The Warring States of Hashrate: Four Survival Archetypes and the Overlooked "Arbitrage" Space

- Core Viewpoint: Cango represents a new archetype for mining companies: high cost-effectiveness and high potential returns.

- Key Elements:

- Asset Model: Low-cost acquisition of second-hand mining rigs, a light-asset, high-value-for-money approach.

- AI Pathway: Focus on flexible AI inference, enabling rapid retrofitting of existing mining facilities.

- Market Perception: Low institutional coverage, leading to a significant perception gap.

- Market Impact: Challenges the traditional valuation logic for mining companies, highlighting alternative investment opportunities.

- Timeliness Note: Medium-term impact.

Preface: When Hashrate Is No Longer the Sole Metric

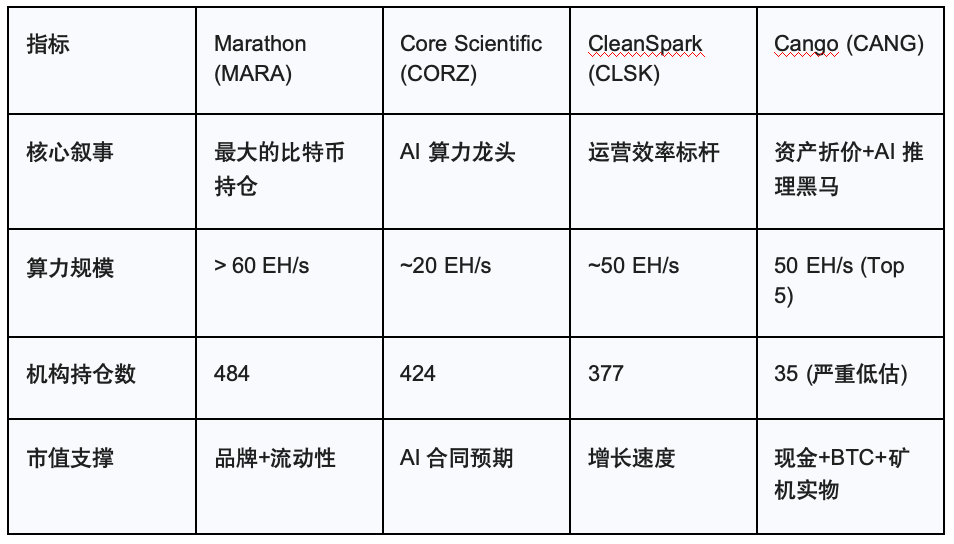

In 2026, the evaluation system of the Bitcoin mining industry is undergoing dramatic changes. Pure "hashrate scale" is no longer the sole determinant of market value. The capital market is seeking two types of targets: giants like Core Scientific that have successfully pivoted to AI, and miners like CleanSpark that pursue extreme efficiency.

Beyond these prominent giants, Cango represents a third, atypical survival model. This article will combine the latest "2025 Bitcoin Mining Market Review" report (hereinafter referred to as the "2025 Annual Report") published by Digital Mining Solutions. We will conduct an in-depth, multi-dimensional comparative analysis between three representative companies—MARA, CLSK, CORZ—and CANG, dissecting the differences in their underlying business logic and the significant pricing discrepancies.

I. Asset Expansion Model: The Unadorned Greatsword vs. Guerrilla Tactics

Regarding the cost of acquiring hashrate (CAPEX), the industry has diverged into two distinct paths.

1. The Heavy Asset Camp: CleanSpark & Riot Platforms

● Core Strategy: "Buy new, not old; build, don't lease." CLSK and Riot tend to invest heavily in building large-scale mining facilities and procuring the latest S21 or XP series miners.

● Advantages: Extremely high energy efficiency (low J/TH), long-term operational stability, highly favored by institutional investors.

● Disadvantages: Extremely high capital expenditures (CAPEX). The cost of new machines typically ranges from $15-$25/TH, leading to a prolonged investment payback period (ROI). Once the coin price stagnates, significant depreciation pressure can erode profits.

2. The Value Arbitrage Camp: Cango

● Core Strategy: "Supply chain leverage, ultra-low-cost expansion."

○ Low-Cost Position Building: Cango did not blindly chase after new machines with extremely high premiums. The 2025 Annual Report specifically points out that Cango rapidly entered the industry's top tier by acquiring second-hand, operational miners, acquiring hashrate at an extremely low cost (approximately $8/TH), building a natural safety cushion compared to peers.

○ Dynamic Upgrading: Cango does not stick with old machines indefinitely. It adopts a "Refresh" strategy, such as upgrading 6 EH/s of hashrate to S21 in Q4, paying only the price difference.

