"Weekly Editor's Picks" is a functional column on Odaily Planet Daily. Besides covering a large amount of real-time information each week, Planet Daily also publishes many high-quality in-depth analyses, but these may be hidden in the information flow and hot news, and may pass you by.

Therefore, every Saturday, our editorial department will select some high-quality articles worth spending time reading and collecting from the content published in the past 7 days. From the perspectives of data analysis, industry judgment, and opinion output, we will bring new inspiration to you in the crypto world.

Now, come and read with us:

Investment and Entrepreneurship

Replaying 1929: The Historical Cycle of Bitcoin Treasury Companies and Investment Trusts

The investment trust mania of the 1920s provides a broad blueprint for understanding financial bubbles built on leverage, reflexivity, and the magic of premium/net asset value growth. What began as a financial innovation quickly evolved into a speculative tool, promising easy riches through financial alchemy. When the music stopped, the same reflexive mechanisms that had propelled prices to euphoric heights accelerated their catastrophic decline.

There are striking similarities to today’s Bitcoin Treasury companies – from the proliferation of new physical companies, to the reliance on a premium to net asset value, to the use of long-term debt to amplify returns.

The price-to-earnings (P/E) ratios calculated based on 7-day data are as follows: The P/E ratio based on float is approximately 12.3x, and the P/E ratio based on adjusted fully diluted supply is approximately 21.9x. The most reasonable valuation benchmark should be somewhere in between these two, which can be called a blended P/E multiple, at approximately 17.1x.

Perpetual contracts are one of the largest markets in the crypto space, second only to stablecoins. Currently, Hyperliquid accounts for approximately 10% of the perpetual contract market. Its share of the spot CLOB (centralized limit order book) market is even lower.

HYPE hasn't been widely discovered in traditional financial circles simply because the team hasn't done any marketing. It's only a matter of time before Wall Street discovers HYPE.

Hyperliquid's data performance is impressive.

The key factors that will drive HYPE's growth in the next round include: front-end distribution, construction of fiat currency entrances, HIP-3, SONN, and the launch of more spot assets.

policy

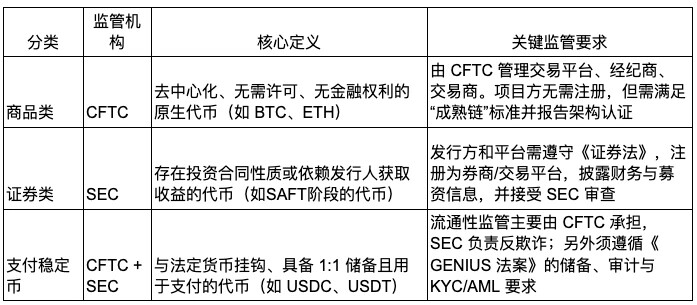

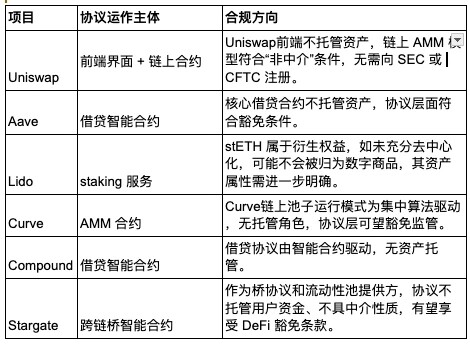

US Congress promotes the CLARITY Act: DeFi is expected to usher in a wave of compliance

The CLARITY Act and the GENIUS Act jointly establish an upstream and downstream regulatory system for digital assets. The former focuses on blockchain infrastructure and asset attribute classification, while the latter is responsible for stablecoin regulatory standards.

For DeFi projects, the new regulations clarify the exemption mechanism to protect protocol developers and introduce autonomous custody rights to protect the property rights of DeFi users.

The power play behind stablecoins

Cryptocurrency has evolved from an "anarchist currency" to an "institutional asset class", and "censorship-resistant currency" also has the function of mandatory censorship.

The GENIUS Act is a sophisticated foreign policy operation disguised as domestic financial regulation. The very institutions that were supposed to be disrupted by cryptocurrencies are now the biggest beneficiaries of the legitimization of crypto regulation.

Standardized financial assets—bonds, funds, REITs—are the ultimate battlefield for RWA.

Hong Kong's "regulatory-technology-ecosystem" framework has provided the industry with a reference trust framework.

B-side enterprises need to pass four levels of compliance verification: asset screening, sandbox rehearsal, license verification, and liquidity sandbox.

