HyperEVM's #1 Arbitrage Team Reveals Their Strategy: How to Make $5 Million in Six Months

- 核心观点:利用HyperEVM与Hyperliquid价差套利获利。

- 关键要素:

- 质押HYPE获30%手续费返还。

- 引入挂单策略提升套利效率。

- 永续合约套利贡献60万美元收益。

- 市场影响:展示跨链套利策略可行性。

- 时效性标注:中期影响

Original author: CBB (@Cbb0fe)

Compiled by Odaily Planet Daily ( @OdailyChina ); Translated by Azuma ( @azuma_eth )

Let’s go back to March 2025. The cryptocurrency market looked bleak, the tariff conflict had a severe impact, and we began to think about where the next potential opportunity might be.

Since 40% of Hyperliquid (HYPE) had yet to be distributed to the community, we saw this as an opportunity. We had previously tested some market-making strategies on Unit (the asset tokenization layer built specifically for Hyperliquid) in February, but we weren't serious about it, just a small-scale experiment.

At the time, HyperEVM had just launched on some DEXs, and my brother suggested, "Why don't we try arbitrage between HyperEVM and Hyperliquid? Even if we lose money, we can still get Hyperliquid's third season rewards."

We decided to give it a try. There was an arbitrage opportunity, but we weren't sure if we could truly compete.

Why are there arbitrage opportunities on HyperEVM?

The block time of HyperEVM is 2 seconds. This means that the price of HYPE is updated every 2 seconds, and during these 2 seconds, the price of HYPE may fluctuate.

Therefore, HYPE on HyperEVM is often "undervalued" or "overvalued" relative to Hyperliquid.

Initial attempts and results

We first built a basic bot program.

Whenever there is a price difference between the AMM DEX pool on HyperEVM and the Hyperliquid spot, we initiate a trade on HyperEVM and hedge on Hyperliquid.

For example, if HYPE’s price rises on Hyperliquid, it is undervalued on HyperEVM. The trading logic at this point is: buy “cheap” HYPE on HyperEVM with USDT0 ➡️ sell HYPE for USDC ➡️ exchange USDC back to USDT0 on Hyperliquid.

In the first few days, we were able to do $200,000-300,000 in daily trading volume on Hyperliquid without any losses and even making a small profit of a few hundred dollars.

Initially, we only executed arbitrage when our profit was above 0.15% (after deducting DEX and Hyperliquid fees). After two weeks, we began to see greater potential as profits were trending upwards.

We identified two other competitors that were doing the same thing but were smaller in scale, and we decided to kill them.

In April, Hyperliquid launched the ability to stake HYPE to receive fee rebates. This was a perfect update for us, as we had a much larger fund size and could take advantage of this opportunity.

We staked 100,000 HYPE tokens, received a 30% rebate on trading fees, and lowered the profit threshold from 0.15% to 0.05%. We hope to minimize competition and force them to give up, allowing us to take advantage of the market. Our goal is to achieve over $500 million in trading volume within two weeks to secure a higher fee tier on Hyperliquid.

As our trading volume grew, so did our profits, and we eventually reached over $500 million in trading volume, completely crushing our competitors.

I still remember that day - two competitors were forced to shut down their bot programs, and my brother and I were flying from Paris to Dubai, watching frantically as our bot "printed money" - the profit that day was as high as $120,000.

After the period of rampant trading volume passed, even though our competitors were now significantly inferior in fees, they refused to give up, forcing us into a very narrow profit margin of 0.04%, which was basically the difference between our fees and theirs. Our trading volume remained strong, and our daily profits were stable between $20,000 and $50,000.

Scaling bottlenecks

As we scaled up, we started to hit bottlenecks.

The gas limit for each block of HyperEVM is 2 million, and one arbitrage transaction requires about 130,000 gas, so each block can only accommodate a maximum of 7-8 arbitrage transactions.

As more and more pools and DEXs are launched on HyperEVM, this number is far from enough, and some transactions will be stuck, resulting in a backlog in the transaction queue and an imbalance in the capital position.

To this end, we have taken a series of measures:

- Use 100+ wallets, each of which sends arbitrage transactions independently to avoid queuing for a single wallet;

- A maximum of 8 arbitrage operations can be performed per block;

- Dynamic gas control: When HyperEVM gas prices soar, the minimum return on investment (ROI) requirement will be increased to avoid sending transactions in vain during high gwei periods;

- Rate Limiting: If too many transactions have been sent in the past 12 seconds, the profit requirement will be increased before sending new transactions.

Optimization strategy

While profits continued to rise and trading volumes consistently outperformed our competitors by 5–10x, we also became morbidly obsessed with optimization.

This isn’t the first time we’ve experienced this – one day you could be printing money while drinking beer, and tomorrow some unknown entity could bring you back to square one overnight.

