From Geopolitical Tensions to Liquidity Tightening, BTC Dragged into Uncontrolled Market Conditions

- Core View: The recent broad decline in the cryptocurrency market was not triggered by a single negative factor. Instead, it was a market-wide risk aversion and deleveraging event jointly triggered by the convergence of multiple factors: escalating geopolitical risks, a correction in liquidity expectations due to the Federal Reserve's hawkish stance, and persistent outflows from Bitcoin spot ETFs.

- Key Factors:

- Escalating Geopolitical Risks: Tensions in the Middle East, with US aircraft carriers on alert and Iran taking a hardline stance, have prompted capital to reduce risk exposure due to heightened uncertainty.

- Macro Expectation Correction: The Fed's January FOMC meeting maintained interest rates, shattering market illusions of an early rate cut and dashing hopes for imminent liquidity easing.

- Cross-Market Synchronized Decline: The simultaneous pullback in the three major US stock indices and traditional safe-haven assets like gold and silver indicates a broad-based contraction in risk appetite among capital.

- Lack of Support from Fund Flows: Bitcoin spot ETFs have experienced consecutive days of net outflows, totaling over $10 billion, weakening the market's ability to absorb selling pressure.

- Break of Key Technical Level: The BTC price fell below the crucial 100-week moving average (around $85,000), triggering passive liquidations of trend-following strategies and leveraged positions.

Original | Odaily (@OdailyChina)

Author | Asher (@Asher_ 0210)

The "big crash" has played out once again.

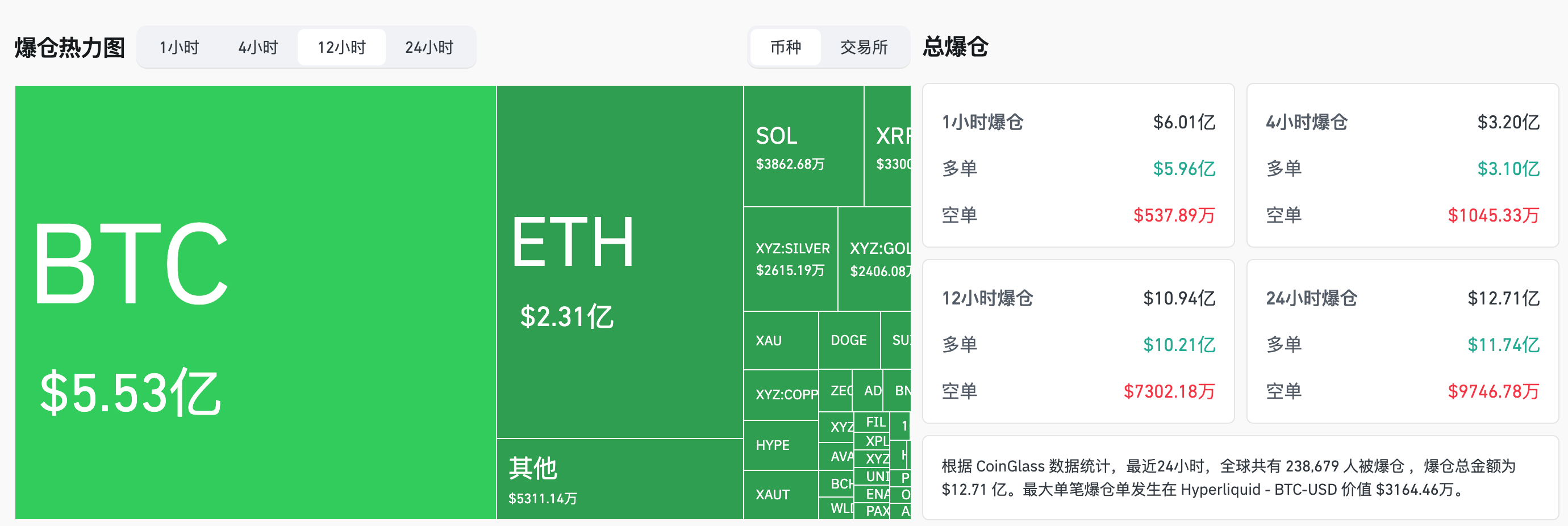

OKX market data shows that from last night to this morning Beijing time, BTC plummeted rapidly from around $88,000, briefly falling below $81,200, marking a 24-hour drop of over 7%. ETH fell from $2,940 to a low of $2,690, a nearly 10% decline in 24 hours. SOL retreated from $123 to around $112, a drop of over 8% in 24 hours. Coinglass data shows that the market saw liquidations of $1.094 billion in the past 12 hours, with long positions accounting for a staggering $1.021 billion. Nearly 240,000 traders were liquidated in the past 24 hours.

This decline was not triggered by a single negative factor but rather the result of multiple factors converging and releasing simultaneously at the same point in time.

Middle East Tensions Suddenly Escalate, Geopolitical Risks Re-emerge in the Market

The sudden escalation of geopolitical risk was one of the earliest significant background factors priced into last night's market decline.

Latest reports indicate that the US aircraft carrier USS Abraham Lincoln and its strike group have entered a state of "lights out" and communication blackout. This move is typically seen as a standard operating procedure preceding major military operations, leading the market to speculate that actions related to Iran are entering a highly sensitive phase.

