Weekly Editors' Picks Weekly Editors' Picks (0709-0715)

"Weekly Editor's Picks" is a "functional" column of Odaily.On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Now, come and read with us:

Now, come and read with us:

invest

invest

Bloomberg: How did the resumption of the Three Arrows crash event trigger a chain reaction in the encryption industry?Very popular, suitable for readers outside the circle to quickly understand what happened to Sanjian and its affiliated organizations.》《In addition, there are three institutional forecasts and opinions this week. For details, see "》《SBF talks to the founder of Real Vision: What do you think of the biggest monetary tightening in economic history?》。

Interview with Sequoia Capital Partners: How do you view the encryption cycle and future trends?

Since most Layer2s may launch Tokens, Dapps on these Layer2s may also launch their own Tokens. Therefore, we can find Layer 2 that may perform retroactive airdrops, use cool Dapps that have not yet issued tokens on these Layer 2, and participate in broader projects such as The Arbitrum Odyssey (currently suspended) to lock up Token distribution.

start a business

start a business

Token Economics: A Guidebook for Encryption Project Economic Model Design

This article is more about terminology and principle explanations, lacking examples and quantification, and a rough reading is recommended.

"One-time airdrop" is not reliable? How should crypto projects improve their token distribution strategies?

A better coin distribution model should have the following characteristics: What users can buy at a discounted price should be "warrants" instead of "airdrop tokens"; Reward users within the scope; formulate modifiable dynamic standards; design and test more creative token distribution mechanisms.An interesting way to build a community token distribution mechanism is to design "gamified KPIs" that use the KPI mechanism to adjust the token distribution rate. For example, adjust the token release rate for revenue metrics to ensure that token holders can earn profits during the project adoption phase, aligning the customer life cycle with the project success cycle, the greater the expansion of the customer life cycle, the longer the success cycle.Can cooperate with "

DeFi

Re-examining the continuous token model: "to Rug" or "Not to Rug"?

"Take it.

Can liquidity services survive without the business itself?

The core of liquidity mining is to use high-inflation governance token emission rewards to guide protocol growth. However, this short-term incentive is very expensive. The misplaced incentive mechanism between the agreement and the liquidity provider has created an extremely fragile liquidity system, especially weakening the purchasing power of the project treasury tokens. POL derivative protocol layer innovations also emerged. Capital efficiency is also a key indicator that is closely related to the project treasury, and the liquidity-as-a-service (LaaS) track that has been spawned from this has developed rapidly.

The article also lists how some liquidity service agreements can provide better liquidity and higher capital efficiency in the context of the bear market. Curve, bribery based on stable currency business; Olympus Pro, bond and reverse bond market; Tokemak, by introducing the role of a third-party liquidity guide (LD), reconstructing the supply and demand relationship of retail users, its service is called For "Liquidity Leasing"; Ondo Finance x Fei Protocol, a structured product vault-based LaaS, splits asset pools and LP assets into multiple investment categories: stable assets with fixed income and volatile assets with variable but higher APY; UMA, a liquidity source that uses Range Token and KPI options to promote capital efficiency; and in terms of UNI-V3 LP management, there are still Untapped organic demand.

Inventory of the empowerment of top DeFi governance tokens: dYdX does nothing, Synthetix returns everything

The article takes stock of the income, sources, and distribution methods of several protocols with the highest income, and understands the empowerment of each head token.

And there are some projects that can provide complete services, such as dYdX, Synthetix, ENS, etc. In theory, the protocol can also capture all value intact. However, due to different degrees of decentralization and other reasons, there are differences in the distribution of income. For example, Synthetix distributes all income to pledgers, and dYdX temporarily does not distribute income to DYDX holders.

In-depth interpretation of DAI: don't let it become Wrapped USDC

Review the mechanism of MakerDAO from the perspective of the balance sheet to understand the root cause of its recent actions.

In 2020, MakerDAO launched the Peg Stability Module (PSM) when the market fluctuated violently. It allows users to swap fiat stablecoins (USDC, USDP, GUSD) with DAI at no cost. PSM has strengthened DAI's peg to the U.S. dollar through arbitrage, and has also changed MakerDAO's balance sheet.

Recently, MakerDAO passed a proposal to invest in U.S. Treasuries, designing a trust structure to indirectly hold real-world assets including Treasuries. From this, the MakerDAO balance sheet becomes:

NFT, GameFi and Metaverse

NFT, GameFi and Metaverse

Comprehensive analysis of NFT liquidity problems and solutions

Two sets of data attracted me: the top 15 NFT marketplaces account for the vast majority of the global NFT market, but their total trading volume is less than 2% of decentralized cryptocurrency exchanges; In the NFT market, 0.06% of whales (owning NFTs worth more than US$1 million) hold US$5.7 billion in NFTs, accounting for 25.7% of the global NFT market value of US$22.2 billion as of July 6, 2022.

