"Weekly Editor's Picks" is a "functional" column of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, Planet Daily also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news, and pass you by.

Therefore, every Saturday, our editorial department will select some high-quality articles that are worth spending time reading and collecting from the content published in the past 7 days, and bring new inspiration to you in the crypto world from the perspectives of data analysis, industry judgment, and opinion output.

Now, come and read with us:

Investment and Entrepreneurship

Bitcoin at $120,000: A capital feast without retail investors

The cryptocurrency market is undergoing an unprecedented reconstruction of capital power. Institutional investors have taken over the market's dominance through systematic layout. The market structure has undergone fundamental changes: volatility has decreased, but liquidations have become more concentrated. Wall Street has monopolized pricing power, and retail investors are collectively powerless. Cryptocurrency no longer subverts traditional finance, it has become the sharpest new weapon of traditional finance.

Arthur Hayes' latest forecast: Bitcoin 25W, Ethereum 1W, see you by the end of the year

The most important variable for profitable trading is to understand how the fiat money supply changes. The three major variables behind it recently are tariffs, wars, and credit.

The altcoin space offers amazing opportunities, and the upcoming Ethereum bull run will completely detonate the market. Maelstrom's year-end targets are: Bitcoin = $250,000; Ethereum = $10,000.

What happened behind Ethereum's 70% surge in a single month?

Billions of dollars of short positions were liquidated in a chain reaction. The market is facing stronger short squeeze pressure. A similar effect is also seen on XRP, while Bitcoin continues to show relative strength.

President Trump is expected to sign an executive order as soon as this week to allow 401k pension plans to invest in cryptocurrencies. This will be one of the most significant positive milestones in the history of cryptocurrencies.

Then there is crypto’s most powerful bull engine: the U.S. deficit spending crisis.

Trading SharpLink, revealing the AGP behind the crypto-stock craze

From "junk stocks" on the verge of delisting to solid consumer brands, from crypto-native companies to cross-border technology upstarts. When people tried to find the driving force behind the scenes, the spotlight was not on Goldman Sachs or JPMorgan Chase, but on a medium-sized investment bank that was not prominent in the public eye before: AGP (Alliance Global Partners). As the trader or key participant in all these transactions, AGP played this model out of all the tricks. On the SharpLink project alone, according to its commission rate, it earned commissions of more than $8 million in a week, and this was just the beginning of its huge plan with a total value of $6 billion.

While Wall Street giants are building compliance bridges for institutional clients, AGP is taking a more radical approach: transforming all kinds of listed companies into "cryptocurrency proxy stocks" in batches, and sitting at the poker table to become the one who designs the rules of the game. Behind the Midas Touch is Wall Street's desire for money and radical change. In the financial market, the one who really makes money is always the one who designs the rules of the game.

Pantera Capital, a 12-year veteran in crypto, is entering a new battlefield in crypto-stocks

In a few months, Pantera Capital evaluated more than 50 listed companies with "financing + buying coins" as the core strategy and began to participate deeply. In order to eat this new cake, Pantera also launched a special "DAT fund". Currently, many Pantera fund limited partners have pledged to invest, and it is expected that a total of more than 100 million US dollars will be invested in multiple DAT projects. Today, its investment and layout can be seen in the "micro strategies" of different currencies.

The business behind the crypto treasury, Galaxy Digital’s move to the U.S. stock market

Galaxy primarily serves two types of corporate treasury participants: (1) self-managed enterprises, which can use Galaxy's institutional-grade technology platform to conduct transactions, lending and pledge operations on their own; and (2) enterprises seeking custodial management, which can work with Galaxy Asset Management to obtain comprehensive management strategies and infrastructure support.

Customized crypto treasury services are also becoming an important source of income for Galaxy. Take SharpLink Gaming as an example. Galaxy not only invested in the company, but also signed an asset management agreement with it to manage its Ethereum treasury.

