Pantera Capital: Ethereum เข้มงวดมากกว่า Fed

ชื่อระดับแรก

การรวบรวมต้นฉบับ: Wu กล่าวว่า blockchain

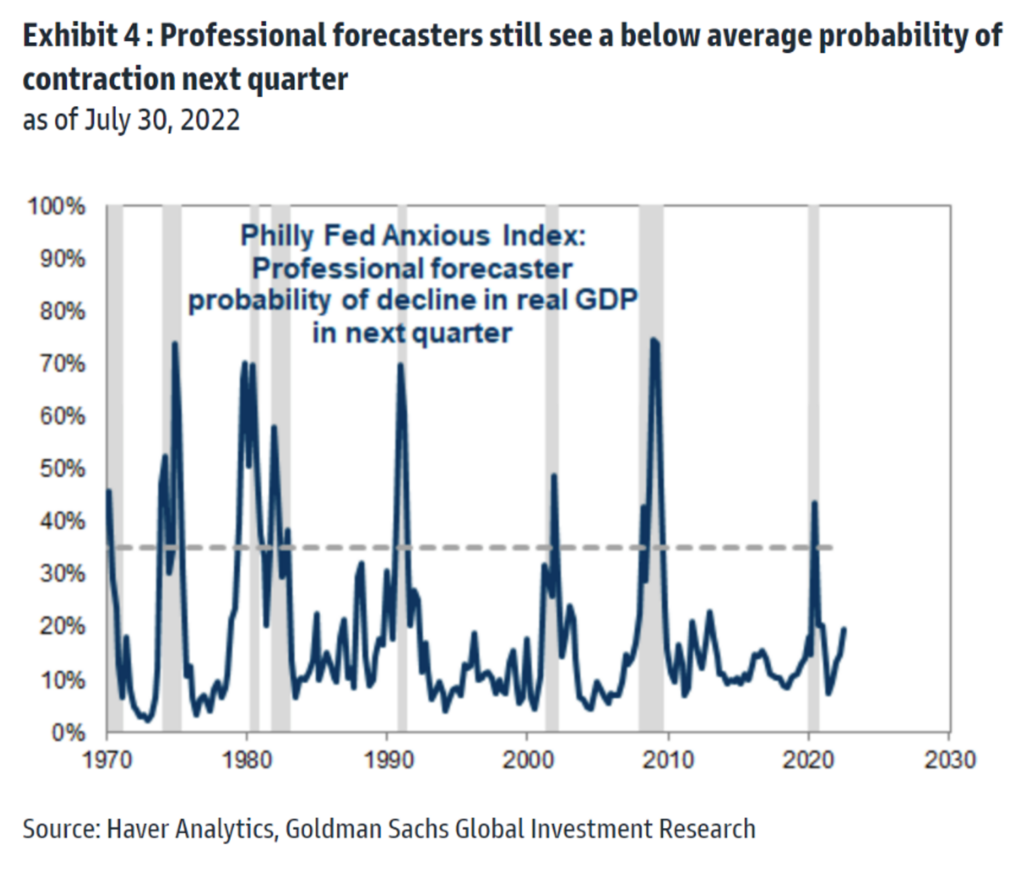

เฟดไม่ได้เข้มงวดมากนัก

เฟดยังไม่มีนโยบายการเงินที่เข้มงวดมากนัก อัตราเงินเฟ้อเพิ่มขึ้นมากกว่าอัตราเงินกองทุนของรัฐบาลกลางในช่วงไม่กี่ปีที่ผ่านมา ที่สำคัญพอๆ กัน เฟดยังไม่ละทิ้งการควบคุมตลาดพันธบัตรรัฐบาลและตลาดจำนอง

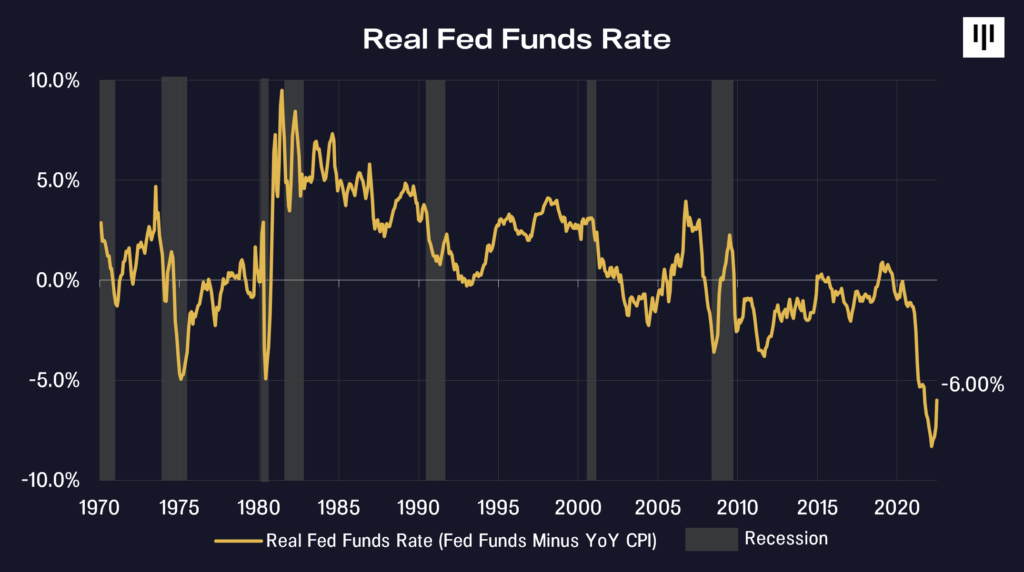

อัตราดอกเบี้ยที่แท้จริง ซึ่งเป็นอัตราที่นักลงทุนได้รับหลังจากหักค่าชดเชยเงินเฟ้อแล้ว อยู่ใกล้ระดับต่ำสุดที่เคยมีมา

เพิ่มเติมเกี่ยวกับเรื่องนี้ในภายหลัง แต่สิ่งหนึ่งที่ชัดเจน: ไม่สามารถควบคุมอัตราเงินเฟ้อที่ควบคุมไม่ได้ด้วยอัตราเงินเฟดต่ำกว่าอัตราเงินเฟ้อ 6% เฟดจะถูกบังคับให้เข้มงวดมากกว่าที่ตลาดคาดการณ์ไว้ในขณะนี้

เมื่อไม่กี่ปีที่ผ่านมา อัตราเงินกองทุนที่แท้จริงของรัฐบาลกลางได้ทำลายสถิติติดลบก่อนหน้านี้ในเดือนกุมภาพันธ์ 2518 ในช่วงทศวรรษที่ 70 เรามีอัตราเงินเฟ้อสูงขึ้นเล็กน้อยเมื่อเทียบเป็นรายปีที่ประมาณ 11.2% แต่เฟดพยายามต่อสู้กับเงินเฟ้อด้วยอัตราเงินกองทุนของเฟดที่ 6.24% ดังนั้นอัตราที่แท้จริงของกองทุนของรัฐบาลกลางคือ -4.96%

เฟดก้าวผ่านเหตุการณ์สำคัญนี้ไปได้ด้วยสีที่สดใส จนกระทั่งลดลงมาอยู่ที่ -8.30% ในเดือนมีนาคม 2565 ในที่สุดเฟดก็เริ่มผ่อนคลายนโยบายผ่อนคลายขนาดใหญ่ เมื่อนโยบายการเงินที่เข้มงวดเริ่มขึ้น CPI อยู่ที่ 8.5% อย่างไม่น่าเชื่อเมื่อเทียบเป็นรายปี

