Originally Posted by Sam @IOSG

introduction

Artemis' 2025 research report indicates that the economic scale of stablecoin settlements will reach approximately $26 trillion in 2024, reaching the level of mainstream payment networks. In contrast, the fee structure of the traditional payment sector is like a "hidden tax": a roughly 3% handling fee, additional foreign exchange spreads, and ubiquitous wire transfer fees.

Stablecoin payments reduce these costs to a few cents or even lower. When the cost of transferring funds plummets, business models will be fundamentally reshaped: platforms will no longer rely on transaction fees to survive, but will instead compete on deeper value propositions—such as savings returns, liquidity, and credit services.

With the enactment of the US GENIUS Act and the similar regulatory model provided by Hong Kong's Stablecoin Ordinance, banks, card networks, and fintech companies are moving from pilot programs to large-scale production applications. Banks are issuing their own stablecoins or collaborating closely with fintech companies; card networks are integrating stablecoins into their back-end settlement systems; and fintech companies are launching compliant stablecoin accounts, cross-border payment solutions, on-chain settlement with built-in KYC, and tax reporting capabilities. Stablecoins are evolving from collateral within exchanges to standard payment infrastructure.

The current shortcomings lie in user experience. Current wallets still assume cryptocurrency expertise; fees vary significantly across networks; and users often even need to hold a highly volatile token before transferring a dollar-pegged stablecoin. "Gas-free" stablecoin transfers, enabled by sponsored fees and account abstraction, will completely eliminate this friction. With predictable costs, smoother fiat exchange channels, and standardized compliance components, stablecoins will no longer feel like "cryptocurrency" but will truly feel like "currency."

Core Insight: Public chains centered around stablecoins already possess the necessary scale and stability. To become everyday currencies, they also need: a consumer-grade user experience, programmable compliance, and imperceptible transactions. As these elements—particularly gas-free transfers and improved fiat-to-currency on-ramps—are refined, the focus of competition will shift from "charging for moving funds" to "the value provided around money movement," including yield, liquidity, security, and simple, trusted tools.

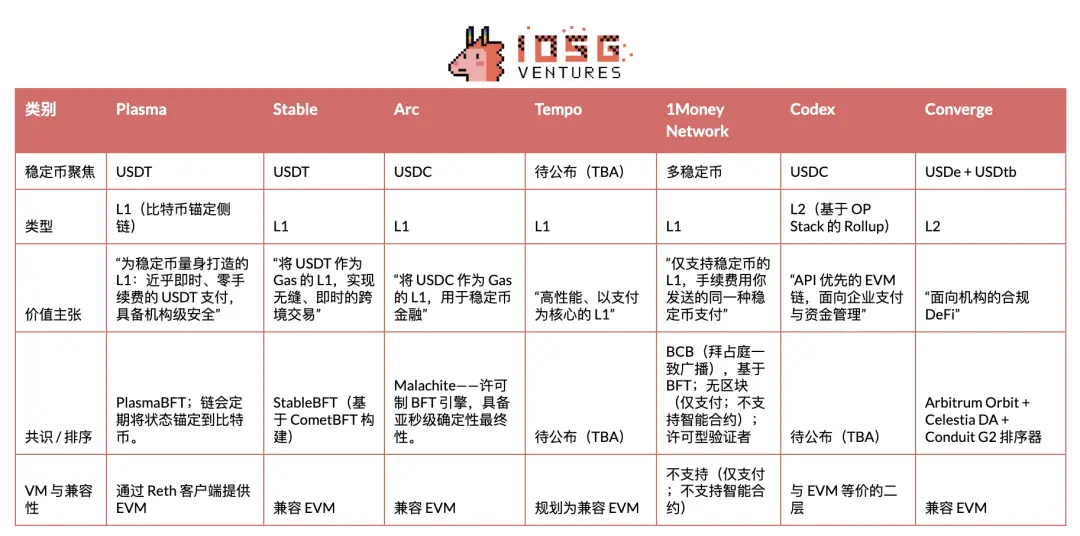

The following is a quick overview of prominent projects in the stablecoin/payment blockchain space. This article will focus primarily on Plasma, Stable, and Arc, delving into the issuers, market dynamics, and other participants behind them, providing a comprehensive overview of the "stablecoin track war."

Plasma

Plasma is a blockchain built specifically for USDT, designed to serve as its native settlement layer and optimized for high-throughput, low-latency stablecoin payments. It entered a private testnet in late May 2025, transitioned to a public testnet in July, and successfully launched its mainnet beta on September 25th.

In the stablecoin payment public chain track, Plasma was the first project to conduct a TGE and completed a successful market launch: it occupied a strong mindshare, set a record for first-day TVL and liquidity, and reached cooperation with many blue-chip DeFi projects since its launch, laying a solid ecological foundation.

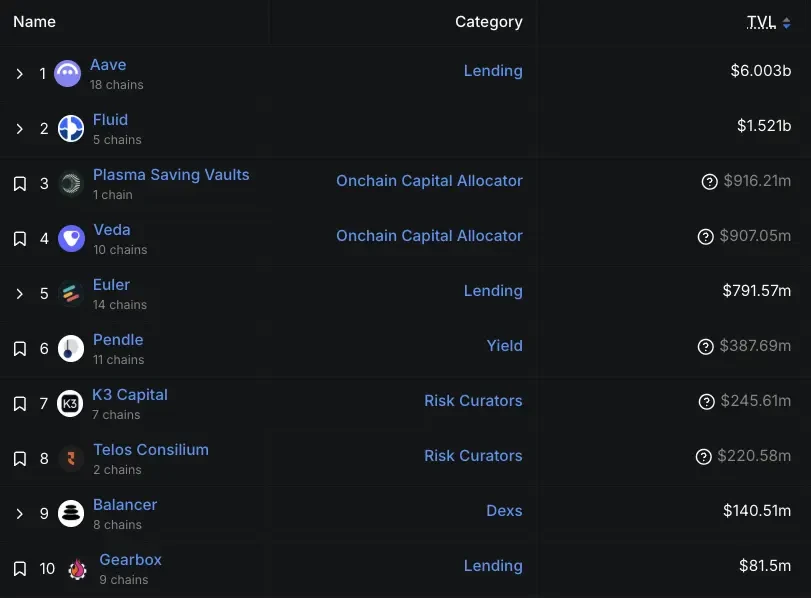

Since the launch of its mainnet beta, Aave's growth has been undeniable. As of September 29th, Aave deposits on the Plasma chain exceeded $6.5 billion, making it its second-largest market. By September 30th, over 75,000 users had registered for its ecosystem wallet, Plasma One. According to the latest data from DeFiLlama, Aave's TVL on Plasma currently stands at $6 billion. While this represents a decline from its peak, it remains Aave's second-largest market, second only to Ethereum ($53.9 billion) and significantly ahead of Arbitrum and Base (both approximately $2 billion). Furthermore, projects such as Veda, Euler, Fluid, and Pendle also contribute significant locked-in value.

