USDT rating controversy: S&P's "stability yardstick," Tether's "market debate," and the transformation into a "shadow central bank."

- 核心观点:USDT评级下调反映传统与加密金融风险认知冲突。

- 关键要素:

- USDT储备中高波动资产占比已达约24%。

- 标普关注极端挤兑下的兑付能力。

- Tether强调市场流动性与长期抗通胀能力。

- 市场影响:推动稳定币评级体系向多维度演进。

- 时效性标注:中期影响

Article authors: May P, Janus R

Article source: CoinFound

Takeaway

- USDT Rating Downgrade and Controversy : The proportion of non-pegged assets (such as BTC and gold) in USDT's reserves has reached approximately 24%. Coupled with inadequate governance and transparency, this has led to its being viewed as an increased risk within the traditional financial framework, resulting in a rating downgrade. The USDT rating downgrade has sparked controversy.

- Tether has significantly increased its gold and Bitcoin reserves : In recent years, Tether has been continuously increasing the proportion of its gold and Bitcoin reserves for purposes such as inflation hedging, asset diversification, reducing its sole exposure to the US dollar, and improving returns.

- The fundamental difference between S&P and Tether lies in their risk perceptions: traditional finance prioritizes "repayment capacity" and focuses on "the ability to liquidate reserves under extreme run conditions"; while Tether prioritizes "market liquidity" and long-term value preservation and risk resistance (especially inflation risk). Their risk measurement dimensions are completely different.

- Tether's strategic intent in its reserve transformation : Tether's reserve model is shifting from a "1:1" cash equivalent reserve to a hybrid model of "hard assets (gold) + digital assets (BTC) + low-risk assets (US Treasuries)". Essentially, this represents a transformation from a "stablecoin issuer" to a "global liquidity provider + digital asset reserve institution," driven by core factors including inflation hedging demand, increased pro-cyclical returns (such as the predicted 2025 BTC/gold bull market), and de-dollarization efforts. In fact, Tether is becoming more like a "shadow central bank" than a simple stablecoin issuer.

- The current rating system has limitations : S&P's "stability rating" covers "repayment risk" and cannot address investors' needs regarding Tether's "asset appreciation ability" and "cyclical resilience." In the future, the market may need more multi-dimensional risk rating information. Furthermore, a dual-framework model of "stability rating (regulation + repayment) + investment risk rating (return + cycle)" may be needed to bridge the gap between traditional and crypto-financial risk perceptions.

- USDT Short-Term Risks and Long-Term Trends : USDT's anchor stability remains supported by on-chain liquidity. However, in the short term, the 24% of its reserves held in highly volatile assets (BTC/gold/loans) may be exposed to risks during the 2026 interest rate cut cycle and potential crypto bear market (Tether had a huge unrealized profit in 2025 due to its gold and Bitcoin reserves; however, the situation may change in 2026). In the long term, the trend of stablecoins becoming more like central banks (inflation-resistant assets + global network + energy) will drive the industry towards greater transparency and standardization.

