During the market crash, who made hundreds of millions of dollars by "playing on the edge"? What opportunities for getting rich are just around the corner?

- 核心观点:加密货币市场遭遇极端暴跌。

- 关键要素:

- 主流币BTC一度跌至101500美元。

- 山寨币单日跌幅超80%-90%。

- 全网爆仓191亿美元创纪录。

- 市场影响:引发大规模财富转移和清算。

- 时效性标注:短期影响

Original | Odaily Planet Daily ( @OdailyChina )

Author|Azuma ( @azuma_eth )

Following 312 and 519, 1011 is destined to be a day written in the history of cryptocurrency.

Last night, affected by Trump's sudden tariff speech, global financial markets plummeted, and the cryptocurrency market also suffered a heavy blow - BTC fell to 101,500 USDT at one point, ETH fell to 3373.67 USDT at one point, SOL fell to 144.82 USDT at one point, and BNB fell to 860 USDT at one point.

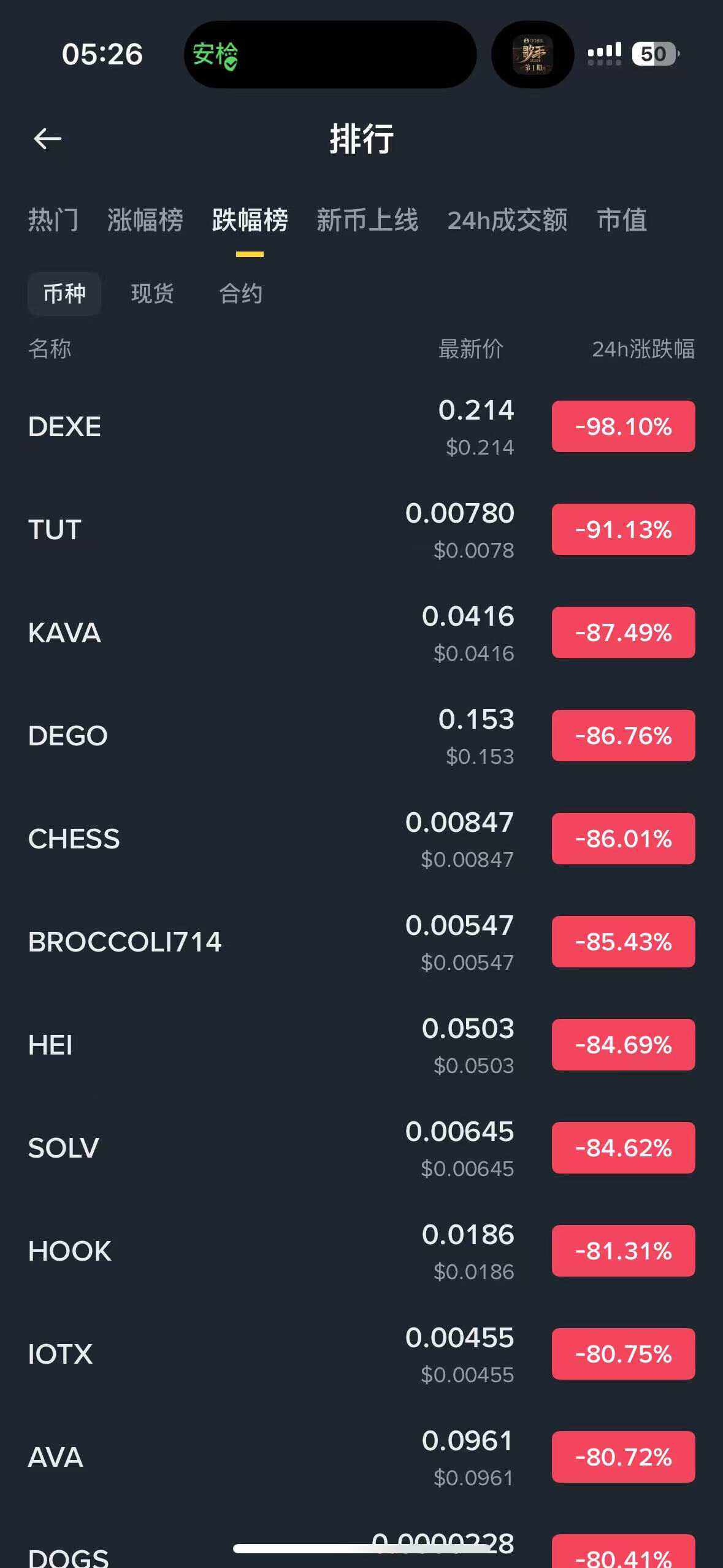

Even more dramatic were smaller altcoins, likely affected by the cascading market liquidations, with several experiencing short-term declines exceeding 80% or even 90%. I personally experienced the March 12th and May 19th market crashes, but I don't recall seeing such dramatic single-day drops across altcoins.

Odaily Note: Screenshot of Binance's decline list in the early morning. This is not even the lowest point of the decline.

Coinglass data shows that as of around 7:40 this morning, the total amount of liquidations across the entire network over the past 24 hours reached $19.133 billion, with as many as 1,618,240 people affected. The largest single liquidation was a $203 million ETH long position on the Hyperliquid platform.