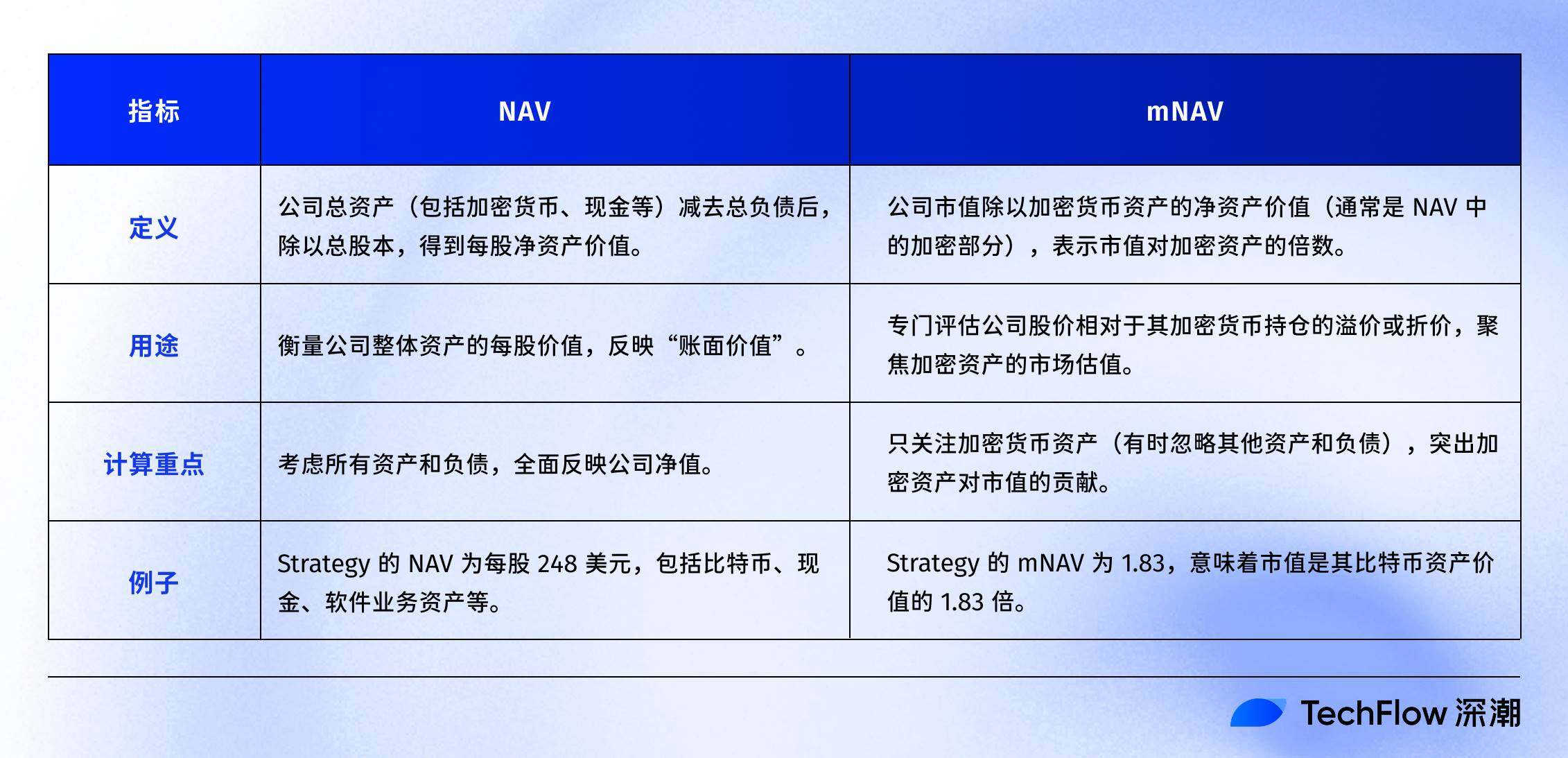

Crypto asset reserve companies can continue to increase their holdings or repurchase their own shares, resulting in their market value often far exceeding their NAV (net asset value). The calculation method of NAV is very intuitive, that is, the value that shareholders can get per share after deducting liabilities from the company's assets.