*Become a maker on Hyperliquid

In June, my brother came up with an idea he’d been thinking about for weeks: “What if, instead of placing orders as takers, we could initiate arbitrage as makers?”

This has two main benefits:

- First, it can capture HYPE's wick candles, which will bring more arbitrage opportunities;

- Second, it can save 0.0245% in handling fees for each transaction, thereby increasing net profit.

But at the same time, this is also a very challenging move, because if we initiate the order on Hyperliquid first, we cannot ensure that the corresponding hedging can be completed on HyperEVM - someone may be faster than us.

Previously, our arbitrage strategy involved initiating a trade on HyperEVM. If the trade failed, we would hold our position on Hyperliquid. If the trade succeeded, we would then hedge on Hyperliquid. However, as the order maker, we had to wait for the trade to be filled on Hyperliquid, and there was no guarantee that the trade would be filled on HyperEVM in a timely manner. This resulted in an unbalanced position and potential losses.

Initially, each test would see a position deviation of ±10,000 HYPE. It was difficult to understand why this was happening, as we were sometimes sending 100 trades in 20 seconds, without any data analysis tools. It was a complete mess.

To solve this problem and enable safe execution of pending order arbitrage, we introduced a series of new concepts and converted them into code modules and parameters:

- Profit Range: defines when to place an order, when to keep it, and when to cancel and replace it;

- Available AMM pools (e.g., the HYPE/USDT0 0.05% pool on HyperSwap, the HYPE/UBTC 0.3% pool on Project X);

- The order size and order quantity of each pool.

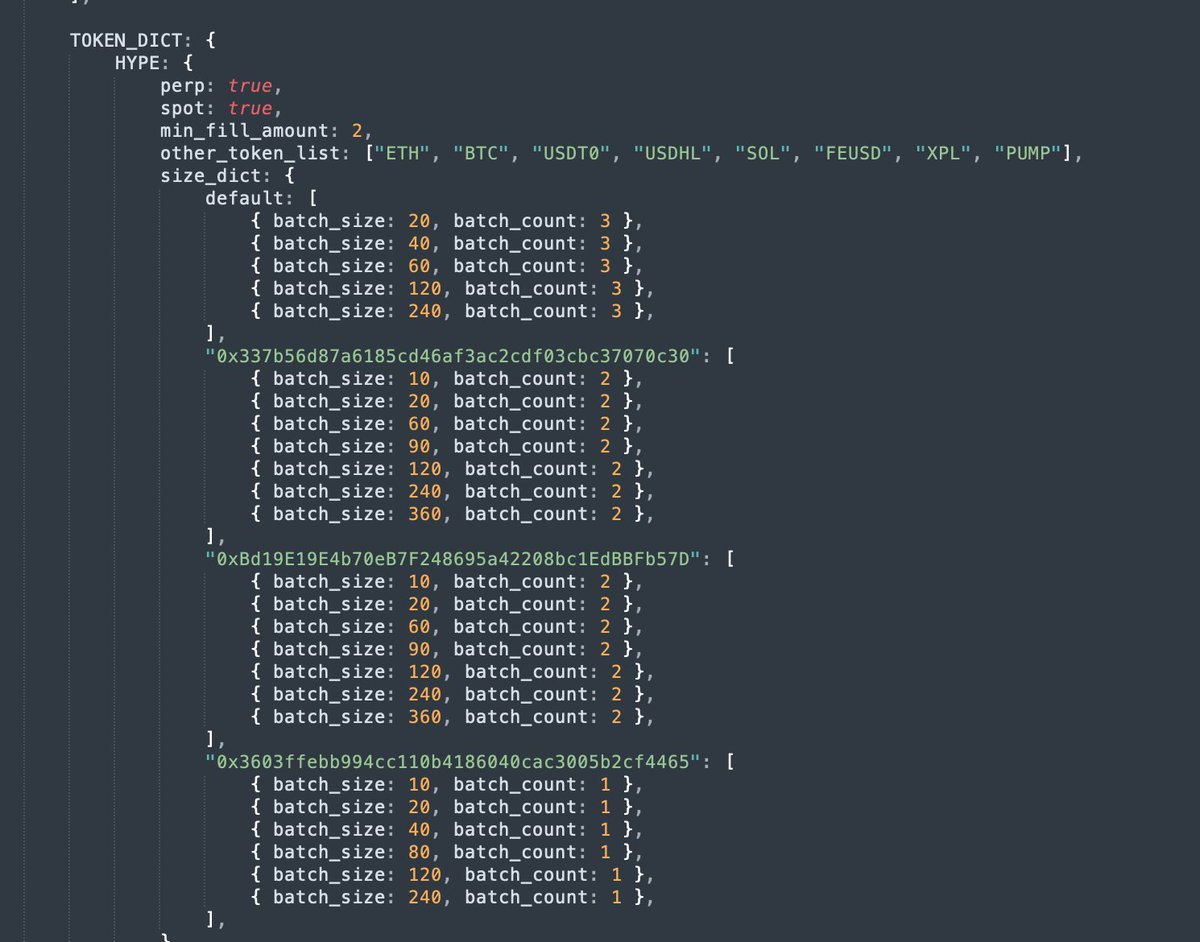

The parameters for a taker transaction are shown in the figure below.