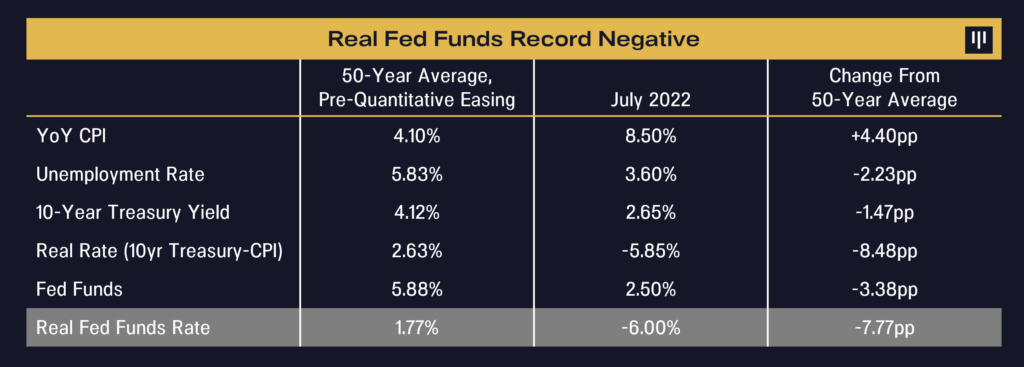

ตามตารางด้านล่าง อัตราเงินกองทุนของรัฐบาลกลางที่แท้จริงยังคงต่ำกว่าอัตราเฉลี่ยในช่วง 50 ปีที่ผ่านมา 7.77% การเพิ่ม 75 bps ก็ไม่ได้ช่วยอะไรเช่นกัน ในที่สุดเฟดจะต้องเข้มงวดขึ้นอีกไม่กี่ร้อยคะแนนพื้นฐาน

ผมยังเชื่อว่าการปรับขึ้นอัตราดอกเบี้ยจะไม่หยุดจนกว่าอัตราของกองทุนรวมจะอยู่ที่ 4-5% เป็นอย่างน้อย

ฉันชอบข้อความนี้:

"ประเด็นทั้งหมดของการปรับขึ้นอัตราดอกเบี้ย 75 จุดพื้นฐานคือการกระชับเงื่อนไขทางการเงิน ประชดคือเมื่อใดก็ตามที่เจย์พาวเวลล์ขึ้นอัตราดอกเบี้ย เขาจะผ่อนคลายเงื่อนไขทางการเงินเพราะเขาไม่ต้องการยอมรับว่าเฟดกำลังเตรียมพร้อมที่จะทำให้ประเทศเข้าสู่ภาวะถดถอย "

ชื่อระดับแรก

อัตราดอกเบี้ยพันธบัตรเรียลติดลบอย่างรุนแรงเช่นกัน

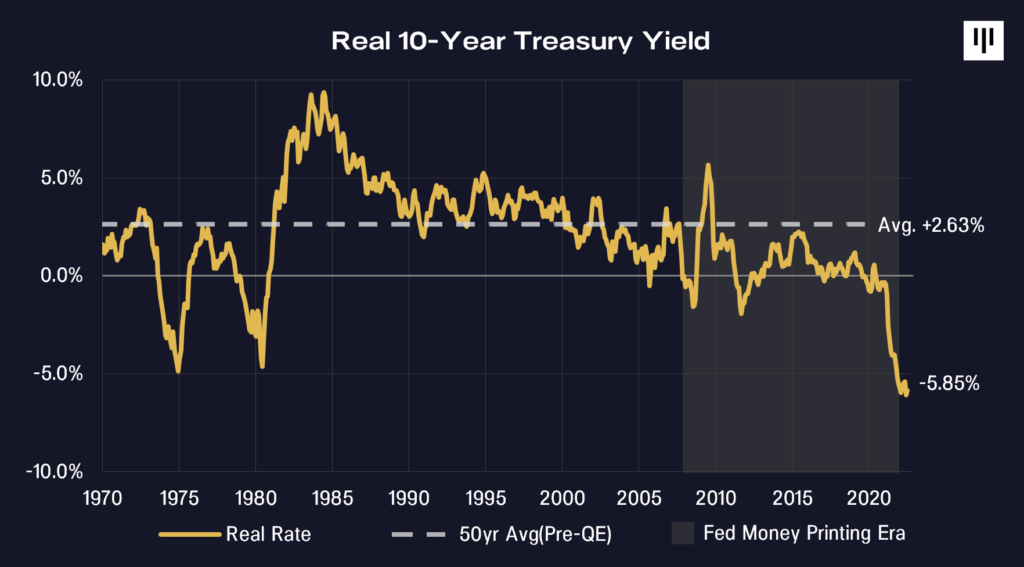

ในขณะที่ฉันทามติคือการปล่อยให้อัตราเงินเฟ้อวิ่งไปที่ 830 จุดพื้นฐานเหนืออัตราดอกเบี้ยนโยบายข้ามคืนนั้นเป็นความล้มเหลวครั้งใหญ่ แต่ก็มีเพียงเล็กน้อยที่ได้ทำเพื่อแก้ไขข้อผิดพลาดเชิงนโยบายที่สำคัญเท่าเทียมกันและต่อเนื่อง: การรักษาอัตราผลตอบแทนพันธบัตรระยะยาวของรัฐบาลและจำนองในระดับที่ ต่ำกว่าตลาดเสรีมาก

ดังที่ Bill Ackman กล่าว ประธานเฟดจะไม่อนุญาตให้อัตราดอกเบี้ยระยะยาวปรับเข้าสู่ระดับตลาดที่ยุติธรรม (สูงกว่ามาก) ด้วยเหตุนี้ เฟดจึงยังคงกระตุ้นภาคส่วนที่อ่อนไหวต่ออัตราดอกเบี้ยอย่างหนาแน่น เช่น ที่อยู่อาศัยและยานยนต์

อัตราผลตอบแทนที่แท้จริงคืออัตราผลตอบแทนพันธบัตรที่นักลงทุนได้รับหลังจากอัตราเงินเฟ้อ สำหรับกระทรวงการคลังสหรัฐฯ อายุ 10 ปี อัตราที่แท้จริงเฉลี่ย 5 ปีก่อนมาตรการผ่อนคลายเชิงปริมาณ (พ.ศ. 2500-2550) อยู่ที่ +2.63%

เฟดตัดสินใจพิมพ์ GDP ของประเทศครึ่งหนึ่งเพื่อผลักดันราคาพันธบัตรให้สูงขึ้น และบีบให้อัตราดอกเบี้ยที่แท้จริงลดลงเหลือ -5.85%

พื้นที่สีเทาซึ่งเป็นโลกใบใหม่ของการซื้อพันธบัตรแบบไม่จำกัด อยู่ที่ระดับต่ำสุดอย่างไม่น่าเชื่อที่ 8.48 จุดต่ำกว่าค่าเฉลี่ย

