays and atomicity failures.

The current architecture requires two separate blockchain interactions: a verification phase (checking signature validity and random number state) and a settlement phase (executing the actual transaction). This design introduces both performance overhead and correctness issues.

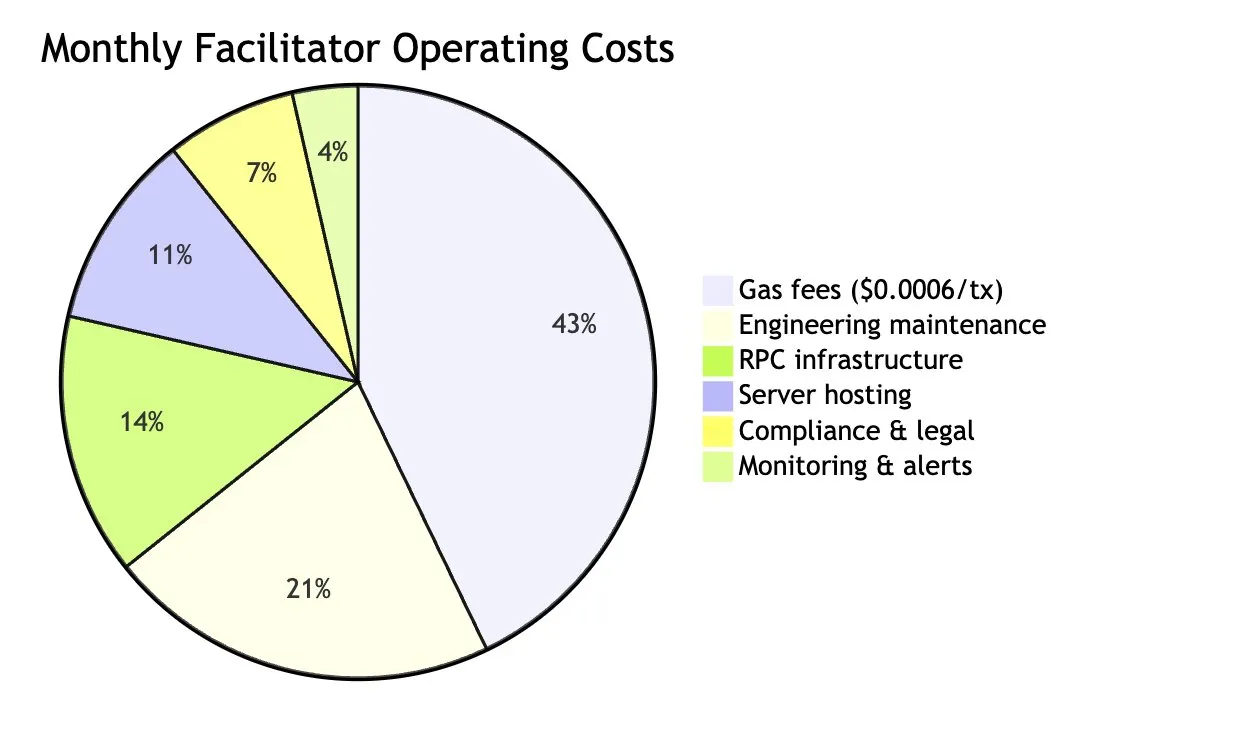

Table 2: Single x402 Payment Delay Analysis

For a single request, a latency of 500-1100 milliseconds is acceptable. However, in real-world applications, this can have a cumulative effect.

- The autonomous research agent collected data from 100 x402 protected APIs: payment overhead and latency of 50-110 seconds;

- The trading bot updates positions from 50 real-time data sources with a latency of 25-55 seconds.

- The AI assistant invokes 20 tools during the conversation, with a delay of 10-22 seconds.

Figure 3: Two-stage settlement failure mode

Violating Distributed Systems Principles: These are not hypothetical problems, but fundamental consequences of breaking down atomic operations (payments) into two-phase commit protocols . Distributed systems research since the 1970s has clearly demonstrated the vulnerability of two-phase commit protocols in the presence of atomic alternatives. The database field has learned this profoundly through the two-phase commit protocol (2PC)—which can lead to system hangs and inconsistencies due to coordinator failure. x402 must avoid repeating this mistake.

