Weekly Editor's Picks (October 25-31)

- 核心观点:加密市场多领域现新机遇与挑战。

- 关键要素:

- 155种山寨币ETF待批,机构资金或促牛市。

- x402协议与AI结合,推动支付与代理创新。

- 加密VC面临流动性困局,亚洲机构式微。

- 市场影响:提振DeFi与AI板块,引机构关注。

- 时效性标注:短期影响。

"Weekly Editor's Picks" is a "functional" column of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, Planet Daily also publishes a lot of high-quality in-depth analysis, but these may be hidden in the news feed and trending news, and you may miss them.

Therefore, every Saturday, our editorial team will select some high-quality articles worth reading and saving from the content published in the past 7 days, bringing new inspiration to you in the crypto world from the perspectives of data analysis, industry judgment, and opinion output.

Now, let's read it together:

Investment and Entrepreneurship

155 altcoin ETFs await approval: Can institutional funds awaken the "dormant bull market"?

Q4 may quickly be dominated by the ETF narrative, boosting related sectors such as DeFi. Macroeconomic impact: $300 billion in stablecoin liquidity will drive a DeFi bull market.

Three highly influential ETFs to watch are: Solana, ProShares CoinDesk 20 ETF, and REX-Osprey 21-Asset ETF. Regardless of whether altcoins can capture the same demand as BTC, the momentum is undeniable.

2025 Trading Guide: Three Essential Trading Categories and Strategies for Traders

Most positive expected value (+EV) autonomous decision-making trading strategies can be categorized into three distinct types (the names of which are my own): Incremental, Convex, and Specialist.

There are three core differentiating dimensions for each category: risk-reward ratio (R:R), probability of success, and frequency.

BitMEX Alpha: A Practical Guide to Trading Funding Rates

Funding rates exhibit predictability, tending to fluctuate within a certain range, influenced by the "structural lower bound" resulting from inherent biases in the funding rate formula and the "capital ceiling" for arbitrageurs. Identifying this structure can form the basis of trading strategies.

Boros’ funding rate futures allow traders to bet on funding rate fluctuations now and use leverage to amplify returns or hedge funding rate exposure in a position.

Trading on Boros offers two ways to profit: 1) revenue from the difference between the exchange’s funding rate and the implied rate on Boros, and 2) the spread generated by changes in trading activity.

Successful trading depends on three key factors: 1) the contract's expiration time (shorter terms favor speculation, while longer terms favor trend following), 2) the choice of exchange (highly volatile exchanges may offer opportunities to capture rate spikes, while more stable exchanges may be better suited for generating profits), and 3) the implied fees at entry, which should be aligned with the overall market outlook (whether bullish, bearish, or neutral).

Crypto VC in the Cracks: Liquidity Dilemma, Ecosystem Reconstruction, and Breaking the New Cycle

Crypto VC has been declining in recent years; the overall activity and influence of Asian VC institutions seem to have declined more significantly in this cycle; and the exploitative practices of market makers and exchanges continue.

As mergers and acquisitions and IPOs become the mainstream exit paths, and as LP types become more diversified and fund cycles lengthen, will crypto VCs—especially Asian VCs—bottom out and rebound in the new cycle?

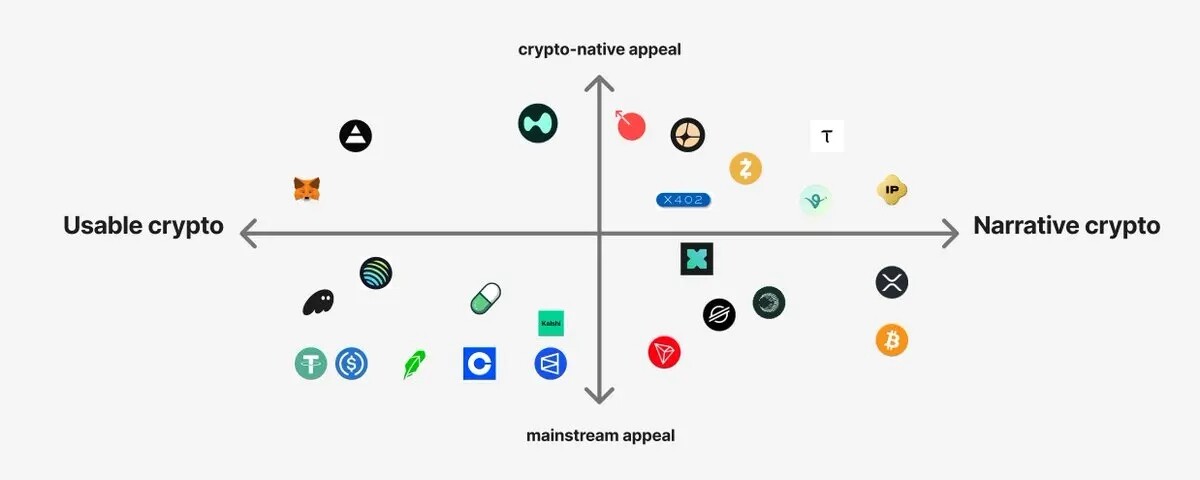

The Diverging Paths of Cryptocurrency: Narrativeism vs. Pragmatism

In the realm of utility cryptocurrencies, product (users) reign supreme; while in the realm of narrative cryptocurrencies, community is king.

