全面解析NFT的流動性問題與解決方案

介紹

一級標題

介紹

最近的清算浪潮使得加密市場中正蔓延著擔憂,從Three Arrows Capital蔓延到Celsius Network、Babel Finance、BlockFi和Voyager Digital等加密機構。過去幾週,由於數字資產價格暴跌,市場損失了數十億美元。

正文

正文

流動性問題不僅對DeFi的發展是致命的,對NFT也是如此。在這篇報告中,我們將重點關注NFT的流動性問題和其解決方案,不僅是因為它被視為Web3的主要門戶,也因為它的門檻更低,用例更多樣化。

NFT流動性解決方案的其他思路

總結

總結

一級標題

總結

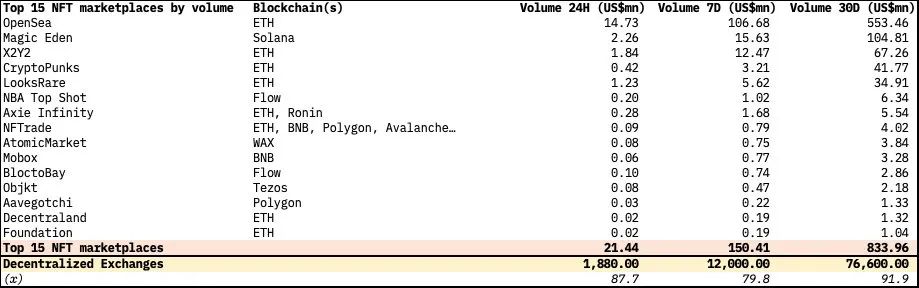

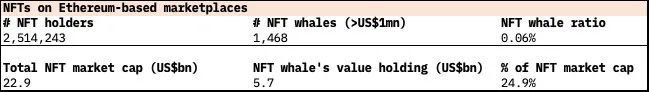

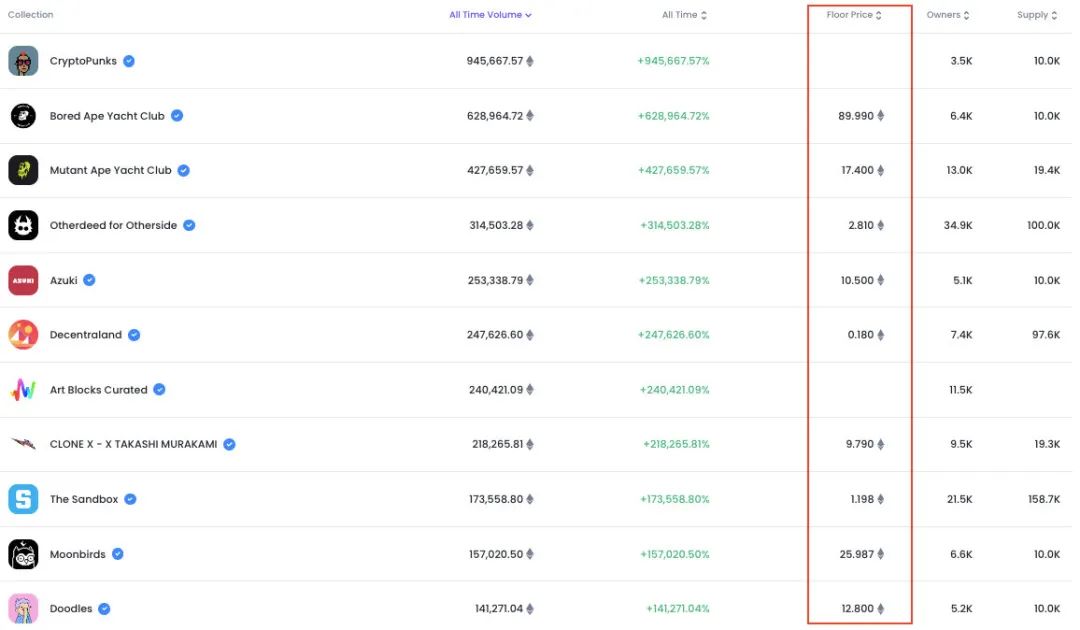

數據更新日期為2022年7月6日

圖片描述

圖片描述

一級標題

一級標題

數據更新日期為2022年7月6日

一級標題

為什麼NFT交易流動性不足?

