Local bull markets may become the norm, and Q4 will usher in market recovery

- 核心观点:当前经济分化,需精选资产应对波动。

- 关键要素:

- AI与半导体是长期增长核心。

- 增持黄金等稀缺实物资产。

- 警惕美股七巨头高占比风险。

- 市场影响:局部牛市延续,波动加剧。

- 时效性标注:中期影响。

Original author: arndxt

Original translation: AididiaoJP, Foresight News

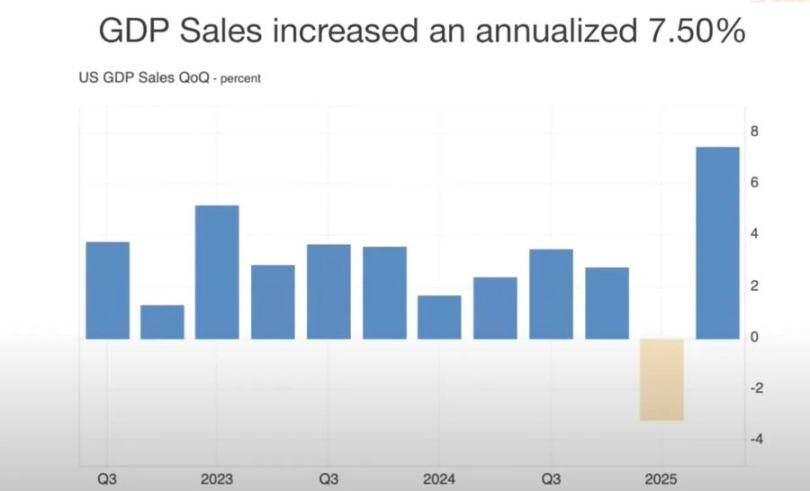

The view that the economy is re-accelerating is actually very one-sided. Currently, it is mainly supported by the assets of wealthy families and investment driven by artificial intelligence. For investors, this cycle cannot simply rely on a general market rise:

- The core of long-term growth is semiconductors and AI infrastructure.

- Increase holdings of scarce physical assets: gold, metals, and some promising real estate markets.

- Be wary of broad-based indices: The high weight of the "Big Seven" masks the overall market fragility.

- Keep a close eye on the US dollar: its direction will determine whether this cycle continues or is interrupted.

Just like in 1998 to 2000, the bull market may continue for a while, but volatility will become more intense and asset selection will be the key to becoming a market winner.

Economic polarization

Market performance is a true reflection of the economy. As long as the stock market remains near its historical highs, it will be difficult to believe that there is an economic recession.

We are in a sharply diverging economic environment:

- The top 10% of income earners contribute more than 60% of consumption and accumulate wealth through stocks and real estate.

- At the same time, inflation is eroding the purchasing power of middle- and low-income families. This widening gap explains why, despite the “reacceleration” of the economy, the job market remains weak and the cost of living crisis persists.

Uncertainty caused by Fed policy

Be prepared for policy volatility. The Federal Reserve must address both the appearance of inflation and the political cycle. This creates opportunities, but also means that if market expectations shift, there could be a sudden risk of a downturn.

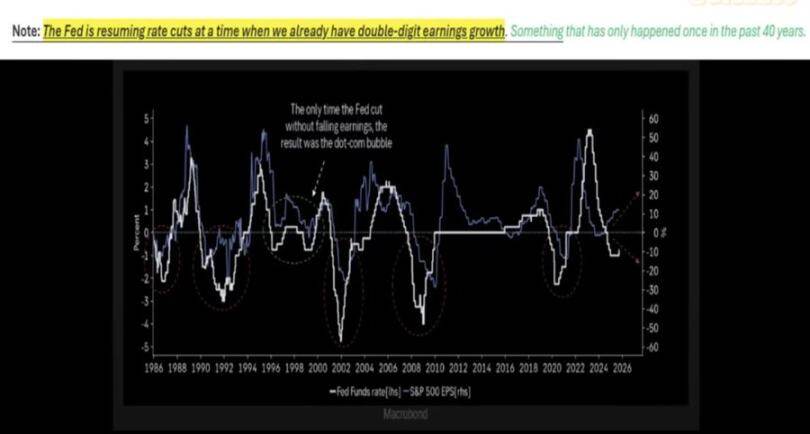

The Federal Reserve is currently in a dilemma:

- On the one hand, strong GDP growth and resilient consumption support a slower pace of interest rate cuts;

- On the other hand, market valuations are too high, and delaying interest rate cuts may trigger "growth concerns."

