RWA Weekly Report|Asset Holders Surge 26%; White House Convenes Crypto Firms and Banks to Discuss Stablecoin Yield Issues (1.28-2.3)

- Core View: The RWA market showed structural differentiation in the week ending February 3rd. The total value of on-chain assets grew steadily, user participation and stablecoin market capitalization rose in tandem, while global regulators are actively promoting rule-making and cross-border cooperation in areas such as stablecoins.

- Key Elements:

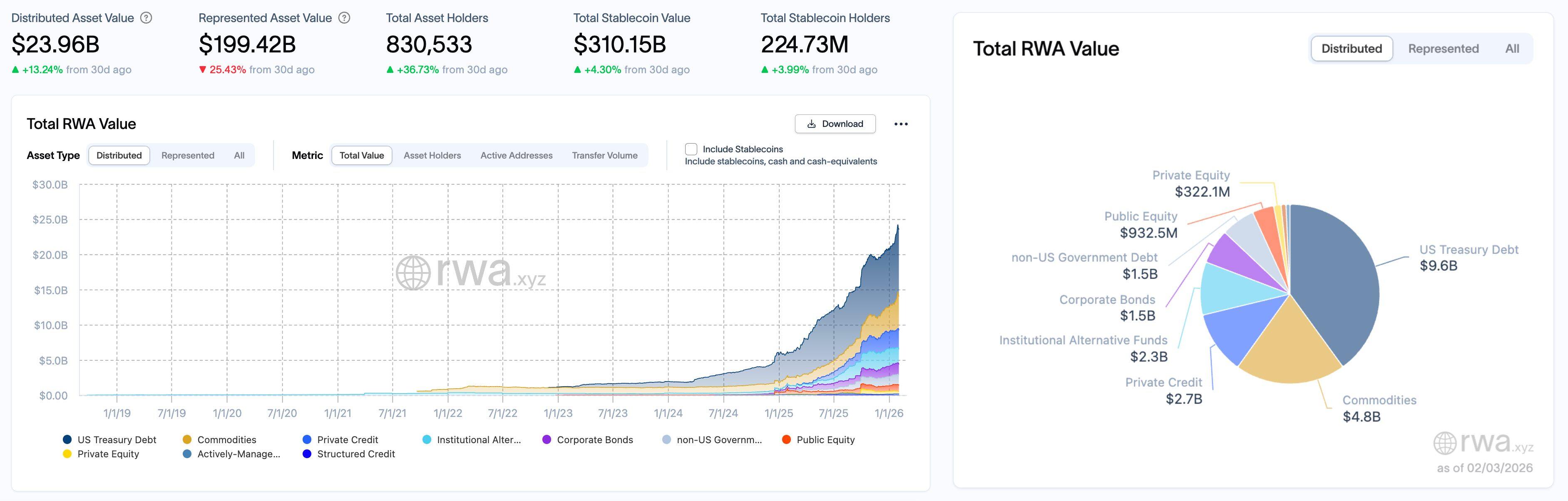

- The total value of on-chain RWA (DAV) increased by 3.14% to $23.96 billion, but the broad representative asset value (RAV) saw a significant 43.86% correction due to statistical adjustments.

- The number of RWA asset holders surged by 26.52% in a single week, and the total stablecoin market cap grew by 4.64% to $310.15 billion, indicating a continued strengthening of the market's capital base.

- Commodity assets and the private credit sector grew by 9.09% and 8% respectively, emerging as the strongest growth categories, reflecting an increase in market risk appetite.

- Intense global regulatory activity: The US White House convened industry consultations on stablecoin yield issues; the SEC and CFTC launched "Project Crypto" to unify regulation; Hong Kong plans to issue its first batch of stablecoin licenses in March.

- In industry developments, Tether disclosed a net profit exceeding $10 billion for 2025; Binance announced it would convert $1 billion in SAFU fund reserves from stablecoins to Bitcoin.