▲ source: DeFiLlama

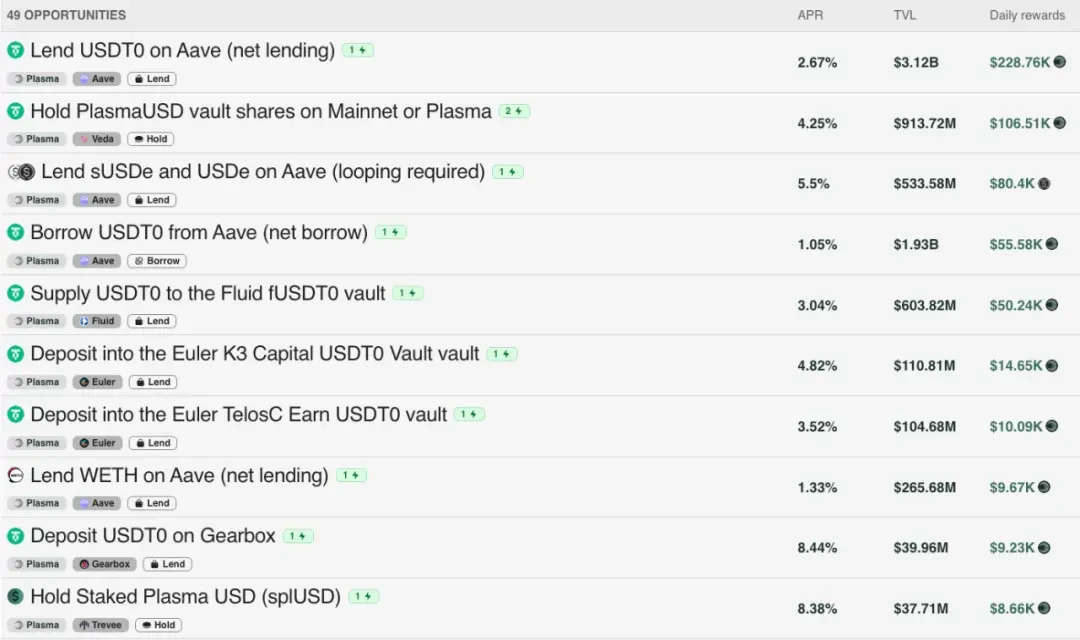

Plasma's early TVL growth also benefited from its incentive budget: according to the official tokenomics model, 40% of the total XPL token supply is allocated to the ecosystem and growth fund. Of this, 800 million XPL tokens (800 million XPL) were unlocked immediately upon the mainnet beta launch to support DeFi incentives for launch partners, liquidity needs, and exchange integrations. The remaining 32% (3.2 billion XPL) will be released monthly over three years. Currently, major on-chain liquidity pools earn an additional 2-8% in XPL rewards, in addition to their base yield.

▲ source: Plasma

Of course, there's also some outside criticism that its early growth was primarily driven by incentives rather than being entirely organic. As CEO Paul emphasized, relying solely on crypto-native users and incentives isn't a sustainable model; the true test lies in future real-world adoption—something we'll continue to closely monitor.

Go-To-Market

Plasma is focused on USDT. It's emphasizing emerging markets, with a particular focus on Southeast Asia, Latin America, and the Middle East. In these markets, USDT's network effects are already strongest, and the stablecoin has become an essential tool for remittances, merchant payments, and everyday peer-to-peer transfers. Implementing this strategic vision requires a robust, on-the-ground distribution strategy: advancing payment corridor by corridor, building an agent network, implementing localized user onboarding, and precisely capitalizing on regulatory timing. This also requires establishing clearer risk boundaries than those employed by Tron.

Plasma views developer experience as its defensive moat and believes that USDT needs to offer a developer-friendly interface, similar to what Circle has done for USDC. Circle has invested heavily in making USDC easy to integrate and develop for, but Tether lacks in this area, leaving a huge opportunity for the USDT application ecosystem—assuming the payment rails can be properly packaged. Specifically, Plasma provides a unified API on top of the payment technology stack, freeing developers in the payment field from having to assemble the underlying infrastructure themselves. Behind this single interface are pre-integrated partners that serve as plug-and-play foundational modules. Plasma is also exploring confidential payments—achieving privacy protection within a compliant framework. Its ultimate goal is clear: "Make USDT extremely easy to integrate and develop for."

In summary, this payment corridor-driven market entry strategy and API-centric developer strategy ultimately converge on Plasma One—the consumer-facing front-end, the product that brings the entire initiative to everyday users. On September 22, 2025, Plasma released Plasma One, a consumer-facing, "stablecoin-native" digital bank and card product that integrates the functionality of storing, spending, earning, and sending digital dollars into a single application. The team positioned it as providing the missing unified interface for the hundreds of millions of users who already rely on stablecoins but still struggle with localized frictions (such as cumbersome wallets, limited fiat currency exchange channels, and reliance on centralized exchanges).

Access to the product is being released in phases via a waitlist. Key features include direct payments from interest-earning stablecoin balances (targeted at over 10% annualized), up to 4% cashback on purchases, instant, zero-fee USDT transfers within the app, and card services that can be used at approximately 150 million merchants in over 150 countries.