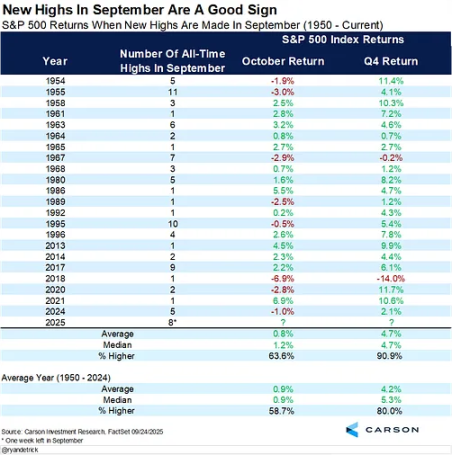

History shows that rate cuts during periods of strong earnings, such as in 1998, can prolong bull markets. But this time is different: inflation remains stubbornly high, the "Big Seven" are posting strong earnings, while the remaining 493 companies in the S&P 500 are performing mediocrely.

Asset selection in a nominal growth environment

One should hold scarce physical assets (gold, key commodities, real estate in supply-constrained areas) and areas that represent productivity (AI infrastructure, semiconductors), while avoiding excessive concentration in stocks driven by internet hype.

The period that follows is less likely to be a full-blown boom and more like a partial bull run:

- Semiconductors remain core to AI infrastructure, and related investments continue to drive growth.

- Gold and real assets are re-demonstrating their value as a hedge against currency debasement.

- Cryptocurrencies are currently facing pressure from deleveraging and excess government debt, but structurally they are closely linked to the liquidity cycle that drives gold higher.

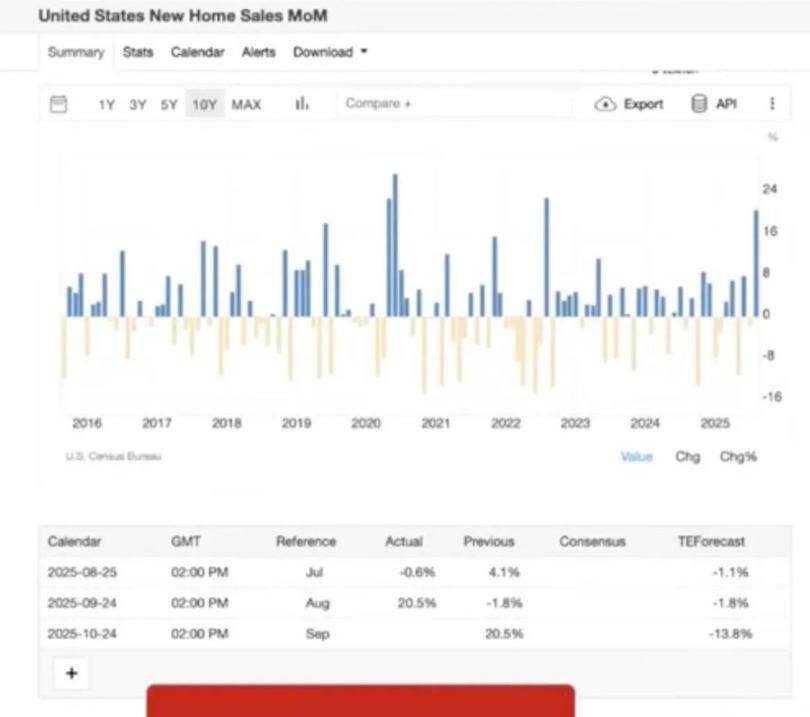

Real estate and consumption trends

If the real estate and stock markets weaken simultaneously, the "wealth effect" that supports consumption will be impacted.

Real estate will experience a short-term rebound when interest rates are slightly lowered, but deep-seated problems remain:

- The imbalance between supply and demand caused by demographic changes;

- Increased default rates due to the end of forbearance periods on student loans and mortgages;

- There are significant regional differences (older groups have asset buffers, while young families are under great pressure).

US dollar liquidity and global layout

The US dollar is a key factor affecting the overall situation. If the global economy weakens and the US dollar strengthens, more vulnerable markets may experience problems before the US.

One overlooked risk is a contraction in the supply of US dollars:

- Tariff policies reduce trade deficits and limit the scale of dollar flows back to U.S. assets;

- The fiscal deficit remains high, but foreign buyers' appetite for U.S. Treasuries has waned, potentially causing liquidity problems.

- Futures market data shows that US dollar short positions have reached a historical extreme, which may trigger a short squeeze on the US dollar and undermine the stability of risky assets.

Political Economy and Market Psychology

We are in the late stages of a financialization cycle:

- Policymakers strive to "maintain the status quo" until important political milestones (such as general elections and midterm elections) have passed;

- Structural inequalities (rents rising faster than wages, wealth concentrated among the elderly) fuel populist pressures and prompt policy adjustments in areas such as education and housing;

- The market itself is reflexive: funds are highly concentrated in seven large-cap stocks, which both supports valuations and sows the seeds of vulnerability.