"Editor's Picks" is a "functional" section of Odaily. In addition to covering a large amount of real-time information every week, it also publishes many high-quality in-depth analysis content, which may be hidden in the information flow and hot news, passing by you.

Therefore, our editorial department will select some quality articles worth spending time reading and collecting from the content published in the past 7 days every Saturday, bringing new inspiration to you in the encrypted world from the perspectives of data analysis, industry judgment, and viewpoint output.

Now, let's read together:

Investment and Entrepreneurship

Decoding the past three Bitcoin cycles: What will drive the next cycle?

The supply shock caused by miners selling off may not necessarily trigger a bull market. But the halving narrative may attract new buyers, and the market can self-adjust. This is the reflexivity of the market.

The market price and liquidity of Bitcoin are vital. From the perspective of the United States, the liquidity situation seems to have bottomed out. With the inflation rate returning to 2%, the global economy should slow down. At that time, the Federal Reserve will get the green light to change monetary policy. This will open the floodgates for another wall of quantitative easing.

Liquidity + growth of network fundamentals + correct narrative = new price discovery.

Reflexivity of new price discovery = new VC funds.

The best time to buy Bitcoin is when everyone thinks it's already dead. The target price of Bitcoin in this cycle is $158,000. The market cap peak of the next cycle will reach $31.5 trillion.

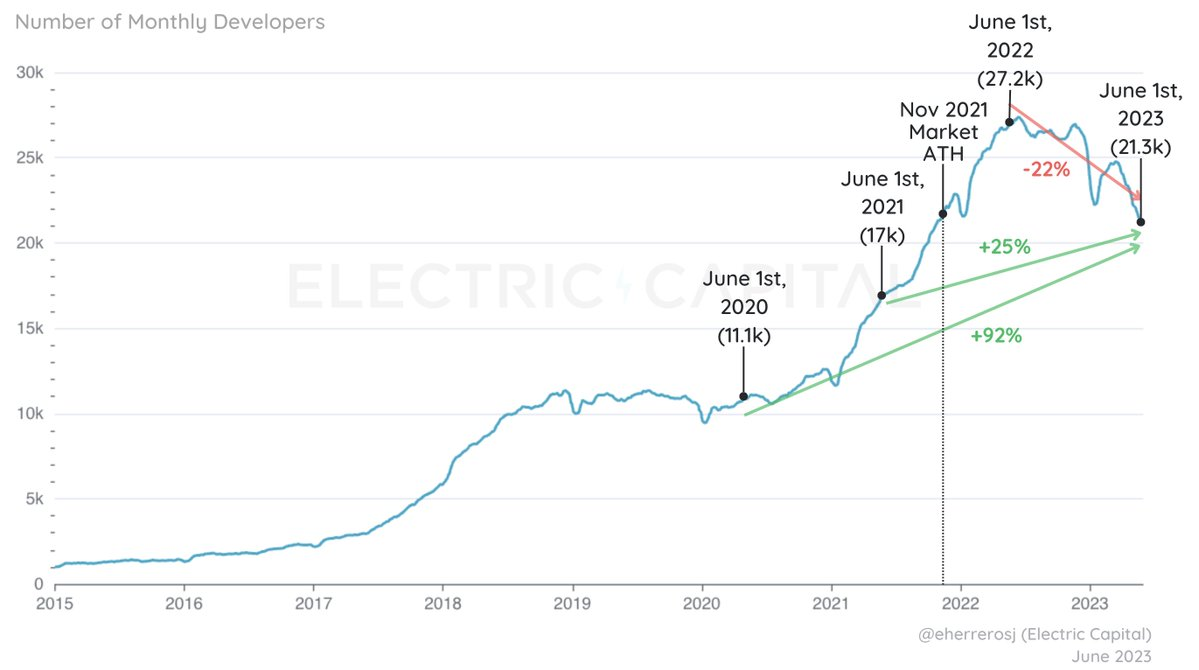

As of June 1, 2023, there are 21,300 active developers per month.

As of June 1, 2023, there are 21,300 active developers per month.

Developers who have been working in cryptocurrency for more than 12 months are still building, contributing more than 80% of the total commits.

Once in a bear market, developers who have been working in the cryptocurrency field for more than a year (emerging and mature developers) will dominate.

Osmosis, Sui, Aptos, Ton, Optimism, Aztec Protocol developers increased compared to the previous year.