Business Model Analysis

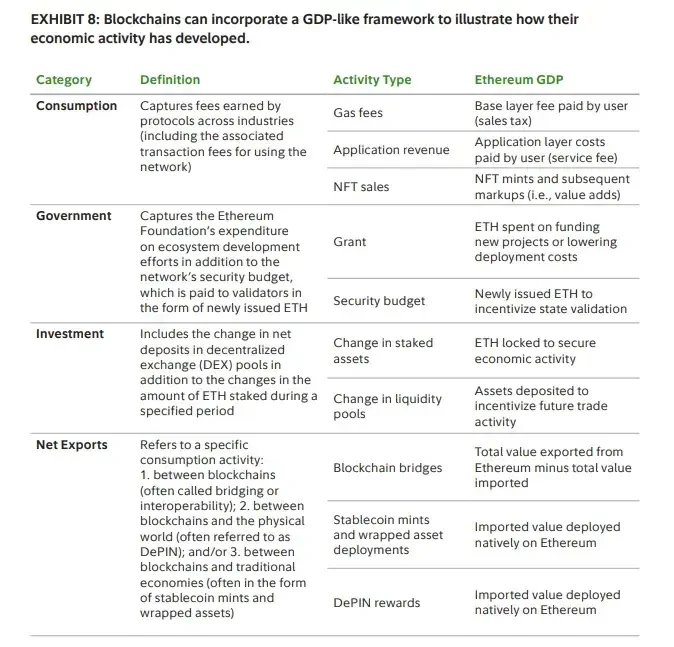

Plasma's core pricing strategy aims to maximize everyday usage while maintaining economic returns through other elements: simple USDT transfers are free, while all other on-chain operations incur fees. Viewed through the lens of "blockchain GDP," Plasma intentionally shifts value capture from a per-transaction "consumption tax" (i.e., gas fees for basic USDT transfers) to application-layer revenue. The DeFi layer corresponds to the framework's "investment" component: its goal is to foster liquidity and yield markets. While net exports (i.e., USDT transfers into and out of cross-chain bridges) remain important, the economic focus has shifted from consumer fees to service fees for applications and liquidity infrastructure.

▲ source: Fidelity

For users, zero fees isn't just about saving money; it unlocks new use cases. When sending $5 doesn't require a $1 fee, micropayments become feasible. Remittances can be sent in full without being deducted by intermediaries. Merchants can accept stablecoin payments without having to cede 2-3% of their revenue to invoicing/billing software and card schemes.

Technically, Plasma runs a paymaster compliant with EIP-4337. This paymaster sponsors gas fees for official USDT transfer() and transferFrom() calls on the Plasma chain. The Plasma Foundation has pre-funded this paymaster with its native XPL token and employs a lightweight validation mechanism to prevent abuse.

Stable

Stable is a Layer 1 optimized for USDT payments, designed to address the inefficiencies of the current infrastructure - including unpredictable fees, slow settlement times, and an overly complex user experience.

Stable positions itself as a payment-specific Layer 1 platform "built for USDT." Its market strategy is to establish direct partnerships with payment service providers (PSPs), merchants, business integrators, suppliers, and digital banks. PSPs favor this approach because it eliminates two operational challenges: managing volatile gas tokens and bearing transfer costs. Given the high technical barriers to entry for many PSPs, Stable is currently operating as a "service workshop" model—independently completing various integration tasks—and plans to solidify these models into an SDK for self-service integration by PSPs in the future. To provide production-grade guarantees, they have introduced "Enterprise Blockspace," a subscription service that ensures VIP transactions are prioritized at the top of blocks, ensuring certainty of first-block settlement and smoother cost prediction during times of network congestion.

In terms of regional strategy, its market entry follows the existing usage trajectory of USDT, implementing an "Asia-Pacific first" approach - and will later expand to other USDT-dominated regions such as Latin America and Africa.

On September 29th, Stable launched a consumer-facing app (app.stable.xyz), targeting new, non-DeFi users. Positioned as a simple USDT payment wallet for everyday needs (P2P transfers, merchant payments, rent, etc.), the app offers instant settlement, zero gas fees for peer-to-peer transfers, and transparent, predictable fees in USDT. Currently, membership is only available through a waitlist. Initial market traction has been demonstrated in South Korea, where Stable Pay has attracted over 100,000 user registrations directly from its offline booth (as of September 29th).

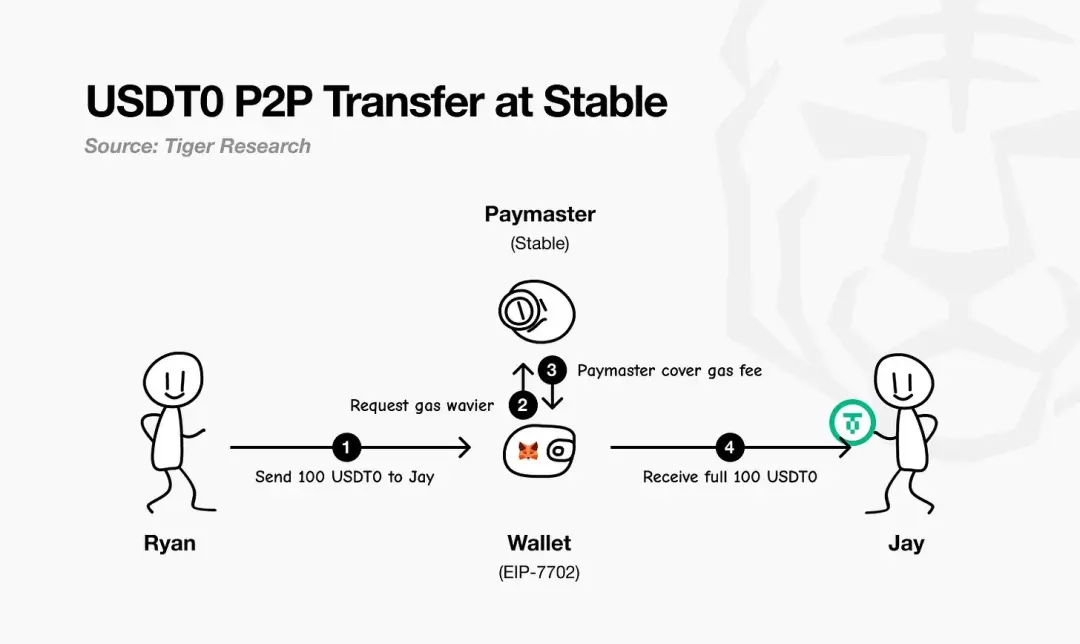

Stable enables gas-free USDT payments using EIP-7702. This standard allows a user's existing wallet to be temporarily transformed into a "smart wallet" for a single transaction, allowing it to run custom logic and settle fees without requiring any separate gas tokens—all fees are denominated and paid in USDT.

