万字解析“The Merge”对以太坊的深远影响

目录

The Merge 的基本背景

对于 ETH :走向可持续通缩、数字债券叙事

对以太坊链 :节能、安全性、去中心化程度和技术风险

对于MEV :MEV 依然存在,加剧验证者收益不平等

对于 Staking 赛道:ETH 资产属性凸显,利好质押市场

其它:ETC 利好、矿工迁移

当我们谈论分叉和 ETHPoW

PoS 后的监管之争与审查风暴

以太坊合并可以说是 2022 年整个加密货币社区最值得期待的事情。以太坊从工作量证明到权益证明的转型不仅是一个技术上的更新,更是一个共识意识形态的转变。合并迫近,CT 以及各方研报对以太坊合并的进程和之后影响的讨论愈发的热烈。本篇文章旨在从内部性和外部性两个角度来梳理合并对以太坊的深远影响。同时,文章的后半部分将包含对分叉话题和监管话题的全景讨论。

在开始我们的论述之前,对于 The Merge 的一些基本背景先进行厘清:

Merge - 以太坊从 PoW 向 PoS 的转型 - 是以太坊向打造安全,可扩展,去中心化,可持续发展网络迈进的重要里程碑。

从宏观来看,The Merge 就是为了使以太坊网络变成强有力的处理层和数据可用性层,作为基础设施为 rollup 提供服务,同时也为分片奠定基础。

从技术上来看,The Merge 意味着于 2020 年上线由 PoS 平行运行信标链将取代 PoW 作为共识层。保持不变的是执行层将继续托管以太坊虚拟机,并验证和广播交易。此外,节点运营商必须同时运行执行层和共识层客户端才能保持在线。

在 PoS 网络里,任何想成为验证者的人都可以质押 32 ETH 从而成为参与网络共识算法的节点。最终确定一个区块需要至少 2/3 的验证者签名,以保证网络安全。恶意一方则会面临质押被罚没的惩罚。

合并不支持链上治理。与比特币或当前版本的以太坊类似,协议治理将通过广泛质押者在链下进行讨论并作出决定

时间预期:据以太坊基金会博客,以太坊合并最终完成时间预计在 9 月 10日- 20 日。合并将分为两个阶段激活:于 9 月 6 日在信标链的 Bellatrix 升级;和 Paris 升级 - 将在执行层达到预定的总难度值时完成,触发合并的终端总难度值为 58750000000000000000000。

进度:以太坊团队自 2017 年以来进行了一系列的测试网合并:3 月 15 日,测试网 Kiln 上线; 6 月 18 日,测试网 Ropsten 顺利完成合并;7 月 6 日Sepolia 测试网完成合并。8 月 11 日的 Goerli 测试网完成合并。

Merge 后计划:像之前提到的合并是以太坊发展的重要里程碑但不是目的地,之后 Vitalik 表示还将会有一系列的升级 - The Surge, Verge, Purge and Splurge。

对于 ETH :走向可持续通缩、数字债券叙事

1. 走向可持续通缩

众所周知,比特币的发行率每 4 年减半,而以太坊的发行率在“合并”时将减少约 90%,这就是社区所讨论的“三重减半”—这也是对比特币减半周期的认可。当三次“减半”同时发生,意味着以太坊将一次性走完比特币网络 12 年的路程。

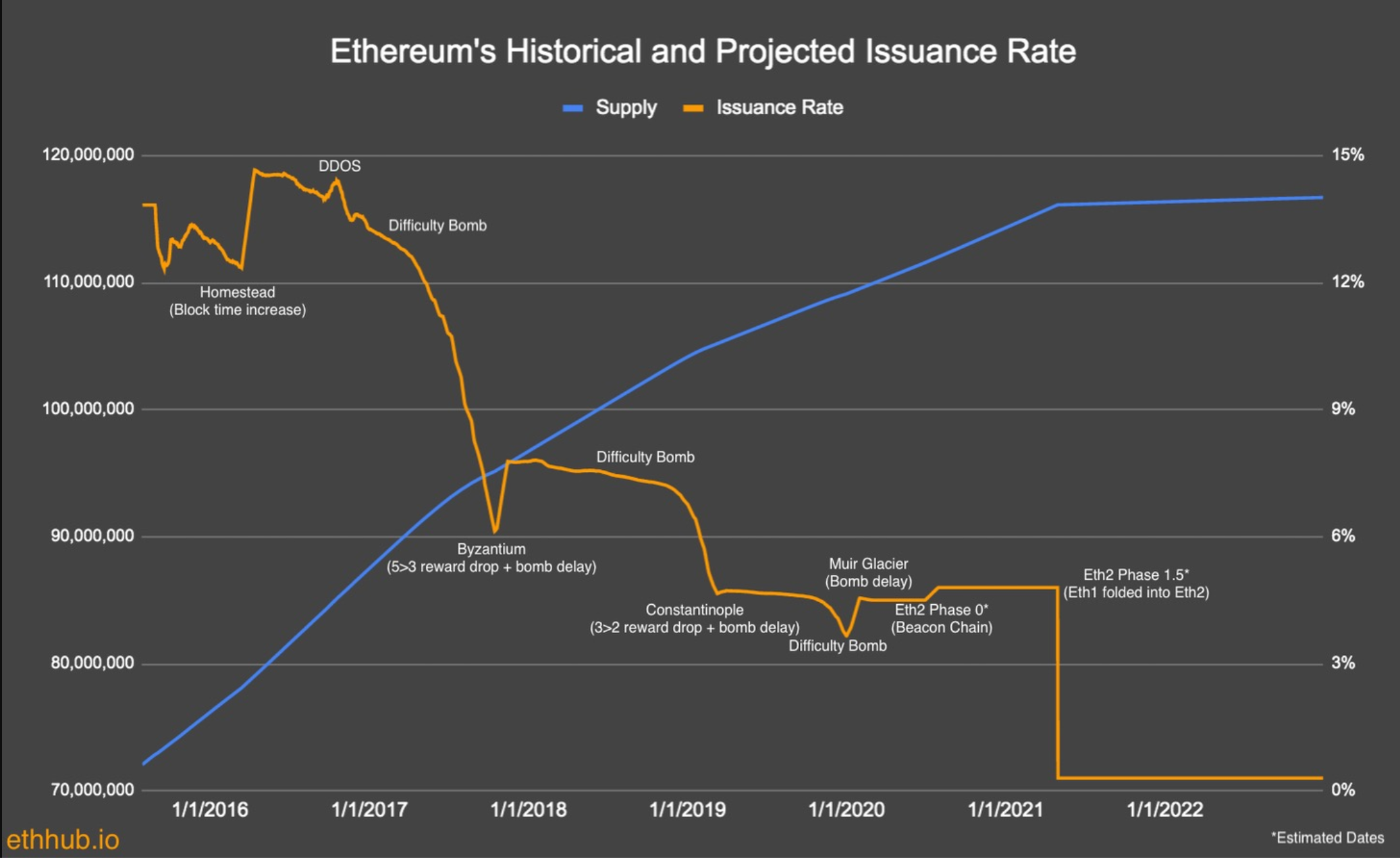

如何发生?在当前的工作量证明 (PoW) 模型下,以太坊每天大约发行 13,500 枚 ETH,每年发行量约占 ETH 总供应量的 4.3%。因为PoS 发行模型是根据网络上积极质押的 ETH 数量来确定的,PoS 也不需要发行大量货币来支付安全费用。根据目前的预测,当“合并”发生时,发行率将下降至 0.3% 至 0.4% 之间。(对比来看,比特币直到2028年发行量才与以太坊相当)

以太坊的发行率和供应曲线,来源:https://docs.ethhub.io/ethereum-basics/monetary-policy/#historical-issuance-impacts

这并不是以太坊第一次通过增加通货紧缩来制定 ETH 货币政策。

早在一年前,2021 年 8 月 5 日以太坊推出了 EIP-1559,将首价拍卖费用机制更改为带有额外矿工小费的新基本费用模式。简单来说,与其向矿工支付全部交易费用,不如将大部分交易费用销毁。这并不是简单对以太坊交易费用管理方式的升级,而是一种实现通货通缩的货币政策手段。

因此“合并”之后,当“三重减半”带来降低的增发率,与 EIP-1559 的 BASEFEE 销毁机制相结合时,以太坊将走向可持续的通缩,这意味着市场内流通的 ETH 变得更少,客观上有助于 $ETH 的价格看涨。事实上,ETH 将发生的通缩预期正是一季度以太坊市值回升的重要逻辑。

2. 数字债券叙事

当质押回报率变成一种无风险收益时,ETH 是否可定性为证券?