CeFi

Explanation of grayscale digital asset trust: operation mode and premium overview

Although self-custody can fully control assets, it involves significant complexity and requires extensive technical knowledge to ensure security and successful implementation. In addition, investments made in this way will face significant tax obligations proportional to capital gains tax and income tax. Exchange products are not only convenient alternatives but also vital components of the digital asset investment field.

The dynamic value of trust products is important because investors may gain investment opportunities in Bitcoin at a discount or a premium, depending on the market conditions at the time, which may change investment risk allocation. Savvy investors can profit from mispriced assets through arbitrage trading strategies.

In the future, the introduction of spot ETFs may simplify these complexities and provide investors with a more efficient and direct way to access digital assets.

DeFi

OKX Ventures: Embracing all markets, how RWA helps DeFi engulf the world

The excess returns generated from past valuation inflation due to declining interest rates seem to be irreversibly moving toward mean reversion. DeFi, or the crypto economy, is re-embracing real-world assets, embracing TradFi, perhaps as a way to seize opportunities in a recession and deleveraging cycle.

Currently, most RWA products are struggling to find product-market fit; alternative asset & non-standard RWA protocols are emerging; government bond RWA will remain mainstream, and equity RWA is gaining attention; the recognition of the crypto community is crucial, and it is harder to achieve cooperation within the native community.