1. Event Recap: The Controversy and Essence of S&P's Downgrade of USDT

1.1 Timeline of Events and Core Conflicts

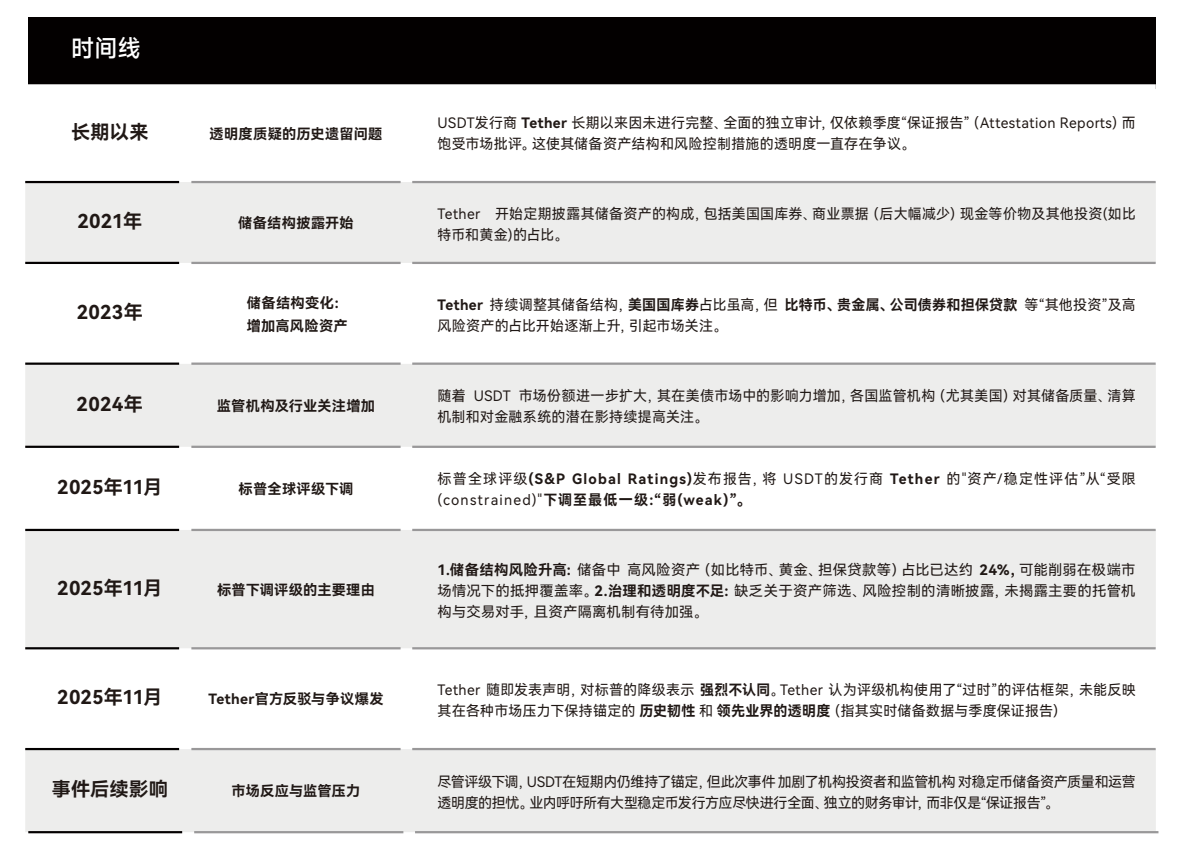

In November 2025, S&P Global downgraded USDT's "Asset/Stability Assessment" from "Constrained" to "Weak," citing two main reasons:

- Reserve structure risk : Tether's reserves contain 24% highly volatile assets (BTC, gold, loans, etc.) (compared to only 12% in 2023). These assets cannot be quickly liquidated in a "panic run" scenario.

- Insufficient governance transparency : The main custodian institution and details of the on-chain staking segregation mechanism were not disclosed, and only a "quarterly assurance report" was provided instead of a full independent audit.

Tether's counterattack focused on " actual market performance " and questioned the rating methods used by the traditional financial system.

- Historical resilience: USDT has remained pegged to the cryptocurrency during eight extreme events, including the collapse of FTX in 2022, the Silicon Valley banking crisis in 2023, and the tightening of crypto regulations in 2024.

- Leading transparency: Since 2021, it has provided " real-time reserve data " (visible at on-chain addresses), and quarterly guarantee reports cover more than 95% of assets, which is better than some traditional money market funds.

(Chart 1: Review of USDT rating downgrade events)

1.2 The essence of the disagreement: the clash between two risk measurement systems

In November 2025, S&P Global Ratings downgraded USDT's stability assessment to the lowest level, "weak." Tether immediately retaliated, accusing S&P of "using an old-world framework" and ignoring the numerous extreme stress tests USDT had undergone over the past decade. This debate is not merely a rating dispute, but a direct clash between two financial civilizations.

