Traders who used perpetual contracts as a hedging tool are already regretting it. What are the alternatives?

- 核心观点:永续合约不适合作为可靠对冲工具。

- 关键要素:

- 自动减仓机制强制平仓盈利对冲仓位。

- 做市商流动性撤资致市场深度暴跌。

- 预言机故障与跨保证金引发连锁清算。

- 市场影响:暴露衍生品结构性风险,促进行业反思。

- 时效性标注:长期影响。

Original text fromYQ

Compiled by Odaily Planet Daily Golem ( @web3_golem )

Between October 10 and 11, 2025, leveraged positions worth $19 billion to $40 billion were forced to liquidate, making it the largest liquidation event in cryptocurrency history. However, this was not due to excessive leverage by retail investors; many of the liquidated positions were purportedly used for hedging: delta-neutral strategies, conservative 1x leverage settings, and professional market maker order books.

We found that perpetual swaps transform market risk into operational risk (exchange failures, auto-deleveraging mechanisms, oracle manipulation, and market maker order cancellations), all of which can be triggered simultaneously during extreme market conditions. While perpetual swaps are highly effective for directional speculation and professional trading, they are not entirely reliable for hedging.

Traditional hedging methods

Delta Neutral Hedge

Hedging involves establishing offsetting positions to reduce exposure to adverse price fluctuations. A good hedging strategy needs to possess four characteristics:

- Path independence: The protection should be effective regardless of whether prices fall steadily or sharply;

- Counterparty reliability: Hedging strategies must work during times of market stress, not fail when they are most needed;

- Predictable costs: Hedging fees should be transparent and bounded;

- Positive convexity: Protective measures should increase, not decrease, as market conditions worsen.

Delta-neutral strategies attempt to create portfolios with zero price sensitivity. Delta measures how the value of a position changes for every $1 movement in the underlying asset.

Standard configuration: Portfolio Delta = Long Position + Short Position = (+1) + (-1) = 0

Traders maintain their positions, potentially collecting funding fees, and expect to be protected against price fluctuations. However, the October 11th liquidation incident demonstrated that this approach has multiple failure modes.

Perpetual Contract

Perpetual futures are derivative contracts with no expiration date, invented by Alexey Bragin in 2011. Key features include:

- Funding rate: A regular payment between longs and shorts to anchor the perpetual swap price to the spot price. When the perpetual swap price is higher than the spot price, longs pay shorts, and vice versa.

- No expiration date: Unlike traditional futures, perpetual contract positions can theoretically be held indefinitely;

- High leverage: usually 10x to 100x, with high capital efficiency;

- Mark Price System: combines exchange order book prices with external oracle data to calculate margin.

Assuming you have $100,000 in capital, you can hedge a $1 million position with $100,000 in margin (1x leverage), leaving $900,000 available. However, in the face of real risk, this efficiency will be eliminated.

The “10.11” large liquidation made contract hedging measures ineffective

After the "10.11" incident, Delta neutral strategies, so-called conservative hedging strategies and professional institutions all suffered systemic damage.

Failure reason 1: Automatic deleveraging (ADL)

Automatic Deleveraging (ADL) is an exchange's last resort. When normal market operations are unable to fill the liquidation gap and the insurance fund is depleted, the exchange will forcefully close profitable positions to absorb losses from bankrupt positions.

Binance’s Auto-Deleveraging (ADL) selection formula: ADL ranking = profit and loss percentage × effective leverage (for profitable positions)

The system specifically targets the most successful, highest leveraged positions, so profitable hedge positions will be prioritized for forced liquidation.

For example, before October 11th, a trader longed $5 million worth of BTC spot using 3x leverage, while simultaneously shorting $5 million worth of BTC contracts around $120,000 to hedge, with no stop-loss orders set. When October 11th occurred, their BTC short position would be forcibly liquidated by ADL, forcing them to hold a naked leveraged long position. Ultimately, their long position would be liquidated, resulting in a total loss of 100% ($5 million).

Hyperliquid experienced 35,000 ADL events on 20,000 users on October 11th. ADL may have improved the returns of most short sellers by forcing liquidations near the market bottom, but this was only a rare occurrence. For hedging purposes, forced liquidations are disastrous.