In traditional finance, NAV is a very common financial indicator, particularly suitable for asset-driven companies, such as real estate companies, investment fund companies, etc.

In the field of crypto-US stocks, the core role of NAV can be summarized as: measuring the impact of crypto assets held by a publicly listed company on the value of its stock. NAV cannot fully capture the market's optimistic expectations for crypto assets.

mNAV = company market value/net value of crypto assets is an advanced tool that is more in line with the dynamics of the crypto market and is used to measure the relationship between a company's market value and its net value of crypto assets.

The tokenization of US stocks has poor liquidity and imperfect supporting tools. In essence, it is still in the initial stage of "only buying up". Common "liquidity attraction models" include incentive liquidity pools, market makers leading liquidity, high-speed off-chain matching + on-chain mapping. What can really stimulate the fission of gameplay are tools and mechanisms.

Also recommended: " Michael Saylor: BTC mortgage bonds are annualized at 10%, and the 9 trillion pension battlefield is ready ", " XRP breaks through new highs, the encrypted parallel world behind the fierce old currency ", " ALT tokens return to zero in four hours, Crypto Beast's tens of millions of dollars harvest ."

Policy and Stablecoins

With the GENIUS Act now enacted, how should we approach the stablecoin narrative with caution?

The passage of the GENIUS Act is not only a loosening of the US's restrictions on stablecoins, but also a clear choice of the digital dollar route - abandoning the central bank digital currency (CBDC) and supporting compliant, private-sector issued US dollar stablecoins. It can be foreseen that this statement by the United States will become a reference paradigm for regulatory design in other countries, and promote stablecoins to enter the general discussion framework of global financial policies.

With the support of institutional and national forces, these emerging stablecoin projects are pushing the function of stablecoins from "Web3 liquidity tools" to a value bridge connecting Web3 and the real economic system. Its usage scenarios are also gradually penetrating from exchanges and wallets into multiple uses such as supply chain finance, cross-border trade, freelancer settlement, and OTC scenarios.

The next stage of growth of stablecoins will inevitably be closely related to the new globalization of the US dollar, and will also become a new battlefield between governments, international institutions and financial giants.

The significance of the GENIUS Act goes far beyond cryptocurrency itself. This may be the first financial regulatory bill in U.S. history that aims to promote growth, competition and protect consumers. Its core is to set clear rules for the market and build a rules-based competitive environment. The GENIUS Act sets clear rules for the market, and the ultimate biggest winners are American consumers and market participants, while also further consolidating the dollar's position in the global economy.

There is still a huge gap in financial access worldwide, and the United States and other countries are in urgent need of alternative payment systems. In the future, many companies may compete around data and regard data as an asset. In this era when data is called "new oil", can blockchain become a "new tool" to carry this data? This is a question worth pondering.

The fully-reserve stablecoin model solves a core problem in the early days of cryptocurrency - consumer regret due to price volatility. This asset is not only a pricing mechanism for crypto transactions, but also an important medium of exchange for the Internet economy.

Payment Revolution: When Stablecoins Begin to Eat into Visa’s Territory

A relatively basic introduction to the advantages of stablecoins and their impact on traditional payments.

Airdrop Opportunities and Interaction Guide

Is it still necessary to play Polymarket now? What is the best strategy for retail investors?

Ethereum and Scaling

Who are the top players in Ethereum?

For many investors, staking may be the key difference between "shallow allocation" and "deep participation". Passive income obtained through compliant investment tools may attract pension funds, endowment funds and sovereign wealth funds to enter the market.

Reserve asset builders are positioning ETH as programmable collateral, an asset that generates yield, provides security, and remains stable.

Why is ETH Treasury more likely to rise than Strategy? How to choose between SBET and BMNR?