Transaction mining incentives are the most direct and effective way to increase the transaction volume of the platform. It is a means of acquiring customers, but not a moat. The effect of reward incentives for pending orders is not very good, because the emergence of aggregators such as Gem and Genie has solved the pain point of lack of traffic for small exchanges. The price war is divided into transaction fees and creator fees.

Web 3.0

secondary title

This article discusses how Arweave can complete a permanent and sustainable storage solution through unique technical advantages and effective economic incentives from three aspects: technology, economic model, and application prospects. permaweb and the layer-2 solution Bundlr provide a Web2-like user experience. The storage fee paid by the user is the permanent storage cost of the miner; the miner's income comes from network fees and block rewards; the donation pool will ensure that the miner's income can cover the cost. AR tokens are similar to ETH and are utility tokens; but similar to BTC, AR adopts a continuous halving model, which makes it "coin holder friendly". Arweave with permanent economic value and commercialized Filecoin are complementary and healthy competition.

Cobo Ventures: An in-depth analysis of the current status and future of the SocialFi track

At the Bridge layer, the RSS reading aggregator Chainfeeds, the Web3 portal Mask Network, etc. meet the user's Web2 product habits, and also serve as a bridge to connect to Web3; in terms of public chains, the representative of SocialFi is DeSo; the SocialFi of the protocol layer has EOS. BBS Network, decentralized social graph protocol CyberConnect, Lens Protocol on Polygon, information flow aggregation protocol RSS3; application layer has direct social Rally.io, Nansen Connect, community social Mirror.xyz, Monaco Planet, community social Friends With Benefits, Whale, etc.

also,"The characteristics of successful SocialFi products include: low cost of use and threshold, good product experience, complete and innovative functions, timely and comprehensive user data synchronization (can be integrated on-chain and off-chain), innovative marketing strategies, and a rapid dissemination mechanism. Balanced and reasonable token economy, continuous incentive mechanism and mature community operation, open up agreements with other tracks, empower more scenarios, and the product itself meets the native needs of Web3, not just the needs of Web2. The ID system of Web3 needs to pay attention to DID and SBT.The Decentralized Social Graph and the State of the Creator Economy

Ethereum and scaling

Ethereum and scaling

After the merger, ETH L1 fees will not decrease; during the 6-12 month window period after the merger, there will be no structural selling pressure from ETH issuance, and the ETH inflation rate will drop from 4.3% to 0.22% after the merger.

New ecology and cross-chain

New ecology and cross-chain

PAData analyzed the liquidity changes and their generation in the first half of the year for the 15 public chains with relatively high locked-up amounts and better development, as well as the 5 protocols with the highest locked-up amounts on the 5 public chains with the highest locked-up amounts. According to the market performance of the currency, it is found that: the stock funds are gathered in the top public chain and the agreement; The average price drop in the first half of the year was about 72.21%, and the average price drop of the 20 protocol tokens in the first half of the year was about 69.65%. Both public chains and protocol tokens have more room for losses and smaller room for profits.

