Strong comeback, Sui ecosystem hits three highs after hacker incident

- 核心观点:SUI 价格强势反弹,生态恢复显著。

- 关键要素:

- SUI 价格月涨 53%,市值 147 亿美元。

- Cetus 黑客事件后 TVL 回升至 22.96 亿美元。

- 上市公司 Lion 增持 SUI 超 100 万枚。

- 市场影响:增强市场信心,吸引主流资金。

- 时效性标注:中期影响。

Original author: 1912212.eth, Foresight News

On July 28, SUI broke through $4.44, reaching a new high since January this year. The monthly increase in the price of SUI tokens exceeded 53%. Since July 24, the daily chart has achieved four consecutive increases, and since June 23, the weekly increase has also achieved four consecutive increases. SUI currently has a total market value of $14.7 billion, ranking 11th, and FDV has risen to $43.048 billion. Such an increase in the price of large-cap protocol tokens naturally attracted the attention of many investors in the market.

How has the Sui ecosystem recovered since the setback in May? What are the reasons for the strong price of the currency?

Sui has recovered from the Cetus hack

On May 22, Cetus, the largest DEX aggregator on the Sui network, suffered a major security vulnerability attack, resulting in the depletion of a liquidity pool of approximately $223 million. The attacker used fake tokens to manipulate the pool, causing losses. However, the response of the Sui community and development team turned the situation around. The Cetus team suspended trading and launched a recovery plan, eventually recovering 85% to 99% of the funds. The frozen assets totaling approximately $162 million were released by community vote, but the centralized approach caused by the frozen assets also caused great controversy in the community. The Cetus protocol was restarted in June and plans to move to a fully open source model to improve transparency and security.

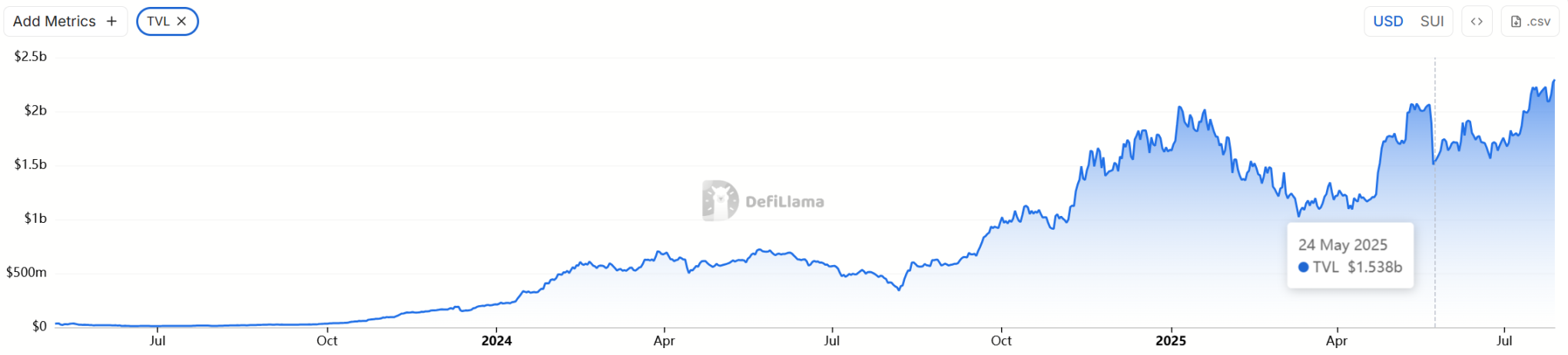

According to defiLlama data, after the hacker attack, Sui's total TVL once dropped to $1.538 billion. As of now, its total TVL has rebounded to $2.296 billion, setting a record high.

Its DEX trading volume has steadily recovered since June. In the past 24 hours, its DEX trading volume exceeded US$550 million, with a weekly increase of more than 8.79%.

Among them, the transaction volume of its ecological protocol Cetus in the past 24 hours reached 225.28 million US dollars, accounting for half of the transaction volume of the entire Sui ecological DEX, and the recovery momentum is quite rapid.