ชื่อระดับแรก

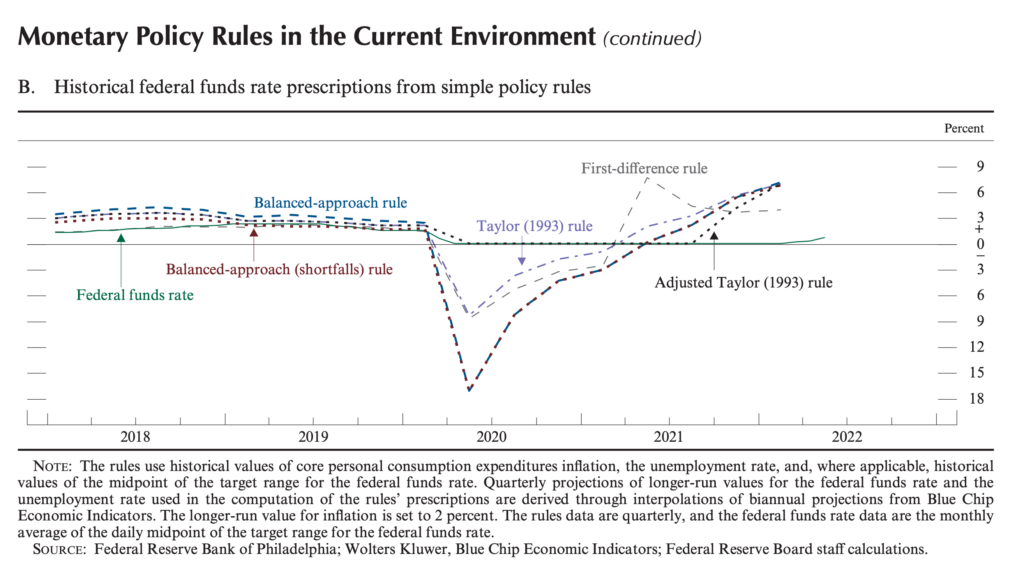

กฎของเทย์เลอร์

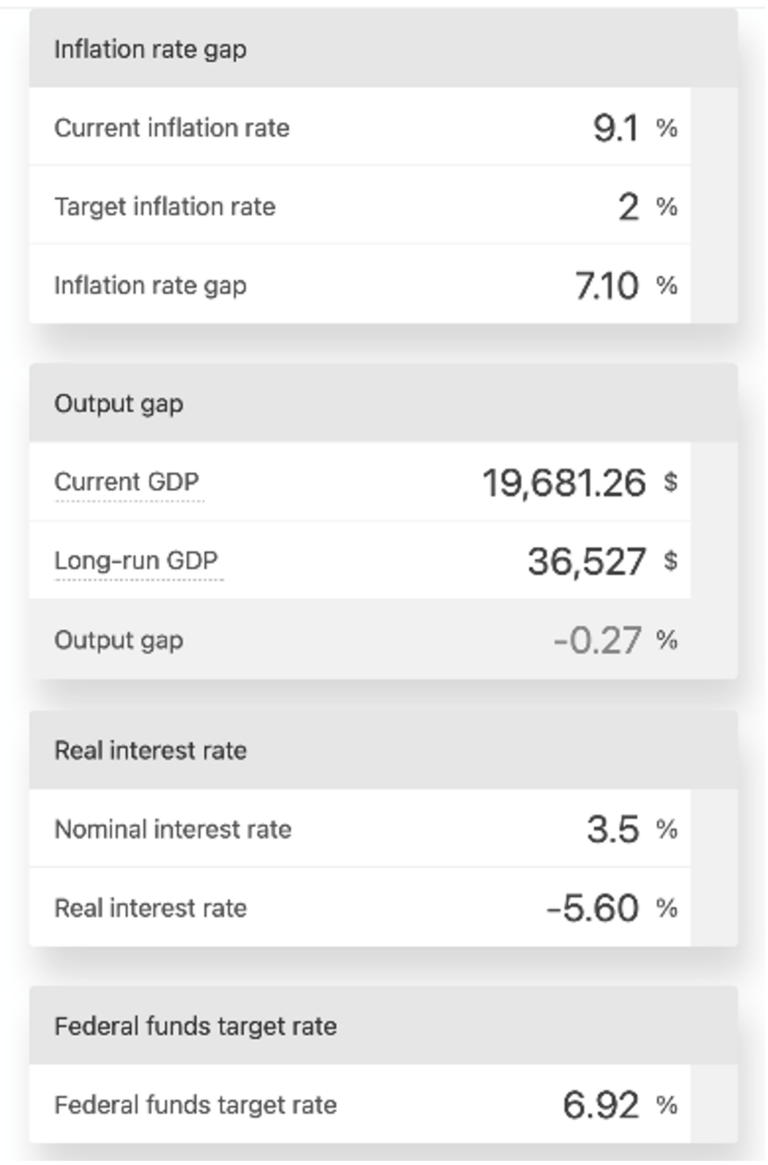

เป้าหมายตามกฎของนักเศรษฐศาสตร์ John Taylor สำหรับอัตราดอกเบี้ยเล็กน้อยคือ 6.92% ซึ่งเป็นประมาณสองเท่าของการคาดการณ์ในปัจจุบัน

ฉันคิดว่าหุ่นยนต์รู้มากกว่ามนุษย์

ในที่สุดอัตราส่วนจะใกล้เคียงกับกฎของเทย์เลอร์มากกว่าที่คาดการณ์ไว้ในปัจจุบัน

“กฎเทย์เลอร์เป็นนโยบายการเงินแบบกำหนดเป้าหมายที่ใช้โดยธนาคารกลาง จอห์น บี. เทย์เลอร์ นักเศรษฐศาสตร์ชาวอเมริกันเป็นผู้เขียนเจอรัลด์ ฟอร์ด และจอร์จ เอช ดับเบิลยู บุชของจอร์จ เอช ดับเบิลยู บุช ซึ่งเป็นที่ปรึกษาทางเศรษฐกิจในการบริหารของประธานาธิบดีจอร์จ เอช ดับเบิลยู บุช ได้เสนอกฎใน พ.ศ. 2535 เป็นวิธีการสำหรับธนาคารกลางในการรักษาเสถียรภาพของกิจกรรมทางเศรษฐกิจโดยการกำหนดอัตราดอกเบี้ย

"กฎขึ้นอยู่กับการเปลี่ยนแปลงในสามตัวบ่งชี้หลัก: อัตราเงินกองทุนของรัฐบาลกลาง ระดับราคา และรายได้จริง กฎของ Taylor ถือได้ว่าการรักษาอัตราระยะสั้นที่แท้จริงให้คงที่และท่าทีนโยบายที่เป็นกลางควรได้รับการตอบสนองเมื่อช่องว่างของผลผลิต เป็นบวกและส่วนต่างเงินเฟ้อเกินเป้าหมายขึ้นดอกเบี้ย

"จากข้อมูลของ Taylor ธนาคารกลางจะใช้นโยบายการเงินที่มีเสถียรภาพเมื่อเพิ่มอัตราดอกเบี้ยเล็กน้อยมากกว่าระดับที่อัตราเงินเฟ้อเพิ่มขึ้น กล่าวอีกนัยหนึ่ง กฎของ Taylor ระบุว่าเมื่ออัตราเงินเฟ้อจริงสูงกว่าเป้าหมาย อัตราดอกเบี้ยจะค่อนข้างสูง ข้อได้เปรียบของกฎวัตถุประสงค์ทั่วไปคือธนาคารกลางสามารถใช้ดุลยพินิจในการใช้วิธีการที่หลากหลายเพื่อให้บรรลุวัตถุประสงค์ดังกล่าว

ชื่อระดับแรก

ภาพรวมของภาวะเศรษฐกิจถดถอย

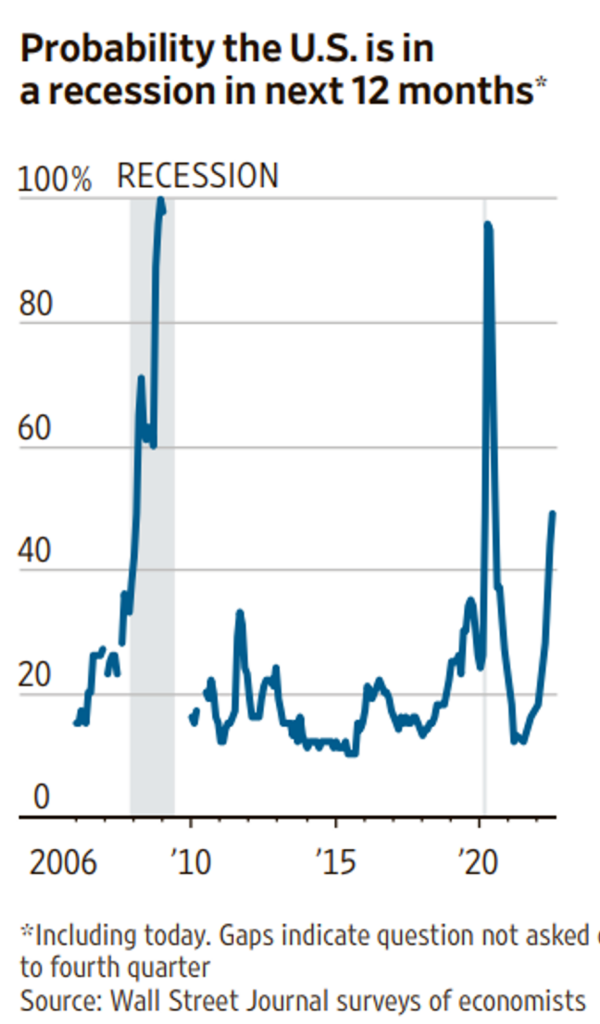

น่าแปลกที่นักเศรษฐศาสตร์ยังมองเห็นโอกาสเพียง 45% ที่จะเกิดภาวะเศรษฐกิจถดถอย แต่นักเศรษฐศาสตร์มักจะล้าหลังในการคาดการณ์ภาวะเศรษฐกิจถดถอย โดยขาดการเติบโตในเชิงลบในไตรมาสแรกและไตรมาสที่สองของปี

