Ethereum's Ten-Year Itch: The Ideal, Dilemma, and Way Out of the World Computer

- 核心观点:以太坊面临中年危机,需突破瓶颈。

- 关键要素:

- Layer 2 分流侵蚀主链价值。

- 外部公链竞争加剧。

- 应用层创新停滞。

- 市场影响:ETH 价格表现落后,需新叙事。

- 时效性标注:中期影响。

Original author: ChandlerZ, Foresight News

Over the past century, humans have redefined the form of computers several times.

From the huge computers created for rocket navigation in the middle of the last century, to IBM pushing mainframes into enterprises, to Microsoft and Apple bringing personal computers into thousands of homes, and then smartphones putting computers in everyone's pocket.

Every leap in computing power reshapes the way people connect with the world.

In 2013, when 19-year-old Vitalik Buterin was playing World of Warcraft, he began to seriously consider a question for the first time because Blizzard arbitrarily weakened the warlock's skills: In the digital world, who can ensure that the rules are not arbitrarily rewritten?

If there is a "world computer" that does not belong to any company, is not controlled by a single power, and can be used by anyone, can it become the starting point for the next form of computing?

On July 30, 2015, in a small office in Berlin, dozens of young developers stared at the block counter. When the number jumped to 1028201, the Ethereum mainnet was automatically launched.

Vitalik recalled: “We all sat there waiting, and then it finally reached this number and started generating blocks about half a minute later.”

At that moment, the spark of world computers was ignited.

Starting point and spark

Ethereum had less than a hundred developers at the time. It was the first to embed smart contracts into the blockchain, providing a Turing-complete stage, making the blockchain no longer just a bookkeeping tool, but a world-class public computer that can run programs.

Soon, this new world computer was put to the test.

In June 2016, a major security incident occurred in the Ethereum-based decentralized autonomous organization “The DAO”, where hackers took away about 50 million to 60 million US dollars of ether by exploiting a smart contract vulnerability. The community had a heated discussion on whether to “roll back history” and finally chose a hard fork to save the assets, which also split off another chain - Ethereum Classic.

This incident brought the issue of world computer governance to the fore for the first time: should we insist on immutability, or should we correct errors to protect users?

The ICO wave from 2017 to 2018 pushed Ethereum to a climax. Countless projects issued tokens through Ethereum, raising billions of dollars in total, pushing the price of ETH to soar. However, the subsequent bubble burst caused Ethereum to enter a trough. The price of ETH fell by more than 90% from its high point at the end of 2018, and network congestion and high fees were criticized. During that period, the popularity of CryptoKitties even caused the main network to be congested to the point of almost shutting down. For the first time, this world computer exposed the limitation of insufficient computing power.

In order to cope with performance bottlenecks, the Ethereum community began to study on-chain sharding solutions as early as 2015, trying to increase throughput by splitting the node verification load. However, sharding technology is complex to implement and progress is slow. At the same time, developers are also exploring off-chain expansion paths, from early state channels and Plasma to the Rollup solution that emerged in 2019. Rollup significantly improves processing power by bundling a large number of transactions and submitting them to the main chain for verification, but the main network needs to provide sufficient data availability support. Fortunately, around 2019, Ethereum made a breakthrough in the field of data availability and solved the problem of large-scale data verification.

Since then, Ethereum has gradually formed an expansion route of "mainnet security, second-layer execution", and the world computer has begun to be disassembled into a multi-layer collaborative system.

