"การปล่อยลมเพียงครั้งเดียว" ไม่น่าเชื่อถือ? โครงการ crypto ควรปรับปรุงกลยุทธ์การกระจายโทเค

ที่มา: Zee Prime Capital

โพสต์ต้นฉบับโดย @Luffistotle

การรวบรวมข้อความต้นฉบับ: Jordan, PANews

มักจะมีการออกอากาศและการประชาสัมพันธ์ที่เกี่ยวข้องในตลาด crypto แต่เราแนะนำว่าทุกโครงการ Web3 ควรพิจารณาวิธีการแจกจ่ายโทเค็นของโปรโตคอลใหม่

Token airdrops ไม่ใช่กลยุทธ์ที่ชาญฉลาด สำหรับโครงการ crypto ส่วนใหญ่ airdrops จะไม่ส่งผลดีมากกว่า "ความนิยม 5 นาที" บางครั้ง เมื่อการออกอากาศสิ้นสุดลง ดูเหมือนว่าจะมี "เวลาที่ต้องทิ้งความรับผิดชอบของฉัน" ไปที่โปรเจ็กต์ ดังนั้น "ของฟรี" เพียงอย่างเดียวไม่ได้ผลสำหรับความสำเร็จในระยะยาวอย่างแน่นอน หากเป้าหมายของคุณคือการทำให้ทรัพย์สินของโครงการมีค่ามากขึ้นเมื่อเวลาผ่านไป การทิ้งทุกๆ ครั้งก็เหมือนกับการขุด "ช่องโหว่" ของการเสื่อมราคาของทรัพย์สินเดิม " ทุนทางการเงินที่มากขึ้น

ในความเป็นจริง เหตุผลที่โครงการต้องการแจกจ่ายโทเค็นไปยังชุมชนการเข้ารหัสก็เพียงเพื่อให้ได้มาซึ่งลูกค้า หลายคนอาจไม่ทราบว่างานส่วนใหญ่ของยักษ์ใหญ่ด้านเทคโนโลยี Web2 คือการ "ทำยอดขาย" แต่ในขั้นตอนนี้ หลายๆ โครงการในสายงาน Web3 ดูเหมือนจะไม่ใส่ใจกับ "การขาย" และโมเดลธุรกิจการขายหลายๆ จะ "ขี้เกียจ" มาก

ในด้านของ Web2 ยักษ์ใหญ่ด้านเทคโนโลยีที่มีการเติบโตสูงบางรายมุ่งเน้นไปที่โมเดลการได้มาซึ่งลูกค้าขั้นพื้นฐานสองแบบ หลักหนึ่งคือต้นทุนการได้มาซึ่งลูกค้า (CAC) และอีกรูปแบบหนึ่งคือมูลค่าตลอดอายุการใช้งานของลูกค้า (CLV) สำหรับโครงการ Web3 โทเค็น Airdrop แต่ละรายการจะคล้ายกับค่าใช้จ่ายด้านการตลาดของบริษัท Web2 กล่าวคือ จะมีการชำระค่าใช้จ่ายในการจัดหาลูกค้า และมูลค่าตลอดอายุการใช้งานของลูกค้าคือผลตอบแทนทางเศรษฐกิจ (เช่น รายได้จากข้อตกลง) ที่ผู้ใช้นำมาผ่าน การใช้แพลตฟอร์ม ผลรวม สำหรับบริษัทเทคโนโลยีแบบดั้งเดิม หากค่าของ "CLV/CAC" สูงขึ้น แสดงว่าความสามารถในการแข่งขันในตลาดแข็งแกร่งขึ้น และนักลงทุนเต็มใจที่จะ "ผลาญเงิน" หากนักลงทุนไม่เห็นค่าระยะยาวนี้ พวกเขาจะเปลี่ยนแปลง กลยุทธ์ต่างๆ เช่น การลดต้นทุนการหาลูกค้า เพิ่มมูลค่าวงจรชีวิตของลูกค้า เป็นต้น อันที่จริง โครงการ Web3 ก็สามารถทำได้เช่นเดียวกัน