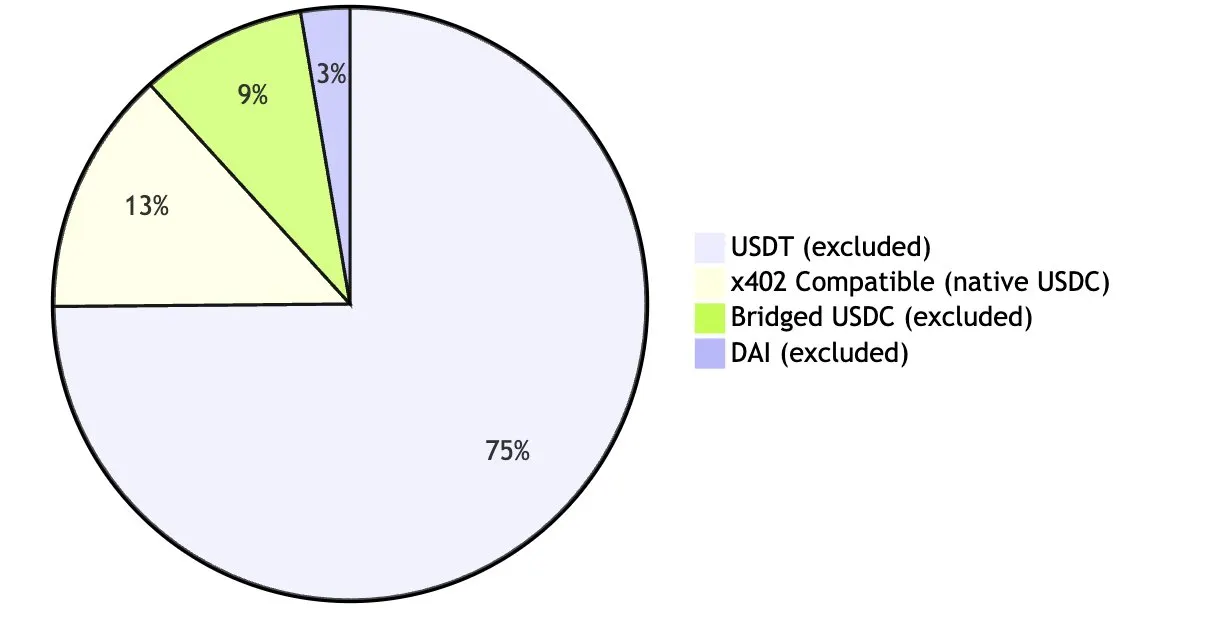

Question 3: EIP-3009's exclusivity fragments the token ecosystem.

The protocol mandates the use of the "transferWithAuthorization()" method from EIP-3009 for payment settlement. Theoretically, any token compliant with EIP-3009 is compatible with x402, but in reality, the number of stablecoins that conform to this standard is far less than the economically mainstream stablecoin set.

Table 3: Stablecoin Compatibility Matrix

Figure 4: Market Coverage of Stablecoins

This means that x402 v1 has compatibility issues with 40% of its primary target tokens . The situation is even more severe for other stablecoins: USDT has never implemented EIP-3009 and has no plans to do so, and as the largest stablecoin with a circulating supply exceeding $140 billion, its absence has a significant impact. DAI, on the other hand, uses a different standard (EIP-2612 license) to achieve similar functionality through a differentiated interface.

Question 4: Multi-chain support is not as advertised as it seems.

The protocol specification claims that x402 supports "Base, Solana, and any EVM network via a self-hosted Facilitator," seemingly achieving chain-agnostic flexibility. However, a closer look at the implementation details reveals that multi-chain support falls far short of expectations.

Table 4: Network Support Matrix of Facilitator

Each Facilitator supports a different subset of networks, resulting in variations in configuration requirements, token lists, and operational maturity levels. The protocol lacks a discovery mechanism that allows clients to query "which chains this merchant supports," forcing service providers to specify a single network in their 402 responses, compelling clients to either pre-deposit funds on a specific chain or abandon the transaction.

Question 5: Facilitator is an unnecessary intermediate layer.

Let's examine the fundamental question of this architecture: Why is a Facilitator absolutely necessary in this design? Several common reasons don't hold up to scrutiny.

