Binary Research:去中心化交易所(DEX)的无限战争

Researcher:Larry Shi @Basics Capital

Contributor:Ashley Lin

Celsius和3AC的流动性危机引发的连环清算再次把CEFI的中心化问题推到了风口浪尖,AEX、HOO的爆雷也将被遗忘许久的CEX问题再次推上了桌面。

极端的市场行情是一面照妖镜,照出了CEFI的真正面目,也照回了去中心化的本真。当资产的交易和存储还在考验人性,而不是依靠技术本身的时候,对用户而言所有的CEFI都在同样的风险之下。

DEFI取代CEFI,至少在加密行业将是必然,或早或晚。

DEX是DEFI的最底层的应用型基础设施,也是DEFI的起点,所有DEFI项目的链上交互基本都要DEX的支撑,DEX交易场景下,用户资产存储在个人钱包,不会像CEX一样托管在中心化交易所,DEX的使用特征是用之方来,用完即走,加之区块链产业的开源特征,DEX很难形成互联网产品的用户网络效应,也很难形成护城河,就连Uni也只能被迫给V3申请了两年的版权保护,所以这个赛道的头部选手参与的更像一场无限战争。

一、趋势迁移

1.流动性迁徙

2022年5月初,Paradigm发布的一篇最新研究报告表明,与头部中心化加密交易平台相比,在ETH/USD、ETH/BTC、以及其他ETH交易对方面,Uniswap协议V3具有更深的流动性。

就2021年6月至2022年3月的数据取样,在ETH/USD交易对上,Uniswap流动性是Binance和Coinbase两个中心化交易平台的2倍;2022年2月至2022年3月对ETH/BTC交易对分析的取样,对于ETH/BTC,Uniswap流动性比Binance高出约3倍,比Coinbase高出约4.5倍。

这是一个令人震惊的结果,却又在情理之中。

Uniswap最初从长尾资产入手,通过独创的AMM对传统订单簿模式的CEX发起侧翼进攻,在CEX上无人问津的小币种在Uniswap找到了流动性,一时成为市场的焦点。

但我们认为这些都是表象,Uniswap更大的魅力在于其运作模式对资产所有权的尊重,它非托管的交易模式必定会成为交易市场的主流,因为中心化交易所资产托管的模式终究背离了资产所有权和控制权属于个人的区块链精神,Mt.GOX被盗,Fcoin 跑路始终是行业的一块块伤疤;加之今年战争的极端市场下,Coinbase等交易所对特定国家账户的封禁;当前暴跌行情下,AEX和HOO的提现问题,这一系列的事件都在加速着交易重心从CEX向DEX的转移。

迁移是悄无声息的,但易位却是显而易见的,悄无声息在过程,显而易见在结果,结果正如Paradigm的报告所述。

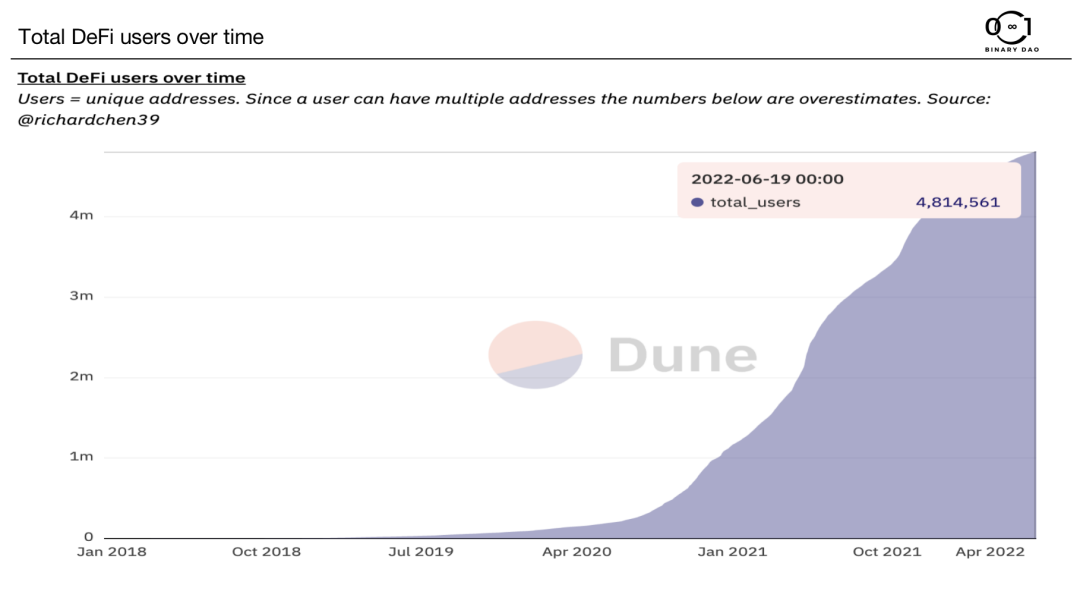

2.用户迁徙

根据DUNE上的DEFI用户增长趋势可以看出,自2018年DEX诞生以来,这场迁移已然开始,至今加密行业的DEFI用户已有481万之多,而且方兴未艾。毕竟,CEX的出现和发展只能算是WEB3.0时代过渡阶段的妥协性解决方案,只是这种现象级的共存还需要相当长的时间。

