Weekly Editors' Picks Weekly Editors' Picks (0702-0708)

"Weekly Editor's Picks" is a "functional" column of Odaily.On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Now, come and read with us:

Now, come and read with us:

Investment and Entrepreneurship

Investment and Entrepreneurship

Dragonfly Capital: Why did DeFi lag far behind L1 in the last cycle?

Looking back, the underlying token has a better risk-reward ratio than any application based on it, at least for now. Most of the hype around DeFi is because it can bring "users" and "liquidity" to L1. However, when users do come to L1, most of the time they are attracted to staking incentives, which they quickly discover are the only things they can do on the blockchain. Not only is the growth of DeFi highly dependent on L1 scaling, but their advantages are also limited by the ecosystems they belong to.

Re-examining the continuous token model: "to Rug" or "Not to Rug"?

DeFi will get exciting again when new categories emerge that can bring real users onto the blockchain who have real financial needs that DeFi can serve. While the rise of NFTs and Web3 in the second half of the cycle has shown a different kind of demand than over-leveraged tokens, these categories will attract new users and reconnect them to DeFi, which will be the story of the next cycle.

Re-examining the continuous token model: "to Rug" or "Not to Rug"?

A bit complicated and lengthy, but helpful for project parties, especially economic designers. The core of the article is to analyze whether the continuous token model bonding curve can be used as a mechanism for stabilizing prices.

The most popular strategy now is that the team uses token issuance to start the community and incentivize the creation of liquidity pools, all of which revolve around a token. It is common for token launch programs to double the liquid supply over the course of a few months to the benefit of holders and stakers. However, if there is not a large enough supply to offset these releases, the growth in token supply will exceed the growth in protocol utility (demand).

DeFi

And the bonding curve is at the heart of the continuous token model. This is the mapping between input and output. Expand supply when there is excess prosperity, contract when the market begs for mercy. The bonding curve acts as a buffer against declines and acts as a dampener for altcoin price movements.

Binary Research: Infinity War for Decentralized Exchanges (DEX)

In the DEX transaction scenario, user assets are stored in personal wallets, and will not be hosted in a centralized exchange like CEX. The use feature of DEX is to use it as it is and leave it when it is used up. Coupled with the open source characteristics of the blockchain industry, DEX is very It is difficult to form the user network effect of Internet products, and it is also difficult to form a moat.

The article also compares four model schemes: the centralized liquidity of UniSwap V3, the joint curve of Curve, the discrete liquidity of Izumi, and the PMM algorithm of DODO.

The author's core point is: the UNI community should eliminate its dependence on Uniswap Labs - Uniswap Labs should eventually become one of the (probably the most important) teams working on behalf of Uniswap, and the Uniswap community should start to maximize its own value in the short term journey of transformation.

NFT, GameFi and Metaverse

NFT, GameFi and Metaverse

In-depth analysis of the correlation between NFT and ETH

(NFTGo.io calculates the market value of NFT based on the maximum value between the floor price of the NFT collection and its latest transaction price to exclude some of the highest-priced collections and reflect the total value of the collection.)

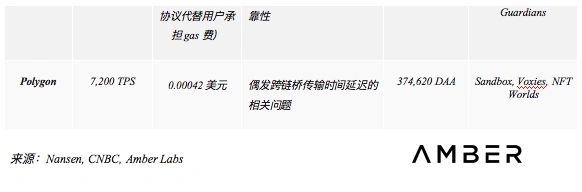

Amber Group: Blockchain of choice for crypto games

A number of games have successfully achieved multi-chain launch. Some games have migrated to new chains (e.g. Axie Infinity), while others have forged entirely new domains with different economic models (e.g. DeFi Kingdoms, Stepn).In addition, I recommend this article "Incuba Alpha Labs" to chain game practitioners》。

Web 3.0

"Ten Questions and Ten Answers" The Difficulties and Prospects of Blockchain Games

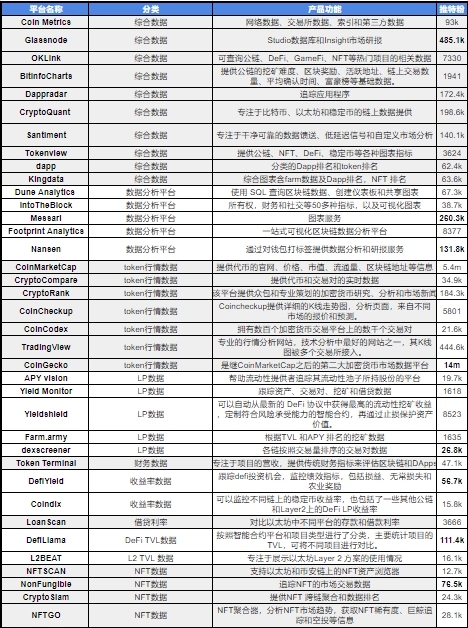

One article summarizes the third-party data platform on the chain

Ethereum and scaling

It is more suitable for newcomers in the industry to establish data thinking and information collection methodology on the chain.Ethereum and scaling》《This week, there are many long articles about L2, and I recommend "》《In-depth interpretation of Layer2 scalability: How does the project choose between ZK-Rollups and subnets?》《In-depth analysis of StarkWare: Want to build a ZK "universe"?Bankless: The end of the L2 token competition

, from different angles.

Foresight Ventures: "Combined for a long time must be divided" modular blockchain and data availability layer

The modular division of the blockchain is very similar to the distributed system in Web2, which essentially splits the business. In addition to breaking through performance bottlenecks, modular blockchains can also enhance security, execution performance, development composability, and improve iteration efficiency and pluggable options. There are three major types of practices in modular blockchain networks: Rollup, Multi-Monolithic, and Subnet.

