Glassnode:数据回顾UST崩盘全程,其对未来行情有何影响?

原文作者:Ding Han

原文来源:Glassnode

比特币市场经历了载入史册的一周,400亿美元的LUNA/UST项目过度膨胀并崩溃,LFG出售了8万枚BTC,Tether 1美元的挂钩价承压,稳定币供应收缩了75亿美元,以及比特币下探接近实现价格。

加密货币市场经历了一个历史性的波动和混乱的一周,两种稳定币UST和USDT的汇率成为焦点。在短短几天的时间里,市值前十的数字资产(LUNA和UST)抹去了投资者们近400亿美元的价值。UST已经完全与美元脱钩,而LUNA由于其过度膨胀的供应量,价格崩溃,下跌至0.00001美元。因此,Luna Foundation Guard(LFG)部署了他们最近购买的80,394枚BTC的储备,试图挽救与美元的挂钩,但是没有成功。

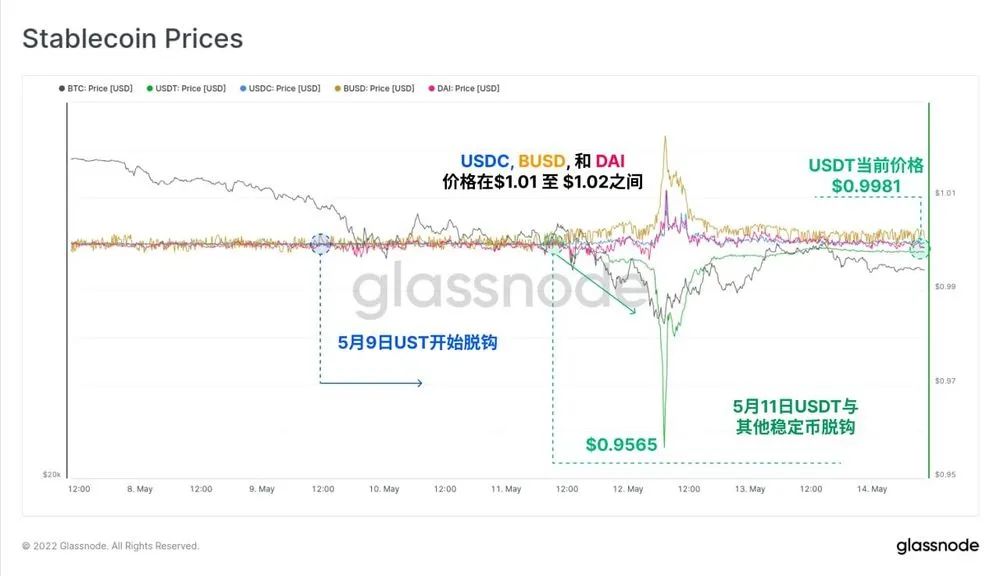

本周晚些时候,在UST脱钩消息的推动下,市场暂时对Tether(USDT)的挂钩质量产生了担忧情绪。USDT兑美元价格短暂下跌至0.9565美元的低点,然而在24小时内恢复至正常水平,目前保持0.998每美元的汇率,两者差价较小。

稳定币的恐慌四处传染,LFG出售了价值32.75亿美元的比特币,比特币在重压下价格下跌21.2%,至26513美元。这是自2020年12月以来的最低价格,自然使市场上的大部分人处于财务压力之下。

在本周的链上周报中,我们将介绍这三个关键话题,即:

UST和LUNA的市场动态,LUNA和UST的供应情况,以及LFG的比特币储备如何部署。

USDT的短暂脱钩,以及它如何影响市场对其他稳定币的看法,如USDC、BUSD和DAI。

比特币逐渐接近实现价格,这在历史上是一个重要的支持水平,以及市场对这一事件的可观察反应。

LUNA壮观的下跌和反思

在过去的几年里,我们已经看到稳定币在数字资产的总市值中占了相当大的比重。5月8日,USDT、USDC、BUSD、DAI和UST稳定币的价值超过了1350亿美元。

稳定币有很多种类,但通常可以用三种类型来表示:

抵押币(USDT、USDC、BUSD)

加密货币过度抵押币种 (DAI)

算法稳定币(UST)

至于UST和LUNA,按照算法设计,允许用户将1个UST换成价值1美元的LUNA(反之亦然),而不考虑两种资产的市场价格。实际上,这意味着当有对UST的需求时,LUNA的供应就会收缩(价格也会上升)。然而,这种反作用力也是相反的,当需求下降,价格下行时,LUNA的供应可以(并且已经)过度膨胀。

