The power game behind stablecoins

- 核心观点:加密货币从反叛走向合规,成为美元霸权工具。

- 关键要素:

- 稳定币被纳入监管,禁止支付利息保护银行。

- 《GENIUS法案》要求严格合规,限制金融创新。

- 稳定币需求可能加剧美国国债市场波动。

- 市场影响:加密行业进一步中心化,美元主导地位强化。

- 时效性标注:长期影响。

Original author: Buttercup Network, Thejaswini MA

Original translation: Saorise, Foresight News

Translator's note: Cryptocurrency, once seen as a "revolution that subverts traditional finance", did not end up on the path of violent confrontation. Instead, it was deeply tied to the regulatory system and political consensus, becoming a "tamed revolution". From impacting tradition to seeking permission, from the ideal of decentralization to the reality of centralized regulation, the absurdity and contradiction of this "revolution" are the core of this article. When rebels bow to the system, is it a game of interests or an inevitability of the times?

In 2025, instead of storming banks, the rebels (cryptocurrency) applied for a charter from the U.S. Office of the Comptroller of the Currency (OCC).

I’ve been trying to understand the GENIUS Act phenomenon. The more I think about it, the more intriguingly absurd it all seems. So let me walk you through how we went from “move fast and break things” to “move fast and regulate.”

The bill has been signed into law, and now the rules are settled. Stablecoins are regulated and no longer a mystery, and we now know who can issue them, who regulates them, and how they work. But this raises an obvious question: What is the point of all this?

Ask anyone in the crypto space, and they’ll passionately proclaim that this is crypto’s mainstream moment, a regulatory revolution that changes everything. They’ll talk excitedly about “regulatory clarity,” “institutional adoption,” and “the future of money,” while clutching that 47-page bill as if it were the Constitution.

If you ask a U.S. Treasury official, he will talk endlessly about how this will unprecedentedly strengthen the dominance of the dollar, ensure security, and attract investment back to the United States, using all the clichés that government officials often say.

On the surface, both sides have won, but to be honest, the greater benefit has flowed to the regulators. Cryptocurrency and Bitcoin once tried to bring down banks and end the hegemony of the US dollar, but now they want banks to issue cryptocurrencies backed by the US dollar.

There’s an interesting paradox at the heart of this whole thing: Banks are understandably terrified of stablecoins. They’re watching trillions of dollars potentially flow out of traditional deposits and into digital tokens that yield nothing but are fully backed. And by making it illegal to pay interest on stablecoins, Congress is essentially protecting the banks from their fears of competition.

The law provides as follows:

“No permitted payment stablecoin issuer or foreign payment stablecoin issuer may pay any form of interest or income (whether in the form of cash, tokens, or other consideration) to a holder solely for holding, using, or retaining a payment stablecoin.”

Cryptocurrency was meant to be a trustless, decentralized alternative to traditional finance. But today, you can send stablecoins on-chain, but you have to do it through an embedded plugin on a venture-backed app, and settle with a licensed issuer whose partner bank is JPMorgan Chase. The future is here, and it looks exactly like the past, only with a better user experience and more regulatory documentation.

The GENIUS Act builds a Rube Goldberg-like system that allows you to use revolutionary blockchain technology, but only if:

- Approved by the U.S. Office of the Comptroller of the Currency

- Holds US Treasury bonds as reserves at a 1:1 ratio

- Submit monthly certification signed by the CEO and CFO

- Allows authorities to order the freezing of tokens

- Promise to never pay interest

- Business activities are limited to "issuance and redemption of stablecoins"

The last point is particularly intriguing: you can innovate finance, but you can never use the innovated finance to do anything else.

We are witnessing the institutionalization of a movement that was supposed to be anti-establishment . Existing stablecoin issuers like Circle are celebrating because they were already largely compliant and now just have to watch their less regulated competitors get kicked out of the space.