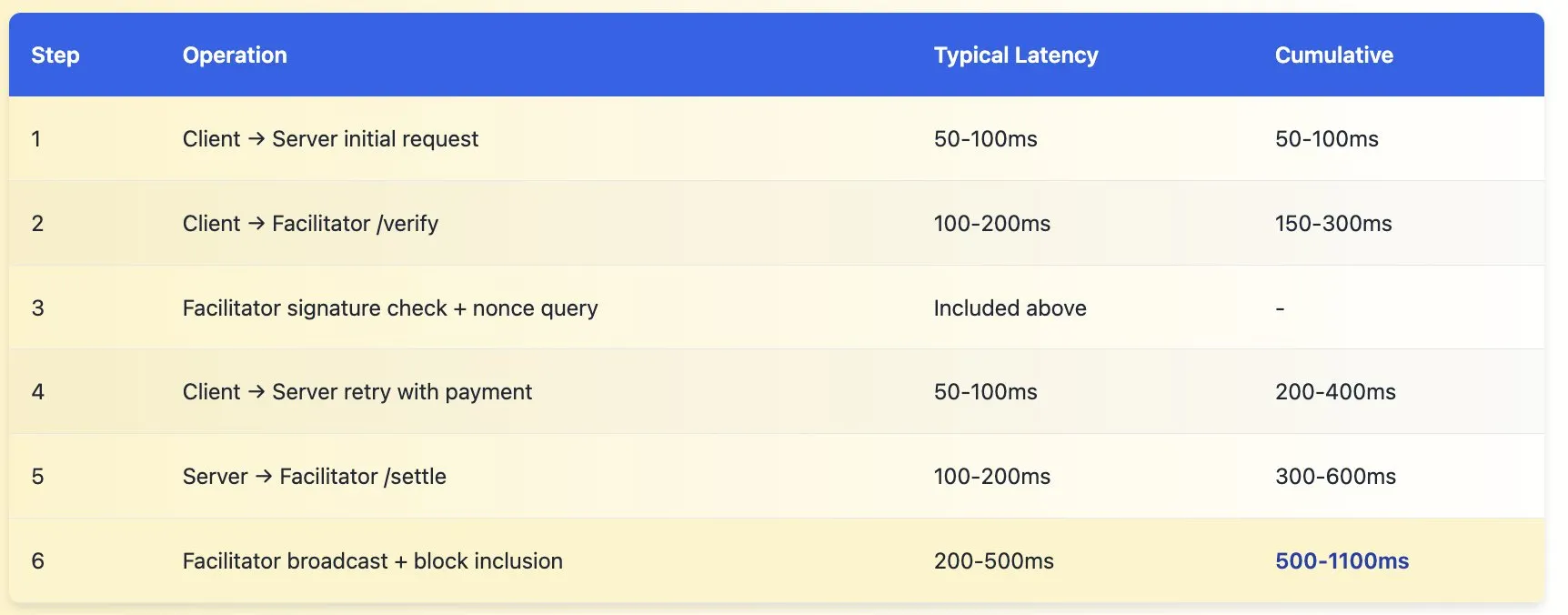

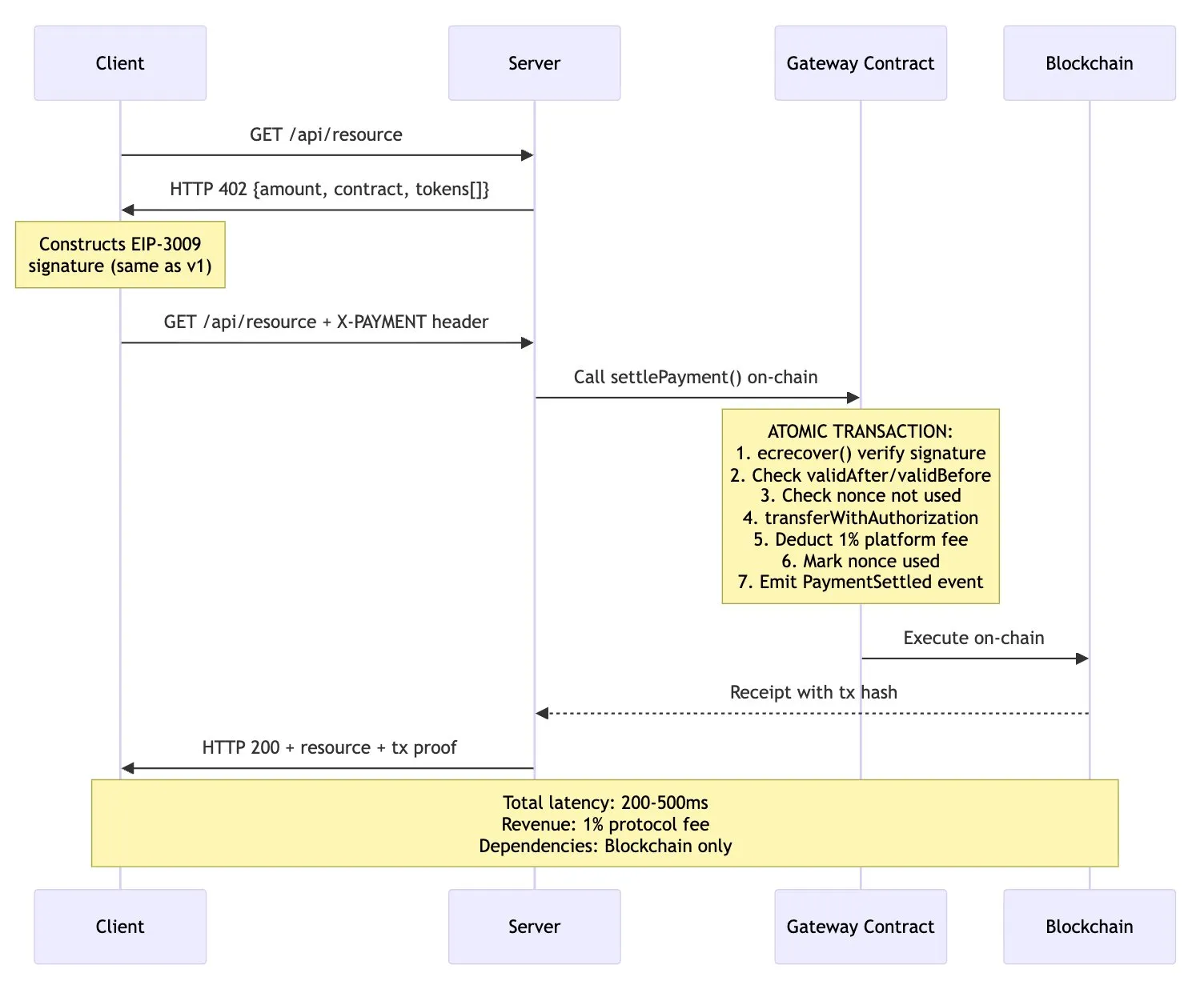

Figure 5: Alternative Architecture – Direct Settlement via Smart Contracts

This alternative design has several advantages:

- Atomicity : Verification and settlement are completed within the same on-chain transaction ;

- Reduced latency : One network round trip is eliminated (from 500–1100ms to 200–500ms);

- Reliability : No longer dependent on Facilitator's online rate or its API availability;

- Economic sustainability : Protocol fees are deducted directly on-chain (e.g., 1% platform fee ).

- Transparency : All settlement logic is on-chain and auditable.