Failure reason 2: Market maker withdrawal

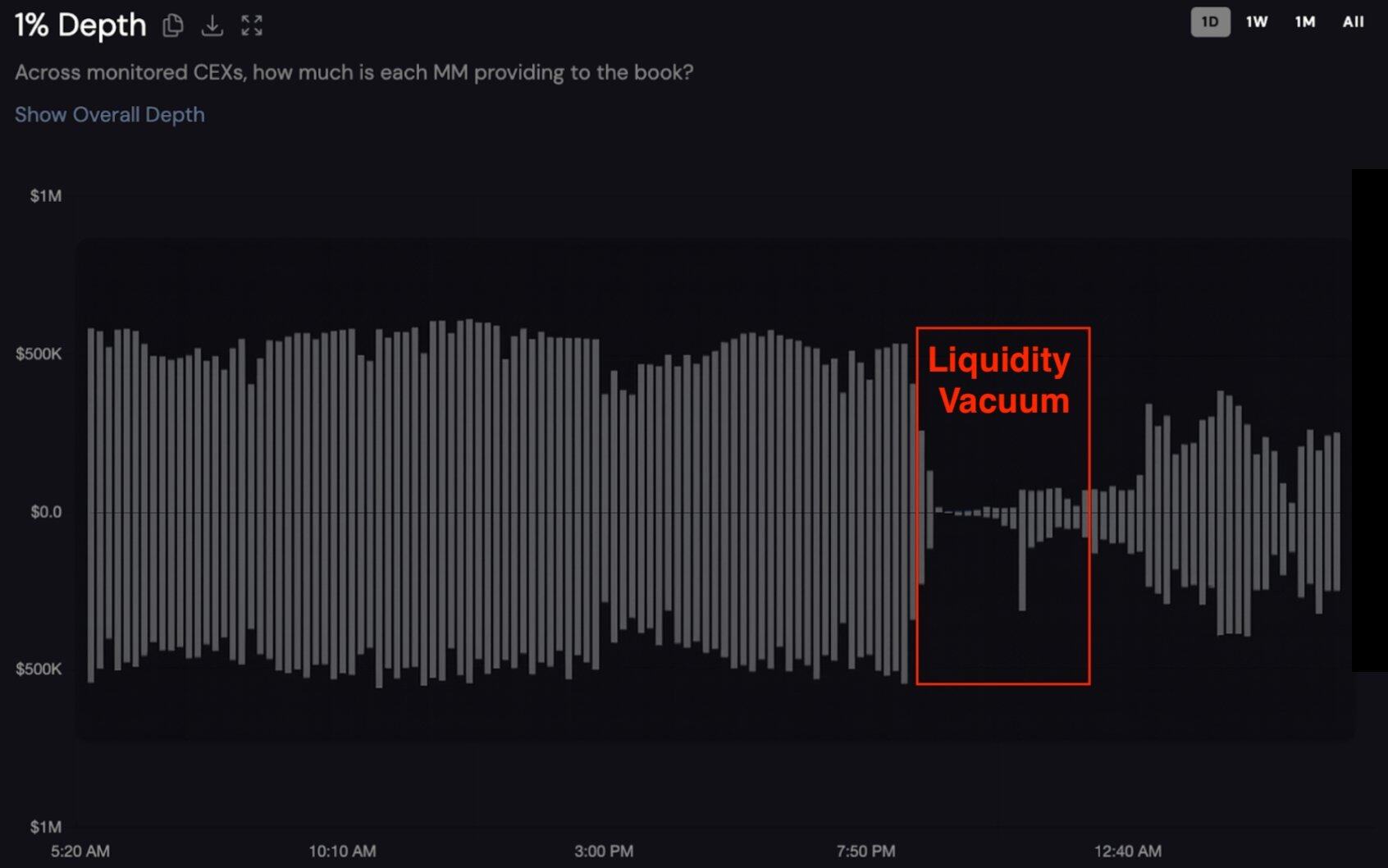

The CEX two-sided 1% depth chart for unnamed token_0 over the past 24 hours. The bottom of the x-axis is the buy price, and the top is the sell price. Data from Coinwatch

During the "10.11" (October 11) trading incident, order book depth for major trading pairs plummeted 98%, from $1.2 million to $27,000, indicating a coordinated withdrawal of funds by professional market makers. Coinwatch Track data shows that major market makers withdrew all liquidity within 15 minutes, and liquidity depth remained below 10% of normal levels for over five hours. Some market makers took over eight hours to restore full liquidity.

Market makers typically use perpetual swaps to hedge inventory, but when ADL occurs, they are forced to hold naked long positions in a falling market, withdrawing all liquidity to cut losses. This causes the previously liquid 24/7 perpetual swap market to evaporate precisely when liquidity is most critical.

Failure Reason 3: Oracle Issues and Cross-Margin Mechanism

Many liquidations were caused by exchanges’ pricing systems using incorrect valuations rather than actual asset impairments, such as the plummeting prices of wBETH and USDe on CEXs.

