BNB's treasury leader faces severe criticism; "CZ's confidant" may be ousted?

- 核心观点:YZi Labs拟改组BNC董事会以挽救其颓势。

- 关键要素:

- BNC股价较高点暴跌超91%。

- mNAV持续异常下跌至0.68。

- 管理层战略执行与沟通不力。

- 市场影响:暴露DAT模式风险,引发市场担忧。

- 时效性标注:短期影响

Original article | Odaily Planet Daily ( @OdailyChina )

Author|Golem ( @web3_golem )

On November 28, YZi Labs (formerly Binance Labs) released a lengthy statement announcing the expansion of the board of directors of CEA Industries, the publicly traded BNB treasury company, and the election of several new directors. The statement expressed disappointment with CEA Industries, stating, "Investing in BNC was based on confidence in the company's fundamentals and its BNB-centric digital asset treasury (DAT) strategy. However, since completing its $500 million PIPE funding round this summer, BNC's stock performance has clearly deviated from this logic, even though BNB's price has already seen considerable gains during this period."

This indicates that the expansion of the board of directors is not a simple organizational adjustment, but rather a rescue effort. According to TradingView data, BNC's stock price has been steadily declining since reaching a high of $68.76 on July 28th, currently trading at $5.97. This represents a 25.75% drop over the past six months, a decline of over 91% from its peak, and has erased all gains since the announcement of the BNB Treasury.

The former financial powerhouse has fallen to this state, causing significant losses not only for investors but also perhaps making YZi Labs regret the decision it made in the summer of 2025.

BNB, born with a silver spoon in its mouth, is a financial powerhouse.

In the summer of 2025, the entire US stock market was restless and turbulent.

"The US stock market is willing to pay more than $2 for $1 of crypto assets," Bloomberg columnist Matt Levine's assessment aptly described the US stock market's frenzy for DAT. According to CoinGecko, as of October 2025, there were 142 publicly listed DAT companies globally, 76 of which were founded in 2025; DAT companies invested a total of $42.7 billion in 2025, with more than half occurring in the third quarter.

As DAT became a buzzword in the capital markets, a crypto asset without a DAT company that treats it as a reserve asset felt as awkward as someone meticulously dressed up for a ball but left uninvited. Consequently, crypto companies began openly and covertly pushing to establish publicly traded DAT companies, packaging their tokens as reserve assets and listing them on the US stock market, telling a story that would attract capital. This included BNB.

In late July 2025, BNB-based publicly traded company CEA Industries (NASDAQ: BNC) made a dazzling debut, announcing the completion of a $500 million private placement led by YZi Labs and renaming itself "BNB Network Company" to officially implement the BNB reserve plan, with the goal of holding 1% of the total supply of BNB.

CEA Industries was the only BNB treasury company at the time to receive official funding from YZi Labs, and thus became a stock market star overnight, with its stock price rising from $8.8 to $68.76 in a single day, an increase of over 680%.

When the altcoin DAT was gaining popularity, CZ stated that "more than 30 listed companies want to establish BNB reserves, but I will support one or two of them." So, what made CEA Industries the chosen one?

The secret lies with David Namdar, CEO of CEA Industries (now known as BNB Network Company).

David Namdar had a diverse professional background before founding BNB Network Company. He previously worked in traditional finance at UBS Hong Kong and Millennium Management. In 2014, he co-founded the crypto investment bank SolidX Partners. In 2017, he co-founded Galaxy Digital with Michael Novogratz, which successfully went public in Canada. After leaving Galaxy, he became an angel investor and advised several DAT (Digital Asset and Technology) companies.

These career experiences provided David Namdar with a wealth of knowledge for founding BNB Network Company. In a live stream on August 26, David Namdar also stated that he and CZ have known each other for eight or nine years and have a good personal relationship. Although they have never worked together, they often communicate in social settings.