ชื่อระดับแรก

ภาวะเศรษฐกิจถดถอยได้เริ่มขึ้นแล้ว

เรามีการเติบโตของ GDP ติดลบสองไตรมาสติดต่อกัน -1.6% ในไตรมาสแรกของปี 2565 และ -0.9% ในไตรมาสที่สอง แม้ว่านี่จะไม่ใช่เกณฑ์ที่กำหนดของ BEA แต่ก็เป็นข้อบ่งชี้ที่ชัดเจนว่าเรากำลังอยู่ในภาวะถดถอย น่าเสียดายที่คำสั่งด้านนโยบายของเฟดไม่ใช่การ "เข้มงวดต่อไปจนกว่าจะทำให้เกิดภาวะเศรษฐกิจถดถอย" เป้าหมายของเฟดคือการส่งเสริมการจ้างงานและรักษาเสถียรภาพของราคา ซึ่งจะต้องมีการเข้มงวดมากขึ้น

ดังที่เราได้กล่าวไว้เมื่อเดือนที่แล้ว เราน่าจะอยู่ในภาวะเศรษฐกิจถดถอยแล้ว

คณะกรรมการตลาดเปิดของรัฐบาลกลาง (FOMC)

Larry Summers พูดถูกมาโดยตลอด เฟดจะไม่หยุดเข้มงวดจนกว่าอัตราเงินเฟ้อจะกลับมาที่ 2% (ซึ่งไม่สามารถควบคุมได้อย่างมีประสิทธิภาพ) ดังนั้นโดยทั่วไปแล้วภาวะเศรษฐกิจถดถอยจะเกิดขึ้น

"หากดูเหมือนว่าเศรษฐกิจกำลังชะลอตัว มันคงเป็นการดึงดูดให้หยุดขึ้นอัตราดอกเบี้ย และแท้จริงแล้ว ผู้คนในตลาดต่างคาดหวังว่าอัตราดอกเบี้ยจะลดลงตั้งแต่เดือนธันวาคมหรือมกราคม ฉันคิดว่านั่นเป็นความผิดพลาดร้ายแรง"

"ผมไม่คิดว่าเราทุกคนน่าจะทำให้อัตราเงินเฟ้อกลับไปสู่เป้าหมายได้โดยไม่เกิดภาวะเศรษฐกิจถดถอย"

– Larry Summers อดีตรัฐมนตรีคลัง 3 สิงหาคม 2565

ชื่อระดับแรก

คำมั่นสัญญาของเทคโนโลยีบล็อกเชน

เราขอแนะนำให้คุณใช้เวลาหกนาทีในการรับชมส่วนนี้ นี่คือคำอธิบายที่ชัดเจนและเรียบง่ายเกี่ยวกับความสำคัญของอุตสาหกรรมของเรา นี่คือไฮไลท์จากวิดีโอ:

"Bitcoin ใช้ทำอะไร มันง่ายมาก มันช่วยให้คุณใช้คอมพิวเตอร์และอินเทอร์เน็ตเพื่อเชื่อมต่อโลก ส่งและรับเงินกับใครก็ได้ในโลก แล้วทำไมมันถึงปฏิวัติวงการ เพราะไม่เหมือนวิธีอื่นในการส่งเงิน เครื่องมือทางอินเทอร์เน็ตนั้นแตกต่างกัน มันทำงานโดยไม่ต้องเชื่อคนกลาง ไม่มีบริษัทใดอยู่ระหว่างนั้น ซึ่งหมายความว่า Bitcoin เป็นโครงสร้างพื้นฐานการชำระเงินดิจิทัลสาธารณะแห่งแรกของโลก เกี่ยวกับการเป็นสาธารณะ ฉันแค่บอกว่าทุกคนสามารถใช้ได้ ไม่ใช่ เป็นเจ้าของโดยนิติบุคคลเดียว"

"เครือข่าย Bitcoin เป็นบล็อกเชนสาธารณะ และทุกคนสามารถเพิ่มรายการไปยังบัญชีแยกประเภทเพื่อโอน bitcoins ของตนให้กับผู้อื่นได้ โดยไม่คำนึงถึงสัญชาติ เชื้อชาติ ศาสนา เพศ เพศวิถี หรือชื่อเสียง สร้างที่อยู่ Bitcoin ฟรีเพื่อรับการชำระเงิน ดิจิทัล Bitcoin เป็นสกุลเงินสาธารณะที่เข้าถึงได้ทั่วโลกสกุลเงินแรกของโลก"

"นี่เป็นความก้าวหน้าทางวิทยาการคอมพิวเตอร์ที่จะมีความสำคัญต่อเสรีภาพและความเจริญรุ่งเรืองของมนุษย์เช่นเดียวกับการกำเนิดของอินเทอร์เน็ต"

"อินเทอร์เน็ตขจัดจุดล้มเหลวเพียงจุดเดียวของโครงสร้างพื้นฐานด้านการสื่อสาร และนำไปสู่คลื่นแห่งการแข่งขันระหว่างบริษัทสื่อใหม่ๆ

"...เป็นความหวังที่ดีที่สุดของเรา เช่นเดียวกับอินเทอร์เน็ตในทศวรรษที่ 1990 เราจำเป็นต้องมีนโยบายสนับสนุนนวัตกรรมในระดับปานกลางเพื่อให้แน่ใจว่านวัตกรรมเหล่านี้จะเติบโตในสหรัฐอเมริกาเพื่อประโยชน์และความปลอดภัยของชาวอเมริกันทุกคน "

ชื่อระดับแรก

การควบรวม Ethereum ที่เกี่ยวข้อง

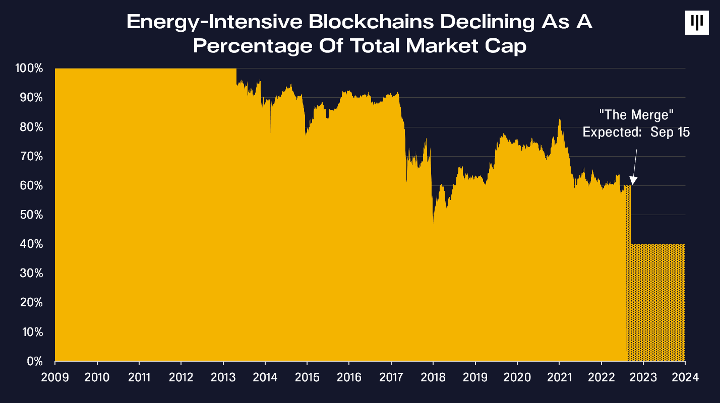

Ethereum จะได้รับการอัปเดตที่สำคัญที่สุดในไม่ช้านับตั้งแต่เปิดตัว "การผสานรวม" เป็นหนึ่งในชุดของการอัปเดตโปรโตคอลในแผนงานของ ethereum ซึ่งเป็นก้าวสำคัญสู่ความยั่งยืนในระยะยาวและความสามารถในการปรับขนาดของเครือข่ายคอมพิวเตอร์ทั่วโลก

ประเด็นสำคัญคือ:

1. การย้ายจาก Proof of Work (PoW) เป็น Proof of Stake (PoS) อย่างเต็มรูปแบบ → Ethereum มีความยั่งยืนมากขึ้น