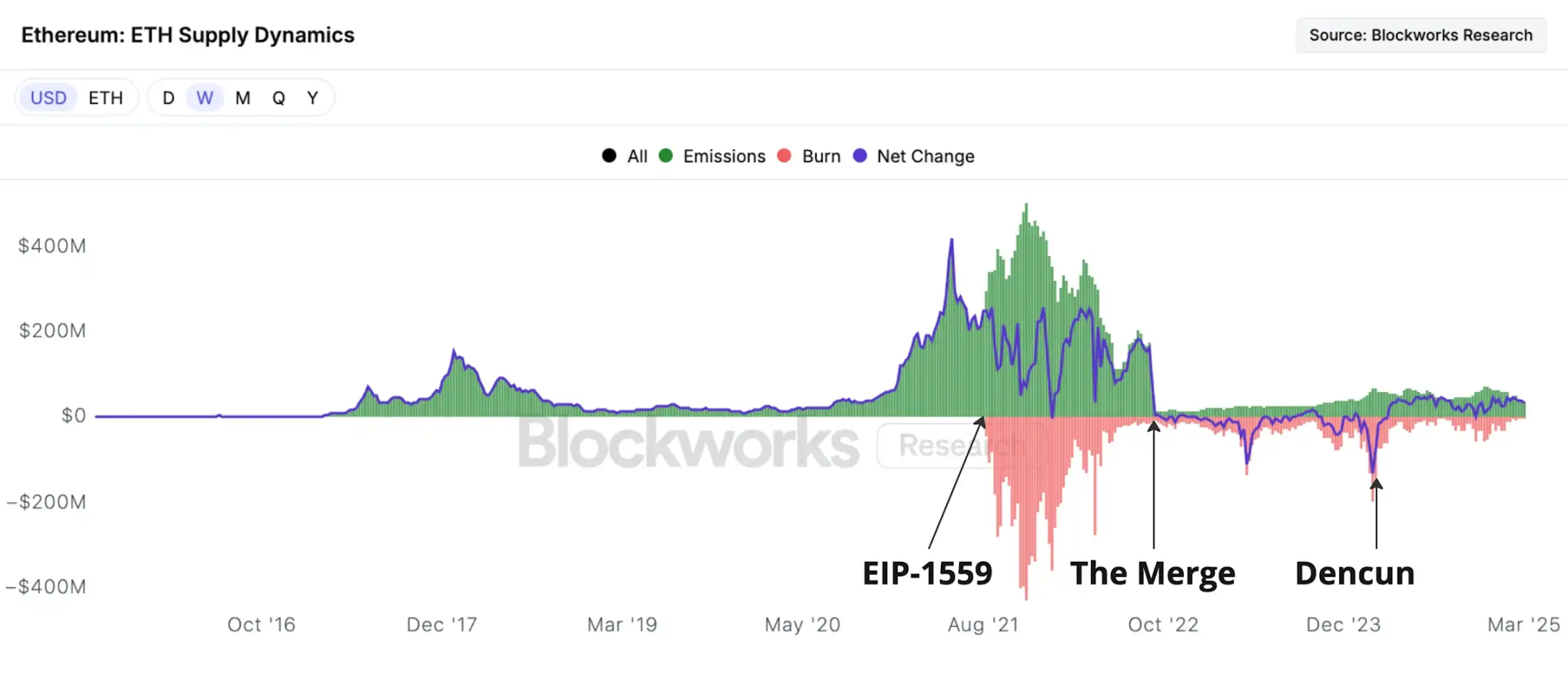

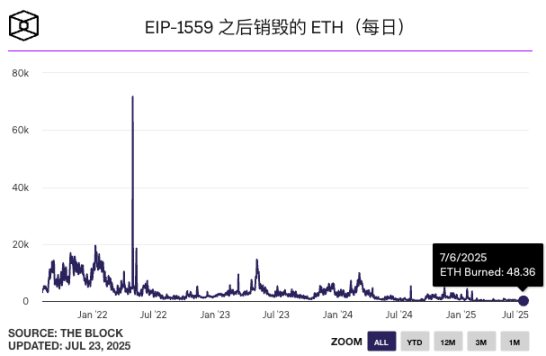

In the following years, DeFi exploded on Ethereum, and decentralized lending, trading, and derivatives sprang up; the NFT craze pushed digital art into the mainstream, and Beeple's work was sold at Christie's for $69 million. Although the network boom was accompanied by high fees, Ethereum began to respond by improving the protocol. In August 2021, the EIP-1559 upgrade implemented a basic fee burning mechanism, destroying the basic fee of each transaction in ETH, thereby reducing inflationary pressure during periods of high demand. This reform caused ETH to experience a brief net deflation during the 2021-2022 bull market, driving its price to a historical high of nearly $4,900.

