Circle's acquisition of Axelar sparks controversy: The giant only wants people, not the cryptocurrency.

- 核心观点:Circle收购Axelar团队引发代币权益争议。

- 关键要素:

- Circle仅收购团队与IP,未涉及AXL代币。

- AXL代币价格因此短线暴跌15%。

- 争议焦点在于代币在资本结构中的底层地位。

- 市场影响:暴露并加剧行业对代币法律属性的担忧。

- 时效性标注:中期影响。

Original article | Odaily Planet Daily ( @OdailyChina )

Author|Azuma ( @azuma_eth )

In the early hours of December 16th, stablecoin giant Circle officially announced that it had completed the signing of an agreement to acquire the core talent and technology of Interop Labs, the initial development team of the cross-chain protocol Axelar Network. This acquisition aims to advance Circle's cross-chain infrastructure strategy and help Circle achieve seamless and scalable interoperability on its core products such as Arc and CCTP.

This was just another typical case of an industry giant merging with a top-notch team, seemingly a win-win situation. However, the key issue lies in the fact that Circle explicitly stated in its acquisition announcement that the transaction only involved the Interop Labs team and its proprietary intellectual property, while Axelar Network, the Axelar Foundation, and the AXL token would continue to operate independently under community governance, and Common Prefix, another contributing team to the original project, would take over Interop Labs' original activities.

In short, Circle acquired the original development team of Axelar Network, but openly abandoned the Axelar Network project itself and its token AXL.

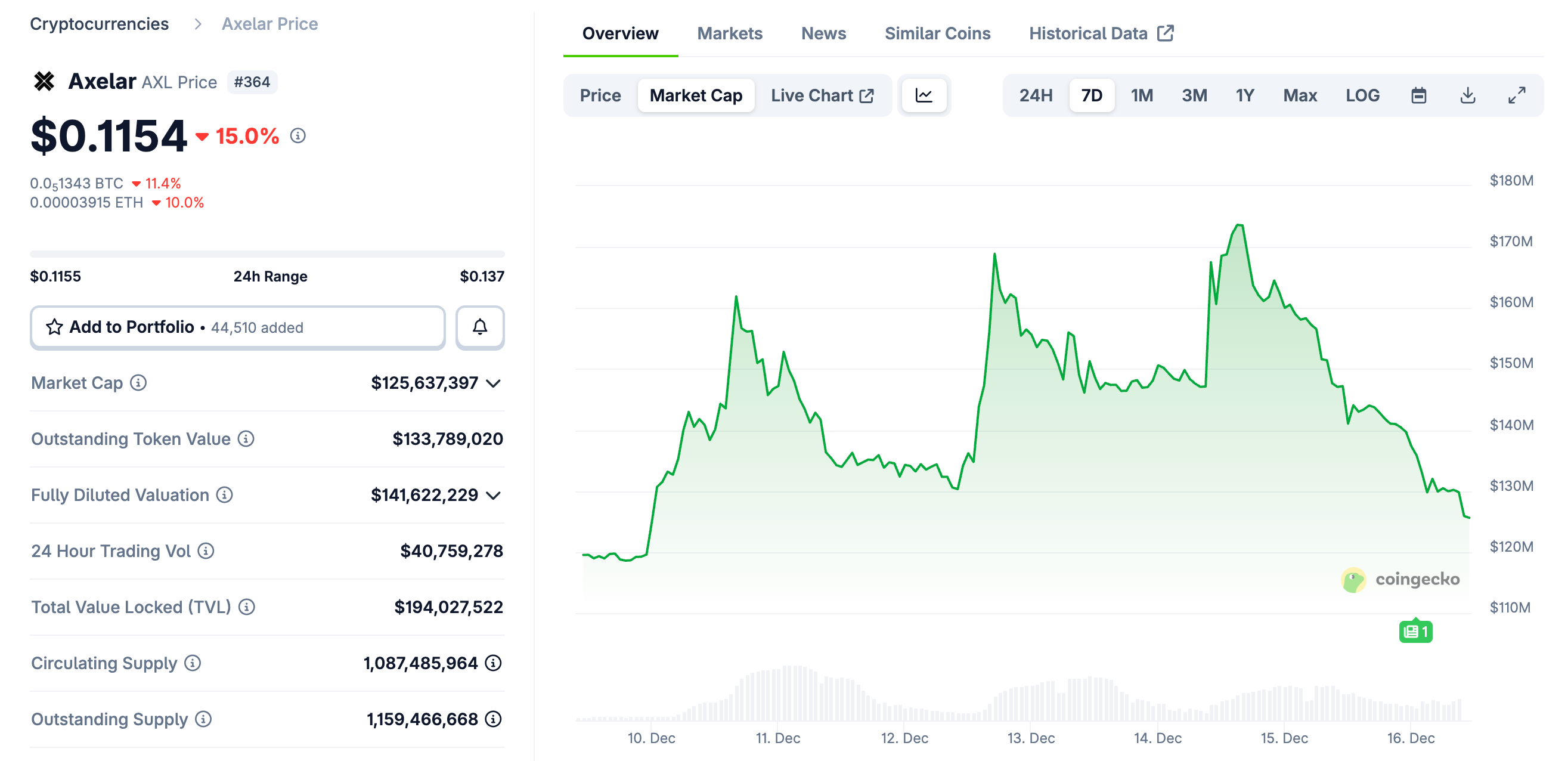

Affected by this sudden news, AXL fell sharply in the short term, and as of about 10:00 a.m. today, it was temporarily trading at $0.115, a 24-hour drop of 15%.

