The hacking of Binance co-CEO He Yi's account reveals key security risks behind meme cryptocurrency manipulation.

- 核心观点:高管社交账号安全漏洞被利用,操纵模因币市场。

- 关键要素:

- 黑客控制高管微信账号发布虚假推广信息。

- 链上数据显示提前建仓、拉盘、抛售的完整路径。

- 模因币低流动性、高情绪依赖特性放大攻击效果。

- 市场影响:暴露行业对Web2社交入口的信任依赖风险。

- 时效性标注:长期影响

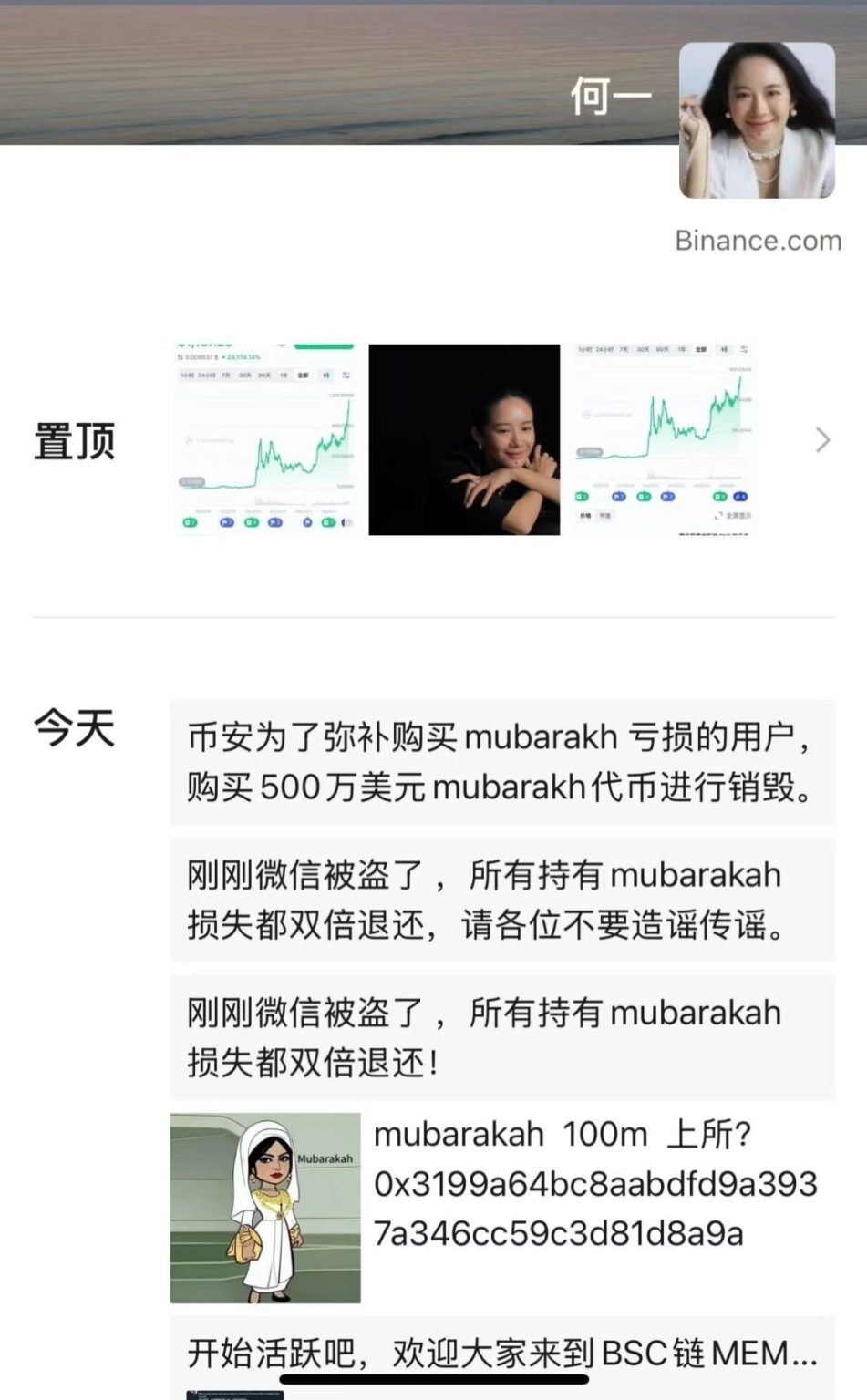

On December 10, 2025, multiple cryptocurrency media outlets reported that Binance co-CEO Yi He's WeChat account was hacked within a short period, and during the period of control, a meme coin called MUBARA (Mubarakah) was pushed to her contacts. Subsequently, the token experienced an abnormal surge and violent fluctuations within a short period. The incident attracted widespread attention, not only because it involved a Binance executive, but also because it served as a prism, reflecting multiple deep-seated issues in the current market regarding social media account security, the speculative mechanisms of meme coins, and users' risk awareness.

Based on publicly reported media reports and traceable on-chain data, this article aims to penetrate the surface and uncover the underlying logic from four dimensions: facts, mechanisms, risks, and industry impact.

I. Event Recap: From Stolen Accounts to Cryptocurrency Fluctuations

According to authoritative media reports such as CoinDesk, Cryptopolitan, and CryptoNews, as well as on-chain data tracking, the events unfolded roughly as follows:

(a) Social media accounts were hacked

He Yi's WeChat account was briefly compromised. Hackers used her WeChat identity to send promotional messages related to the memecoin MUBARA to her contacts. It's worth noting that WeChat, as a mainstream social platform in the Web2 era, still wields significant influence over account credibility within the crypto industry, particularly in private communication and industry information flow, which foreshadowed subsequent market reactions.

(ii) On-chain data shows signs of early planning

Multiple analysts pointed out that two new wallets purchased approximately $19,000 worth of MUBARA in the hours leading up to the promotion. The token subsequently surged, with gains exceeding 200% at one point, followed by significant selling activity at the peak, resulting in profits exceeding $40,000 for some buyers. The on-chain behavior clearly exhibited a typical complete structure of "early accumulation → information trigger → price surge → selling."

