Weekly Editors' Picks Weekly Editors' Picks (0521-0527)

"Weekly Editor's Picks" is a "functional" column of Odaily.On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Now, come and read with us:

Now, come and read with us:

Investment and Entrepreneurship

Investment and Entrepreneurship

Glassnode: BTC and ETH are diminishing returns, but capital may re-enter the encryption field

On-chain, block space demand for Ethereum and Bitcoin has dropped to multi-year lows, and the rate of burning ETH through EIP1559 is also currently at an all-time low. Combine that with poor price performance, worrisome derivatives pricing, and extremely subdued demand for Bitcoin and Ethereum block space, and we can infer that headwinds are likely to continue on the demand side. The bear market is not going to end anytime soon.

The Ultimate Bear Market Guide for Junior, Advanced Crypto Players

Bear market three guiding principles: bear market is an opportunity, live, keep learning.

For a bear market, the author recommends choosing between a conservative and moderate risk portfolio, as a more aggressive risk portfolio is an excessive pursuit of an unknown bull market. Remember, the goal in a bear market is to get our portfolio into the next bull market intact.

Hutt Capital: Overview of Blockchain VC Landscape in 2022

DeFi

The blockchain VC investment market has grown considerably in the past 12-18 months, reflected in: the emergence of mega funds/asset aggregators, the supply of capital driving more competition among funds for deals, high Quality blockchain venture capital funds have been massively oversubscribed and difficult to obtain, DAOs and guilds are robbing traditional VC funds of market share, professional funds are increasing, Web3 has become the trend of general-purpose VC funds, but professional funds dominate .

The original sin of DeFi: understanding the limitations of DeFi from the actual banking business

Currently, real-world adoption of any crypto stablecoin is limited. The vast majority of DeFi protocols are self-digestion of leverage. DeFi yield comes from arbitrage spread/speculative demand. In a bear market with less volatility, borrowing utilization falls.

The breakthroughs for DeFi are: on-chain banking is cheaper given the cost structure; instant payments/settlements; and tokenization allows for borrowing incentives that are not possible today.

While there are many algorithmic stablecoin designs that are fundamentally flawed and ultimately doomed to collapse. There are plenty of stablecoins that are theoretically viable but risky; there are also plenty of stablecoins that are theoretically very robust and have withstood the extremes of crypto market conditions in practice. Edge cases and robustness should be the first things we check.

NFT, GameFi and Metaverse

NFT, GameFi and Metaverse

NFT cycle rotation: wild, bubble and value return

The NFT trading volume cycle has the characteristics of "hot spot detonation", "from large to small", and "continuity". At present, the market is in the extension wave of a large cycle. The development stage of NFT has shifted from "mass media" to "community communication", and its hype cycle presents "plate rotation". At present, the NFT market is in the transitional stage of "Expectation Expansion Period" and "Bubble Burst Period".

The NFT market will inevitably be affected by the overall encryption market, but at the same time the NFT market is more "slow" than it. Chain games, DAO, derivatives and other sub-industries combined with NFT have entered different stages of independent development.

Not Okay Bears has a clear narrative of "ETH>Solana". The Not Okay Bears community expressed outrage at being removed from Opensea.

Web 3.0

secondary title

Starting from nine application categories, discuss the future of encrypted native consumer products

In-depth analysis of X-To-Earn Ponzi system: speculator effect, team control and sustainability of utility

Ethereum and scaling

Ethereum and scaling

How will the ETH merger rewrite the history of supply and demand dynamics?

The article ignores technical discussions and focuses on the factors that affect the price of ETH.