New ecology and cross-chain

Modular blockchains will be the basis for widespread engineering and practice of blockchains.

New ecology and cross-chain

Establish a Layer 1 evaluation framework from five dimensions

The higher the fees paid to validators, the more secure the network and the higher the settlement assurance. The current blockchain network spends more on security costs than its own income.

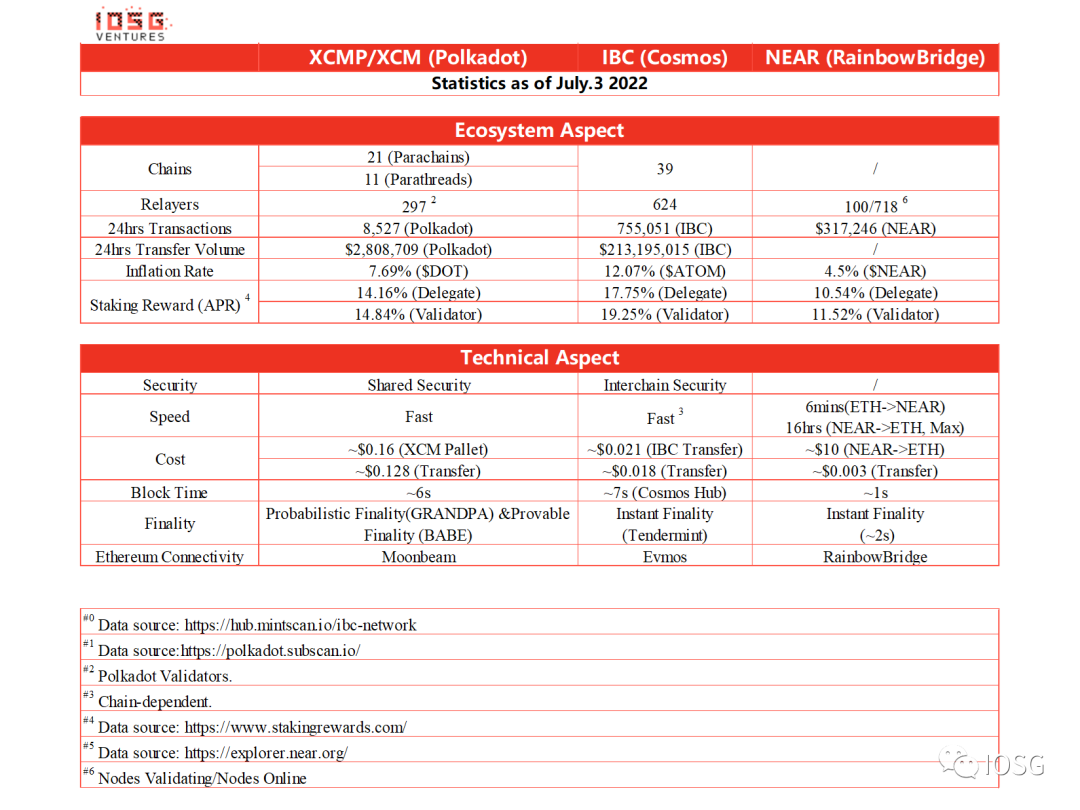

IOSG Ventures: Explain the status quo and future pattern of multi-chain ecology in detail

The advantage of the light client lies in security. By verifying certain information, the two chains can know what happened on the opponent chain without relying on the assumption of trust in the external verifier, so the security is basically equivalent to the chain itself. The native communication mechanism of Polkadot and Cosmos solves the connectivity problem within the ecosystem well.

DAO

hot spots of the week

hot spots of the week

In the past week,Three Arrows CapitalIn the past week,Three Arrows CapitalHas filed for bankruptcy protection in New York court, CelsiusdownsizingAbout 150 people, accounting for a quarter of the total number of employees, CelsiusPaying off $120 million in Maker debt, and againRepay 34.4 million DAI to Maker、, Celsius related address,CelsiusTransferred nearly 20,000 ETH24462 WBTCreorganization of the board of directors,, the U.S. tax law may write off "non-commercial bad debts" for investors in platforms such as Celsius0xb1 Twitter accountfile for bankruptcy protectionFormer KeyFi CEO Jason Stone behind is suing Celsius, accusing the latter of operating a "Ponzi scheme," Voyager Digitalfile for bankruptcy protection,, with more than 100,000 creditors expected,Plan to repay user assets through Sanjian repayment, distribution of new shares and platform tokens$377 million in debt to Voyager,CoinLoanAlameda Research hasCrema FinanceReturn the Voyager loan and get back the collateral

lower the withdrawal amount,In addition, in terms of policies and macro markets, the U.S. Department of the Treasury issued the "》,RussiaRussiaMonetary Authority of SingaporeMonetary Authority of Singaporecentral african republicOr consider restricting retail investors from investing in cryptocurrencies,central african republicCentral Bank Digital Currency Research Institute

perspectives and voices,CircleApply for a "smart contract" patent;BlockFiperspectives and voices,TPS CapitalIt means that 50% of the customer funds held are short-term positions, and 10% are used as collateral.

Institutions, large companies and top projects,Said that the company is independent of Three Arrows Capital and is also one of the creditors of Three Arrows Capital;Zhao ChangpengBinancesaid it is in acquisition talks with more than 50 crypto companies,BinanceEthereum Sepolia Testnet

NFT and GameFi fields,Othersidethe merger has been completed;STEPNNFT and GameFi fields,RedditWith "Editor's Picks of the Week" series

With "Editor's Picks of the Week" seriesPortal。

See you next time~