(III) Binance and CZ responded.

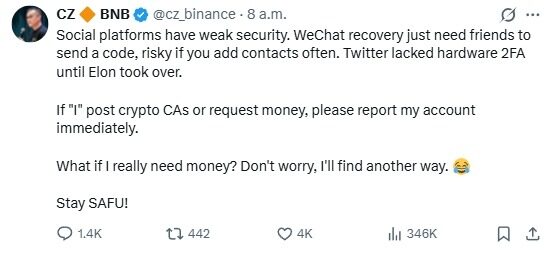

Changpeng Zhao (CZ) immediately warned users on social media not to trust token recommendations from the stolen accounts, emphasizing the significant security risks associated with social media accounts on Web2 platforms. The Binance team subsequently confirmed that the account had been recovered and simultaneously issued a security alert to warn users of fraudulent activities; the situation did not escalate further.

II. The intersection of on-chain and social dimensions: A typical "trust hijacking" event

Structurally, this was not a simple hacking incident, but the result of multiple overlapping mechanisms.

(i) Hijacking social identity is less costly than hijacking assets.

Because social media accounts are hosted by Web2, their security relies on the platform's internal mechanisms. However, trust within the crypto industry is highly concentrated on individuals (such as founders, CEOs, and early investors). This means that a hacker only needs to briefly control a highly trusted account to trigger real market activity. This "information gateway" risk is becoming a widespread security weakness in the industry.

(ii) The low liquidity and high volatility of meme coins amplify the effects of attacks.

Memecoins typically possess the following characteristics: low market capitalization and extremely low operating costs; investor sentiment driving prices; heavy reliance on external narratives and guidance; and a lack of fundamental basis for judgment. Once there is a stimulus resembling "endorsement," even information posted by a hacked account can trigger rapid price fluctuations. This structure of the memecoin market naturally amplifies such events.

(III) The information dissemination path of the event presents a closed trust chain.

The WeChat private domain environment has a strong trust transmission effect: information source = industry executives, information channel = private domain communication, information form = direct forwarding, private communication, and information verification threshold = extremely low. In this environment, some users are easily persuaded by "insider information"-style hints, thus quickly following up on transactions.

III. Structural Risks in the Crypto Industry

The incident itself has been brought under control, but the systemic problems it exposed in the industry deserve further discussion.