Meanwhile, Tether faces a life-or-death choice : become transparent and accountable, or be banned from U.S. exchanges by 2028. For a company that built its fortune on opacity and offshore banking, this is like letting a vampire work the day shift.

Of course, given Tether’s size, perhaps it doesn’t need to care too much. With a market cap of $162 billion, it’s larger than Goldman Sachs, larger than the GDP of most countries, and, frankly, larger than the entire regulatory apparatus that tries to constrain it. When you get to that level of size, “comply or leave” sounds less like a threat and more like a suggestion.

The "Libra Clause," a provision that essentially prevents tech giants from issuing stablecoins at will, is named after Facebook's failed attempt to issue a global digital currency. Remember when everyone was panicking that Facebook might undermine sovereign currencies? Under today's system, if Facebook wants to issue a stablecoin, it must obtain unanimous approval from the Federal Council, and the token must not pay interest and must be fully backed by U.S. government debt.

Let’s talk about the economic logic of everyone’s sudden attention to this matter . US merchants currently pay Visa and Mastercard 2%-3% in fees for each transaction, which is often the largest expense besides wages. The cost of stablecoin payments is only a few cents, and large settlements are even less than 0.1%, because blockchain infrastructure does not require huge banks and card organizations to share a piece of the pie. The $187 billion in card swipe fees each year could have stayed in the pockets of merchants. In this way, it is not difficult to understand Amazon and Walmart’s interest in stablecoin solutions: Why pay the card organization duopoly when you can send digital dollars directly?

@Visa

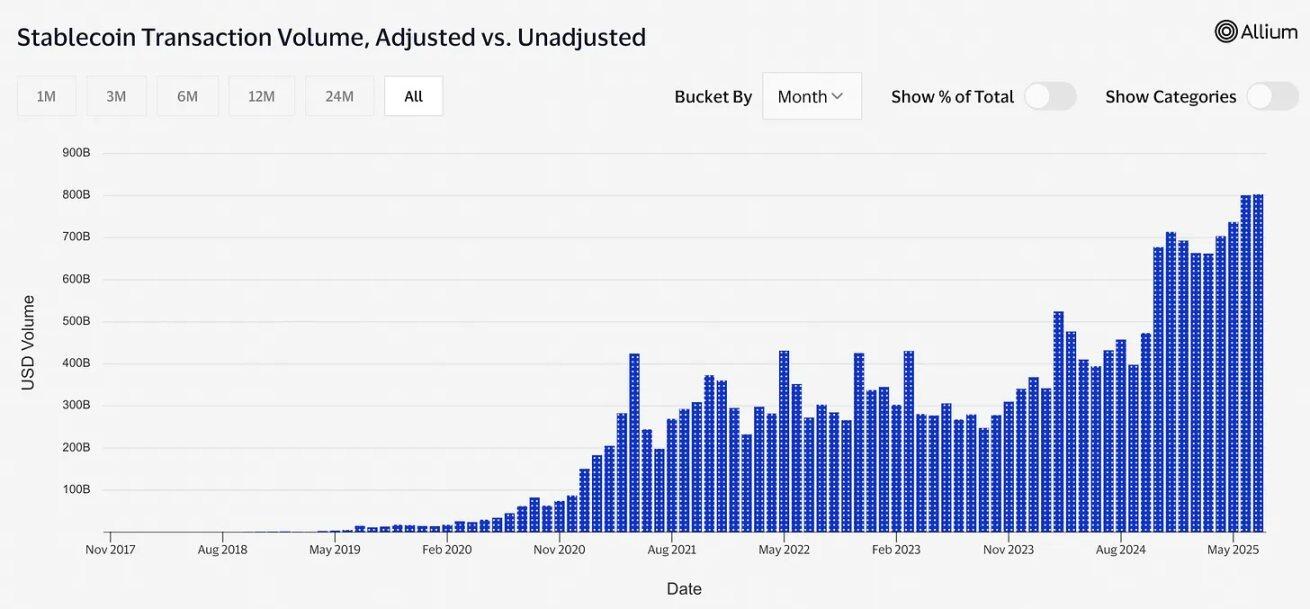

There’s also a scary feedback loop that no one wants to talk about: if stablecoins really take off and trillions of dollars are issued, a large portion of the demand for U.S. Treasuries will come from stablecoin reserves.