As Tiger Research's flowchart illustrates, the process is as follows: the payer initiates a payment; the EIP-7702 wallet requests a gas fee exemption from Stable's paymaster; the paymaster sponsors and settles network fees; and finally, the payee receives the full amount without any deductions. In practice, users only need to hold USDT.

▲ source: Tiger Research

In terms of its business model, Stable prioritizes market share expansion over revenue in the near term, leveraging gas-free USDT payments to acquire users and build payment traffic. Long-term profitability will primarily come from within its consumer applications, supplemented by select on-chain mechanisms.

In addition to USDT, Stable also sees significant opportunities in other stablecoins. With PayPal Ventures' investment in Stable at the end of September 2025, as part of the deal, Stable will natively support PayPal's stablecoin, PYUSD, and promote its distribution, allowing PayPal users to pay "directly with PYUSD," with gas fees also paid in PYUSD. This means PYUSD will also be gas-free on the Stable chain—extending the operational simplicity of the USDT payment rail that attracted PSPs to it to PYUSD as well.

▲ source: https://x.com/PayPal/status/1971231982135792031

Architecture Analysis

Stable's architectural design begins with its consensus layer—StableBFT. This is a custom-developed proof-of-stake protocol based on CometBFT, designed to provide high throughput, low latency, and high reliability. Its development path is pragmatic and clear: in the short term, it focuses on optimizing this mature BFT engine, while the long-term roadmap points to a transition to a directed acyclic graph (DAG)-based design to pursue even greater performance scalability.

Above the consensus layer, the Stable EVM seamlessly integrates the chain's core capabilities into developers' daily work. Its purpose-built precompiled contracts allow EVM smart contracts to safely and atomically call core chain logic. Future performance improvements are expected with the introduction of StableVM++.

Throughput also depends on data processing capabilities. StableDB effectively addresses the storage bottleneck after block generation by separating state submission from data persistence. Finally, its high-performance RPC layer abandons a monolithic architecture and adopts a split-path design: lightweight, specialized nodes serve different types of requests, thereby avoiding resource contention, improving long-tail latency, and ensuring real-time responsiveness even when chain throughput increases significantly.

Crucially, Stable positions itself as Layer 1, not Layer 2. Its core philosophy is that real-world commercial applications shouldn't have to wait for upstream protocol updates to implement payment functionality. By fully controlling the validator network, consensus strategy, execution layer, data layer, and RPC layer, the team prioritizes the core guarantees required for payment scenarios while maintaining EVM compatibility, allowing developers to easily migrate existing code. The result is a Layer 1 blockchain that is EVM-compatible but fully optimized for payments.

Arc

On August 12, 2025, Circle announced that its Layer 1 blockchain, Arc, which focuses on stablecoins and payments, will enter a private testnet in the coming weeks and launch a public testnet in the fall of 2025, with the goal of launching the mainnet beta version in 2026.

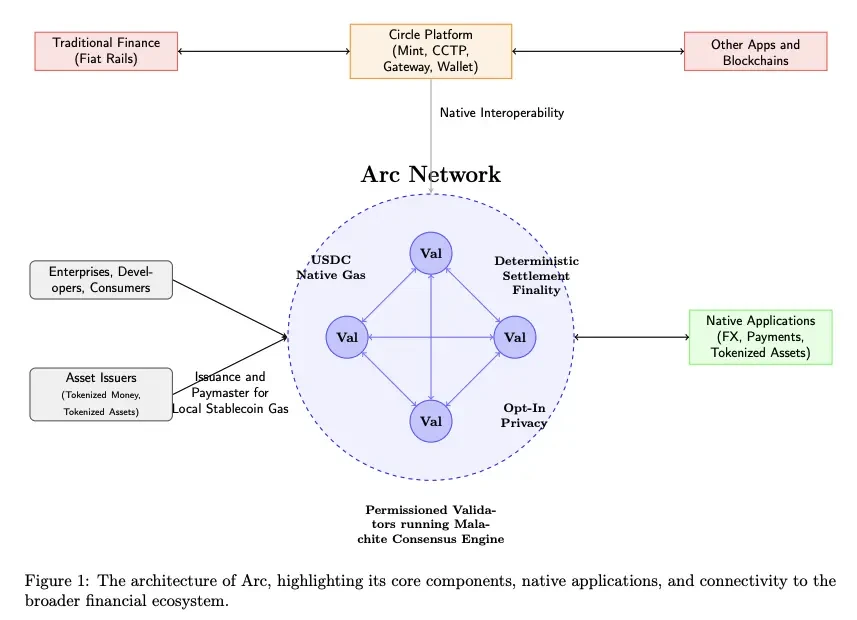

Arc's core features are that it is operated by a permissioned set of validators (running the Malachite BFT consensus engine), providing deterministic finality; its native gas fees are paid in USDC; and it provides an optional privacy layer.

▲ source: Arc Litepaper

Arc is directly integrated into Circle's entire ecosystem—including Mint, CCTP, Gateway, and Wallet—enabling the seamless transfer of value between Arc, traditional fiat payment rails, and other blockchains. Businesses, developers, and consumers will conduct transactions through applications on Arc (covering payments, foreign exchange, asset tokenization, and more), while asset issuers can mint assets on Arc and act as paymasters, sponsoring gas fees for their users.

Arc uses a consensus engine called Malachite and adopts a permissioned Proof-of-Authority mechanism, with validator nodes being run by known authoritative organizations.