(a) Social media account security has become a new attack surface in the Web3 ecosystem.

As the industry develops, the social media accounts of project teams, exchange executives, and key opinion leaders (KOLs) have become the primary entry points for Web3 information dissemination. Compared to smart contracts or exchange security systems, these entry points are more vulnerable: Web2 platforms rely on traditional security mechanisms such as account passwords and SMS verification; they lack on-chain verifiable identities; and they lack immutability. Therefore, events such as "account hijacking → market volatility" are almost inevitable in the future.

(ii) The speed of information dissemination and the speed of reaction both lead to tail risks.

The crypto market remains highly information-asymmetric: hackers or manipulators occupy the upstream of the information chain, while ordinary users are at the tail. The market reaction mechanism is more like a "transmission" rather than an "equilibrium" mechanism. Therefore, the time difference in information access held by a small number of people is enough to create a rapid profit-making window.

(iii) Memecoins inherently lack the ability to price risk.

The meme market almost entirely lacks fundamental value analysis; instead, it relies on sentiment, social signals, informational stimuli, and celebrity influence. This means that as soon as the narrative is briefly hijacked, prices will deviate from their normal course. Such events are not uncommon but are an inevitable consequence of the structural flaws in the meme market.

IV. Risks at the User Level: Why are investors ultimately the ones who get fleeced?

Although the incident was caused by a hacker intrusion, the users are the ones who truly bear the risk.

(i) Users often make decisions based on a "familiar identity".

Many people don't base their judgments on token structure, liquidity, or contract security, but rather on: where the information comes from, whether it's "forwarded by an acquaintance," whether it seems to be an insider opportunity, or whether there's time pressure. This kind of judgment logic is easily exploited by attackers.

(ii) Lack of information verification mechanism

Many users failed to: double-check the source, verify with official channels, check on-chain liquidity, analyze the size of the liquidity pool, and identify "premature accumulation" behavior. In the memecoin ecosystem, where participants are predominantly young and speculative, this risk is further amplified.

(iii) Retail investors are always the slowest to react.

The standard time-series chain is: manipulators buy in → hackers promote the token → token price rises → retail investors enter → manipulators sell off. Retail investors are often the last link in this chain, ultimately bearing the losses.

V. Industry Implications: How to Reduce Similar Incidents in the Future?

From an industry perspective, this event offers at least three important insights:

(i) The project team and the transaction need to establish an on-chain verifiable official announcement channel.

Examples include DID (Decentralized Identity) binding, on-chain signature announcements, decentralized identity authentication, and multi-platform synchronization mechanisms. These mechanisms reduce users' reliance on a single Web2 platform, improving information credibility from the source.

(ii) Social media account security should be part of industry-level risk management.

This includes, but is not limited to: enabling stronger verification for executives' social media accounts, establishing multi-level internal verification mechanisms within teams, and isolating and managing the social media access points of key personnel. The cost of this type of security protection is far lower than the losses caused by a single market fluctuation.

(III) User education must be upgraded

Educate users: Do not rely on "insider information," do not judge authenticity based on a single screenshot, do not chase rising prices in low-liquidity tokens, and do not equate meme coins with "insider opportunities." Only when users upgrade their awareness will the attack surface of such scams truly decrease.

Conclusion

The incident of He Yi's WeChat account being hacked has largely subsided. Although it did not cause large-scale losses, the reality it reveals cannot be ignored: the trust structure of the crypto industry is being further amplified by the "social gateway" and "meme-ification" of its ecosystem. The fact that a single message from a stolen account could trigger price fluctuations demonstrates the industry's continued high dependence on information sources, and the characteristics of the meme market further amplify the fragility of this dependence.

In the long run, the industry needs systematic improvements in identity mechanisms, information verification mechanisms, user education, and social media security. Specifically, a three-pronged upgrade is required: in identity mechanisms, a shift from "personal trust" to "on-chain trusted identity"; in information mechanisms, a shift from "Web2 one-way propagation" to "on-chain verifiable publishing"; and in user awareness, a shift from "blindly following the crowd" to "rational decision-making." Otherwise, similar incidents will continue to repeat themselves, and ordinary investors will always be the ones who truly suffer.