買家少

儘管NFT在“移動”當前實體資產鏈的敘述上有著巨大的想像力,但對大眾市場來說仍然是非常新穎的。缺乏歷史數據點和被廣泛接受的估值分析是造成炒作難度高、定價困難的關鍵原因。由於稀有程度和主觀觀點的不同,即使是同一系列中的NFT也可能會有截然不同的價格。這就導致了流動性較低,資金效率不理想。

不出售

不出售

一級標題

一級標題

許多NFT投資者採用鑽石手策略(指打算堅定持有股票或其他資產的策略)進行投資,不願意出售他們的NFT來換取即時的流動性。因此,NFT金融化的發展是解決NFT流動性問題的熱門話題。

一級標題

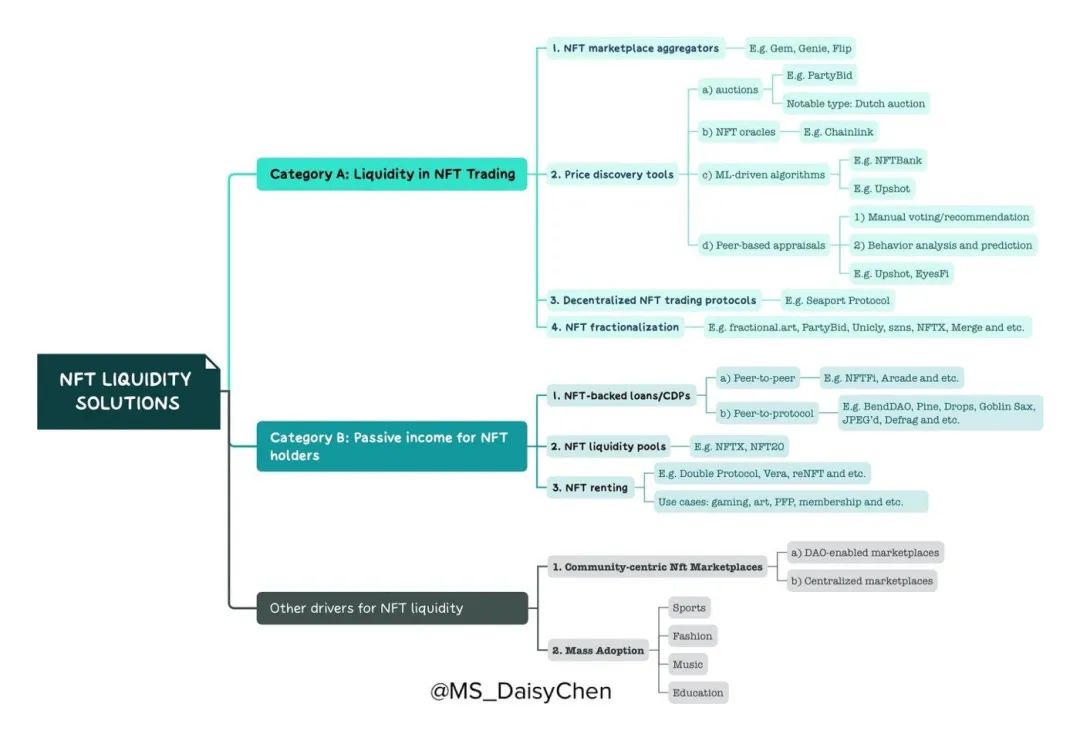

現有的NFT流動性擴展解決方案

A類:NFT交易和增值協議

以更平穩和更低成本的方式促進NFT點對點交易:1)NFT市場聚合器;2)價格發現工具;3)去中心化的NFT交易協議;4)NFT分片。

NFT市場聚合器

NFT市場聚合器可能是目前NFT流動性解決方案中最引人注目的。一個聚合平台整合了大多數NFT交易市場的NFT上架,並為NFT投資者提供了前所未有的“視野“。此外,通過允許用戶批量購買,可以節省高達40%的gas費用。目前,排名前三的聚合器分別是Gem(已被OpenSea收購)、Genie(已被Uniswap Labs收購)和Flip。

最近對Gem和Genie的收購表明,聚合器是單個市場/ DeFi池獲取用戶流量的有效前端工具。它們還允許通過批量購買降低gas費用,並減少NFT交易買家的麻煩。但是,儘管今年NFT聚合器被大肆宣傳,但它們在根本上類似於web2中的Deliveroo / Booking.com,因為它們只聚合NFT上架和定價等信息,而沒有向NFT市場注入額外的流動性。