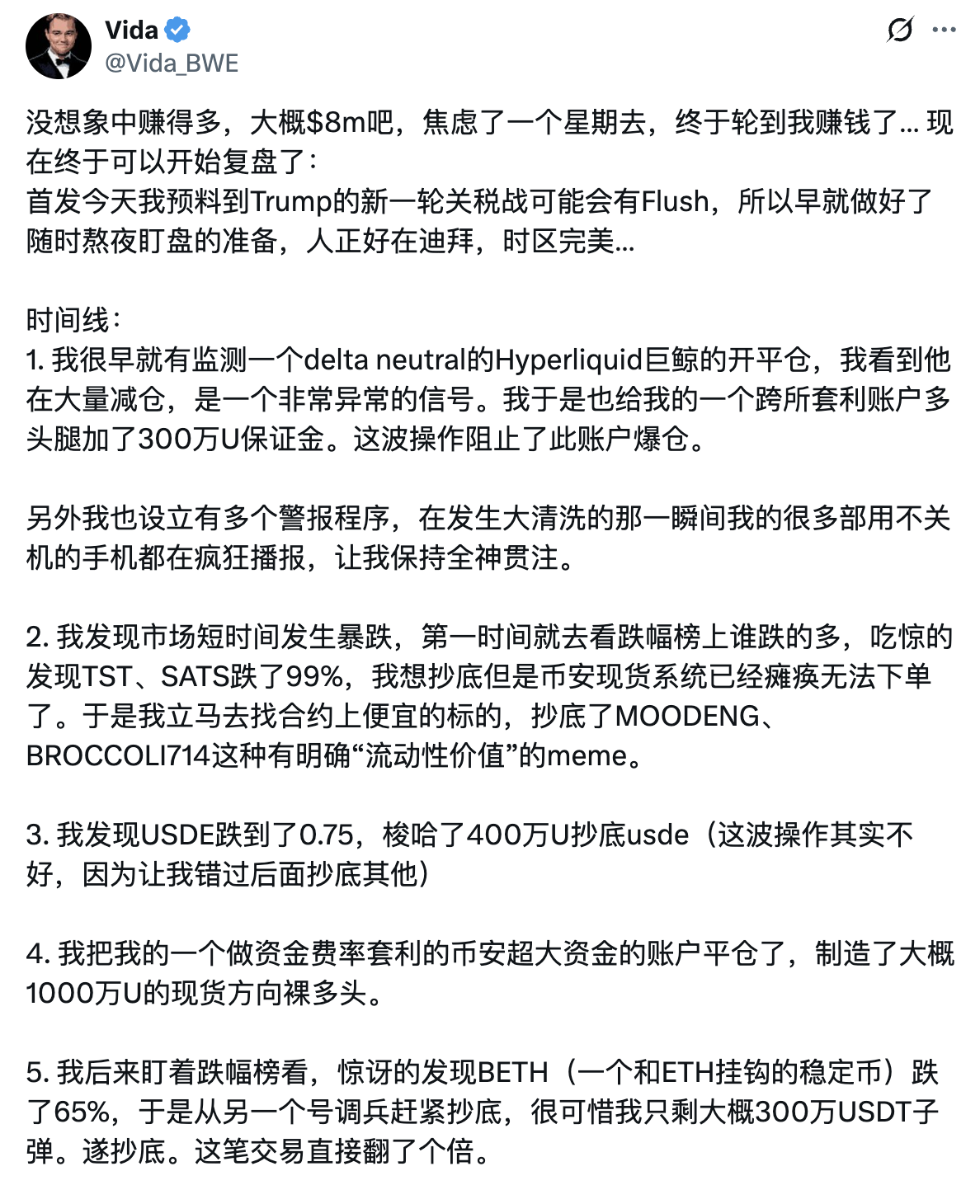

Under extreme market conditions, although the positions of most users suffered heavy losses (for example, Maji suffered multiple liquidations overnight), some people "fished in troubled waters" and seized the opportunity to get rich under extreme market conditions.

Get-Rich-Quick Opportunity 1: Direct Short Selling

The easiest opportunity to get rich quickly is naturally to short sell directly, and there is no need to elaborate on this.