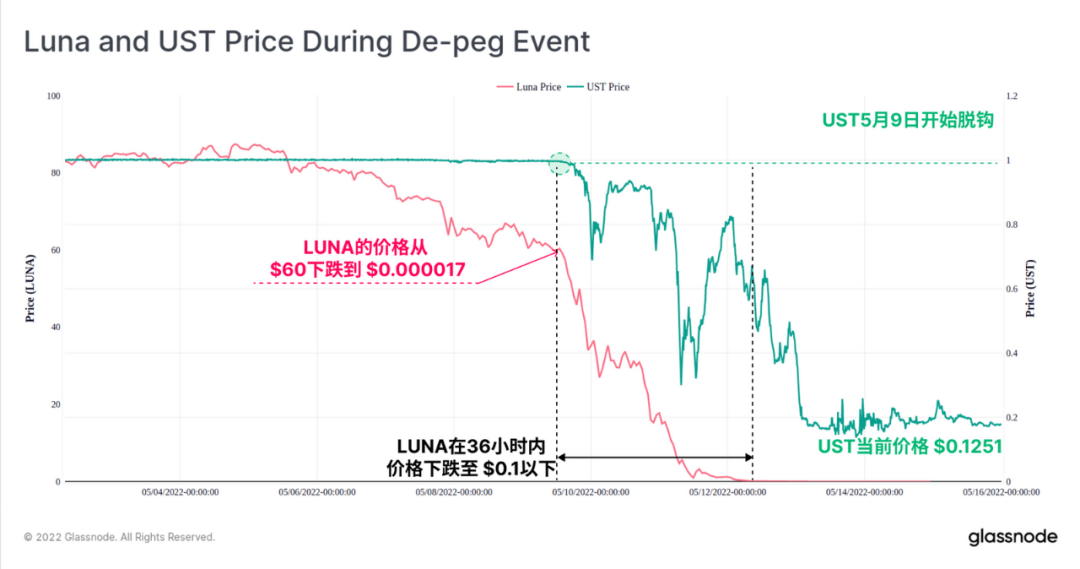

5月9日,UST开始与美元脱钩,当时LUNA价格在60美元左右(距离119美元的历史前高下跌了49.5%)。在接下来的36小时内,LUNA价格跌至0.1美元以下,UST在0.30美元和0.82美元的极端之间交易。这使协议赎回机制进入了超速状态,因为所有用户都很恐慌,他们在用1个UST换取价值1美元的LUNA,造成供应的急速膨胀,进一步压低了价格。

在写这篇文章的时候,LUNA现在的价格是0.0002美元(比ATH下跌99.9998%),UST稳定在0.1251美元左右,远远低于期望的1美元挂钩价。

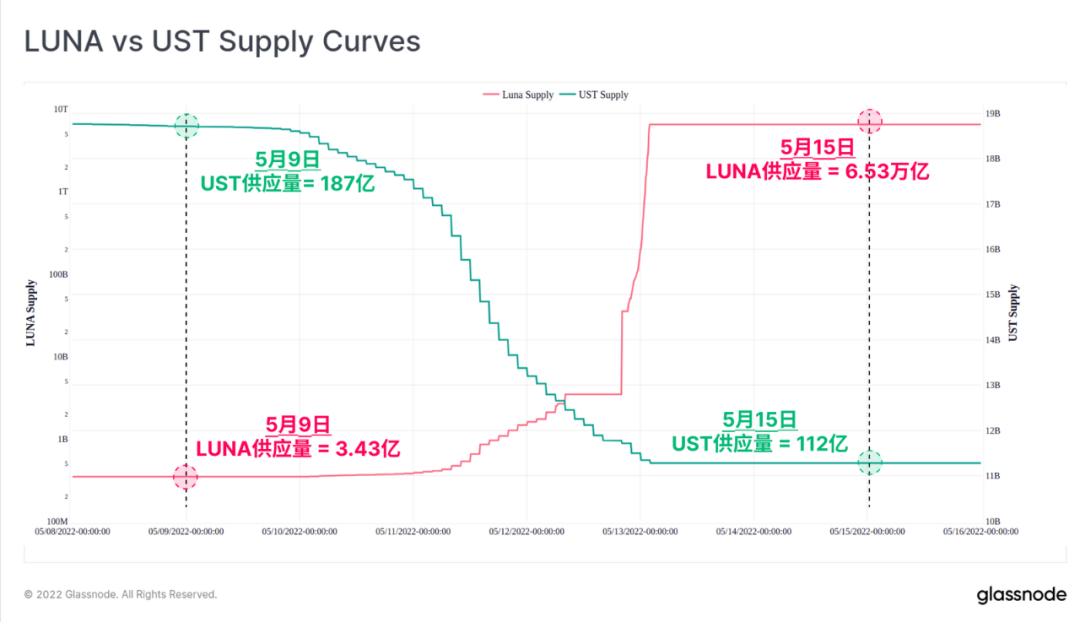

我们可以在下面的图表种看到LUNA供应膨胀的幅度,UST供应(绿色,RHS)呈线性比例,而LUNA供应(红色,LHS)呈对数比例。在一周的时间里,75亿UST被赎回(占供应量的40%),而LUNA的供应量从3.43亿膨胀到超过6.53万亿,年化通胀率为99,263,840%。

5月13日的某一时刻,项目方甚至暂停了LUNA区块链,因为供应量的过度膨胀对网络稳定性和治理产生了二阶效应。

Terra区块链在区块高度7607789上正式停止。Terra的验证者们已经停止了网络,准备拟定一份计划重组网络。更多更新信息陆续推出。--Terra(UST) 2022年5月13日