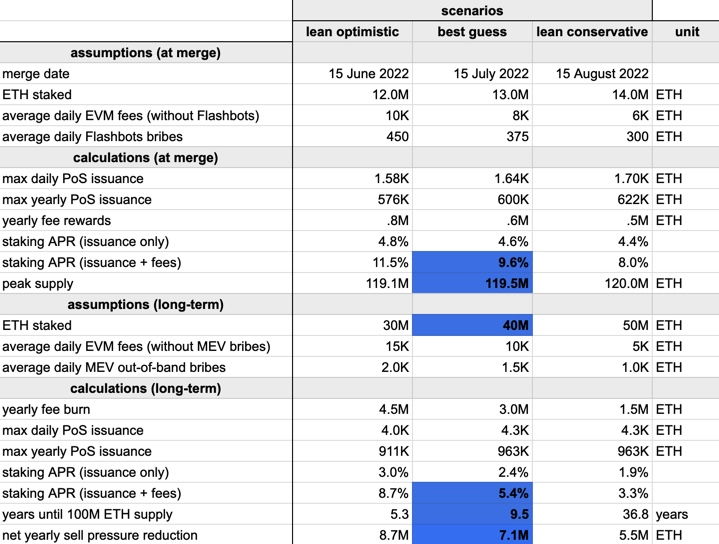

ETH 研究员 Justin Drake 预计,合并后,质押者可以获得大约 8-11.5% 的 APR

这个话题聚焦于 Howey Test 的三要素讨论。目前 ETH 存在争议的是后两点,联合投资企业(In a common enterprise)、从他人的努力中获得利润的期望。抛开这个辩论,关于 ETH 成为全球数字债券的叙事并不新鲜,Bitmex 首席执行官 Arthur Hayes 在今年 4 月的一篇文章《Five Ducking Digits》详细论述了 ETH 作为永续债券的巨大价值以及取代美元国债的可能。那么 ETH 的债券叙事会带来什么?

监管讨论:合并后,ETH 成为准政府债券会更有利于监管,甚至促使一些组织或政府接受加密货币;但同时,随着新的交易所商业模式和更复杂的客户交易出现,对中心化交易所的监管可能会发生改变。此外,SEC 主席刊文表态,SEC 对待加密市场与其它资本市场一样,也引发合并后ETH 或将遵循合规的担忧。

提升估值:传统债券收益率是基于时间的,而 ETH 的质押奖励却没有时间限制。这使 ETH 质押可被视为一种“永久债券”,对于投资者这无疑是巨大的吸引力。

促进采用:相比于一种货币, ETH 作为一种债券的分类,会利于更多大众投资者做相应投资组合,加快参与到加密生态系统。

ETH 债券理论的另一个挑战可能是衍生品的流动性。Hayes 在文章中指出,未来三个月ETH/USD 期货可能出现“流动性不足”的情况。虽然购买和对冲 ETH 可能是一种积极的套利交易,但缺乏流动性可能会阻碍其采用。

对以太坊链:节能、安全性、去中心化程度和技术风险

根据以太坊的发展目标 - 安全性,去中心化,可持续发展,以及可扩展性,这次合并对以太坊链本身有着怎样的影响呢?

安全性

从安全性上来看,PoS 网络将使攻击成本提高,并具有更容易从攻击中恢复以及抗审查性的特点。关于这三点,Vitalik 在文章《为什么是 PoS ?》已经做出了非常清晰的解释。

我们已经知道矿机分为两种:GPU 和 ASIC,其中为了提升挖矿效率,ASIC 专门用于计算某一系列公式使得成本更高。

由于租 GPU 的价格便宜,所以攻击网络的成本就是租到足够的算力以超过现有的矿工,根据 Vitalik 的计算,攻击 6 小时的成本约为 $0.26。

使用 ASIC 矿机的成本会更高,本身 ASIC 的预期使用时间为两年,考虑磨损和迭代。如果一个链被 51% 攻击了,社群大概会更换 PoW 算法来做出应对,ASIC 矿机就会失去价值,根据 Vitalik 的计算,攻击 6 小时的成本约为 $486.75。

而 PoS 的成本几乎是百分百的资本成本 - 质押的 ETH,假设 ~15% 的报酬率足够吸引人们抵押,作恶者攻击 6 小时,总攻击成本约为 2,189 美元。而且长期来看,如果人们习惯更低的报酬率,攻击成本可能会上升到 $10,000 的程度。

这样看来 PoS 网络的攻击成本是 PoW 的 5-20 倍。

抗攻击性

从攻击中恢复的能力来看,基于 GPU 的挖矿基本对攻击没有抵抗力且很难恢复。由于基于 GPU 的攻击本身成本就低,一旦攻击者把攻击成本提高,诚实的矿工就会因为无利可图而退出。

在基于 ASIC 的系统,社群虽然有办法应对第一波攻击,但接下来的攻击就会变得很容易。 社群可以在第一波攻击之后,硬分叉来更换至 PoW 的算法,这也意味着 ASIC 矿机就会变的毫无价值,这对社区和攻击者都会是一波打击,但是如果攻击者能扛住 ASIC 变得毫无价值的打击,并持续攻击,接下来的情况就会和以上描述的 GPU 攻击一样。

然后在 PoS 的情况下,面对 51% 攻击,罚没机制将会把大比例的攻击者的抵押自动销毁。此外遇到更难侦测的攻击,社群可以协调一个“少数者发起软分叉”从而大量销毁攻击者的资金,而不需要采取“硬分叉删除货币”措施。

抗审查性

最后,由于 GPU 和 ASIC 挖矿非常容易被侦察到,这意味着政府可以轻易的关闭矿场。相比之下,可以通过普通电脑,甚至 VPN 完成的 PoS 共识机制似乎抗审查性更加高。然而,政府机构也不是没有办法从出块的过程进行审查,文章会在会在「监管」部分进一步分析。

去中心化

虽然基于 GPU 的挖矿足够去中心化,但是根据上述的抗攻击性比较 GPU 挖矿与 PoS 机制相去甚远。 而参与 ASIC 矿机挖矿意味着几百万美元的成本,这并不是普通人能参与的。而参与 PoS 的共识网络门槛相对低很多:首先需要明白的是 PoS 网络中有两种节点 - 提议(propose)区块的节点和不提议区块的。如果想要提出区块则需要质押 32 ETH,这可以是一次性质押或者是散户通过质押运营商的少量质押。

绝大多数的节点虽然不提议区块,但是也起到至关重要的作用。它们负责监听新区块,验证其到达时的有效性,并让所有区块提议者负责。如果区块有效,它们将会将其广播至网络。而运行这样的节点只需要普通电脑和网络即可。

这样的设定保证每个人都能运行节点,进而保证了以太坊的去中心化程度。

当然关于 PoS 的去中心化也不是没有质疑的声音,有的人认为 PoS 机制使富人更富,但是 Vitalik 的观点是 ASIC 挖矿也使富人更富,而相比之下,至少 PoS 的门槛更低,使更多人有机会参与。正因为 PoS 参与群体广泛,且节点的质押和 Gas 费用分摊,相当于小节点的数量优势减缓巨鲸财富增长。

节能

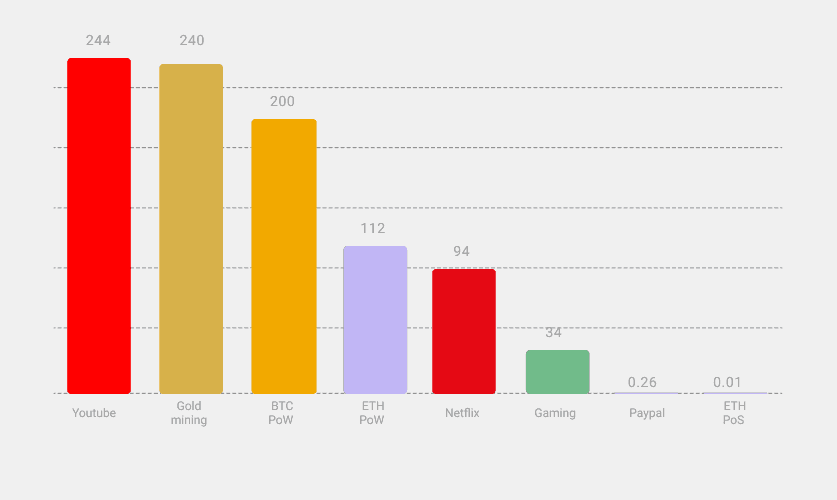

我们都知道 PoW 网络出块是算力竞争 - 如果你有更多的算力,就可能赢得区块奖励,这样的竞争对矿机和电力提出越来越高的要求和需求。而 PoS 机制中区块提议者是被“随机”选中的,从而完全的抹去了原先的军备竞赛。从而 PoS 节点相对 PoW 节省了将近 99.95% 的能源损耗,这样的改变对一直以来的环保争议给出了强有力的回应。

PoS 后能源消耗,来源 https://ethereum.org/en/energy-consumption/

技术风险

作为一个生态系统,以太坊如果合并失败将产生一系列影响,比如波及生态上的众多应用以及 L2。有人形象地称合并为“在飞机仍在飞行时更换发动机”,充满着挑战和风险。

合并意味着两个网络系统的融合 - 信标链和主网,但这并不是简单的加法。一直以来以太坊的合并秉承着“最小破坏”的原则,因为牵动着大量的资金和网络上的应用。同时,以太坊团队也在不停的测试和实战演习 - 这就是为什么在正式合并前存在着十一个影子分叉,和四个测试网合并测试。