Original | Odaily (@OdailyChina)

Author | Ethan (@ethanzhang_web3)

RWA Sector Market Performance

According to the rwa.xyz data dashboard, as of February 3, 2026, the total on-chain value of RWA (Distributed Asset Value) reached $239.6 billion, an increase of $7.3 billion from $232.3 billion on January 27, representing a weekly gain of 3.14%. In terms of the broad RWA market size, i.e., the total value of representative assets (Represented Asset Value), there was a significant correction, dropping from $3551.7 billion on January 27 to $1994.2 billion, a decrease of $1557.5 billion, or 43.86%. This may be due to adjustments in statistical methodology, a situation that has frequently occurred before and is not an anomaly.

Regarding the number of asset holders, the total number of asset holders increased from 656,444 to 830,533, a net increase of 174,089 in a single week, representing a growth rate of 26.52%. The stablecoin market maintained its upward trend, with total market capitalization rising from $2963.9 billion to $3101.5 billion, an increase of $137.6 billion, or 4.64%. The number of stablecoin holders also grew from 223.87 million to 224.73 million, an increase of 0.38%.

In terms of asset structure, U.S. Treasury bonds remain the largest component of the current on-chain RWA market, with a market value of $9.6 billion on February 3, slightly down by $200 million from $9.8 billion the previous week, a decrease of approximately 2.04%. Commodity assets continued to expand, rising from $4.4 billion to $4.8 billion, a gain of 9.09%, making it the single asset category with the strongest growth this cycle.

The private credit sector expanded steadily, growing from $2.5 billion to $2.7 billion, an increase of $200 million for the week, or 8%. The market value of institutional alternative funds remained stable at $2.3 billion, unchanged from last week. Corporate bonds and non-U.S. government debt showed similar adjustments, both moving from $1.6 billion and $847 million to $1.5 billion. The former experienced a slight correction, while the latter saw a significant increase of $653 million, a rise of 77.1%.

The public equity sector declined, falling from $1.1 billion to $933 million. Although the data showed a slight decrease, it remained largely stable. Private equity also saw a synchronized slight decline, dropping from $389.6 million to $322.1 million, a decrease of $67.5 million, or 17.3%.

Trend Analysis (Compared to Last Week)

Over the past week, the RWA market overall showed structural divergence: the total value of distributed on-chain assets grew steadily, while representative assets experienced a significant correction. User participation and total stablecoin market capitalization rose in tandem, further solidifying the capital foundation. From an asset structure perspective, commodity and private credit assets attracted more incremental capital, reflecting a gradual increase in market risk appetite. In contrast, Treasury bonds and private equity performed relatively weakly, possibly due to limited yields and liquidity constraints, leading to a decline in popularity.

Market Keywords: User Expansion, Rising Risk Appetite, Strength in Commodities and Credit

Key Event Review

The White House convened representatives from the crypto industry and traditional banking on Monday for a closed-door meeting on stablecoin rewards, a core contentious issue in crypto legislation. Participants included Coinbase, several crypto industry associations, and banking organizations. The meeting was chaired by Patrick Witt, a member of the President's Digital Asset Advisory Committee.

Crypto industry representatives generally gave positive reviews of the meeting. Summer Mersinger, CEO of the Blockchain Association, stated that the meeting was an important step in advancing bipartisan digital asset market structure legislation, with stablecoin rewards being one of the remaining key points of disagreement. Cody Carbone, CEO of the Digital Chamber of Commerce, also noted that parties had identified main pain points and potential compromise directions but had not yet reached a final solution, with the goal of forming a path by the end of February.

Reports indicate that the stablecoin rewards issue primarily centers on whether to allow third-party platforms (like Coinbase) to offer rewards to stablecoin holders. Banking organizations continue to oppose such practices, fearing they could divert bank deposits, impact community banks' lending capacity, and criticizing the previously passed GENIUS Stablecoin Act for having regulatory loopholes on this issue.

Informed sources stated that the banking side maintained a relatively firm stance during the meeting, with limited flexibility in negotiations. The White House plans to narrow the scope of subsequent consultations, urging parties to make decisions on specific compromise solutions in future meetings.