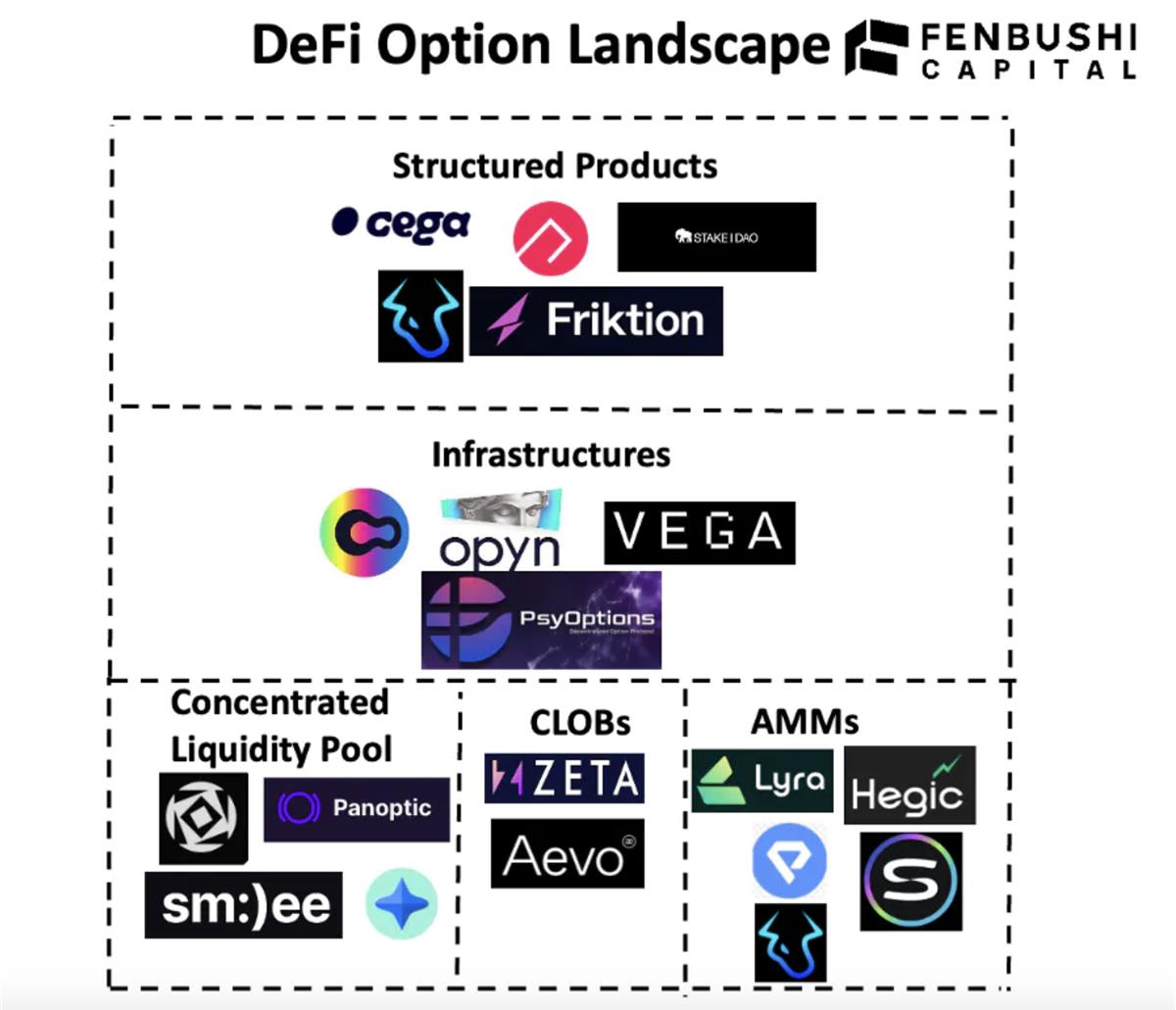

Currently, DEX and CEX futures trading volume accounts for about 2%. If we assume that the market share of on-chain options will reach a similar level as on-chain perpetual contracts, the estimated on-chain options trading volume should be around 800 million USD, which may not be enough to incentivize market makers to provide liquidity on-chain.

The use of derivatives of concentrated liquidity LP positions may be one way to solve liquidity problems because there is already a large amount of liquidity in the concentrated liquidity pool. These products (Infinity Pool, Panoptic, Itos, Smilee, etc.) also provide significant product differentiation for CEX, such as the ability to speculate on long-tail assets. The main challenge for them is to convince concentrated liquidity LPs to re-deposit their liquidity into their pools.

In the long run, the author is bullish on on-chain options protocols based on CLOB (Central Limit Order Book). This protocol first uses off-chain order book matching and on-chain settlement similar to dYdX, and then gradually moves the order book on-chain as the underlying blockchain infrastructure improves. The new derivatives release liquidity from the centralized liquidity pool by finding similar payment functions between Uni V 3 LP positions and options sellers. In short, the goal of all these protocols is to take the other side of impermanent loss to solve the liquidity problem hindering the growth of the options market.

Mint Ventures: MakerDao's hidden worries, not just RWA exposure

The recent driving forces behind MKR's price rise include: the protocol's monthly expenses decreasing; transforming collateral from interest-free stablecoins to government bonds or stablecoin financial management, significantly improving financial income expectations, reflected in the decrease in PE ratio; Founder Rune selling other tokens such as LDO in the secondary market and continuously repurchasing MKR for months, giving the market confidence; lowering the threshold for governance to repurchase funds from the project surplus pool (System surplus) from $250 million to $50 million; the grand narrative of Endgame; and the recent narrative of RWA seems to be well received by the market.

MakerDao's core business has never changed, fundamentally aligning with projects like USDT, USDC, BUSD, etc., which gain "seigniorage income" from the issuance and operation of their stablecoins.

The competitive advantages of Dai include: the legitimacy and brand of being the "first decentralized stablecoin", and the network effects of stablecoins.

The real challenges for MakerDao are: the continuous shrinkage of Dai's scale and long-term stagnation of expanding use cases; how the subDAO project can succeed in entrepreneurship while still receiving MKR and Dai funding; the limited stablecoins on MakerDao's account available for further purchasing RWA, making it difficult to continue increasing positions in US bonds; and whether MakerDao can continue to maintain cost control.

In addition, Dai's stable fee rates have recently been raised from 1% + to over 3%, which further reduces the demand for borrowing through MakerDao, which is unfavorable for maintaining the scale of Dai.

Inventory of Balancer's Innovative Initiatives: 7 types of liquidity pools and architectural logic

Enhanced Pool: Utilizing idle liquidity for mining;

Balancer upgrades all stable-type liquidity pools (stable pools, semi-stable pools, etc.) to combinable stable pools, which can directly trade with their LP tokens, i.e., "nested" transactions, or use LP tokens to form trading pairs with assets like WETH in other pools, thus reducing the gas fees for joining and exiting liquidity pools;

Liquidity Bootstrapping Pool: Has helped over 130 projects with fundraising;

Weighted Pool: Provides liquidity with various token-specific weights;

Custodial Pool: Suitable for fund managers, allows for management fees;

Linear Pool: Introduces target price ranges for trading pairs;

Protocol Pool: Custom-built DeFi protocols on top of Balancer.

Balancer v2 separates the AMM logic, token management, and bookkeeping, with token management and bookkeeping being handled by the Vault, and the AMM logic of each pool is independent. In terms of architecture, Balancer v2 also transitions from each Vault in v1 individually safeguarding assets to a single Vault holding all assets.