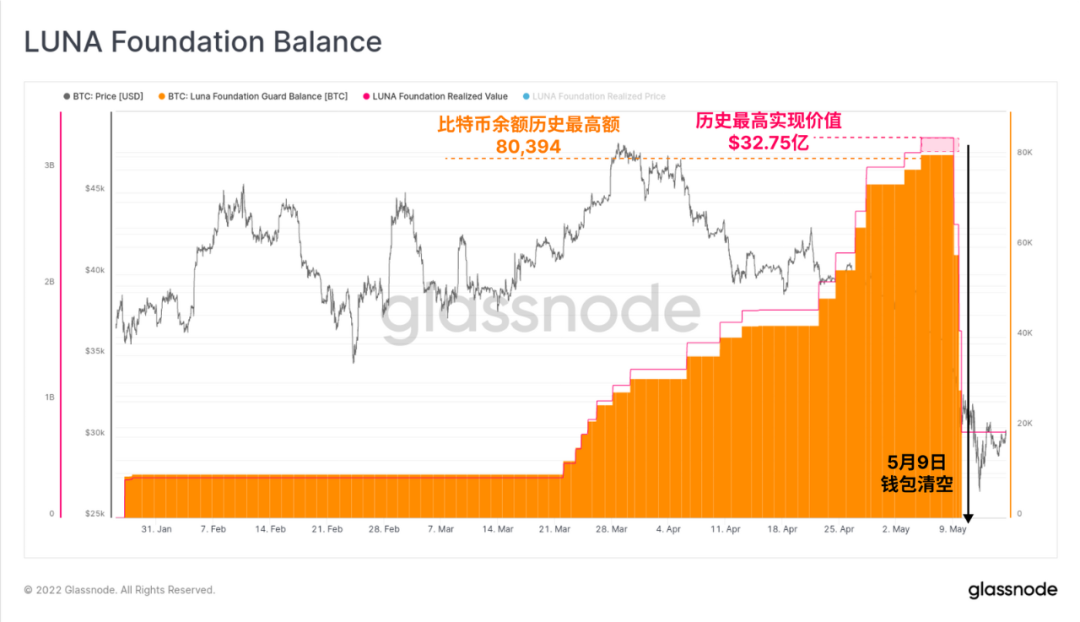

随着UST挂钩的交易走低,Luna Foundation Guard开始部署他们的比特币储备,这是他们近期购买的,以努力稳定美元挂钩。近几个月来,他们的总储备已经积累到80394枚BTC,最大的收购发生在3月21日和5月5日之间。他们持有的比特币在被添加到钱包时的总变现价值为32.75亿美元。

这些钱包在5月9日和10日之间的21.5小时内被完全清空。

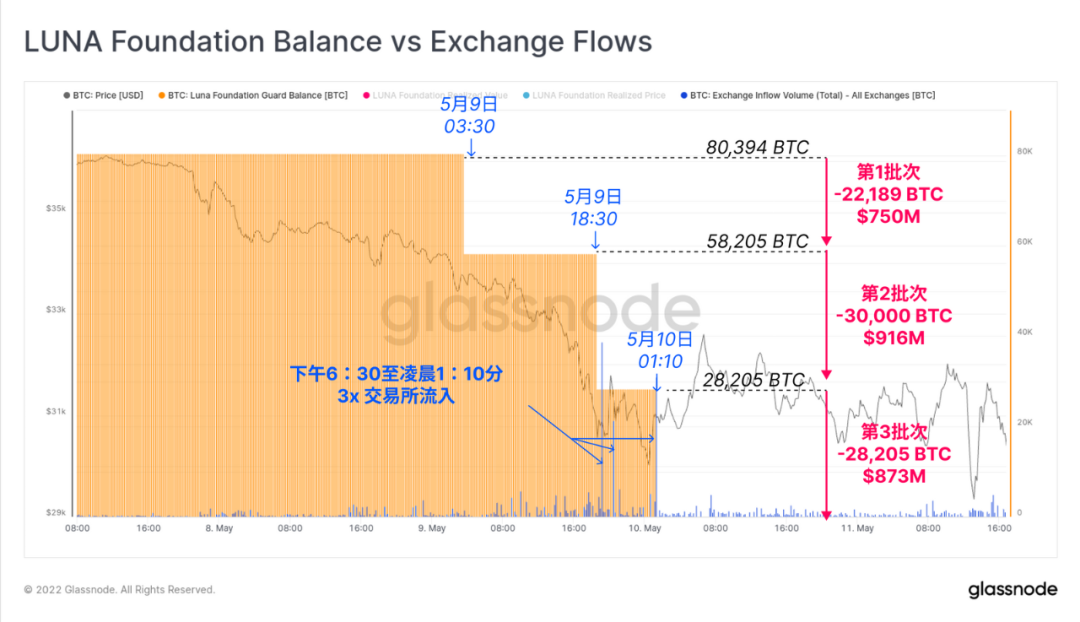

如下图所示,LFG的比特币余额分三次被清空。第一批部署了大约价值7.5亿美元的比特币(22,189枚BTC),5月9日3:30,UST的挂钩价下降至0.98美元。第二批30,000枚BTC(9.16亿美元)在15小时后部署,最后一批28,205个BTC(8.73亿美元)在6.5小时后从钱包中被清空。

5月9日18:30至5月10日01:10期间,随着LFG雇佣的做市商在托管人之间转移比特币,出现了一系列同等规模的交易所资金流入(蓝色显示)。根据我们的评估,这些钱币的最初目的地是:

52,189枚BTC通过OTC场外交易被发送到Gemini交易所(这些资金很快被部署到其他地方,包括Binance交易所)