With his extensive professional experience and the added advantage of being a "CZ confidant," David Namdar naturally secured investment from YZi Labs and quickly rose to become the leading figure in BNB's financial treasury.

But as both sides were envisioning a bright future, they did not realize that the moment of their alliance would be their last happy time together.

mNAV dropped to 0.68, and YZi Labs personally cleaned up the mess.

According to CEA Industries' official financial dashboard, it currently holds 515,054 BNB, worth over $460 million, with an average cost of $851.29, still lower than the current price of BNB. However, CEA Industries' mNAV is 0.68. mNAV is the ratio of a company's market capitalization to the value of its cryptocurrency holdings. When mNAV < 1, it means that the premium of the stock price relative to the cryptocurrency has disappeared, and there is a discount in trading.

Although the DAT hype has subsided and the mNAV of many DAT-listed companies has fallen below 1 (related reading: The turning point of DAT? These 12 financial companies have mNav values that have fallen below 1 ) , the situation of CEA Industries cannot be simply attributed to the market.

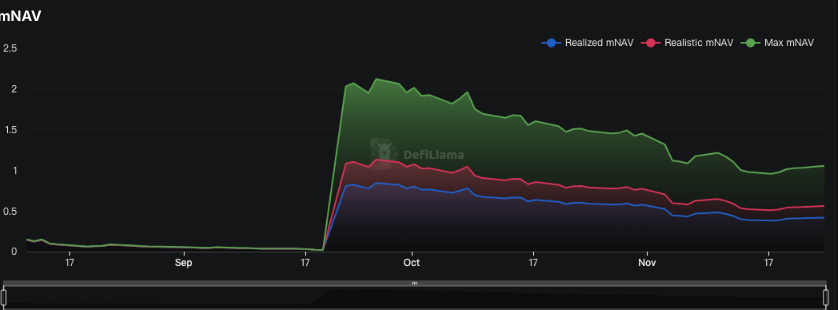

According to DeFiLlama data, CEA Industries' mNAV has been declining since announcing the BNB Treasury plan, with no upward trend whatsoever.

The decline in mNAV often occurs in conjunction with a decline in token prices—when the price of crypto tokens falls, mNAV will fall, which in turn weakens DAT's fundraising ability, increases equity dilution, leads to a decline in stock price, and then enters a vicious cycle in which mNAV continues to fall.

The key point is that while BNB prices continued to rise from August to October, even reaching a new high of $1375.11, CEA Industries' mNAV continued to decline during this period. However, due to the lack of data transparency at the time, no one knew the reason. (Odaily note: CEA Industries' official financial dashboard was launched on November 19.)

Compared to other BNB treasury companies, CEA Industries' exceptional nature becomes even more apparent.

Nano Labs is a publicly traded company implementing a BNB reserve strategy. According to DeFiLlama data, its BNB holdings are 128,000, less than a quarter of CEA Industries' BNB reserves, but Nano Labs' mNAV remained above 1.5 between August and October.

The mNAV anomaly caused the stock price to plummet, and even YZi Labs, once a close ally, finally had to step in to "clean up the mess."

In its lengthy post, YZi Labs made no attempt to conceal the problems plaguing CEA Industries. Ella Zhang, head of YZi Labs, stated that BNC's poor stock performance was primarily due to "weak strategic execution, insufficient investor communication, and inadequate board oversight." YZi Labs also specifically named CEA Industries for issues such as delayed filing of key SEC documents, failure to update its digital asset treasury and NAV data in a timely manner, and a confused external identity and strategic narrative.

Since YZi Labs posted its article, CEA Industries' official account and CEO David Namdar have not made any public statements. It is unclear whether this can be interpreted as "If you make a mistake, you have to admit it and accept the consequences."

However, as the handpicked financial leader of BNB, CEA Industries is clearly not something YZi Labs wants to give up easily. In a lengthy article, it stated that it will soon announce the specific list of board candidates. Odaily will continue to follow up on whether David Namdar, a "CZ confidant," will be ousted during the change of power.