2. อัตราการออก Ethereum ลดลง 90% → Ethereum มีแนวโน้มที่จะกลายเป็นสินทรัพย์เงินฝืด

ชื่อระดับแรก

Ethereum มีความยั่งยืนมากขึ้น

การย้ายไปสู่การพิสูจน์การเดิมพันจะมีผลกระทบอย่างมีนัยสำคัญต่อความยั่งยืนของ Ethereum โดยลดการใช้พลังงานลงประมาณ 99.95% จากมุมมองด้านสิ่งแวดล้อม สังคม และธรรมาภิบาล (ESG) นี่เป็นการปรับปรุงครั้งใหญ่อย่างชัดเจน

Proof-of-work และ Proof-of-stake เป็นกลไกที่เป็นเอกฉันท์ที่ช่วยให้เครือข่ายคอมพิวเตอร์ยอมรับสถานะปัจจุบันได้ ในกรณีนี้ เครือข่ายคอมพิวเตอร์ทำงานร่วมกันเพื่อรักษาความปลอดภัยและบำรุงรักษาบล็อกเชน (ซึ่งจริงๆ แล้วเป็นเพียงฐานข้อมูลธุรกรรม) กล่าวโดยย่อ กลไกที่เป็นเอกฉันท์ช่วยให้บล็อกเชนทำงานอย่างปลอดภัยในลักษณะกระจาย

การลดพลังงาน 99.95% จะมาจากการเปลี่ยนแปลงของ Ethereum จาก PoW ซึ่งเป็นกระบวนการรักษาความปลอดภัยของเครือข่ายที่ต้นทุนหลักคือค่าไฟฟ้าและฮาร์ดแวร์ ในระบบ PoS ต้นทุนหลักในการรักษาความปลอดภัยของเครือข่ายคือเงินทุนในรูปของโทเค็นที่เดิมพัน และนั่นไม่ต้องใช้ไฟฟ้ามากนัก

ทั้งสองมีเป้าหมายเดียวกันในการบรรลุฉันทามติแบบกระจาย ในขณะที่ทำให้เอนทิตีเดียวเข้าควบคุมเครือข่ายได้ยากมาก (เช่น การโจมตี 51%) ประการหลังนี้ทำให้มั่นใจได้โดยการควบคุมสำหรับความเป็นไปไม่ได้ทางกายภาพหรือทางเศรษฐกิจ

ใน Bitcoin ภายใต้ PoW ใครบางคนต้องซื้อฮาร์ดแวร์และไฟฟ้าให้เพียงพอเพื่อให้ได้พลังงานแฮชมากกว่า 50% ของเครือข่าย

ใน Ethereum ภายใต้ PoS ใครบางคนต้องสะสมมากกว่า 50% ของโทเค็นเดิมพันทั้งหมดในเครือข่าย

สถานการณ์ทั้งสองต้องใช้เงินทุนสูงและทำให้ผู้โจมตีต้องเสียค่าใช้จ่ายมากกว่าที่พวกเขาจะได้รับ ดังนั้นจึงไม่น่าจะเกิดขึ้น

ชื่อระดับแรก

อุปทาน Ethereum อาจเป็นภาวะเงินฝืด

หากคุณสงสัยว่าเหตุใดจึงเรียกเหตุการณ์นี้ว่า "การผสาน" ซึ่งหมายถึงการ "ผสาน" ของ Ethereum mainnet (ชั้นการดำเนินการ) กับ Beacon Chain (ชั้นฉันทามติ) ซึ่งทำงานควบคู่กันไปตั้งแต่เดือนธันวาคม 2020 Ethereum ซึ่งอำนวยความสะดวกในการทำธุรกรรม DeFi ของเราในปัจจุบันคือชั้นการดำเนินการซึ่งทำงานบนหลักฐานการทำงาน ชั้นฉันทามติของ Beacon Chain ใช้ Proof of Stake การควบรวมกิจการของทั้งสองคือเมื่อ Ethereum เปลี่ยนไปสู่การพิสูจน์การเดิมพัน แล้วสิ่งนี้เกี่ยวข้องกับการจัดจำหน่ายและการจัดหาอย่างไร?

ปัจจุบัน การออกใหม่ของ Ethereum อยู่ที่ประมาณ 14undefined600 ETH/วัน ซึ่งเป็นผลรวมของ 13undefined000 ETH จากรางวัลการขุดบน mainnet และ 1undefined600 ETH จากรางวัลการเดิมพันบน beacon chain หลังจากการ "รวม" จะไม่มีหลักฐานการทำงาน ดังนั้นจึงไม่มีรางวัลการขุด เหลือเพียงรางวัลการเดิมพันรายวัน 1undefined600 ETH

ปีที่แล้ว การอัปเกรดในลอนดอนเริ่มใช้งานจริง โดยแนะนำค่าธรรมเนียมขั้นต่ำ (เรียกว่าค่าธรรมเนียมพื้นฐาน) สำหรับการทำธุรกรรมแต่ละรายการเพื่อให้ถือว่าถูกต้อง ตามเว็บไซต์ ethereum ค่าธรรมเนียมจะถูกเผา ลบประมาณ 1undefined600 ETH ออกจากอุปทานรายวันทั้งหมดโดยอิงจากราคาน้ำมันเฉลี่ย 16 gwei (gwei เป็นหนึ่งในพันล้านของ ETH)

ชื่อระดับแรก

ชื่อเรื่องรอง

ไม่กี่เดือนที่ผ่านมา

Ryan Sean Adams: คุณบอกเราได้ไหมว่าเกิดอะไรขึ้นในช่วงสามเดือนที่ผ่านมา?

Dan:“เรามีตลาดกระทิงในทุกสิ่ง: อัตราดอกเบี้ย หุ้น สกุลเงินดิจิตอล ในตลาดกระทิง ผู้คนใช้เลเวอเรจมากขึ้นเรื่อยๆ”

“ในอุตสาหกรรมคริปโต บริษัทปล่อยสินเชื่อส่วนใหญ่เริ่มต้นในปี 2560 พวกเขามีความสุขกับการที่ตลาดเพิ่มขึ้นในช่วงเวลานี้ หลังจากนั้น Bitcoin มีขนาดเล็กลงเพียงไม่กี่พันดอลลาร์ บางคนใช้เลเวอเรจมากเกินไปเมื่อตลาดตกลง 80% อันตรายจริงๆ "

“ฉันคิดว่าทุกคนควรมีประเด็นว่าเมื่อใดก็ตามที่คุณมีเทคโนโลยีที่พลิกโฉมหน้าผู้คนจะลองใช้โมเดลธุรกิจทุกรูปแบบ เหมือนกับ Internet ในยุค 90 บางอย่างได้ผล บางอย่างก็ใช้ไม่ได้ บางอย่างก็ยอดเยี่ยม โชคดีที่ บางคนไม่โชคดีนัก แต่สุดท้าย เนื่องจากเทคโนโลยีพื้นฐานนั้นดีมาก ดังนั้น บล็อกเชนจึงมีความสำคัญอย่างยิ่ง”

Joey:"ฉันจำได้ว่าตอนที่ฉันเข้าร่วม Pantera ครั้งแรก Dan กล่าวว่า 'ผลิตภัณฑ์สระว่ายน้ำมักจะถูกจำกัดด้วยสินทรัพย์ที่มีสภาพคล่องน้อยที่สุด' ผู้ให้กู้เริ่มปล่อยให้คนยืมกับสิ่งที่พวกเขาคิดว่าใกล้เคียงกับหลักประกันแบบหนึ่งต่อหนึ่ง แต่นั่นไม่ใช่กรณีจาก จุดยืนด้านสภาพคล่อง”