28,205枚BTC通过直接转账发往币安

LFG后来证实,他们几乎卖掉了所有的比特币,截至5月16日,他们的库存只剩下313枚BTC。

截止目前,基金会的剩余储备由以下资产所构成:313枚比特币,39914枚BNB,1973554枚AVAX,1847079725枚UST,222713007枚LUNA(其中221021746枚处于验证者质押状态)

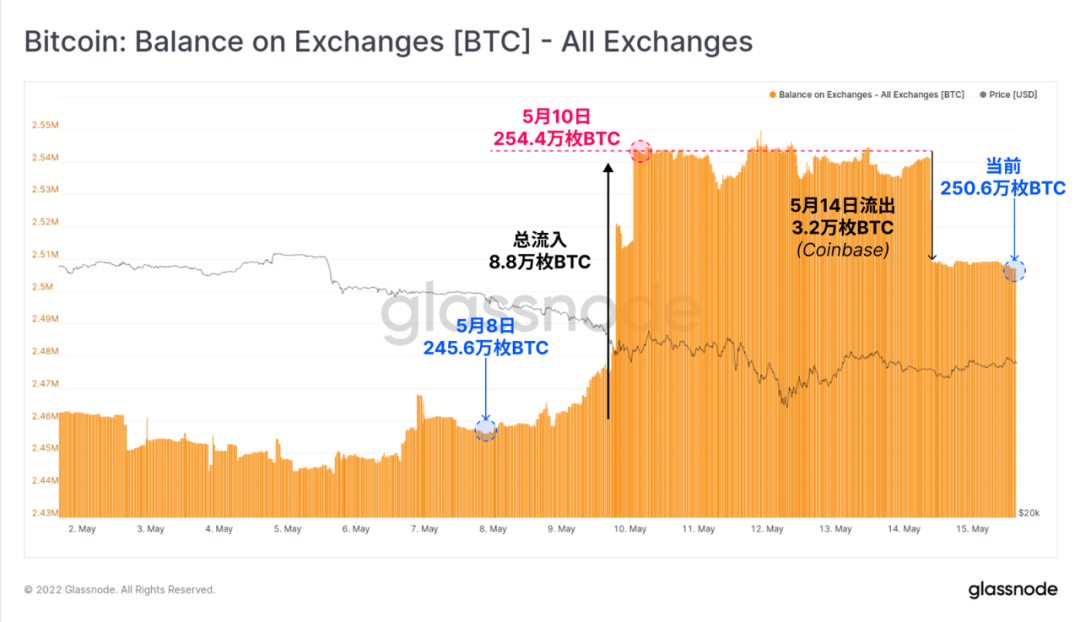

在此期间,交易所的总余额增加了约8.8万枚BTC,这比LFG部署的80394枚要多。这预示着这些事件引发了传染效应和恐慌,因为比特币投资者增加了卖方的压力。5月14日,Coinbase出现了大量资金外流,尽管Coinbase似乎不是LFG来源的比特币的接收地。

不稳定币的传染

仿佛本周还没有经历足够的混乱,5月11日,按市值计算最大的稳定币Tether(USDT)也经历了脱钩的压力。虽然UST的规模很大(210亿美元),但许多人认为USDT的规模为830亿美元,以其目前的形式对市场具有系统重要性,是许多交易所的主导报价对。

从5月11日中午到5月12日中午,USDT的价格脱离了1美元的挂钩价,达到0.9565美元的低点,然后在36小时内恢复,最终恢复到0.998美元。在此期间,其他主要稳定币USDC、BUSD和DAI经历了1%到2%的溢价,因为投资者转向他们认为风险较小的资产。