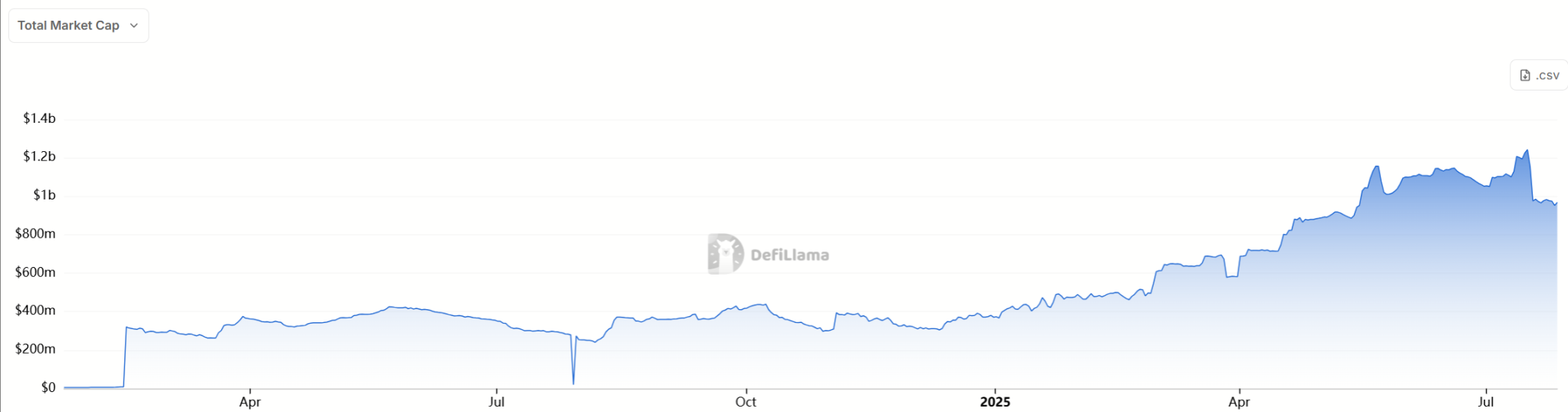

In terms of stablecoin data, the total market value is $968.38 million, which has fallen back in the past 7 days, but is still at a historical high. It is particularly noteworthy that the inflow of USDT has soared by 21% in the past day.

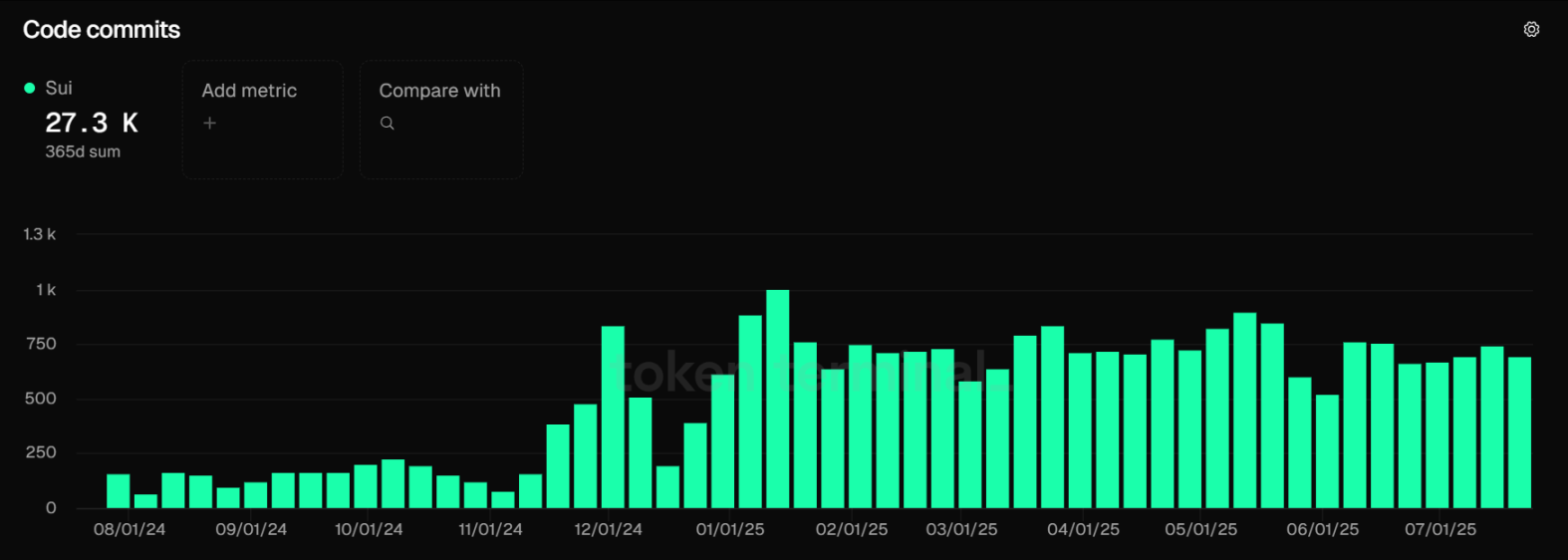

Code commits are used to count the total number of commits made to the project's public GitHub code repository. It reflects the update activity of the code repository. Terminal data shows that after its activity was briefly negatively affected in late May and early June, its code commits quickly rebounded to a high level.