- S&P represents the "regulation-capital adequacy-solvency" system.

- Tether represents a system of "market liquidity - global transaction demand - on-chain instant settlement".

- These two approaches to measuring risk are fundamentally different, thus making it impossible for them to reach a consensus. The dispute between S&P and Tether, on the surface, is a war of words over "stability ratings," but in essence, it reflects two worlds with completely different understandings of risk.

- S&P and Tether represent two distinct worlds: one from 100 years of traditional finance, the other from 10 years of on-chain high-frequency markets. S&P uses the logic of "central bank—bank—money market fund"; Tether relies on the logic of "on-chain liquidity—perpetual leverage—insurance fund—automatic liquidation".

The logic represented by Tether is one that traditional financial markets cannot currently employ.

1.3 What S&P sees is: the redemption logic of traditional finance.

In the traditional financial framework, all instruments promising 1:1 redemption (money market funds, commercial banks, stablecoins) must meet two hard conditions:

1. Reserve assets must be highly secure and readily liquidated : S&P pointed out in its report that BTC, gold, and loan assets account for more than 20% of Tether's reserves. These assets are highly volatile and have long liquidation cycles, and may not be able to be quickly sold at face value in a "panic run" scenario.

2. Governance structure must be transparent and custody arrangements must be transparent : S&P believes that Tether's custodian information, on-chain collateral segregation, and risk disclosure are still insufficient.

In other words, in S&P's world, the key risk of a "stablecoin" lies in whether it can withstand the pressure of everyone rushing to redeem their coins at once. This is the redeemability of the traditional system.

1.4 Tether adheres to the logic of liquidity in the crypto world.

If TradeFi's stability stems from "whether the reserves are sufficient, fast enough, and secure enough," then Tether's stability comes from "whether I can maintain massive on-chain liquidity, whether the risks of the perpetual market can be absorbed, and whether the secondary market can maintain price anchoring." In other words...

- TradFi measures stability by its ability to pay out, while Crypto measures stability by its market liquidity plus liquidation stability.

- Tether's ten-year record (including multiple panic market events) does show that USDT's de-pegging is often not due to "insufficient reserves," but rather to "short-term imbalances in secondary market liquidity," which are quickly corrected each time.

Why did Tether retaliate so strongly? Because it adheres to a different set of "market logic." Tether's response emphasizes three points:

1. USDT has maintained a 1:1 peg under all extreme emotional conditions : including multiple cryptocurrency exchange collapses, rapid interest rate hikes by the Federal Reserve, tightening regulations, and bank runs. From Tether's perspective, "I am not theoretically stable, but have never deviated from the peg in ten years of actual operation. The true rating of a stablecoin is given by the market every day, not by a model."

2. Real-time reserve data + quarterly proof reports provide sufficient transparency : Tether believes it is superior to certain shadow banks or MMFs like TradeFi. However, S&P does not endorse the "real-time web page disclosure" format because S&P's methodology emphasizes "unaudited transparency and credible transparency."

3. BTC/Gold is an "inflation hedge + strategic reserve," not a high-risk exposure : The surge in BTC and gold prices in 2025 brought Tether huge paper profits (over $10 billion). This effectively makes Tether a hybrid central bank-like model of "hard assets + US Treasury bonds + loans + digital assets." Tether's worldview is, "I am like a country's central bank reserve; my structure is not the traditional dollar system, but a new global asset basket." But S&P's worldview is, "You are not a central bank; you are just a token issuer that promises 1:1 redemption."

1.5 Why do the two sides have completely conflicting understandings of "risk"?

It reveals a key fact: the crypto market and TradeFi are completely different in their risk-taking logic.

- Arthur Hayes published an article on November 27th about perpetual contracts, which serve as a prime example of the current inability to integrate traditional and crypto finance. In traditional finance (TradFi), the risk of forward contracts stems from "unlimited liability for margin calls." In TradeFi, delayed liquidation, margin calls, and investors losing money can all lead to further losses and the need for margin calls, potentially requiring the use of all personal assets to repay debts. Therefore, TradeFi must require the holding of "extremely high-quality assets," and any volatility is unacceptable.

