2025 US Interest Rate Cuts: A Data-Driven Policy Shift and the Fed's Risk Rebalancing

- 核心观点:美联储降息是对经济数据变化的平衡性调整。

- 关键要素:

- 就业增长放缓,失业率升至4.4%。

- 核心PCE通胀呈下行趋势至3.1%。

- FOMC投票出现分歧,显示前景判断不一。

- 市场影响:政策节奏将更依赖数据,预期趋于谨慎。

- 时效性标注:中期影响

The Federal Reserve has cut interest rates, bringing them to a three-year low.

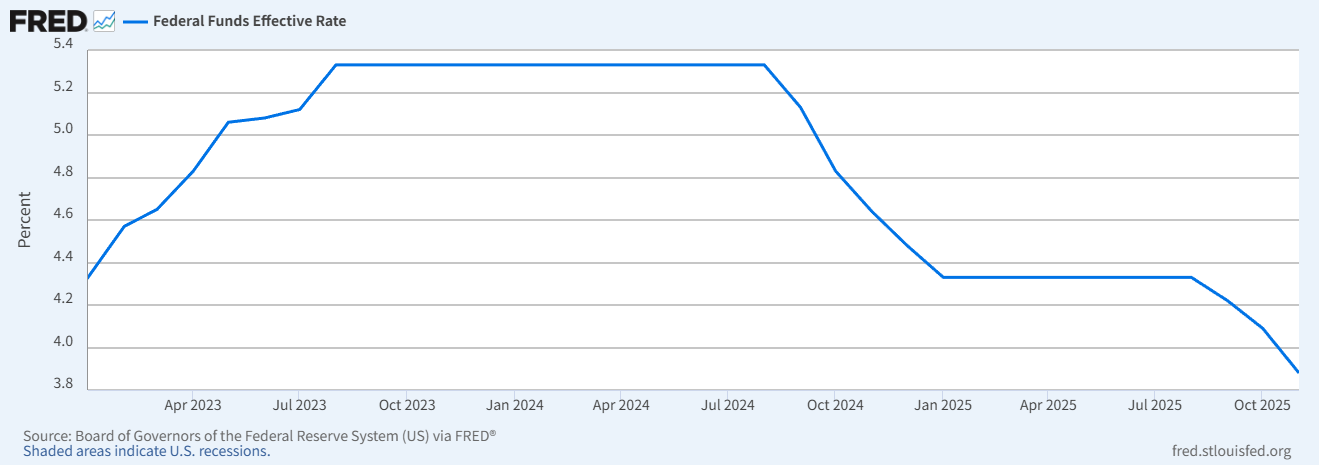

At its meeting on December 10, 2025, the Federal Reserve announced that it would lower the target range for the federal funds rate by 25 basis points to 3.50%–3.75%. This is the third rate cut this year and the lowest level in the past three years. Although the market has been speculating about the timing of the rate cut in the past few months, the real reasons for the policy implementation have long been hidden in the official wording and economic data.

Figure 1: Federal Funds Rate Trend, 2023-2025 (Source: Federal Reserve FRED Database)

Official wording shows subtle adjustments, with a focus on moderate inflation and increased attention to employment.