Also recommended: " Hong Kong's Stablecoin Policy Implementation: Fully Grasp the Key Points " and " Decoding Hong Kong Monetary Authority Documents: The "Strictness" and "Flexibility" Behind Stablecoin Supervision ."

Airdrop Opportunities and Interaction Guide

A complete review of the 15 projects shortlisted for Binance MVB Season 10

Bitcoin Ecosystem

Bitcoin Ecosystem Recovery: Analysis of Four Core Tracks

Ethereum and Scaling

Ethereum’s 10th Anniversary: Analyzed from 7 dimensions, is ETH’s rise just beginning?

The internal fundamentals and the external environment are resonating: the core indicators are improving, the technology is constantly upgrading, and the team governance is optimized, making the Ethereum network stronger; at the same time, the emerging narrative of stablecoins and RWAs, as well as the incremental funds brought by ETFs, have injected a steady stream of upward momentum into ETH.

For this reason, more and more asset management institutions and analysts are optimistic about the medium- and long-term prospects of Ethereum, believing that it is expected to challenge new heights in the next few years.

The Risks Behind Ethereum’s Treasury

Ethereum Treasury risk management is more complex than the Strategy model. Ethereum Treasury generates returns through staking, but this process carries risks such as limited liquidity and smart contract security. Enterprises must find a balance within the limitations of capital deployment.

Also recommended: " The Tenth Anniversary of Ethereum: Revisiting the Journey of ETH's Change of Dealership and the Return of Chip Centralization ", " Unveiling the Two Major Players Behind ETH's Current Surge: Tom Lee VS Joseph Rubin ", " OKX Research Institute | The Tenth Anniversary of the Ethereum Genesis Block: The World Computer Myth in Progress ", and " The Ten-Year Itch of Ethereum: The Ideals, Dilemmas and Breakthroughs of the World Computer ".

CeFi & DeFi

The tokenized stock market is expected to grow 2,600-fold. Who will benefit?

The tokenized stock market is currently worth $500 million, but if even 1% of the global stock market can be tokenized, the market could reach $1.34 trillion by 2030. This represents a potential 2,680-fold growth, driven primarily by regulatory clarity and mature infrastructure by 2025.

Tokenized stocks support 24/7 global trading and allow for tokenized stock ownership. Its key differentiator is its integration with DeFi, enabling investors to use their stocks as collateral for lending and earning returns without having to sell them.

Unlike other RWAs that require creating demand from scratch, tokenized stocks directly tap into the $134 trillion global stock market and address a clear pain point. This combination of existing demand and solvable pain points makes it the RWA category with the greatest potential for mass adoption.

xStocks is issued by Swiss-based Backed Finance and strictly complies with Swiss DLT regulations. Its innovation lies in holding the underlying shares through a Liechtenstein SPV, ensuring that assets remain securely isolated even if the exchange is hacked.

Robinhood demonstrated its regulatory arbitrage acumen: issued by Robinhood Europe UAB, a Lithuanian-registered company, it categorized its tokens as derivatives within the EU MiFID II framework, cleverly circumventing the compliance costs of securities issuance.

The most fundamental difference between the two lies in the difference in the legal attributes of equity certificates and price tracking contracts.

xStocks is a transparent engine that empowers liquidity and ecosystems, providing liquidity upgrade solutions for listed companies; Robinhood is a strategic springboard for those who retain control, suitable for rapid financing of growing companies that value control.

On July 21st, Ethena Labs announced a $360 million PIPE (Private Investment in Equity) transaction with stablecoin issuer StablecoinX. StablecoinX plans to list on the Nasdaq under the ticker symbol "USDE" (the same as Ethena's stablecoin, USDe). Simultaneously, the Ethena Foundation launched a high-profile $260 million ENA token buyback program, attempting to leverage capital to stabilize the price and boost market confidence.

Ethena is demonstrating its ambition to become a rising star in the stablecoin sector through ENA token repurchases, the flywheel model's growth engine, USDtb's compliance strategy, the potential benefits of the fee switch, and Converge's layout in the RWA track. It may become the next high-quality target that combines innovation and stability in this cycle.

Also recommended: " Regulatory talks, license acquisition, alliance formation: a look at the recent actions of Ondo, the light of RWA ."

Web3 & AI

Weekly Hot Topics Cramming

This past week, the SEC Chairman announced Project Crypto ( 5 Key Takeaways ); the White House released a report on digital assets ( 5 conclusions and two uncertainties ); the US Treasury will manage the US BTC reserve ; the SEC approved a physical redemption mechanism for Bitcoin and Ethereum ETFs ( Interpretation ); Hong Kong's "Stablecoin Bill" officially came into effect; and Binance Coin (BNB) broke through $860, setting a new all-time high ( Interpretation ).