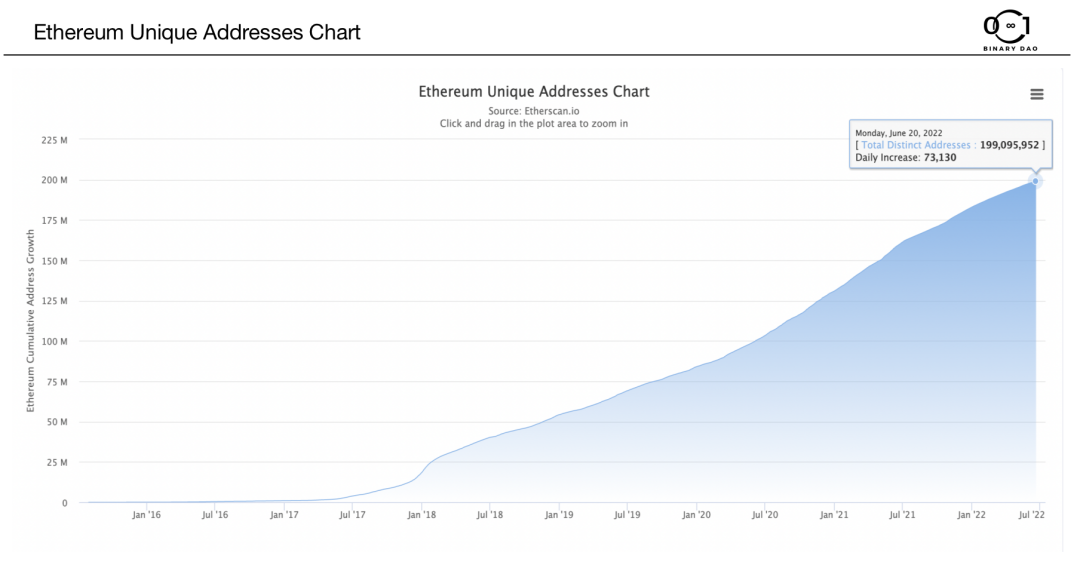

以太坊钱包地址增长是最有说服力的指标之一,2017年的区块链产业讲的是协议层的叙事,虽千链丛生,但所谓的区块链技术除了炒币,再无应用。

彼时以太坊钱包的实际地址数刚过百万,而DEFI的生态正是在以太坊发生并且逐步成长的,根据ETH的地址数增长趋势图可以看出2018年之后整个区块链产业的链上运动浩浩荡荡,一往无前。

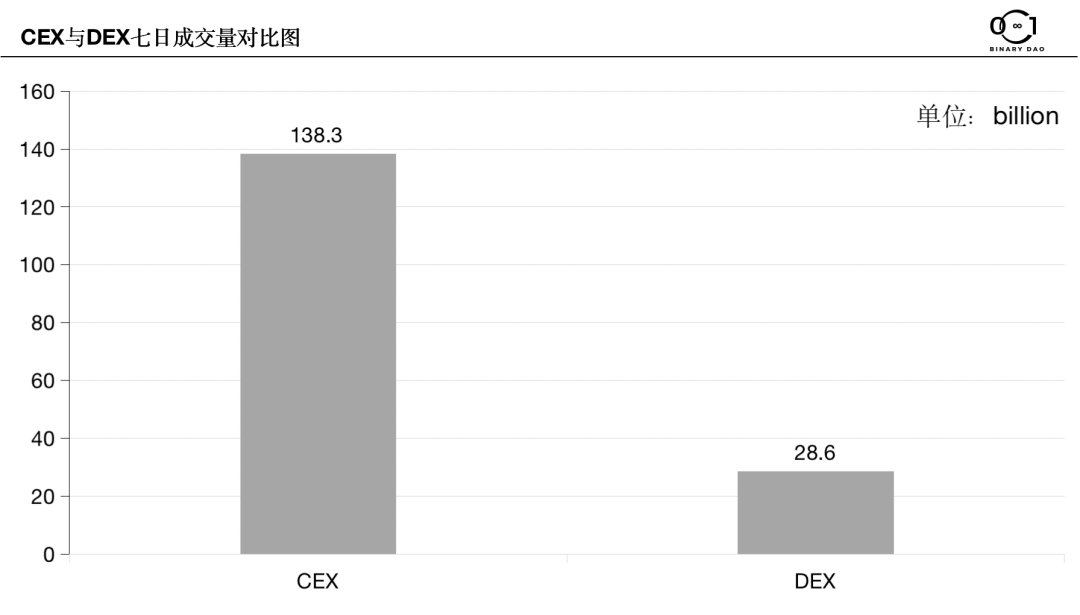

3.成交量迁徙

从交易量来看,取6月份近7天成交额的总和做对比,DEX的总成交额已经接近CEX总成交额的20%,可见DEX已经逐渐成为不可忽视的一股力量,特别是大额订单的执行上,Curve和UniSwap等DEX体现出强劲的优势。

二、DEX战争

当前市场流动性困境之下,DEFI市场资金持续出逃,DEX的TVL自然也难以幸免,流动性匮乏的的后果是DEX的用户体验也变得越来越差,不同DEX对存量用户的争夺日趋激烈。

什么样的DEX才是用户所需,哪些因素才是市场所要?