▲ source: Circle

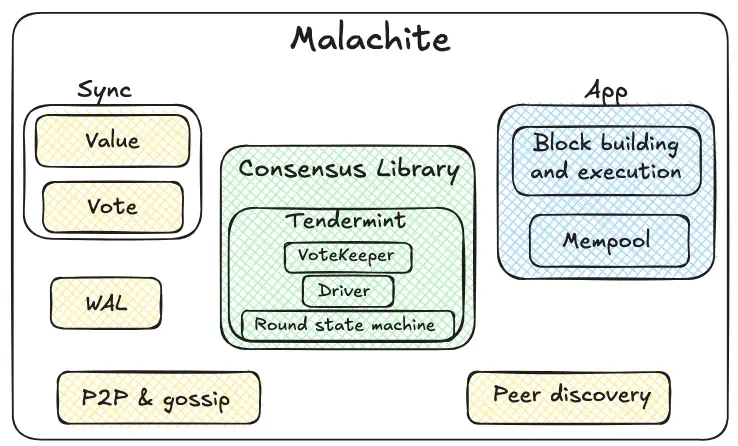

Malachite is a Byzantine fault-tolerant consensus engine that applications can embed to achieve strong consistency agreements and finality across many independent nodes.

The consensus library, highlighted in green, is the core of Malachite. Its internal round state machine uses a Tendermint-style round mechanism (proposal → pre-vote → pre-commit → commit). A voting daemon is responsible for aggregating votes and tracking quorum. The driver coordinates these rounds over time, ensuring that the protocol remains consistent even when some nodes are delayed or fail. The consensus library is intentionally universal by design: it handles "values" in an abstract manner, making it accessible to diverse applications.

Around the core modules are reliability and network infrastructure components highlighted in yellow. Peer-to-peer and gossip protocols transmit proposals and votes between nodes; a node discovery mechanism establishes and maintains connections. A write-ahead log persistently stores key events locally, ensuring security even after node crashes and restarts. The synchronization mechanism features dual paths for value synchronization and vote synchronization. Lagging nodes can achieve data synchronization by obtaining finalized output results (values) or by completing missing intermediate votes required for ongoing decisions.

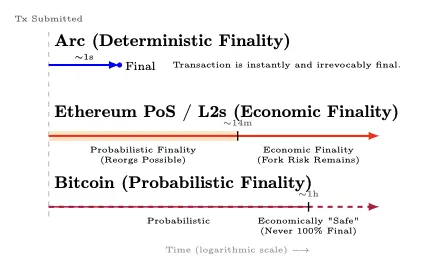

Arc provides deterministic finality of approximately 1 second - when ≥ 2/3 of the validators complete the confirmation, the transaction is immediately and irreversibly finalized (with no risk of reorganization); Ethereum Proof of Stake and its second-layer solution achieve economic finality in approximately 12 minutes, transitioning to an "economically final" state after an initial probabilistic phase of possible reorganization; Bitcoin exhibits probabilistic finality - as the number of confirmations accumulates over time, it reaches an "economically secure" state after approximately 1 hour, but 100% finality can never be achieved mathematically.

▲ source: Arc Litepaper

Once ≥⅔ of the validators confirm a transaction, it transitions from an “unconfirmed” state to 100% finality (without a “reorganization probability trail”). This property aligns with Principle 8 of the Principles for Financial Market Infrastructures (PFMI), regarding guaranteed finality of settlement.

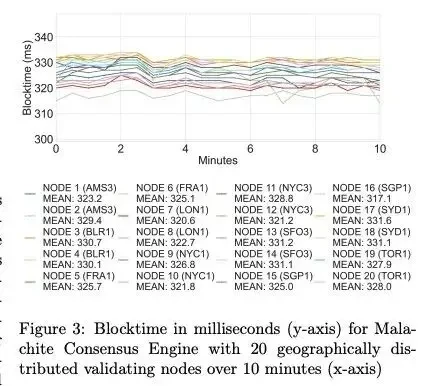

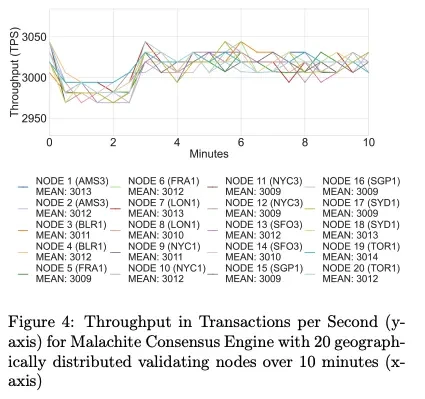

In terms of performance, Arc achieved a throughput of approximately 3,000 TPS and a final confirmation delay of less than 350 milliseconds on 20 geographically distributed verification nodes; and achieved a throughput of more than 10,000 TPS and a final confirmation delay of less than 100 milliseconds on 4 geographically distributed verification nodes.

▲ source: Arc Litepaper

▲ source: Arc Litepaper

Planned upgrades for the Malachite consensus engine include support for a multi-proposer mechanism (expected to increase throughput by approximately 10 times), and an optional lower fault tolerance configuration (expected to reduce latency by approximately 30%).

Arc also introduced an optional confidential transfer feature for compliant payments: transaction amounts are hidden, while addresses remain visible. Authorized parties can access transaction values through a selectively disclosed "view key." The goal is to achieve "auditable privacy"—suitable for banks and businesses that require on-chain confidentiality without sacrificing regulatory compliance, reporting obligations, or dispute resolution mechanisms.

Arc's design choices prioritize the predictability institutions demand and its deep integration with the Circle technology stack—but these advantages come with trade-offs: a permissioned, proof-of-authority (PoA) validator set concentrates governance and censorship power in known institutions, and a BFT system tends to halt rather than fork in the event of a network partition or validator failure. Critics argue that Arc resembles a walled garden or consortium blockchain for banks rather than a trusted, neutral public network.

But this trade-off is clear and reasonable for enterprise needs: banks, payment processors, and fintech companies prioritize deterministic finality and auditability over ultimate decentralization and permissionlessness. Longer-term, Circle has hinted at its intention to evolve toward permissioned proof-of-stake, open to qualified stakers under slashing and rotation rules.

