Lessons learned from the $180 million investment: The current entry point for Web3 is not social networking, but the wallet.

- 核心观点:钱包是当前Web3生态的核心入口。

- 关键要素:

- Farcaster放弃社交,转向钱包开发。

- 钱包是链上身份与资产管理的唯一凭证。

- DEX增长及传统机构入场凸显钱包价值。

- 市场影响:推动行业资源向钱包赛道聚集。

- 时效性标注:中期影响。

Recently, Dan Romero, the founder of Farcaster, which was once hailed as a promising Web3 social platform, stated in an open letter that after 4.5 years of exploration, the "social-first" approach has proven unworkable, and the company will now focus entirely on wallet product development because "every new and retained wallet user is a new user of the protocol."

This star project, which has raised a total of $180 million and is valued at nearly $1 billion, has provided an important commentary on the battle for entry points in the Web3 industry with an attitude that is almost like "admitting mistakes".

This shift reflects the core difference between Web3 and Web2. In the Internet era, social networking is undoubtedly a super gateway for traffic aggregation.

Facebook connects 2.9 billion users worldwide through its social relationship network, while WeChat, based on social networking, has developed a full range of services including payment and office functions. Social attributes have become the "traffic cornerstone" of internet products.

However, the core of Web3 is value exchange rather than information transmission. The primary need for users to enter the ecosystem is to manage digital assets and complete on-chain activities.

This makes wallets, which carry private key management and asset interaction functions, a natural entry-level product for Web3. Farcaster's transformation is essentially an endorsement of this logic, but is this really the end of the Web3 entry point?

Why are wallets becoming increasingly important?

The core value of a wallet stems from its irreplaceable role as an on-chain interaction portal.

Unlike the account and password system of Internet products, in the Web3 world, a wallet address is a user's unique identifier, and a private key is a certificate of asset ownership.

Whether configuring crypto assets, participating in DeFi, or using on-chain applications, all operations must be initiated and verified through a wallet, making the wallet the "first door" for users to enter the Web3 ecosystem.

The explosive growth of on-chain users in the past two years , in particular, has further amplified the strategic value of wallets.

With the maturity of Ethereum L2 technology, the recovery of the Solana ecosystem, and the entry of traditional financial institutions, the number of active users on the chain continues to expand.

Dune data shows that in the third quarter of 2025, there were 830 million active crypto wallet addresses worldwide, of which 82% of the addresses initiated on-chain transactions within 30 days, and the number of DApps connected to wallets increased by 117% compared to the previous year.

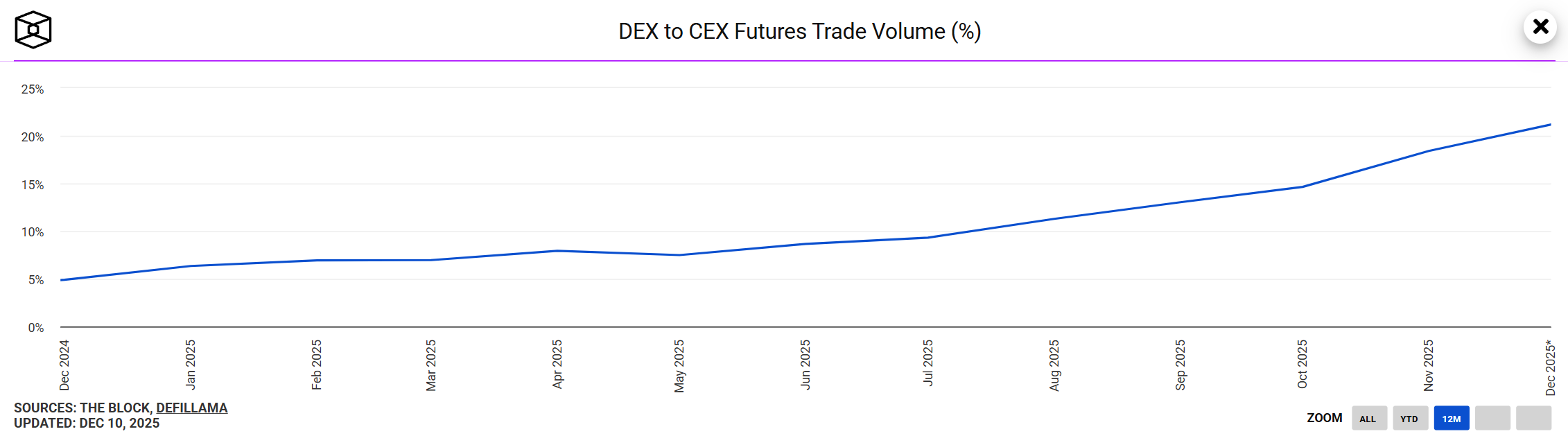

Meanwhile, the rise of DEXs and the erosion of CEX market share further highlight the irreplaceable nature of wallets.

Since 2025, the market share of DEX has increased from 10.5% at the beginning of the year to 19% at the end of the third quarter, and the share of the futures market has also increased from 4.9% to 13%.

Global DEX spot trading volume reached $1.43 trillion in the third quarter, a 43.6% increase from the previous quarter, setting a new record.

The core logic behind this shift is users' pursuit of autonomy over their assets. By connecting their wallets to DEXs, users no longer need to entrust their assets to exchanges, thus realizing "I am in control of my assets." This trend is driving wallets to upgrade from tools to ecosystem gateways.