● Comparative Conclusion: CLSK excels in efficiency, while Cango wins in cost-effectiveness per unit of hashrate. In the current fiercely competitive environment, Cango's unique "light-asset" model provides greater resilience against risks.

II. AI Transformation Path: International Freight Hub vs. Same-City Express Delivery Network

As mining rewards halve, AI has become a battleground for mining companies. Data from the 2025 Annual Report shows that companies with clear AI/HPC revenue significantly outperform pure mining companies in stock price performance. However, on this track, Cango and the giants have chosen completely different entry points.

1. Core Scientific: International Freight Hub

● Business Model: CORZ secured a massive contract with CoreWeave, focusing on building Tier 3/4 level mega data centers.

This is akin to constructing a massive "international airport cargo terminal." It specializes in serving "giant containers" (large model training tasks) with astonishing throughput. However, such infrastructure has extremely high requirements for "runways and control towers" (dual power feeds, ultra-high redundancy), with construction cycles spanning years and capital barriers reaching billions. Once built, it becomes an irreplaceable core hub.

● Valuation Logic: The market views it as "core infrastructure," assigning a high premium because it controls scarce, non-replicable resources.

2. Cango: Same-City Express Delivery Network

● Business Model: Cango avoids the red ocean of building "airports," choosing instead to focus on the long tail of "AI inference." Through low-cost, ultra-fast AI transformation, it converts scattered mining facilities worldwide into decentralized AI nodes.

This is like building a dense network of "same-city fulfillment centers" or an "express delivery network."

○ Flexible Transformation: It doesn't require building expensive airport runways. Instead, it leverages existing community outlets (mining sites) with simple power and network upgrades for a plug-and-play approach.

○ Handling Small Packages: It doesn't ship giant containers but specializes in high-frequency, rapid processing of massive volumes of "small packages" (inference requests from SMEs, real-time response tasks).

○ Intelligent Scheduling: Through a middleware platform, it schedules globally dispersed computing power like dispatching couriers, forming a distributed network.

● Comparative Conclusion: CORZ is engaged in "heavy infrastructure," earning expensive toll fees, but it's heavy and slow. Cango is in the "last-mile logistics," profiting from high-frequency turnover and flexibility. On the eve of an explosion in AI inference demand, Cango's "express delivery" model, capable of quickly responding to SME needs, has seized the advantages of "speed" and "breadth."

III. Market Perception and Shareholder Structure: Crowded Trade vs. Uncharted Territory

If fundamentals determine the long-term floor, then deviations in market perception determine short-term explosive potential. The institutional holding data disclosed in the 2025 Annual Report reveals the most striking contrast.

1. Wall Street's Darlings: MARA & IREN

● Current State: "Crowded Trade."

○ Data: MARA has 484 institutional holders, IREN has 433.

○ Logic: Almost all funds focused on Crypto or AI have already allocated to these leaders. Their information is fully transparent, and expectations are already fully priced into the stock (Priced-in). Driving the stock price higher requires exceptionally stunning performance that exceeds expectations.

2. The Forgotten Corner: Cango

● Current State: "Uncharted Territory."

○ Data: Despite its hashrate scale ranking among the global top five (50 EH/s), Cango has only 35 institutional holders.

○ Logic: This means the vast majority of institutional capital has not yet covered this company. Such extreme information asymmetry is often the source of alpha returns.

○ Catalyst: As Cango's AI business begins to be disclosed, or its Bitcoin holdings are re-evaluated, even if only a small amount of institutional capital starts to "fill the gap," for a low-liquidity, undervalued stock like this, it could have a significant marginal impact on pricing.

○ Comparative Conclusion: Investing in MARA is following consensus, betting on industry Beta. Investing in Cango is anticipating a perception correction, betting on the Alpha brought by institutional entry.

IV. Conclusion: The Investor's Choice

Finally, we return to the core valuation logic.

In-depth Commentary:

The market's current pricing for CORZ and MARA incorporates a high "expectation premium." Cango's market capitalization is even lower than its book "hard assets" (BTC holdings + miners + cash - debt).

This means the market has not yet assigned any positive valuation to Cango's 50 EH/s hashrate or its Tier 2 AI transformation.

Investment Recommendations:

● If you believe in the herd effect of capital, pursue absolute liquidity and industry Beta, MARA remains the top choice.

● If you are bullish on the certain explosion of the AI training segment and don't mind high valuations, CORZ is the purest play.

● However, if you are a value investor seeking a high-upside bet with an asset floor below and an AI transformation option above, then Cango, under the current pricing system, clearly offers an extremely attractive entry point.