目前有 4 个独特的客户端运行以太坊 PoS 节点,这意味着如果节点运行者在执行上遇到问题都可以切换到其他客户端上。在合并执行的过程中,重要的参与者之间需要保持良好的沟通,比如在共识层上的验证者需要更新至正确的最大难度值(TTD)并且保证节点的统一更新,因为如果足够的节点掉线的话,以太坊网络将被迫暂停。

虽然挑战重重,但是回顾历史上的测试网合并都并没有重大问题出现,并且信标链自 2020 年上线以来也都一直在平稳运行着。此外,鼓励开发者发现漏洞,从现在到 9 月 8 日的时间里,发现漏洞的赏金高达 100 万美元。

对于MEV :MEV 依然存在,加剧验证者收益不平等

MEV 或最大可提取价值自 2021 年开始逐渐成为以太坊生态中的重要问题,它的影响广泛 - 从引入中心化的问题到用户体验。由此,以太坊合并后对 MEV 有着怎样的影响也是值得探讨的问题之一。

简要回顾 MEV 是什么:虽然理论上 MEV 的定义是矿工或者验证者在进行交易排序,区块审查,甚至是区块链重组时可以提取的价值。但事实上,使 MEV 发生的主导者是一群独立的网络参与者,被称为搜索者(the searchers)。通过运行复杂的算法,他们可以捕捉潜在的 MEV 机会,当发现这样的机会时,搜索者会愿意支付更高的 gas 费用从而使交易被执行,而这部分 gas 费用则去到矿工或是验证者的手里。这样来看,矿工或验证者是 MEV 的执行方和间接的受益者。

其实,以上的描述已经透露了合并以后 MEV 还是会存在,并且来自 MEV 的利润将会流向验证者。

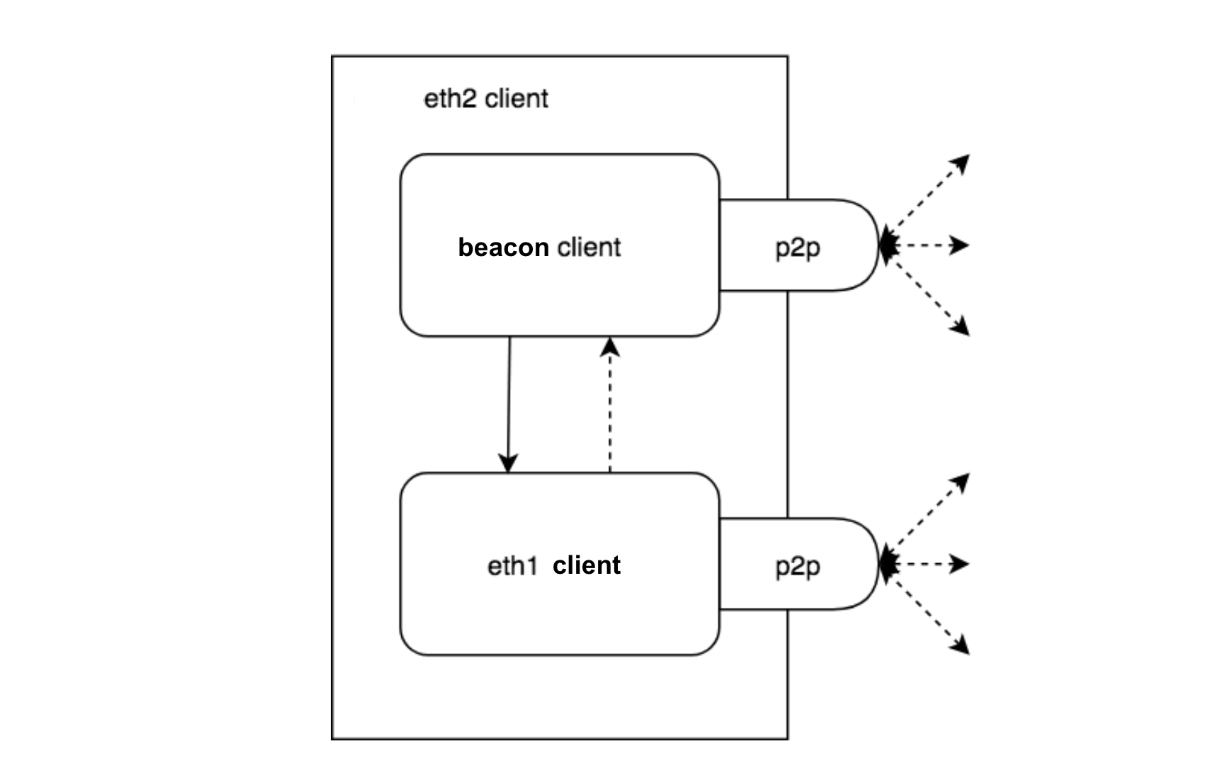

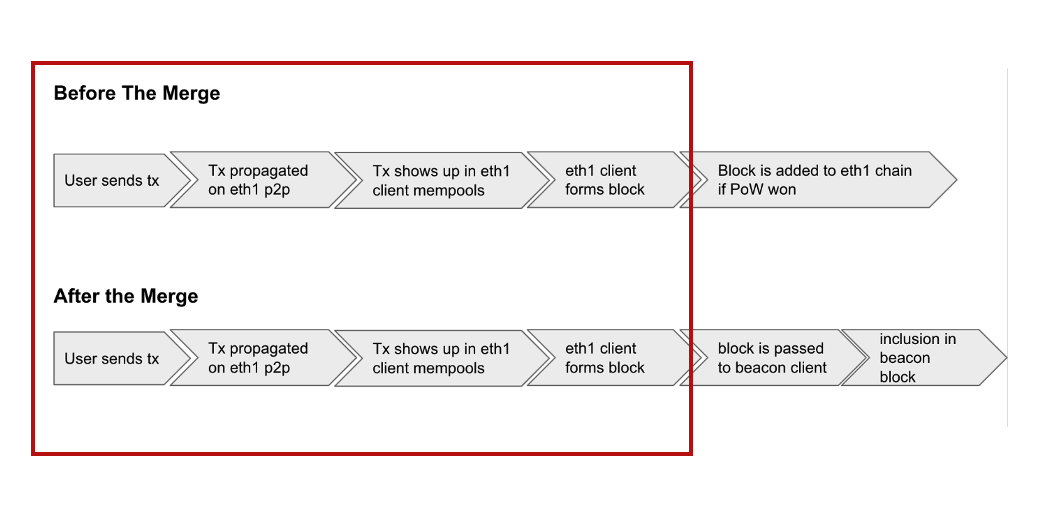

之前提到,以太坊合并是以太坊执行层和信标链作为共识层的升级融合。原来 PoW 的客户端被停止了共识的责任,而专注于mempool、执行有效性和 EVM。而信标链则被启动了共识的责任,即区块投票(attestation)和区块提议(proposal)。

MEV 之所以存在就是因为合并以后的以太坊网络还有着 PoW 时期的影子。从下面的图可以看出以太坊合并后的客户端包含着信标链客户端和 PoW 客户端。而合并后的出块去要两个客户端之间来回的交流:

1)ETHPoW 客户端:从 mempool 中收集交易,排序,然后初步出块,并发送至信标链客户端。

2)信标链客户端:由提议者将其包含进信标链的区块并准备由 attester 对其与有效性进行投票。

而 MEV 的产生就存在于第一步。

注:因为ETH2.0的说法已经过时,本文用ETHPoS 代替 eth2, ETHPoW 代替 eth1。

来源:https://ethresear.ch/t/eth1-eth2-client-relationship/7248

从以下的流程图也可以看出,与合并前不变的是前一部分,就是交易的排序,收集入区块,这里也是 MEV 机会产生的部分。只不过对 MEV 有最终控制权的变为了验证者,因为是由它们向 PoW 客户端请求区块并把它包含在信标链的区块里。

这意味着什么?在合并之前,MEV 之所以是以太坊生态里严峻的问题之一就是因为 MEV 所带来的巨大财富价值被集中在几个群体手里,比如 MEV 搜索机器人和区块 builder - 它们能比被人更好的提取 MEV 价值 (更多的时间投入+更精良的算法)。但是在合并后,验证者变成了 MEV 供应链终端的最终控制者,而成为验证者的过程在合并后变得更加的民主和去中心化,同时意味着提取 MEV 的群体变得更加多元和分散。

当然也有另一种观点认为,PoS 后的 MEV 会被有足够资本的验证者所垄断。合并之后出块的可预测性让用户不再发交易到公共交易池(mempool)而是私下向特定节点提出贿赂,转而从公开竞拍转为私下贿赂。而质押越多的节点或者运营商将会获得更多贿赂和提取 MEV 的机会。

MEV 对以太坊生态影响复杂,研究者和服务商也在就其弊端探讨和寻找解决方案。以 Flashbots 为首的团队就提出了“提议者-构建者分离” (propsoer-builder seperation) 的解决方案,这个方案分为三个阶段。从 2020 至今,矿工可通过运行 mev-geth 来更加公平的最大化的捕获 MEV。而第二阶段,也就是以太坊合并之后,Flashbots 将推出 mev-boost 作为中间件为验证者搭建更加健康的拍卖市场,容 Flashbots 和其他区块构建者一并在市场中竞价,而验证者只需向 mev-boost relay 询问 (query) 价格最高的区块即可。