“ถ้าคุณดูที่ GBTC มีปัญหาด้านสภาพคล่องอยู่ 2 ข้อ นั่นคือต้องใช้เวลา 6 เดือนในการขายหลังจากซื้อ บริษัทบางแห่งจะให้คุณยืมเป็นเงินสดในอัตราส่วนสินเชื่อต่อมูลค่าที่สูงมาก แม้ว่าสินทรัพย์อ้างอิงจะไม่ใช่ก็ตาม ขายได้เลย แม้ว่าจะเป็นของเหลว GBTC ก็ไม่ใช่ปริมาณที่ตรงกับ Bitcoin เช่นกัน GBTC เป็นสินทรัพย์ที่มีสภาพคล่องน้อยกว่ามากและมีการซื้อขายในตลาดที่ไม่ต้องสั่งโดยแพทย์”

ชื่อเรื่องรอง

Defi กับวอลล์สตรีท

Ryan: คุณคิดอย่างไรกับคำวิจารณ์ที่ว่า “DeFi เหมือนกับ Wall Street”

Joey:"พวกเขาแตกต่างกันอย่างสิ้นเชิงในแนวทางที่สำคัญมาก ในอดีตที่ Wall Street ยังไม่มีความโปร่งใสมากนักเกี่ยวกับสิ่งที่เกิดขึ้นจริง ในปี 2008 ไม่มีใคร (แม้แต่คนในบริษัทเหล่านี้) รู้ว่าอนุพันธ์ของพวกเขาเป็นอย่างไร เมื่อจำเป็นต้องมีเงินช่วยเหลือ รัฐบาลต่าง ๆ ต่างก็คาดเดาว่าพวกเขาต้องใช้เงินเท่าไรในการประกันตัวจริง ๆ และพวกเขาไม่รู้ว่าความเสี่ยงในตราสารอนุพันธ์จะเกิดขึ้นนานเท่าใดหลังจากทุกอย่างเกิดขึ้น ใน การเงินแบบดั้งเดิม เพราะสิ่งต่าง ๆ ทึบ คุณไม่รู้จริง ๆ ว่าเกิดอะไรขึ้น คุณไม่รู้ว่าความเสี่ยงที่แท้จริงของคุณคืออะไร และคุณได้รับสถานการณ์แปลก ๆ เหล่านี้ในการเงินแบบดั้งเดิม”

“บริษัท CeFi ที่สร้างบน DeFi เช่น เซลเซียส ก็มีปัญหาเดียวกัน ถ้าเซลเซียส แสดงรายละเอียดของเงินทุกดอลลาร์ที่ฝากเข้าไปในเซลเซียสบนเว็บไซต์ของพวกเขา ผมไม่คิดว่า เราจะพูดถึงเซลเซียสในวันนี้ ไม่ใช่ลูกค้า ลูกค้าจะทำอย่างไรหากรู้ว่าต้องรอสองปีจึงจะถอนเงินออกได้ทั้งหมดและนำเงินไปลงทุนในสินทรัพย์ที่อาจกลายเป็นศูนย์ได้ (หมายถึง LUNA)"

Dan:“ความโปร่งใสเป็นหัวใจสำคัญของบล็อกเชน โครงการ DeFi ช่วยให้คุณเห็นสิ่งที่เกิดขึ้น อย่างไรก็ตาม อย่างที่โจอี้พูด ถ้าคุณรู้จริง ๆ ว่าเกิดอะไรขึ้นเบื้องหลังผู้ให้กู้แบบรวมศูนย์เหล่านี้

“เรื่องราวของ Lehman นั้นน่าสนใจมาก เพราะเมื่อมันล้มเหลว ไม่มีใครรู้ว่าการกระทำของพวกเขาทำให้บริษัทตกอยู่ในความเสี่ยง และไม่มีใครรู้ว่าพวกเขามีหลักประกันอะไร ทุกคนเอาเท่าที่ทำได้ สัญญาที่เป็นโมฆะไม่ได้คืนหลักประกัน มัน ทุกอย่างเป็นเพียงความยุ่งเหยิง ในตอนแรก ผู้คนคิดว่า 'เงินหายไป 120,000 ล้านดอลลาร์ แย่จัง โลกกำลังจะแตก เมื่อกระบวนการล้มละลายสิ้นสุดลงในอีก 6 ปีต่อมา พวกเขาสูญเสียเงินไป 39,000 ล้านดอลลาร์ นั่นไม่สำคัญเมื่อเทียบกับความเสียหายบ้าๆ ที่เกิดขึ้นกับคนทั้งโลก มันจะดีกว่าสำหรับกระทรวงการคลังสหรัฐฯ ที่จะเขียนเช็คมูลค่า 3.9 พันล้านดอลลาร์ล่วงหน้า มันบ้ามาก เพราะไม่มีใครรู้ กล่องดำที่สมบูรณ์"

“นั่นคือความสวยงามของ DeFi โปรโตคอลจะมีข้อมูลทั้งหมดและคุณสามารถเลือกได้ ตัวอย่างเช่น คุณต้องการเริ่มต้นธุรกิจบน MakerDao หรือไม่ คุณสามารถดูสถิติทั้งหมดและตัดสินใจว่าเป็นความคิดที่ดีหรือไม่ ”

"ยกตัวอย่าง Mt. Gox มันเป็นโครงการ CeFi ที่ล้มเหลว เรายังคงเผชิญกับการล้มละลาย เมื่อ 7 ปีที่แล้วและมันยังคงดำเนินต่อไป และใน DeFi เราก็ทำสำเร็จแล้ว เราผ่านวิกฤตเดือนพฤษภาคมมาแล้ว มันจบลงแล้วและเรากำลังทำสิ่งต่อไป ไม่มี ผู้เสียภาษีแม้แต่คนเดียวที่จ่ายสลึงเดียว”

“ผู้ให้กู้แบบรวมศูนย์รุ่นต่อไปจะถูกบังคับให้มีความโปร่งใสมากขึ้น เราทำการทดลอง 5 ปีในกล่องดำทั้งหมดและไม่ได้ผลดีนัก ไม่ว่าจะเป็นแรงจูงใจในเชิงพาณิชย์หรือหน่วยงานกำกับดูแล (อาจทั้งสองอย่าง) ไม่มีใครจะทำ ต้องการปล่อยสินเชื่อหลายพันล้านดอลลาร์ให้กับหน่วยงานที่ไม่รู้ว่ากำลังทำอะไรอยู่”

"เราเห็นแม้กระทั่งว่า Credit Suisse และผู้ให้กู้สำนักงานครอบครัวขนาดใหญ่รายอื่นๆ พวกเขาไม่รู้ว่าลูกค้าของพวกเขาใช้เงินกู้มากน้อยเพียงใด"

“ทุกคนกำลังเรียนรู้บทเรียนนี้ทั้งในพื้นที่ crypto และในตลาดหุ้นปกติ พวกเขาจะถูกบังคับให้เปิดเผยเพิ่มเติมเกี่ยวกับเลเวอเรจที่พวกเขามี และความไม่สมดุลระหว่างกรอบเวลาความรับผิดชอบและสินทรัพย์ สถาบันกำกับดูแลอาจมีบทบาทมากขึ้น และเรียกร้องความโปร่งใสมากขึ้น”

Joey:"อย่างที่สองคือการควบคุมความเสี่ยง มีคำกล่าวที่ดีในซอฟต์แวร์ว่า 'ยิ่งแย่ยิ่งดี' ฉันคิดว่าคุณสามารถคิดแบบนั้นได้ในระบบควบคุมความเสี่ยง ในวอลล์สตรีท ผู้คนคิดกลไกควบคุมความเสี่ยงที่ซับซ้อนมากเหล่านี้ และโน้มน้าวตัวเองว่า พวกเขารู้ดีกว่าใคร ๆ และกลไกความเสี่ยงนั้นถูกต้อง คุณเห็นสิ่งนี้ในปี 2008 กับปัญหา credit default swap หากคุณดูประวัติทางการเงินในช่วง 300 ปีที่ผ่านมา ไม่ว่าจะเป็นการจัดการเงินทุนระยะยาว ไม่ว่าจะเป็น Three Arrows หรือใครก็ตามคุณจะเห็นมันหลายครั้ง”

