Original author: Lex, ChainCatcher

Original editor: Fairy, ChainCatcher

In July, a project called Graphite Protocol (GP) gained nearly 30 times in a short period of time, and its circulating market value once reached 190 million US dollars. Since July 23, it has reached new ATH almost every day.

What is the origin of this GP that suddenly appeared? Is it a flash in the pan hype or a potential stock with real value? Today, let's take a deep look at the story behind this project.

Image source: coingecko

Is Graphite Protocol the “tax collector” of Bonk.Fun?

Graphite Protocol is positioned as a multi-chain infrastructure project that aims to lower the development threshold of Web 3 applications through no-code tools.

However, this grand vision is still on the way. At present, the real "hard currency" of Graphite Protocol comes from its deep binding with the Solana ecosystem's top meme launchpad Bonk.fun.

In just 73 days, Bonk.fun quickly surpassed the once-dominant Pump.fun with its explosive user growth and revenue performance, and occupied 55% of the Meme sales market.

Graphite Protocol provides underlying technical support for the Bonk.fun platform, and in return receives 7.6% of the protocol revenue, which will be automatically used to repurchase and destroy GP tokens in the secondary market.

This design enables Graphite Protocol to advance from a simple tool provider to a "tax collector" of the Bonk ecosystem. It no longer needs to build a huge user base by itself, but can directly share its growth dividend by parasitizing a mature ecosystem that already has huge traffic and activity.

GP’s Double Trump Card: Hard-core Founders and Deflation Mechanism

In addition to the in-depth cooperation with Bonk.fun, the team behind Graphite Protocol is also an important advantage. Project leader Tom Solport enjoys a good reputation in the Solana community and is a practical founder and builder. His most well-known achievement is the acquisition and successful revitalization of Taiyo Robotics, a blue chip NFT project on Solana.

Taiyo Robotics was first minted in November 2021, but fell on hard times after the original development team dropped out. In December 2021, Tom Solport took over the project and quickly developed and executed a detailed roadmap, including the creation of a custom marketplace for Taiyo Robotics.

Even in the bear market, the Taiyo project continues to build and has won the trust of the community. The industry generally evaluates Tom as a Builder who "can do things and does not run away". This strong personal IP brings strong trust endorsement to Graphite Protocol.

In addition, GP has designed a powerful deflation mechanism: whether it is the agreement share from Bonk.fun or the service fee paid by users (SOL, ETH, MATIC), it will eventually be converted into GP tokens and destroyed. Under the constraint of a fixed total amount, this deflationary flywheel provides solid mathematical support for the price of GP tokens.

Image source: Graphite Protocol White Paper

On the cusp of the trend, under the undercurrent: GP's hidden worries and suspense

Although GP has risen rapidly thanks to strong cooperation and mechanism design, its growth logic also has risk exposure that cannot be ignored.

Most of the current GP's value is still highly dependent on its binding relationship with Bonk.fun. Whether it is the decline of Bonk's popularity, the adjustment of cooperation terms, or rumors of ecological rifts, any negative signal may directly impact GP's income base and market narrative.

GP’s token history also presents complex variables.

The predecessor of GP was $SCRAP, which was originally planned to be released linearly within 4-5 years starting from 2023. As the Graphite Protocol is fully developed, $SCRAP is eliminated and replaced by $GP. Old holders can exchange $SCRAP for "Graphite fragments" for staking and receive $GP in installments, but the conversion channel has been closed.