After a few days of fine-tuning, we were able to avoid most imbalances, and when they did occur, we immediately used the time-weighted average price to close our positions as quickly as possible to limit risk. This was a complete game-changer. Our competitors were still only taking one-sided trades, while we were crushing them, trading 20 times their volume.

*Skip USDT/USDC trading on Hyperliquid

The next challenge we encountered was the unique situation of USDT0. USDC is the top-ranked stablecoin on Hyperliquid, while USDT0 is the top-ranked stablecoin on HyperEVM. The pool with the best trading volume and arbitrage opportunities on HyperEVM is the HYPE-USDT0 pool. However, since we need to use USDT0 on HyperEVM and USDC on Hyperliquid, we have to execute two transactions on Hyperliquid to rebalance between the two assets.

For example, when the price of HYPE rises:

- Execute an order on Hyperliquid ➡️ Sell HYPE for USDC (0% commission);

- Buy HYPE with USDT0 on HyperEVM;

- Sell USDC and buy USDT0 on Hyperliquid (taker fee 0.0245%).

The problem is in step 3:

- We need to pay taker fees (lower profits and reduced competitiveness);

- The USDT0/USDC market on Hyperliquid is immature, with high slippage and inaccurate pricing.

Therefore, we decided to skip this step as much as possible. To do this, we built new parameters and logic:

- USDC threshold: USDT0 → USDC transactions will be skipped only when the USDC balance is > 1.2 million;

- USDT0 threshold: USDC→USDT0 transactions will be skipped only when the USDT0 balance is > 300,000;

- Real price data source: Call the Cowswap API every minute to obtain real-time USDT0/USDC prices instead of relying on the Hyperliquid order book.

*Introducing perpetual swaps (perps) arbitrage

Let me be clear, we have almost never used leverage or perpetual contracts in the cryptocurrency space (except for that one time on BitMex in 2018 which was not very successful), so we didn’t actually understand what they were at the beginning.

However, we later noticed that HYPE perpetual contracts had significantly higher trading volumes than spot contracts, and their fees were slightly lower (0.0245% for spot contracts and 0.019% for perpetual contracts). We decided to try using perpetual contracts to optimize our strategy. Since our competitors hadn't yet adopted perpetual contracts, we had virtually exclusive access to this market liquidity.

During testing, we discovered that using perpetual contracts not only allows us to capture more arbitrage opportunities but also earn funding. When the HYPE perpetual price shows a premium or discount relative to the spot price, we can further exploit arbitrage opportunities. This is something our competitors simply don't do.