พูดง่ายๆ ก็คือ คุณทำเงินได้เมื่อ "มูลค่าตลอดอายุการใช้งานของลูกค้า" มากกว่า "ต้นทุนการได้มาซึ่งลูกค้าใหม่" และสูญเสียเงินเมื่อไม่ได้เป็นเช่นนั้น นอกจากนี้ วงจรการคืนเงินลงทุนก็มีความสำคัญมากเช่นกัน สำหรับนักลงทุนแล้ว พวกเขาหวังเป็นอย่างยิ่งว่าระยะเวลาการคืนเงินลงทุนจะสั้นที่สุดเท่าที่จะเป็นไปได้ การคืนต้นทุนการลงทุนภายใน 12-24 เดือนจะดีกว่าการรอ 5-7 เดือน ปี.

(หมายเหตุ: แนวคิดบางส่วนที่กล่าวถึงข้างต้นอาจเป็นประโยชน์กับโครงการ Web3 แต่บางแนวคิดไม่มีผลต่อโครงการ Web3 มากนัก)

ในด้านของ Web3 หากคุณต้องการให้ "โทเค็น airdropped" ของคุณมีบทบาทเป็น "เครื่องมือหาลูกค้าใหม่" ดังนั้นสำหรับโครงการ Web3 ที่แทบไม่ได้สร้างรายได้ในระยะเริ่มต้น (ในขณะนี้ มูลค่าตลอดอายุการใช้งานของลูกค้าของคุณต่ำมาก ) ) ขอแนะนำให้กำหนดชุดของกลยุทธ์ airdrop อย่างไม่เป็นทางการ โดยทั่วไปแล้ว ในฐานะเจ้าของโปรโตคอล เป้าหมายของคุณควรเป็นการออกอากาศโทเค็นให้มากที่สุดเท่าที่จะเป็นไปได้ให้กับคนที่เหมาะสม ซึ่งจะใช้แอปพลิเคชันของคุณในอนาคตและแปลงเป็นลูกค้าที่มีมูลค่าตลอดอายุการใช้งานสูง หากคุณออกอากาศโทเค็นทั้งหมด/บางส่วน ให้กับคนผิดก่อนเวลาอันควร ไม่เพียงแต่ พวกเขาจะละทิ้งผลิตภัณฑ์ของคุณในอนาคต แต่ พวกเขายังมีโอกาสน้อยที่จะแปลงผู้ใช้ที่มีมูลค่าตลอดอายุการใช้งานสูง และ มันจะยากสำหรับคุณที่จะสร้างผลิตภัณฑ์ที่เป็นมิตรต่อตลาดมากขึ้น ผลิตภัณฑ์

ในตลาดหลักทรัพย์แบบดั้งเดิม เหตุผลที่ผู้คนซื้อและถือหุ้นและตราสารทุนเป็นเพราะพวกเขาเชื่อว่าพวกเขาสามารถได้รับสิทธิในกระแสเงินสดในอนาคต และการซื้อหุ้น/ตราสารทุนที่มีศักยภาพจะทำให้พวกเขาได้รับมูลค่าที่คาดการณ์ได้ ดังนั้น หุ้นประเภทนี้และ Equity น่าสนใจมาก ในความเป็นจริงโทเค็นสามารถถือเป็นเครื่องมือการลงทุนที่คล้ายกับหุ้น หากคุณเปิดตัวโทเค็นการกำกับดูแลที่ไร้ค่า หมายความว่าผู้ถือไม่สามารถได้รับ "ผลประโยชน์ที่จับต้องได้" ดังนั้น ตราบใดที่มูลค่าของโทเค็นนี้มากกว่าศูนย์ ผู้ถือจะเลือกที่จะขายมากกว่าถือเป็นเวลานานโดยไม่ลังเล ท้ายที่สุด การถือครองโทเค็นการกำกับดูแลที่ไร้ค่าเป็นเพียงการสร้างเหตุการณ์สภาพคล่องสำหรับนักลงทุนรายแรกและทีมงานของโครงการ (แน่นอน ทีมงานโครงการหวังเป็นอย่างยิ่งว่ายิ่งมีผู้ถือโทเค็นการกำกับดูแลมากเท่าไรก็ยิ่งดีเท่านั้น)

