Messari:可能激发下一次牛市的三个加密趋势

原文来源:Messari

原文编译:PANews

下一个牛市将会由当前熊市中仍坚持构建的技术和趋势驱动,但并非所有技术或趋势都具有同等价值。所以,让我们在本文中探索哪些加密趋势可能激发下一次牛市。

实际上,我们可以用一个框架来评估加密趋势,该框架考虑的主要因素包括:

1、创新

2、10 倍价值潜力

3、总可寻址市场 (TAM)

4、价值捕获

5、竞争力

考虑到该框架,我们或许可以评估以下三个趋势,看看这些趋势是否真的有能力催化下一波牛市加速到来。

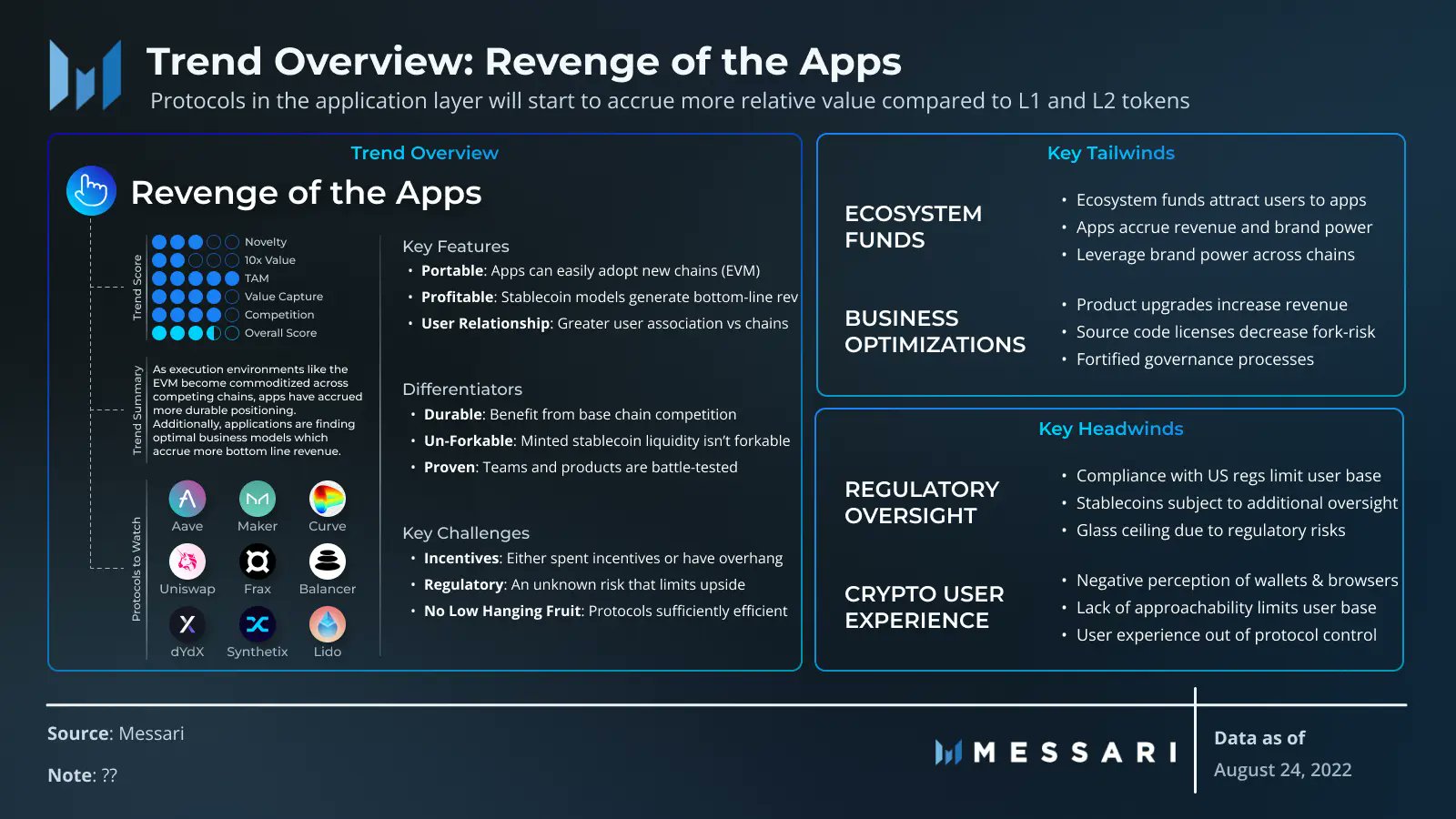

一、应用协议

过去,加密行业似乎更看重网络协议,而非应用协议。但现在,市场竞争动态已经发生了微妙的变化。新的生态系统将竭尽全力实现 EVM 兼容性,从而让应用协议能够轻松部署。

随着区块链竞争越来越激烈,诸如 EVM 这样的执行环境开始探索商品化和盈利模式,在这种情况下,加密应用获得了更稳固的行业定位。不仅如此,加密应用本身正在寻找更优化的商业模式,旨在累积更多“底线收入”(bottom line revenue)。