SEC Chair and CFTC Chair Launch Project Crypto to Unify Crypto Regulation

According to an SEC disclosure, SEC Chair Paul S. Atkins and CFTC Chair Mike Selig officially launched the joint initiative "Project Crypto" at CFTC headquarters on January 29. The initiative aims to coordinate the regulatory standards of the two agencies for the crypto market, in response to the bipartisan market structure legislation advancing in Congress. Paul S. Atkins stated that the current regulatory model struggles to adapt to the convergence of technologies, and fragmented regulation has become a source of confusion rather than protection for investors. Project Crypto will seek to establish a unified framework in areas such as trading, clearing, custody, and risk management, adhering to the principle of minimum effective dose for appropriate regulation. Additionally, SEC Staff have provided guidance over the past year on Memecoins, stablecoins, mining, staking, and broker financial responsibility, clarifying that registered advisors and regulated funds can hold crypto assets in specific state-chartered financial institutions. This initiative marks a shift in regulatory focus from enforcement-driven to rule clarity, aiming to reduce compliance costs through inter-agency collaboration.

Eddie Yue, Chief Executive of the Hong Kong Monetary Authority (HKMA), stated at a Legislative Council meeting on Monday that the HKMA plans to issue the first batch of stablecoin issuer licenses in March, with the initial number of approvals being very limited. The HKMA has currently received 36 applications, and the review process is nearing completion. Key review areas include risk management, anti-money laundering controls, reserve asset quality, and application scenarios. Licensed issuers must comply with local cross-border activity regulations, and future exploration of mutual recognition arrangements with other jurisdictions is possible.

UK Financial Services Regulation Committee Launches Regulatory Investigation into Stablecoins

The UK House of Lords Financial Services Regulation Committee announced today the launch of a new investigation into the growth of stablecoins in the UK and the proposed regulatory regime, calling for written evidence from all sectors, with a deadline of March 11, 2026.

The investigation, initiated by Committee Chair Baroness Noakes, aims to assess the potential impact of stablecoins on the UK financial services industry and macroeconomy. Core issues include: the expected development of the GBP stablecoin market, comparisons with US and EU regulatory regimes, and whether the proposed frameworks by the Bank of England and the Financial Conduct Authority (FCA) balance international competitiveness with consumer protection. The investigation will also examine whether stablecoins could impact monetary policy execution and traditional financial intermediaries.

Circle CEO Jeremy Allaire posted on X, stating that according to Artemis data, USDC on-chain transaction volume exceeded $8.4 trillion in January, while the total on-chain transaction volume for the stablecoin market was $10 trillion.

US President Nominates Crypto-Friendly Kevin Warsh as Federal Reserve Chair

The US President posted on Truth Social, nominating Kevin Warsh as the next Federal Reserve Chair. Kevin Warsh is currently a researcher at the Hoover Institution and a lecturer at Stanford Graduate School of Business, having served as a Federal Reserve Governor from 2006 to 2011. Kevin Warsh holds a friendly stance towards cryptocurrency, having stated that Bitcoin is an important asset that can serve as a policy overseer and does not pose a systemic threat to Bitcoin's ability to manage the economy. Additionally, Kevin Warsh participated as an angel investor in the algorithmic stablecoin project Basis and crypto index management company Bitwise. Although he has expressed support for a central bank digital currency framework, he is considered a hawk on monetary policy. The nomination still requires Senate confirmation to succeed Jerome Powell, whose term expires in May.

The Hong Kong Securities and Futures Commission (SFC) and the United Arab Emirates (UAE) Securities and Commodities Authority (SCA) signed a Memorandum of Understanding (MoU) today to strengthen cross-border regulatory cooperation on digital asset-related matters. This landmark MoU is the first agreement signed by the SFC with an overseas regulator concerning the regulation of licensed digital asset entities. The MoU establishes a framework for enhanced regulatory cooperation, including mutual consultation and information exchange regarding the regulation of cross-border licensed digital asset entities, fully reflecting the SFC's commitment to promoting international cooperation in line with its ASPIRe roadmap.

New York Attorney General Criticizes GENIUS Stablecoin Act: Insufficient Consumer Protection

New York State Attorney General Letitia James and four local district attorneys recently sent letters to several Democratic lawmakers, criticizing the GENIUS Stablecoin Act, signed into law by Trump last year, for having major flaws in consumer protection, particularly for not requiring stablecoin issuers to return stolen funds in case of theft.