With USDC as its native fuel currency, an institutional-grade RFQ/FX engine, sub-second finality, optional privacy support, and deep integration with Circle's full-stack products, Arc encapsulates the fundamental capabilities that enterprises truly need into a complete payment rail.

Stablecoin Rail Wars

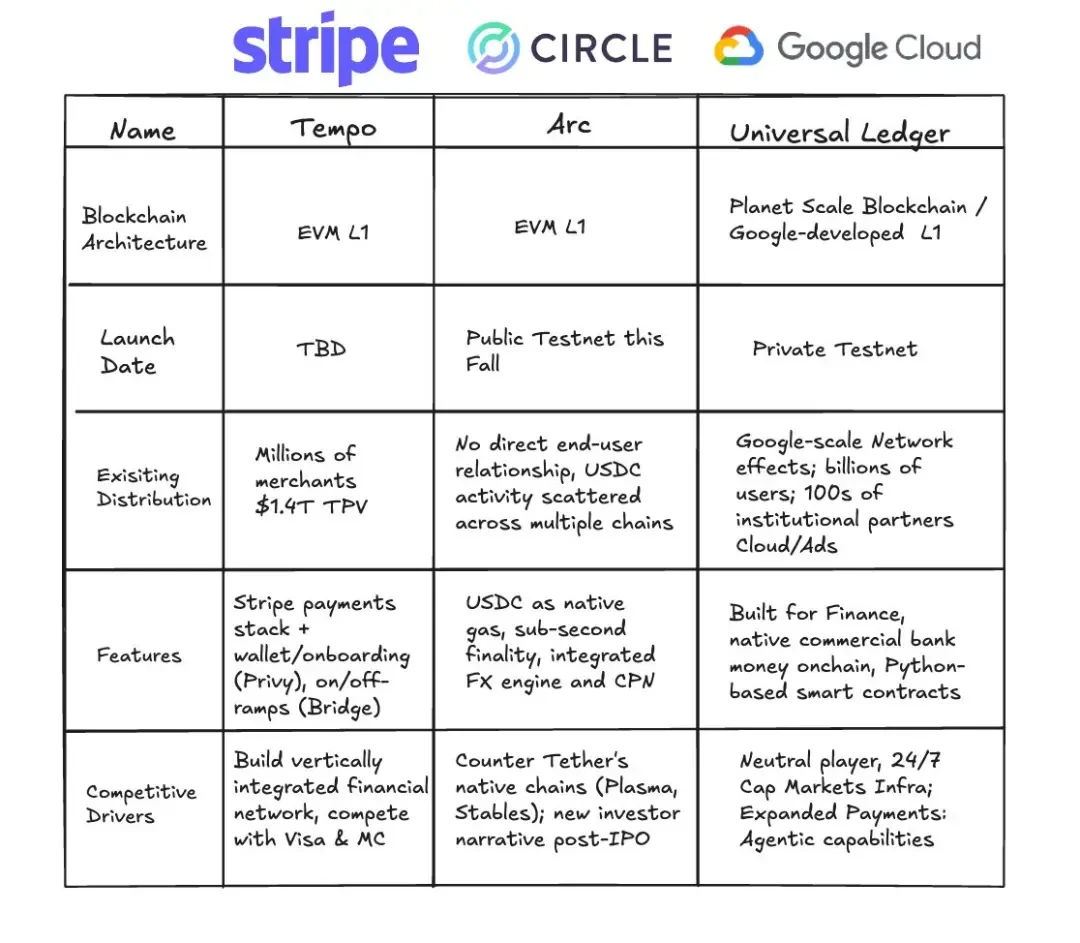

Plasma, Stable, and Arc aren't just three competitors in a single race; they're different paths toward the same vision: making the dollar as free as information. Looking at the bigger picture, the true battleground emerges: the issuer camp (USDT vs. USDC), the distributional moats of incumbent chains, and the permissioned rails that are reshaping enterprise market expectations.

Issuer Camp: USDT vs. USDC

We're witnessing two simultaneous races: competition among public chains and a battle among issuers. Plasma and Stablecoins clearly prioritize USDT, while Arc is dominated by Circle (the issuer of USDC). With PayPal Ventures investing in Stablecoins, more issuers are entering the market, each vying for distribution channels. In this process, issuers will shape the market entry strategies, target regions, ecosystem roles, and overall development direction of these public stablecoin chains.

Plasma and Stable may have chosen different market paths and initial target areas, but their ultimate anchor points should be the markets where USDT already dominates.

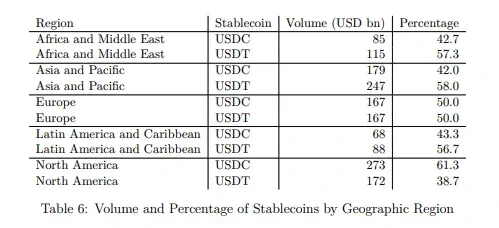

Tether's USDT performs more strongly in regions with more emerging markets, while Circle's USDC is more popular in Europe and North America. It's important to note that this study only covers EVM chains (Ethereum, BNB Chain, Optimism, Arbitrum, Base, and Linea) and does not include the Tron network, which has significant USDT usage. Therefore, USDT's actual real-world footprint is likely underestimated.

▲ source: Decrypting Crypto: How to Estimate International Stablecoin Flows

Beyond differing regional focuses, the strategic choices of issuers are reshaping their roles within the ecosystem—in turn, influencing the priorities of public stablecoin chains. Historically, Circle has built a more vertically integrated technology stack (wallets, payments, cross-chain), while Tether has focused on issuance/liquidity and relied more heavily on ecosystem partners. This divergence is now creating space for USDT-focused public chains, such as Stable and Plasma, to build more value chain components independently. Meanwhile, USDT 0 is designed to unify USDT liquidity to facilitate multi-chain expansion.