A Quick Look at the rETH Risk Assessment Report Released by MakerDAO

New ecology and cross-chain

New ecology and cross-chain

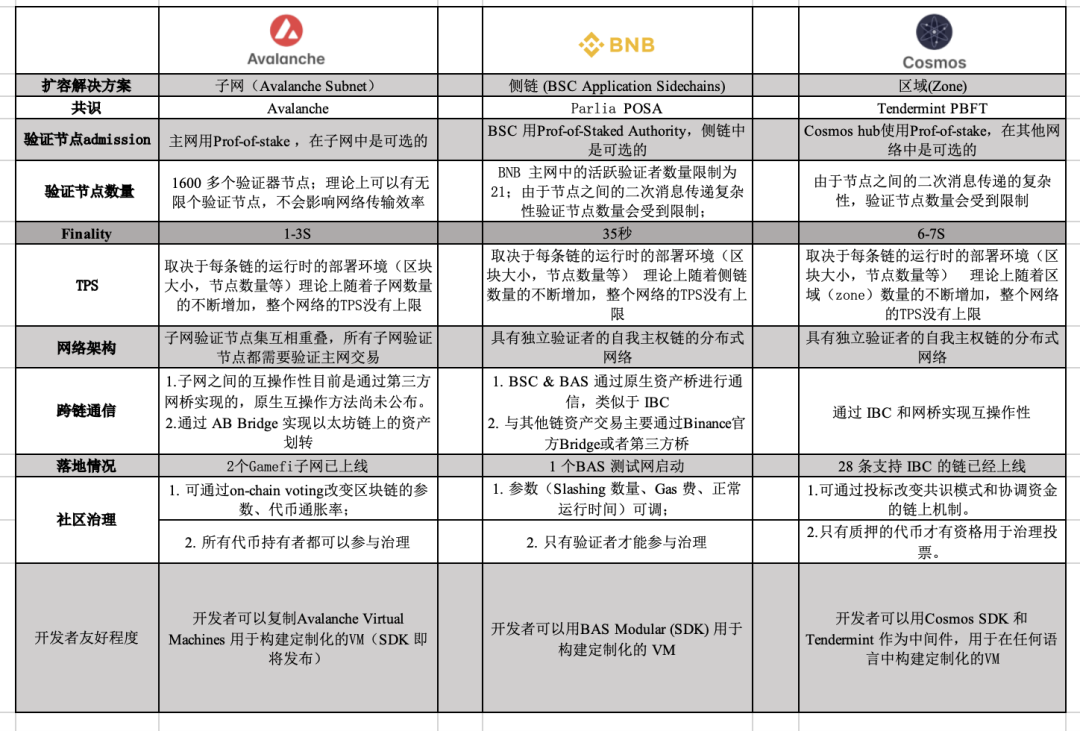

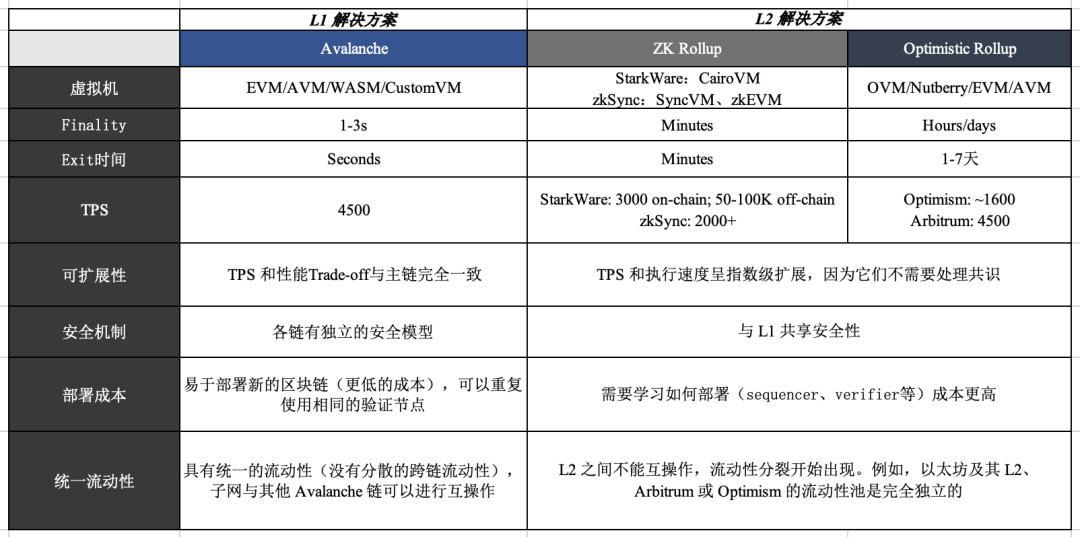

Interpretation of Avalanche: From EVM-compatible L1 to "Subnet Pioneer"