ใครก็ตามที่ศึกษาเศรษฐศาสตร์จุลภาคจะเข้าใจความจริงอย่างชัดเจนว่า ราคาของสินค้าโภคภัณฑ์ใดๆ ถูกกำหนดโดยความสัมพันธ์ระหว่างอุปสงค์และอุปทาน ดังแสดงในรูปด้านล่าง:

หากคุณไม่สามารถสร้างอุปสงค์สำหรับโทเค็นได้ (ซึ่งในขั้นตอนนี้ของตลาดคริปโตหมายถึงการสร้างความต้องการให้ผู้คนจำนวนมากขึ้นถือครองโทเค็น) และเพิ่มอุปทานของโทเค็นต่อไป คุณสามารถจินตนาการถึงผลที่ตามมาได้ แม้ว่าราคาจะไม่ใช่ทุกอย่าง ดังที่เราเคยเห็นมาก่อนในเรื่องเล่าเกี่ยวกับโปรโตคอลมากมาย แต่ราคาก็เป็นปัจจัยที่สำคัญมากอย่างแน่นอน

1. แอร์ดรอป

1. แอร์ดรอป

โทเค็นแอร์ดรอปฟรีไม่ควรเป็นแบบ “ครั้งเดียวทิ้ง” และพูดตามตรง ฉันเคยเห็นตัวอย่างโทเค็นแอร์ดรอปที่ให้ผลลัพธ์ไม่ดีมาหลายครั้งแล้ว cpt n3mo นักวิจัยของบริษัทร่วมทุนสัญชาติเกาหลีใต้ Hased ได้ทำการวิเคราะห์เชิงปริมาณของ "การลดลงของโทเค็นแบบครั้งเดียว" และพบว่าในกรอบเวลาที่ต่างกัน ราคากลางแสดงประสิทธิภาพที่ต่ำมาก ประสิทธิภาพลดลง 36% ดังนั้น เป็นการยากที่จะบอกว่าโทเค็นกำลังเข้าสู่ "มือขวา" แม้ว่าโทเค็นแบบ airdrop เพียงครั้งเดียวสามารถบูตชุมชนและดึงดูดผู้ใช้รายแรกได้มากขึ้น แต่ก็ดูเหมือนจะไม่ได้ผลดีในระยะยาว

อย่างไรก็ตาม airdrops โทเค็นฟรีสามารถส่งผลกระทบต่อจิตวิทยาของผู้เข้าร่วมได้ (ลองนึกถึงผลการบริจาค เมื่อแต่ละคนเป็นเจ้าของไอเท็ม การประเมินมูลค่าของไอเท็มจะดีขึ้นอย่างมากเมื่อเทียบกับก่อนที่เขาจะไม่ได้เป็นเจ้าของมัน) และโครงการยังสามารถปล่อยระยะเวลาการล็อคโทเค็นได้นานขึ้นด้วยการจัดหากลไกการกระจายโทเค็นดังกล่าว ผู้เข้าร่วม airdrop จะได้รับประโยชน์มากขึ้น แม้ว่าจากมุมมองของการเก็งกำไร ผู้ใช้ที่สามารถเข้าร่วมการออกอากาศก่อนกำหนดจะได้รับประโยชน์มากขึ้น แต่ถ้า "กิจกรรมการออกอากาศ" กลายเป็นพฤติกรรมที่ต่อเนื่อง ก็อาจไม่ใช่เรื่องเลวร้าย