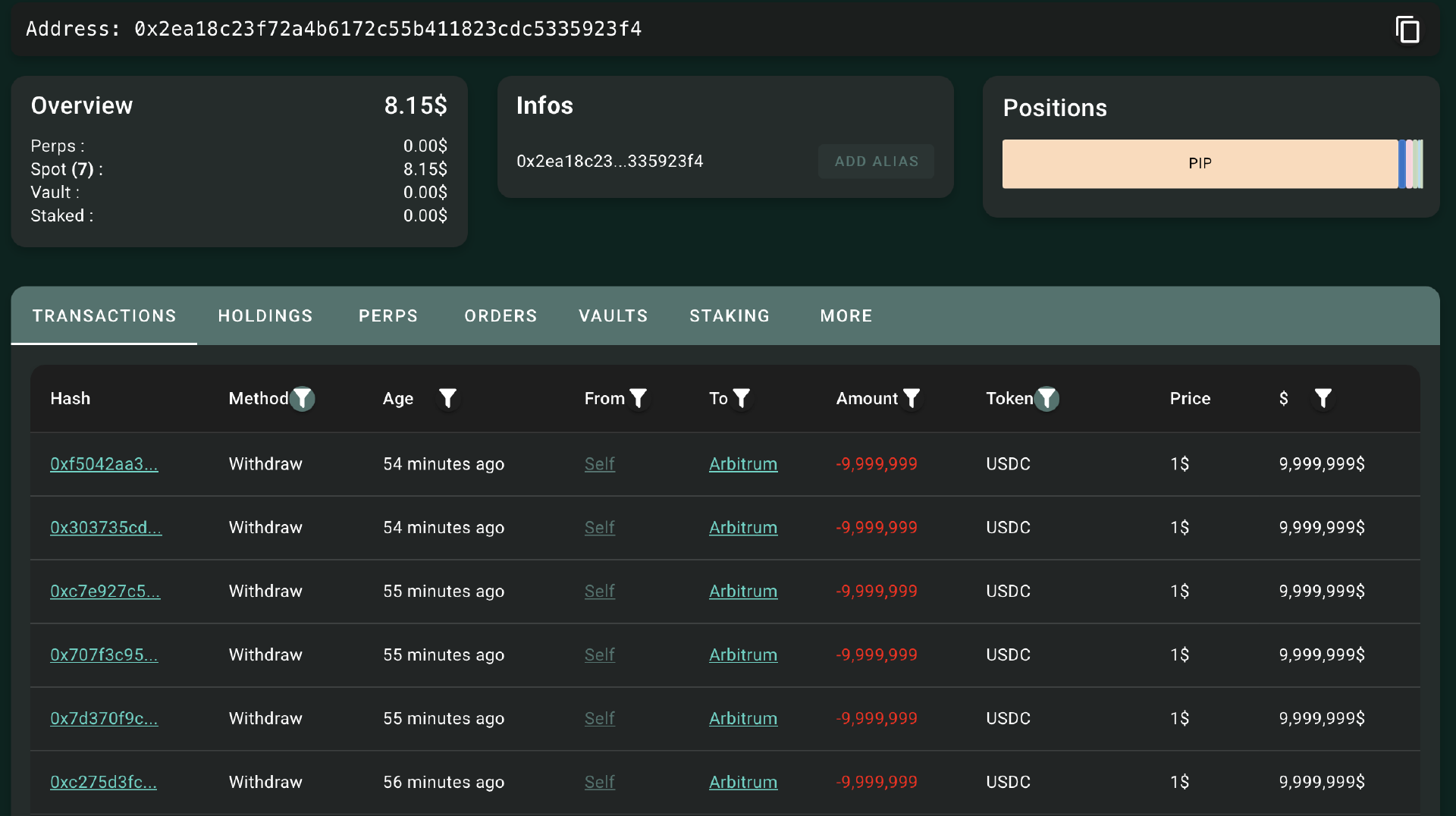

To give a simple example, Hypurrsan data shows that the whale address starting with 0x2ea18 has made a profit of US$72.33 million by shorting BTC and ETH in the past 24 hours. The whale has withdrawn US$60 million in USDC to Arbitrum and secured the profits.

Opportunity to get rich quick 2: Buy at the bottom

Compared to contract traders, the biggest opportunity for spot traders is naturally to buy at the bottom. If you placed an order at a low price last night or stayed up all night, you will have the opportunity to buy:

$1.25 in XRP;

$0.095 in DOGE;

$0.55 SUI;

$1 IP;

XPL at $0.25 (it was $2.7 just a few days ago);

$0.1 USD ARB;

AAVE at $79;

$1.65 PENDLE;

$0.05 JUP;

$0.13 ENA;

$2 in UNI;

Trump at $1.5;

$0.001 of ATOM (yes, you read that right!);

$0.00000 IOTX (yes, you read that correctly! See the picture ↓)…

Aside from small-cap altcoins, mainstream currencies like ETH and SOL, while seemingly experiencing modest declines, also present excellent bargain hunting opportunities. Due to liquidity constraints, the prices of some liquidity-derivative tokens have experienced significant price fluctuations, with WBETH dropping to as low as $430 and BNSOL to as low as $34.9. Who would have thought before going to bed last night that they would see ETH at $400 and SOL at $30?

After the market recovered relatively, many KOLs began to show off their profit status on X Mingpai. For example, Vida ( @Vida_BWE ) directly disclosed that its overnight profit was about 8 million US dollars.

Get-Rich-Quick Opportunity 3: Stablecoin Depegging

Apart from the copycat stocks which still have some uncertainty, the short-term unbundling of USDe was also a great opportunity to buy at the bottom last night.