- However, in crypto finance, the risk is borne by an "insurance fund + automatic liquidation + ADL" (automatic leveraged closing). This is because in crypto perpetual contracts, traders do not bear unlimited liability for losses. In the crypto finance system, liquidation surpluses replenish the insurance fund, liquidation fees are injected into the insurance fund, ADL provides a safety net, and exchanges supplement with their own funds. The end result is that crypto users at most lose their margin, but do not incur debt. Therefore, the crypto market is more accepting of highly volatile assets because of the market structure's safety net.

This is the essence of the disagreement between S&P and Tether: S&P measures the risk of TradeFi, namely, "If everyone runs on your funds, can you still withdraw them?" Tether, on the other hand, deals with the risk of Crypto, namely, in a 24/7 high-volatility market, can I guarantee trading, liquidity, and global high-frequency use? The two are not measured by the same dimensional system.

2. Tether's Reserve Transformation: The Strategic Logic from "Stablecoin" to "Shadow Central Bank"

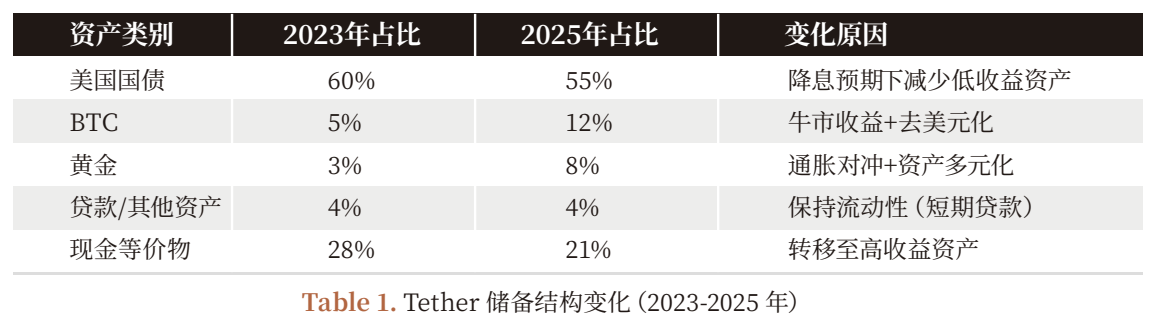

2.1 Time series changes in reserve structure (2023-2025)

2.2 Why increase the proportion of BTC and gold? Balancing pro-cyclical returns with long-term strategy.

Tether's reserve structure transformation (2023-2025) is not random, but rather a result of a triple consideration of "returns - risks - strategy" :

1. Inflation hedging demand : The Fed's interest rate hikes from 2022 to 2024 led to a decline in the purchasing power of the US dollar (US CPI rose from 2% to 8%), making gold (a traditional inflation hedging tool) and BTC (digital gold) the core assets for hedging inflation;

2. Increased Procyclical Returns : In 2025, the price of BTC rose from $40,000 to $65,000 (an increase of 62.5%), and gold rose from $1,900/ounce to $2,500/ounce (an increase of 31.6%). Tether's unrealized floating profits accounted for 70% of its net profit ($10 billion) in the first nine months of 2025 (compared to only $3 billion from Treasury bond interest).

3. De-dollarization strategy : Tether will reduce its dollar reserves from 75% in 2023 to 55% in 2025 by increasing the proportion of gold and BTC, thereby reducing its exposure to the dollar as a single asset (in response to the US debt ceiling crisis and the global trend of de-dollarization).