นอกจากนี้ยังมีข้อเสียของ "การทิ้ง Airdrop แบบครั้งเดียว": ผู้ใช้ใหม่รู้สึกว่าพวกเขากำลังพลาดระบบนิเวศซึ่งเป็นโอกาสที่ดี ซึ่งจริงๆ แล้วกระทบต่อการรับเลี้ยงบุตรบุญธรรม เพราะผู้ใช้ใหม่รู้สึกว่า "โอ้ Airdrop จบแล้ว เรียนรู้เกี่ยวกับระบบนิเวศนั้น มันไม่มีความหมายเลย” จากมุมมองนี้ โครงการ Web3 สามารถกระตุ้นผู้สนับสนุนรายแรก ๆ ในรูปแบบของ “การพัฒนาระยะยาว” แทนที่จะถูกเพิกเฉยหลังจากปล่อยโทเค็นเพียงครั้งเดียว แต่การเปลี่ยนแปลงพื้นฐานที่สุดคือการเปลี่ยนธรรมชาติของ airdrops ให้เป็น warrant และเปลี่ยนกระบวนการจูงใจจากแบบไม่ต่อเนื่องเป็นต่อเนื่อง การมองในแง่ดีเป็นตัวอย่างที่ดี แรงจูงใจมีหลายขั้นตอน แม้ว่าระยะเวลาจะยาวนานกว่า แต่อย่างน้อยก็เป็นขั้นตอนที่สำคัญใน ทิศทางที่ถูกต้อง

แล้วเราจะบรรลุ “ความยั่งยืน” ได้อย่างไร? คำตอบนั้นง่ายมาก คือการทำให้ผู้เล่นใหม่เป็นส่วนสำคัญของระบบนิเวศ (การมีส่วนร่วมในผลิตภัณฑ์ใหม่ การกำกับดูแล ฯลฯ) ในขณะเดียวกันก็อนุญาตให้พวกเขาได้รับผลประโยชน์ที่คล้ายกันกับผู้ใช้ที่มีอยู่ โปรเจ็กต์ไม่สามารถปฏิเสธ "สิทธิพิเศษ" ของผู้ใช้เพียงเพราะว่าพวกเขามาเล่นเกมช้า นับประสากับผู้ใช้ใหม่จำนวนมากที่เพิ่มมูลค่าให้กับโปรเจ็กต์จริงๆ สิ่งที่คุณต้องการทำคือดึงดูดผู้ใช้ที่สร้างคุณค่าสูงสุดให้กับโปรเจ็กต์ ไม่ใช่ผู้ใช้ที่เข้าสู่ตลาดก่อน

ชื่อระดับแรก

2. ออกแบบกลไกการกระจายโทเค็นของชุมชน

จะสร้างกลไกการกระจายโทเค็นของชุมชนได้อย่างไร แนวทางที่น่าสนใจคือการออกแบบ "gamified KPI" ที่ใช้กลไก KPI เพื่อปรับอัตราการกระจายโทเค็น ขณะนี้ Zee Prime Capital กำลังสำรวจแนวทางนวัตกรรมที่มุ่งปรับวิสัยทัศน์ของโปรโตคอลให้สอดคล้องกันและผลตอบแทนของชุมชน