Tether在5月12日脱钩压力最严重的时候宣布,仍然开放赎回仍然开放,而且价值20亿美元的赎回已经在进行中了。

在市场高波动的情况下,Tether继续向经过验证的客户提供赎回,今天正在处理20亿美元的赎回请求。

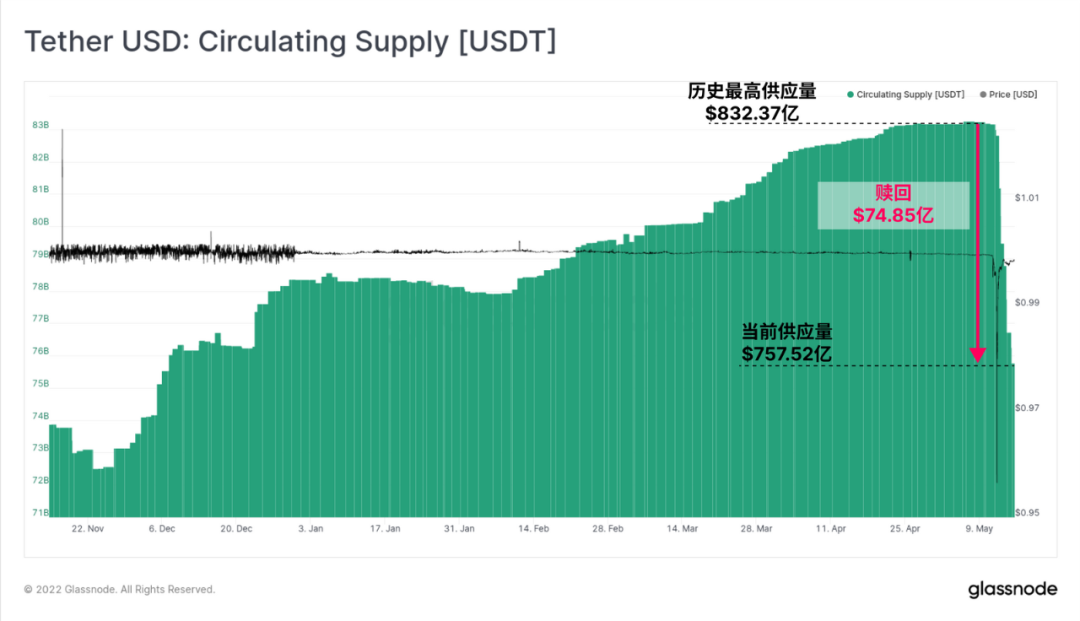

如果我们看一下USDT的供应,我们可以看到,确实有超过74.85亿美元的USDT已经在本周被赎回。USDT总供应量从接近812.37亿美元的ATH下降到757.5亿美元。正如我们在上周的报告中指出的那样,最近稳定币的供应收缩了29亿美元,是历史上最大的一次,主要是由USDC推动的。因此,这种规模的外流现在已经使本周在这一指标上处于领先地位。

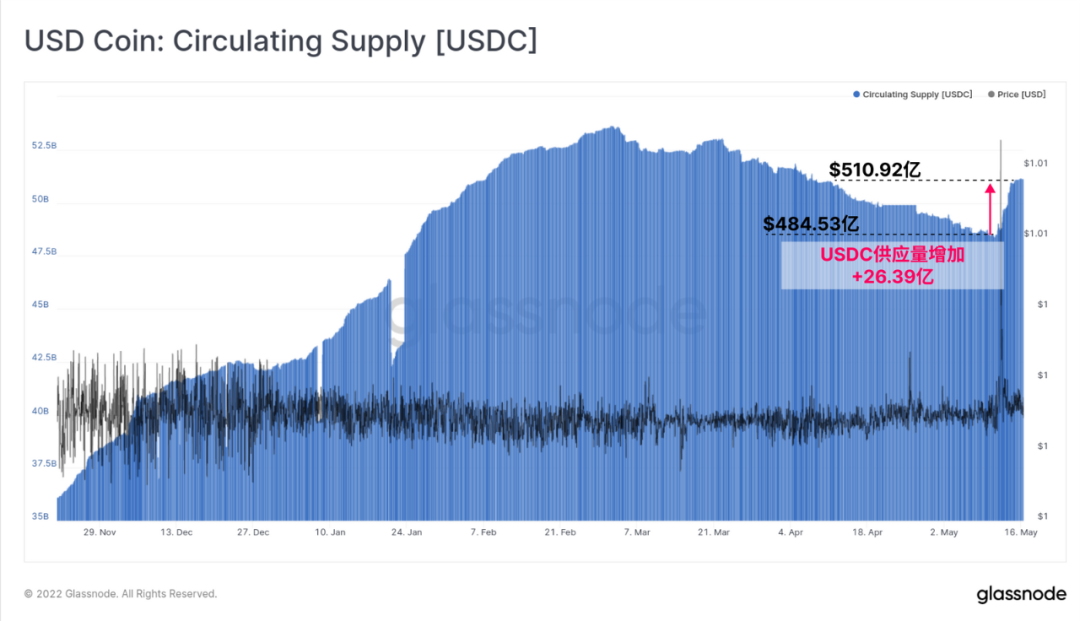

本周,我们还看到其他主要稳定币供应的有趣变化,提供了关于压力时期市场偏好的洞察力。USDC扭转了自2月下旬以来的供应收缩趋势,增加了26.39亿美元。鉴于USDC在过去两年的主导性增长,这可能是一个指标,表明市场偏好从USDT转向USDC作为首选稳定币。