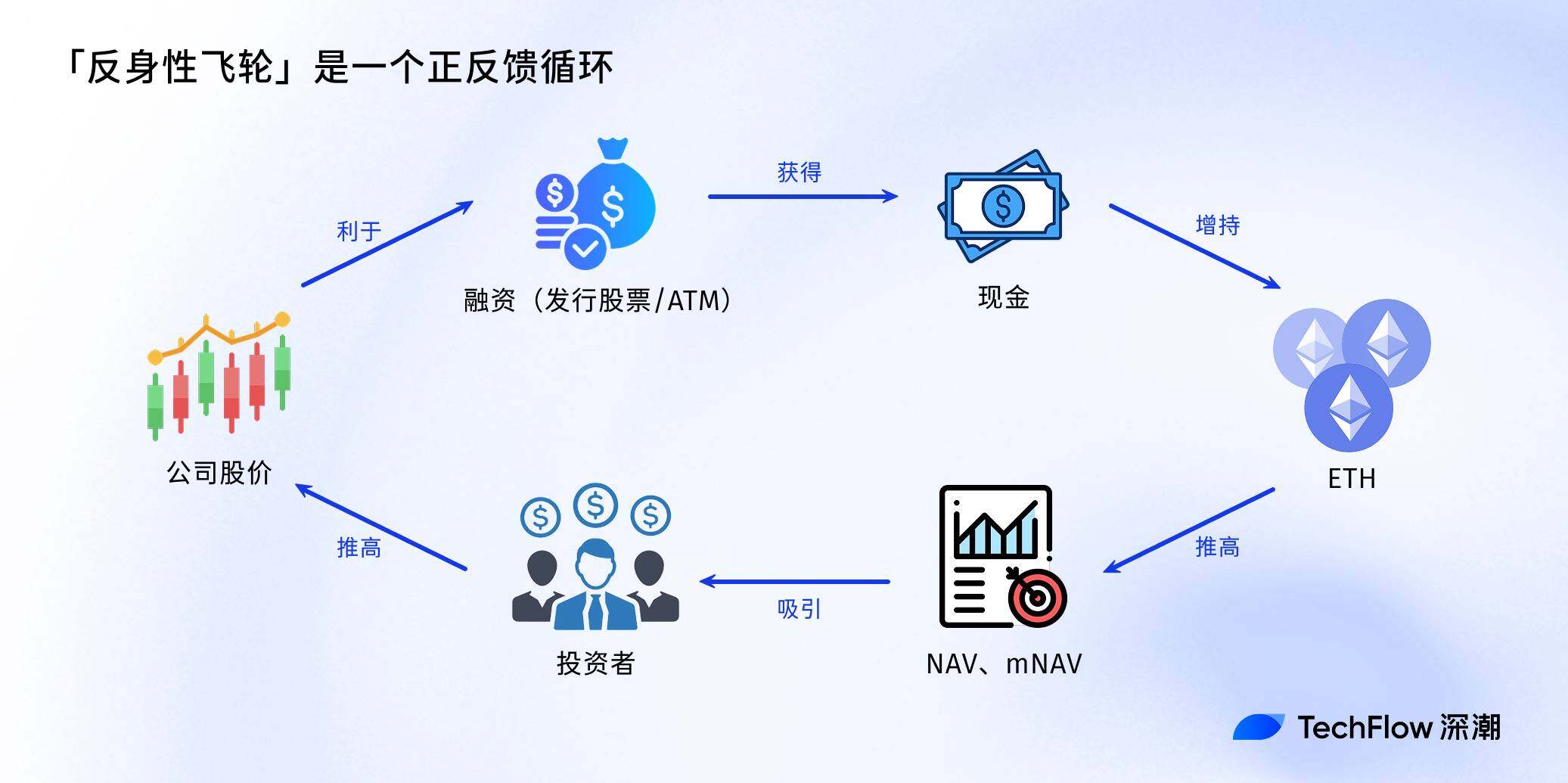

Treasury firms are essentially trying to arbitrage the difference between the long-term compound annual growth rate (CAGR) of the underlying assets and the cost of capital.