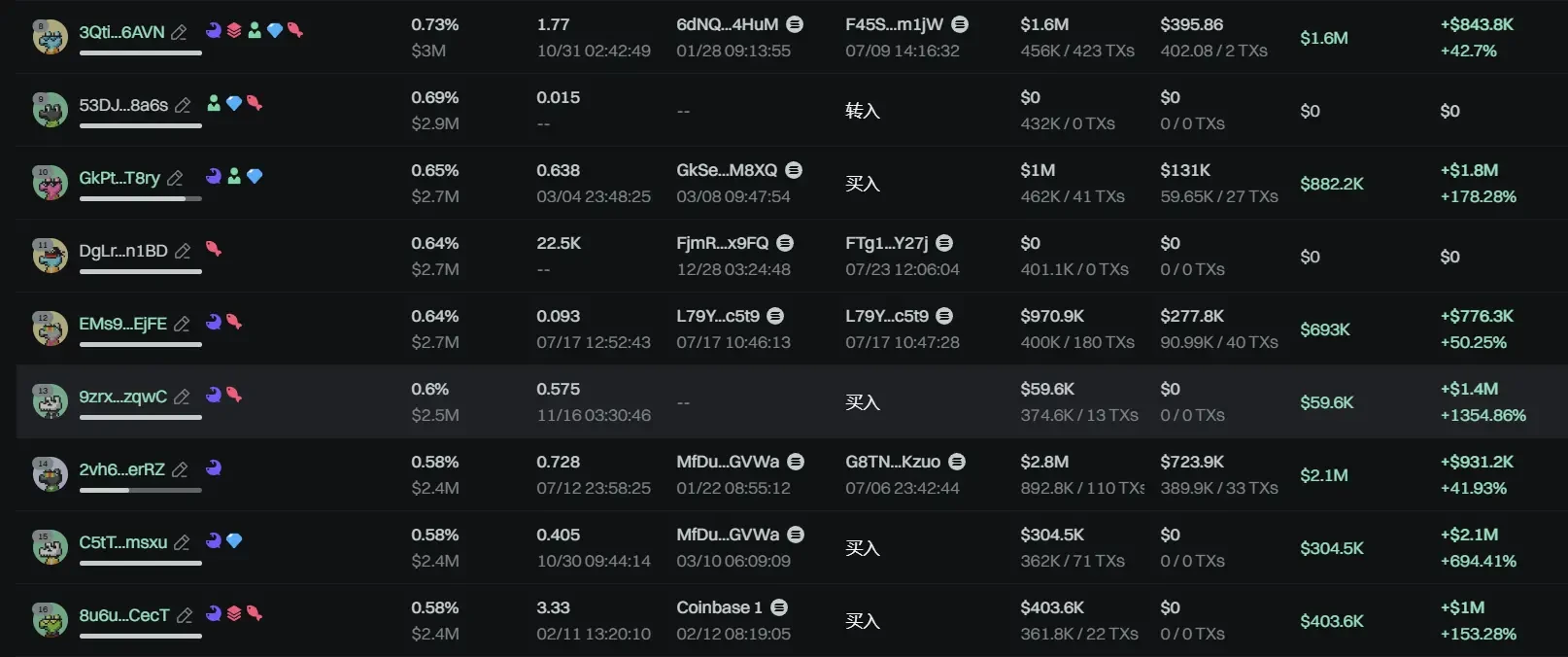

As of late July 2025, the total supply of $GP is 150 million, with only 30 million in circulation, accounting for about 20%. This means that up to 80% of the tokens are still unlocked, and their unlocking schedule and specific distribution structure (team holding ratio, lock-up mechanism, etc.) have not been fully disclosed, and potential selling pressure is difficult to estimate.

More importantly, the sharp rise in the short term has attracted a large number of profit-taking orders. Once the market sentiment changes, the price correction may be extremely sharp.

GP token holdings top 20 profit chart, source: GMGN

Graphite Protocol has the triple support of a hardcore founder, real income and deflation mechanism, but it still faces many challenges from a dark horse in the primary market to a long-term blue chip.

How to reduce dependence on a single ecosystem, gradually disclose a more transparent token economic structure, and expand diversified growth engines will determine whether it can truly embark on the next stage of growth curve.

(This article is for reference only and does not constitute investment advice)

- 核心观点:Graphite Protocol短期暴涨但长期存隐忧。

- 关键要素:

- 绑定Bonk.fun获7.6%收入分成。

- 创始人Tom Solport有成功项目经验。

- 通缩机制支撑代币价格。

- 市场影响:短期吸引投机,长期需验证价值。

- 时效性标注:短期影响。