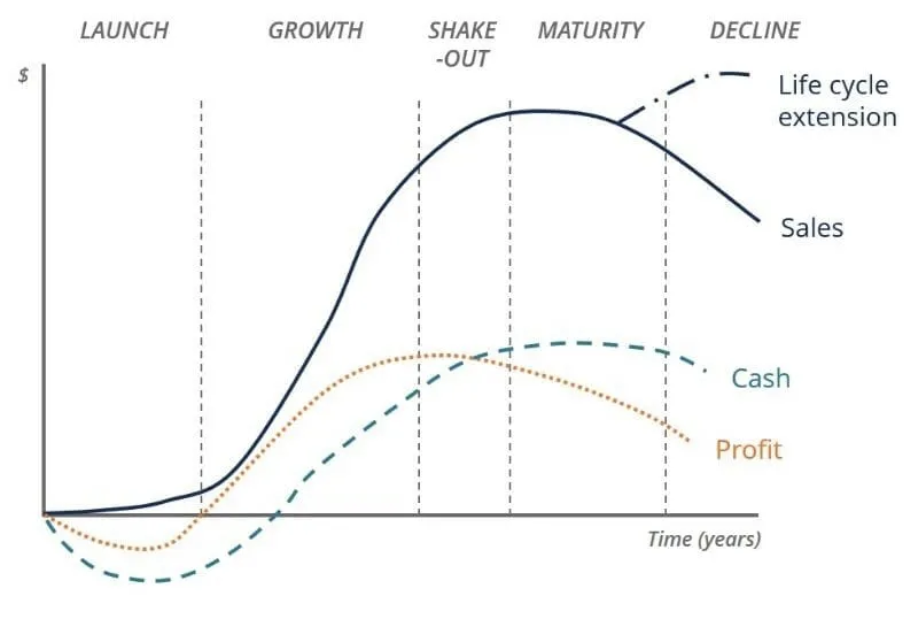

ตัวอย่างเช่น คุณสามารถปรับอัตราการปล่อยโทเค็นสำหรับเมตริกรายได้ ตรวจสอบให้แน่ใจว่าผู้ถือโทเค็นมีกำไรในระหว่างขั้นตอนการยอมรับโครงการ และจัดวงจรชีวิตลูกค้าให้สอดคล้องกับวงจรความสำเร็จของโครงการ ยิ่งขยายวงจรชีวิตลูกค้ามากเท่าไหร่ วงจรความสำเร็จก็จะยิ่งมากขึ้นเท่านั้น อีกต่อไป (คุณสามารถอ้างถึงความสัมพันธ์ระหว่างเส้นทางการพัฒนาวงจรชีวิตและความสามารถในการทำกำไรขององค์กรแบบดั้งเดิม)

ชื่อระดับแรก

3. สำรวจวิธีการกระจายโทเค็นที่สร้างสรรค์

ไม่ต้องบอกว่าวิธีการกระจายโทเค็นใด ๆ นั้นมีความเสี่ยง มาตรฐานการตรวจสอบที่เป็นที่รู้จักคือการโจมตีแบบเปิดของ Sybil แต่วิธีที่ดีที่สุดในการลดความเสี่ยงอาจยังคงเพิ่มประสิทธิภาพและปรับปรุงมาตรฐานการกระจายโทเค็นอย่างต่อเนื่อง เพื่อให้ต้นทุนลดลงจนถึงระดับความคลาดเคลื่อนที่ยอมรับได้ แทนที่จะใช้เฉพาะค่าจริง ของรายได้ airdrops แบบดั้งเดิม

ดังนั้นเราจึงจำเป็นต้องคิดค้นวิธีการแจกจ่ายโทเค็นของโครงการ เช่น การอนุญาตการปรับเปลี่ยนกลยุทธ์การแจกจ่ายโทเค็น และให้ส่วนลดมากขึ้นแก่ผู้ใช้ที่รอเวลาปล่อยโทเค็นนานขึ้น พูดง่ายๆ ก็คือ เมื่อสำรวจนวัตกรรมในวิธีการแจกจ่ายโทเค็น สิ่งที่สำคัญที่สุดคือความคิดสร้างสรรค์

ในเรื่องนี้ ตัวอย่างหนึ่งที่โดดเด่นในตลาด crypto คือระบบ KARMA ของ Brahma Finance KARMA เป็นระบบคะแนน (ผูกมัดด้วยจิตวิญญาณ) ที่ผู้ใช้จะได้รับรางวัลสำหรับการทำงานหนักในชุมชน แต่สิ่งจูงใจจะมอบให้ตามกิจกรรม และคะแนนรางวัลอาจลดลงหากคุณไม่ใช่นักกิจกรรมในชุมชน หากคุณสามารถรับคะแนน KARMA ที่สูงขึ้นได้ คุณก็มีสิทธิ์เข้าถึงห้องนิรภัยพิเศษบนโปรโตคอลและรับสิทธิประโยชน์อื่นๆ (เช่น การซื้อสินค้าหายาก การเข้าถึงโปรโมชั่น) ปัจจุบัน บราห์มาไฟแนนซ์กำลังจะเปิดตัว KARMA V2 โดยมีเป้าหมายเพื่อโปรโมตระบบนี้ไปยังโปรโตคอลอื่นๆ มากขึ้น