The letter specifically named Tether (USDT) and Circle (USDC), arguing that the two major stablecoin issuers could still earn interest on related assets after funds were stolen, while victims lacked effective recourse. New York prosecutors pointed out that while the act grants stablecoins higher "legitimacy endorsement," it does not simultaneously strengthen key regulatory requirements such as anti-terrorism financing, anti-money laundering, and crypto fraud prevention.

The GENIUS Act is currently entering the implementation phase, requiring stablecoins to be fully backed by US dollars or highly liquid assets and imposing annual audits on issuers with a market cap exceeding $50 billion. However, New York prosecutors believe these measures are still insufficient to address the widespread use of stablecoins in illicit fund flows.

According to Chainalysis data, approximately 84% of illegal crypto transaction volume involved stablecoins in 2025. Based on this, New York authorities are calling for further strengthening of the regulatory framework to better protect consumer rights.

Recently, Binance announced in an "Open Letter to the Crypto Community" that it will adjust the asset structure of the SAFU Fund, gradually converting the existing $1 billion stablecoin reserve into a Bitcoin reserve, with plans to complete the exchange within 30 days of this announcement. Binance will conduct regular reviews of the SAFU Fund's asset size. If the fund's market value falls below $800 million due to Bitcoin price volatility, Binance will supplement Bitcoin to restore the fund size to $1 billion.

Based on Binance's assessment of Bitcoin as the core asset of the crypto ecosystem and its long-term value, Binance is willing to share industry uncertainties during periods of industry pressure and heightened cycle volatility, continuously investing resources into the crypto ecosystem. This move is part of Binance's long-term commitment to industry development, and related work will continue to be advanced, with more progress gradually shared with the community.

Tether 2025 Net Profit Exceeds $10 Billion, Gold Reserves Surpass $17.4 Billion

Tether reported a net profit exceeding $10 billion for 2025, primarily driven by the growth of its USDT stablecoin and increased investments in US Treasury bonds.

The company ended the year with $6.3 billion in excess reserves backing $186.5 billion in USDT liabilities, making it one of the largest holders of US government debt, with a Treasury exposure as high as $141 billion. The company's reserves hold $17.4 billion worth of gold and $8.4 billion worth of Bitcoin.

OSL Group Announces $200 Million Equity Financing

Stablecoin trading and payment platform OSL Group (863.HK) announced today a $200 million (approximately HK$1.56 billion) equity financing to deepen its strategic layout in areas such as stablecoin trading and payments. According to the plan, the raised funds will be used for strategic acquisitions, expanding global payment and stablecoin business, product and technology infrastructure development, and daily operations.

Ivan Wong, Chief Financial Officer of OSL Group, stated: "OSL Group's strategic positioning in the stablecoin trading and payment track has received full market recognition and broad support. This financing will allow the company to introduce more like-minded strategic and long-term investors. It not only enables the timely capture of high-quality licensed trading and payment enterprises globally through fundraising but also expands the shareholder base and capital scale, laying a solid first-mover advantage for the company to advance its compliance-based globalization strategy."

Hot Project Updates

Ondo Finance (ONDO)

One-Sentence Introduction:

Ondo Finance is a decentralized finance protocol focused on structured financial products and the tokenization of real-world assets. Its goal is to provide users with fixed-income products, such as tokenized US Treasury bonds or other financial instruments, through blockchain technology. Ondo Finance allows users to invest in low-risk, highly liquid assets while maintaining decentralized transparency and security. Its ONDO token is used for protocol governance and incentive mechanisms. The platform also supports cross-chain operations to expand its application within the DeFi ecosystem.

Latest Updates:

On January 29, according to official news, Ondo Finance's yield-bearing stable asset USDY has been officially deployed on Sei. USDY is backed by short-term US Treasury bonds and bank deposits, making it the first permissionless tokenized US Treasury base asset on Sei. Currently, USDY's market capitalization exceeds $1.2 billion. This integration brings one of the largest capital pools in the RWA field into the Sei ecosystem.

Previously, according to official data, Ondo Finance's Total Value Locked (TVL) has surpassed $2.