At the same time, the special circumstances surrounding the acquisition itself, which "want people but not tokens" and the resulting "equity vs. token" issue, have also sparked much discussion in the community, with supporters and opponents of this acquisition model holding their own opinions and arguing endlessly.

Opposing viewpoint: This is a disguised form of exploitation; Circle's reckless actions only hurt token holders...

The core of the opposing side consists of some venture capitalists, which is not hard to understand—"I invested real money in the project's token rights and got a lot of tokens. Now you've lured away the people who did the work. What use is this token to me?"

Simon Dedic, founder of Moonrock Capital, commented: " Another acquisition, another RUG . Circle's acquisition of Axelar, while explicitly excluding the foundation and the AXL token, is practically a crime. Even if it doesn't break the law, it's unethical. If you're a founder who wants to issue tokens: either treat it like equity, or get out of here."

Mike Dudas, co-founder of The Block and founder of 6MV, commented: "To everyone who thinks this is a token vs. equity issue, I can tell you definitively that this is entirely Circle's doing . Rumors have it that Circle's VP of Corporate Development told one of Axelar's co-founders, 'I don't care about your investors,' and 'bought' the CEO and IP right under their noses without paying any consideration, and these IPs and teams were crucial to Arc's launch."

The founder of Lombard Finance posted a chart showing AXL's price movement and predicted: "The core team of Axelar has been bought by Circle, and AXL may now be worthless. It's been over three years since the token was issued, and the team's equity has already been fully realized . But this outcome is very unsettling: the team and/or investors sold tokens to profit, while token holders can only cling to a distant dream. "

ChainLink community leader Zach Rynes stated, "This once again exposes the token vs. equity conflict of interest that plagues the crypto industry. The development team behind the protocol was successfully acquired, while the token holders who funded the team received nothing. The so-called continued independent operation under community governance is tantamount to the development team abandoning users in pursuit of a better future. This is the primary issue that the industry urgently needs to address if we hope to attract real capital."

SOAR Ecosystem Director Nicholas Wenzel stated, "The Axelar token is heading towards zero. Thank you for your participation. This is yet another acquisition where token holders gained nothing, while equity holders profited handsomely. "

Supporters argue that this is normal market behavior, and tokens are inherently at the bottom of the capital structure.

If the opposing side focuses more on the unfair treatment of token holders, the supporting side will focus more on the market rules for financing and mergers and acquisitions.

Arca's Chief Investment Officer, Jeff Dorman, believes Circle's approach is sound and provides a lengthy explanation of corporate financing capital structures and the inherent disadvantages of tokens.

Companies raise funds through different tiers of capital structure, and these tiers have a clear priority order, with some tiers naturally taking precedence over others—secured debt > unsecured senior debt > subordinated debt > preferred stock > common stock > tokens.

Countless historical cases have shown that the interests of one type of investor are achieved at the expense of another type of investor.

- In bankruptcy liquidation, creditors win at the expense of equity investors;

- In leveraged buyouts (LBOs), equity holders often profit at the expense of creditors;

- In take-under transactions, creditors typically have priority over equity holders;

- In strategic acquisitions, creditors and shareholders typically benefit (but this is not always the case).

- Tokens are often at the very bottom of the capital structure...

This does not mean that tokens have no value, nor does it mean that tokens necessarily need some kind of "protection mechanism." However, the market needs to recognize a reality: when a company acquires a company that is not valuable to begin with, and the tokens issued by that company are almost worthless, token holders will not receive a "magical dividend" out of thin air. In this case, the gains from equity are often achieved at the cost of token losses.

Electric Capital co-founder Avichal Garg commented, "This is normal. If all future value is created by the team, no company will be willing to pay returns to investors."

The core question: What exactly is a token?

In the acquisition saga between Axelar and Circle, where the latter prioritized the developers over the cryptocurrency, both sides seem to have valid points.

The opposition's anger is genuine : token holders took on the risks when the project faced its most difficult period, when it desperately needed liquidity and narrative support, only to be completely excluded at the crucial juncture of value realization. In the end, the core team and intellectual property achieved value realization, while the tokens remained trapped in the vacuum of "community governance" narratives. The market gave its most direct vote through price, which will undoubtedly severely undermine the value of any token that holds true value.

The arguments of the supporters also have a realistic basis : from a strict capital structure perspective, tokens are neither debt nor equity, and naturally do not have priority in the context of mergers and acquisitions and liquidations. Circle did not violate existing business rules; it simply made a rational choice regarding the assets most valuable to it.

The real core of the conflict is not whether Circle is ethical, but a question that the industry has long deliberately avoided: what exactly is a token in the legal and economic structure?

When the future looks bright, tokens are implicitly considered "quasi-equity," imbued with the illusion of claiming future success; however, in real-world scenarios such as mergers, bankruptcies, and liquidations, they are quickly reduced to their original form as "certificates without rights." This narrative of equity-like representation, and its underlying structural flaws, is the root cause of recurring conflicts.

The Axelar acquisition may not be the last such controversy, but hopefully it can serve as an opportunity for the industry to further consider the positioning and significance of tokens. Tokens do not inherently possess rights; only institutionalized and structured rights will be recognized at crucial moments. The specific implementation still requires all practitioners to explore and practice together.