2.3 The "Sweetness and Hidden Dangers" of Profit Structure: Risks Under Pro-Cyclical Conditions

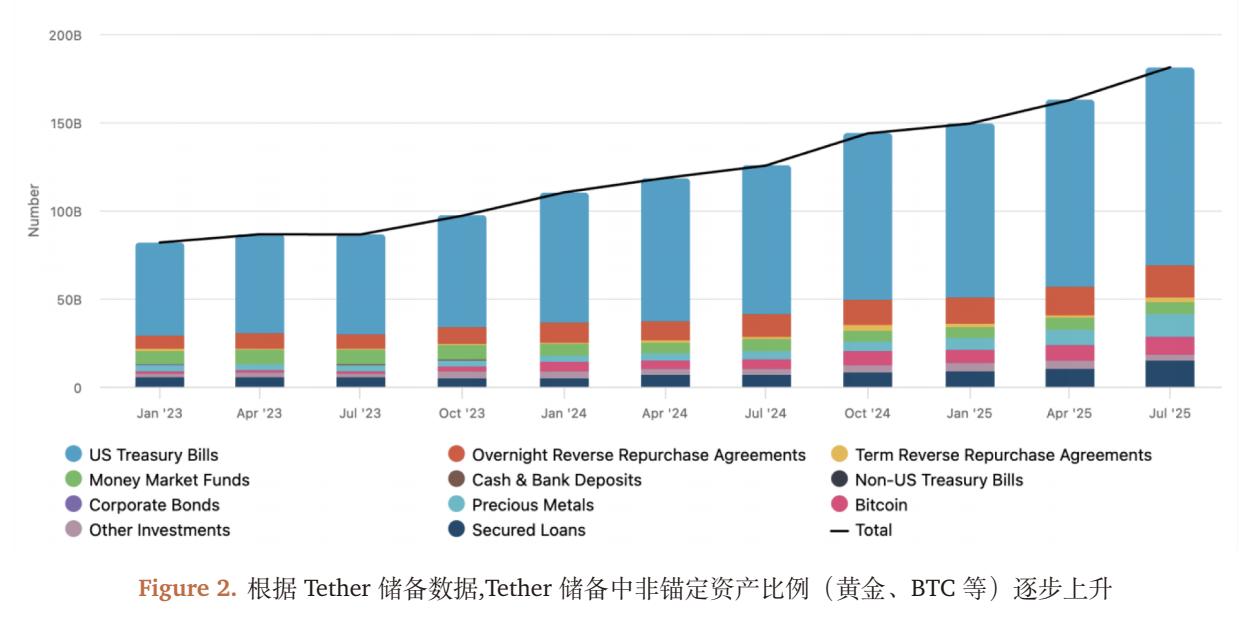

Tether's 2025 results (net profit exceeding 10 billion in the first nine months) appear impressive, but its profit structure is highly dependent on the " bull market cycle ":

- Stable income : Interest income from approximately $135 billion in U.S. Treasury bonds (with a 1-year yield of approximately 2.2% in 2025), contributing approximately $3 billion;

- Unrealized gains : Unrealized gains from BTC (approximately 100,000 coins) and gold (approximately 10 million ounces) contributed approximately $7 billion (equivalent to a $25,000 increase per BTC coin and a $600 increase per ounce in gold).

Risk transmission mechanism:

- If the Federal Reserve cuts interest rates by 25 basis points in 2026 (market consensus), Tether's interest income from Treasury bonds will decrease by $325 million per year ($135 billion * 0.25%).

- If the price of BTC drops by 20% (back to $52,000) and gold drops by 10% (back to $2,250/ounce), Tether's unrealized floating profits will shrink by approximately $2.5 billion (a $250 million reduction in BTC value + a $2.5 billion reduction in gold value).

- If the crypto market enters a bear market (such as in 2022), the issuance of stablecoins will shrink (USDT issuance will decrease from 80 billion to 60 billion in 2022), and Tether's holdings of government bonds will decrease, further compressing interest income.