On September 15, 2022, The Merge was completed. The core energy of the world computer was switched from the power-consuming PoW to PoS, energy consumption was reduced by 99%, and the new issuance rate was reduced by 90%. ETH holders began to participate in the network through staking, and the energy system of this world computer was completely replaced.

Data from one year after the merger showed that the net supply of Ethereum had decreased by approximately 300,000 ETH, which is in stark contrast to the amount that should have been issued under the PoW mechanism. This deflationary feature has reinforced the market's expectations of ETH's scarcity.

After the above changes, by the end of 2023, the performance and economic mechanism of the Ethereum mainnet have improved, but new challenges have also emerged. In order to reduce costs and encourage the development of Rollup, Ethereum implemented the "Dencun" upgrade (Deneb + Cancun) in March 2024, introducing EIP-4844, the so-called Proto-Danksharding technology. This improvement adds special "data blob" transactions for Rollup to submit batch transaction data. Since blob data is only stored for a short time, the cost is much lower than ordinary call data, which greatly reduces the cost of submitting data from the second-layer network to the mainnet. The successful launch of Dencun marks a significant reduction in the cost of Rollup and another step forward for the world computer to achieve the goal of sharding.

Ten years have passed, and this world computer has evolved from an ideal in a white paper into an irreplaceable infrastructure in reality.

However, behind the brightly lit nodes, new difficulties quietly emerged...

The fog of middle age

Entering 2024-2025, the difficulties faced by Ethereum will become more apparent.

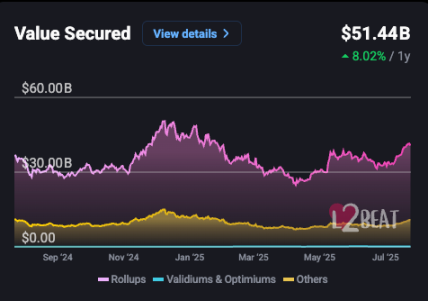

Layer 2 has a significant diversion effect

The Rollup-centric route that Ethereum has embraced in recent years has relieved the pressure on the main chain, but it has also caused a large number of transactions and values to remain on the second-layer network and fail to flow back to the main network. Standard Chartered Bank bluntly stated in a report in early 2025 that the rise of the second-layer network has eroded the value capture of the Ethereum main chain. The report estimates that the leading Ethereum second-layer launched by Coinbase alone has "taken away" about US$50 billion in Ethereum ecosystem market value.

Transactions and applications that might have been conducted on the mainnet were transferred to the lower-cost L2, and the mainnet's transaction fee income and on-chain activities decreased accordingly. This trend became more obvious after the Dencun upgrade. EIP-4844 greatly reduced the cost of submitting data to the mainnet for Rollup, further increasing the attractiveness of L2 shared transactions. In recent years, the number of daily transactions of Rollup such as Arbitrum and Optimism has repeatedly matched or even exceeded the mainchain, which verifies the picture of "Ethereum outsourcing transaction execution."

In other words, the parts of the world’s computer operate efficiently on the outside, but the value-capturing capabilities of the mainframe are eroded.

Competition from external public chains is becoming increasingly fierce

Due to Ethereum's early performance and fee shortcomings, many competitors have tried to provide faster and cheaper alternatives.