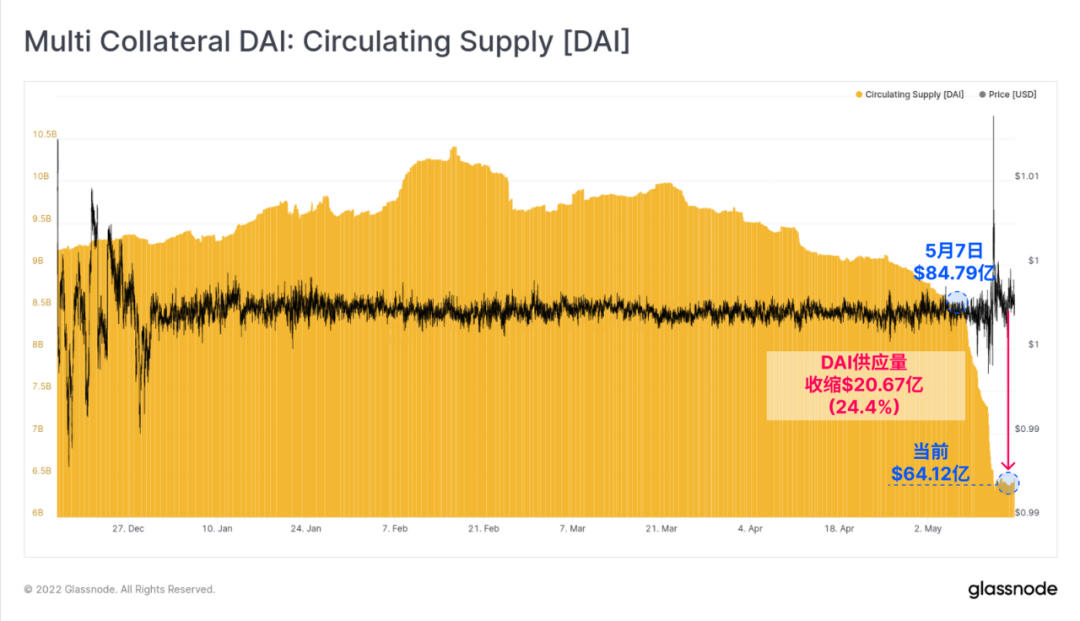

另一个供应量发生巨大变化的稳定币是DAI,它的供应量下降了24.4%,因为有20.67亿美元被烧毁。DAI是一个过度抵押的稳定币,由存放在Maker协议中的其他数字资产提供支持。当代币持有人通过偿还和燃烧DAI来结清他们的头寸时,DAI的供应将收缩。

这个过程可能是随意的,也可以是在金库清算的情况下被迫进行。然而,尽管抵押资产波动很大,对DAI的需求上升,以及清算事件,DAI还是设法保持了强有力的1美元挂钩,只有非常小的溢价。

链上实现的严重损失

随着LUNA传奇的发展,LFG收购的比特币在链上卖出的价格比购买时低得多。USDT与美元的挂钩也受到压力,价格跌破了2021年7月设定的2.9万美元的支持水平。这实际上使2021-22年周期的所有投资者陷入亏损,并催生了大量和广泛的净损失。

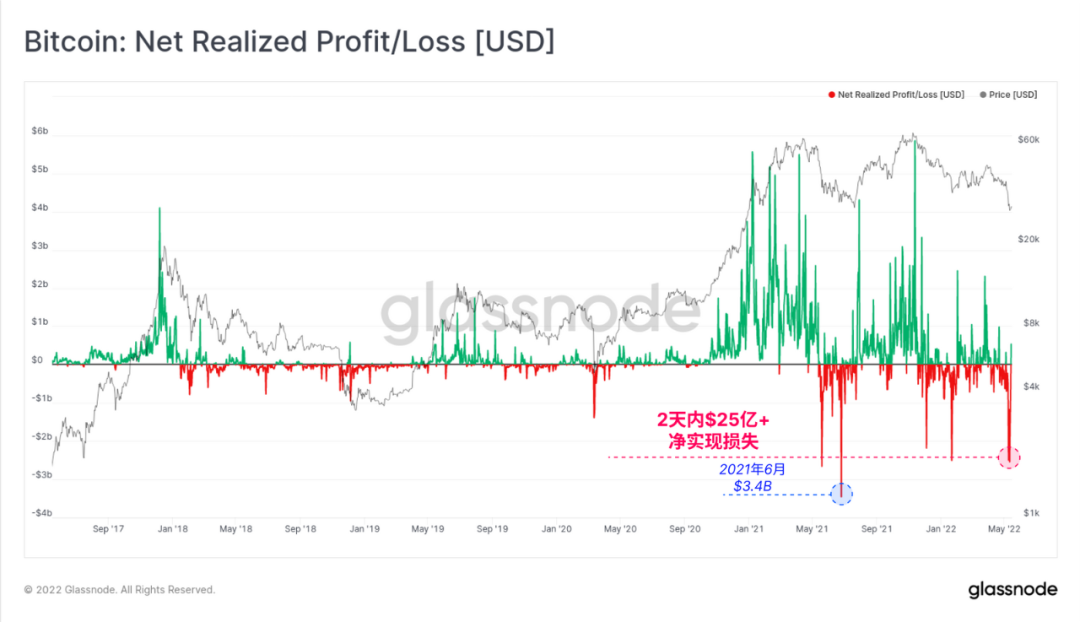

所有链上消费实现的净损失连续两天达到25亿美元以上,这与历史上最大的投降事件相当(如果从总和上考虑则损失历史之最)。

仅LFG一家就贡献了7.037亿美元的已实现损失。请注意,这反映了比特币进入和离开LFG钱包之间的损失,并没有考虑到BTC被交易为UST和供应量过度膨胀的LUNA时的额外损失。

随着比特币市场规模的扩大,以美元计价的损失自然会随着时间的推移而增加。因此,我们可以建立一个 "相对已实现的损失 "指标,用整个网络的每日已实现的损失除以已实现的市值,以比较各周期的损失。

