BNB breaks through $860 to set a new record high. Who is the biggest winner?

- 核心观点:BNB价格创新高,跻身全球资产前列。

- 关键要素:

- 币安推动:年度销毁27亿美元BNB。

- 生态建设:BNB Chain技术升级,稳定币活跃。

- 财库壮大:多家上市公司增持BNB。

- 市场影响:提振市场信心,推动行业上行。

- 时效性标注:中期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author: Wenser ( @wenser 2010 )

For BNB Holders, today is undoubtedly the most exciting day - with the recovery of the crypto market, the price of BNB has risen all the way to over $860 , setting a record high. This also means that BNB has jumped to 186th place in global assets, surpassing well-known listed companies such as Strategy, SoftBank International, and Nike. Behind this, it is not only due to the strong promotion of Binance and the long-term construction of the BNB Chain ecosystem, but also inseparable from the recent BNB reserve treasury team. Not only that, with the new high of BNB, the personal wealth of CZ and others has also ushered in a new round of rapid expansion. Odaily Planet Daily will analyze the causes and impacts of the historical high of BNB prices in detail in this article for readers' reference.

Behind BNB's new high price: 3 major factors boosting its soaring price

There are three main reasons for BNB's rapid rise:

Binance’s strong push: Annual token destruction exceeds $2.7 billion; CZ stands on the platform

The primary reason for BNB to reach a new high is the strong promotion of Binance. Among them, CZ, the founder of Binance, played a huge role as a leader. Under his leading example, BNB naturally has a huge amount of market attention and a large number of loyal fans.

In addition, as the industry's leading cryptocurrency exchange, Binance has prepared various Launchpad IPOs, Alpha points, and fee reduction mechanisms for BNB Holders, creating an excellent market environment for BNB's reluctance to sell.

Not only that, as a "large holder" of BNB, Binance also single-handedly leads the BNB destruction plan: According to statistics, from January 2025 to date, BNB has completed 3 destructions, with a total of more than 5.72 million tokens destroyed, with a cumulative value of up to US$2.777 billion (calculated based on the token price at the time of destruction). Among them:

- In January 2025, the 26th BNB quarterly destruction will destroy a total of 2,141,487.27 BNB, worth approximately US$636 million.

- In April 2025, the 27th quarterly BNB destruction occurred , with a total of 1,944,452.51 BNB destroyed, worth approximately US$1.17 billion at the time.

- In July 2025, the 28th BNB destruction took place , with a total of 1,643,698.8 BNB destroyed, worth approximately US$971 million.

Long-term development of BNB Chain: both technological development and community building

The price support of BNB is naturally inseparable from the long-term construction of the ecosystem.

Apart from the Meme coin craze that started last year, the construction of BNB Chain can be seen from two aspects: on the one hand, BNB Chain has previously announced an upgrade in the second half of 2025 : it plans to increase the block gas limit to 1G, support 5,000 transactions per second, and increase throughput by 10 times; the new generation of BNB Chain will achieve a final confirmation time of <150 milliseconds, 20,000+ TPS, and built-in privacy functions at the protocol layer; on the other hand, the development of BNB Chain's stablecoins also highlights the positive trend of its liquidity growth from the side. According to the stablecoin report "State of Stablecoins" released by Artemis data , as of June 30, 2025, BNB Chain occupies a leading position in the use of stablecoins with 11.8 million active addresses. This is also closely related to the "0 handling fee transactions" that BNB Chain has been promoting.

In addition, the MVB activities and hackathon activities officially initiated by BNB Chain have always been one of the industry's trendsetters. Recently, it announced the list of selected projects for the 10th season . Since 2021, the number of incubation projects has increased to more than 200, which shows that its ecological activity is remarkable.

According to official news from BNB Chain, Circle will issue interest-bearing stablecoin USYC natively on BNB Chain. USYC uses U.S. Treasury bonds as underlying assets, supports on-chain interest calculation and near-instant USDC exchange, and users can earn income while maintaining liquidity, which is another potential project in the stablecoin track.

BNB Chain MVB Season 10 Selected Projects

BNB Treasury Company Camp: The Latest Price Pillar

When it comes to BNB’s latest price support, under the general trend of coin-stock convergence, the growing strength of the BNB reserve treasury company camp is also crucial.

In June this year, Nano Labs Ltd (NA), a US-listed company, announced that it had signed a convertible bond subscription agreement (hereinafter referred to as the "Agreement"). According to the agreement, the company will issue convertible promissory note bonds ("Bonds") with a total principal of US$500 million, which will be subscribed by multiple investors. The first phase plans to purchase BNB worth US$1 billion through convertible bonds and private placements; the long-term goal is to hold 5% to 10% of the total circulation of BNB. According to a post by Kong Jianping, the founder of Nano Labs , 120,000 BNBs have been purchased so far, and purchases are still ongoing.

In July, Windtree (WINT), a U.S.-listed company, announced that it had signed a $60 million securities purchase agreement with Build and Build Corp. Future subscriptions may generate a total return of up to $140 million, with a total subscription amount of up to $200 million. The proceeds from this fundraising will be mainly used to launch the BNB treasury strategy and acquire BNB. Windtree is also expected to become the first Nasdaq-listed company to provide direct investment exposure to BNB tokens.

In addition, Yzi Labs (formerly Binance Labs), one of the main players in the BNB ecosystem, has recently reached a cooperation agreement with 10x Capital . The former will support the latter in building the first BNB reserve company in the United States, led by former Galaxy co-founder David Namdar, and 10X Capital Chief Investment Officer Russell Read and @SaadNaja, who worked at Kraken, will participate in the construction. This also marks the strong combination of BNB and Wall Street . The company may be the "BNB strategy company selected and invested by CZ himself" as rumored.

