It seems to be thriving, but in fact it is lurking in crisis. Will HyperLiquid be the next target of US regulators?

- 核心观点:Hyperliquid凭借HLP机制快速崛起。

- 关键要素:

- HLP做市池管理超5亿美元资金。

- 平台实现超10亿美元年化现金流。

- 代码未审计,治理集中化引争议。

- 市场影响:挑战中心化交易所,推动DeFi创新。

- 时效性标注:中期影响

This article comes from: Bloomberg

Compiled by Odaily Planet Daily ( @OdailyChina ); Translated by Moni

In just two years, a decentralized exchange built by a dozen engineers has gone from obscurity to attracting the attention of top investment institutions, leveraging billions of dollars in trading volume, and becoming a new focus in the crypto derivatives market. It is Hyperliquid.

Today, perpetual futures—a derivatives trading model with no expiration date—dominate crypto speculation, with monthly trading volume exceeding $6 trillion. Hyperliquid thrives in this field. Although it is still far smaller than the leading exchange Binance, Hyperliquid has surpassed Coinbase in some indicators.

Although Hyperliquid is popular among users in the crypto community for its transaction speed and transparency, its explosive growth has also caused some controversy. During the cryptocurrency market crash last week, platform traders suffered $10 billion in liquidation losses in a very short period of time.

Although nominally a decentralized exchange, Hyperliquid remains controlled by a small core team, raising questions about its true degree of decentralization. For investors like Paradigm and Pantera Capital, this presents both an opportunity to bet on the future of digital finance and a reminder that many core aspects of the crypto industry remain outside the regulatory system.

Earlier this year, at the Coinbase Summit in Manhattan, New York, representatives from BlackRock, Coatue, and other traditional financial institutions gathered to discuss the next phase of the crypto industry. During the event, Dave Olsen, president of Jump Trading, publicly called Hyperliquid the first truly competitive competitor to Binance . This begs the obvious question:

Why has Hyperliquid stood out in such a short period of time?

Essentially, HyperLiquid isn’t a “powerful” trading platform. It’s currently run by a team of about 15 people under the Singaporean entity Hyperliquid Labs. Its co-founders are Jeff Yan and the anonymous “iliensinc.” Jeff Yan, a former quantitative trader at Hudson River Trading and later a crypto trading platform called Chameleon Trading, has learned from years of industry experience that speed alone isn’t enough to guarantee a cryptocurrency trading platform’s survival; liquidity is the true test.

Cryptocurrency exchanges that rely on token-based incentive models, such as dYdX and GMX, often struggle to maintain long-term growth because market makers often leave once their rewards run dry. To address this liquidity issue, Hyperliquid has found its own solution: the Hyperliquidity Provider (HLP). This is an active market-making pool that allows users to deposit funds to serve as the platform's "market maker capital." The platform then uses an algorithm to continuously post buy and sell quotes, ensuring the market is always staffed. Currently, the system holds over $500 million.

Felix Buchert, algorithmic trader at market maker Wintermute, said: “If there are no users, market makers will not come; if there is no liquidity, users will not come, so it involves a chicken and egg problem. The success of Hyperliquid lies in the introduction of HLP, which ensures that quotes can be made for almost any type of token transaction.”

In fact, HLP plays a triple role—

1. Liquidity Provider: HLP undertakes the main market-making function of the platform, ensuring the depth and stability of buyers and sellers.

2. Risk Buffer: When users experience losses or market volatility, HLP acts as a systemic risk hedge pool, absorbing liquidation losses and avoiding the use of automatic deleveraging (ADL) commonly seen on traditional exchanges. This way, profitable users will not be forced to close their positions due to systemic risk.

3. Revenue Sharing Mechanism: All users who deposit funds into HLP can share the platform’s handling fee income and funding rate income.

It can be said that the HLP treasury strategy has shaped Hyperliquid's unique competitive advantage, allowing Hyperliquid to quickly stand out in the highly competitive field.

As the crisis looms, will HyperLiquid be the next target of US regulators?

Crisis 1: HLP code has not passed public third-party audits

HLP is a booster for HyperLiquid's rapid development, but it also sows the seeds of crisis.

Some in the crypto industry have identified potential conflicts of interest in HLP. Vishal Gupta, a former Coinbase executive, noted: “HLP can act as a counterparty in certain transactions. When you run an exchange, you should set the rules and be the referee, but you shouldn’t be on the field to participate in the game. Otherwise, no one can ensure that your rules are fairly enforced.”

Although every HLP transaction on Hyperliquid is recorded on-chain in real time and is publicly auditable, and HLP's share of overall trading volume is gradually decreasing as more external market makers join, it is important to note that the HLP code has not yet passed a public third-party audit .

A Hyperliquid Labs spokesperson explained: “Unlike centralized exchanges, transparency is inherently designed into Hyperliquid. Every trade, liquidation, and validator action is verifiable in real time, and the platform never holds custody of user funds.”

During last weekend's market crash, Hyperliquid (HLP) once again became a focus of attention. Public data shows that while major traders on the Hyperliquid platform suffered losses, the HLP treasury recorded approximately $40 million in gains. The plunge also triggered Hyperliquid's auto-deleveraging mechanism (ADL), a standard defense for crypto exchanges: when risk buffers are depleted, the system deducts positions from profitable accounts to absorb losses.