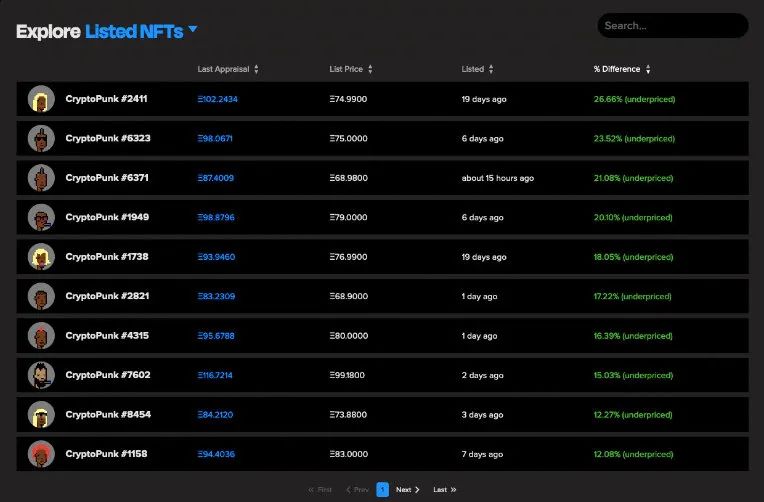

價格發現工具

這種類型的工具可以解決NFT的定價困難和高度投機問題,以幫助用戶進行投資決策。此外,價格發現為NFT金融化的發展奠定了至關重要的基礎。與市場價格容易同步的可替代代幣不同,NFT的定價要復雜得多,因為由於其P2P交易特性,出價、要價和實現價格可能相當不一致。

目前,有幾種價格發現方法:

(a)與傳統世界一樣,拍賣特別適合價值高的NFT。與傳統的英式拍賣模式相反,荷蘭式拍賣採用的是降價方式,在拍賣中,藝術家和拍賣師通知所有潛在藏家,並在拍賣前收集他們所有的投標價格,以確定上限價格。然後拍賣將從最高限價開始,並在每一段預定的時間內下降XX%,直到所有NFT以投標人指定的投標價格售罄。

拍賣有利於NFT發行者,但準確的定價結果會極大地犧牲市場資本效率,因為其鎖定了競標者的資本,而這些資本的總和很可能超過被競標者所購買的NFT交易的價值。

(b) 像Chainlink這樣的NFT預言機可以從區塊鏈中檢索NFT收藏品的最低價格,併計算它們的時間加權平均價格(TWAP)。這可以通過跟踪平均價格為投資者提供一個參考價格範圍。

然而,它的限制是,TWAP需要巨大的交易金額才能保證準確,因此它也容易受到預言機攻擊和市場操縱。

©機器學習驅動的算法可以很好地服務於相對豐富的數據點(例如稀有度統計和特徵)的NFT收藏品,因為它更有效地利用定量分析來進行價格預測。

例如,NFTBank,一個綜合性的NFT資產管理公司,為1900多個NFT項目提供價格發現服務。它由一個機器學習模型提供動力,該模型的數據輸入包括NFT元數據、銷售歷史、特徵值、類別、銷售時間等。

另一個例子是Upshot,它開發了專門的機器學習算法,可以收集歷史銷售數據、二級市場數據和NFT元數據,從而生成可靠的評估。使用算法,Upshot每小時重新定價270K+頂級NFT商品,包括Bored Apes, Art Blocks和CryptoPunks。

由於ML驅動的算法需要大量的數據點來得出計算結果,所以它對具有豐富的歷史銷售數據、稀有屬性和特徵以及較低波動性的NFT收藏品更有意義。投資者可能會發現,對於那些在市場上沒有太多可比性的NFT項目而言,它並不是很準確。

(d) 基於同行的評價包括1)人工投票/推薦;2)行為分析和預測機制。就像數字藝術一樣,NFT的定價更主觀,因此很難計算量化結果,因此對於這類類型的評估,集體判斷可能是更可靠的類型。

OpenSea在6月中旬宣布將遷移到Seaport Protocol,這是一個開源的Web3市場協議,旨在安全有效地交易NFT。 OpenSea比中心化的DeFi同行超前了一步,它推出了協議,降低了35%的gas費用,透明地公開了鏈上交易,並允許其他開發者分叉。

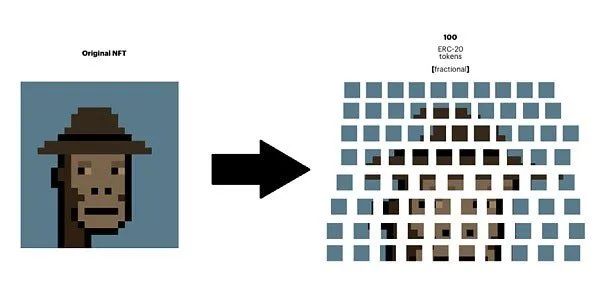

NFT分片

NFT分片

圖片描述

圖片描述

NFT分片是指將一個給定的NFT拆分成多個可以在市場上單獨交易的部分。該過程涉及到智能合約,該合約將ERC-721代幣劃分為若干F-NFT或可替換的ERC-20代幣。由於這些ERC-20代幣可以在DeFi系統中使用,並可以通過AMM的流動性挖礦被市場估值,它可以極大地提高價格發現和流動性。另一個更明顯的原因是,它鼓勵去中心化,因為它讓普通投資者獲得高價值NFT項目的敞口。

