Crypto Treasury Magic Failed: Six Public Companies Betting on BTC That Failed

- 核心观点:企业比特币财库战略效果分化,部分公司股价未达预期。

- 关键要素:

- 174家上市公司持有近百万枚比特币。

- 多家公司股价在购币后短暂上涨后回落。

- Strategy购币规模近期显著收缩。

- 市场影响:可能引发对企业比特币战略的重新评估。

- 时效性标注:中期影响。

Source: Cointelegraph

Compiled by Odaily Planet Daily ( @OdailyChina );

Translator: Moni

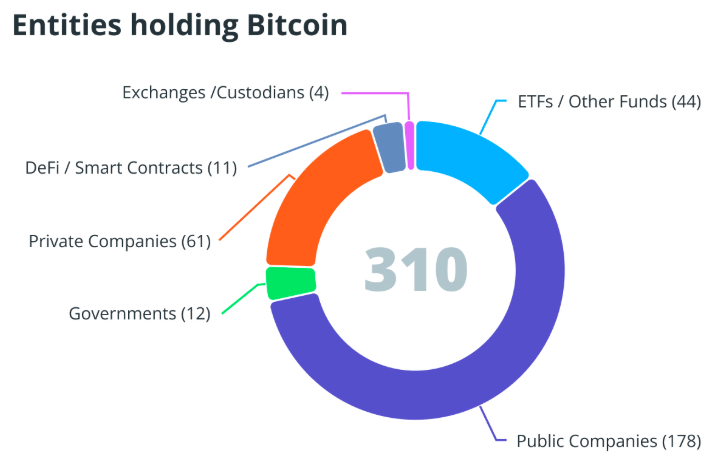

Since Strategy pioneered its Bitcoin treasury strategy, its Bitcoin holdings have reached 632,457, and the company's stock price has risen 2,200% since the strategy's launch in August 2020. Today, a growing number of companies are following Strategy's lead, leveraging financing instruments such as convertible bonds to build Bitcoin treasuries. BitcoinTreasuries data shows that as of August 29, 2025, 174 public companies hold Bitcoin, with 161 holding more than one BTC. Total holdings have reached 989,926 Bitcoin, representing approximately 4.7% of the total Bitcoin supply.

However, this seemingly innovative capital boom seems to be gradually cooling down. The stock prices of some companies that adopted Bitcoin treasury strategies have not risen as sharply as expected. Let us take stock of the six listed companies whose bets on BTC have not yet paid off.

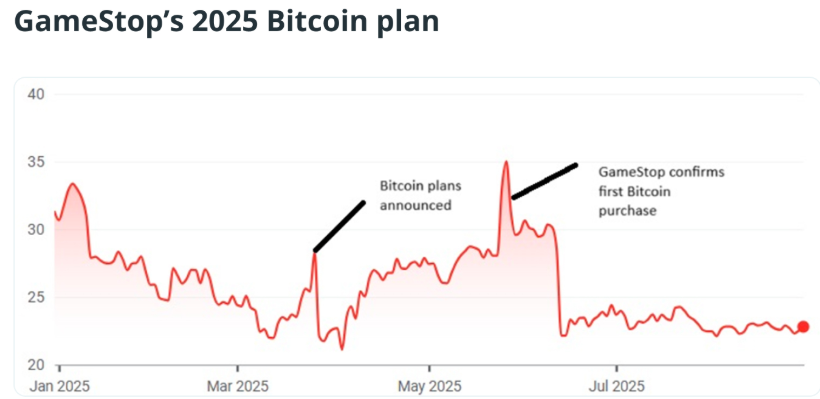

GameStop: 4,710 BTC

GameStop's fate has long been intertwined with Bitcoin and cryptocurrencies. In 2021, retail traders on the r/WallStreetBets subreddit on Reddit triggered a short squeeze on GameStop stock, propelling meme finance into the mainstream. On March 26, 2025, GameStop announced plans to invest in Bitcoin, sending its stock price surging 12%. Following the disclosure on May 28 that it had purchased 4,710 Bitcoins, the stock price soared to a peak of $35 per share.

However, the good times did not last long. Investors quickly announced a sell-off of their stocks after both positive events, causing GameStop's stock price to fall by more than 27% so far this year .