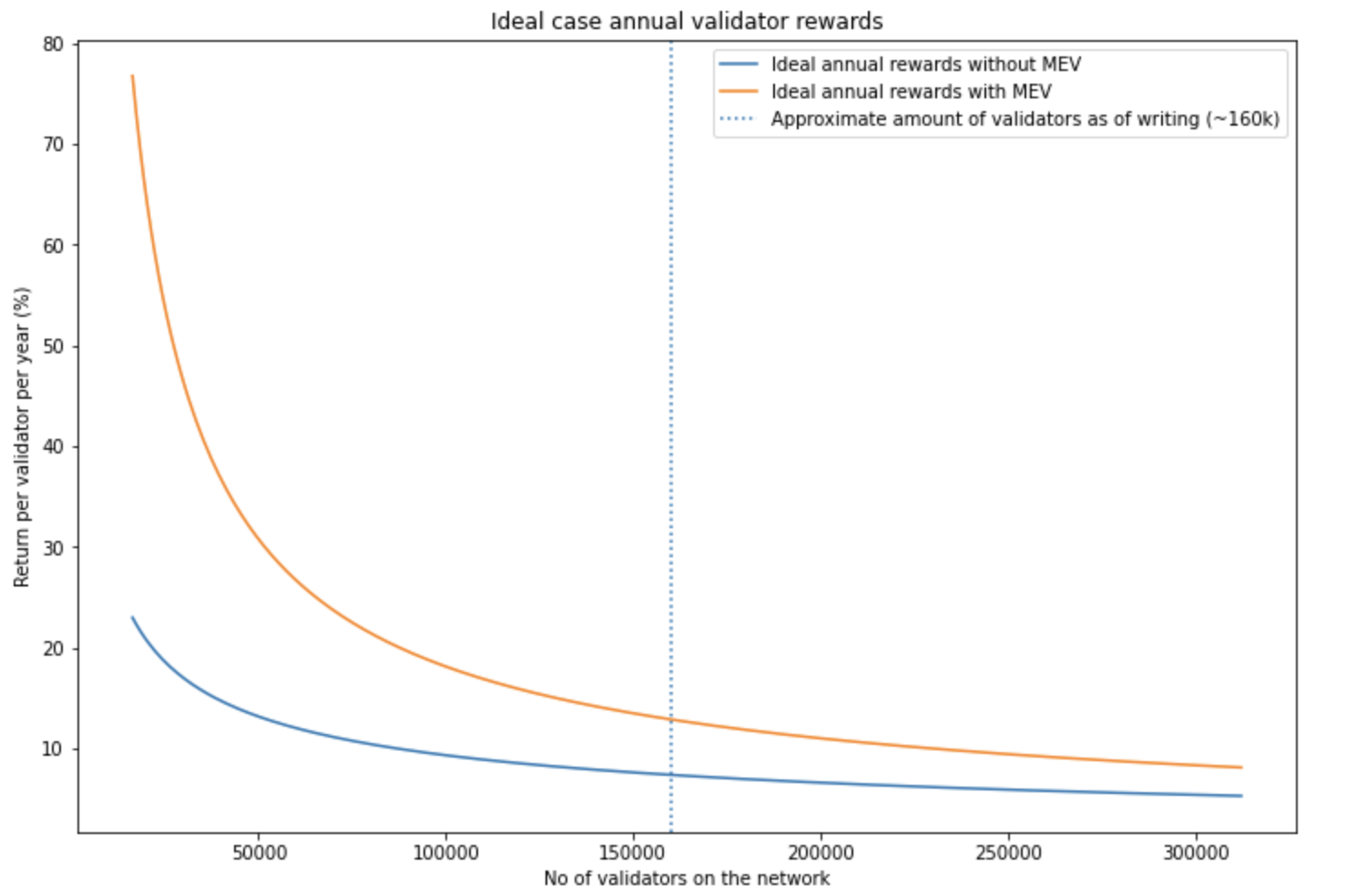

根据来自Flashbot 的 Alex Obadia 和 Taarush Vemulapalli 分析显示,MEV 将会显著提升验证者的收益约 75.3% - 从没有 MEV 的 7.35% 质押奖励提升至 12.86%。此外,回顾合并对 ETH 的内部影响,由于合并后 ETH 变成微通缩,这也意味着验证者获得的奖励将被压缩,这样导致 MEV 的奖励变得更有诱惑力。由于 MEV 显著提升验证者的奖励,这可能就表示可能会有更多验证者加入网络验证,预示着更安全的网络。

来源:https://hackmd.io/@flashbots/mev-in-eth2

此外,验证者之间的收益差异不仅由 MEV 所影响,因为验证者被随机选中来提议区块,所以幸运性也决定了验证者能够提议区块的数量(也就是捕获 MEV 的次数):根据统计分布图,其中最幸运的验证者一年可提议至少 39 个区块,而最不幸的一年最多只能提议 15 个区块。由此来看验证者被选中的可能性(幸运性)进一步的加大了验证者的收益差异。

这个差异带来的潜在影响有几点,Falshbots 的 Alex 在视频中解释到,推测来看,这样的差异可能会让验证者参与质押池 - 来更加均匀的获得收益,而不是成为单独的验证者。此外这样的差异也可能加剧“富人变富”的理论,因为资产充裕的验证者会获得更多区块提议的机会,从而捕获更多 MEV 价值。当然,这些猜测还有待合并后的数据来进一步佐证。

对于 Staking 赛道:ETH 资产属性凸显,利好质押市场

在以太坊早期白皮书描述中,ETH 主要价值在于:加密市场中的货币属性;Gas 消耗;计息资产。 一直以来 ETH 作为最重要的抵押品之一,为加密市场提供流动性,随着“合并”对质押的引入,各类 DeFi 协议、交易所、钱包及 ETH 质押服务参与程度又不断加深。这种背景之下,ETH 作为一种生产资料,资产属性将越发明显。

首当其冲利好的是 Staking 赛道。

不论哪条 PoS 公链,独立成为一个节点来进行 Stake 都不是一个简单的事情。当普通用户无法直接参与到 Staking 中,对于公链整体的安全性和去中心化程度也打了一个问号。而用户也希望具有专业运维设备、知识、经验以及足够资金的第三方,可以进行投票权委托,由验证人来代替他们维护网络共识并获得奖励(一定比例作为对其所提供服务的报酬)。

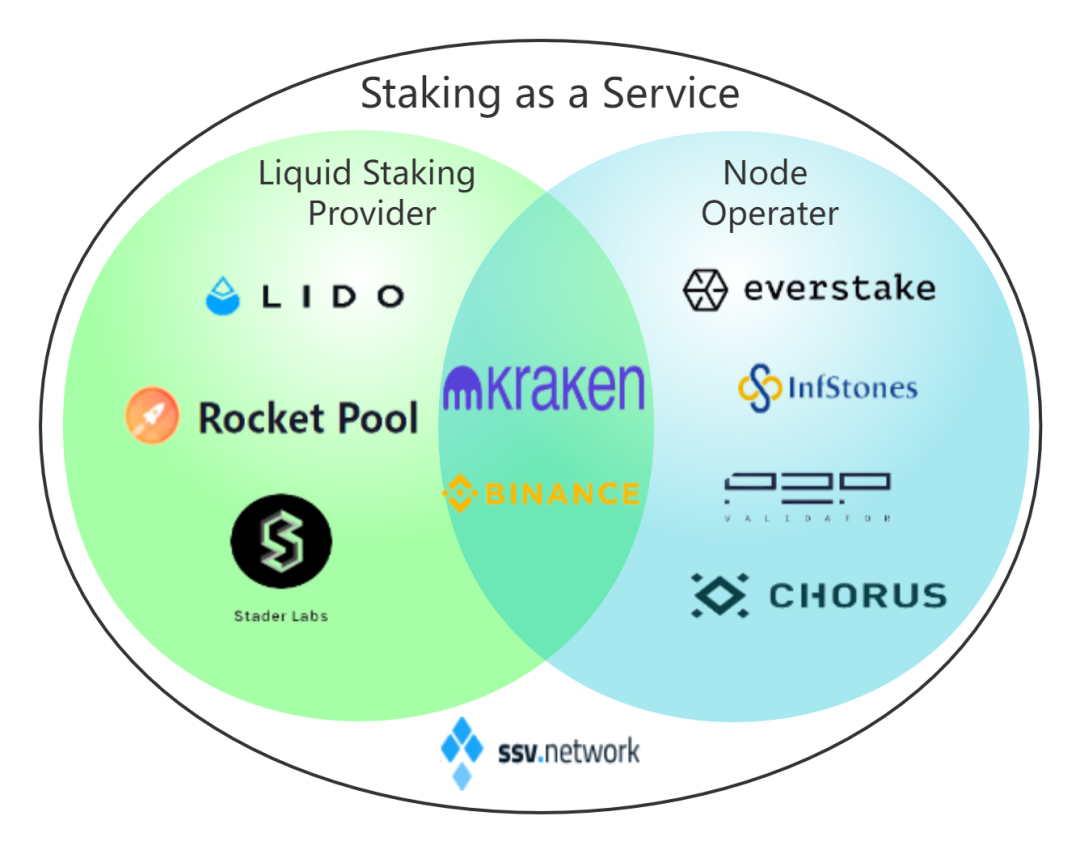

这种供需关系下,催生了一些机构给普通用户提供代理质押的服务,即 Staking as a Service. 主要分为节点运营商(Node Operator)和流动性质押服务商(Liquid Staking Provider),前者运行节点,维护共识;后者提供质押衍生品,解决 PoS 质押流动性问题。