2.4 The ultimate goal of strategic transformation: from "stablecoins" to "shadow central banks"

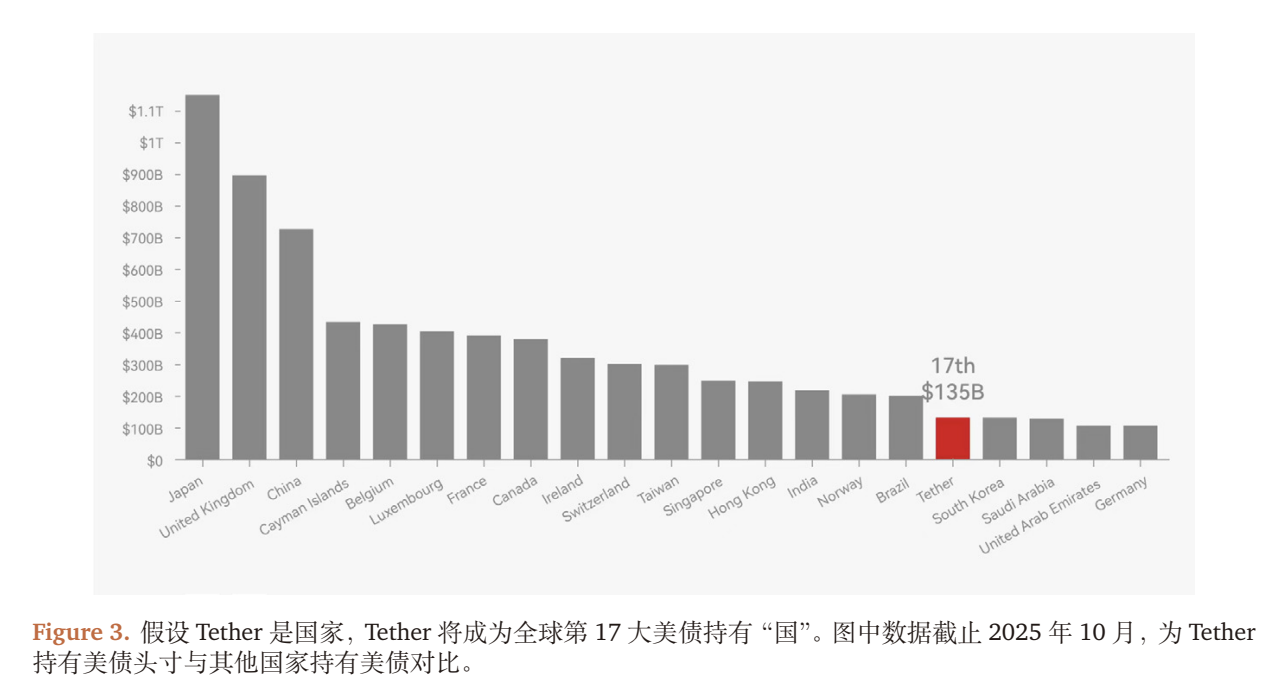

By tracking Tether's on-chain addresses and business layout, we discovered that it has transcended its role as a "stablecoin issuer" and is building a "shadow central bank" system encompassing " anti-inflation asset reserves + global stablecoin issuance + on-chain distribution network + energy ."

- Inflation-hedging asset reserves : BTC and gold account for 24%, corresponding to "central bank foreign exchange reserves";

- Global stablecoin issuance : USDT accounts for 70% of the total stablecoin transaction volume in 150 countries, corresponding to "central bank fiat currency issuance";

- On-chain distribution network : Partnering with 200+ exchanges/DeFi protocols such as Binance and Uniswap to enable instant global transfers of USDT;

- Energy strategy : Invest $1 billion in Bitcoin mining farms (accounting for 5% of global hashrate by 2025) to hedge the energy costs of BTC mining.

2.5 Market Performance: USDT's Pegging Stability and Liquidity

- Anchoring deviation : From 2023 to 2025, the average price deviation of USDT (the price difference with the US dollar) was only 0.02%, far lower than that of USDC (0.05%) and DAI (0.1%).

- On-chain liquidity : USDT liquidity pools on Uniswap V3 have reached $5 billion (compared to only $1 billion in 2023), and market maker spreads have remained stable at less than 0.01%.