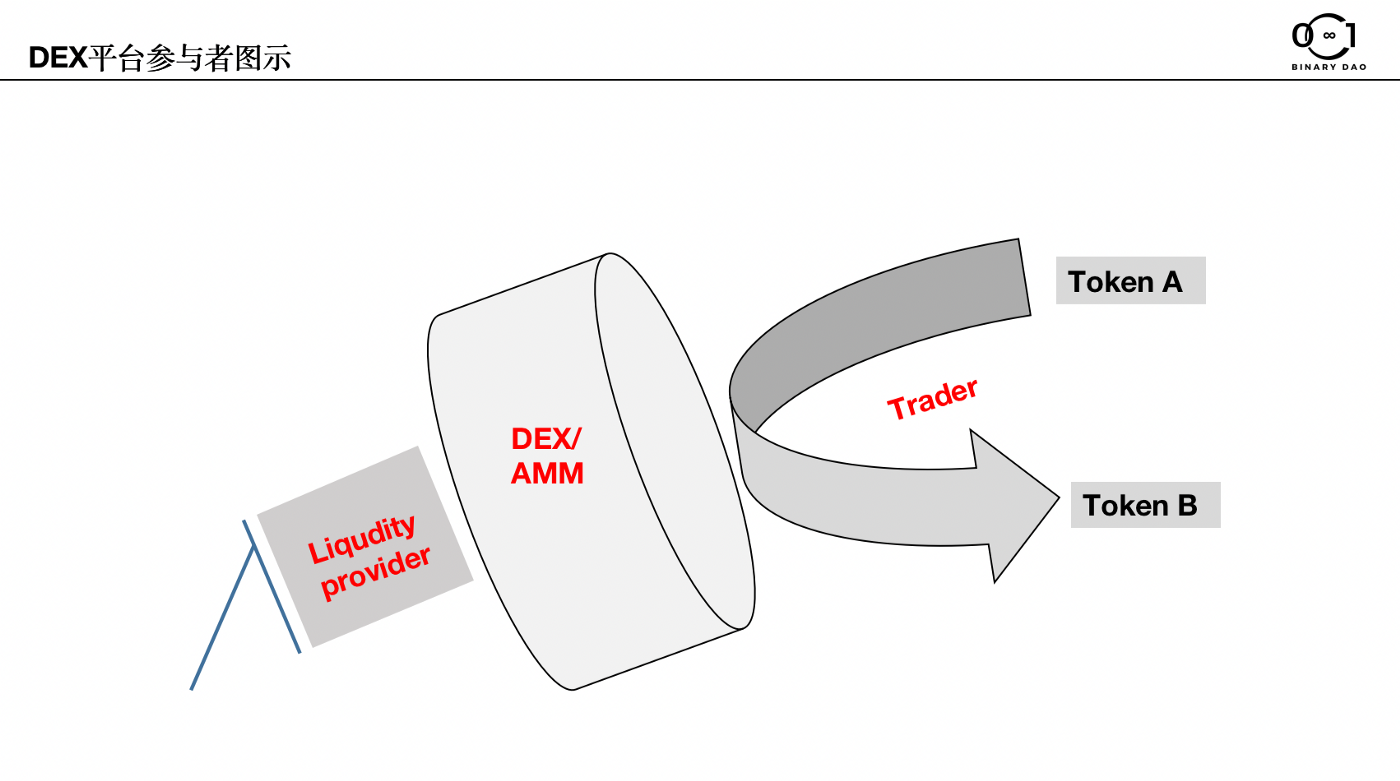

我们拆解DEX的参与主体,主要包含Trader、DEX平台和Liquidity Provider三个部分,AMM的出现让DEX从理论变成了现实,特别是AMM+LP的组合让点对池的操作得以实现,特别是UniSwap2.0之后仿盘尽出,绝大部分DEX平台都是千篇一律,市场的链上流动性变得逐步分散。

就DEX的竞争而言,谁能获得更好的用户体验,谁才能握住用户和资金的流向,DEX竞争的基本单位是什么?

首先,交易平台竞争力的根本是资产安全,在这点上DEX非托管的模式并无差异。

其次,站在用户视角,Trader的需求永远都是以最好的价格买到自己想要的token或者卖出自己的token,所以对Trader而言,报价优势和流动性优势这两个基本要素尤为重要。