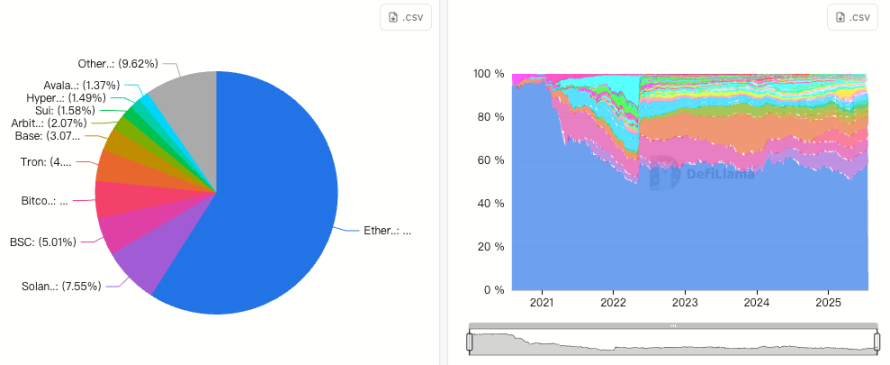

For example, Solana, which focuses on high throughput, attracts a large number of developers. Most emerging projects and MEME projects in this bull market are mainly deployed on Solana. In the field of stablecoins, Tron, with its transmission advantage of nearly zero handling fees, carries the massive issuance and transfer of mainstream stablecoins such as USDT. The USDT circulating on the Tron chain has now exceeded 80 billion, surpassing Ethereum in scale to become the largest stablecoin network, and its turnover is also much higher than Ethereum. This means that in the key track of stablecoins, Ethereum has given up its dominant position.

Not only that, public chains such as BNB Smart Chain also share some of the traffic of GameFi, altcoin transactions, etc. Although Ethereum is still the largest ecosystem in terms of the number of DeFi protocols and TVL, accounting for about 56% of the industry's DeFi activities as of July 2025, it is undeniable that under the coexistence of multiple chains, Ethereum's relative dominance has declined compared to its peak period.

Governance and security concerns

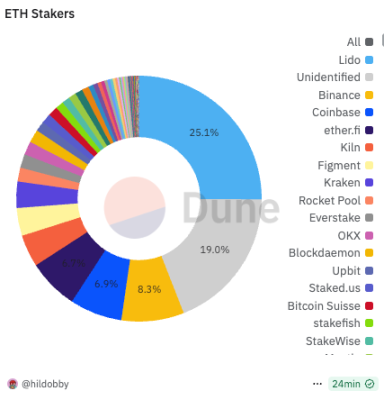

After the transition to PoS, the issue of staking centralization has caused community concern. According to the rules, participation in Ethereum network verification requires a staking threshold of 32 ETH, which has prompted retail investors to participate through staking pools or exchange entrustment, thus forming a situation dominated by a few large staking service providers. The largest decentralized staking pool, Lido, once occupied more than 32% of the staking market share of the entire network. As more competitors joined, Lido's share dropped slightly to about 25%, but it is still far ahead of entities such as Binance (about 8.3%) and Coinbase (about 6.9%) that ranked behind it. The community is generally worried that if any single entity holds more than 1/3 of the verification weight, it may affect block consensus and even network security.

Vitalik has called for limiting the proportion of a single verification entity through transaction fees, for example, to below 15%. However, in the 2022 Lido governance vote, the proposal to set a self-limiting cap was rejected by more than 99% of the votes. Currently, according to Dune data, there are more than 1.12 million validators on the Ethereum network, with a total of more than 36.11 million ETH participating in staking, and staked ETH accounts for 29.17% of the total supply. How to promote the diversification of staking participants without sacrificing network security remains an unresolved issue.

The role of the foundation is controversial

Over the years, the Foundation has been accused of lacking transparency in ecosystem funding and fund management, and the community has often questioned its sale of holdings at ETH highs and its lack of public explanation. In the view of some early developers, the Foundation's "hands-off governance" has led to the continuous accumulation of ecological divisions and narrative confusion, making it difficult for the governance system to form effective guidance.