NFT, GameFi, and Metaverse

GameFi about to rise? Quick introduction to the four chain game projects in the Starknet ecosystem

The article introduces Loot Realms, Dope Wars, Influence, and Topology.

As the mainnet upgrade date of Starknet approaches, the Loot ecosystem game Loot Realms will also open its first playable version, LootSurvivor, to players on the Starknet mainnet at the end of July this year. As the first blockchain game launched on the Starknet mainnet, Starknet's Quantum Leap will bring what changes to players' experience and will also be validated in this game.

Ethereum and Scalability

The sharp increase in total expenses in the second quarter was temporary; focus should be on L2 solutions; the growth rate of staked ETH has slowed down; Ethereum's operational leverage has led to massive burning.

Observations by Cregis Research: New problems caused by three transitions in Ethereum

Cregis Research: The value of Ethereum account structure archaeology and account abstraction

Ethereum, running in a decentralized environment, still faces the biggest pain point: a linear environment cannot execute high-concurrency and complex code compilation. This is why Vitalik Buterin has always encouraged users to enter the layer 2 network, advocated for contract wallets and account abstraction, and even encouraged users to give some privacy to the projects in exchange for social login, social recovery, and other user experiences similar to Web 2.0. If Ethereum does not make these changes, it will never be able to achieve its vision and will always be just an accessory to Bitcoin.

Account Abstraction (AA) Wallet = Contract Account (CA) + Off-chain Communication Standard.

The flaws of AA wallets are: the cost of creating CA is high, the security of CA depends on the builder of smart contracts, CA can currently only run on EVM chains, calling a CA wallet relies on EOA signatures, and the security logic has not been upgraded.

Exploring the Future Opportunities of Ethereum Block Space: How to Design Ethereum GAS Derivatives?

The spot gas market of Ethereum may also benefit from the derivatives market. With the development of Ethereum gas derivatives, we have the opportunity to develop a complete set of products to provide better user and developer experiences (for example, users and developers can expect or rely on a fixed gas price without worrying about price fluctuations) and improve the efficiency of Ethereum block space price discovery.

When designing these products, regulatory/legal, market, and protocol-specific issues need to be considered. In addition, the granularity of market participants must be improved to support active trading of these products.

Favorable conditions for market development are forming, such as the concentration of gas buyers (that is, due to the development of L2/account abstraction), the increase of products used for hedging (for example, staking products), and the improvement of granularity of various stakeholders in the trading supply chain (for example, through infrastructure improvements).

Five Major Disruptors, an Overview of LSD Track Potential Projects

In order to compete for market dominance (or even weaken its monopoly position), latecomers must offer something better or different from Lido. These advantages could include: higher returns, easier access, higher composability and/or security, innovation.

The article briefly summarizes five LSD projects that may have the most potential, explores how they compete with market leader Lido in terms of technology, economics, and user experience, and become market disruptors by providing novel solutions, namely Prisma, Swell, unshETH, Origin Ether, Diva.