报价优势指的是,对于某个特定资产而言,以在其特定时间的刚性出售需求而言,哪个平台能给出更好的价格,用户就会选谁。

流动性优势是指,在相对优势的价格之下,谁能承载更好的流动性,用户就会选谁。

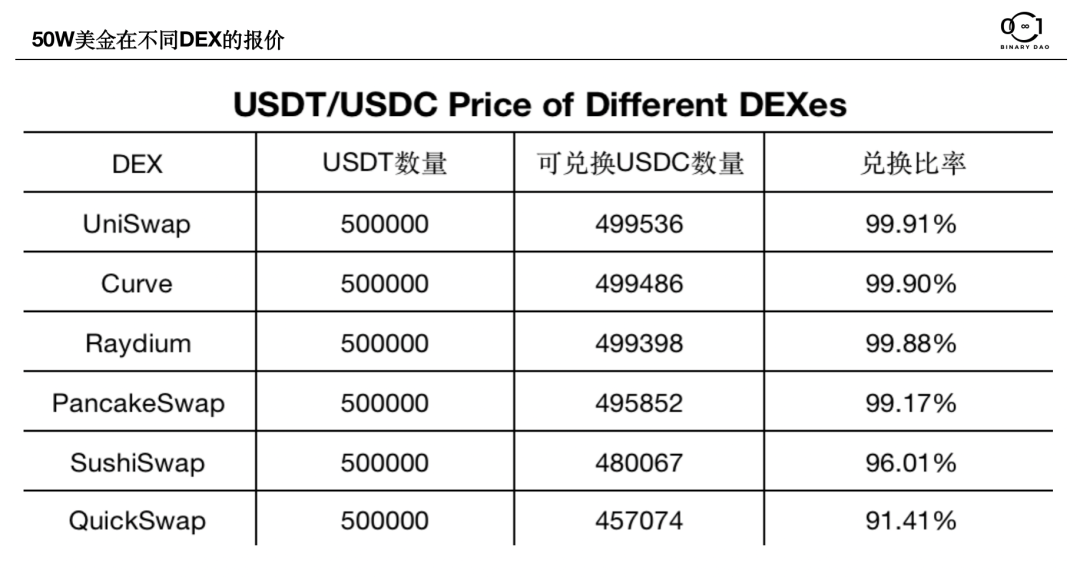

我们以50W枚USDT交易需求在市场不同DEX报价,发现各个平台可兑换的USDC差异额非常大。

显而易见,其中UniSwap V3在这一交易对的报价方面表现最好,50W枚USDT可兑换为499536枚USDC,在这个特定的时间段表现最好,Uni V3的集中流动性解决方案居功至伟。

显而易见,其中UniSwap V3在这一交易对的报价方面表现最好,50W枚USDT可兑换为499536枚USDC,在这个特定的时间段表现最好,Uni V3的集中流动性解决方案居功至伟。

关于其他链上的几个交易平台对50W枚USDT的报价分别是:Curve上可兑换499486枚USDC,Raydium上可兑换为499398枚USDC,Pancake上可兑换为495852枚USDC,Sushi上可兑换为480067枚USDC,QuickSwap上可兑换为457074枚USDC,可见各个平台的报价差异非常之大,因为AMM的交易执行有别于CEX的订单簿模型,所以报价优势和流动性优势直接影响了Trader的交易体验,最终会形成各个DEX自己的差异化优势。

关于其他链上的几个交易平台对50W枚USDT的报价分别是:Curve上可兑换499486枚USDC,Raydium上可兑换为499398枚USDC,Pancake上可兑换为495852枚USDC,Sushi上可兑换为480067枚USDC,QuickSwap上可兑换为457074枚USDC,可见各个平台的报价差异非常之大,因为AMM的交易执行有别于CEX的订单簿模型,所以报价优势和流动性优势直接影响了Trader的交易体验,最终会形成各个DEX自己的差异化优势。

再者,在用户视角,从市场需求的导向来看,对Liquidity Provider而言,谁能提供更高的资本效率,谁就能捕获更多的LP,而LP+LP资本效率也正是其能满足Trader需求的根本支撑。

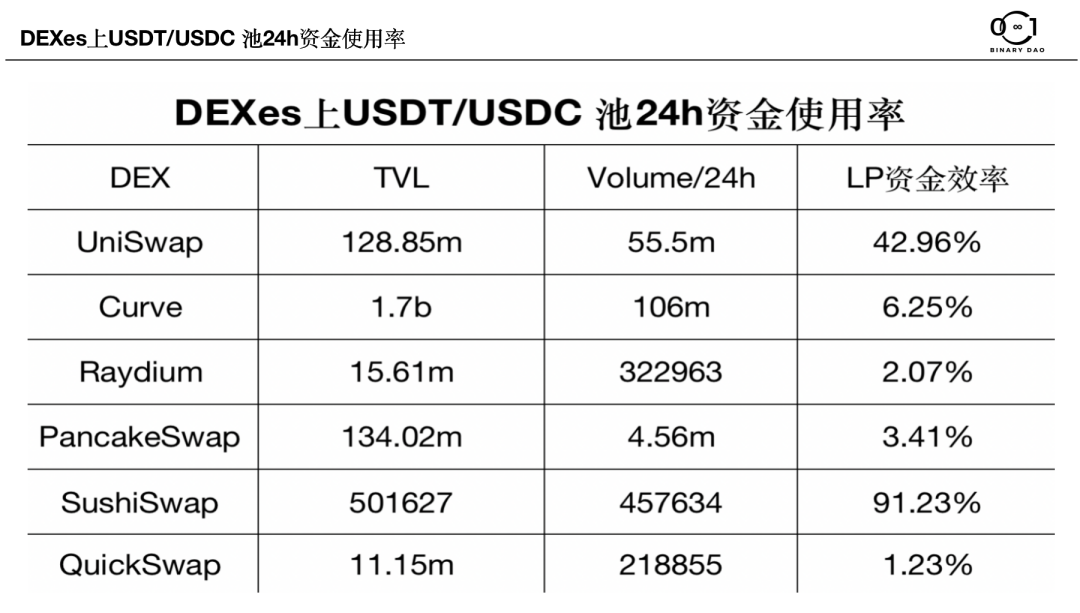

上述对50W枚USDT各平台给出了不同的报价,报价差异很大,那其同期在平台上的USDT/USDC的LP池的资金情况又是如何呢?

根据上图我们可以看出UniSwap上USDT/USDC的TVL有128.85m,24小时的成交量有55.5m,这样算出128.85m的24小时资金使用率为42.96%。

综合对比,除了Sushi由于USDT/USDC资金量不足出现了数据异常之外,其他几个平台的资金使用率都非常低,Curve的24小时资金使用率是6.25%,Raydium为2.07%,Pancake为3.41%,QuickSwap为1.23%,这样看来Uniswap在LP的资金效率方面独树一帜。

但是还有一个可怕的数据是Curve在USDT交易对LP的捕获能力上竟然达到了1.7b,这是一个绝不容忽视的异常数据,主要是因为Curve在Uni V3尚未出现之前就以其算法和0.04%的手续费绝对优势垄断了稳定币和同源币对(如ETH/stETH)的交易市场,当然Curve的稳定币池是以USDT/USDC/DAI三个币对存在的,同时3池在滑点优化方面体验较好。