圖片描述

將一個CryptoPunk NFT拆分為100個ERC-20代幣

這一領域最引人注目的項目之一是fractional.art。你可以將web3錢包與fractional.art連接起來。以ERC-20代幣的形式購買分片的NFT。作為一個NFT分片代幣持有者,你可以參與NFT底價的投票。該平台還設置了7天拍賣功能,當投資者打算購買NFT的所有部分,即擁有整個部分時,可以觸發該功能,讓每個人都可以參與競價過程。

PartyBid由PartyDAO開發,是一個NFT拍賣平台,支持包括OpenSea在內的多個市場上的NFT。任何人都可以發起一個“Party”來貢獻ETH以共同競標NFT分片。這是通過PartyBid的MarketWrapper合約實現的,該合約提供了一個通用接口來聚合所有NFT投標。 PartyBid 建立在fractional.art 之上,用於對成功出價的NFT 進行分片。成功競標將收取2.5ETH的費用和2.5%的代幣價值,該代幣價值將被轉移到PartyDAO的金庫。

NFT的分片可能是下一個大趨勢,因為它對流動性產生了積極的影響,但它並非沒有風險。 F-NFT可能會引發監管問題,因為它們可能被視為未經授權的ICO。 SEC委員Hester Peirce在2021年警告稱,F-NFT可能被視為證券。此外,管理知識產權和宣傳權可能是棘手和復雜的,取決於NFT的特徵和類型。

B類:鑽石手NFT投資者的被動收益

正如我們在本報告開頭提到的,造成NFT資產流動性問題的關鍵因素之一是投資者更喜歡持有NFT資產,而不實現他們的利潤。為了解決源於這種行為的流動性問題,現有傳統金融世界的3個主要措施旨在服務於這些長期持有NFT的投資者:1) NFT支持的貸款/抵押貸款;2) NFT交易流動性池;3) NFT交易租賃/借貸。

它們都提供被動的收入流,並提高NFT投資者的資本效率,同時向市場提供額外的流動性。值得注意的是,這一類別下的許多平台已經納入了A類別下的解決方案,因為它們以各種方式服務於這兩種類型的措施。

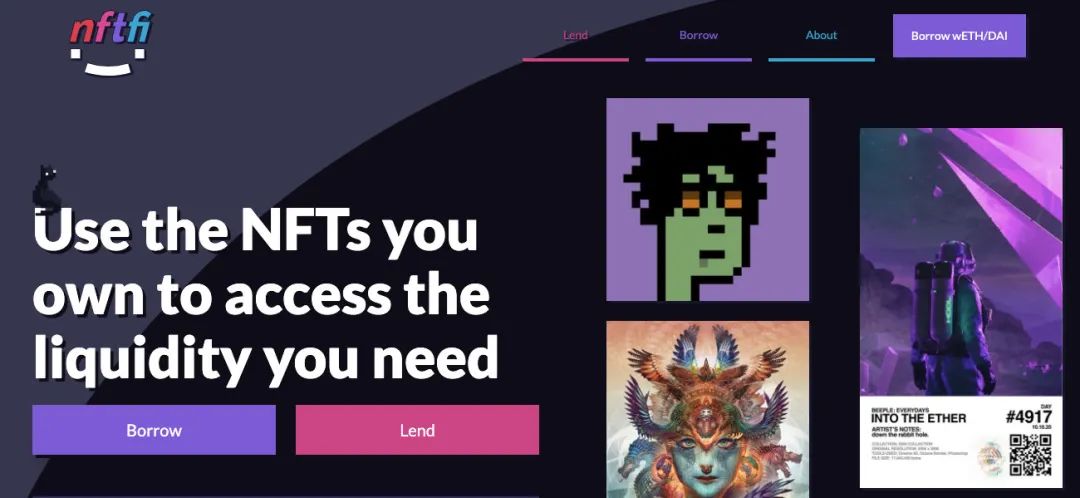

NFT支持的貸款/ CDP

截至2022年5月1日,與債務滲透率約為35%(240億美元/ 650億美元)的全球藝術品市場相比,NFT債務滲透率僅為0.5%(約2.5億美元/ 370億美元),因此預計隨著市場總規模的增長,流動性也會提高。