赛道分类,来源:mint ventures

对于转为 PoS 共识的以太坊来说,相比其它 PoS 公链,由于一些限定条件(比如验证者公钥和存入 32 ETH的提现凭证),质押者会面临不少问题:

高资本:尽管 32 ETH (只是对节点规模和去中心化程度之间的一个平衡点)并不是永久设定,但这仍然是一笔不小的资金

早期质押的机会成本:由于 PoS 链和 PoW 链目前尚未 Merge,所以目前的 ETH 只能单向的从 PoW 链存储到 PoS 链(信标链),在信标链启用转账功能之前,验证者都无法提出他们的以太坊

损失流动性:在质押过程中,ETH 无法转移、交易

而这些恰恰是流动性质押服务商解决的痛点:取消质押门槛、质押池解决提款需求、质押凭证代币解决流动性。

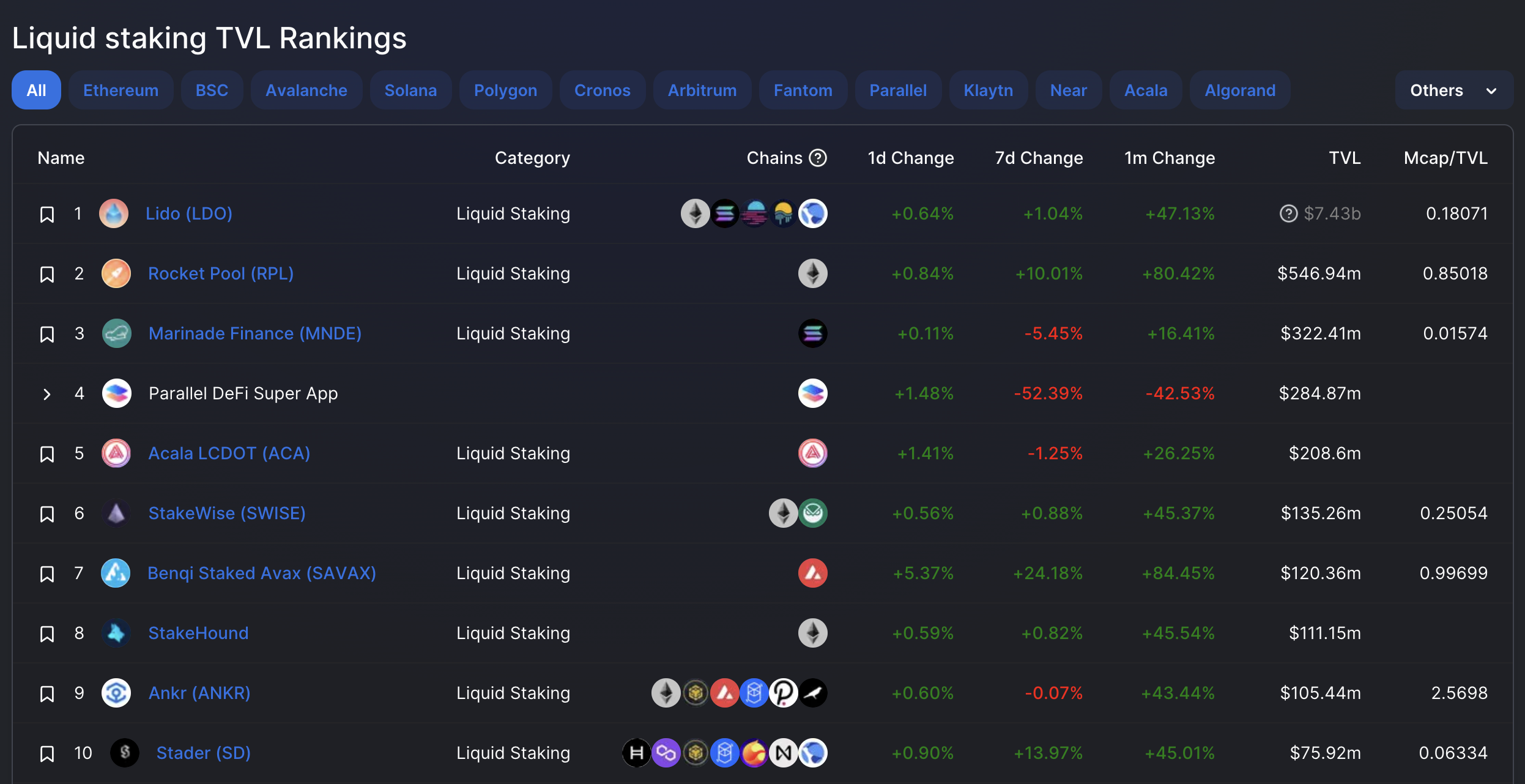

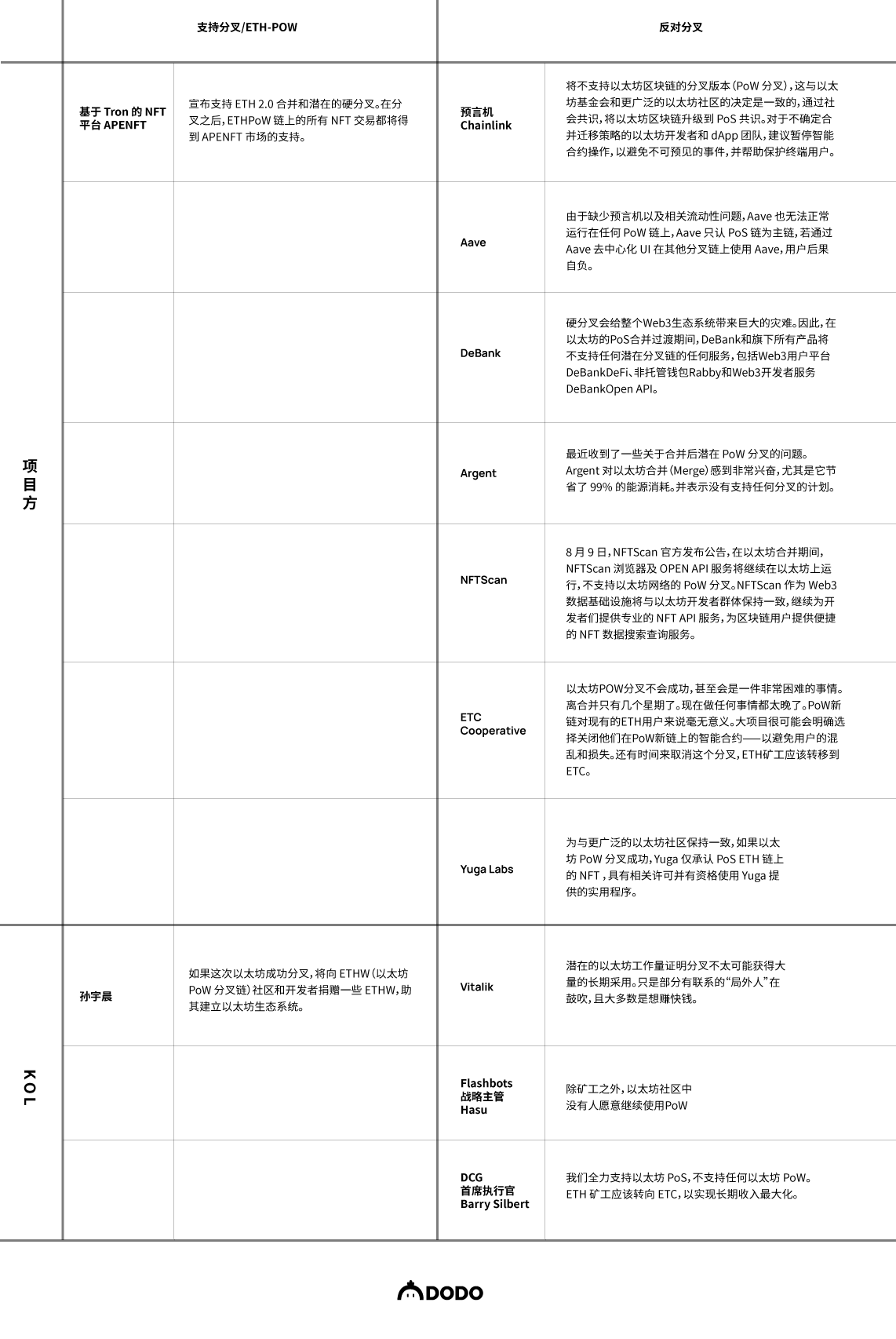

数据来源:https://defillama.com/protocols/liquid staking

截止 8 月 25 日,以太坊信标链上已质押 1408 万枚ETH,验证者总数 417,041,当前 APR4.1%,这几乎是一个无风险收益率。Kraken 在《2022年第一季度质押状况》的报告中预计,在以太坊完成合并后,质押用户的年收益率可以达到 8.5%-11.5%。随着 Merge 的推进与完成,以太坊质押率还有更多的增长空间,这将利好质押赛道服务商。