Both are equally important and can be mutually reinforcing – narrative-driven cryptocurrencies can drive speculative behavior, which in turn drives the adoption of utility cryptocurrencies.

Builders are better off starting by focusing on their strongest areas of expertise; traders, on the other hand, always bet on "narratives".

Also recommended: " 17th Anniversary of the Bitcoin White Paper: Half Sea, Half Flame ", " If this continues, no one will trade crypto anymore ", " A year of trading crypto yields less than my mom's A-share trading ", " Making Money Against the Market: The Survival Strategy of Crypto Arbitrageurs ", " Data Calculation of the Value of MegaETH's First Points Program ".

Policy and stablecoins

The next stage for stablecoins: from assets to services.

Airdrop Opportunities and Interaction Guide

A step-by-step guide to participating in the MetaMask Season 1 airdrop event

Meme

Chillhouse, leading the market on its own, is the story of "Web3 entertainment".

x402

With x402 gaining popularity, is this "concept coin" with its soaring price truly meaningful?

Client requests data → API returns status code and data; clients can now directly pay API fees with stablecoins; acilitator can handle on-chain payments for API developers; x402 eliminates reliance on manual and third-party payment platforms.

In the last wave of AI hype, we saw many AI tokens skyrocket to market capitalizations of billions of dollars, but these tokens were practically meaningless. The so-called x402 token has created the perfect speculative market.

We will soon see the convergence of x402 payments, ERC-8004 trustless agents, and verifiable AI, leveraging the open nature of blockchain to build a reputation and trust system for AI—another topic worth exploring in depth.

From AI frameworks to x402, who will be "made rich in bulk" by the second wave of encrypted AI?

The x402 protocol, which has recently become incredibly popular, is not built on the infrastructure of the first wave of AI agent hype in 2024. Both waves face the same problem: they are too early.

x402's best partner, ERC-8004: How does it solve the trust problem of AI agents?

x402 → Enables automation of micro-payments for AI tasks; ERC-8004 → Provides on-chain identity and reputation tracking for AI agents.

Infrastructure: EigenCloud, Taiko, Eternal AI, NEAR, Phala Network;

Middleware: OpenServ, Unibase, Santa, Kinic AI, ChaosChain, NovaNet;

Application layer: Zyfai, Virtuals Protocol, Praxis, Cortensor, Semantic Layer.

A summary of the latest popular x402 concept projects across various ecosystems

Prediction Market

Trump is going to open his own casino.

Trump enters the prediction market: Truth Predict faces off against Polymarket

Ethereum

Are Henan locals holding up half the sky? A deep dive into Ethereum nodes.

CeFi & DeFi

Messari Researcher: Using Perp DEX to trade US stocks – the next new blue ocean.

Stock perpetual contracts remain a high-potential but unproven area with limited appeal in the on-chain market, primarily due to audience misalignment, weak demand, and more popular alternatives such as ODTE options.

Market demand has not yet been fully realized due to infrastructure and regulatory constraints. Hyperliquid's recent HIP-3 upgrade offers the best opportunity for stock perpetual contracts, but adoption is expected to be gradual.

Also recommended: " Lazy Person's Guide to Financial Management | Reflect Early Bird Deposit Open; Perena Launches Season 1 Points Program (October 29) ".

Web3 & AI

Weekly Hot Topics Intensive Review

Over the past week, the surge in PING fueled the x402 narrative; the tariff cloud eased, and the market rallied ; the US-China talks concluded, the Federal Reserve cut interest rates again , and Bitcoin dipped slightly; the Federal Reserve announced the end of quantitative tightening ( full text of the resolution ); Bessant: the US will no longer consider imposing a 100% tariff on China ; the Ministry of Commerce: China and the US will simultaneously suspend some tariffs and control measures for one year.