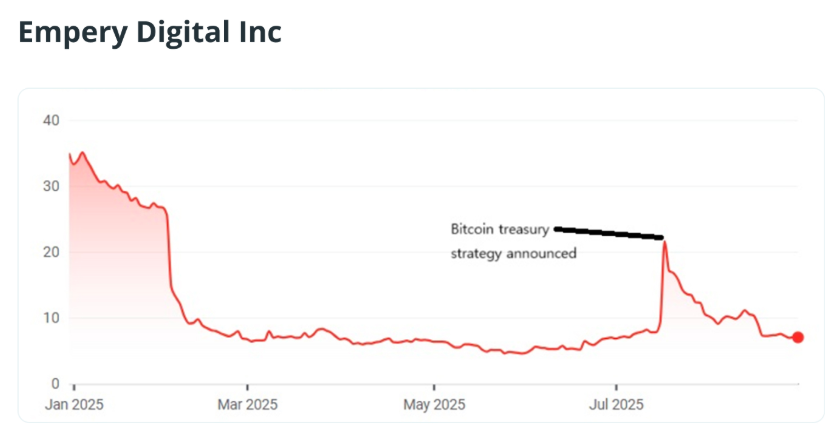

Empery Digital: 4,019 BTC

Not all businesses buying Bitcoin have a GameStop backstory, and many have nothing to do with cryptocurrency or blockchain. For example, MicroStrategy was a business intelligence software company before pioneering Bitcoin Treasuries, and Japan's Metaplanet started out as a budget hotel operator.

Electric vehicle manufacturer Volcon announced a $500 million Bitcoin funding strategy on July 17, and two weeks later changed its name to Empery Digital and switched its ticker symbol to EMPD on the Nasdaq.

Prior to this correction, Empery Digital's stock price had mostly traded between $6 and $7, well below its January high of $35. The announcement of its Bitcoin treasury strategy on July 17th briefly pushed the stock price up to $21, but the surge was short-lived, with the stock falling back to its more normal $7 range this week.