也正因为Curve的资金效率不高,Uni V3才得以从Curve口中分得一杯羹,即使如此,Curve的稳定币和同源币交易对已经深度绑定了其他DEFI协议,俨然成为DEFI2.0的应用型底层,一半以上的知名DEFI项目都要去Curve部署流动性,所以即使资金使用率略有逊色,UniSwap也很难撼动其超强的LP捕获能力。

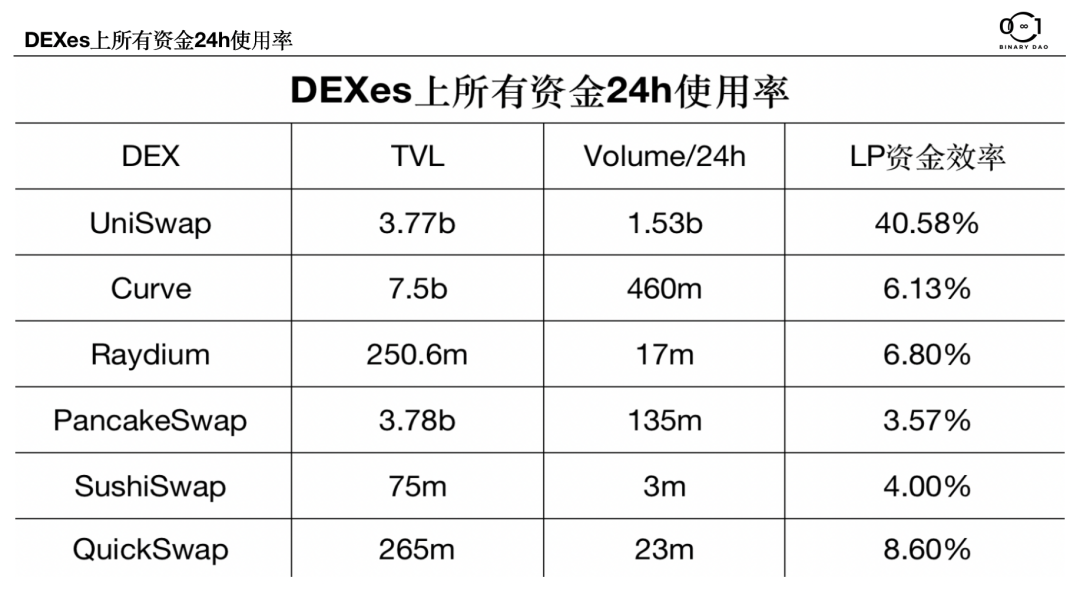

接下来,我们就要再来对比一下各个DEX平台所有LP资金的TVL和资金使用效率。

如图,在TVL的捕获能力上,Curve、UniSwap和Pancake这三个平台表现最佳,分别为7.5b,3.77b和3.78b,其他几个平台的TVL流失已经惨不忍睹,如果我们统计DEX上24小时的所有交易对资金数据,发现UniSwap的24小时资金使用率依然最高,竟然高达40%以上,根据这种资金使用效率估计,UniSwap对其平台LP提供的平均年化可以在50%左右,而其他平台则表现相对较弱,分别为Curve 6.13%,Raydium 6.80%,PancakeSwap 3.57%,Sushi 4%,QuickSwap 8.60%。

值得关注的是Pancake,它拥有3.78b的TVL,资金使用率却是所有统计在内的DEX的倒数第一,前面我们在统计50W枚USDT兑换比率的时候它同样表现不佳,这是已经沦落的Uni V2系DEX们的普遍问题,却无从解决,这样看来,V3的版权保护确实挤压了模仿者们的生存空间。

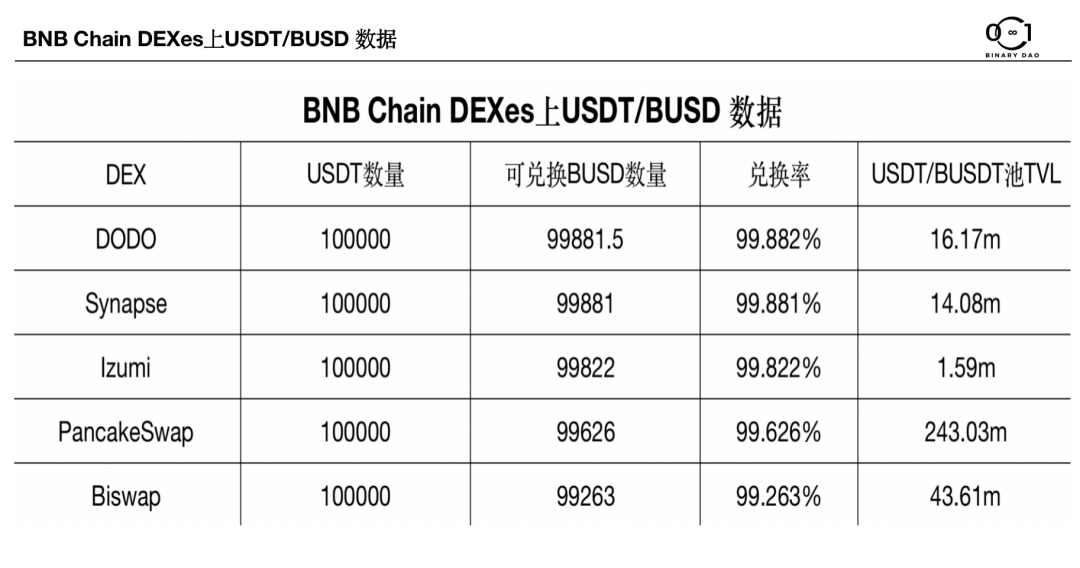

但是由于UniSwap和Curve这种表现更优秀的产品并未接入BNB chain,那在生态仅次于以太坊的BNB Chain上哪个DEX更具备竞争优势呢?