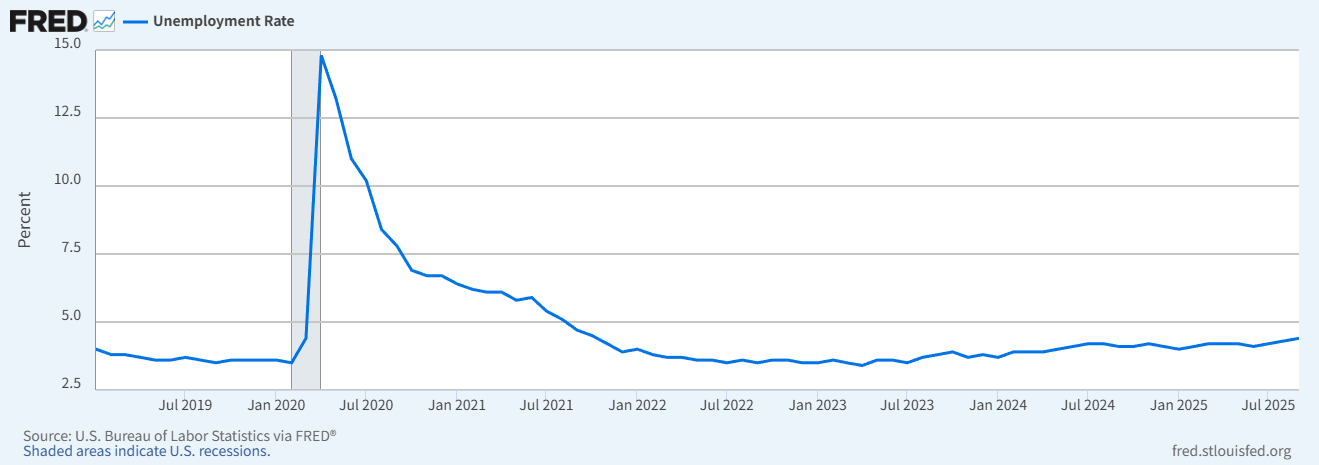

The Federal Reserve's policies are never driven by emotion, but rather by established patterns. Since the middle of this year, the wording in official documents has subtly shifted: descriptions of inflation have become more moderate, and the focus on the labor market has continued to increase. Especially after entering the third quarter, employment data showed a significant slowdown—data from the U.S. Department of Labor showed that non-farm payrolls fell from 180,000 in July to 119,000 in September, and the unemployment rate rose to 4.4% by September, causing the "risk balance" policy framework to begin to tilt.

Figure 2: US Unemployment Rate Trend, 2019-2025 (Source: US Department of Labor/FRED)