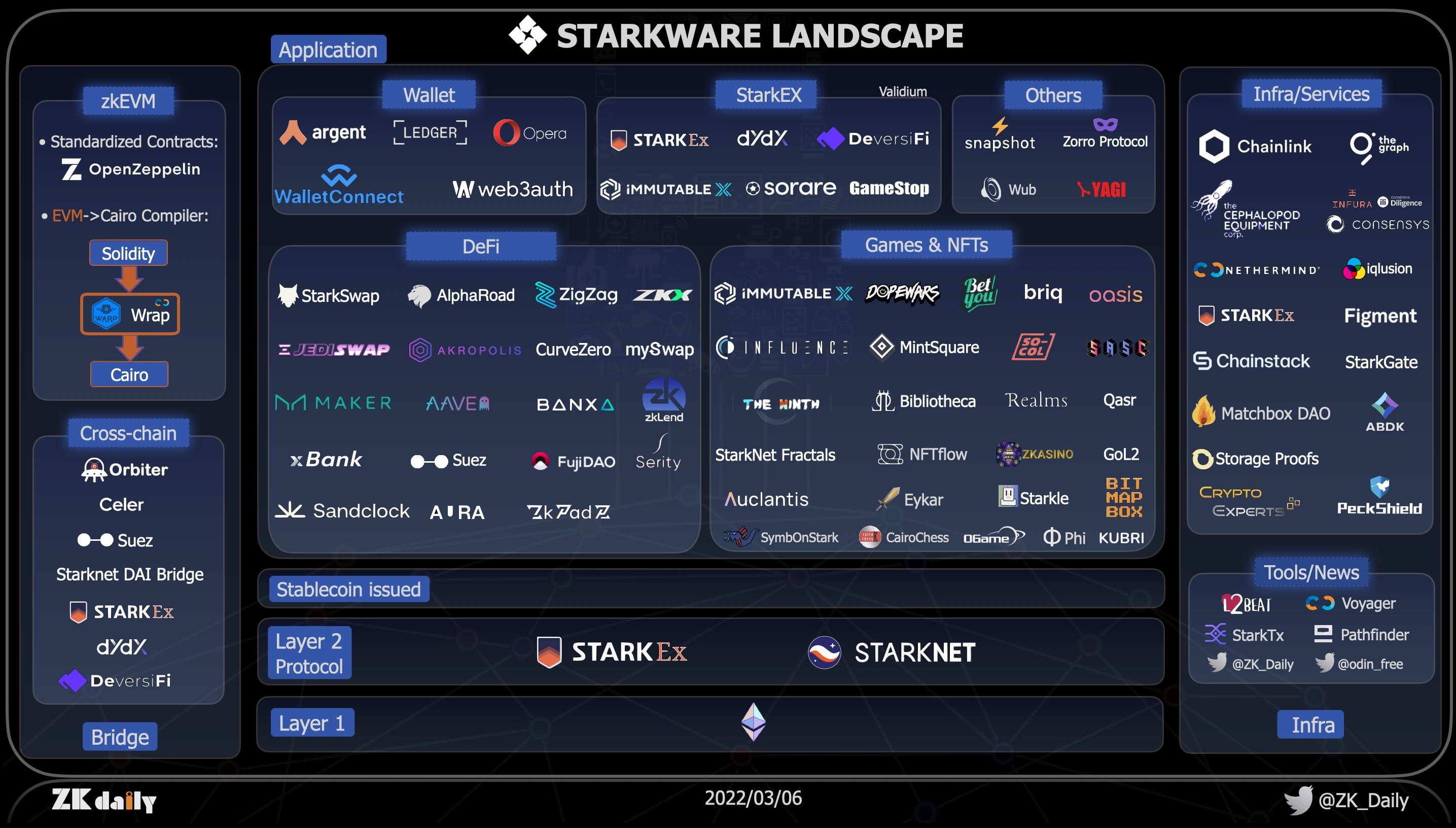

The article summarizes nearly 50 projects in the StarkWare ecosystem, including 4 projects using the StarkEx expansion engine and more than 40 projects based on StarkNet, which are almost evenly distributed in the three categories of infrastructure, DeFi and NFT/games , of which more than 10 projects have been built on the test network.

DAO

In-depth analysis of 7 common voting mechanisms of DAO

secondary title

In-depth analysis of 7 common voting mechanisms of DAO

One coin, one vote is prone to "rational indifference", and a poorly designed voting decision-making mechanism can easily lead to "rabble".

The reason why DAO needs to choose democracy as the governance ethics is in line with practical interests. An extensive and fair decision-making mechanism can help DAO organizations mobilize more wisdom and resources, develop towards "goodness" and survive for a long time.