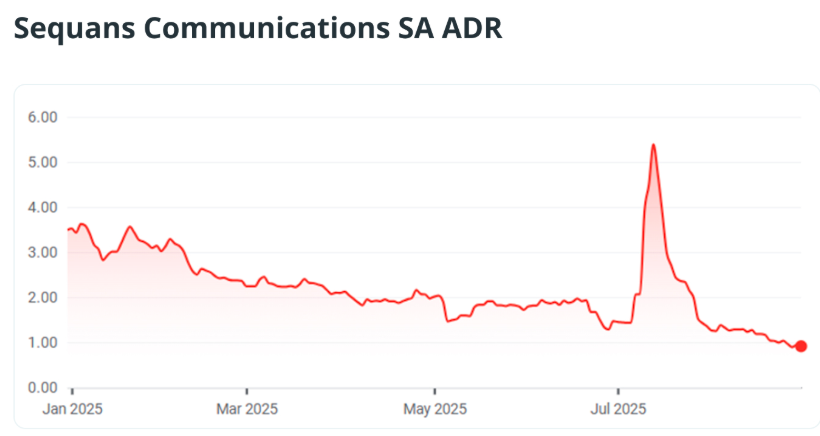

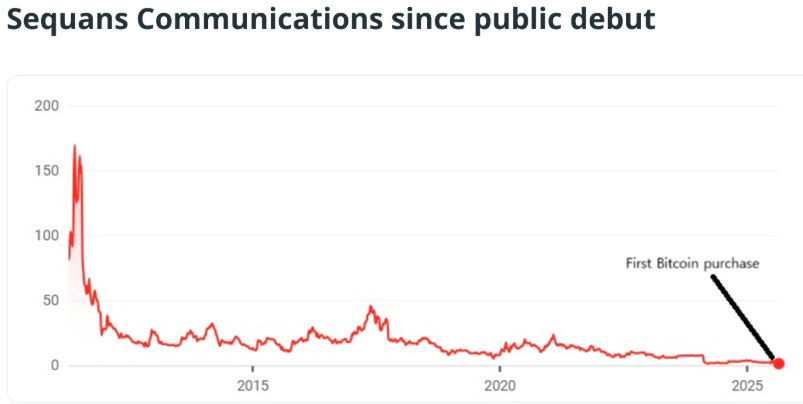

Sequans Communications: 3,170 BTC

Sequans Communications is a French semiconductor company that went public on the New York Stock Exchange in 2011 under the ticker symbol SQNS. In early July 2025, Sequans's stock price hovered at $1.45 after a year of steady decline. On July 10, the company announced its first Bitcoin purchase, triggering a surge in its share price. The stock price briefly soared to $5.39 in the following days, but this upward momentum quickly faded, and by early August, it had fallen back to $1.25 .

Sequans recently announced that it would raise $200 million through a rights offering to support its plan to accumulate 100,000 BTC by 2030. However, this good news did not prevent SQNS’s stock price from falling, and it has now fallen to the $0.9 range .

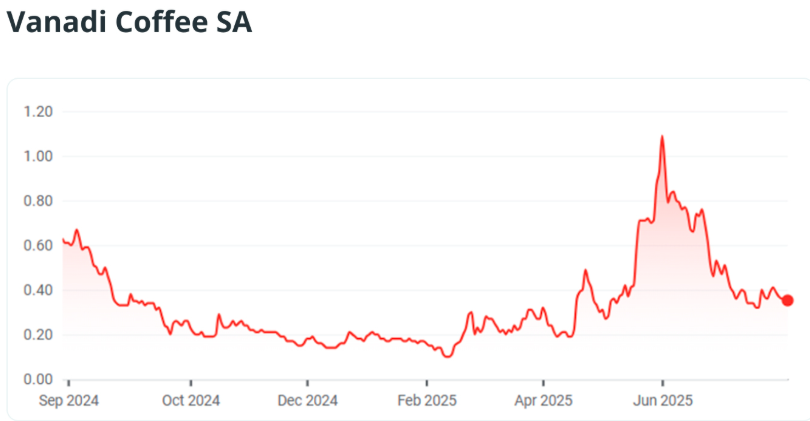

Vanadi Coffee: Holds 100 BTC

Like many companies turning to Bitcoin, Spanish coffee chain Vanadi Coffee is doing so due to financial difficulties. In 2024, the company reported an annual loss of €3.33 million ($3.9 million), up from €2.87 million the previous year.

On June 29th, the company announced the launch of its Bitcoin reserve program, and the next day its stock price soared to €1.09, closing the month up over 300%. However, by the time trading began on Friday, August 29th, 2025, Vanadi Coffee's share price had fallen back to 35 euro cents. While still up 95.6% year-to-date, it was down 44% compared to the same period in 2024 .

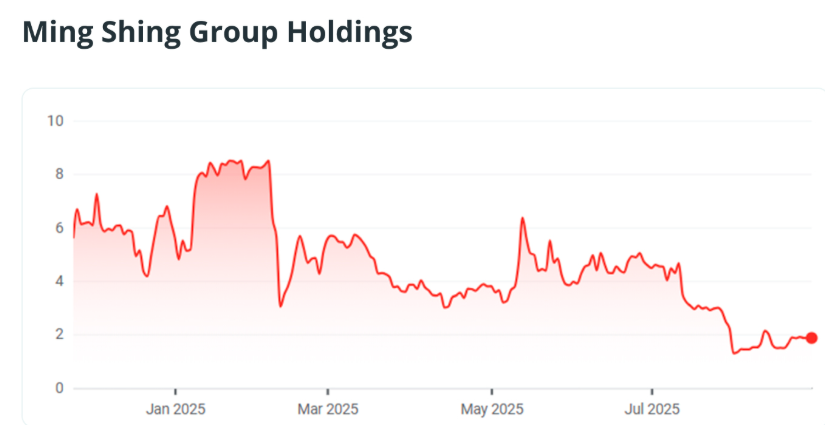

Mingcheng Group: holds 833 BTC

Mingcheng Group is a construction engineering company headquartered in Hong Kong. It was listed on the Nasdaq in November 2024 with an issue price of US$5.59. It has now started its Bitcoin treasury reserves and purchased 500 Bitcoins for the first time on January 13, 2025, and now holds a total of 833 Bitcoins.