As a programmable scarce reserve asset, ETH plays a fundamental role in maintaining the economic security of the chain as more assets migrate to the blockchain network. Compared with BTC, ETH can generate native income through staking, re-staking and lending, which provides stronger certainty for preferred stock interest payments and should theoretically receive a higher credit rating. The ETH treasury naturally enjoys a higher mNAV premium due to its native income mechanism.

Many institutions may not be willing to go long on ETH directly, but ETH Treasury can act as an intermediary - absorbing directional risks while providing institutions with returns similar to fixed income. The ETH Treasury model can be seen as a fusion of MicroStrategy and Lido designed specifically for traditional finance.

The competitive landscape of ETH treasury companies will be fundamentally different from that of BTC treasury companies. The Bitcoin ecosystem has formed a winner-takes-all situation (MicroStrategy's holdings are more than 10 times that of the second largest corporate holder), and it has dominated the convertible bond and preferred stock markets with its first-mover advantage and strong narrative control. The ETH treasury started from scratch, with no single dominant entity and multiple projects developing in parallel. This state of no first-mover advantage is not only healthier for the network, but also fosters a more competitive and accelerated development environment. Given the similar ETH holdings of the leading companies, SBET and BMNR are likely to form a duopoly.

SBET has the advantage of being more retail-driven (thanks to Joe Lubin’s leadership and the team’s continued transparency in increasing their holdings of ETH per share), while BMNR has easier access to institutional liquidity thanks to Tom Lee’s deep connections in the traditional financial world.

Sharplink narrative bubble burst? ETH version of Strategy still undecided

SharpLink Gaming's financing method of combining private equity financing (PIPE) and at-the-market offering (ATM) to purchase ETH has begun to be questioned by the market.

The funds for Strategy to purchase BTC come from convertible bond financing. The risks of this type of financing are debt maturity pressure, interest payment, etc., but it will not cause significant equity dilution and market selling pressure. Therefore, it is a good strategy to achieve "left foot stepping on the right foot to go to the sky" in the upward stage of BTC. However, the private equity financing (PIPE) adopted by SharpLink will directly dilute the equity and cause selling pressure on the stock price.

However, there is a listed company with ETH reserves in the market that did not use equity financing to raise funds, but instead adopted a convertible bond financing + revolving loan financing model, also known as the "TraFi + DeFi hybrid financing structure", which is BTCS. On the one hand, the company raised funds in traditional finance to purchase ETH through convertible bonds and ATMs; on the other hand, BTCS used ETH as collateral to lend stablecoins in DeFi protocols such as Aave to purchase ETH.

BlackRock enters the ETH collateralized ETF, which tracks and projects will benefit first?

The launch of a staking ETF may mean a structural reassessment of the nature of assets. ETH can obtain staking rewards by participating in on-chain verification, and the current actual annualized return rate is about 3.5%.

The winners in the staking track include liquidity staking protocols and CEX.

Whoever can win the ETF cooperation resources first will occupy a more core position in the next encryption cycle.

The real reason why ETH worth $1.9 billion is collectively queuing up to unstake is...

Starting on July 16, the number of ETH unstacking requests increased dramatically, with the number of validators in the exit queue soaring from 1,920 to more than 475,000 on July 22, and the waiting time increasing from less than an hour to more than eight days.

The sharp surge was mainly caused by the surge in ETH lending rates that began on July 16. The surge in interest rates triggered a widespread liquidation of ETH revolving loan strategies, which in turn intensified the decoupling pressure of ETH-based liquidity staking and re-staking tokens (LST and LRT).

Ethereum’s 1.9 billion unstaking wave: profit-taking or a new starting point for the ecosystem?

Validators on the Ethereum network are queuing up to release their staked ETH, but this does not mean they will definitely sell it.

Also recommended: " Ethereum is undergoing a "major change": is it a good opportunity to get on board, or a signal to escape? " " The waiting time for ETH unstaking has reached a new high, are Ethereum holders about to call each other stupid? "

Multi-ecology

ETH vs SOL: Crypto War in 2025, Trillion Capital Bet on the New and Old Order

ETH and SOL are diverging under the dual impetus of capital and policy, one is precipitating into institutional assets, and the other is exploding into a consumer main chain.