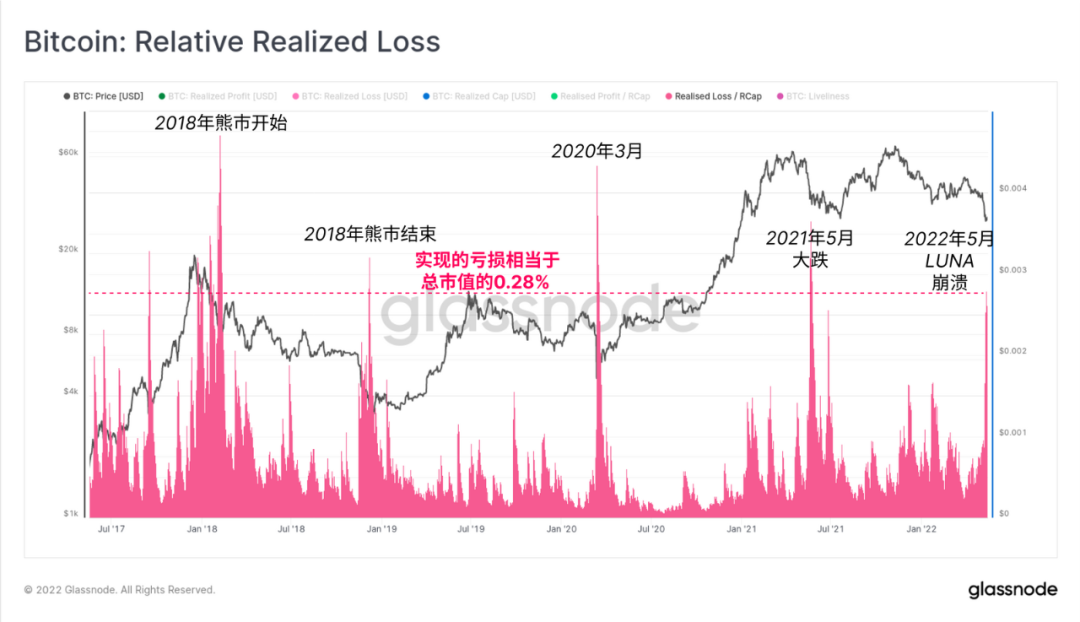

在这里,我们可以看到,LUNA投降仍然引发了过去5年中最大的损失事件之一,引发的总损失相当于已实现市值的0.28%。本次下跌可以与以下事件相提并论:

2018年熊市的开始和结束抛售事件

2020年3月的新冠肺炎崩溃事件

2021年5月的抛售,有趣的是,本周正在庆祝该事件一周年。

实现价格近在咫尺

实现价格是链上分析中最古老,也是最基本的度量概念之一。它的计算方法是,用变现市值(即所有比特币在最后一次移动时的价格总和)除以流通供应量。因此,它反映了对供应中所有比特币的总成本基础的估计。

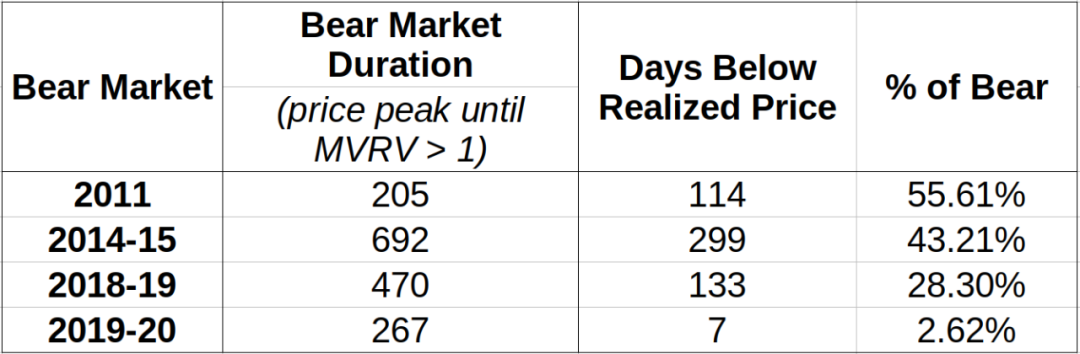

从历史上看,实现价格在熊市中提供了良好的支持,并在市场价格低于它时提供了市场底部形成的信号。下表显示了以前的熊市周期,以及价格低于实现价格的时间比例。

可以看出,随着时间的推移,每个熊市周期在实现价格以下的相对时间较少。这可能部分是由于市场对其存在的普遍认识(它在2018年首次被发现 )。2020年3月仍然是最明显的偏差,仅有7天的时间低于实现价格,而不是像之前周期中持续了几个月。

当市场达到本周价格低点26513美元时,实现价格在24000美元。随着市场在LFG BTC销售的重压下崩溃,LUNA和UST所持有的价值被破坏,以及对Tether的恐惧,现货价格下降到实现价格的9.5%以内。