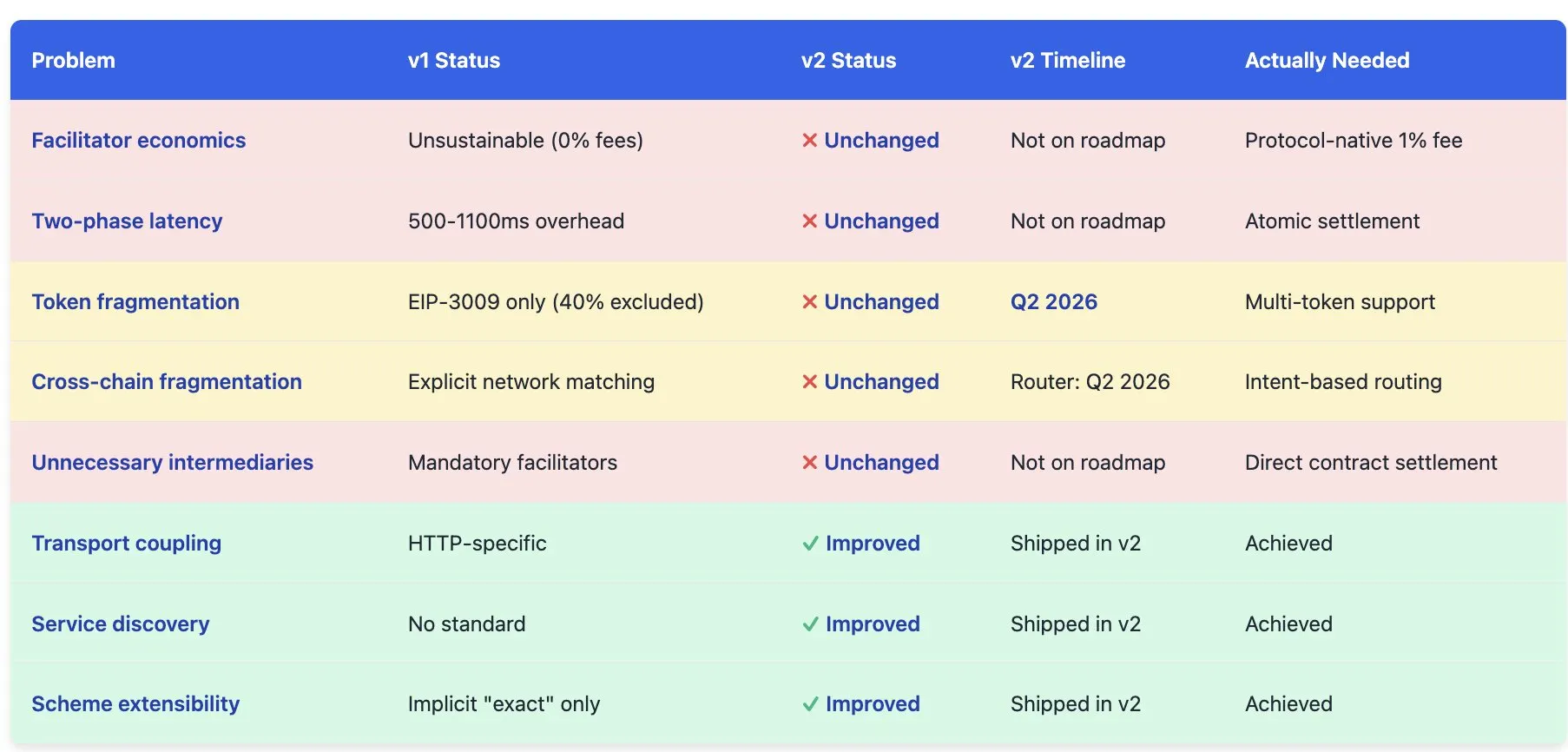

v2 Solution: Improvements and Legacy Defects

The x402 team has released the v2 specification branch, attempting to address some of the limitations of v1 through a "transport-independent refactoring." However, a review of the changelog, roadmap, and specification documentation reveals that while v2 achieves incremental improvements, it fails to resolve the aforementioned fundamental architectural issues.

Changes in v2:

- Transport abstraction: The protocol is broken down into three layers: type (data structure), logic (schema), and representation (HTTP, MCP, A2A);

- Solution scalability: Standardizes the "precise billing" scheme and supports new schemes (pay-as-you-go billing, e-commerce scenarios);

- Service discovery: A new Bazaar API has been added for discovering x402 resources.

The core issues that remained unchanged in v2:

- Maintain the existing Facilitator architecture (Client → Facilitator/Verification → Facilitator/Settlement → Merchant);

- The zero-cost economic model is maintained (Facilitator still receives no compensation).

- The two-phase settlement model will be retained.

- Continue the exclusivity of EIP-3009 (token support postponed to Q2 2026);

- Explicit matching of the network is still required (no cross-chain abstraction).

- The Facilitator mediation mechanism is still mandatory.

Table 5: Comparison of Problem Solving Across Versions

Conditions required for Internet-level adoption

Based on thirty years of research on distributed systems and payment protocols, I propose the following architectural principles:

- Achieving economic sustainability through protocol fees: A stable return is generated by deducting a 1% settlement fee on-chain.

- Atomic settlement is achieved through smart contracts: single on-chain transactions eliminate race conditions.

- Token flexibility: Simultaneously supports EIP-3009, EIP-2612 licenses and standard ERC-20.

- Chain abstraction: Implementing intent-based routing through the Circle cross-chain transfer protocol and the Across protocol.

- Minimalist Trust: A direct settlement mechanism that does not require a mandatory Facilitator

Table 6: Comprehensive Comparison of Architecture Solutions

in conclusion

x402 v1 has made substantial progress in solving this problem that has plagued the industry for thirty years. Based on mature blockchain infrastructure, micropayments are economically feasible. The agent economy has further fueled the urgent need for machine-native payment protocols. Coinbase's endorsement and integration with Google A2A provide institutional credibility, and its technical approach (HTTP 402 status code + blockchain settlement + cryptographic authorization) is itself reasonable.

However, a good vision and corporate support do not guarantee the success of a protocol. The Facilitator model creates an unsustainable economic mechanism—critical infrastructure suffers long-term losses. The delays and atomic failures introduced by the two-phase settlement architecture can be completely avoided with atomic solutions. EIP-3009's exclusive fragmentation of the token ecosystem excludes 40% of the USDC supply and almost all competing stablecoins. Multi-chain support remains only nominal; end users still have to face the reality of inter-chain fragmentation. Even when direct smart contract settlement offers superior features, the Facilitator still exists as a redundant intermediary.

While the v2 solution improves upon traditional methods in transport abstraction, service discovery, and billing model scalability, it doesn't address core issues such as economic models, two-phase settlement, token limitations, and cross-chain fragmentation. The roadmap postpones key fixes to Q2 2026. An autonomous internet requires an autonomous payment system—x402 v1 proved technical feasibility, and v2 demonstrated incremental improvements, but a true solution still requires groundbreaking changes.