Data Revealed: Who Holds the SOL?

DeFi researcher Ignas wrote an article analyzing the distribution of SOL tokens, including staked SOL, locked and staked SOL data, and the proportion of SOL held in wallets.

At present, Solana is still the best choice for building applications in the crypto space - it has a large number of users, sufficient liquidity, a clear regulatory environment, excellent wallets, and global access infrastructure. However, some applications still choose to build their own underlying technology to explore new market structures. Solana needs to become the preferred platform that "can both connect with existing users and boldly experiment with market microstructures."

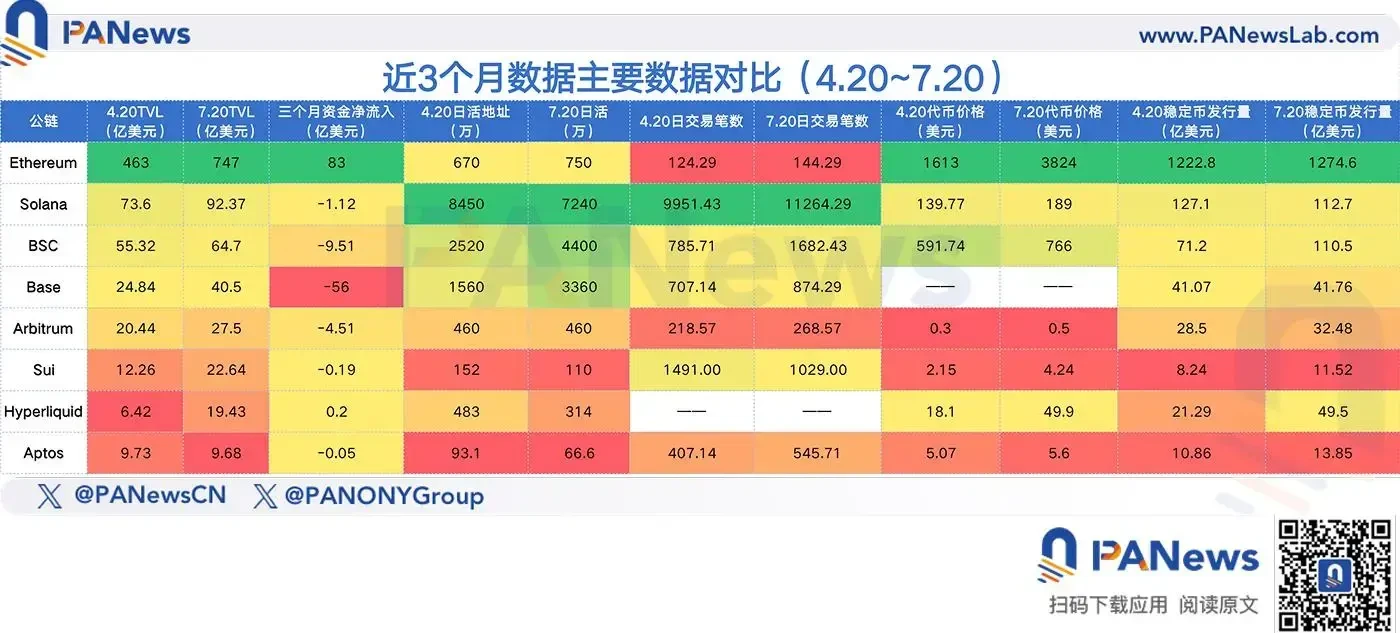

The recent performance of public chain data is not as intense as the market's response to token prices. Although Sui, Hyperliquid, Base and other networks have also seen significant improvements in data driven by the market, the magnitude of this improvement is obviously lower than the increase in token prices. Obviously, this is a round of recovery in which funds are ahead of the ecosystem. Behind this recovery, whether the price performance of tokens can be transformed into the ecological prosperity of various public chains, or even drive actual application tracks such as DeFi and chain games like the previous bull market, may be the core factor for this round of copycat season to last longer.