In addition, regarding policy and macro markets, Newsom stated he would consider running for president in 2028 , escalating his public spat with Trump; Trump stated he had not considered running for a third term in 2028 ; Nvidia's total market capitalization surpassed $5 trillion; Trump plans to announce Powell's successor months ahead of schedule , with five final candidates already narrowed down; US President Trump: Considering appointing Bessant as Federal Reserve Chairman , but he himself does not want to take the position; US Representatives will introduce legislation to ban the president , his family, members of Congress, and all elected officials from trading cryptocurrencies or stocks; US Democratic senators demanded that Trump explain his pardon of Binance co-founder CZ ; PayPal signed an agreement with OpenAI to become ChatGPT's payment wallet ; CME Group: Asia-Pacific institutional investors have high hedging demand and are beginning to turn to virtual currency investment; Japanese startup JPYC issued the world's first yen stablecoin ; Hong Kong Securities and Futures Commission launched a tender for a virtual asset trading monitoring system ; Hong Kong Secretary for Justice: Issuance of stablecoins pegged to the Hong Kong dollar must apply for a license ; Shanghai Composite Index surpassed 4000 points again after ten years;

Regarding opinions and statements: Bessant: The Federal Reserve is still living in the past, and its predictive models have failed ; Fortune magazine revealed that 37 donors provided funding for the White House banquet hall , including the co-founder of Gemini; Peter Schiff declared war on CZ: BTC will eventually go to zero , "tokenized gold" is the digital return of currency, he is considering attending a debate in Dubai, and plans to launch a token ; CZ: He will focus on investment business at YZi Labs in the future and has been invited to serve as a crypto advisor to several governments; CZ: Kyrgyzstan's national stablecoin and CBDC have been launched on BNB Chain, and the national cryptocurrency reserve includes BNB; CZ responded to "being selected for the Hurun Rich List with a fortune of 190 billion yuan" : Divide by 100, it's about right; Tiger Research report states that the target price for BTC in Q4 is $200,000 ; Equation founder: He has closed his long positions in FORM, and the market has become desensitized to the Meme speculative narrative ; Jia Yueting: BlackRock increased its holdings of FFAI stock and completed the first batch of C10 crypto treasury configurations; Bubblemaps: MEGA The pre-sale was found to have been subjected to Sybil attacks , with over 20 entities using multiple wallets to bypass the maximum allocation limit;

Regarding institutions, major companies, and leading projects: S&P gave Strategy a B- rating ( Analysis ); Consensys plans to list in the US , hiring JPMorgan Chase and Goldman Sachs as lead underwriters; tokenized securities market platform tZero is preparing for its 2026 IPO ; Bernstein gave SharpLink an "Outperform" rating with a 75% bullish outlook; Circle launched its Arc blockchain public testnet, with Visa and BlackRock participating; Western Union plans to launch a stablecoin on the Solana chain in 2026; Binance is considering integrating Binance.US into its global business , or allowing its global exchanges to directly access the US market; Ondo Global Markets is expanding its stock tokenization platform to BNB Chain ( Analysis ); BNB Chain completed the third batch of BNB airdrops in its $45 million "Rebirth Support" program; Telegram will launch Cocoon (a confidential computing open network) in November; MetaMask has launched multi-chain accounts ; Polymarket will return to the US by the end of November, after which it will launch POLY. Tokens will be airdropped ; Trump Media, under Trump's umbrella, will enter the prediction market with "Truth Predict"; Binance.US will open USD1 deposits and launch the USD1/USDT trading pair; MetaMask will launch the MetaMask Rewards reward points program ; KITE will announce its token economics : a total supply of 10 billion tokens, with an initial circulating supply of 18%; Aster will announce the burning of 50% of its buyback tokens ; zkPass will announce its token economics : a total supply of 1 billion tokens, with a community share of 48.5%; Ferrari plans to launch a digital token, "Token Ferrari 499P"; Ant Group has applied for registration of several Web3-related trademarks, including "ANTCOIN," in Hong Kong .

On the data front, about 60% of global stock markets hit all-time highs , accelerating the bull market for risk assets; SPAC funding reached a new high since 2021, with cryptocurrencies being one of the main trading areas; Paxos released a PYUSD verification report : the total circulating supply exceeded 2.6 billion, a record high, an increase of about 125.5% compared to August; Binance hired a close friend of Trump's eldest son to lobby the White House , paying $450,000 in the past month.

Regarding security, Lighter responded to the " HYPE abnormal order book data " issue, stating that it was caused by an out-of-control bot and did not trigger liquidation; the front end has already hidden it. GMGN responded to the theft rumors, stating that the platform is secure , user funds are undamaged, and that it will fully compensate users who suffered losses due to phishing attacks; compensation has already been issued to users affected by the MEV attack... Well, it's been another tumultuous week.

Link to the "Weekly Editor's Picks" series is attached .

See you next time~