At the same time, modern exchanges are promoting cross-margining to improve capital efficiency, where all positions are backed by the entire account. When wBETH plummeted 89% due to an oracle failure, traders who had hedged their BTC positions elsewhere saw their collateral evaporate simultaneously across all their positions. The margin backing their BTC hedges was depleted by the losses on wBETH, and a single margin call crippled all other positions. Cross-margining also transforms isolated risk into losses across the entire portfolio.

XPL/PLASMA: Conservative 1x leverage strategy fails

The October 11 crash demonstrated systemic failure, and the XPL/PLASMA manipulation incident in August 2025 showed that even a 1x leveraged hedge against pre-launch tokens could lead to catastrophic failure due to price manipulation in the presence of weak market liquidity.

Hyperliquid pioneered pre-launch perpetual swap trading, allowing for token speculation before the emergence of a spot market. Plasma's XPL token garnered widespread attention, with many traders attempting to hedge their airdrop allocations by shorting XPL perpetual swaps. The logic was that if a user expected the XPL token to be worth $10,000, they would short a $10,000 perpetual swap before launch to lock in value.

The August 2025 whale price manipulation incident caused heavy losses for users using 1x leverage for hedging. (Related reading: Hyperliquid Exposed Again to Whale Manipulation: XPL Rise 200% Pre-Market, Short Position Liquidation, Reaping $46 Million )

1x leverage creates a false impression for users, believing it provides security and requires a 100% negative movement to liquidate. However, for pre-launch tokens with a maximum leverage of 3x, when whales can drive the price up by 200% by draining the thin order book, 1x leverage provides no protection.

One trader who was liquidated said: "1x hedge, account destroyed, and lost half of my XPL configuration." This also reflects a paradox: using a conservative hedging strategy should reduce risk, but the final loss is greater than holding the unhedged underlying asset.

How to reduce the risk of perpetual contract hedging?

Despite evidence that perpetual hedging is a mistake, some participants have no choice. Here are some guidelines for reducing (but not eliminating) risk.

Capital requirements

When proper risk management is employed, the capital efficiency of perpetual contracts disappears. The required capital formula is:

- Normal volatility: Funds = Position size × 1.4

- Volatility in October: Funds = Position Size × 1.65

- Pre-launch tokens: Funds = Position size × 2.5+

To safely hedge a $100,000 BTC position, a minimum of $140,000 is required. However, during the stress period, $165,000 is recommended. Before going online, more than $250,000 is required.

If your funds are less than 1.5-2 times the position size, do not attempt to hedge with perpetual contracts. The risk you create is greater than the risk you want to eliminate.

Forced stop loss and take profit

When hedging with perpetual contracts, stop-loss and take-profit orders must be set before opening a position. "10.11" Many traders hedge without an exit strategy, believing they can't get liquidated. They believe a delta-neutral strategy means "set it and forget it." Without a predetermined exit point, risk exposure includes: sudden volatility spikes (being liquidated before reacting), sudden funding rate spikes (causing position loss), oracle failures (causing collateral to be mismarked), and infrastructure failures (preventing manual intervention).

For each perpetual hedge position, please define the following points before opening the position:

Stop loss:

Conservative: 15-20% counter-trend movement at the time of entry;

Medium: 25-30% counter-trend movement;

Highest: 40-50% (only with 1x leverage and a large buffer);

If you're long 1 BTC in spot trading at $120,000 and short 1 BTC in a perpetual swap with 1x leverage, your stop-loss should be set at $156,000 (a 30% counter-trend fluctuation). If the BTC price surges to $156,000, the hedge will automatically close, resulting in a $36,000 loss. However, your spot profit is $36,000, while your hedge will lose $36,000, resulting in a net neutral outcome.

Taking profits on hedges is crucial because funding rates and opportunity costs accumulate over time.

Diversified investment across multiple platforms

Avoid concentrating your perpetual swap hedges on a single exchange. Spread your hedge across at least three exchanges (e.g., 40% Binance, 35% Bybit, 25% OKX). Maintain separate collateral pools, use different settlement currencies whenever possible, and avoid cross-platform margining.

Hedging on a single platform means that an operational failure on the exchange can destroy the entire hedging transaction. On October 11, Binance experienced oracle failures for wBETH, BNSOL, and USDe; auto-deleveraging (ADL) failures in specific regions; and API failures in specific modules.

Leverage Restrictions

For hedged positions, the maximum leverage is 1x, no more. For a funded account, hedging $1 million requires $1 million in margin plus a 30-50% buffer, for a total of $1.3-1.5 million. Trading positions with different risk parameters should be maintained in separate accounts. Avoid hedging cross-margin and speculative positions.