Simultaneously, statements from Iran have also shifted noticeably towards a posture of readiness for combat. Iran's First Vice President Aref, speaking on the regional situation, stated that Iran has maintained a state of combat readiness since the current administration took office, will not initiate war, but if conflict is provoked, it will defend itself with a firm stance, emphasizing that "the outcome of war will not be decided by the enemy." He pointed out that preparations for a state of war are currently necessary.

Although the situation has not yet evolved into substantive conflict, this state of being "highly opaque, unverifiable, and difficult to predict" is in itself sufficient to influence market behavior. Against a backdrop of already tight liquidity and receding risk appetite, geopolitical uncertainty was rapidly priced in, prompting capital to favor reducing directional exposure rather than continuing to bet on high-volatility assets.

FOMC "Hawkish Landing," Liquidity Expectations Repriced

The decline in crypto prices still cannot be separated from the Federal Reserve.

At the January FOMC meeting, the Fed kept the benchmark interest rate unchanged in the range of 3.50% to 3.75% and emphasized in its statement that the unemployment rate has stabilized while inflation remains at a relatively high level. While the stance itself did not significantly exceed market expectations, it served to finalize expectations on an emotional level—the vague hopes the market still held for near-term rate cuts or even a policy pivot were officially compressed or even eliminated.

For risk assets, such moments often do not manifest as "new negatives" but rather as the realization that "positive factors can no longer be further front-run." Since 2025, Bitcoin has experienced pullbacks following multiple FOMC meetings, precisely a repeat performance of this mechanism: it's not that policy suddenly turned hawkish, but that the market had to acknowledge that liquidity would not arrive as early as anticipated.

When positions have already been built up and leverage elevated, this confirmation of "the shoe dropping" is itself enough to trigger risk release—it is not the first push that topples the dominoes, but rather what causes all the already teetering structures to lose their support simultaneously.

Not Just Crypto Falling, US Stocks and Precious Metals Also "Turn"

More alarmingly, this decline is not a "solo performance" by the crypto market.

On the US stock front, the decline in major indices serves as a significant signal of weakening market risk appetite. The Nasdaq 100 index fell approximately 1.6%, the S&P 500 dropped about 0.75%, and the Dow Jones Industrial Average also declined around 0.2%. The three major indices were generally under pressure, with the technology sector particularly weak, dragging down overall market risk sentiment.

Meanwhile, the precious metals market, traditionally seen as a "safe-haven asset," also experienced sharp volatility. After a recent strong rally, gold prices saw a significant short-term pullback last night, with clear profit-taking emerging in the market. Silver also retreated rapidly from its highs, with a notable decline. This indicates that capital is not simply rotating from risk assets to safe-haven assets but is rather reducing overall risk exposure in a high-volatility environment.

When stocks fall, crypto assets come under pressure, and precious metals also pull back simultaneously, the signal sent by the market is quite clear. Capital is simultaneously reducing exposure across multiple asset classes, with overall risk appetite contracting rapidly.

In such an environment, Bitcoin naturally finds it difficult to remain unscathed. It is neither truly regarded by the market as a safe-haven asset, and due to its own high-volatility nature, it often becomes one of the first assets to be sold off when sentiment shifts towards risk aversion.

Sustained ETF Outflows Significantly Reduce Crypto Market Absorption Capacity

Changes in the capital flow picture provided the final piece of the puzzle for this round of decline.

Looking at Bitcoin spot ETF data, capital is continuously exiting. Data shows that in just the past week, BTC spot ETFs have seen sustained net outflows, with multiple days recording single-day outflows exceeding hundreds of millions of dollars. The cumulative net outflow has already surpassed $1 billion.

More importantly, the withdrawal of ETF funds is not a one-time venting but rather continuous, multi-day, trend-like position reduction. This means institutional capital is not choosing to "buy the dip and provide support" during the pullback but is more inclined to reduce overall risk exposure, waiting for clearer macro and market signals.

In such a capital environment, the market lacks a "buffer." When prices decline, ETFs do not provide sustained buying power; the market relies more on existing capital to digest selling pressure on its own. Once key price levels are breached, selling behavior quickly dominates, while buying interest lags significantly, forcing prices to rapidly seek a new equilibrium through further declines.

Not a Black Swan, but a Concentrated Release of "Forced De-risking"

The essence of BTC's current decline is not triggered by a single unexpected negative event but is the result of the market's overall repricing of risk assets under the overlay of multiple risk factors. Escalating geopolitical uncertainty, revised macro liquidity expectations, and the lack of stable structural absorption in the crypto market against a backdrop of sustained ETF net outflows ultimately triggered the market's proactive "braking" behavior.

When long-term capital and passive buying are absent, the market often forces trend-following strategies and leveraged positions to exit involuntarily by driving prices down through key trend levels, thereby completing the first phase of risk clearance. In this process, Bitcoin broke below the highly-watched 100-week moving average (around $85,000), a level that has acted as a "safety net" in multiple adjustments since last year and is also the default defense line for many trend models and leveraged positions.

From the outcome, the market has now completed the first round of rapid deleveraging and emotional clearance. However, true stabilization still depends on two conditions: first, whether key technical levels can be recaptured and held firmly; second, whether risk capital is willing to re-enter the market to participate in price discovery. Until then, high volatility and low confidence may remain the dominant themes for this phase.