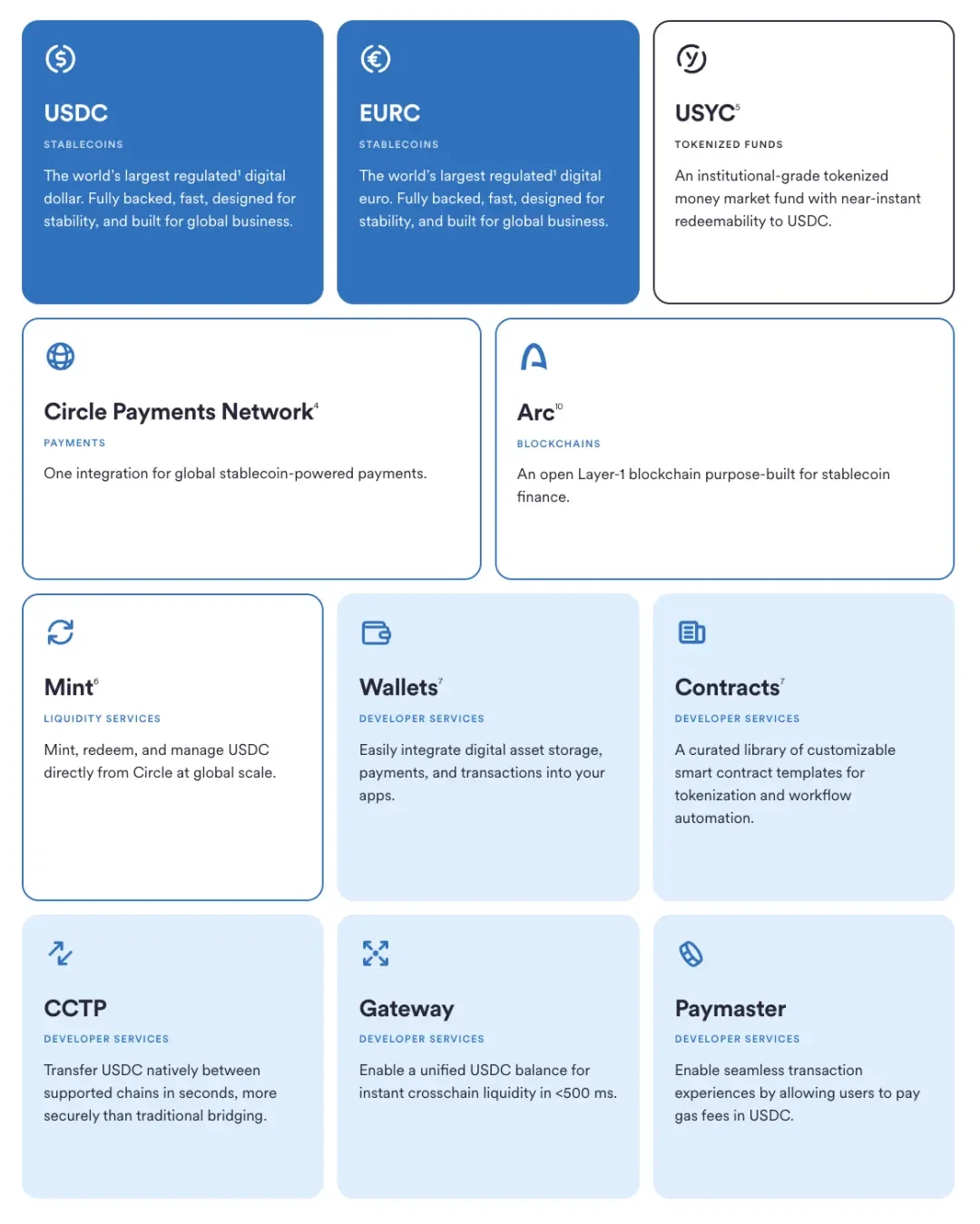

At the same time, Circle's ecosystem building has been cautious and cumulative: it started with the issuance and governance of USDC, then took back control by disbanding Centre and launching a programmable wallet. Next came CCTP, which transformed it from relying on cross-chain bridges to adopting a native burn-and-mint transfer method, thereby unifying cross-chain USDC liquidity. By launching the Circle Payments Network, Circle connected on-chain value with off-chain commerce. And Arc is the latest step in this game. Flank These core pillars are services for issuers and developers—Mint, Contracts, Gateway, and Paymaster (gas fees denominated in USDC)—which reduce dependence on third parties and tighten the feedback loop between product and distribution.

▲ source: Circle

Response strategies of existing public chains

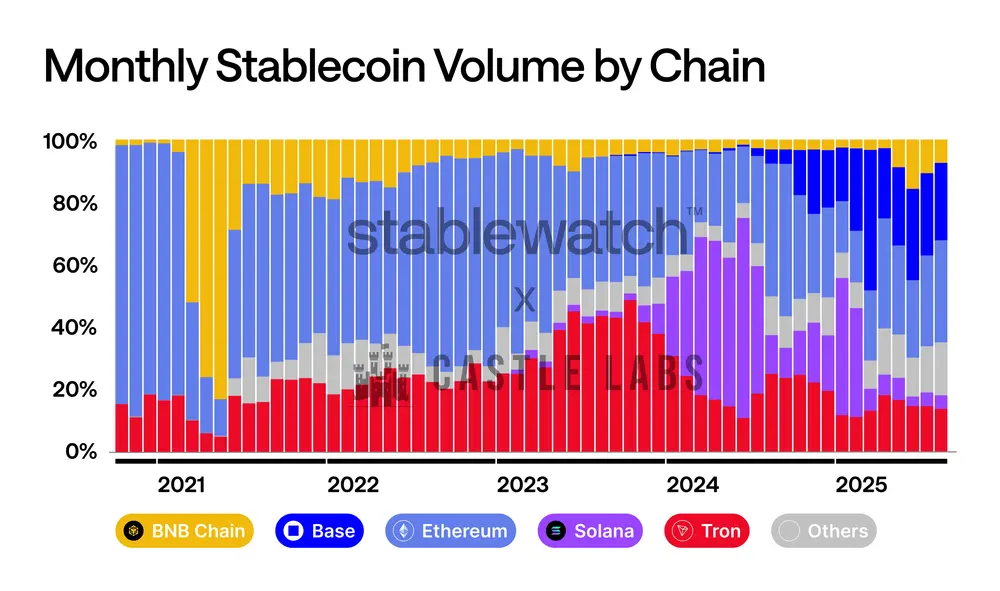

Competition for stablecoin trading volume has always been fierce. The dynamics of the market landscape are clearly visible: early on, Ethereum dominated, followed by the strong rise of Tron, the sudden emergence of Solana in 2024, and more recently, the growing momentum of Base Chain. No single chain can maintain its dominant position for long—even the strongest chains face competition for monthly market share. With the entry of specialized public chains focused on stablecoins, competition is bound to intensify, but incumbent giants will not easily cede market share; we can foresee that they will adopt aggressive strategies in terms of fees, finality, wallet user experience, and fiat currency exchange integration to defend and expand their stablecoin trading volume.