Data indicators prove that the Cetus incident has not destroyed SUI, but is accelerating its maturity.

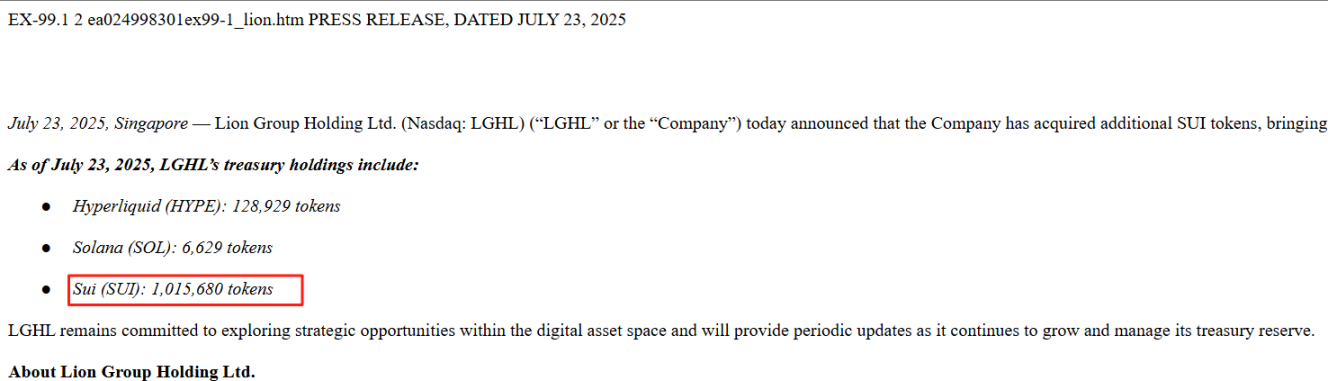

Listed company Lion bought more than 1 million SUI

It has become a trend for US listed companies to use their capital reserves to purchase tokens. Previously, Strategy purchased BTC and made huge profits, which attracted many to imitate it. Later, ETH/SOL/ENA and other reserves followed suit.

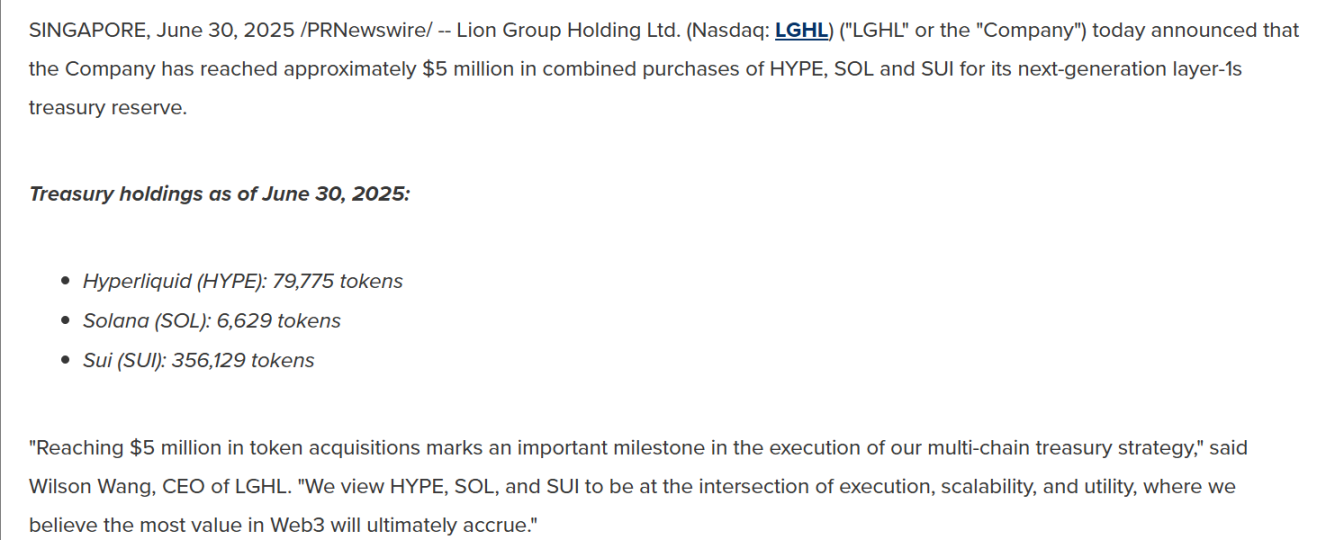

In June 2025, Lion Group Holding Ltd. (LGHL), a Nasdaq-listed company, purchased SUI, SOL, and HYPE tokens, expanding its crypto asset reserves to $9.6 million. Data showed that Lion Group purchased 356,129 SUI tokens.