Perhaps affected by market liquidity (some users needed to exchange USDe for USDT to supplement margin), USDe was decoupled last night and fell to $0.6268 in panic . Some users took this opportunity to buy at the bottom and made a fortune after the anchor was repaired.

Afterwards, Ethena officially confirmed the safety of USDe and even made some extra money from the extreme market conditions . "Due to market volatility and large-scale liquidations, the secondary market price of USDe has fluctuated. We can confirm that the minting and redemption functions of USDe have remained operational without any downtime, and that USDe remains overcollateralized. Due to liquidations, the market's contract trading price has been and continues to be below the spot price. Because Ethena holds spot and shorts contracts, this has unexpectedly generated additional income for USDe. Therefore, due to the impact of this sudden event, USDe's overcollateralization ratio will be higher than yesterday."

No need to worry, only a few people make profits, and those who miss out are destined to fail.

For those who missed last night's market (including myself), watching the above opportunities slip away may be somewhat envious or anxious, but the fact is that only less than 1% of users can get rich from this, and more than 99% of users can only face losses in their accounts when they wake up.

Overnight, nearly $20 billion was wiped out in the contract market. This was a night of great wealth transfer in the market, and also a night when many users lost their fortunes ... In the current market fluctuations, all we can do is reduce risks and save our bullets - after all, only by staying on the table can we play to the end.