At the same time, the voices of opinion leaders gradually faded. Vitalik and several early developers still have great influence, but rarely make clear statements on key directions. They choose to restrain themselves, avoid influencing market sentiment, and avoid intervening in governance disputes. In the long run, this restraint has brought another vacuum: the community lacks consensus, no one is willing to take decision-making responsibility, and many proposals lack promoters. Open discussions have decreased, and technical routes and ecological strategies have turned to closed-door discussions.

Without a clear helmsman, the world computer is running but lacks a sense of direction.

Gaps in the application layer and unsatisfactory market performance

If Ethereum hopes to become the world's on-chain computer, its value should not only be in providing computing power and security, but also in whether it can carry a steady stream of new applications and new experiences, allowing developers and users to see the boundaries of imagination being constantly broken.

But after ten years, the only applications that have been truly verified by the market and successfully scaled are still DeFi and NFT. After that, the application layer seemed quiet.

Social, gaming, identity, DAO and other areas that were once highly anticipated have yet to produce phenomenal products comparable to DeFi and NFT.

Web 3 social networks such as Friend.tech and Lens were once very popular, but their popularity soon faded and their retention rate was extremely low; on-chain games were once a hot topic, but most of them remained at the level of simple token economic experiments and found it difficult to enter the mainstream; decentralized identity and DAO governance are still more at the stage of technical exploration and small-scale experiments.

On-chain data confirms this lack. In July 2025, the number of ETH destroyed by the Ethereum network per day was less than 50, setting a new historical low. Compared with the average daily destruction of nearly 1,000 ETH during the frenzy of 2021, it is almost incomparable.

During the same period, the 7-day average number of active addresses dropped to about 566,000, and did not even reach the high point since March 2024; the number of new addresses added daily was about 120,000, and the monthly number of on-chain transactions was about 35 to 40 million.

For a network that bills itself as the world's computer, that means the spark that could ignite a new wave of large-scale applications is missing.

Ethereum has the largest developer community in the industry and is not short of technical reserves, but it has yet to find a killer application that can attract tens of millions of new users and change their usage habits. Ten years later, this machine is still powerful, but it is still looking for its next mission.

This stagnation in the application layer is also reflected in market performance. ETH was close to its all-time high of $4,900 in November 2021, but has not broken through for many years. The boost brought by technical benefits such as mergers and fee system reforms is limited, and the price trend from 2022 to 2024 continues to lag behind Bitcoin, Solana and even BNB. Entering 2025, other crypto assets have frequently set new records, while the price of ETH is still hovering around $3,000. In April, the ETH/BTC ratio even fell below 0.02, hitting a multi-year low. ETH, once regarded as a fuel in the field of smart contracts, is losing its wealth effect in the market.

Recently, the strategic allocation of listed companies and institutions has brought some support to ETH. Companies such as Sharplink Gaming and BitMine have publicly disclosed their treasury strategies, issuing convertible bonds, preferred stocks, market-priced offerings and other products, and using the funds raised to increase their holdings of ETH. Unlike Bitcoin, ETH can bring protocol-layer income through staking and re-staking, becoming a "interest-bearing" digital asset in the corporate treasury. This native income feature makes it attractive. Within a few weeks, the price of ETH rebounded from its lows to above $3,600.

However, some analysts pointed out that this round of recovery came more from the active allocation of funds. The on-chain ecology itself did not see a significant leap. The price rebound was not accompanied by developer innovation and user influx, but more like a stopgap option when market funds were looking for targets.

Technological advances and the entry of institutions cannot replace applications that can truly change user habits and release new demands.

Ten years later, Ethereum still needs to answer that original question: As the world's computer, what kind of programs should it run to ignite the world's imagination again?

The road ahead, the direction for the next decade

Faced with the mid-life test of internal and external difficulties, whether Ethereum can get out of the trough depends on whether its technology and ecology can open up new growth space.