As a micro-cap company with a market value of only a few million dollars, Lion's action is limited in scale but has great symbolic significance.

On July 24, according to SEC documents, Lion Group, a Nasdaq-listed company, increased its holdings of SUI tokens, bringing its total holdings to 1,015,680. At the current price of $4.25 per token, it is worth about $4.316 million.

Previously, the US listed company Everything Blockchain Inc. (EBZT) also planned to invest $10 million in five major blockchain networks: Solana (SOL), XRP, Sui (SUI), Bittensor (TAO) and Hyperliquid (HYPE).

As crypto assets penetrate mainstream finance, SUI's Layer-1 positioning attracts listed companies seeking high growth. In the future, if more companies follow suit, SUI's liquidity and price stability will be further improved.

SUI spot ETF is expected to be approved

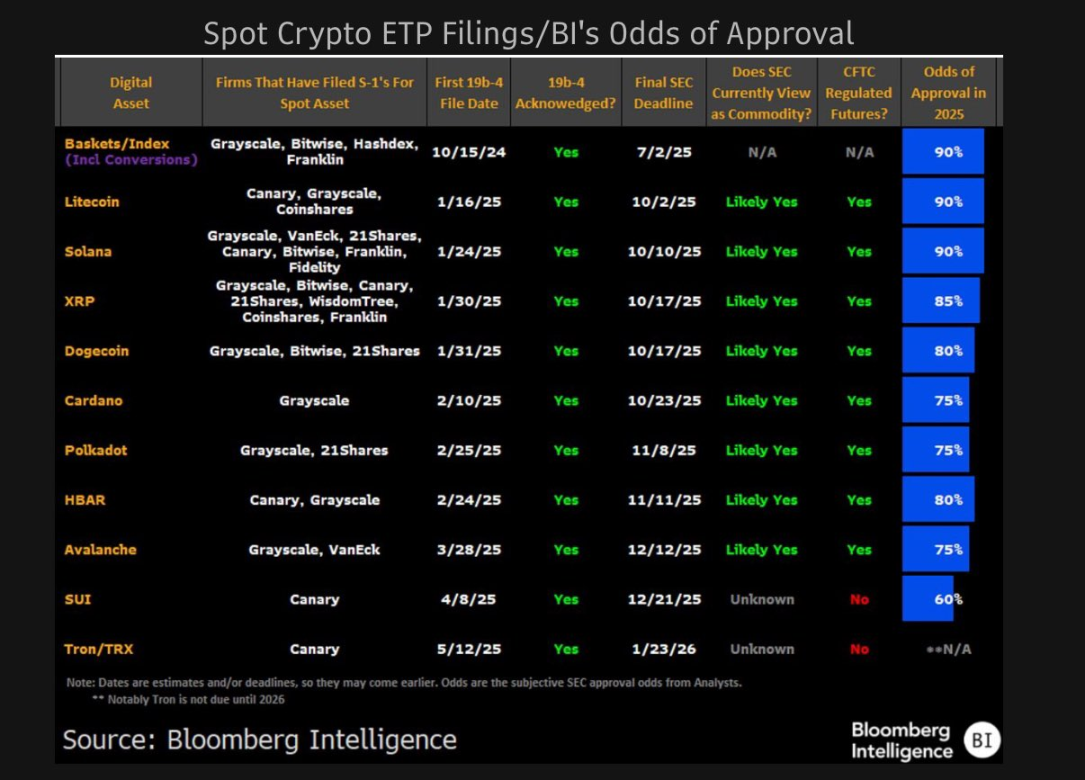

The potential approval of the SUI ETF marks a key step in the mainstreaming of cryptocurrencies. The U.S. Securities and Exchange Commission (SEC) has officially started the review process for Canary Capital's SUI spot ETF application, which was submitted in March 2025 and postponed by the SEC in June. The review period can be extended to 240 days. 21 Shares' SUI ETF is also on a similar review track, with the 19 b-4 form submitted by Nasdaq starting the evaluation in June.

Similar to the inflow data performance of Bitcoin and Ethereum spot ETFs, if the SUI spot ETF is approved, it will undoubtedly boost market confidence and have a positive impact on the currency price.

In June this year, Eric Balchunas, senior ETF analyst at Bloomberg, said that SUI expects the probability of ETF approval to be 60%.

Earlier this year, asset management company VanEck released a report predicting that SUI will occupy 5.5% of the market share, with a market value of approximately $61 billion. Based on the 3 billion coins in circulation at that time, the price of a single coin may reach $16. Yesterday, Twitter KOL 0 x 0 xFeng tweeted that "SUI should hit a new high."

In the bull market of copycats, SUI may continue to lead the market.