有兩種類型的貸款發行者:點對點(P2P)和點對協議(P2Protocol)。大部分貸款是通過NFTFi、Arcade等P2P貸款平台發放的。其餘由BendDAO、DropsDAO、PineDAO、Goblin Sax等P2Pool貸款供應商發行。

目前NFT支持貸款的總市場規模超過2.5億美元。由於波動性較高,NFT貸款機構可以獲得比傳統加密貨幣支持的貸款更高的預期回報。

a) NFT支持的P2P借貸平台。這一領域最大的兩家公司是NFTFi和Arcade,其中迄今為止發行的貸款總額約為2.4億美元。目前,由於其他長尾NFT項目的高波動性和不確定性,這些P2P平台只支持藍籌NFT。

NFTFi是建立在NFT借貸協議MetaStreet之上的。它允許NFT所有者使用他們的NFT作為抵押來借入wETH或DAI,而貸方可以通過提供這些貸款來賺取利息。 NFTFi的90天貸款要求年利率高達1000%,而較長期限貸款的平均年利率為90%。自2020年5月成立以來(截至2022年7月5日),該公司已處理了13363筆貸款,金額為2.17億美元。 NFTFi對成功貸款(不包括違約貸款)的貸款人收取5%的利息收入。一些抵押NFT包括打包的Crypto Punks(約佔貸款的29%)和BAYC(23%)。

Arcade(2000萬美元)建立在Pawn protocol上,自2022年成立以來,促進了約2000萬美元的貸款。除了wETH和DAI,用戶還可以通過從選定的列表中抵押NFT來借用USDC。與NFTFi不同的是,Arcade在貸款開始時向借款人收取2%的預付款。

上述兩家P2P借貸平台都不承擔任何風險,也不依賴算法定價來實現擴展。然而,可擴展性受限於其定制的貸款條款,以及潛在的慢速匹配,因為藉款人必須等待還價。

b) P2Protocol NFT支持的貸款

P2Protocol貸款市場的規模仍然很小(3000萬- 5000萬美元)。主要玩家包括BendDAO, Drops, Pine, Goblin Sax, JPEG 'd和Defrag。一些貸款平台,如BendDAO,採用投票代管代幣經濟學來激勵NFT持有者在各種貸款池中提供流動性。與DeFi流動性池類似,它們通過發行治理代幣來提高貸款人的利潤。

為了解決P2P借貸市場匹配緩慢的問題,P2Protocol 借貸項目允許即時流動性,因為匹配過程是由協議處理的。但其缺點是,自動貸款條款需要豐富的數據點,如實時價格和稀有程度統計,因此限制了NFT選擇已經具有的定量屬性的流動性。

即使有了NFT支持的超額抵押的貸款(至少50%),由於“自願”違約的可能性更高,NFT支持的貸款機構仍然承擔著更大的風險。當NFT的價值小於貸款額時,借款人就會放棄償還貸款。為了降低此類風險,準確的價格發現、信用風險分析和保險都是許多藉貸平台已經整合或正在積極探索的重要增值服務。

受NFT市場聚合器的啟發,NFT支持的貸款聚合器和基礎設施可能會成為下一個趨勢,因為NFT貸款市場仍然是碎片化的(尤其是在P2Protocol)。除了上面提到的MetaStreet之外,Spice Finance是一個新的項目,旨在通過集成各種NFT的P2Protocol協議,以便整合現有的P2Protocol貸款到一個單一的平台上。除此之外,它還建立了一個機器學習的NFT評估工具和信用風險系統,以支撐綜合貸款平台。

這類聚合器的最大風險來自於高度的集成和可組合性,因為項目繼承了所有底層應用程序的風險。

NFT流動性池

與DeFi一樣,如果NFT定價錯誤,用戶可以進行套利,從而促進價格發現。此外,流動性提供者通常會獲得LP代幣,並可以通過質押來提高回報。然而,考慮到NFT的高波動性和投機行為,下跌的風險對平台和投資者來說可能都是一個挑戰。

NFT租賃可以適用於各種用例,包括遊戲、藝術、PFP、會員NFT等。例如,藝術展覽、品牌或活動可能會租賃與他們相匹配的特定數字藝術NFT。或者有些人想要加入一個社區一段時間,他們可能會將NFT會員出租一個月(聽起來像是訂閱付費內容)。

一級標題

DAO聽起來像是這樣一個市場發展的有機場所,特別是有了前面提到的降低開發門檻的Seaport Protocol。此外,中心化的NFT市場也在積極探索社區功能,比如Coinbase的測試版NFT市場就專注於為買家和賣家創建一個社交社區。

總結

一級標題

總結