This sounds good, but the problem is that stablecoin demand is inherently more volatile than traditional institutional buyers . Once people lose confidence in stablecoins and start to redeem them en masse, all Treasury bonds will flood the market in an instant. At that time, the US government's borrowing costs will depend on the mood of cryptocurrency Twitter users that day, just like betting mortgage payments on the mood swings of short-term traders. The US Treasury market has experienced ups and downs, but "panicked stablecoin users trigger algorithmic selling pressure" is the first time.

Most intriguingly, this mirrors the evolution of cryptocurrency from an “anarchist currency” to an “institutional asset class .” Bitcoin was supposed to be peer-to-peer electronic cash that didn’t require a trusted third party, but now there’s a federal law that requires that digital dollars can only be issued by highly trusted, strictly regulated third parties who are accountable to higher-level regulators.

The law requires stablecoin issuers to be able to freeze tokens on the blockchain network when requested by the authorities. This means that every "decentralized" stablecoin must have a centralized "emergency kill switch." This is not a bug, but a feature.

We have successfully created a “censorship-resistant currency” that also has the ability to enforce censorship.

Don’t get me wrong, I’m all for regulatory clarity and dollar-backed stablecoins. This is great: crypto innovation has rules to follow, and the mainstreaming of a digital dollar is a real revolution. I’m all for it. But don’t pretend this is some generosity of regulatory enlightenment. It’s not that regulators suddenly fell in love with crypto innovation, it’s that someone walked into the Treasury Department and said, “Why don’t the world use more dollars, just in digital form, and have them buy more U.S. Treasuries to back it up?” And so stablecoins went from “dangerous crypto stuff” to “a great tool for dollar hegemony.”

Every USDC issued means selling one more Treasury bond . $242 billion in stablecoins means tens of billions of dollars flowing directly into Washington, driving up global demand for U.S. Treasuries. Every cross-border payment avoids the euro or yen, and every foreign exchange market that lists regulated U.S. stablecoins is another "franchise" of the U.S. monetary empire.

The GENIUS Act is the most sophisticated foreign policy operation disguised as domestic financial regulation.

This raises some interesting questions: What happens when the entire crypto ecosystem becomes an appendage of U.S. monetary policy? Are we building a more decentralized financial system, or are we creating the world's most complex dollar distribution network? If 99% of stablecoins are pegged to the dollar and any meaningful innovation requires approval from the U.S. Office of the Comptroller of the Currency, have we accidentally turned a revolutionary technology into the ultimate export business of fiat currency? If the rebellious energy of cryptocurrency is directed to improving the efficiency of the existing monetary system rather than replacing it, as long as payments are settled faster and everyone can make money, will anyone really care? These are not necessarily problems, but they are far from the problems people wanted to solve when the movement first started.

I keep teasing this, but the fact is, this might actually work. Just as free banking in the 1830s evolved into the Federal Reserve System, cryptocurrencies may be on their way out of their chaotic adolescence and into maturity as a systemically important part of financial infrastructure.

To be honest, for 99.9% of people, they just want to transfer money quickly and cheaply, and they don’t care about monetary theory or decentralization at all.

Banks are already planning to become the main issuers of these newly regulated stablecoins. JPMorgan Chase, Bank of America, and Citigroup are said to be preparing to provide stablecoin services to their clients. The institutions that were supposed to be disrupted by cryptocurrencies have now become the biggest beneficiaries of the legalization of crypto regulation.

This isn’t the revolution anyone expected, but it may be the revolution we got. And oddly enough, it’s kind of genius.