虽然最早开启以太坊质押服务的是中心化交易所,以 Kraken 或 Binance 等交易所运营的验证者节点成为占比最大的群体,但随着对以太坊去中心化理念的实践,质押池的去中心化将是下一个锚点。目前有三种使用公开交易代币的流动性质押协议:Lido、Rocket Pool 及 Stakewise,其中以太坊社区选出来对抗 CEX 的质押池、被誉为以太坊去中心化守护者的 Lido finance,其质押凭证 stETH 已经展现出其流动性和 DeFi 可组合性所带来的护城河和网络效应,尤其是团队在“去信任的以太坊抵押之路”问题上,表现出令人深刻的决心和努力(技术细节请查看原文)。

Coinbase 在以太坊合并之前上线流动质押代币 cbETH,用户可以通过 cbETH 出售、转移、消费或以其他方式使用锁定的质押 ETH

其它:ETC 利好、矿工迁移

对 ETC (Ethereum Classic,以太坊经典)生态

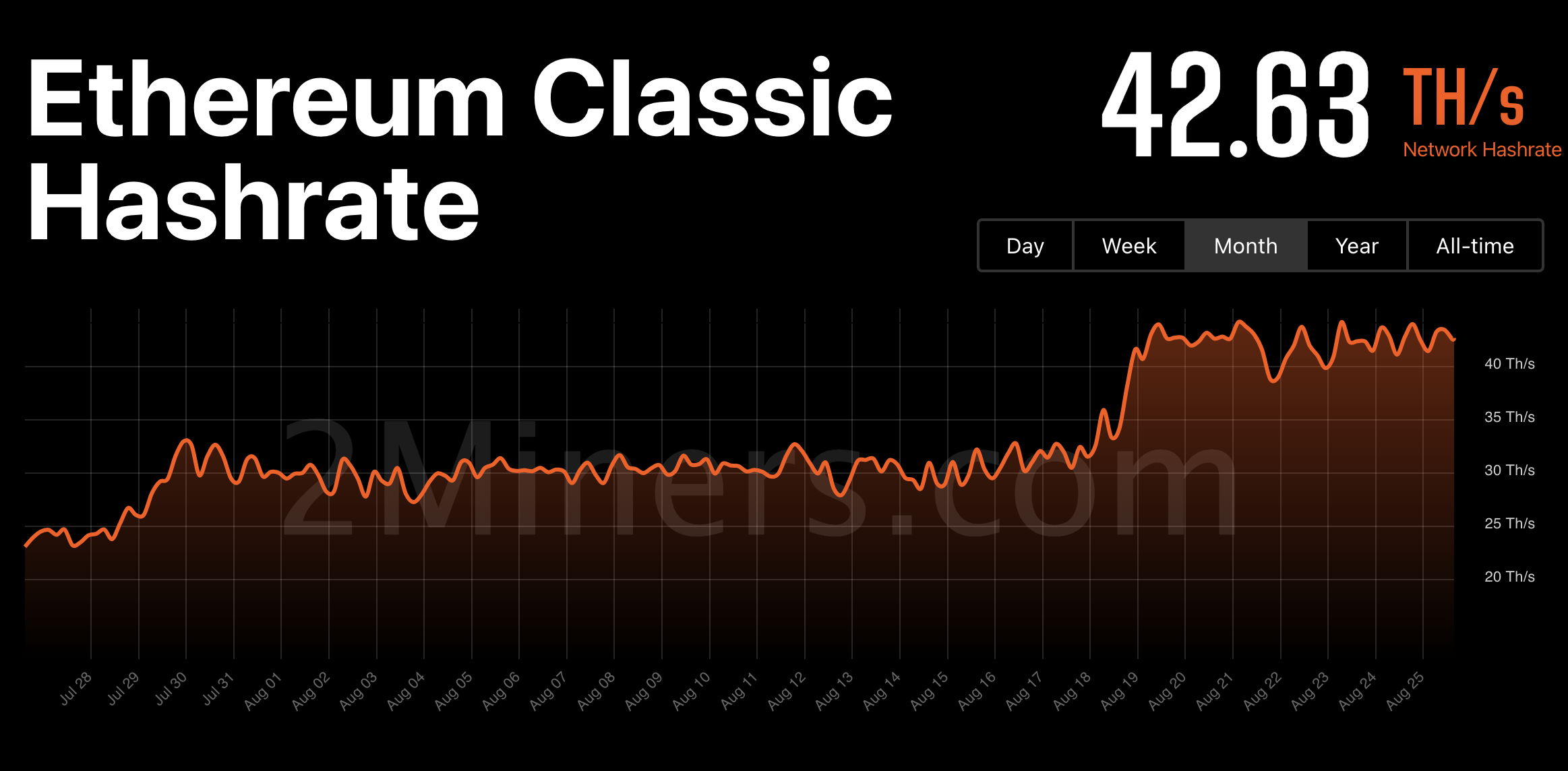

ETC 链的出现源于 2016 the DAO 事件的硬分叉。在过去的一个月里 ETC 价格急剧增长了 140%。截至 8 月 25 日,根据 2miners 数据显示以太坊经典的算力增长约 86%。此外,Antpool 也投资 1000 万美元力挺以太坊经典生态系统。ETC 或许短期面临着利好的形势,但是长期来看并不会有持续提升的表现。以太坊经典与以太坊的算力相差将近 37 倍,矿工大量涌入以太坊经典,必然会导致全网算力激增,加大挖矿难度。同时,考虑到 ETC 与 ETH 的价格相差近 42 倍,长期下去,矿工很有可能会因为收益小于成本而离开。

此外,Messari 的分析员也指出,以太坊经典的生态实际上一直没什么起色 - 用户数量和交易量,以及应用也可以说基本没有。所以短期来看合并可以是用户针对 ETC 的一次投机,而并无其他意义。

矿工

矿工自以太坊上线以来一直是其生态的重要利益相关者,他们在 GPU 矿机上的总投资约为 150 亿美元。然而,在以太坊合并至 PoS 之后,所有的设备将被闲置。从另一个角度来看,合并的本质是对权力的重新分配,合并之前以太坊以每个区块 2 个 ETH 的速度来奖励矿工和信标链上的验证者,而合并之后,对矿工的奖励将停止,这也就是之前提到的为什么 ETH 的发行将减少 90%。

面临着矿机失效和权力的重新分配,矿工的态度是消极的。但是,由于合并的推迟,矿工们希望能够最大化在 PoW 挖矿的时间。同时,大部分矿工对合并完立马转 PoS 持怀疑的态度,很多人觉得即使在合并后,以太坊也会维持 PoS+PoW 的状态,保守的估计还能再挖矿至少一年。

当然,以太坊发展为 PoS 是生态长期的目标是大势所趋。矿工自然而然的也会考虑其他的出路,比如转移到 ETC 或者其他的可用 GPU 挖矿的公链上 - Kadena、Conflux、Monero、Ravencoin。但是可以看出这些公链的体量相比以太坊来说还是十分有限的,很难承受大量的算力涌入。此外,矿工还可以选择利用矿机搭建高性能的数据中心或者为 Web3 协议提供计算,另一个出路就是目前正在热议的分叉问题。

当我们谈论分叉和 ETHPoW

1. 什么是分叉

简单来说,就像我们走在一条道路上,后来出现分歧,于是道路分成了两条。一种是达成共识,共同选择向左走还是向右走;另外一种没有达成共识,各自选择一条路。

当我们操作手机上的 APP 时,总是遇到过系统提醒你进行更新或者你授权进行系统自动更新。但在没有中心化授权管理的前提下,如何升级加密货币网络?分叉解决的就是这个问题,只是这里出现了两种不同的机制:即硬分叉和软分叉。

硬分叉是对软件的彻底改变,它要求所有用户升级到最新版本的软件。所以硬分叉是与以前版本区块链的永久分歧(但需要注意的是,由于存在相同的历史记录,因此如果你在分叉之前持有代币,那么你将在这两个网络上同时获得代币,这种“糖果”的诱惑也是部分投机者对硬分叉狂热的原因)。比如 2017 年比特币因为区块容量之争发生了分叉,出现了原始的比特币(BTC)和新的比特币现金(BCH)。

软分叉是通过支持向后兼容的软件升级方式实现。 一般来说,由于新的升级不会与之前的规则发生冲突,因此你只能实施某些限制。软分叉已经用于比特币和以太坊区块链等等,通常用于实现软件升级(例如前文提到的 EIP-1599)。