应用协议发展趋势

1、核心特点

便携性:APP 现在可以轻松适应新的(EVM)区块链;

可盈利性:利用稳定币模式,应用协议可以产生“底线收入”;

用户关系:相比于传统网络协议,应用协议可以产生更好的用户关联。

2、关键差异

可持续性:应用协议将从基础链竞争中收益;

不可分叉:铸造的稳定币流动性不会面临分叉风险;

可验证性:产品和团队经得住实战考验。

3、主要挑战

激励:需要提供 ETH 激励,或是提供超额激励措施;

监管:需要面临监管不确定性风险;

有利因素

1、生态基金

生态基金将吸引更多用户到 APP;

APP 将累积收入和品牌力量;

利用品牌力量拓展更多区块链。

2、业务优化

产品升级将增加收入;

源代码许可将减少分叉风险;

强化治理流程

不利因素

1、监管

美国监管机构的合规性要求将限制用户群发展;

预计稳定币将受到额外监管;

2、加密用户体验

用户对加密钱包和浏览器持有负面看法;

缺乏可接近性限制了用户群发展;

用户体验超出协议控制。

二、去中心化社交

去中心化社交为人们提供链上声誉、组织 (DAO) 和内容所有权,其中内容所有权是关键,因为它为人们提供了一种最终获取自己创造价值的方式,这意味着互联网将重新构建价值流。

去中心化社交是一种完全开放、个性化且“可拥有”的社交媒体,社交类 APP 可以创建独立的盈利模式,用户也可以通过自己创建的内容获得收入,这一领域的主要产品包括数据主机、社交图谱和社交应用程序。

去中心化社交发展趋势

1、核心功能

收入:盈利模式丰富多样,比如 P2E;

开放数据:社交图谱数据可在应用之间迁移;

可延展性:去中心化社交是开源且完全可定制化的。

2、关键差异

可寻址市场规模较大:包括社交网络广告和数字商务;

可防御性:社交图谱和基础设施能够快速完成并得到有效巩固;

“便携式才能”:开发者和用户体验获取更便捷。

3、主要挑战

可扩展性:去中心化社交应用的日活用户量规模一般较高,会给区块链造成一定压力;

隐私性:去中心化社交应用的数据是开放的,由于缺乏隐私性,可能会让部分用户感到不快;

用户体验:在钱包体验方面,普通用户可能略有不佳。

有利因素

1、用户“拥有”内容

通过 NFT,用户希望拥有并分享内容;

用户拥有内容将能开启更多功能设计;

当用户掌握了内容所有权,用户粘性将进一步提升。

2、社交投资

投资活动将变得更具社交性,比如 WSB 和 DAO;

过去缺乏原生社交投资平台,未来或许有较大发展潜力;

投资各方需要在社区中建立信誉,也会随之出现一批提供构建投资信誉的原生工具。

不利因素

1、移动端加密会被限制

移动端的加密集成并不高效;

iOS 历来都是“坚定的看门人”;

极大地限制了可用的用户群。

2、数据问题

社交应用产品通常会产生海量数据;

当前区块链难以处理海量交易数据;

需要支持未发布数据的可用层。

三、Web3 游戏

Web3 游戏的目标是让玩家拥有其游戏内数字物品的所有权,并利用代币创造游戏内经济,继而推动参与游戏的玩家在游戏获得到成就感并对这种感觉产生依恋,并且更愿意在游戏中投入资金。

在 Axie Infinity 这样的“边玩边赚”游戏模式推动下,Web3 游戏越来越受欢迎,越来越多 Web3 游戏也开始将 Token 融入自身机制中。虽然到目前为止还没有出现一款可持续的 Web3 游戏,但这一领域已经吸引了大量投资,旨在开发下一个“爆款游戏”。

Web3 游戏发展趋势

1、核心功能

激励:玩家可以通过投入游戏时间获得收入;

玩家拥有的内容:玩家拥有“游戏内容所有权”;

游戏易于上手:更快上手,有助于进一步推动 Web3 游戏普及采用。

2、关键差异

高收入:参与 Axie Infinity 这样的玩赚游戏可能比参与 DeFi 获得更多收入;

可防御性:铸造的稳定币流动性不会面临分叉风险;

“便携式才能”:开发者和用户体验获取更便捷。

3、主要挑战

竞争性:与传统游戏相比,Web3 游戏目前仍处于下风;

不稳定性:游戏经济稳定性有待提升;

开发周期较长:Web3 游戏迭代难度更大。

有利因素

1、电竞+市场增长

基于电子竞技驱动的游戏受欢迎程度较高;

游戏市场会持续拓展到移动端;

游戏行业容易吸引投资,继而推动市场大幅增长。

2、用户“拥有”内容

游戏玩家更愿意自己“拥有”内容;

游戏玩家更有机会获利;

二级销售增加能够提升游戏收入。

不利因素

1、Web3 游戏机制设计

对于在公开市场运行的多个游戏项目,控制难度较高;

过长的开发周期会增加游戏机制风险;

产品/市场契合度难以评估。

2、游戏分销问题

主要游戏分销仍被苹果等大公司控制;

游戏的加密集成仍有局限;

基于移动端的加密游戏市场仍处于婴儿期。