Furthermore, the deployment of wallets by traditional financial institutions further confirms their industry position. For example, Bank of New York Mellon has launched a custodial wallet using MPC (Multi-Party Computation) to provide secure asset storage services for institutional clients.

BlackRock went even further, stating that the company's goal is to replicate everything in today's traditional finance into digital wallets.

The entry of these traditional institutions has not only brought incremental users to the wallet sector, but also propelled wallets to become a core bridge connecting traditional finance and Web3.

Giants Compete: Strategies and Gameplay in the Wallet Sector

Faced with the strategic value of the wallet sector and the challenges faced by CEXs, crypto industry giants have launched comprehensive plans, with the development paths of Coinbase, Binance, and OKX forming a new landscape for the industry.

As a compliance benchmark in the United States, Coinbase's wallet product is deeply integrated with its own exchange ecosystem, allowing users to seamlessly achieve a closed-loop operation of "fiat currency purchase - on-chain interaction - asset transfer back".

With the reforms to the Base chain this year, the Coinbase wallet has become the main interaction portal on the chain, attracting developers and users through transaction fee subsidies and other means, forming a comprehensive platform integrating finance, messaging, content creation and decentralized applications.

Binance, on the other hand, leverages its scale advantage to build a "full-scenario wallet ecosystem," with its wallet products integrating full-chain services such as public chain interaction, staking, and Launchpad.

Inspired by OKX's open ecosystem, Binance launched the CEX-DEX seamless trading feature in August 2025, allowing users to directly access liquidity from relevant DEXs through their wallets without having to transfer assets across platforms.

Among the wallet strategies of the three major players, OKX's forward-looking strategy is the most pioneering. As early as 2023, OKX broke free from the limitations of a single public chain and established a "multi-chain priority" development strategy.

Its wallet has stably supported asset storage and interaction across 130 public blockchains, making it one of the wallet products in the industry that supports the most public blockchains.

Meanwhile, with the OKX wallet's core code fully hosted on GitHub, its open-source transparency has earned the trust of developers worldwide through its open and standardized API interfaces.

Currently, it has been integrated with thousands of decentralized applications, forming an ecosystem matrix that covers almost all on-chain activities, and open source has become a new trend in the industry.

OKX was also one of the first institutions to support direct wallet connection between exchanges. I heard that they built a technical team of hundreds of people and spent millions of dollars every month to create this wallet that is so popular with users.

It also stormed into the crowded wallet market with a commanding lead and became a leading Web3 product. It has to be said that such foresight and the courage to spend money are truly rare.

Thanks to OKX's early planning, Coinbase and Binance also saw the opportunity and chose to follow suit strategically, which is also a major focus for major exchanges this year.

Currently, almost all wallets have formed their own wallet ecosystems to meet the growing demand for on-chain economic activities, which has also helped to expand the wallet's status in the ecosystem.

Is the landscape of Web3 gateways already set? The answer is not necessarily.

Although wallets have now established themselves as a core gateway to Web3, it is too early to say that the situation is "set in stone," as the current landscape of Web3 gateways is still subject to some changes.

Looking back at the industry's development, the focus of entry points has shifted twice: in the early days, user demand was concentrated on exchanges, and CEXs became the absolute entry point with their deposit and withdrawal advantages, once monopolizing industry traffic.

With the rise of Ethereum smart contracts and the explosion of the DeFi and NFT ecosystems, users' demand for asset autonomy has driven the focus of entry points to wallets, which are gradually taking on core functions such as DApp interaction and asset management.

This pattern is still evolving dynamically.

In the future, with technological iterations, the landscape of entry points may further evolve. The integration of AI and wallets is already taking shape, with some products using AI agents to achieve natural language interaction and intelligent risk warnings, making wallets more relevant to the needs of ordinary users.

Meanwhile, the widespread adoption of account abstraction may lower the barrier to wallet use and drive further penetration of access points.

Just as the browser entry point in the early days of the mobile internet was eventually diverted to social media and e-commerce, the Web3 industry is still in its early stages, and technological iterations and evolving needs may still give rise to new entry point forms.

However, what is certain is that with the trend of blockchain finance becoming a clear one, the core value of wallets will continue to be strengthened.

As OKX CEO Star stated at the recent Abu Dhabi Financial Week, the internet generation is creating a completely new on-chain economy, and in the coming decades, approximately 50% of global economic activity will run on the blockchain.

Correspondingly, the scale of crypto asset custody by traditional financial institutions has grown by 120% this year.

Behind these data lies the continued prosperity of on-chain economic activities, and wallets, as core tools for asset management and interaction, will directly benefit from this trend.

Of course, looking back at Farcaster's transformation is not the end, but the starting point for the Web3 industry to return to its core value.

The gateway to the internet is connecting people to people, while the gateway to Web3 is connecting people to value (and in the future, it may connect machines to machines). This core difference determines the irreplaceable nature of wallets.

For industry participants, whether they continue to deepen wallet technology innovation or explore the integration of wallets with other scenarios, the core focus should be on user asset security and experience optimization.

The battle for Web3 gateways may not be over yet, but wallets, with their unique value, have become the most certain winner in this stage.

So, who will be the next winner in this race?