2. 为什么要分叉

众所周知,比特币是自由、开源的软件,这意味着任何人可以、也永远可以自由改变比特币的代码,正是这种自由、开源的属性,让我们今天拥有了几千种分叉和克隆的加密货币。不管是通过复制代币还是软件升级的方式,对开源软件进行试验的选项是加密货币的基本组成部分,也有助于能够在去中心化系统中进行更改和升级。

分叉对于区块链的长久成功至关重要,它能帮助区块链和加密货币在开发时集成更多的新功能。不然我们只能寄希望于在某个协议的生命周期内,这些开发者写出的 code 永远没有 bug,一成不变的规则能永久保护我们。

3. 分叉可以避免吗

2016 年,The DAO 项目被黑客攻击,损失了约 6000 万美元的 ETH。为了追回被盗的资产,以太坊团队投票采取了硬分叉的方式。自此,以太坊分裂出了两条链,原链(ETC)和新的分叉链(ETH)。

这曾经引发了巨大的社区争议,反对分叉的人们认为,基金会进行硬分叉,实际上违背了区块链去中心化的核心准则。所以这部分人留在了原有链上 ETC,这条链被称为以太经典。如今 ETH 成为市值第二的加密货币,但 ETC 也仍然存在,即使它的市值只有 ETH 的 2.5% 左右。

比较而言,以太坊和比特币的分叉世界观极不相同。比特币社区坚决抵制任何硬分叉,比如会用算力碾压采取攻击(当然与其「价值储存」的定位、维护稳定性的诉求分不开)。 而 Vitalik 对 ETC 非常包容,以太坊社区一直没有采用 51% 的算力攻击 ETC。

如何来回答分叉可否避免这个话题?首先,分叉是共识规则中的一个设定,它是一个 feature 而不是一个 bug。其次,分叉即自由。区块链捍卫了个人的选择权,即使是一小部分人不认可,少数人仍然保留自由选择的权利,去对抗绝大多数人。在区块链的世界里,我们要杜绝「绝大多数人的民主是一种暴政」的可能性,即少数「一定」要服从多数。同样,今天你也可以选择不服从 PoS ,你可以选择分叉,至于能否成功,能走多远,另当别论。

究其根本,我们保留的是决定哪个加密货币单位拥有多数共识的权利。因为历史已经证明,人们通常会遵循拥有加密货币用户多数人共识的区块链。

4. 以太坊分叉的可能性

经过几次延迟后,这次以太坊似乎终于近了一步,无数信息显示它将在今年 9 月迎来合并。随之而来的第一个讨论,即是这次以太坊是否会分叉。

在 BitMEX 最新研究文章《ETHPoW vs ETH2》中,我们可以看到关于探索以太坊 PoS 合并后 ETHPoW 的可行性,有一个比较客观的猜想:尽管 ETHPoW 链可能面临许多技术挑战,其长期可行性存在问题,但它的存在可能在中短期内为交易者和投机者提供令人兴奋的机会。

简单来说,有困难,但会分叉,短期有操作空间,无中长期叙事逻辑。

而在 ETC Cooperative 最新的致宝二爷(此次分叉事件主导者)公开信中,ETC 基金会认为当前的分叉讨论背景与当年 ETH/ETC 的背景截然不同,当时没有 DeFi 或稳定币,所以无法产生真正的破坏,言下之意,对方低估了或忽略这个 "不可分叉性 "现实,因为 ETH PoW 分叉会带来巨大的混乱以及用户的损失,且当前距离分叉时间紧迫,难以改变。更明智的决定是ETH 矿工转移到 ETC,以使他们的收入长期最大化。

5. 各方态度

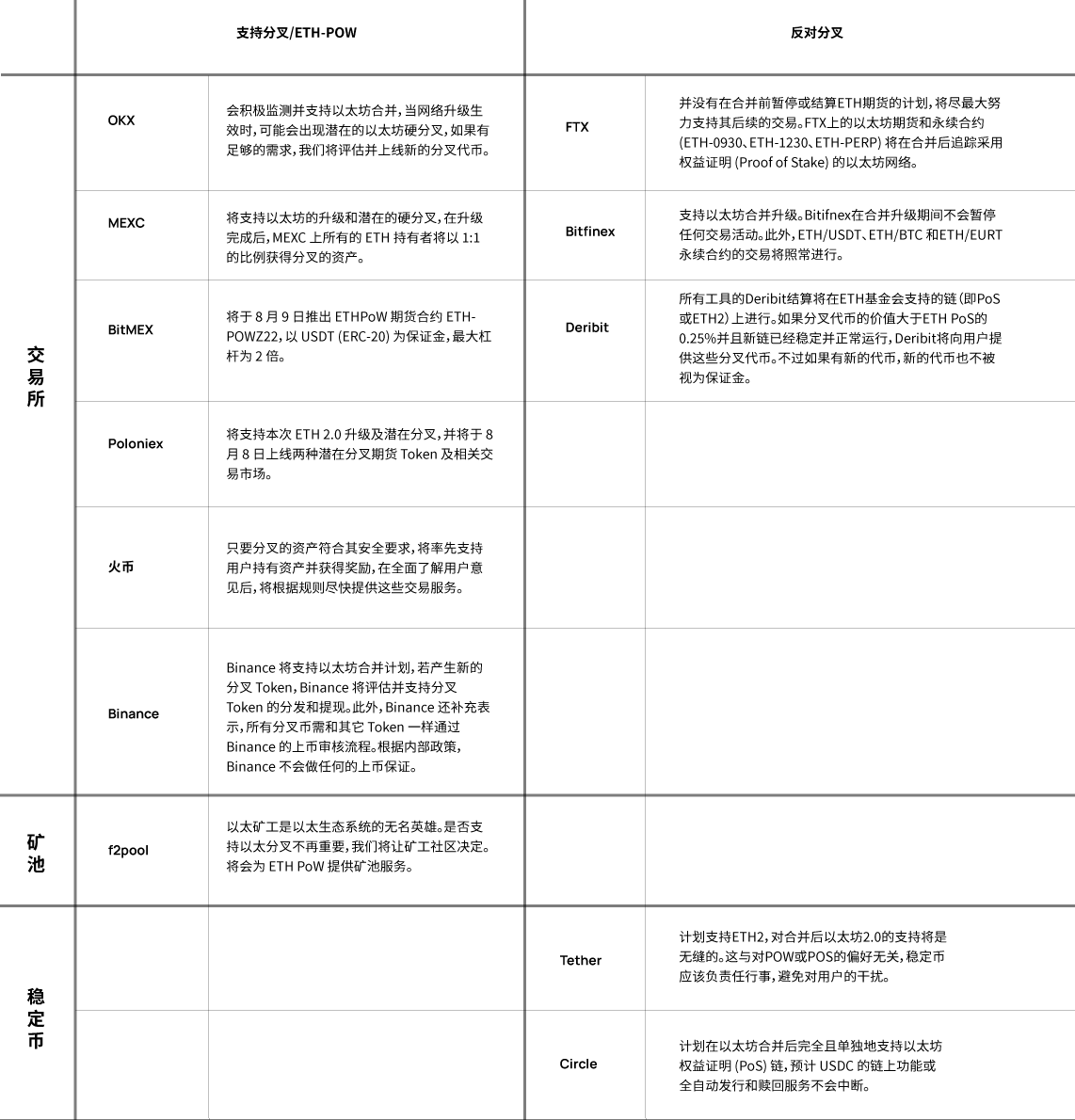

在这场以太坊内战中,目前(截止8月25日)各方的态度如何?

值得注意的是,在这场内战中,以太坊基金会和 Vitalik 不再是唯一的主导者,正如 Vitalik 所言,稳定币可能将是“未来硬分叉的重要决定因素”。一直追求突破不可能三角的以太坊,在未来五到十年内,可能会出现更多有争议的硬分叉,而中心化的 Stablecoin 发行商可能会变成更具影响力的决策者。

6. 成功概率

在这场还未结束的大讨论中,以太坊生态的各方都有各自利益出发点。 USDC/USDT们不会让价值 1 美元的 Token 变成 2 美元,交易所们也很难放弃这哪怕短期却可观的交易收入。

所以,看你如何理解「分叉的成功」,是评价一个短期的行为,还是定义一个长期的愿景。

随着分叉项目 EthereumPoW 写公开信回复 ETC、在 GitHub 上公布了 ETHW Core 初始版本源代码,各方质疑不断。目前来看,ETH-POW 获得了部分社区、交易所、矿工和 KOL 的支持,但作为短期利益博弈的工具,随着流动性的枯竭,注定昙花一现,毕竟真正对 PoW 有信仰的人可以直接选择已经历过这一切的 ETC,但一切的未来都映射在价格中了。

7. 影响

如果我们简单来总结分叉的影响,这些维度值得关注:

分叉带来的财富效应:利好交易所和矿工,但分叉链也是一个巨大的零售陷阱,糖果的价值的确带来短期交易,用户在获得免费代币的同时,也会面临套利风险,当所有人都在考虑做空 USDC、stETH 或任何会失去价值的代币时,在不考虑 MEV 机器人的前提下,机会仍然渺茫;同时,合并期间资产波动性会加剧,这可能会触发抵押水平不足的用户清算。

分叉带来的市场混乱:以目前的表态来看,主流的资产、协议和基础设施都反对分叉,但如果分叉成功,它们是否改为支持 ETH-POW 仍是一个未知数。例如众多支持多链生态的DeFi 协议,哪些将支持 PoW 版本,哪些将继续与以太坊 PoS 保持完全一致?这势必会带来经济和治理的混乱。

PoS 后的监管之争与审查风暴

在讨论对 PoS 后的以太坊进行监管时,有两个角度:一个是宏观的对 PoS 机制是否为债券的讨论,另一个则是 PoS 后节点的抗审查性。

1. 合并之后 ETH 是否会被视为一种证券?