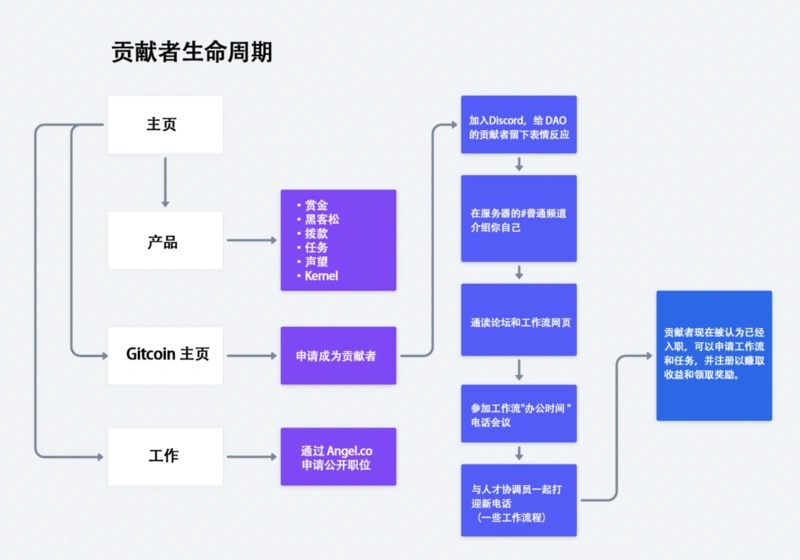

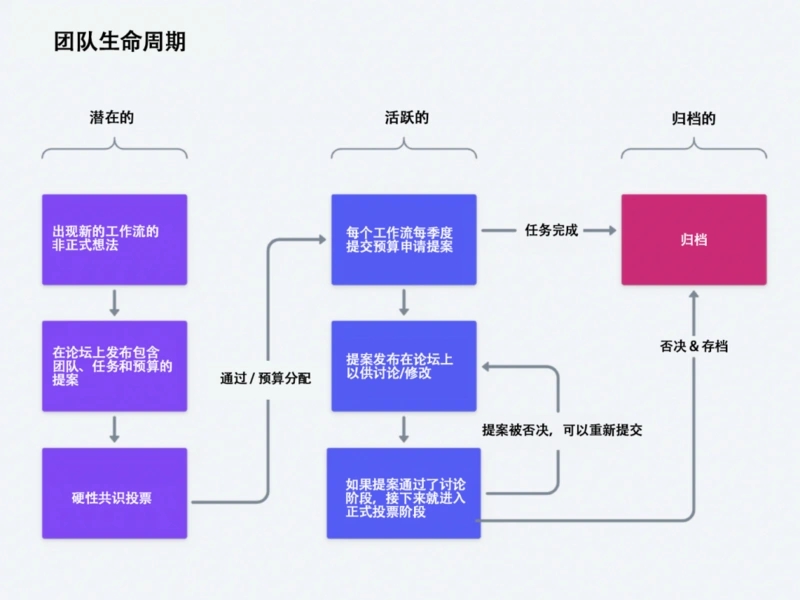

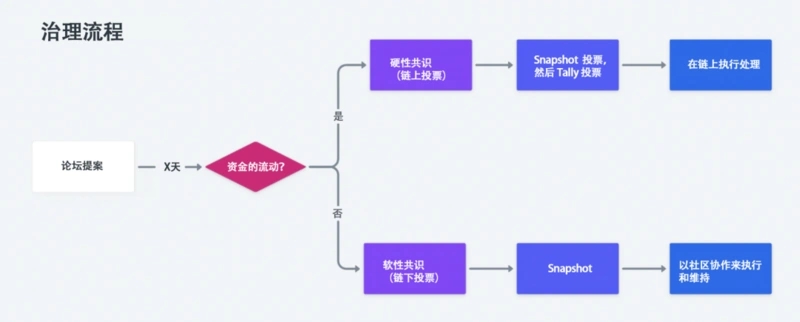

Gitcoin was originally a "public goods" DAO, whose mission was to "build and finance digital public goods". The article contains three diagrams of GitcoinDAO's contributor life cycle, team life cycle, and governance process.

hot spots of the week

hot spots of the weekThree Arrows CapitalIn the past week, the market has dropped again,Three Arrows Capital》《A large amount of ETH was transferred to the exchange, and various institutions shared the bear market survival guide; the Terra crash continued to ferment, but the radiation radius was significantly reduced. For details, see "》《Glassnode: Looking back at the UST crash, what impact will it have on the future market?》《Institutions hit hard by Luna thunderstorm》,Changpeng Zhao: 7-point summary and 3-point suggestions on the UST/LUNA crashThe Terra Revival Plan is officially passed, and the ten things you care about the most are hereTerra new chainrules

also,), most mainstream exchanges support Terra airdrops;also,Supreme People's CourtPublished the "Opinions on Strengthening the Judicial Application of Blockchain",a16zChairman of UK FCANGC VenturesLaunches fourth crypto fund at $4.5 billion,JPMorganLaunched a new fund with a scale of US$100 million,CoinbaseJPMorgan

MetaMaskCryptocurrency Has Replaced Real Estate as One of the Preferred Alternative Assets, Bloomberg Analyst PredictsOptimismIt expects to lose about $1.4 billion this year;Recruit a product marketing manager, or issue Token,Announcing the details of its next iteration of upgrading Bedrock,About 17,000 brushing addresses were removed, more than 14 million OP tokens will be redistributed; in response to the YFII plunge,Merit CircleYFII core developer

OpenSeaIndicates that YFII has not been issued additionally, nor has it been attacked.eBayInitiate a community proposal to revoke YGG's seed round token allocation;Launched the Web3 market protocol Seaport Protocol,First issue of NFT,Azukigame stationLaunch of cryptocurrency and NFT wallets,Airdrop limited edition Twin Tigers physical jackets for holders to exchange for NFT, STEPNMonthly revenue up to $100 million, the daily transaction fee net profit reaches 3-5 million US dollars,With "Editor's Picks of the Week" series...well, another week of ups and downs.

With "Editor's Picks of the Week" seriesPortal。

See you next time~