我们以10W枚USDT在BNB Chain上兑换BUSD为例,发现Pancake的表现真的很差,兑换比率只有99.626%,在统计范围里只能排到第四,DODO和Synapse兑换率不相上下,值得注意的是Izumi的TVL只有1.59m,但其对10W枚USDT的报价竟然远好过Pancake,如果Izumi能够捕获10m以上的TVL,其报价表现很有可能好于DODO。

我们以10W枚USDT在BNB Chain上兑换BUSD为例,发现Pancake的表现真的很差,兑换比率只有99.626%,在统计范围里只能排到第四,DODO和Synapse兑换率不相上下,值得注意的是Izumi的TVL只有1.59m,但其对10W枚USDT的报价竟然远好过Pancake,如果Izumi能够捕获10m以上的TVL,其报价表现很有可能好于DODO。

三、解决方案对比

结合前面几个平台的表现,我们来研究比对他们所采用的数学模型方案:

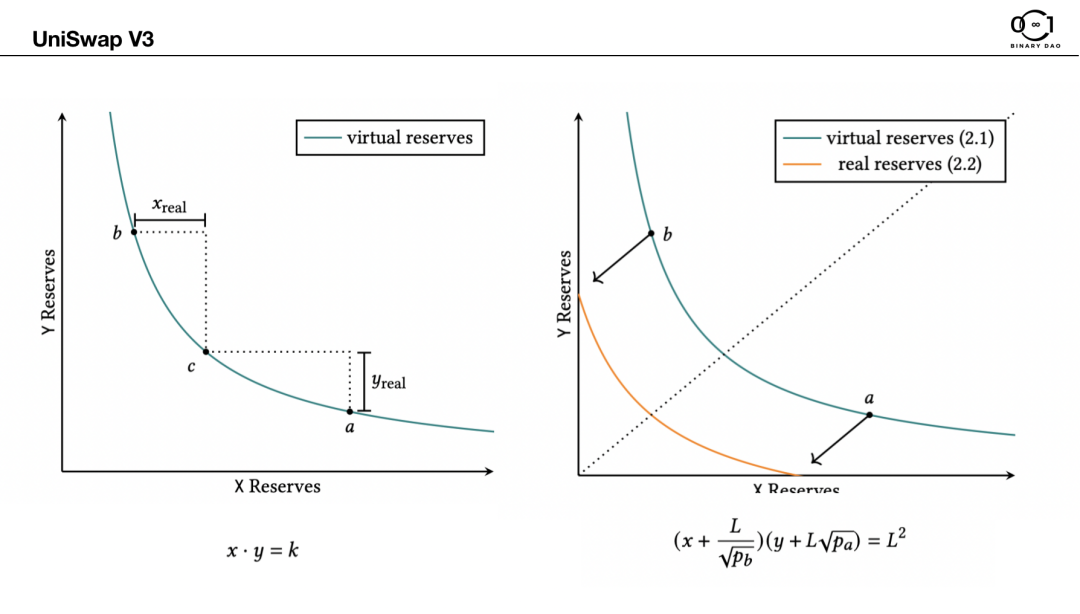

1、UniSwap V3的集中流动性

在UniSwap V3出来之前,90%的DEX都是V2的仿盘,典型代表如Sushi,pancake和quickswap,以0.3%的手续费,把资金平铺在X*Y=K的曲线上,V3做了三点改良:

将流动性分割在频繁交易的价格区间,提升LP的资本效率;

针对不同的交易币对设置不同的手续费,留住制造了更多的交易场景,留住了不同需求的交易用户;

LP token的NFT化,阻断了竞争对手对其LP的吸血;

这些改进满足了Trader对于报价和流动性的需求,同时也满足了Liquidity Provider对于资本效率的要求,所以Uni V3推出之后很快收复了V2时代被仿盘瓜分的市场,现今Uni的日均交易占比达到整个生态DEX的70% 以上。

这些改进满足了Trader对于报价和流动性的需求,同时也满足了Liquidity Provider对于资本效率的要求,所以Uni V3推出之后很快收复了V2时代被仿盘瓜分的市场,现今Uni的日均交易占比达到整个生态DEX的70% 以上。