Rising employment risks prompt policy rebalancing

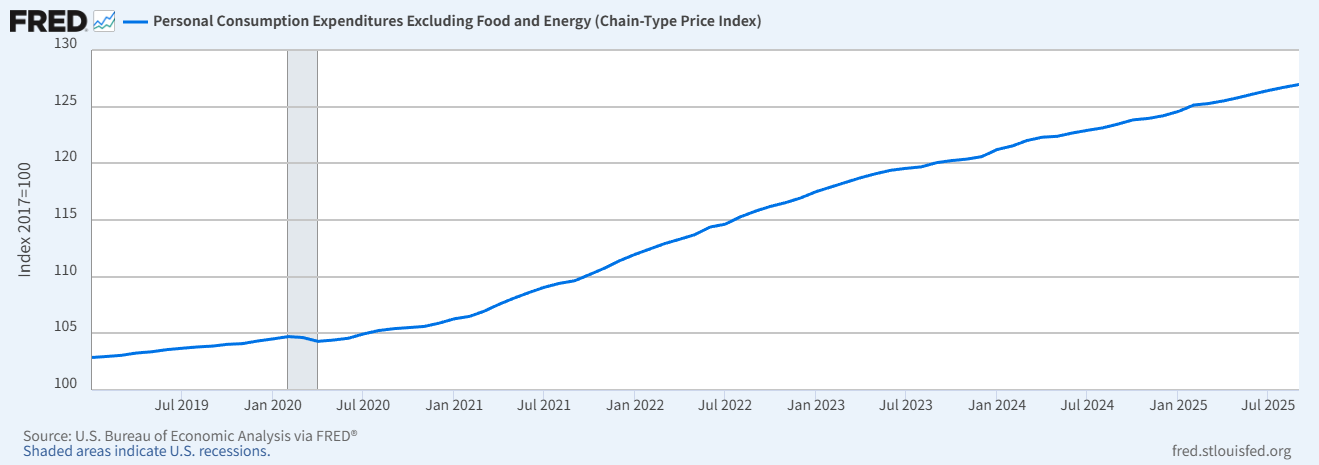

In its latest resolution, the Federal Reserve explicitly stated that "recent job growth has slowed and the unemployment rate has risen slightly." This is a rare assessment, meaning that the previously "very strong" labor market is now, for the first time, considered to be under downward pressure in official statements. In contrast, while inflation remains above the 2% long-term target, the 3.1% year-on-year growth rate of core PCE in November (Fed data) led to the official wording merely stating "still too high," rather than the more vehement "stubborn" or "persistently exceeding the target." This difference in wording is sufficient to illustrate that policymakers' priorities regarding risks have shifted.

In a sense, this rate cut is a "rebalancing" process. After a two-year tightening cycle, high policy rates have begun to put pressure on the economy—especially on businesses and consumers with high financing costs. The Federal Reserve is not easing policy because inflation has completely disappeared, but rather because of subtle changes in the employment situation (the unemployment rate hit 4.4% in September), forcing it to adjust its pace. This is not the "full-scale easing cycle" that the outside world had expected, but rather an action to find room between data and risks.

Figure 3: Core PCE Inflation Trend, 2019-2025 (Source: U.S. Bureau of Economic Analysis/FRED)

Interest rate adjustments will remain flexible, and the future will depend on economic data.

The Federal Reserve maintained restraint in its policy approach. The statement repeatedly emphasized that future interest rate adjustments "will depend on the latest data and risk assessments," rather than proceeding along a predetermined path. This open-ended statement leaves room for flexible future responses while also lowering market expectations for consecutive rate cuts and aggressive easing. In other words, the Fed did not commit to lower interest rates, but simply hoped that each step of its policy would follow actual economic changes.

The voting differences reveal differing assessments of the economic outlook among policymakers.

Furthermore, the voting results of this FOMC meeting also revealed a signal: 9 votes in favor and 3 against, a rare divergence in recent years. The dissenting opinions did not question the policy direction, but rather reflected a growing disagreement among policymakers regarding the economic outlook—Federal Reserve Governor Milan favored a 50-basis-point rate cut, while Chicago Fed President Goolsby and Kansas City Fed President Schmid advocated maintaining the current interest rate. This internal difference itself serves as a reminder that the Federal Reserve does not believe the current situation is clear enough to establish a single path, and future policy may adjust its direction, rather than exhibiting a consistent unilateral trend.

The market is paying attention to the risk signals behind the timing of interest rate cuts.

Overall, this rate cut is a response to economic realities, rather than a gesture of reassurance to the market. While inflation has not returned to the target, the core PCE growth rate of 3.1% in November has shown a sustained downward trend; the job market remains robust, but no longer as strong as in the previous two years; economic growth remains resilient, but uncertainties persist. Under these multiple constraints, the Federal Reserve's choice is a balanced adjustment: neither allowing the economy to remain under prolonged pressure from high interest rates, nor allowing excessive policy easing to reignite inflation.

For the market, the key information is not "interest rate cuts have occurred," but "why interest rate cuts have occurred at this time." The significantly increased weight given to the word "risk" in official documents indicates that future policymakers will rely more on data than on expectations or verbal promises, and the pace of policy implementation will be more cautious.

The future direction of data-driven monetary policy

This adjustment marks both a cyclical turning point and a significant signal, reflecting policymakers' meticulous assessment of the economy and demonstrating their efforts to maintain balance amidst uncertainty. The future direction of US monetary policy hinges on the intersection of three key indicators: employment, inflation, and growth. For instance, if the unemployment rate rises to 4.5% in the first quarter of next year (close to the Fed's median forecast for the end of 2025), the pace of interest rate cuts may accelerate; if core PCE rebounds above 3.5%, policy easing may even be paused. Changes in each of these indicators will be crucial in determining the next direction of interest rates.