KARMA V2 ของ Brahma Finance จะเป็นระบบรางวัลอย่างต่อเนื่องสำหรับผู้ใช้ขั้นสูงซึ่งสามารถลดต้นทุนการได้มาซึ่งผู้ใช้ได้อย่างมากเมื่อเทียบกับเงินอุดหนุนโดยตรง ทีมงานสามารถเพิ่ม "โทเค็นลดราคา" หรือ "โทเค็นฟรี" ตามคะแนน KARMA ฯลฯ ตัวเลือก ฟังก์ชันการจัดการระบบยังสามารถช่วยให้โครงการวางแผนการเผยแพร่โทเค็นได้ดีขึ้น เช่น จำเป็นต้องปรับจำนวนการเผยแพร่โทเค็นและเวลาเผยแพร่ให้ตรงกับค่าโปรโตคอลหรือไม่

สรุป

สรุป

กล่าวโดยย่อ รูปแบบการกระจายเหรียญที่ดีกว่าควรมีลักษณะดังต่อไปนี้:

1. สิ่งที่อนุญาตให้ผู้ใช้ซื้อในราคาลดควรเป็น "ใบสำคัญแสดงสิทธิ" แทน "โทเค็น airdrop"

2. ผ่านกระบวนการที่ยั่งยืน โครงการสามารถให้รางวัลแก่ผู้ใช้ในระยะเวลาที่นานขึ้น

3. กำหนดมาตรฐานไดนามิกที่ปรับเปลี่ยนได้

4. ออกแบบและทดสอบกลไกการกระจายโทเค็นที่สร้างสรรค์ยิ่งขึ้น

ในความเป็นจริง ในช่วงต้นปี 2017 Fred Ehrsam ผู้ร่วมก่อตั้ง Coinbase ได้กล่าวถึงมุมมองที่คล้ายกันในบล็อกของเขา โดยหวังว่าโครงการจะสามารถปรับมูลค่าการพัฒนาของตนเองให้สอดคล้องกับสิ่งจูงใจที่ผู้ใช้ติดตาม:

"ผู้ออกแบบโปรโตคอลต้องคิดเกี่ยวกับวิธีออกแบบลักษณะวิวัฒนาการของบล็อกเชน โดยเฉพาะอย่างยิ่ง ออกแบบชุดสิ่งจูงใจทางเศรษฐกิจเพื่อให้ผู้คนเข้าร่วมมากขึ้น จากนั้นเพิ่มประสิทธิภาพและปรับปรุงอย่างต่อเนื่อง"

Fred Ehrsam พูดถูก เป้าหมายสูงสุดของโปรเจ็กต์/โปรโตคอลการเข้ารหัสคือการ "จัด" คุณค่าของตัวเองให้สอดคล้องกับความสนใจของผู้ใช้ และนี่คือมู่เล่ที่จะเปลี่ยนการพัฒนาโปรเจ็กต์/โปรโตคอลให้ประสบความสำเร็จในระยะยาว การเกิดขึ้นของระบบโทเค็นแบบกระจายอำนาจทำให้เราเห็นว่าเป้าหมายนี้สามารถกลายเป็นจริงได้ แต่เราต้องคิดอย่างรอบคอบและพยายามจัดแนวคุณค่าของโครงการให้สอดคล้องกับความสนใจของผู้ใช้

ในขณะเดียวกัน การใช้ระบบโทเค็นแบบกระจายอำนาจไม่ได้รับประกันการบรรลุเป้าหมายของ "คุณค่าในตัวเองที่สอดคล้องกันและความสนใจของผู้ใช้" - 99% ของโครงการเข้ารหัสได้พิสูจน์สิ่งนี้แล้ว วิถีการพัฒนาของโทเค็นส่วนใหญ่ก็คล้ายกัน ในแผนภูมิต่อไปนี้ (แนวโน้มราคาโทเค็นที่แสดงในแผนภูมินี้ดูคุ้นเคยหรือไม่):

ดังนั้นเราจึงควรผลักดันขอบเขตและช่วยโครงการ crypto สร้างและสร้างวิธีการกระจายโทเค็นที่ดีขึ้น