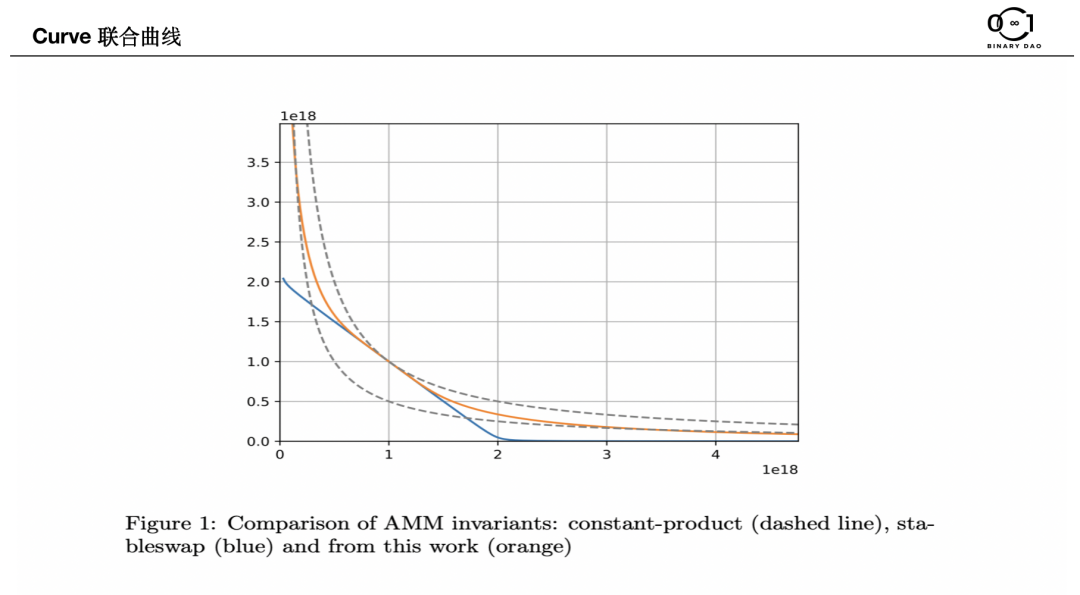

2、Curve的联合曲线

Curve曾是全网TVL最大的DEFI协议,TVL一度高达23b之大,Curve采用的联合曲线结合了恒定产品(XYK)和恒定的价格不变量,通过算法让流动性集中在多个需求的汇集点上,所以其在特定价格区间内的流动性非常充足,甚至超过Uni V3的数倍,其交易滑点也基本为 0。

Curve用曲线的联合将其币对在某个流动性的位置强制锚定,打造一个特定的集中流动性范围区间,形成特定价格倾斜的曲线,这就可以把滑点降到最低。

Curve用曲线的联合将其币对在某个流动性的位置强制锚定,打造一个特定的集中流动性范围区间,形成特定价格倾斜的曲线,这就可以把滑点降到最低。

这种设计有着天然合适的需求场景,比如稳定币之间的兑换,如USDT/USDC/DAI等之间的兑换;另外就是同源币对之间的兑换,比如ETH/stETH。所以市场九成以上的同源币对和USDT交易对的流动性都部署在Curve。

对于非稳定币对或非同源币对,Curve的解决方案是引入了依赖指数移动平均的内部预言机,效果差强人意。

它有点像Uni V3的子集,但又略不相同。Curve是在其子集区间里靠算法执行流动性调剂,而Uni V3的流动性范围只能靠手动调整,所以Uni V3对做LP的要求更高。

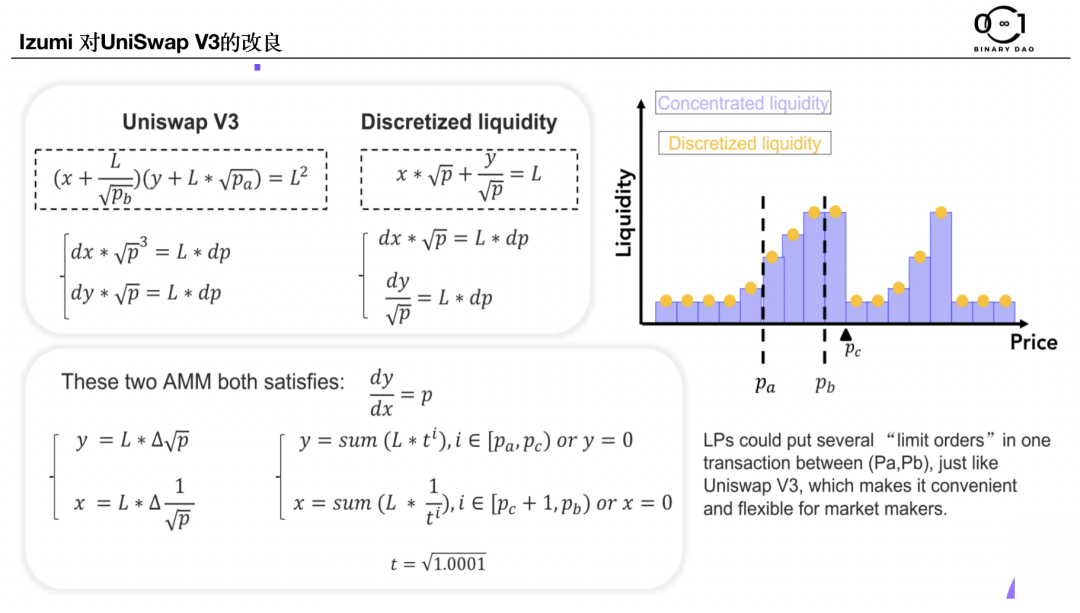

3、Izumi的离散流动性

Izumi是个创业的新秀项目,目前还在早期阶段,iZiSwap平台TVL 仅仅28m,但是在USDT/BUSD的交易对上,它竟然以1.59m的资金池做到了比Pancake上243m的资金池更好的报价,这种对LP资金的利用效率十分惊人,非常值得关注。

iZiSwap独创了Discretized-Liquidity-AMM模型,通过以分散的方式实现限价订单,使资本效率最大化。

如图所示,Discretized-Liquidity-AMM(DLAMM)对现有的Uniswap V3进行了改进,将集中的价格范围切割成小块,精确地将其定位,制造出了集中流动性的分离状态,使每个价格区间都需要流动性,这样不仅满足了限价订单的链上操作,还极大提升了LP资金的使用效率。