ชื่อเรื่องรอง

คำติชมของ DeFi อ้างอิงตนเองมากเกินไป

Ryan: “DeFi อ้างอิงตัวเองมากเกินไป ไม่มีสินทรัพย์ในโลกแห่งความจริง และแม้ว่าคุณจะเดิมพันบางอย่าง มันก็เป็นโทเค็น DeFi อีกอันหนึ่ง คุณคิดอย่างไรกับความคิดเห็นนี้”

Joey:“ถ้าคุณดูประวัติศาสตร์ของนวัตกรรมในเทคโนโลยีทางการเงิน ผู้คนใช้คำวิจารณ์นี้ทุกครั้ง ไม่ว่าจะเป็นการคิดค้นของบริษัทร่วมทุนเมื่อหลายร้อยปีก่อน หรือการคิดค้นออปชั่น สวอป ตราสารอนุพันธ์ วิธีที่ผู้คนวิจารณ์ น่าสนใจ มีทั้งถูกและผิด ในช่วงแรก เทคโนโลยีใหม่ ๆ มีการเก็งกำไรอย่างมาก พวกมันอ้างอิงตัวเองมาก เมื่ออินเทอร์เน็ตออกมาครั้งแรก เป็นกลุ่มนักวิชาการที่ส่งเอกสารให้กันและกันเพื่อพิจารณาโดยเพื่อน ค่อนข้างเป็นตัวของตัวเอง อ้างอิง"

"แต่เมื่อเวลาผ่านไป ผู้คนค้นพบกรณีการใช้งานใหม่ๆ สำหรับเทคโนโลยีเหล่านี้ พวกเขาหาวิธีใหม่ๆ ในการใช้งานเทคโนโลยีเหล่านี้ในโลกแห่งความเป็นจริง คุณก้าวไปข้างหน้าอย่างรวดเร็ว 5-10 ปี และไม่มีใครวิจารณ์เช่นนั้นอีกต่อไป หรืออย่างน้อย คนที่ วิจารณ์แบบนี้ไม่มีใครสนใจหรอก เพราะเห็นได้ชัดว่าพวกเขาคิดผิด ลองนึกภาพว่าวันนี้อินเทอร์เน็ตเป็นเพียงการอ้างอิงตนเองซึ่งไม่มีความหมาย หลายคนบอกว่าในยุค 90 คุณสามารถหาวิดีโอของ รายการทอล์คโชว์ที่พิธีกรเยาะเย้ยบิล เกตส์ว่า 'อะไรบ้าๆ ที่คุณเรียกว่าอินเทอร์เน็ต ดูเหมือนตลก ประวัติรถยนต์ก็เหมือนกัน' ม้าของฉันเร็วกว่า ดังนั้น ฉันไม่ต้องการรถคันนั้น ผู้คนสายตาสั้นมากเมื่อพูดถึงนวัตกรรมทางเทคโนโลยี"

“จริงอยู่ทุกวันนี้ แต่มันเริ่มเปลี่ยนไปแล้ว การทำสิ่งต่าง ๆ ในโลกแห่งความจริงยากกว่าในโลกเสมือนจริง แต่ฉันคิดว่าเราเริ่มเห็นสิ่งนั้นมากขึ้น อนุพันธ์ มันอาจจะเริ่มห่างเหินมากขึ้น -- ตัวอย่างเช่น ผ้าซินธิติกมีแรงฉุดใหม่มากมายเมื่อเร็วๆ นี้ จากนั้น มีบางอย่างเกิดขึ้นในโลกแห่งความเป็นจริงที่ Maker Dao มันดิบและเร็วมาก แต่ฉันคิดว่า ถ้าเรามีการสนทนานี้อีกครั้งในห้าปี มันจะดูไม่ดิบและเร็ว”

Dan:ชื่อเรื่องรอง

Defi ทำงานได้อย่างราบรื่น

Ryan: DeFi ทำได้ดีแค่ไหนในพายุลูกนี้?

Joey:“ถ้าคุณดูความแตกต่างของ DeFi สิ่งสำคัญคือวิธีการทำงาน มันเร็วกว่ามากในด้านผู้ชำระบัญชี เมื่อเทียบกับบริษัท CeFi แล้ว DeFi มีกลไกการชำระบัญชีที่เรียบง่าย กลไก CeFi ไม่ทำงานแบบนั้น ใช่ ฉันมีเพื่อนที่เคยใช้บริษัทเหล่านี้และฉันรู้ว่าเมื่อใกล้จะเลิกกิจการพวกเขามักจะให้เวลา 24~48 ชั่วโมงในการเติมสภาพคล่อง แม้ว่าพวกเขาจะตกต่ำกว่ามูลค่าที่ตราไว้ก็ตาม เพราะพวกเขาไว้วางใจพวกเขาในฐานะคู่สัญญา มีความเสี่ยงสูงในการทำเช่นนั้น ใน DeFi คุณไม่มีปัญหานั้นจริงๆ”

Dan:ชื่อเรื่องรอง

มาโครด่วน

Dan:“มุมมองหลักของฉันในอีก 12 เดือนข้างหน้าคือ crypto จะแยกตัวออกจากเรื่องมหภาคและซื้อขายบนปัจจัยพื้นฐานของตัวเอง จะมีผู้คนจำนวนมากใช้ผลิตภัณฑ์ crypto, DeFi จะเป็นธุรกิจตามปกติ ฯลฯ

"ในด้านมหภาค ผมคิดว่าเฟดจะต้องขึ้นอัตราดอกเบี้ยให้มากกว่าที่หลายคนพูดถึง หน้าที่ของเฟดคือขึ้นอัตราดอกเบี้ยจนกว่า CPI หลักจะต่ำกว่า 2% ซึ่งจะใช้เวลาไม่กี่ปี และสิ่งต่างๆ จะคงอยู่ตลอดไป

“โดยทั่วไปแล้ว ฉันคิดว่าอัตราดอกเบี้ยจะยังคงเพิ่มขึ้นต่อไป และสกุลเงินดิจิทัลก็จะเพิ่มขึ้นเช่นกัน

Joey:สิ่งที่เราคาดหวัง

DeFi: มีสิ่งที่น่าสนใจมากมายเกิดขึ้นใน DeFi ในที่สุดเราก็เริ่มเห็นตัวเลข DeFi อย่าง TVL เริ่มกลับมาเป็นขาขึ้น มูลค่าตลาดรวมของ DeFi อยู่ที่ประมาณ 2 หมื่นล้านดอลลาร์ มูลค่าตลาดของ crypto คือหนึ่งล้านล้าน ฉันคิดว่ามันไร้สาระที่มูลค่าตลาดของ DeFi น้อยกว่า 10% ฉันจะยืนยันว่ามันสูงกว่านั้นมาก 20/30% ของตลาด crypto ทั้งหมด ดังนั้นเราจึงมีแนวโน้มที่ดีต่อ DeFi ในระยะยาว

ชื่อระดับแรก

ไฮไลท์การสัมภาษณ์ Real Vison

Raoul Pal: คุณเห็นรางวัลความเสี่ยงขึ้นและลงที่นี่ได้อย่างไร?

Dan:“เวลาที่ดีที่สุดในการซื้อคือเวลาที่ผู้คนคาดการณ์ว่าการลดลงครึ่งหนึ่งครั้งต่อไปจะเกิดขึ้นได้อย่างไร ที่ราคา 65,000 ดอลลาร์ใน bitcoin ซึ่งได้ผลดี ไม่มีใครพูดแบบนั้น แต่ทุกคนกลับมีท่าทีรั้นมากในตอนนั้น”

“ตอนนี้เราอยู่ที่ 20,000 ดอลลาร์ และผู้คนคิดว่าราคาจะลดลงอีก 50% เป็นเวลาที่เหมาะสมในการซื้อ และเมื่อทุกคนเป็นผู้เชี่ยวชาญในตลาดหมี ก็เป็นสัญญาณที่ดีว่าถึงเวลาแล้ว”

"นอกจากนี้ เวลาเองก็ช่วยเยียวยาบาดแผลได้มากมาย จริงไหม ไม่ว่าคนจะมีอำนาจมากแค่ไหน เป็นเวลาแปดเดือนแล้วที่เราอยู่ในระดับสูงสุด สิ่งต่างๆ เหล่านั้นได้ถูกแยกออกไปในช่วงเวลานั้น เราทำได้ดีเกินค่าเฉลี่ย ระยะเวลาของตลาดหมีหรือความลึกเท่าๆ กัน เราตกต่ำมาแปดเดือนแล้ว"

Raoul Pal: คุณกำลังซื้อกำไรหรือกำลังรอดู?