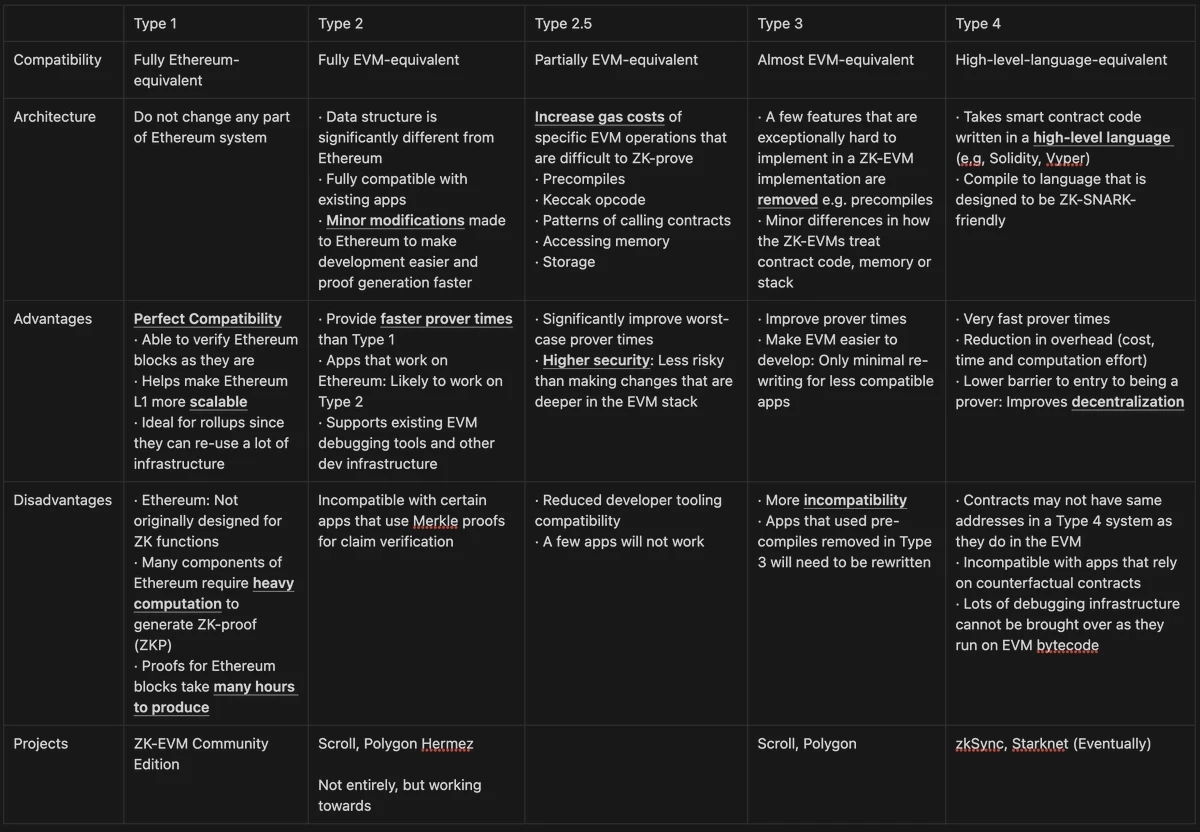

Explaining the Five Types of ZK-EVM: Architecture, Advantages, and Solutions

An Overview of the Seven Major L2 Networks: What are Their Advantages and Potential?

Introducing the advantages of Optisium, Arbitrum, Polygon, Base, Mantle, opBNB, and zkSync.

Catching up on the weekly highlights

During the past week, the judge ruled in favor of both the SEC and Ripple on partial motions, but the securities status has not been determined, the court ruled that trading and algorithmic sales of XRP do not constitute investment contracts, while institutional sales violate securities laws, the US SEC responded to the Ripple case: recognizes partial ruling by the court, but will still review the related decisions, the US SEC sued Celsius Network and its former CEO Alex Mashinsky, the US FTC reached a $4.7 billion settlement agreement with Celsius, but its co-founder has not reached a settlement, the Department of Justice reached a non-prosecution agreement with Celsius, Celsius: company restructuring not affected by the $4.7 billion settlement agreement with FTC, Google Play changes tokenized digital asset policy to allow integration of NFTs in apps and games (Detailed explanation), SlowMist: a total of $265 million flowed out of Multichain, spread across 9 chains, FTX launches claims website and temporarily goes offline;

In addition, in terms of policies and macro market, the Fed's overnight index swap suggests a reduced possibility of a second rate hike this year, the EU released its Web 4.0 and virtual world strategy to guide the next technological transformation, and the US Department of Justice announced the first criminal case involving a smart contract attack on a DEX operation;

In terms of views and voices, Fed's Daly: we are in the final stage of the rate hiking cycle, Temasek's Chief Investment Officer: not planning to invest in cryptocurrency companies due to regulatory uncertainties, BIS report: inherent structural deficiencies of cryptocurrencies make them unsuitable as currency instruments, Arkham: not affiliated with any government agencies, the platform will never sell user data;

In terms of institutions, large companies, and leading projects, Binance will launch the Launchpad project Arkham (ARKM), ConsenSys Layer 2 network Linea plans to go live on the mainnet this week, Coinbase L2 network Base is opening the mainnet to developers, with the mainnet expected to be publicly released in August, Polygon PoS chain has successfully executed the Indore hard fork. Polygon proposes to upgrade the MATIC token to POL (Analysis of the economic model). Participants in the Fei Protocol Genesis Event Wallet can file for compensation. The case is currently being handled by the Higher Court of San Francisco.

In the NFT and GameFi fields, BAYC will launch the IP tool Made by Apes this month... Well, it's been an eventful week.

Attached is the series "Weekly Editor's Picks".

See you next time~