At the same time, market sources said that the coin-to-share issuance platform led by Binance will be launched soon, which is expected to further consolidate the industry status of Binance, BNB Chain and BNB in the next 3-5 years or even longer.

The spreading impact of BNB's new high: CZ's net worth rises to over $112 billion, who will be the first to go public through backdoor listing in the US stock market?

As BNB prices hit a record high, the crypto market is surging and ushering in a new round of changes. From an industry perspective, crypto trader Eugene believes that "this is the first mainstream coin other than Bitcoin to break through the previous high pressure level. Although I don't hold any positions yet, this is a positive signal for the acceleration of Total 3 (the total market value of cryptocurrencies excluding BTC and ETH)." From a personal perspective, CZ's wealth has also ushered in a new round of skyrocketing.

BNB hits a new high, CZ's net worth surges to $112.717 billion thanks to his holdings

According to a report published by Forbes in June 2024 , CZ BNB's total holdings account for 64% of the total circulation, or about 89.1 million BNB; in addition, the Binance founding team is allocated 80 million BNB tokens, and Binance still controls 46 million of the original tokens. In addition, according to CZ himself, 98% of the assets in his portfolio are BNB; 1.32% are Bitcoin.

In summary, CZ’s current net worth totals approximately $112.717 billion, including:

- BNB holdings are worth $76.26 billion (based on BNB’s current price of $856);

- The value of BTC holdings is approximately US$1.027 billion (calculated based on a BNB:BTC ratio of 98%:1.32%).

- The value of Binance’s BNB holdings corresponding to its shares is approximately US$35.43 billion (calculated based on a 90% shareholding ratio).

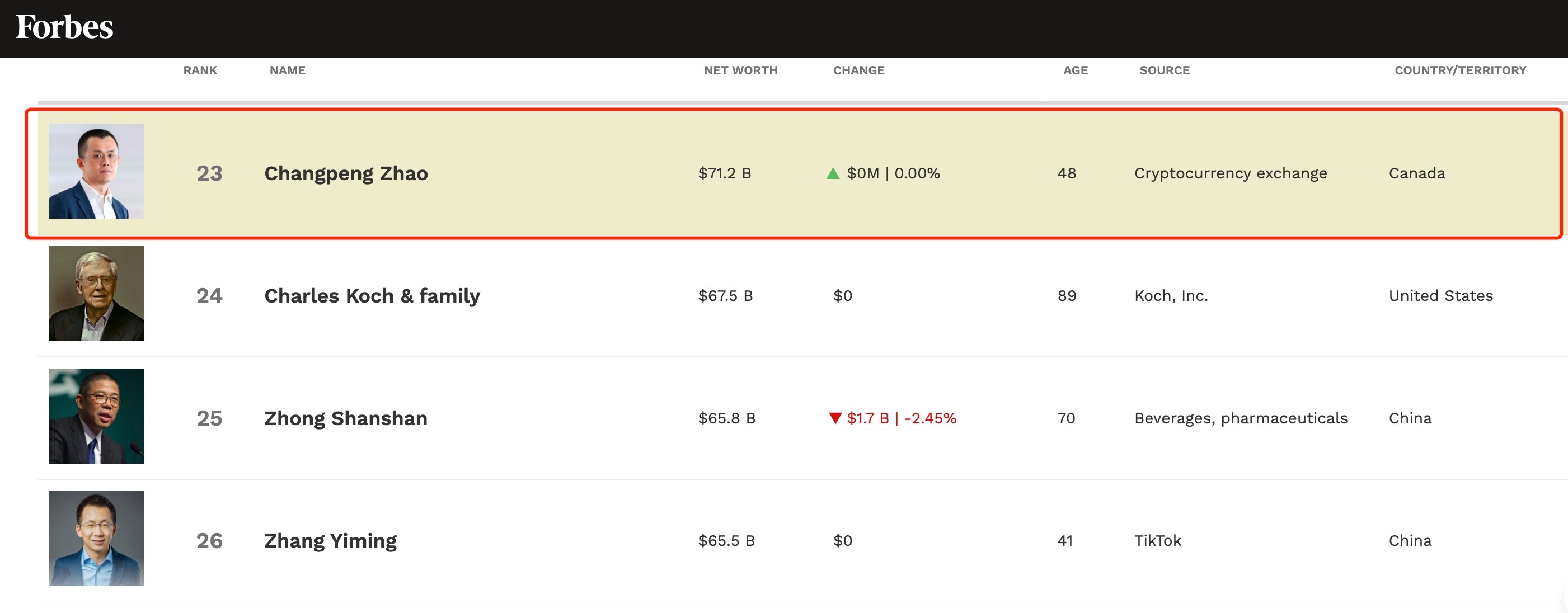

Of course, this is just an estimate of CZ’s cryptocurrency holdings based on historical public information. According to the Forbes Rich List Real-Time List , CZ’s current personal assets are $71.2 billion, ranking 23rd on the global rich list.

CZ surpasses the richest Chinese Zhong Shanshan and ByteDance founder Zhang Yiming

At the same time, the "shell company" of the "BNB Reserve Company" supported by CZ himself that went public through a backdoor listing has also become the next focus of market attention. Many people have placed bets, hoping to ambush the next wealth code.

Who will be the first official BNB Treasury stock?

At present, the potential companies that can take the title of "the first legitimate stock" of the BNB Reserve Treasury Company are mainly Build and Build Corp, a listed shell company controlled by the former CEO of Coral Capital Holdings, and BNB Treasury Company (to be named) that 10X Capital is about to jointly build with Kraken and supported by Yzi Labs.

The former is a partner of Windtree; the latter is “the first BNB reserve company in the United States”, but it remains to be seen who will be the first to be announced and the corresponding stock code. Odaily Planet Daily will also follow up with the report as soon as possible.