BitMEX Alpha: Same as before, the encryption period will not expire.

- 核心观点:比特币四年周期规律依然有效。

- 关键要素:

- 四次减半均引发相同市场周期。

- 当前比特币跑输主流资产。

- 市场再现杠杆爆仓等结构性裂痕。

- 市场影响:预示加密市场将经历深度回调。

- 时效性标注:中期影响。

“Every time we hear ‘this time is different,’ the cycle ultimately proves that ‘nothing is different.’”

Every four years, the Bitcoin market follows a remarkably consistent rhythm, shaped by a core part of Bitcoin's code: the halving of mining rewards . Approximately every 210,000 blocks, the network reduces mining rewards by half, thus slowing supply (deflation).

Historically, each halving has led to the same sequence: accumulation → parabolic rise → speculative peak → crash and recovery .

● 2012–2014: The first halving triggered Bitcoin's earliest true bull market, pushing the price from double digits to over $1,000. The subsequent collapse of Mt. Gox marked the first major bear market.

● 2016–2018: The second halving led to the super frenzy and ICO bubble in 2017, and the subsequent bear market in 2018 was triggered by China's regulatory crackdown and rampant token issuance (project teams frantically fleecing investors).

● 2020–2022: The third halving ushered in the “institutional era” for cryptocurrencies—with the entry of MicroStrategy, Tesla, and ETFs—and peaked in 2021. This was followed by a crash in 2022, driven by the chain reaction of collapses at LUNA, 3AC Capital, and FTX.

● 2024 to present: The most recent halving occurred on April 19, 2024, reducing the block reward to 3.125 BTC. We are now in the middle of the fourth cycle.

The pattern repeats so precisely that some analysts estimate that market peaks typically occur within 12-18 months after each halving, roughly in the middle of a 4-year cycle .

We believe this cyclical pattern stems from Bitcoin's inherent logic and the characteristics of the cryptocurrency industry:

We've heard long ago that "this time is different"—that unfulfilled "supercycle."

If the idea that "the cycle is dead" sounds familiar, it's because we've experienced it before.

During the 2020-2021 bull market, the crypto industry collectively touted the so-called "Supercycle" argument—that Bitcoin and various leading cryptocurrencies had matured, shedding their "boom-bust" characteristics, and that we would "only go up." Advances in blockchain technology protocols, along with unprecedented liquidity from sectors like NFTs, GameFi, and DeFi, seemed to prove that "this time is different."

This argument seemed very reasonable at the time. Tesla added Bitcoin to its balance sheet, Musk promoted Dogecoin (DOGE) on live television, the "diamond hand" was a source of pride, and retail investors were making money. DeFi and NFTs were rewriting the way on-chain finance works. Many KOLs predicted that with so many new players and applications, Bitcoin and even leading altcoins would no longer suffer the massive 70% drawdowns of the past.

But the “supercycle” ultimately proved unsustainable due to its own overheating . What followed was a stark reminder of the deep-seated nature of the crypto cycle: the death spiral of LUNA/UST, the liquidation of Three Arrows Capital, and the bankruptcy of FTX wiped out hundreds of billions of dollars in market capitalization, even causing Bitcoin to plummet by nearly 80% from its peak.

Today, a more subtle form of optimism has returned; with inflows into spot ETFs, institutional funds, and deeper liquidity, the market seems to have finally broken free from the boom-bust cycle. But history rarely recedes so easily. The confidence that peaked in 2021 is resonating once again.

Why Cycles Still Exist – The Structural Logic of Cryptocurrencies

Even with ETF inflows and Wall Street infrastructure, cryptocurrency remains a deeply cyclical industry by design .

The expansion mechanism of cryptocurrencies makes it inevitable. When market sentiment turns bullish, new coins (pump and dump) emerge overnight, project teams easily raise millions, and liquidity floods into perpetual contracts and leverage. This explosive growth in issuance and leverage drives prices up—until it can't go any further.

Cryptocurrency perpetual contracts dominate trading volume, meaning price action is driven not only by real demand but also by liquidation mechanisms . High leverage makes pump-and-dump schemes appear effortless, while crashes are catastrophic. The industry's reflexivity —narrative driving prices and prices feeding back into narratives—guarantees excessive market stretching .

Ultimately, new token supply (unlocking/issuance), dilution of attention, and fatigue from excessive leverage erode momentum. When the "last buyers" disappear, the structural features that built the rally begin to reverse. This built-in feedback loop ensures that cryptocurrencies cannot escape the cycle—they are a manifestation of the cycle themselves.

Bitcoin's current state – underperforming mainstream assets and its hidden flaws

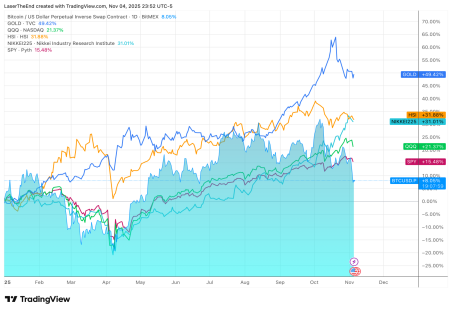

We believe the cycle is still at work, with an "invisible hand" guiding price action for the following reasons: Despite positive news in 2025 such as the approval of spot ETFs, institutional inflows, and record highs in gold and stock prices, Bitcoin has underperformed almost all other major assets . The only plausible explanation seems to be Bitcoin's 4-year cycle.

● Driven by easing concerns about global liquidity and inflation, stock markets in the United States, China, South Korea, and Japan have risen by about 20-30% year-to-date (YTD).

● Gold has repeatedly hit record highs, rising 50% year-to-date, solidifying its safe-haven status.

● In contrast, Bitcoin has only risen about 9% year-to-date and has yet to break its previous high in 2021 .

If the cycle had truly ended, Bitcoin should have led this risk-on environment, not lagged behind . Its relative weakness suggests we are nearing the final stages of the cycle—cooling down and recovery. Further evidence is that the crypto ecosystem is once again showing internal cracks, foreshadowing a deep correction that exists only within the crypto market itself.

On October 10-11, 2025, the crypto market suffered the largest liquidation cascade in history, wiping out nearly $19 billion in leveraged positions within 24 hours. Market makers and proprietary trading desks were forced to unwind , triggering a widespread flash crash in altcoins. Weeks later, Stream Finance, a DeFi protocol with a TVL (total value locked) of hundreds of millions, disclosed a loss of $93 million, froze withdrawals, and its xUSD stablecoin subsequently collapsed by more than 70%.

These are not macro-level shocks. They are crypto-native fractures that surface when leverage, complacency, and cyclical fatigue converge—just like past cycles.

The cycle will continue – an unpopular perspective

We suggest traders consider an alternative perspective: what if the established crypto cycle still works?

Every halving remains significant. Every bull market still tends to be excessive. Every crash still provides a reset (a shakeout). Bitcoin's recent performance and the reappearance of structural cracks may not be unusual—they may precisely confirm that the underlying rhythm remains intact.

Whether the next explosive rally comes six months or a year from now, the same underlying logic will likely still guide it. And when the market once again insists "this time is different," historical cycles may quietly and predictably provide a powerful counterargument.