在「数字债券叙事」部分提到,以太坊合并后的 PoS 机制是否更加符合 Howey test 的标准还在激烈的辩证中。

虽然 CFTC 前主席曾暗示 PoS 共识机制中用作抵押的代币很可能被视为证券商品。以及,验证者质押所带来的相对稳定的收益,也可能使得监管者认为验证者比矿工更接近金融实体。

假设,合并后的以太坊被定义为证券 (securities),一方面的观点认为这将利于监管而促进机构以及政府对加密货币的接受;而另一方遍的声音比如 Michael ********Saylor 认为 PoS 将会使验证者变得不合规而暴露在繁重的监管要求之下,尤其是以 CEX 为首的交易所将会需要采取新的商业模式。

8 月 23 日,SEC 主席 Gary Gensler 也表明 “没有理由仅仅因为加密市场使用不同的技术就将它与其他资本市场区别对待,证券法仍适用。“ 看来合并后的以太坊极有可能遵循证券法进行合规。

2. 合并后节点的抗审查能力是怎样的?

OFAC 制裁引发的担忧

自从 Tornado Cash 被美国财政部海外资产控制办公室(OFAC) 制裁后,以太坊社区表示对 PoS 后节点抗审查能力的担忧。Dune 上的数据也验证了这一担忧,目前的信标链确实是较为中心化的,66% 的验证服务商可能会遵守 OFAC 的监管,如 Lido, Coinbase,Kraken 等。

节点运营商会面对怎样的制裁,以及如何应对?

这意味着监管可以通过协议的验证者节点对以太坊进行协议级审查,并阻止验证者对某些转账进行打包。

面对制裁的潜在可能和危机感,加密对冲基金 Arcane Assets 的 Eric Wall 发起一项讨论,“若监管通过某些协议(如 Lido 、Coinbase 等)的验证者节点,对以太坊进行协议级别的审查,以太坊社区将如何反应” 共计 7363 人参与投票,其中 62% 的人选择「会将这种审查视为对以太坊的攻击,并选择通过社区共识烧掉他们的质押」,9.3% 的人选择「容忍审查」,另外 28.7% 的人选择弃权。其中,Vitalik 也参加了这个投票并选择会将审查视为对以太坊的攻击。

随后,社区对审查的热议推动中心化的质押服务商站队。最近 Coinbasde CEO Brian Armstrong 就表示宁愿退出质押业务也不愿接受政府部门的审查。市场份额占比最高的以太坊质押运营商 Lido Finance 也表明 “Lido 的使命是让质押变得简单且安全,并保持以太坊(和其他 PoS 网络)去中心化和抗审查。” 这两家运营商控制 38% 的已质押以太坊。其他以太坊验证节点运营商包括 Kraken、Binance、Stakeed.us、Bitcoin Suisse 等暂未表态。

质押服务商为应对审查的具体行动可能是将具体业务搬出美国。以太坊核心开发者电话会议上也讨论出采取 social slashing 来惩罚这种行为的应对机制,即协调以太坊实施硬分叉剔除违规验证者,同时也鼓励用户分散到不同的质押协议上。

从区块构建的过程来看,验证者如何应对审查?

从验证者出块的过程上来看,抗审查十分复杂,因为抗审查并非两种非黑即白的选择 - 遵循或者不遵循。Bitmex 在最近的研究文章中指出,PoS 后以太坊的抗审查性会比 PoW 时期更加复杂,它的解决方案也是 Vitalik 在自己博客中持续研究的话题。这种复杂性来自于相比矿工受审查时面临的 3 种选择,PoS 后的以太坊节点面临着至少 8 种选择:

拒绝在你生产的区块中包含「OFAC 禁止」的交易。

拒绝证明包含 OFAC 禁止交易的区块。

制作并验证符合 OFAC 规则的区块,即使它们与不符合规则的区块相冲突。

拒绝在包含 OFAC 禁止交易的区块之上生成区块。

拒绝验证链中包含 OFAC 禁止交易的区块。

拒绝使用 OFAC 禁止交易区块的区块验证。

拒绝在链中包含对区块的认证,因为 OFAC 禁止你生产的区块的交易。

无视 OFAC 的规则。

目前,监管部门很可能无法理解这些技术上的细微差别,从而难以下手。

此外,以太坊社区中的一些人担心对 MEV-Boost “中继运营商”或将验证者与区块构建者联系起来的实体进行审查。但是值得庆幸的是,近期 Flashbots 已开源他们的运行中继软件,这将鼓励更多人去运行中继器,并扩大验证者的选择。

审查的问题依然沉重

以上提到的解决方案都是积极且可行的,但是我们也不得不直面沉重的现实:回应 OFAC 对 Tornado Cash 的制裁,以太坊的基础设施 Infura 和 Alchemy,稳定币 USDC 背后的公司 Circle,以及应用 Uniswap 和 AAVE 都已经屏蔽了 TC 相关的地址。

最近召开的以太坊核心开发者会议上,有人表示以太坊的发展指标一直都是成为中性的抗审查的网络,这也是为什么人们容忍高昂的手续费用。如果有一天以太坊将被监管控制,这将象征着网络的失败,开发者也可能会大批离去。

我们都对去中心化抱有美好的憧憬,但是以太坊的去中心化实现,并不依靠着美好愿景或是道德遵守,而是通过一系列的机制让作恶更难,让监管审查的成本更高而实现的。我们不能道德绑架中心化的节点运营商去和监管对抗,加密货币律师 Geoff Costeloe 解释道,”因为它们毕竟是有盈利义务的实体。从根源来看来看,当「抗审查」不比「审查」更有利可图时,才是问题的本质“。介于目前的抗审查解决方案还处于研究阶段,我们只能期待以太坊团队的研究成果和其具体实施方案。

毫无疑问,以太坊合并是加密世界的一个里程碑式事件。

以太坊合并是否会如期顺利完成,矿工何去何从?硬分叉是否会成功,又是否会给目前的以太坊生态带来一种混乱的状态?合并之后 ETH 是否会被视为一种证券,OFAC 监管会对以太坊的去中心化带来哪些影响?目前的以太坊真的做好转 POS 的准备了吗?

面对种种问题和质疑,以目前以太坊的图景和路径来看,我们仍可以保有这样的信念:如果合并出现任何问题,它只会延迟到问题得到解决。

Reference

https://launchpad.ethereum.org/zh

https://blog.bitmex.com/ethpow-vs-eth2/

https://newsletter.banklesshq.com/p/ethereum-merge-investing-strategy-eth?triedSigningIn=true

https://notes.ethereum.org/@vbuterin/pbs_censorship_resistance

https://www.coindesk.com/tech/2022/08/10/whats-at-stake-will-the-merge-turn-ether-into-a-security/

https://foresightnews.pro/news/detail/9029

https://www.youtube.com/watch?v=zsgC6mNP9eU&ab_channel=ETHGlobal

https://www.bitpush.news/articles/2931401

https://www.chaindd.online/3682050.html

免责声明

本研究报告内的信息均来自公开披露资料,且本文中的观点仅作为研究目的,并不代表任何投资意见。报告中出具的观点和预测仅为出具日的分析和判断,不具备永久有效性。

版权声明

未经 DODO 研究院授权,任何人不得擅自使用(包括但不限于复制、传播、展示、镜像、上载、下载、转载、摘编等)或许可他人使用上述知识产权的。已经授权使用作品的,应在授权范围内使用,并注明作者来源。否则,将依法追究其法律责任。

关于我们

「DODO 研究院」由院长「Dr.DODO」带领一群 DODO 研究员潜水 Web 3.0 世界,做着靠谱且深度的研究,以解码加密世界为目标,输出鲜明观点,发现加密世界的未来价值。「DODO 」则是一个由主动做市商(PMM)算法驱动的去中心化交易平台,旨在为 Web3 资产提供高效的链上流动性,让每个人都能轻松发行、交易。

更多信息

Official Website: https://dodoex.io/

GitHub: https://github.com/DODOEX

Telegram: t.me/dodoex_official

Discord: https://discord.gg/tyKReUK

Twitter: https://twitter.com/DodoResearch

Notion: https://dodotopia.notion.site/Dr-DODO-is-Researching-6c18bbca8ea0465ab94a61ff5d2d7682

Mirror:https://mirror.xyz/0x70562F91075eea0f87728733b4bbe00F7e779788