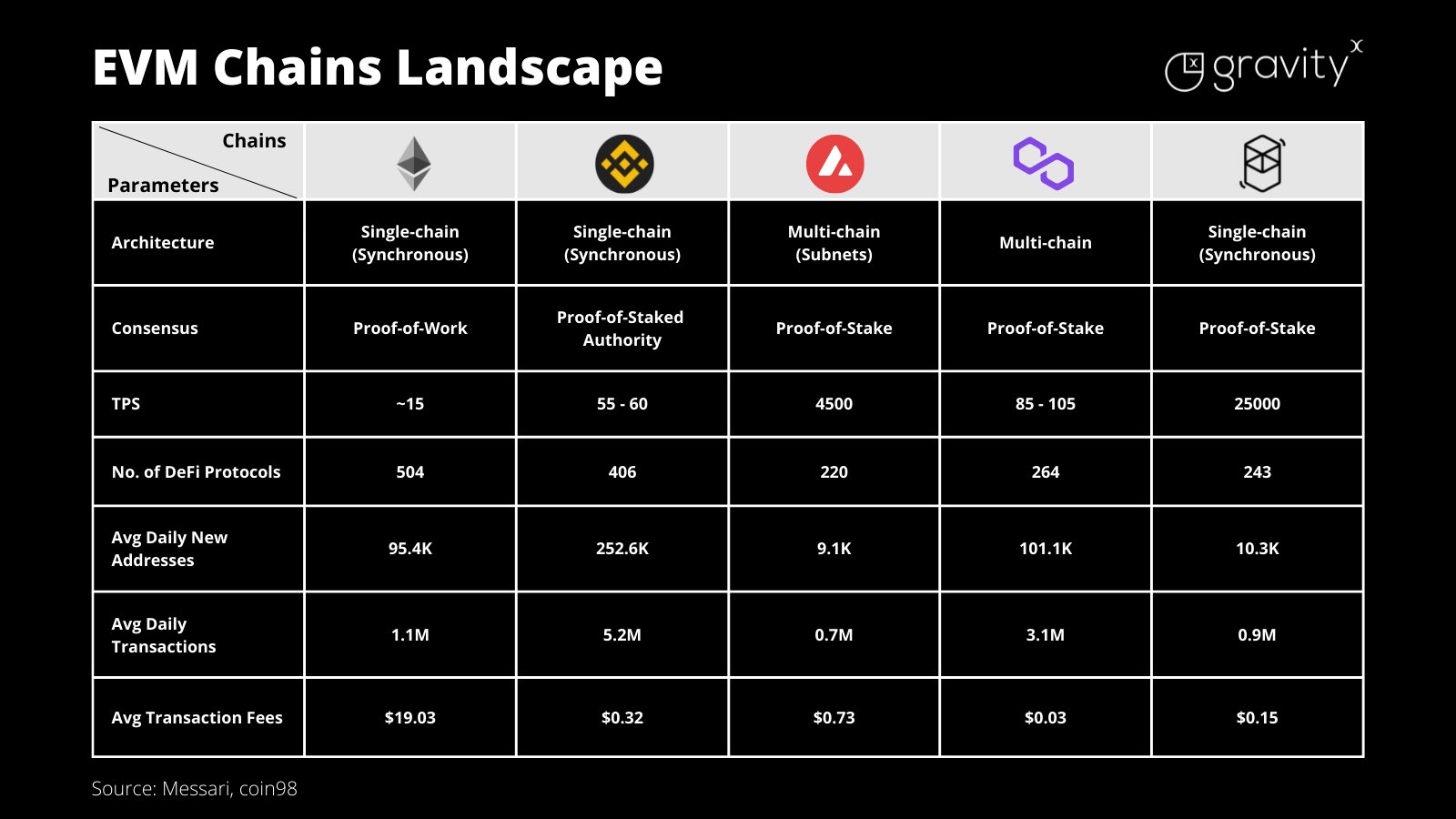

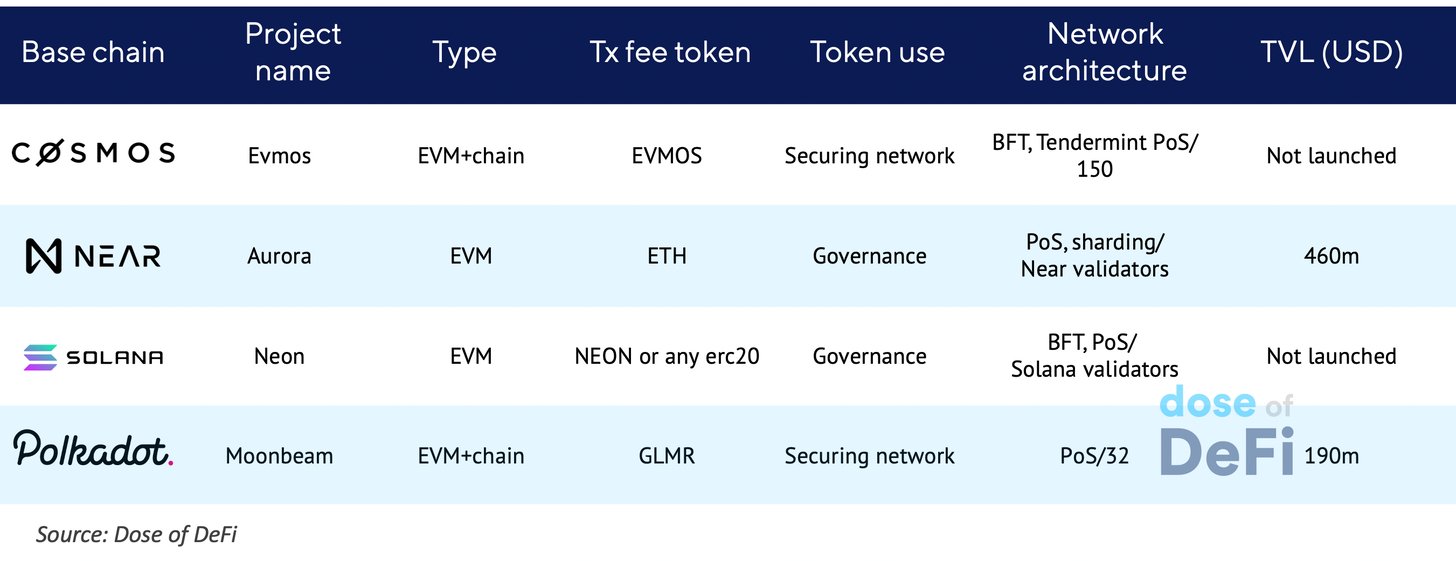

Comprehensive interpretation of EVM ecology: Which public chains are compatible with EVM? Which ones are not compatible?

The EVM compatible ecology includes Avalance, Binance Smart Chain, Fantom, and second-layer solutions such as Arbitrum and Optimism.

Non-EVM compatible chains include Solana, Cosmos, Near Protocol and Polkadot.

Projects to establish EVM compatibility on non-EVM chains include Aurora on NEAR Protocol, Moonbeam on Polkadot, Evmos on Cosmos, Neon on Solana, Oasis Emerald Paratime on Oasis Swao, and plans announced by Algorand. Rollups with EVM compatibility include zkEVM, Hermez zkEVM, and Scroll ZK rollup.

Security and decentralization are the biggest advantages of zkSync over competing public chains. In the Layer 2 track, in the short term, zkSync's main competitors are Arbitrum and Optimism. In the long run, zkSync and StarkWare will compete in the ZK Rollup series Layer 2.

DAO

secondary title

Exploring the Best Differences in DAO Contributor Identity: Why Multilateral Work Continues?

The shape of the employment picture will become more and more like a cloud, rather than a stuffy tank. The design of DAO tools should take into account the objective reality and needs of contributor mobility.

hot spots of the week

secondary titlehot spots of the weekIn the past week, Three Arrows Capital participated inDeFiance CapitalNFT fund Starry NightPurse net worth shrinks to $4.2 million,SuConsider Legal Action Against Three Arrows Capital, Three Arrows CapitalFounderZhu,and Kyle Davies are currently missing, because the founder of Three Arrows Capital was accused of not cooperating with the liquidation process, the New York court heldCreditor Emergency HearingTweeted by Zhu Su,Said Hope Liquidator did exercise good faith in StarkWare Token Warrants, U.S. Court AuthorizesLiquidators of Three Arrows Capital can claim the assets of Three Arrows Capital in the United StatesTeneofirst meeting of creditorsTetherwill be held on July 