Some analysts believe Hyperliquid's ADL rules are extremely radical, practically textbook. Jeff Yan later responded on X, stating that Hyperliquid is a non-predatory liquidator and will not actively select profitable liquidations . He also explained that all Hyperliquid orders, trades, and liquidations are executed on-chain, allowing anyone to permissionlessly verify the liquidation process and system solvency. This transparency and neutrality make fully on-chain DeFi an ideal form of global financial infrastructure. Some centralized exchanges (CEXs) significantly underreport their liquidation data. For example, Binance only publicly displays a single transaction when thousands of liquidations occur simultaneously, potentially underestimating the actual liquidation volume by a factor of 100. He hopes the industry will recognize transparency and neutrality as core characteristics of the new financial system.

Crisis 2: Centralized “decentralization” and controversial governance structure

If HLP is the engine, then the validator is the cab.

Hyperliquid currently has approximately 24 validating nodes, far fewer than Ethereum's over a million. Critics argue that this design leads to a high degree of centralization. For example, Kam Benbrik, head of research at blockchain validation firm Chorus One, noted, "When you control more than two-thirds of the stake, you can pretty much do whatever you want on the chain."

While the lack of identity verification is central to HyperLiquid's appeal to crypto users, and this model follows the path of some high-growth cryptocurrency exchanges in the past, the problem is that such exchanges often subsequently face regulatory scrutiny. Tarun Chitra, founder of cryptocurrency risk modeling firm Gauntlet, explains, "The markets with the highest growth rates tend to be emerging or the least mature because most existing market participants don't understand their significance."

Currently, the Hyper Foundation still controls nearly two-thirds of the staked tokens HYPE, and therefore has significant influence in governance and verification decisions. Although the Hyper Foundation chooses to abstain from voting in some decisions to respect community consensus, its concentration of power is still a concern, and this centralization problem was clearly exposed in the previous "JELLY incident": at that time, the "attacker" used the platform's public computing logic, algorithmic processes and risk control mechanisms to create a "codeless attack" on the JELLY token with poor liquidity, which was extremely lethal to both the market and traders. HyperLiquid validators eventually voted to liquidate the transaction, and the foundation used its own funds to compensate affected users. At that moment, Hyperliquid was almost the same as a traditional exchange that rolled back the transaction.

Jeff Yan explained at the time that the JELLY incident was a "special case" that required the urgent intervention of the 16 validators at the time to protect user interests.

Crisis 3: Financial structure risks and self-balancing in the regulatory gray area

Hyperliquid's financial structure also appears to be highly risky. The platform uses a significant portion of its transaction fees to repurchase HYPE tokens, creating a flywheel effect: the more transactions, the higher the token price. To date, the HyperLiquid Assistance Fund, a fund driven by platform fees, has accumulated over $1.4 billion. Supporters see this as a growth driver, but critics warn that such repurchases often only boost prices in the short term.

Long-term investor Santiago Roel Santos noted that this token buyback model is “highly reflexive” and relies on continued growth in trading volume to sustain.

In fact, for a platform that prides itself on innovation, this model is actually quite traditional: the exchange encourages user participation and improves liquidity through tokens that are closely linked to the platform's growth.

Although Hyperliquid's process is fully on-chain and transparent, many similar platforms in history have collapsed rapidly due to the "token incentive bubble". Many of them seem to be in demand for technology, but in the end they are proved to be just greed for an unstable reward protocol.

Despite this, market interest is surging.

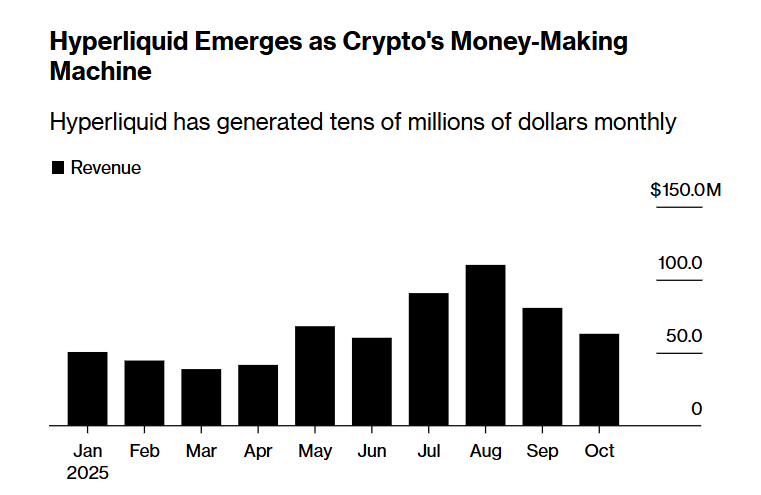

According to DefiLlama, over 100 projects are currently building on Hyperliquid, making its ecosystem comparable in scale to those of BNB Chain or Solana. David Schamis, co-founder of Atlas Merchant Capital, stated, "In a sense, Hyperliquid is like Coinbase (an exchange) and Ethereum (a public blockchain) rolled into one. The platform has already achieved over $1 billion in annualized free cash flow with fewer than 15 full-time employees."

In May of this year, Hyperliquid Labs submitted two comment letters to the U.S. Commodity Futures Trading Commission (CFTC), expressing support for a clear regulatory framework for decentralized finance (DeFi) in the United States and pledging to work constructively with regulators to promote a more open, transparent, and efficient financial system. However, Hyperliquid's success appears to have exposed some loopholes in the current regulatory framework, particularly the relatively relaxed stance in the United States, which has provided Hyperliquid with room to thrive. The question remains: how long can Hyperliquid remain outside the regulatory spotlight?