所以这是iziswap能够逆势绝杀pancake的关键,这种模型在流动性枯竭的当下将更加具备生存能力。

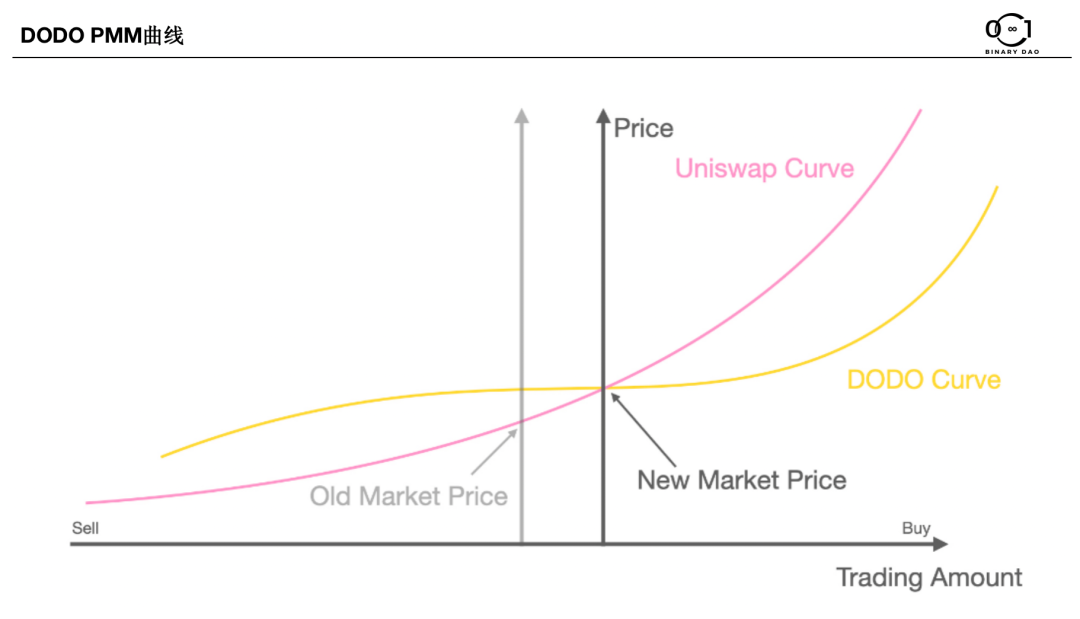

4、DODO的PMM算法

DODO算是老牌的DEX了,其PMM算法也是原创,全称是Proactive Market Maker,这个算法通过预言机引入了一个标的价格,这个标的价格也可以通过链上的供需机制来进行价格发现,可以将流动性聚集在标的价格附近,从而有效降低交易用户的滑点,同时也提高了LP的资金效率。

这个模型中资金池的斜率k可以自定义设置,以此来调节滑点的大小,所以相较于V2 系的DEX们,DODO的配置更加灵活,资金效率也会更好;相对于V3,这种策略就略逊一筹,但是其无偿损失明显更小,所以对LP的要求不高,适合傻瓜式LP操作者。

四、潜在问题与规避

DEX在市场份额的争夺无法停止,也从未停止,在极度提升资本效率的同时,在优化交易滑点的同时,也暴露着更多的风险敞口。

比如Curve的联合曲线,在稳定币对和同源币对的兑换中,一旦价格离开了斜线切点的位置,只要很少的资金就会形成价格脱锚,而这种币对一旦脱锚则容易引发市场恐慌,从而恶性循环,UST的脱锚和stETH的脱锚依然历历在目。

再比如Uni V3,将大量的资金迁移到频繁交易区间,一旦出现快速下跌或快速上涨的极端行情,就很容易出现插针的情况,6月13日ETH下跌触发了MakerDAO上6.5亿美金的清算,就导致了Uni V3的独立插针。

链上交易,我们该如何选择DEX,该如何避坑?

如果你不是一个从业者或者研究者,我建议你选择1inch这样的交易路由,它可以用算法去分解和分配各个平台的交易执行,一般都可以为你的交易需求提供一个不错的价格,是傻瓜式操作的巅峰之作。但如果从行研的视角看,1inch是建立在各个DEX之上的,也就是如果DEX本身没有突破性的进展,你使用1inch也得不到好的交易结果。

DEX赛道是一条有始无终的探索之路,对项目方是,对用户也是,这条路上每个项目方都值得尊敬,每个用户都值得鼓励,因为我们一起践行了去中心化落地的第一步。

技术层的前进在交叉复现的改良中螺旋向上,DEX赛道乾坤未定,难有终局。对用户而言,可坐而上观,可去留随意,在DEX这个赛道的产品选择上永远不要产生路径依赖,因为加密世界美轮美奂的叙事多是带刺的鱼钩,当下的最佳可能成为下阶段的垫底,路径依赖犹如温水中的青蛙,被煮熟端上屠夫的餐桌时你定会发现,旁边还有一盘韭菜。

注:市场实时变动,本文采样数据为2022年6月中旬,如果实时校对可能会有出入,本文观点仅作研究交流,不做商业使用,如有观点表述不当,敬请斧正。

参考材料:

https://www.paradigm.xyz/2022/05/the-dominance-of-uniswap-v3-liquidity

https://dune.com/rchen8/defi-users-over-time

https://uniswap.org/whitepaper-v3.pdf

https://curve.fi/files/crypto-pools-paper.pdf

https://docs.dodoex.io/chinese/dodo-xue-yuan/pmm-suan-fa-gai-lan/pmm-suan-fa-xi-jie

https://mp.weixin.qq.com/s/8xn8J8SAr8bbTlcS1hNhFg