The recent performance of public chain data is not as intense as the market's response to token prices. Although Sui, Hyperliquid, Base and other networks have also seen significant improvements in data driven by the market, the magnitude of this improvement is obviously lower than the increase in token prices. Obviously, this is a round of recovery in which funds are ahead of the ecosystem. Behind this recovery, whether the price performance of tokens can be transformed into the ecological prosperity of various public chains, or even drive actual application tracks such as DeFi and chain games like the previous bull market, may be the core factor for this round of copycat season to last longer.

CeFi & DeFi

Data Revealed: How Much Money Can MEV Bot Make from CEX-DEX Arbitrage?

The average profit margin of CEX-DEX arbitrage is 38.5%;

Bot strategies vary, but the excess returns of top traders mostly decay within 0.5 to 2 seconds;

As competition among blockchain builders intensifies, the profit margins of CEX-DEX arbitrage are shrinking year by year;

Blockchain construction is a low-profit business. If you do not have an order flow with ultra-high MEV value, there is no opportunity to enter the market today.

$112 million breakthrough: Polymarket returns to the U.S. through QCX backdoor listing

Polymarket recently acquired QCX, a small derivatives trading platform, for $112 million. With the help of QCX's "license", Polymarket can finally legally reopen services for US users. After the crypto circle gradually becomes a mainstream in the financial market, the dual hybrid route of Token+IPO may also be realized on Polymarket.

Looking for the next UNI? 5 unsold Perp DEX projects worth paying attention to

Five Perp DEX dark horses that have not yet issued coins - edgeX, Lighter, Aster, Ethereal, and Paradex - have either rapid growth, abundant resources, or are backed by star VCs. They are key projects that cannot be missed by the current round of "money-pulling" army and contract players.

Web3 & AI

NFT

PENGU rebounded by 360% from the bottom, is the fat penguin ecosystem ushering in a second spring?

For a long time, the Pudgy Penguins ecosystem has been focusing on offline IP, online Meme, Abstract live broadcast, etc., using Web2 content logic, real economy, and creator economy to promote brand marketing and token growth.

Hot Topics of the Week

In the past week, Trump officially signed the GENIUS Act ( interpretation ); various sectors started to rotate, the NFT sector rose , BNB broke through $800 , setting a record high; listed companies continued to announce their entry into encryption;

In addition, in terms of policies and macro markets, insiders said: After Japanese Prime Minister Shigeru Ishiba lost the Senate election, the Bank of Japan is expected to stick to its stance of gradual rate hikes ; the FBI ended its investigation into the founder of Kraken and returned the seized equipment; many places warned of the risk of illegal fundraising of virtual currencies ;

In terms of opinions and opinions, the U.S. Treasury Secretary said: The U.S. dollar is accelerating on the blockchain , and blockchain will reshape the payment system;

In terms of institutions, large companies and leading projects, Tron rang the opening bell at the Nasdaq Exchange in Times Square, New York; Circle will issue interest-bearing stablecoin USYC natively on BNB Chain ; Polymarket acquires a trading platform and plans to return to the US market ; Jia Yueting enters RWA ( interpretation );

In terms of data, Trump Media & Technology Group (DJT.O) announced that its total Bitcoin reserve purchases have reached $2 billion ;

On the security front, $44.2 million was stolen from Indian cryptocurrency exchange CoinDCX … Well, it’s been another week of ups and downs.

Attached is a portal to the “Weekly Editor’s Picks” series.

See you next time~

- 核心观点:机构主导加密市场,散户边缘化。

- 关键要素:

- 华尔街垄断定价权,波动率下降。

- 特朗普或允许养老金投资加密货币。

- 稳定币法案推动Web3与现实经济连接。

- 市场影响:加速机构化,重塑市场结构。

- 时效性标注:中期影响。