In addition, in terms of policy and macro-markets, foreign media reported that the White House is lobbying against a stock trading ban involving the president ; CBOE submitted a new proposal to simplify the listing process for crypto ETFs ; the Hong Kong Monetary Authority stated that a six-month transitional arrangement will be set up after the implementation of the Stablecoin Ordinance, allowing applications for a basket of fiat-pegged stablecoins. The first license may be issued early next year , and stablecoin issuers must "identify and prevent" customers from using VPNs . Initially, the identity of Hong Kong's compliant stablecoin holders must be real-name registered ; the Bank of Korea has established a virtual asset department to lead internal discussions on the Korean won stablecoin ; analysts say that the "money changer" business has not been affected for the time being ; Vanuatu held a national resource promotion conference in Hong Kong to promote its government-controlled company to apply for a stablecoin license; Telegram founder Pavel Durov was again questioned in France on suspicion of illegal content on the platform;

In terms of opinions and voices, Ray Dalio: At least 15% of the portfolio should be allocated to Bitcoin and gold ; Bernstein: Bullish on ETH, but Ethereum Treasury Strategy Company needs to properly handle liquidity and risks ; Yi Lihua: The market has completely entered a long bull market and may say goodbye to the traditional 4-year cycle; Vitalik retweeted: Ethereum has had zero suspensions and zero maintenance in 10 years ; the Ethereum Foundation published a document "Lean Ethereum", outlining its development vision for the next decade ; Tyler Winklevoss: Gemini users' access to JPMorgan Chase's data has been restricted due to "angering" the bank ( interpretation ); Solana co-founder Anatoly Yakovenko dismissed Meme coins and NFTs as "digital garbage" ; Pudgy Penguins refuted rumors: It has not acquired OpenSea ; OpenSea team members: Token airdrops will be comprehensively evaluated based on user profiles ; OpenSea's top 1 historical trading volume user Pranksy: He does not expect OpenSea's airdrop to be successful ; Securities Times: Bank of China, Standard Chartered and other note-issuing banks are expected to be the first to be approved for Hong Kong stablecoin licenses;

In terms of institutions, large companies and top projects, Canaan Inc. announced that it will use BTC as its long-term reserve asset; BTCS, a US-listed company, plans to raise $2 billion to expand its ETH reserves ; SharpLink Gaming bought a total of approximately $300 million in ETH last weekend and pledged all of it ; CEA Industries Inc. (NASDAQ: VAPE), a US-listed company, and 10 X Capital jointly announced the establishment of a BNB-based crypto asset reserve treasury ( interpretation ); Ethereum's 10th Anniversary Torch Commemorative NFT is open for free minting; ARK Invest and SOL Strategies cooperate to provide staking services ; PayPal launched "Pay with Crypto" , supporting wallet transactions such as Coinbase and MetaMask; MetaMask launched the "stablecoin interest" function , allowing users to deposit stablecoins directly on the front end of the wallet to earn income; Linea announced its token economic model ( detailed explanation ) and native ETH income and destruction mechanism ; Mill City Ventures III raised $450 million to launch the SUI treasury strategy ( interpretation ); pump.fun is suspected of using only 1 The repurchase of tokens using 100% of daily revenue may be unsustainable. On July 29, USD 1 briefly decoupled from its peg , reaching a low of 0.9934 USDT ( interpretation ). JD.com's JD Chain has registered JCOIN and JOYCOIN, which may be the names of its stablecoins . OKX has become the first global platform to offer compliant crypto derivatives trading in the UAE . TRON Inc. plans to raise $1 billion .

According to the data, the disappearance of Bitcoin premium on Coinbase may indicate a slowdown in U.S. institutional buying ; Charles Schwab released the results of its Q3 trader sentiment survey: 43% are bullish on cryptocurrencies ; survey: 14% of American adults own cryptocurrencies , and 64% of investors believe that they are extremely risky... Well, it's another week of ups and downs.

Attached is a portal to the "Weekly Editor's Picks" series.

See you next time~

- 核心观点:比特币财库公司重现1929年金融泡沫特征。

- 关键要素:

- 杠杆与资产净值溢价依赖相似。

- 新实体激增加速泡沫形成。

- 长期债务放大回报风险。

- 市场影响:警示加密货币市场潜在系统性风险。

- 时效性标注:中期影响。