18th,Applied to the Singapore court for interim relief and management of Sanjian's assets in Singapore,Disclosure of Liquidated Celsius Loan Overcollateralization Positions, Celsius Announcesfile for bankruptcy protection, currently holds $167 million in cash to support the restructuring of the business,Celsius has repaid all debts on Aave, MakerDAO, Compound, the repayment exceeds US$800 million, CelsiusBalance sheet gap of about $1.2 billion,, claiming US$40.6 million from Three Arrows Capital, Celsius mortgaged US$403 million in assets,108 million loan from FTX,Musk terminates deal to buy TwitterTwitter sues MuskCall for completion of $44 billion takeover dealRespond with pictures

In addition, in terms of policies and macro markets,: Now they have to disclose the robot information in court;,In addition, in terms of policies and macro markets,The U.S. inflation rate reached 9.1% in June, and may usher in faster interest rate hikesus treasury departmentEuropean Central BankHongkongSaid that some key principles of the digital euro have been clarified, including privacy protection, etc.,HongkongBitcoin mine in Texas, USA

perspectives and voices,Almost all are turned off to save electricity;Circle Announces Details of USDC Reserve AssetsV God: Holds $55.7 billion in cash and treasury reserves,V GodIndicates that the PoS mechanism will not vote to change the protocol parameters; The Block claims that Huobi'sHBTC Has a Transparency ProblemHBTC redemption rate is 100%

Institutions, large companies and top projects,StarkWare, the HBTC official website information update is not timely, causing doubts;Institutions, large companies and top projects,It is confirmed that StarkNet Token will be launched and will be airdropped to the community next year.Uniswap v3 and green asset poolsCelo network

NFT and GameFi fields,once stopped producing blocks;NFT and GameFi fields,OpenSea announced that it will cut about 20% of its staffWith "Editor's Picks of the Week" series

With "Editor's Picks of the Week" seriesPortal。

See you next time~