由于上述总的已实现的损失,已实现的市值下降了79.2亿美元,代表了比特币网络的资本外流,并导致已实现的价格下降了60美元,至23,940美元。

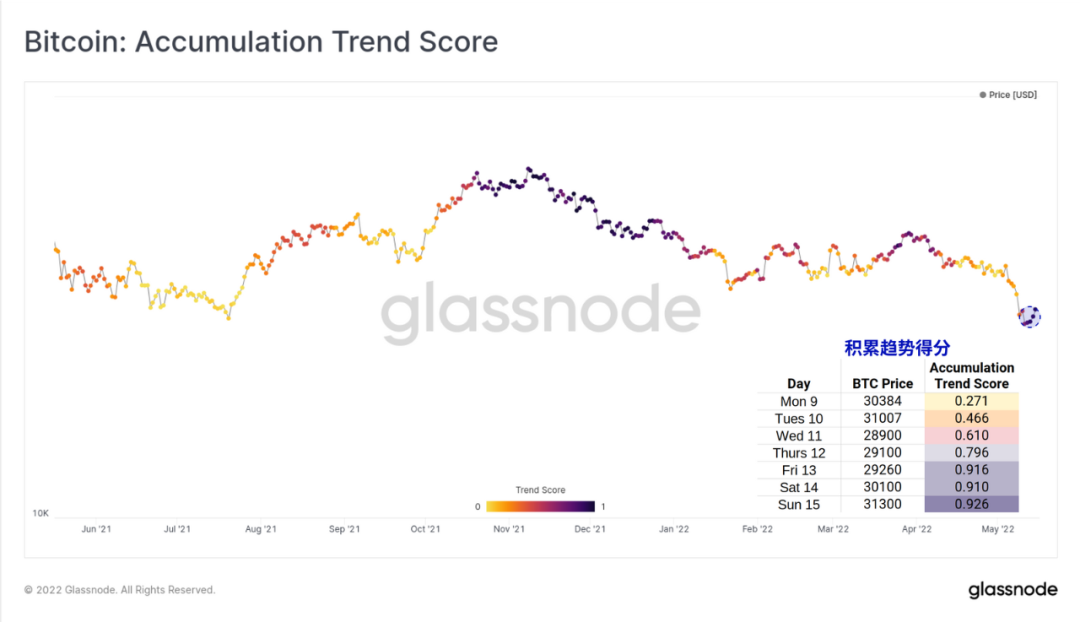

尽管出现了波动,但是市场上的多头似乎做出了强烈的反应,因为价格跌到了实现价格。下面的图表和表格显示了积累趋势得分,当市场上有很大一部分人在增加他们的链上余额时,它将返回接近1的数值。

5月12日星期四,当市场处于最低点时,积累趋势得分从低于0.3的非常微弱的数值中逆转,返回到0.796的数值以上。支持比特币价格反弹到3万美元,在本周剩下的时间里,该分数回到了0.9以上,表明发生了强烈的买盘活动。

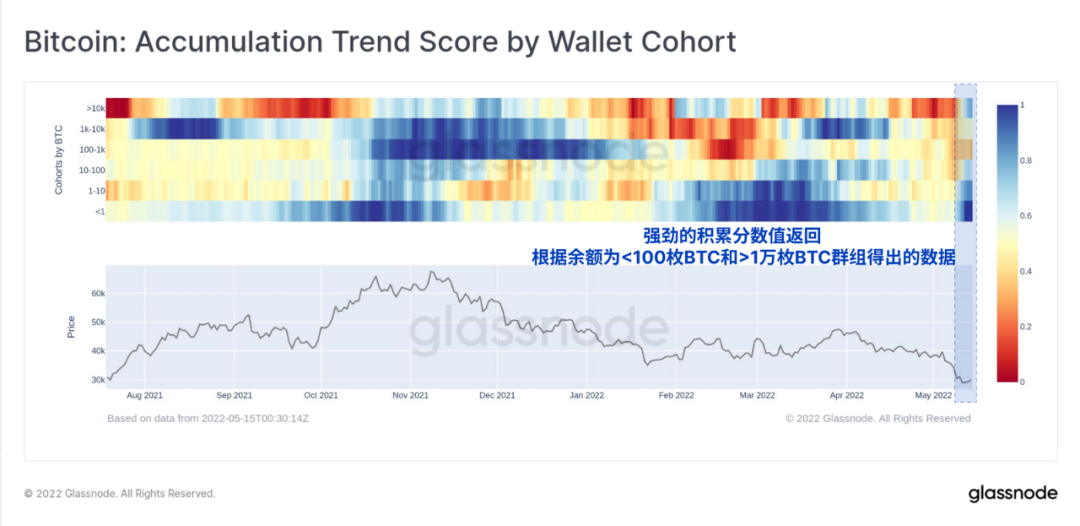

观察参与的各种钱包群组,我们可以进一步确认这一点。我们可以看到,从5月初所有群组的微弱积累(<0.3,暖色),到本周大多数群组的强大积累(>0.7,冷色),迅速发生了逆转。

到目前为止,少量比特币的持有者(<1BTC)是最大的积累者,并得到了拥有超过1万个BTC的鲸鱼的支持(这包括完全分配的LFG余额)。持有100枚BTC到1万枚比特币的钱包群组在其净积累方面仍然较弱。

值得注意的是,虽然交易所余额上升,实现的损失达到了历史水平,而且LFG卖出了8万枚BTC,但总市场仍然增加了他们的余额。这抵消了过去一周对累积趋势得分有很大影响的卖出影响。

来自Glassnode引擎室的未发布指标

本周发生的事情在本质上是历史性的,然而在许多方面,呈现出教科书式的数字资产熊市的特征。已经有各种例子表明,大名鼎鼎的加密货币项目原来是不稳定的,并最终在其自身重量下崩溃。这类事件通常是由熊市的价格下跌压力催生的,因为需求减弱,实验系统(通常有杠杆作用)受到压力。

随着稳定币日益成为市场上的基础层基础设施,脱钩事件的冲击波,特别是最大的稳定币USDT如果发生脱钩将产生广泛的影响。UST和USDT脱钩的双重动力,约400亿美元的LUNA/UST价值灰飞烟灭,加上LFG增加了8万枚BTC的抛售压力,创造了一个完美的风暴。这一事件无疑也将迅速吸引监管部门的紧迫关注。

至于是否需要全面回归到实现价格来平息这个熊市,以及如果需要的话,是几个月、几周、几天还是只是短暂的一瞬间,还有待观察。如果我们观察到的积累表明多头愿意在2万美元的范围内提供支持,那么这些日子也许已经过去了。还要注意的是,仍然有大量的宏观、通胀和货币政策力量作为阻力。未来的道路可能还会坎坷。