▲ source: Stablewatch

Major public chains have taken action:

- BNB Chain launched the "Zero Fee Carnival" campaign at the end of the third quarter of 2024, and cooperated with multiple wallets, centralized exchanges and bridges to completely waive users' USDT and USDC transfer fees. The campaign has been extended to August 31, 2025.

- Tron is moving in a similar direction. Its governance body has approved a reduction in the unit price of network "energy" and plans to launch a "gas-free" stablecoin transfer solution in the fourth quarter of 2024, further consolidating its position as a low-cost stablecoin settlement layer.

- TON takes a different approach, completely hiding this complexity through the Telegram interface. Users experience “zero transaction fees” when transferring USDT to contacts (the actual cost is borne or absorbed by the Telegram wallet within its closed-loop system). Normal network fees are only incurred when withdrawing to the open public chain.

- The core narrative behind Ethereum's L2 is a structural upgrade, not a short-term promotion. The Blob space introduced by the Dencun upgrade significantly reduces data availability costs for Rollups, enabling them to pass on these savings to users. Since March 2024, transaction fees on major L2 blockchains have declined significantly.

Permissioned Rails

A parallel track is accelerating: permissioned ledgers built for banks, market infrastructure, and large enterprises.

The most anticipated new addition is Google Cloud Universal Ledger, a permissioned Layer 1 blockchain. Google states that it targets applications in wholesale payments and asset tokenization. Although public details are limited, its leaders position it as a neutral, bank-grade blockchain, and CME Group has completed initial integration testing. GCUL is a non-EVM blockchain developed independently by Google, running on Google Cloud infrastructure and using Python smart contracts. Far from being a public blockchain, its model is based on trust in Google and regulated nodes.

▲ source:

https://www.linkedin.com/posts/rich-widmann-a 816 a 54 b_all-this-talk-of-layer-1-blockchains-has-activity-7366124738848415744-7 idA

If GCUL is a single cloud-hosted rail, the Canton Network adopts a "network of networks" model. Built around Digital Asset's DAML smart contract stack, it connects independently governed applications, enabling the synchronization of assets, data, and cash across different domains while maintaining granular privacy and compliance controls. Its roster of participants includes numerous banks, exchanges, and market operators.

HSBC Orion (HSBC digital bond platform) has been online since 2023 and has hosted the European Investment Bank's first pound-denominated digital bond - a £50 million issuance under the Luxembourg DLT framework through a combination of private and public chains.

In terms of payments, JPM Coin has provided value transfer services to institutions since 2020, supporting programmable intraday cash flows on rails operated by JPMorgan Chase. At the end of 2024, the bank reorganized its blockchain and tokenization product line into Kinexys.

At the core of these efforts lies a pragmatism: preserving regulatory guardrails and clear governance structures while drawing on the best of public blockchain design. Whether implemented as a cloud service (GCUL), an interoperability protocol (Canton), a productized issuance platform (Orion), or a bank-operated payment rail (JPM Coin/Kinexys), permissioned ledgers converge on a single promise: faster, auditable settlements under institutional-grade control.

in conclusion

Stablecoins have crossed the threshold from a niche crypto space to a payment network, and the economic implications are profound: when the cost of transferring a dollar approaches zero, the profit margin of charging fees for transferring funds disappears. The market's profit center shifts to the value that stablecoin transfers can provide.

The relationship between stablecoin issuers and public chains is increasingly evolving into an economic tug-of-war over who captures reserve yields. As we've seen with Hyperliquid's USDH, its stablecoin deposits generate approximately $200 million in treasury yield annually, which flows to Circle rather than its own ecosystem. By issuing USDH and adopting Native Markets' 50/50 revenue split—half going to buy back HYPE tokens through a support fund and half to ecosystem growth—Hyperliquid has "internalized" this revenue. This could be another direction beyond the "stablecoin public chain," where existing networks capture value by issuing their own stablecoins. The sustainable model would be an ecosystem where issuers and public chains share the economic benefits.

Looking ahead, auditable, private payments will gradually become standard for payroll, treasury management, and cross-border fund flows. This is achieved not by creating a "completely anonymous privacy chain," but by concealing the specific amounts in transactions while keeping the counterparty's address visible and auditable. Stable, Plasma, and Arc all adopt this model: providing enterprise-friendly privacy protection and selective disclosure capabilities, compliant interfaces, and a predictable settlement experience, thereby achieving "hiddenness when confidentiality is required and transparency when it is required."

We will see stablecoin and payment chains roll out more features tailored to enterprise needs. Stable's "Guaranteed Blockspace" is a prime example: a reserved capacity channel that ensures payroll, treasury, and cross-border payments are settled with consistent latency and cost, even during peak traffic. It's like a reserved instance in the cloud, but for on-chain settlement.

With the emergence of the next generation of stablecoins and payment chains, this will unlock even more opportunities for applications. We’ve already seen strong momentum in DeFi on Plasma, with consumer-facing frontends like Stable Pay and Plasma One, but the bigger wave is yet to come: digital banking and payment applications, smart proxy wallets, QR code payment tools, on-chain credit, risk stratification, and a new class of interest-bearing stablecoins and the financial products built around them.

The era when dollars can flow as freely as information is coming.

- 核心观点:稳定币支付公链正重塑金融基础设施。

- 关键要素:

- 稳定币年结算额达26万亿美元。

- 支付成本降至几美分,远低于传统3%费率。

- Plasma、Stable、Arc三大项目推动技术升级。

- 市场影响:推动零费率支付,催生新商业模式。

- 时效性标注:中期影响