Dan:"แผนบำเหน็จบำนาญสาธารณะ เงินบริจาค ฯลฯ กำลังเข้ามา มันเป็นช่วงเวลาที่ดีจริง ๆ เพราะพวกเขาใช้เวลาสี่ถึงห้าปี ผ่านการทำงานหนักทั้งหมด คณะกรรมการการลงทุน รวมเป็นหนึ่งเดียว และตอนนี้พวกมันถูกกว่ามาก"

"เรายังไม่เห็น 'แรงจูงใจ' ที่เพียงพอ เพราะนักลงทุนส่วนใหญ่กำลังจัดเรียงพอร์ตการลงทุนของพวกเขาจริงๆ มันเป็นเรื่องน่าตกใจครั้งหนึ่งในชีวิตสำหรับตลาดมหภาคและบล็อกเชน ทุกคนต่างลังเล และพยายามทำให้แน่ใจว่าพวกเขาเข้าใจสถานการณ์สภาพคล่อง ฯลฯ "

“แต่ฉันคิดว่าเราอยู่ในจุดที่ดีจริง ๆ สถาบันหลายแห่งเพิ่งได้รับการอนุมัติเมื่อเร็ว ๆ นี้ ในหลาย ๆ กรณี พวกเขาได้จัดสรรเงินทุนพื้นฐาน 10 จุดสำหรับพื้นที่ blockchain พวกเขากำลังจัดการ $100 พันล้านหรือหลายพัน $100 ล้านในการระดมทุน นั่นหมายถึง $100 ล้านในพื้นที่ blockchain ในช่วงหลายปีที่ผ่านมา ฉันเห็นสินค้าโภคภัณฑ์กลายเป็นสินทรัพย์ประเภทหนึ่งพร้อมกับตลาดเกิดใหม่ ฯลฯ ฉันเห็นได้อย่างง่ายดายว่าบล็อคเชนในอีกห้าปีนับจากนี้มันจะเป็นสินทรัพย์ ระดับ."

"10 bps ไม่ใช่เป้าหมายสุดท้ายใช่ไหม มันต้อง 500-800 bps หรือมากกว่านั้น นั่นเป็นอีกเหตุผลหนึ่งว่าทำไมฉันถึงรั้นในพื้นที่นี้: ฉันเห็นหน่วยงานขนาดใหญ่จำนวนมากที่ต้องผ่านความยากลำบากอย่างแท้จริงจาก 0 ถึง 1 อย่าง ตอนนี้พวกเขาเข้ามาและจัดสรรคะแนนพื้นฐาน 10 คะแนนแล้ว พวกเขาสามารถได้รับคะแนนพื้นฐาน 20 คะแนน หรือ 50 คะแนนพื้นฐาน หรือ 100 คะแนนพื้นฐาน หรือ 500 คะแนนพื้นฐานได้อย่างง่ายดาย”

Raoul Pal: คุณกำลังดูเพลงไหนอยู่?

Dan:"DeFi มีราคาถูกมากในตอนนี้ - ฉันคิดว่า DeFi ควรเป็นส่วนสำคัญของสิ่งที่ผู้คนลงทุน"

"พรมแดนต่อไปคือเกมบล็อกเชน NFT และอะไรทำนองนั้น ตอนนี้พวกเขากำลังเข้าถึงกลุ่มคนจำนวนมหาศาลเพราะมีผู้คนจำนวนมากที่ใช้มัน"

"แต่สำหรับทุกคนที่พยายามมีบางอย่างในพอร์ตโฟลิโอของคุณ สิ่งสำคัญคืออย่าไปทุ่มเทให้กับสิ่งใดสิ่งหนึ่งมากเกินไป"

Raoul: NFT เป็นเทคโนโลยีที่ดีมาก คุณคิดอย่างไร?

Dan:"มันเป็นศิลปะรูปแบบใหม่ การล้อเลียน NFT นั้นง่ายมาก คุณจ่ายเงินหลายล้านเพื่อซื้อโค้ดซอฟต์แวร์หนึ่งชิ้นหรือ 100 ปีที่แล้ว Marcel Duchamp บนผนังในปารีส โถปัสสาวะถูกใส่เข้าไป และตอนนี้มันมีมูลค่า 150 ล้านเหรียญสหรัฐ ”

"ศิลปะเป็นเรื่องของแนวคิดและชุมชน ทุกยุคทุกสมัยมีงานศิลปะของตัวเอง (วอลล์สตรีทมีศิลปินกราฟิตีจำนวนมาก) ในอีก 10 หรือ 20 ปีข้างหน้า พวกเขาจะกลายเป็นงานศิลปะชิ้นสำคัญ"

"เหตุผลหนึ่งที่คนชอบศิลปะคือมันสนุกใช่ไหม มันคือชุมชน มันคือการแบ่งปัน ฉันได้คุยกับนักธุรกิจที่ประสบความสำเร็จมากคนหนึ่งซึ่งเป็นที่รู้จักในโลกศิลปะด้วย และเขามองในแง่ลบต่อ NFT มาก อาจจะมีก็ได้ นักสะสมบางคนที่ซื้องานศิลปะเพราะชอบงานศิลปะและนำไปเก็บไว้ในโกดังที่เจนีวาแต่ไม่มีใครเห็น คนส่วนใหญ่ซื้องานศิลปะเพื่อติดไว้ที่ผนังห้องนั่งเล่น

"มีกี่คนที่สามารถเดินผ่านห้องนั่งเล่นของคุณได้ แม้ว่าคุณจะเป็นนักสังคมนิยมจริงๆ ก็ไม่มากนัก คุณสามารถให้ผู้คนจำนวนมากดูคอลเลคชัน NFT ของคุณได้ การแบ่งปันทำได้ง่ายกว่ามาก ฉันคิดว่ามันจะทำให้หลายๆ ผู้คนเข้ามาในพื้นที่ blockchain NFT มีความสำคัญมากและหลายคนไม่ได้ให้ความสนใจกับมันมากนัก”

“สิ่งเหล่านี้ใช้เวลาหลายทศวรรษและจะไม่เกิดขึ้นในชั่วข้ามคืน Gen Z ที่ซื้อ NFT จะรวย 50/60 ใน 30 ปี พวกเขาคงไม่ซื้อภาพวาดยุคฟื้นฟูศิลปวิทยาใช่ไหม”

"คนรุ่นใหม่สามารถเลือกได้ว่าใครจะเป็นผู้ชนะ และมีกลุ่มที่มีความรู้ด้านเทคโนโลยีมากที่เติบโตมาพร้อมกับ NFT"

Raoul Pal: อะไรคือข้อผิดพลาดที่โง่ที่สุดที่คุณเคยลงทุนในสกุลเงินดิจิตอล?

Dan:"พูดตามตรง การขาย มีหลายสิ่งหลายอย่างที่ฉันอยากจะซื้อหรือเสียใจที่ไม่ได้ทำ แต่สิ่งเดียวที่เสียใจอย่างสุดซึ้งคือการขาย"

“หากผู้คนมีทรัพยากรทางการเงินและอารมณ์ที่จะอยู่ในอุตสาหกรรมนี้ คุณต้องมี เพราะบล็อคเชนกำลังจะเปลี่ยนโลก ซึ่งหมายความว่าราคาจะสูงขึ้นมากในระยะยาว”

ลิงค์ต้นฉบับ