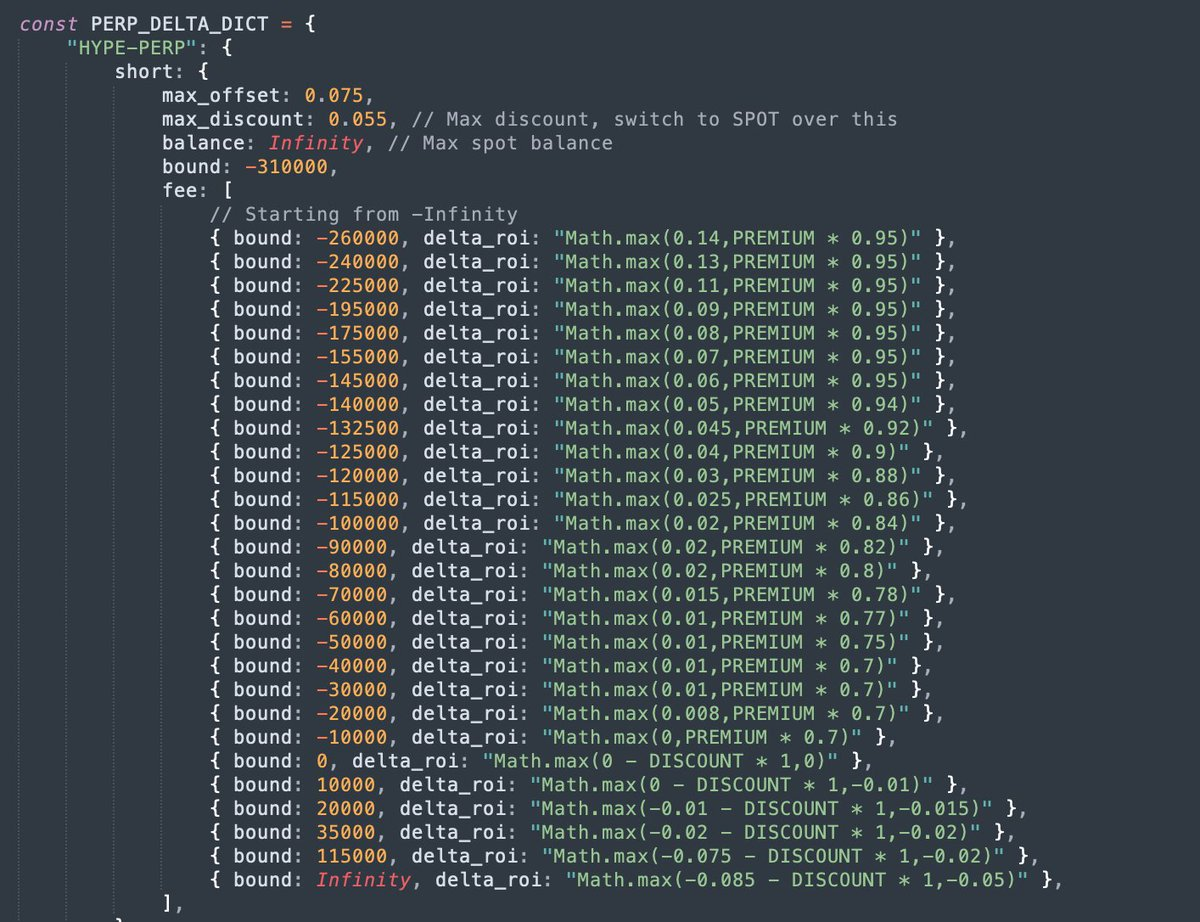

Therefore, we designed a new set of system parameters:

- Bound: The maximum amount of HYPE that can be shorted or long to avoid forced liquidation or depletion of USDC/HYPE balance;

- Premium/Discount: Real-time monitoring of the deviation of perpetual price relative to spot price;

- Max Premium / Max Discount (Threshold): When the premium is too high, stop buying and switch to spot trading;

- Progressive ROI (Progressive Return on Investment): The larger the position, the higher the required profit rate to avoid getting stuck in a long or short position.

- ROI formula: Dynamically adjusted based on perpetual premium/discount + position size.

The following is the parameter interface for configuring HYPE short positions as a taker.

The introduction of perpetual swaps proved to be one of our most significant improvements. It generated approximately $600,000 in revenue from funding alone and opened up more premium/discount arbitrage opportunities.

Division of labor and collaboration

Many people asked us how we divided the work and how we cooperated.

To the outside world, I'm often seen as the "chatty one" who only posts random jokes on CT, while my brother is the quiet tech geek who codes. But the reality is far more complex. Our collaboration is very similar to the rhythm of Blur's mining days .

When working on a bot like this, you never know when the next bug or market shift will occur. We're constantly solving problems, optimizing algorithms, and aligning our thinking. Any changes we make are only implemented after consensus is reached.

He was in charge of the coding and also built the control panel so that I could manage the parameters. I couldn't code at all (literally none), but I knew how to configure the strategy to get the best performance in the market. My brother, on the other hand, was the opposite: he could code but he couldn't configure the strategy.

We also have very different personalities: my brother likes frequent updates and rapid experiments (which I think is too radical); I am more conservative and believe in not moving as long as I can make money (which he thinks is too lazy).

A typical conversation between us goes like this.

Me (actually quite venomous): "This program seems weird... what did you change?"

Him: "No... well, maybe I changed a few small things."

For both of us, one of the strange things about building a bot without a formal company process is that after 250 updates, it feels like you’ve created something you no longer fully understand or control. When you push a new update, it’s sometimes hard to grasp all the impacts it will have.

Conclusion

For the past 8 months, we have devoted almost all of our time to this program.

Especially since June, Wintermute's monster market makers have joined the fray, bringing with them massive liquidity and a full quantitative team. I still remember our five-day trip from Istanbul to Bodrum in July—we were supposed to be on vacation, but ended up spending the entire five days locked up in a hotel debugging software.

Our final results are:

- Profit: $5 million;

- Total trading volume on Hyperliquid: $12.5 billion;

- Gas fees paid on HyperEVM: $1.2 million (20% of the chain’s total fees);

- Cumulative development time: 2000+ hours;

- Market share: 5% of Unit trading volume;

For now, we've decided to take a break and give the robots a break. We're looking forward to the next rounds of Hyperliquid Season 3 and Unit Season 1.