- Institutional holdings : The proportion of USDT held by institutions increased from 15% in 2023 to 30% in 2025, indicating that institutions have come to regard USDT as a "combination tool that combines liquidity and asset appreciation (rather than a pure stablecoin)".

3. Future Outlook: The Evolution of Stablecoin Rating Systems

3.1 Limitations of the current rating system: It only covers repayment risk.

S&P's stability rating addresses the question of whether stablecoins can be redeemed , but it fails to meet the core needs of institutional investors:

- Yield quality : Is Tether's profitability sustainable? (For example, the decline in yields after a cut in Treasury bond interest rates)

- Exposure Risk : Is the proportion of BTC and gold too high? (What would be the impact on reserves if BTC fell by 20%?)

- Operational risks : Is Tether's governance transparent? (e.g., the security of assets under custody)

3.2 Surpassing the current rating system

In the future, the crypto market may need a more comprehensive rating system that goes beyond just redemption and stability. The future rating design might need to be as follows:

Stability rating (upgrade from existing framework)

- Key indicators : "Safety factor" of reserve assets (proportion of cash equivalents), "Liquidity factor" (liquidation cycle of highly volatile assets), and "Transparency factor" (independent audit coverage and disclosure of custody information);

- Objective : To answer the question, "Can stablecoins maintain redemption under extreme run conditions?"

Investment Risk Rating (New Framework)

Key metrics :

- Return quality: Stable returns (government bond interest) account for a proportion (>=50% is considered "low risk");

- Exposure management: High volatility asset allocation (<=10% is considered "low risk");

- Operational risks: the issuer's profit growth rate (>=10% is considered "stable"), regulatory compliance (such as US MSB license, EU MiCA certification);

- Objective : To answer the question of whether stablecoin issuers can continue to operate and whether their reserve assets can appreciate in value.

3.3 Industry Trends: From "Controversy" to "Standards"

The current dispute between S&P and Tether is essentially a matter of traditional finance exporting its rules to the crypto market . We believe:

- In the short term : Regulation will drive "mandatory transparency requirements" for stablecoins (such as the US Stablecoin Act requiring 100% cash equivalent reserves, and the EU MiCA requiring full audits).

- In the medium term : the rating system will evolve, and ratings will no longer be limited to the "regulatory-capital adequacy-solvency" framework. Institutional investors will assess stablecoins in different scenarios based on both "stability rating" and "investment risk rating."

- In the long term , stablecoins may further differentiate into "pure stable instruments" (such as USDC, 100% cash equivalent) and "stable instruments with added value" (such as USDT, hybrid reserve) to meet the needs of different investors.

Risk Warning

1. Risk of price fluctuations in reserve assets : A decline in the prices of BTC and gold will lead to a devaluation of Tether's reserves, affecting confidence in redemption;

2. Regulatory policy risks : If the US and EU require stablecoins to hold 100% cash equivalents, Tether will need to sell BTC and gold, leading to a significant decline in profits;

3. Market liquidity risk : In extreme market conditions (such as the collapse of FTX in 2022), a depletion of on-chain liquidity may lead to USDT becoming unpegged.

4. Operational and management risks : Tether's lack of governance transparency may lead to internal operational risks (such as the theft of custodial assets).

Download link for the research report "USDT Rating Controversy" : https://app.coinfound.org/research/1

Website : https://dataseek.coinfound.org/

X : https://x.com/CoinfoundGroup

Analyst Disclaimer: This report is based on publicly available information and reasonable assumptions and does not constitute investment advice. The analyst does not hold any positions in Tether or USDT.

Copyright Notice: This report is copyrighted by Coinfound.

About CoinFound

CoinFound is a TradeFi Crypto data technology company serving institutional and professional investors, providing services such as RWA asset data terminals, RWA asset ratings, Web3 risk relationship graphs, AI analytics tools, and customized data. From data integration and risk identification to decision support, it helps institutions acquire key intelligence and transform it into actionable insights at a lower cost and higher efficiency, building the underlying infrastructure for global RWA.