Technology: Making the world's computers faster and more unified

The community has drawn up a blueprint for upgrades in the post-merger era.

Vitalik explained in his article "The Possible Future of Ethereum: The Surge" that the core goal of the next stage is to increase the overall throughput of the main network and the second-layer network to 100,000 transactions per second while maintaining the decentralization and robustness of L1; at the same time, ensure that at least part of L2 can fully inherit the core characteristics of Ethereum (trustlessness, openness, and anti-censorship); and make the experience of the entire network more like a unified ecosystem, rather than 34 fragmented blockchains. This means that in the future, cross-L1/L2 transfers, capital flows, and application switching will become as simple as operations within a single chain.

EIP-4844 in 2024 is just the starting point, and data sampling and compression technologies will be introduced later.

With the maturity of zero-knowledge proof technologies such as ZK-SNARK and ZK-STARK, the performance bottleneck is expected to be broken, and users who have spilled over to other public chains and L2 in the past may return.

Governance and Economy: How Mainchain Can Regain Value

Not only performance, Ethereum is also thinking about how to allow the core of the world's computer to continue to capture value.

In July 2025, the Ethereum Foundation launched a new structural reform called "The Future of Ecosystem Development", attempting to move from behind the scenes to the front and become the helmsman guiding the development of the ecosystem. The Foundation has proposed two long-term goals: one is to maximize the number of people who directly or indirectly use Ethereum and benefit from its underlying values, and the other is to enhance the resilience of technical and social infrastructure.

To this end, the Foundation reorganized into four pillars centered around "acceleration, amplification, support, and long-term communication," reorganized the internal team, established modules such as corporate relations, developer growth, application support, and founder support, and strengthened the team's content and narrative to enhance community cohesion.

The foundation also pledged to increase transparency, emphasize more targeted public goods funding, launch a Launchpad to support governance and sustainable operations, while reducing operating expenditure ratios and establishing a funding buffer of approximately 2.5 years.

This series of actions is generally viewed by the outside world as substantive adjustments by the foundation in response to criticism of its laissez-faire approach, and is also seen as a boost for the foundation for the next decade.

In the community discussion, new ideas have emerged: Can we extract some benefits from the prosperity of Layer 2? Or optimize the protocol fee and MEV distribution mechanism so that the main chain can also share the growth dividend in the Rollup era. These plans are still being explored, but they reflect a common concern - if there is no active adjustment, the main chain may degenerate into a simple liquidation layer, and its value and vitality will be continuously diluted.

Standing at the crossroads looking for new sparks

The technology and funds are not enough.

In the past, each round of Ethereum boom was sparked by new applications and new narratives. But now, the entire blockchain industry is in a period of innovation silence, lacking phenomenal breakthroughs.

Perhaps blockchain itself needs to undergo a self-revolution, giving rise to new narratives and applications in areas such as social interaction, identity, and AI. Some people also believe that the next round of breakthroughs may come from the impact of the external ecosystem.

Vitalik further reminded in his speech "The Next Decade of Ethereum" that Ethereum developers should not just copy Web 2, but should focus on future forms of interaction, including wearable devices, AR, brain-computer interfaces, and local AI, and incorporate these new entrances into the design vision of Web 3.

Looking back over the past decade, Ethereum still has the largest developer community, the most abundant applications, and deep technical accumulation in the industry. However, it is facing bottlenecks, competition, and new life.

As Vitalik said: "The past ten years of Ethereum have been a decade in which we focused on theory. In the next ten years, we must change our focus and think about what impact we will have on the world." In his view, the next generation of applications must not only have different functions, but also retain shared values. At the same time, these applications must be good enough to attract those who have not yet entered the crypto field.

The world's computer is experiencing a decade of itch. It has not stopped running, it is just looking for new directions.

The next decade belongs to it and to everyone who still believes in this dream.

But as Vitalik said, "Everyone who speaks out in the Ethereum community has the opportunity to participate in the process of building the future together."