Mingcheng Group’s Bitcoin strategy initially sent the stock soaring to an all-time high of $8.50, but it quickly fell to $1.85.

On August 21, the company announced it would subscribe for an additional 4,250 bitcoins through a share issuance for $483 million. If the transaction were completed, Ming Shing would become Hong Kong's largest corporate bitcoin holder, surpassing Boyaa Interactive, which holds 3,640 bitcoins. It is currently the second-largest publicly listed bitcoin treasury in Asia, behind only Metaplanet. While the announcement briefly boosted Ming Shing Group's struggling stock price, most of the gains were erased within the day .

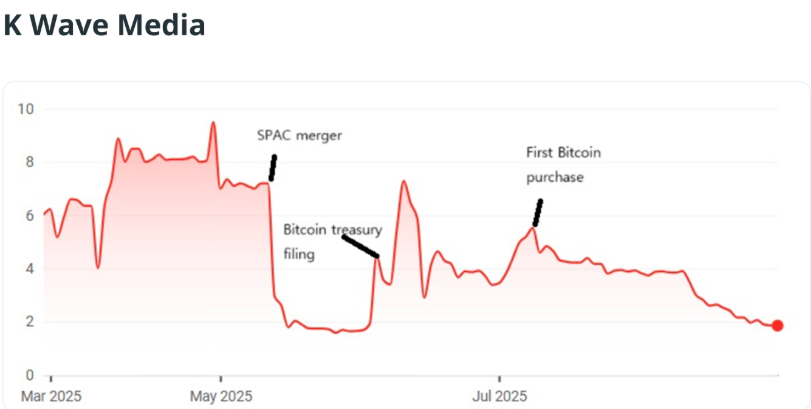

K Wave Media: Holds 88 BTC

South Korean entertainment company K Wave Media first purchased Bitcoin in July 2025, but its stock price has been declining since then. The company has raised $1 billion to acquire Bitcoin, but its stock price is still under pressure.

Global Star Acquisition completed a special purpose acquisition company (SPAC) merger with K Enter Holdings on May 13 to form K Wave Media, but its stock price has continued to fall since the company first purchased Bitcoin on July 10, closing at $1.85 on August 28, slightly lower than its recent high of $1.92 on July 3, the day before it filed its Bitcoin financial report.

How long will Michael Saylor's Bitcoin investment strategy last?

Michael Saylor, co-founder and chairman of Strategy, has made waves in the financial world with his Bitcoin investment strategy. Strategy's method for acquiring Bitcoin is simple: issuing equity or equity-linked securities to fund the purchase of Bitcoin, then holding the asset on its balance sheet. While issuing more stock typically depreciates the stock price, buying large amounts of Bitcoin increases the price of BTC, thereby boosting Strategy's valuation and allowing it to issue more debt.

The cycle continues…

This strategy has been so successful for Strategy that it has attracted numerous imitators. However, in recent weeks, the Bitcoin financial model championed by Michael Saylor has been losing momentum. This is because once the price of BTC falls too close to a company's per-share Bitcoin price target, or net asset value (NAV), the stock loses the valuation cushion that once supported its share price, leading to a so-called "death spiral," whereby a company's access to financing dwindles as its market capitalization shrinks. Without buyers and lenders, the company is unable to expand its holdings or refinance existing debt. Forced liquidations can occur when loans mature or margin calls occur.

Meanwhile, whales are collectively fleeing BTC for ETH (see: "Whales Are Fleeing BTC for ETH: Is a New King Emerging? "). Analysts suggest that the rationale for long-term Bitcoin holdings is being reevaluated, while the value of Ethereum's asset allocation is being revalued. The strategic deployment of treasury companies has been a key driver of Ethereum's price rise, with SharpLink and Bitmine recently sparking a "strategic arms race" in the market. Strategy, a pioneer in Bitcoin treasury, has seen a significant reduction in its purchases over the past two weeks, from thousands to just a few hundred .

Market conditions may be relatively stable at the moment, and the White House's policies remain firmly supportive of cryptocurrencies, but the cryptocurrency winter will eventually arrive. What will be the fate of Bitcoin Treasury then?