If you think 1x leverage looks capital inefficient, then you are not suitable for permanent hedging. With 10x leverage, a 10% adverse move will result in liquidation, while with 1x leverage, more than 50% of moves are likely to survive.

Close monitoring

The "10.11" crash occurred in the early morning hours (UTC+8), lasting 90 minutes from the start of the decline to the peak. At this time, many North American traders were on their way home from get off work, and European and Asian traders were likely asleep.

This situation isn’t unique to October 11th. The March 2020 crash occurred on a Thursday, the May 2021 crash occurred on a Wednesday, and the FTX crash happened over the weekend. Liquidation chain reactions are not limited by business hours, time zones, or sleep schedules.

Without 24/7 monitoring capabilities, perpetual hedging strategies face unacceptable risk. The 90-minute window on October 11th was insufficient for most people to:

- Identify the chain reactions taking place;

- Assess which positions are risky;

- Accessing exchange platforms (many APIs timed out);

- Implementing safeguards across multiple exchanges;

- Adjust stop-loss or increase margin according to changing circumstances;

Traders often find their accounts liquidated when they return from commuting, sleeping, or weekend activities. Some have configured monitoring alerts, but they don't react quickly enough. Traders check their phones and see the alerts, but the exchange app remains silent. By the time they open their computers, their positions have been automatically reduced or liquidated.

Professional trading operations require a dedicated monitoring team, working in shifts. Minimum infrastructure includes 24/7 manual monitoring, redundant communication systems, distributed geographic coverage, pre-authorized response procedures, and automated failover.

For individual traders and small firms, these requirements are prohibitively expensive. A three-shift, two-person operation would cost $300,000 to $500,000 annually in labor costs alone, not including technology costs. Such costs only make economic sense for portfolios exceeding $10 million to $20 million. For smaller players, the alternative is full automation or no perpetual hedging at all. Simply relying on "I'll check my phone regularly" or "I've set an alert" isn't enough. The October 11th liquidations demonstrated that even for traders actively monitoring the market, 90 minutes is too short a timeframe for manual response.

If you can't meet these monitoring standards through a dedicated team or robust automated systems, the appropriate response is to use a custodial service, hire a professional risk management team, or abandon perpetual hedging altogether. The October 11th crash compressed the entire liquidation cycle to 90 minutes, and the next crash could be even faster. While infrastructure continues to improve, trading complexity and capital concentration are also increasing. Without continuous monitoring capabilities, perpetual hedging strategies can expose you to catastrophic risks—the very risks that hedges are supposed to protect against.

Not using contract hedging is the best alternative

Across all analytical dimensions (overall market crash, individual token manipulation, user sophistication), the conclusion is consistent: perpetual swaps have failed. They failed as a hedging tool when it was most needed. Therefore, unless one is specialized in a specific field and has a sufficient capital buffer, perpetual swaps are not an effective hedging tool.

For 95% of users, perpetual swaps function more like a speculative tool than a hedging tool. They work well when the market is calm and hedging isn't necessary, but fail in stressful situations where hedging is crucial. For all participants in the crypto market, there are better alternatives to using perpetual swaps.

- VCs with locked tokens: Consider over-the-counter (OTC) transactions or structured products with minimum return guarantees, gradually realizing returns during the unlocking period, accepting directional risks rather than creating operational risks through contracts.

- Hedge funds: can use tail risk options, Chicago Mercantile Exchange (CME) futures, and position adjustment for unhedged exposures. Perpetual contracts are only suitable for tactical arbitrage within 24 hours.

- Margin traders: Sell some tokens immediately after the TGE, place tiered limit orders, accept directional exposure, and avoid using Pre-perpetual contracts.

- Retail traders: Maintain position size to account for drawdown risk, follow profit-taking principles, and accept the risk of not being able to afford derivative hedging.

- Market Makers: They perform option-based inventory hedging, physically deliver futures, reduce inventory levels, and increase the spread of unhedged risks.

Conclusion

The cryptocurrency industry should stop promoting perpetual swaps as reliable hedging tools for everyday users. They should be viewed as speculative tools that enable price discovery, directional leveraged trading, professional arbitrage, and market maker inventory management, but with extreme caution.

The October 11th liquidation incident clearly demonstrated that perpetual swaps transform market risk into operational risk. These operational risks are highly correlated, triggering simultaneously when the market is under pressure . The best hedging strategy in the cryptocurrency space is to avoid hedging altogether: reduce leverage, allocate assets appropriately, and gradually profit. When diversifying across truly diverse assets, we must accept that some risks cannot be hedged and can only be avoided as much as possible.